Payments handled through check in businesses or via direct account transfer has been a vital part of most industries in the world. With technology, today, these monetary transactions have a digital medium where transactions can be done using applications using smartphones. Hence, many people across the world now prefer to do transactions using them using just their fingertips. This online transfer of money between bank accounts has made the reimbursements process easier for both, individual and business transactions.

In this blog, you can read about -

- What are reimbursements?

- Types of reimbursements?

- What is an accountable plan?

- What is the best way to handle employee reimbursements?

- Why automate the reimbursements process?

What Are Reimbursements?

Reimbursements are the extra compensation amount paid by a company or an individual for the overpayment done while buying a product for self or a third party. In simpler words, when an organization transacts an “X” amount to deposit it in the seller’s account, it initiates a payment.

Now, if the payment gets transacted from the company’s account but is not received by the seller due to some technical or other reasons, the entrepreneur who is purchasing the product can issue a repayment request from another party. This money which is received back by an individual or an organization is better known as reimbursements. It is very common in most business activities and even in an individual life for daily transactions.

The term reimbursements sound similar to refund but there is a huge difference between both. Even if both of them are meant for returning the money from the previous transaction, these words are used from different perspectives. A refund occurs when an individual wants his money back from the seller as he did not like the product purchased. In contrast, reimbursements are done when there is an error of overpayment or some transactional issue in the original payment.

Types of Reimbursements

In businesses, usually, all the organisations have to reimburse employee expenses at a certain point in time. These reimbursements are done for various purposes - expenses made by the employees for office supplies, travel to an expo, moving expenses etc. Hence, an employer’s HR department must ensure that the employees in the business are aware of what these employee reimbursements mean and how they should account for them.

Let us understand the different types of reimbursements available for the employees -

Business expense reimbursements

This reimbursement is given by the employers to the company’s employees for any business-related expenses they have incurred while doing any work that is related to the organization. It is strictly related to projects related to the business. For a better understanding of these reimbursements, an employee should know what types of expenses are included in this category by the IRS. It includes -

- Education or Training

- Business Travel

- Business supplies

- Business tools

- Miscellaneous expenses related to business

According to the rules by the IRS, employers must provide reimbursements to the employees if they include it as a part of their income. However, both must know the rules about what is included in reimbursements that are considered tax-free.

Auto-mileage and travel reimbursement

It is another type of business travel reimbursement. However, certain characteristics set these reimbursements apart from the others in this category. Let us understand in more detail -

Standard mileage rate

Employers in the US provide mileage rates to reimburse employees for the use of personal vehicles for business trips. It is given for the expenses incurred for the wear and tear of the vehicle as well as fuel prices. According to available data, most organisations make use of the standard IRS mileage rates while reimbursing personal vehicle travel done by the employees. This rate is calculated on a yearly basis by the IRS to determine the deductible costs. IT has fixed at 0.585$ per mile for the year 2022 if an employee uses his vehicle for business use.

Per diem travel

Most employers in the US provide a fixed per diem allowance to the employees when they are on business trips. It includes lodging, meals and even the incidental travel expenses done by the employees for business trips.

The employers keep a track of the employee reimbursements with the help of travel receipts maintained by the employees. Another option is for the businessman can keep a track of the expenses using a tracking receipt to have up-to-date information about the expenses incurred during the trips. One more method is the employer can fix a certain amount permitted for employee reimbursements based on the assumption that he wants to avoid the hassle of regularly tracking expenses.

According to the available information, the General Services Administration is the authority that decides the per diem rates each October for the different regions in the U.S.

Medical expense reimbursement

One more type of employee reimbursement in the US is the Medical expense reimbursement plan, popular as MERPS. Employers provide healthcare reimbursements to the employees as an alternate method to offer health benefits. These are better known as Section 105 plans.

A type of MERP used by employers to provide health expenses to the employees is the health reimbursement arrangement that is HRA. The different popular HRA used for offering health reimbursements are -

- Qualified small employer HRA (QSEHRA)

- Individual coverage HRA (ICHRA)

- Group coverage HRA (GCHRA)

QSEHRA

A small business owner can use QSEHRA to set a monthly or yearly limit for health reimbursements of his employees for insurance premiums that are tax-free. This can be used only for businesses that have less than 50 employees at the workplace and if the company does not offer any group health insurance plan to them.

