Employees are often sent on business trips by employers when it comes to on-site and client projects. While these trips are for monetary gains and focused on client interactions right from their industry, it does offer a good experience for the worker.

He not only gets a chance to visit different factories, workshops and stores but also interact more closely with the clients. These trips are often managed by the HR department of the organizations and are inclusive of travel, food and stay. This business-related travel is known as per diem in the United States of America.

What is Per Diem in the US?

The fixed daily rate of reimbursement for an employee per day on a business trip is known as “Per diem” in America. This allowance is given by the organization to the employees. Its rates are set by the General Services Administration (GSA). It is the reimbursement given to employees for daily lodging, food meals and incidental expenses that he has incurred in these business-related tours.

These rates are offered in America by GSA within the continent whereas, for other locations, they are set by the Department of Defense and foreign rates. As per the law, it is the authority of the State Department to fix the rates outside the U.S.

What does Per Diem cover?

If you are an employer it is natural to have questions about when is the per diem required to be paid and what it covers. It usually covers total cost related to -

- Lodging

- Meals

- Incidentals per day

Each expense in this has a predetermined rate which is decided by the average costs as per the location. In America, the IRS permits these rates for the employees and employers to make the reimbursements easier for both of them. It does not cover the actual expenses but only those mentioned above.

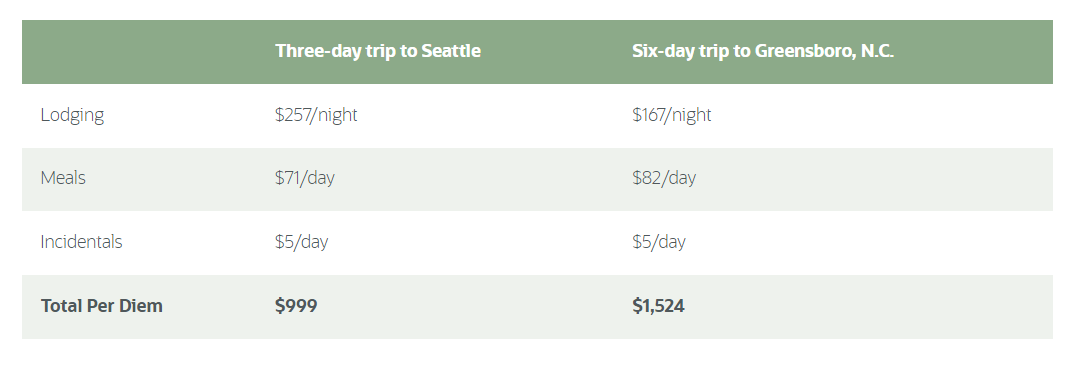

Now if you are thinking about how this work, the HR department of the organization must maintain a separate file to keep a track of the employees on the business trips. This daily rate during the professional trip is not a part of the employee’s monthly wages associated with tax purposes. Under this model, it is usually observed that the company pays only for the first and last of the professional trip as the employee might be in the office or at home during the visit. This could be more understood from the following figure -

What are the Per Diem rates for 2022?

The GSA publishes these per diem rates per year. It is even used by the government of America to reimburse federal employees for their work-related travel within the country. These rates have been adopted even by the private sector in the nation. The prime reason for this is these rates set for business travel reimbursements must be equal to or less than the government rates if the company wants them in tax deductibles for the firm and does not want to impose its tax on the employees.

The per diem rate standard rate applies to 2600 counties in the United States of America and varies according to the location. It could be expensive in a posh locality and is dependent on location-specific areas. For instance, the rate is significantly higher in cities like New York, Los Angeles or California as compared to the smaller towns.

