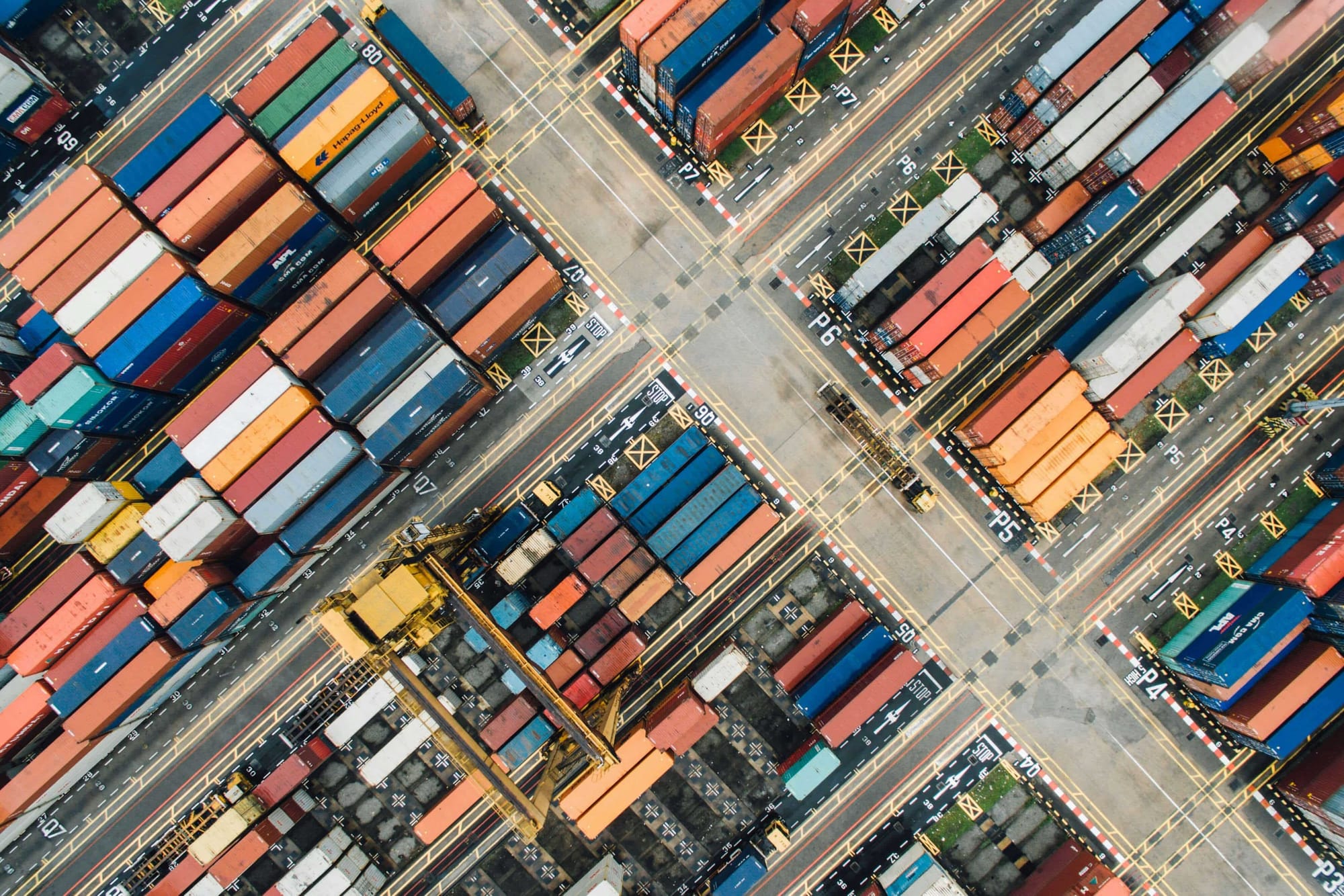

Procurement costs are no longer limited to what a business pays its suppliers. In today’s volatile economic environment, they include sourcing, logistics, compliance, and operational expenses that directly influence profitability and resilience. As inflation, supply chain disruptions, and pricing volatility persist, understanding procurement costs has become a strategic priority rather than a back-office concern.