ICHRA

This plan can be used by employers without any specific restrictions. It can be used by any industrialist with no limit on the number of employees. Furthermore, there is no contribution limit for this plan. This plan permits the employees to set reimbursements categories for the employees on the basis of their position and the number of working hours (seasonal, hourly, part-time, full-time) at the organization. This plan can be given to an employee even if he is not included in the group health insurance plan of the company.

GCHRA

This is an integrated HRA. The employers can use this reimbursement plan on a group health insurance plan for the employees for reimbursing what their existing plan doesn’t cover. This plan is tax-free and usually provides health benefits for the employees. As per the available data, employers use this plan to make high deductibles work well for employees and offer top-tier health benefits. The HR professionals use this benefit for recruiting talented professionals in the industry.

Employee stipends reimbursements

Employee stipends are considered beneficial reimbursements for the organization by the employers. It permits the business to set a fixed allowance for the employees according to their level in the company. The stipends provide additional pay benefits to the employees who have a minimum wage. Using it, these employees can submit requests for reimbursements for their business expenses and get approvals from the HR managers as needed. The top 3 employee stipend benefits usually given by employers are -

- Wellness

- Remote work

- Health

What is an Accountable plan?

Business owners usually have an accountable plan. They handle all business-related expenses and even reimbursements under this plan. An employer uses an accountable plan for the proper management of all business-related expenses that cannot be counted under income. Furthermore, this cost cannot be withheld from the employees.

Even if this accountable plan is not checked by the IRS, it assists the employers to fix a criteria for reimbursements which fits in the IRS regulations. These regulations help the business owners have a clear picture about which reimbursements must be included under deductibles and which of them can be counted under taxable income. The accountable plan is a beneficiary for the employees. It provides security to the employees and ensures that they are not taxed on employer reimbursements.

It is necessary for an entrepreneur in the US to have an accountable plan for his business as there is an IRS Publication 12 rule for the same. It states that the payments given to employees for business travel and other expenses are counted under a nonaccountable plan and considered as wages. These are treated as the supplementary wages apart from the salaries. These wages are subject to the withholding and payment of income, Medicare, social security and even the FUTA taxes.

What is the best way to handle employee reimbursements?

The employers today have started adopting innovative techniques for smoothening the processes in their organization. In this era of digitization, the best way to handle employee reimbursements is by workflow automation. If there is a dedicated reimbursement system installed at the workplace, the business owner will have immediate solutions for the reimbursements.

This reimbursement application will customise all the processes based on employer’s business requirements according to the company’s expense policies. An employee who has been involved in the business trips or even shelved something personally can report the expenses on this application. As this solution is not on the desk, the employer needs to make certain modifications to his existing structure to accommodate the previous workflows.

Why automate the reimbursements process?

Automating the reimbursements process would prove to be beneficial for the employers as well as the employees. It not only provides tax benefits but also provides multiple intangible benefits for both. When the employer uses a reimbursements system, he can offer to pay for educational courses for the employees under intangible benefits. It not only enhances the employee skills but also brings various advantages to the employer’s table. It increases loyalty of the employees and can be a strong point for employee retention strategies.

Moreover, a reimbursements system ensures accurate track record of the employer’s expenditures with no errors. It assists the employers in having a good idea about what expenditures the employees have made during professional business trips. It also proves as an insight for the entrepreneur to plan his next trip and decide where he needs to do cost-cutting for business trips.

Conclusion

When the employers have an accurate expense plan, it becomes easier to record the expenses done for office supplies, travel, meals, accounting for the multiple transactions and other business records. This makes the reimbursements for the employees easier and gives a better understanding for the HR regarding tax. If you are searching for an integrated accounting software to handle the daily business transactions, Deskera is the best choice for you. We offer the best business platform that records your transactional activities and even business reports for your organization.