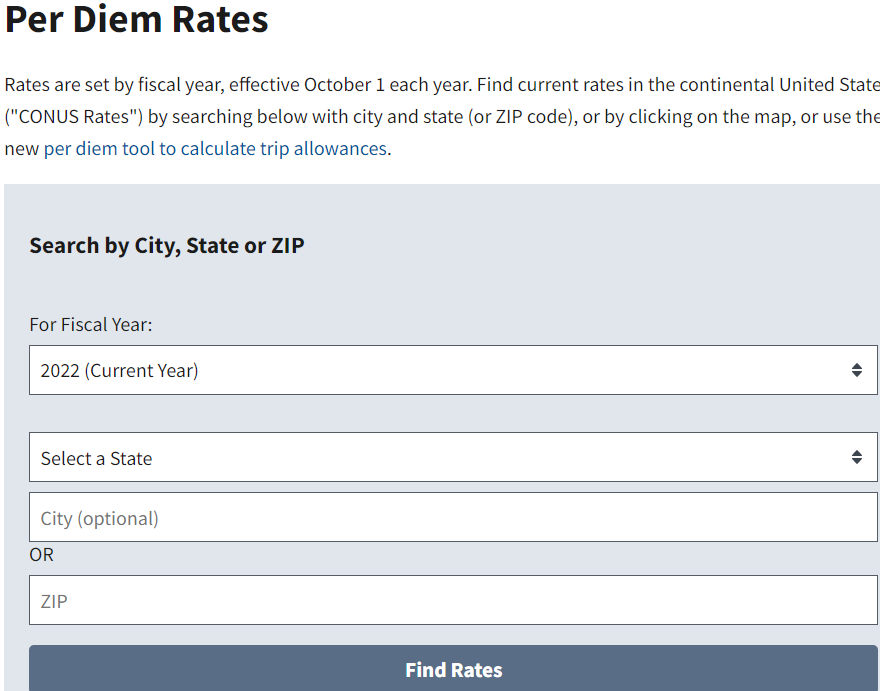

These federal per diem rates for each location can be checked on the GSA website - https://www.gsa.gov/travel/plan-book/per-diem-rates.

Accountable plan

While following these rates, it is the responsibility of the employee to be true, loyal and not indulge in any malpractices of the accountable plan. Let us understand it in more detail -

Accountable Plan

The employers must follow the 3 key rules to include per diem in the accountable plan. Only after meeting these rules, qualifies as an accountable plan. The three rules are -

- The expenses for the employee must be for a business plan.

- The concerned employee must mention adequate expenses for the trip and should notify the employer within a stipulated time.

- Also, as per the rules, the employee is liable to return any additional amount as reimbursement of travel allowance transferred for the professional trip back to the employer.

As per the IRS, the criteria for a reasonable period varies for each employer and motto of the trip. However, it has specified some actions which should be done by the employer within a reasonable period. These include -

- He/she must receive an advance 30 days before the business expense trip

- The worker should give details of the expenses incurred or paid within 60 days of the business trip

- He or she must return excess reimbursement given by the employer within 120 days after it was incurred.

- The organization should at least give a quarterly statement that questions the employees to adequately return or adequately account for the outstanding advances and the employee must comply and answer to it within 120 days after receiving it.

How is the Per Diem breakdown?

The per diem rules in the United States of America can be confusing for an employer because of the way it has been written on the IRS website. To make it easier for the HR department, let us get this straight:

- Federal per diem rate: It is the amount paid to the US federal government employees for lodging, food meals and incidental expenses when these workers travel away from home in the nation for business purposes. Amounts above the fixed rate are counted as income and would be considered taxable.

- Incidental expenses: This amount is the fees and tips given to hotel staff, baggage porters, carriers, and other staff for their services

- Substantiation: It is used for reporting and as evidence to verify that the per diem qualifies as a business expense.

- Travel expenses: These are expenses that include lodging, meals and incidental expenses.

- Transportation: This is the cost incurred for travelling from one business location to another or between different customers for work purposes.

Where to get the Per Diem calculator

Employees can search for the current per diem rates fixed by the government on

Benefits of Per Diem

This per diem has turned out to be an advantage for employers. It assists to reimburse travel expenses for the employees and simplifies accounting as well as expense reporting to the employers. This gives a better idea to the HR to predict employee travel and fix his expenses for a business trip.

While the employees can keep the unspent money if it falls under the government’s rates effectively at that time, it also serves as a prime factor that aids the HR professionals. It saves their accounting time and reduces a lot of paperwork. The HR can revise the expense incentives given to employees on business tours and minimize expenses for the organization which would also be a big plus point for his profile.

Taxes on Per Diem

As per the law, these payments are not under the bracket of employee wages and hence are considered non-taxable if they meet the government-specified conditions. This amount becomes taxable only if:

- The per diem rate is more than the permitted federal per diem rate

- The employee failed to file an expense report with the employer

- The worker’s expense report did not mention details of date, time, place, amount of expense incurred and purpose of the business trip

- The employee was given a per diem for the travel but his employer did not require the expense report

In the above circumstances, the per diem expense is considered as employee wages and falls under payroll taxes. If the employee does not include it in his tax, it would be considered income tax withholding and should be reported on the W-2 form by the employer. In case of the rate is above the permissible amount, it would be considered as wages for the worker.

When it comes to substantiating the travel and related expenses, the employee must maintain a calendar log. It will include the days he has travelled on business trips, the location and the business purpose of the travel. This assists to provide a correct reimbursement report to the employer and also helps the employer to fix a travel allowance for the next employee in turn.

In case the worker has been on a business trip to a location where he was needed to stay for more than 12 months, then he would not be exempted from taxes. Furthermore, even if the employee was given 2 separate assignments or more but the stay was above the allowed period, he would not be liable for tax exemption. To save himself from unfavourable tax situations, the employee must take aid from a legal tax advisor before he jets off to an extended business trip.

Conclusion

Working on a client’s location and business trips are learning points in an employee’s career and can have a positive effect on his career. To ensure he does not get involved in complicated cases of per diem, he should have a basic understanding of this allowance provided by the US government and know its terms and conditions.

How can Deskera Help You?