Recent data highlights the growing pressure on procurement teams. Around 40% of companies have experienced higher sourcing costs over the past year, driven largely by inflation and ongoing supply chain challenges. At the same time, 53% of supply chain leaders identify rising prices as one of their biggest concerns, underscoring how procurement decisions now play a critical role in protecting margins and ensuring business continuity.

The expectations placed on procurement functions are also intensifying. A 2025 report reveals that 78% of procurement professionals are under pressure to reduce operating costs, with 58% working against clearly defined cost-reduction targets. This shift reflects a broader transformation of procurement—from a transactional function to a performance-driven discipline focused on cost optimization, efficiency, and long-term value creation.

This is where modern ERP solutions like Deskera ERP become essential. Deskera ERP helps businesses gain end-to-end visibility into procurement spend, automate purchasing workflows, and track costs in real time. With integrated procurement, inventory, and financial management, Deskera enables organizations to control procurement costs proactively, improve forecasting accuracy, and make data-driven decisions that support sustainable growth.

What Are Procurement Costs?

Procurement costs refer to all expenses incurred in sourcing, purchasing, and managing goods or services, not just the price quoted by a supplier. While the unit cost of materials or services is the most visible component, businesses also bear costs related to processing purchases, managing suppliers, moving goods, and ensuring quality and compliance. Together, these elements determine the true cost of procurement.

At a high level, procurement costs fall into several key buckets. These include direct procurement costs such as raw materials and production-related services, and indirect procurement costs like office supplies, IT services, and maintenance. Beyond what is purchased, organizations also incur transaction and processing costs—from requisition creation and approvals to purchase order management, invoicing, and payments.

Procurement costs also extend to supplier management and operational overhead. Activities such as vendor onboarding, contract negotiations, performance monitoring, compliance checks, inspections, and quality assurance all require time, tools, and resources. In addition, logistics, transportation, inventory holding, and risk-related costs—such as supply disruptions or price volatility—significantly influence overall procurement spend.

Understanding procurement costs in this holistic way is essential for effective cost control. When businesses gain visibility into every cost driver—from bid preparation and administrative effort to unapproved or maverick spending—they can identify where money leaks occur. This clarity enables smarter interventions, such as supplier consolidation, better contract terms, and automation of the requisition-to-pay process, ultimately leading to stronger cost discipline and more efficient procurement operations.

Key Components of Procurement Costs

Procurement costs are made up of several visible and hidden elements that together define the total cost of acquiring goods or services. Looking only at supplier prices can mask significant cost leakage. A clear breakdown helps businesses identify where spend accumulates and where tighter controls or process improvements can deliver the most value.

Direct Material and Service Costs

These are the most visible procurement costs and typically the largest share of total spend. They include the base or unit price of raw materials, finished goods, components, and contracted services that directly support production or service delivery. Although straightforward on the surface, direct costs can fluctuate due to volume changes, supplier pricing, tariffs, and market conditions.

Indirect Procurement Costs

Indirect costs cover purchases that support daily operations but are not part of the final product or service. Examples include office supplies, IT subscriptions, maintenance, utilities, facilities services, and professional fees. Because indirect spend is often fragmented across teams and suppliers, it is prone to unmanaged or maverick spending and benefits greatly from standardization and preferred supplier programs.

Transaction and Processing Costs

Every procurement activity carries an operational cost. These include expenses related to requisition creation, approvals, purchase order processing, goods receipt, invoicing, and payments, as well as procurement staff time and system usage. Manual and disconnected processes increase cycle times, error rates, and overall procurement costs.

Supplier Management and Contract Costs

Organizations also incur costs to identify, evaluate, onboard, and manage suppliers. This includes contract drafting and negotiation, legal review, performance monitoring, audits, dispute resolution, and ongoing relationship management. While effective supplier management reduces risk and improves long-term value, inefficient contract and vendor processes can inflate costs.

Logistics, Freight, and Transportation Costs

These costs arise when moving goods from suppliers to warehouses or business locations. Freight charges, fuel surcharges, handling fees, and international shipping costs can significantly impact procurement budgets, especially for global or import-heavy supply chains. Order consolidation and strategic carrier partnerships help control these expenses.

Inventory Holding and Management Costs

When goods are stored, additional costs accumulate. These include warehouse rent, insurance, handling, inventory shrinkage, obsolescence, and third-party inventory services. Poor demand planning or overbuying can quickly increase inventory-related procurement costs.