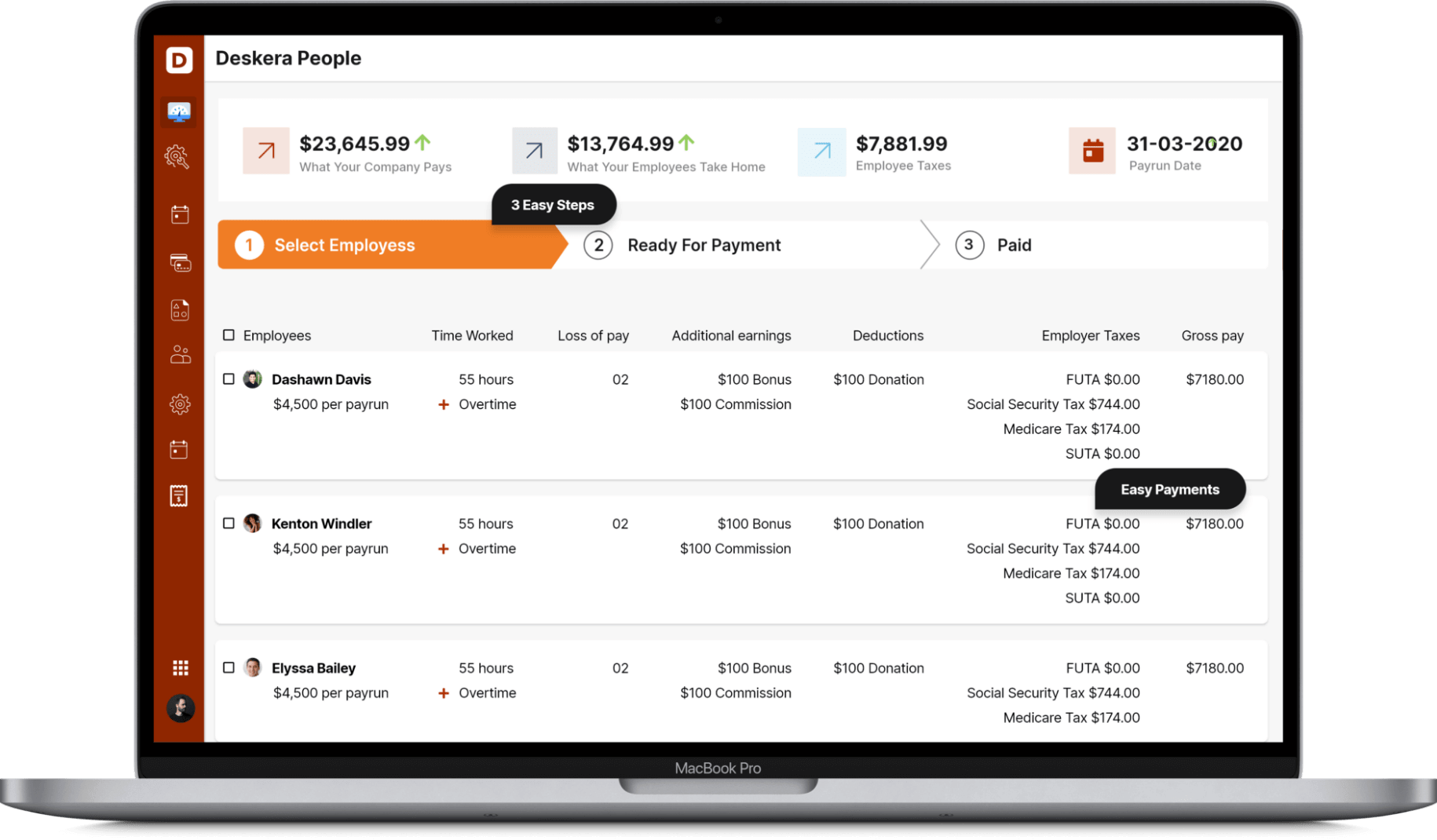

How Deskera Can help You?

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key Takeaways

- If an employee has used his personal assets for business purposes, the employer owes its appropriate reimbursement to him. The employee can ask for reimbursement related to meals, travel, hotel accomodation, personal car, fuel expenses etc.

- The other business expenses provided by the employers include educational training,health and wellness, remote working. The business owner must also give expenses incurred for business tools and other miscellaneous to the employees.

- A small business owner with less than 50 employees can make use of the QSEHRA plan to offer health reimbursements to the employees. The other plans under this for more than 50 employees are ICHRA and GCHRA.

- The business owners must have an accountable plan that helps to maintain which transactions cannot be counted under taxable income. It ensures the amount is not withheld for any purpose from the employees.

- The easiest way to keep a track of these reimbursements is using a system for the transactional data. The application maintains accuracy of the employee’s expenses and there are no errors when it comes to pay them for the extra incurred charges.

- Also, the reimbursement application provides a detailed business report for the entrepreneur which helps him to determine where the employees have spent the dollars. It can be of great use to him while deciding the next business trip for the team and also assist him for making decisions related to cost-cutting

Related Articles