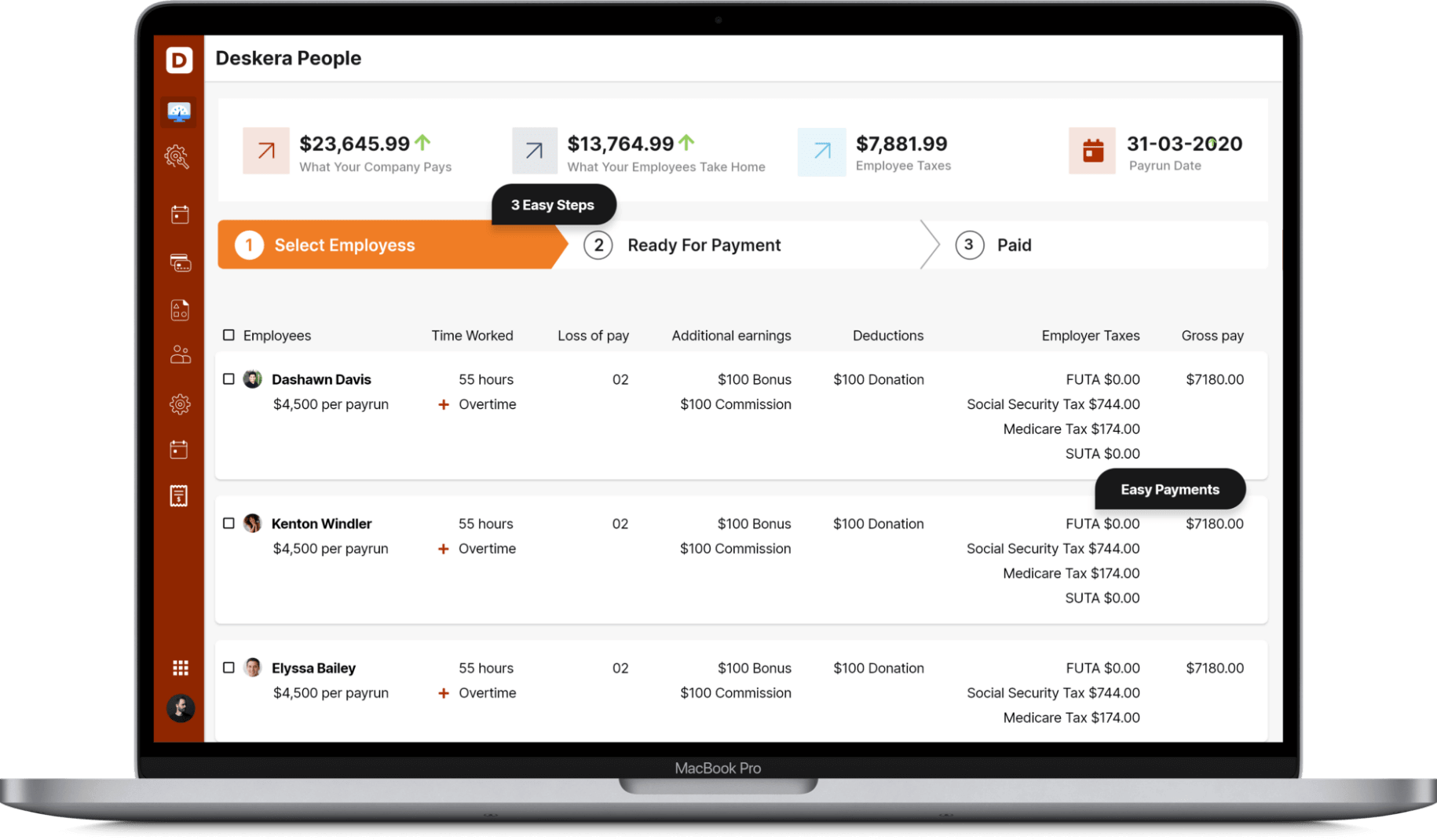

Deskera People is a cloud-based software that will help to create and assign custom pay components to an employee in light of your requirements.

Deskera Books can help you automate and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Sign up now to avail more advantages from Deskera.

Learn about the exceptional and all-in-one software here:

Keynotes

1. Per diem is a fixed amount decided by the Federal government of the US for employees who need to travel to client locations for the business state - within state or country or even to foreign locations.

2. It includes lodging, meals and other expenses incurred by the employee during the stay. He must maintain a complete detail of the cost incurred - even any tips given to porter, luggage carrier and travel tickets which is usually given in advance by the employer.

3. The employee must reimburse the costs spent on the trip within the permitted time from the employer. He can keep the extra amount if it falls under the allowances. If it is extra and falls under the tax bracket, he must mention it in his annual taxation report. If he does not do so, the employer must include it in the W-2 form.

4. If the employee has stayed at a location for more than a year, even if he is doing multiple projects, he would not be considered legal for tax exemption. In such scenarios, he must take the help of the tax advisors to avoid unfavourable circumstances.

5. The HR department can make use of the reimbursements claimed by an employee for a business trip to decide an allowance for a trip for another employee or a group about the business trip and revise it according to the needs.

Related Articles