Taxes, Duties, and Compliance Costs

For cross-border purchases, procurement costs also include customs duties, import taxes, tariffs, and regulatory compliance expenses. These costs vary by product type, origin country, and trade policies, and can materially affect sourcing decisions.

Strategic Opportunity Costs

Beyond direct expenses, procurement decisions can create opportunity costs. These occur when organizations miss supplier incentives, fail to leverage volume discounts, overlook market trends, or bypass compliant sourcing practices for short-term gains. While not always recorded in financial statements, opportunity costs directly impact long-term profitability and competitiveness.

Quality and Rework Costs

Costs incurred due to defective materials, non-conforming services, re-inspections, returns, rework, and production delays caused by supplier quality issues. Poor-quality inputs often lead to downstream costs that exceed the original purchase price.

Risk and Disruption Costs

Expenses arising from supply disruptions, supplier insolvency, geopolitical issues, demand shocks, or single-supplier dependency. These may include expedited shipping, emergency sourcing, production stoppages, or premium pricing for alternate suppliers.

Compliance and Governance Costs

Beyond taxes and duties, procurement also incurs costs for policy enforcement, audits, regulatory adherence, ESG compliance, and documentation. Non-compliance can result in penalties, reputational damage, and corrective actions.

Technology and Systems Costs

Costs related to procurement software, ERP platforms, integrations, data maintenance, user training, and system upgrades. While these are often classified as IT expenses, they are critical enablers of efficient procurement operations.

Change Management and Training Costs

Expenses associated with upskilling procurement teams, onboarding users to new tools, process changes, and supplier adoption programs. These costs are essential for sustaining procurement efficiency but are frequently underestimated.

Financing and Working Capital Costs

Procurement decisions influence cash flow, payment terms, early payment discounts, and days payable outstanding (DPO). Poorly structured contracts can increase financing costs and strain working capital.

Sustainability and ESG-Related Costs

Investments required to meet ethical sourcing, environmental standards, supplier audits, and sustainability reporting. While these may increase short-term costs, they reduce long-term risk and improve brand value.

Data and Spend Visibility Costs

Costs tied to data cleansing, spend classification, analytics, and reporting efforts needed to gain accurate procurement insights. Poor data quality can lead to missed savings opportunities and inefficient decision-making.

Internal Coordination and Stakeholder Costs

Time and resources spent on cross-functional alignment, approvals, exception handling, and stakeholder communication, especially in decentralized procurement models.

By understanding these components together, businesses gain a realistic view of procurement spend and can design targeted strategies to reduce waste, improve efficiency, and strengthen overall cost control.

How to Calculate Procurement Costs

Calculating procurement costs requires looking beyond supplier invoices to understand the total cost involved in acquiring goods or services. This broader view—often referred to as Total Procurement Cost (TPC)—captures every direct, indirect, and operational expense incurred from sourcing to payment. Without this calculation, businesses risk underestimating spend and missing opportunities for cost optimization.

Step 1: Identify All Cost Components

Start by listing every cost associated with procurement, not just the purchase price. These typically include:

- Supplier price (base or unit cost)

- Freight, shipping, and handling

- Duties, tariffs, and taxes

- Supplier onboarding and contract costs

- Internal labor and administrative costs

- Inspection, quality control, and returns

- Warehousing, insurance, and inventory handling

- Software, systems, and technology overheads

- Legal, compliance, and audit fees

Each of these contributes to the true cost of procurement. For example, onboarding a new supplier consumes procurement, finance, and legal resources—making internal labor and system usage a real, measurable cost.

Step 2: Calculate Total Procurement Cost (TPC)

Once all cost elements are identified, add them together using the following formula:

Total Procurement Cost (TPC) = Supplier Price

- Freight, Shipping & Handling

- Duties & Taxes

- Supplier Onboarding & Contract Costs

- Internal Labor & Administrative Costs

- Inspection, Quality & Returns

- Warehousing & Insurance

- Software or Systems Overheads

- Legal, Compliance & Audit Fees

This figure reflects what the organization is actually spending to procure goods or services.

Step 3: Measure Procurement Cost per Unit

To assess efficiency at a granular level, calculate Procurement Cost per Unit:

Procurement Cost per Unit = Total Procurement Cost ÷ Number of Units Purchased

Example: If a company spends:

- $50,000 on supplier prices

- $5,000 on freight and taxes

- $2,000 on admin and labor

- $3,000 on software and compliance

The Total Procurement Cost is $60,000. If 12,000 units were purchased, the procurement cost per unit is $5.

Step 4: Track Process-Level Efficiency Metrics

In addition to cost per unit, businesses can calculate:

- Cost per purchase order

- Cost per invoice processed

High values often indicate excessive manual approvals, process bottlenecks, or poor data visibility. Monitoring these metrics regularly helps identify inefficiencies and areas where automation or centralized workflows can reduce costs.

Step 5: Apply Best Practices for Accurate Cost Measurement

To ensure procurement costs are calculated consistently and accurately:

- Conduct regular audits to capture all direct and indirect costs

- Use integrated procurement or ERP systems for real-time data tracking

- Implement standardized cost classification and reporting

- Review procurement cost metrics periodically to identify waste and improvement opportunities

By systematically calculating procurement costs, organizations gain clarity over their true spend, improve cost control, and make more informed sourcing and process decisions.

Why Procurement Costs Matter in Business

Procurement costs have a direct and lasting impact on how efficiently a business operates and how profitably it grows.

Since procurement touches every department—from production and operations to finance and compliance—even small inefficiencies can scale into significant financial strain.

Understanding and managing procurement costs helps organizations move from reactive spending to proactive cost control and value creation.

Impact on Profit Margins

Procurement costs directly influence the cost of goods sold and operating expenses. Even minor increases in sourcing, logistics, or processing costs can erode profit margins, especially in high-volume or low-margin businesses. Effective procurement cost management helps protect margins by controlling total spend rather than focusing only on unit prices.

Influence on Cash Flow and Working Capital

Procurement decisions affect payment terms, inventory levels, and days payable outstanding (DPO). Poor visibility into procurement costs can lead to overbuying, excess inventory, or unfavorable supplier terms, all of which strain cash flow. Optimized procurement helps maintain healthier working capital and improves financial predictability.

Operational Efficiency and Scalability

High procurement costs often signal inefficient processes, such as manual approvals, duplicate purchases, or fragmented supplier bases. Streamlining procurement reduces cycle times, lowers administrative overhead, and enables the organization to scale operations without a proportional increase in costs.

Supplier Performance and Risk Management

Procurement costs are closely tied to supplier reliability, quality, and compliance. Weak supplier management can result in hidden costs such as rework, delays, penalties, or emergency sourcing. Managing procurement costs effectively encourages stronger supplier relationships and reduces exposure to supply chain risks.

Budget Control and Spend Visibility

When procurement costs are not clearly tracked, spending becomes difficult to control. Limited visibility increases the risk of maverick spending, budget overruns, and poor forecasting. Clear procurement cost insights enable better budgeting, accurate forecasting, and informed decision-making.

Long-Term Business Competitiveness

Businesses that manage procurement costs strategically are better positioned to adapt to market changes, pricing volatility, and supply disruptions. By controlling total procurement costs, organizations can reinvest savings into innovation, growth, and customer value—strengthening their competitive advantage over time.

Common Challenges in Managing Procurement Costs

Managing procurement costs is complex because spend is distributed across suppliers, departments, and processes. Without the right controls and visibility, costs tend to accumulate quietly, making it difficult for businesses to identify inefficiencies and take corrective action.

Lack of Spend Visibility

Many organizations struggle with fragmented procurement data spread across systems, teams, and spreadsheets. This lack of centralized visibility makes it difficult to track total spend, identify cost leakages, or analyze purchasing patterns accurately.

Manual and Inefficient Procurement Processes

Heavy reliance on manual workflows for requisitions, approvals, and invoice processing increases administrative effort, delays purchases, and raises the risk of errors. These inefficiencies inflate transaction and processing costs over time.

Supplier Price Volatility

Fluctuating raw material prices, fuel costs, tariffs, and currency changes make procurement costs unpredictable. Without real-time data or flexible sourcing strategies, businesses find it challenging to manage sudden cost increases.

Maverick and Uncontrolled Spending

Purchases made outside approved procurement processes often lead to higher costs, poor contract compliance, and missed volume discounts. Uncontrolled spending also weakens governance and complicates budget tracking.

Poor Demand Forecasting and Planning

Inaccurate demand forecasts can result in overstocking or last-minute purchases at premium prices. Both scenarios increase procurement and inventory holding costs while reducing operational efficiency.

Limited Supplier Performance Insights

When supplier performance is not tracked consistently, issues such as poor quality, late deliveries, or non-compliance go unnoticed. These problems introduce hidden costs like rework, delays, and expedited sourcing.

Compliance and Regulatory Pressures

Managing procurement in regulated environments adds complexity and cost. Failure to meet internal policies, tax requirements, or industry regulations can result in penalties, audits, and reputational risk.

Resistance to Change and Technology Adoption

Even when cost-saving tools are available, resistance to process changes or slow adoption of procurement technology can prevent organizations from realizing full efficiency gains. This limits the ability to control costs in the long term.

Best Practices to Control and Optimize Procurement Costs

Controlling procurement costs is not just about negotiating lower prices. It requires end-to-end visibility, disciplined processes, and continuous control across the entire spend lifecycle.

The following best practices help procurement teams reduce waste, improve efficiency, and make more informed financial decisions while supporting long-term business goals.

Centralize Vendor and Contract Data

Maintaining all supplier information—contracts, pricing, quotes, renewal dates, and compliance documents—in a single system improves visibility and control. Centralized data eliminates duplication, simplifies vendor comparisons, and ensures that decisions are based on accurate and up-to-date information.

Automate Routine Procurement Activities

Manual purchase requests, approvals, and invoice processing increase cycle times and error rates. Automating these workflows reduces administrative costs, improves accuracy, and ensures that every transaction is recorded for compliance and audit readiness.

Negotiate Proactively, Not Reactively

Review contracts and pricing well before renewal dates. Early negotiations provide leverage, allow time for supplier benchmarking, and help avoid rushed renewals that lock businesses into unfavorable terms or higher costs.

Consolidate and Rationalize Suppliers

Managing too many suppliers increases complexity and limits negotiating power. Supplier consolidation enables volume discounts, simplifies contract management, reduces invoice processing costs, and strengthens relationships with high-performing vendors.

Track Actual Usage and Consumption

Regularly compare what is paid for against what is actually used, especially for SaaS tools, subscriptions, and recurring services. Usage-based insights help identify underutilized resources and eliminate unnecessary spending.

Standardize Procurement Processes

Consistent procurement workflows—such as standardized intake forms, approval rules, and vendor evaluation criteria—reduce variability and improve compliance. Standardization shortens procurement cycles, improves spend analysis, and enhances cost predictability.

Prioritize Cost Avoidance Over Cost Recovery

Preventing unnecessary spend is more effective than correcting it later. Scrutinize purchase requests, identify overlapping contracts, and align procurement decisions with business priorities to avoid waste before it occurs.

Conduct Regular Spend Analysis

Ongoing spend analysis helps identify cost drivers, maverick spending, and savings opportunities. Data-driven insights enable better sourcing decisions, improved category management, and continuous cost optimization.

Implement Category Management

Organizing procurement by category allows teams to leverage economies of scale, consolidate purchases, and develop targeted sourcing strategies. Category management improves supplier performance while reducing total procurement costs.

Run Quarterly Procurement Reviews

Instead of relying on annual reviews, conduct procurement assessments quarterly. Frequent reviews help track spending trends, adjust budgets, and renegotiate supplier terms early—keeping procurement strategies aligned with changing business needs.

By applying these best practices consistently, organizations can move beyond short-term cost cutting and build a structured, efficient, and value-driven procurement function that supports sustainable growth.

Business Outcomes of Effective Procurement Cost Management

Effective procurement cost management delivers benefits that extend well beyond short-term savings. When procurement costs are controlled strategically, businesses gain stronger financial discipline, operational resilience, and long-term competitive advantage.

Improved Profitability and Cost Efficiency

By managing total procurement costs rather than focusing only on purchase prices, organizations reduce waste, eliminate inefficiencies, and protect profit margins. Lower procurement costs directly improve operating margins and overall financial performance.

Stronger Cash Flow and Working Capital Control

Optimized procurement practices improve payment terms, inventory levels, and spend predictability. This results in healthier cash flow, better working capital utilization, and reduced reliance on short-term financing.

Better Budgeting and Forecast Accuracy

Clear visibility into procurement costs enables more accurate budgeting and forecasting. Businesses can anticipate cost fluctuations, plan for demand changes, and make informed financial decisions with greater confidence.

Increased Operational Agility

When procurement costs are well managed, organizations can respond faster to market changes, supplier disruptions, or demand shifts. Streamlined processes and reliable supplier relationships enhance business agility without driving up costs.

Reduced Risk and Improved Compliance

Effective cost controls strengthen governance across procurement activities. Improved supplier oversight, standardized processes, and audit-ready systems reduce compliance risks, penalties, and exposure to supply chain disruptions.

Stronger Supplier Relationships

Cost transparency and structured supplier management lead to more collaborative, long-term supplier partnerships. These relationships often result in better pricing, improved service levels, and shared efficiency gains.

Scalability and Sustainable Growth

A disciplined approach to procurement cost management allows businesses to scale operations without a proportional increase in procurement overhead. This creates a solid foundation for sustainable growth and long-term competitiveness.

By delivering these outcomes, effective procurement cost management transforms procurement from a cost center into a strategic driver of business value.

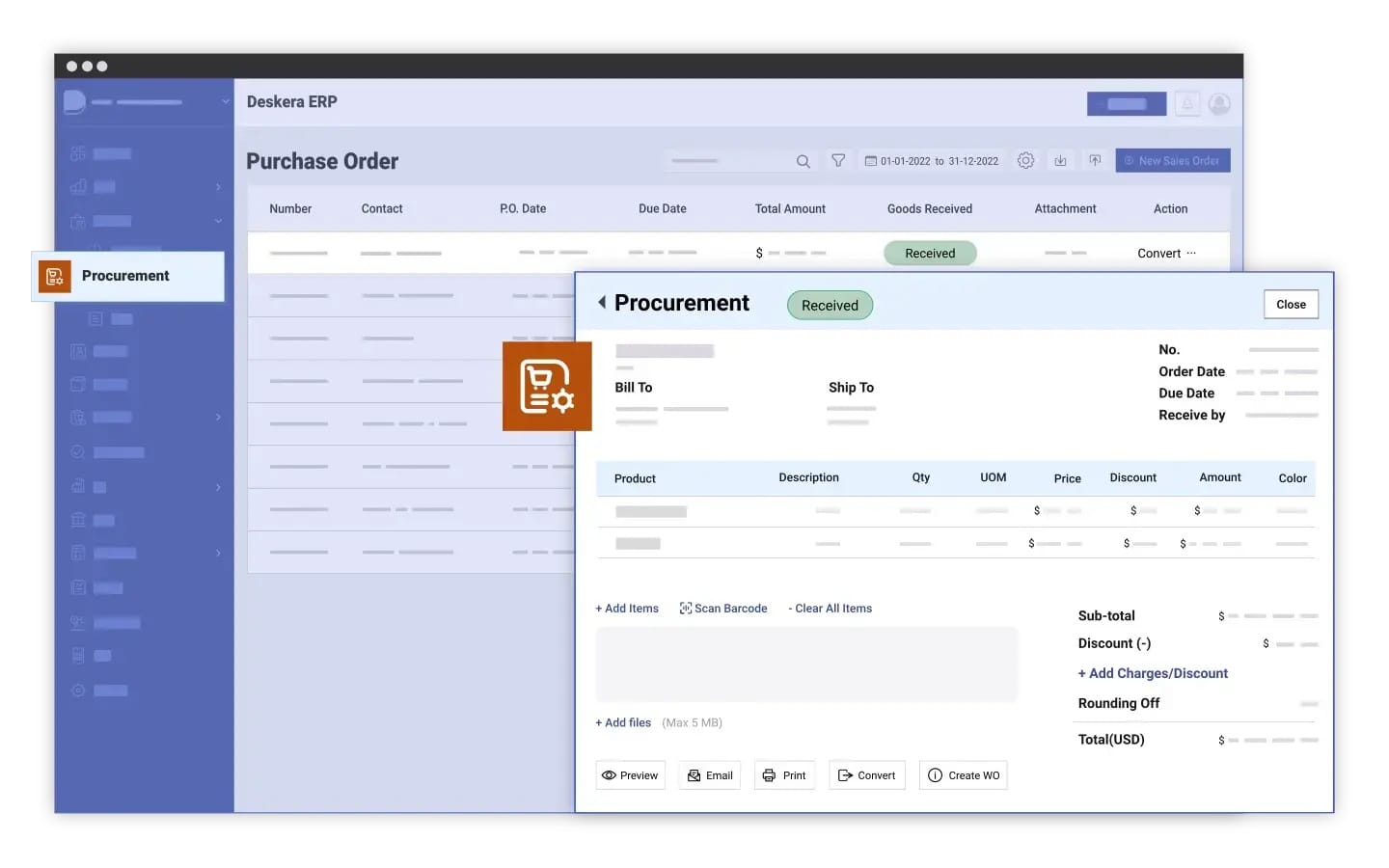

How Deskera ERP Helps You Manage Procurement Costs

Deskera ERP enables businesses to manage procurement costs more effectively by bringing visibility, control, and automation across the entire procurement lifecycle. Instead of managing spend through disconnected tools and manual processes, Deskera provides a unified platform that helps reduce cost leakages and improve decision-making.

Centralized Procurement and Spend Visibility

Deskera ERP consolidates all procurement data—purchase requests, purchase orders, supplier details, invoices, and payments—into a single system. This centralized view allows businesses to track total procurement spend in real time, identify cost overruns early, and eliminate duplicate or unapproved purchases.

Automated Purchase-to-Pay Workflows

With automated requisitions, approval workflows, and invoice processing, Deskera ERP reduces manual effort and processing costs. Standardized workflows ensure faster cycle times, fewer errors, and better compliance with procurement policies, lowering overall transaction costs.

Better Supplier and Contract Management

Deskera ERP helps manage supplier information, pricing, and performance in one place. Improved supplier visibility enables better negotiations, consistent pricing enforcement, and timely contract renewals—reducing contract leakage and supplier-related cost risks.

Improved Demand Planning and Inventory Control

By integrating procurement with inventory and sales data, Deskera ERP improves demand forecasting and purchase planning. This helps prevent overbuying, excess inventory, emergency purchases, and expedited shipping costs that often inflate procurement spend.

Real-Time Cost Tracking and Reporting

Deskera ERP provides real-time reports and dashboards that track procurement costs across categories, suppliers, and time periods. These insights help procurement and finance teams analyze cost drivers, monitor budgets, and take corrective action proactively.

Stronger Compliance and Audit Readiness

Built-in controls, approval hierarchies, and audit trails ensure that every procurement transaction follows defined policies. This reduces compliance-related risks, audit effort, and the financial impact of unauthorized or non-compliant spending.

Scalability and Cost Control as You Grow

As transaction volumes increase, Deskera ERP allows procurement operations to scale without increasing administrative overhead. Automated processes and centralized data help maintain cost efficiency even as the business expands.

By using Deskera ERP to manage procurement costs, businesses gain tighter control over spend, improved operational efficiency, and a structured foundation for long-term cost optimization and growth.

Key Takeaways

- Procurement costs go far beyond supplier prices and directly influence profitability, cash flow, and operational efficiency, making them a strategic business concern.

- Procurement costs include all direct, indirect, and operational expenses involved in sourcing, purchasing, managing suppliers, and processing transactions.

- A complete view of procurement costs requires accounting for direct, indirect, transactional, logistics, inventory, compliance, risk, and opportunity-related costs.

- Calculating Total Procurement Cost (TPC) provides a realistic picture of spend and helps measure efficiency through metrics like cost per unit, order, or invoice.

- Effective procurement cost management protects margins, strengthens cash flow, improves scalability, and supports long-term competitiveness.

- Limited visibility, manual processes, price volatility, maverick spending, and poor forecasting are key barriers to controlling procurement costs.

- Centralization, automation, supplier consolidation, proactive negotiation, spend analysis, and regular reviews are essential to reducing waste and improving control.

- Procurement technology enables real-time visibility, process automation, better supplier management, and data-driven cost optimization.

- Strong procurement cost control leads to improved profitability, better budgeting, reduced risk, stronger supplier relationships, and sustainable growth.

- Deskera ERP provides centralized visibility, automated workflows, real-time reporting, and integrated planning to help businesses control procurement costs end to end.

Related Articles