Data released by the Ministry of Statistics and Programme Implementation show that EPFO (Employees’ Provident Fund Organisation) has added 1.7 million new subscriber accounts in April 2022, a sharp jump of 41.6% compared to April 2021.

As a fact, the total number of EPFO accounts has been growing at a breakneck speed since 2018-19. For instance, while 61.12 lakh new subscribers opened PF accounts in 2018-19, the number grew to 77.08 lakh in 2020-21 and 1.22 crore in 2021-22.

Central Employer Registration is part of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 contains rules regarding the Employees’ Provident Fund in India. Employees Provident Fund is a flagship social legislation that aims to provide a lump sum amount after a certain period to all salaried professionals in India.

Central Employer Registration is a mandatory compliance form to be filled by all employers under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. This article explains Central Employer Registration and the rules governing it.

For convenient understanding, this article on Central Employer Registration has been divided into the following subsections:

- What is the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952?

- Which Organizations Come Under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952?

- Which Compliance Forms Are Mandatory as per the PF Act 1952?

- What is Central Employer Registration?

- Online Central Employer Registration Without DSC - The Process

- The DSC Registration Process

- Conclusion

- Key Takeaways

What is the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952?

The Employees’ Provident Funds and Miscellaneous Provisions Act 1952, of which the Central Employer Registration is a part, is a social legislation that aims to create a retirement corpus for salaried professionals working in Indian companies, establishments, factories, and organizations. It is a welfare scheme where the employer and the employees contribute some amount to the EPFO, which invests the amount in high-yield investment instruments.

Employees can withdraw money from their Provident Fund (PF) account after attaining the age of 58. However, employees can also withdraw the PF amount fully or partially if they remain unemployed for two months.

The Employees’ Provident Funds and Miscellaneous Provisions Act 1952, of which the Central Employer Registration is a part, states that the concerned employer must make all deposits to the employees’ PF accounts.

So, although both the employer and employees contribute to the PF, it is the employer’s responsibility to deposit the total amount with the EPFO. It is good to note that the interest gets credited to the employees’ account, not the employer’s.

Which Organizations Come Under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952?

The Employees’ Provident Funds and Miscellaneous Provisions Act 1952, of which the Central Employer Registration is a part, applies to, including but not limited to, the following types of organizations:

- Factories engaged in the production of cement, cigarettes, general/ mechanical/ electrical engineering products, paper, textiles, iron, steel, etc

- All factories/ industries engaged in the production of goods and materials mentioned in Schedule I (under Sections 2(i) and 4) of the Employees’ Provident Funds and Miscellaneous Provisions Act 1952

- All establishments engaged in tea plantation and production (except for tea plantations in Assam)

- Establishments engaged in iron ore, gold, manganese, or limestone mining

- Coffee curing establishments

- Establishments in the biscuit, bread, milk, and confectionary making industry

- Motor roads transport establishments

- Mica mines and industry

- Factories in the plywood industry

- Factories engaged in automobile repairing and servicing

- Cane farms owned by sugar companies

- Factories engaged in the milling of dal, flour, and rice

- Factories in the starch industry

- Hotels and restaurants

- Factories engaged in the drilling, exploration, prospecting, or production of natural gas or petroleum

- Factories engaged in the production of leather and leather products

Which Compliance Forms Are Mandatory as per the PF Act 1952?

According to the Employees’ Provident Funds and Miscellaneous Provisions Act 1952, all employers or establishments coming under the purview of the Act must fill out and submit the following compliance forms:

- Central Employer Registration

- ECR - Electronic Challan Cum Return

- Activate UAN (Universal Account Number)

- Form 5A - Return of ownership

- Form 11 - Declaration Form

- Form 13 - Transfer Claim Form

- Form 19 - Form to claim the dues by Member

- Form 20 - Form to claim the dues by the Nominee

- Form 10D - Application for monthly pension

What is Central Employer Registration?

Central Employer Registration is a mandatory registration form all employers of organizations coming under the purview of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 must fill out and submit to the concerned authority.

The concerned authority is usually the ‘Commissioner’ for Employees’ Provident Fund appointed under section 5D of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. The term ‘Commissioner’ may also be used to refer to a Deputy or Regional Provident Fund Commissioner.

Before 01.04.2012, the Central Employer Registration process was offline. However, from 01.04.2012, the Employees’ Provident Fund Organisation mandated that employers have to mandatorily register their factory/ establishment/organization online through the Online Registration of Establishments (OLRE) portal.

Employers willing to register their establishment or factory must visit the Online Registration of Establishments (OLRE) portal to fill out and submit the Central Employer Registration.

Please note that the Employees’ Provident Fund Organisation has set up a toll-free number (1800-118-005) for employers facing trouble generating a PF Code after submitting the Central Employer Registration through the online OLRE portal. The toll-free number remains operational between 9:45 AM and 5:45 PM on all working days.

Employers may also email ‘olre@epfindia.gov.in’ by clearly mentioning the problem.

Central Employer Registration form can be filled out and submitted online by employers belonging to the following categories:

- Establishments coming under the purview of the Employees’ Provident Funds and Miscellaneous Provisions Act 1952

- Establishments that do not come under the purview of the Employees’ Provident Funds and Miscellaneous Provisions Act 1952 but where the majority of employees show a preference for the Provident Fund system

- Establishments possessing a PF Code number but willing to get a different PF Code number for a separate branch; however, this is not mandatory and is usually done by employers for administrative convenience.

- Employers possessing a PF Code number do not have to fill out the Central Employer Registration form; however, they can fill up Form 5A through the Electronic Challan cum Return (ECR) login

According to the Employees’ Provident Funds and Miscellaneous Provisions Act 1952, possessing a PF Code, which comes after Central Employer Registration, is mandatory for employers before deducting any PF contribution from employees. Also, according to the revised guidelines issued by the Employees’ Provident Fund Organisation, all remittances made by employers must be done after creating a challan by visiting the EPFO’s Employer Portal.

A circular issued on 01.12.2015 by the Employees’ Provident Fund Organisation states that employers applying for Central Employer Registration must upload a Digitally Signed Document or Digital Signature Certificate (DSC) at the time of submitting the application. The DSC must be in the employer’s name.

It is also worth noting that the employer’s PAN (Permanent Account Number) will also get verified during the Central Employer Registration process.

After an employer completes the Central Employer Registration process, they are assigned the PF Code. After receiving the PF Code, the employer can remit the PF through Electronic Challan cum Return (ECR). Central Employer Registration also makes an employer eligible to use the E-return tools to generate the ECR files.

Online Central Employer Registration Without DSC - The Process

Follow the process mentioned below to complete the online Central Employer Registration without DSC:

- Open EPFO’s official website

- Click on ‘Our Services’ and ‘For Employers’

- Click on ‘Online Registration of Establishment (OLRE Portal)’

- You will be redirected to the Central Employer Registration home page

- Click on ‘Register’

- Log in if you have already registered

- In the Central Employer Registration form, enter details like the employer’s name, father’s name, PAN, date of birth, address, mobile number, email, user name, and question hint

- The portal will send you a PIN on your mobile number and an activation link on your email address

- You must type the PIN in the requisite box and click on the activation link.

- After finishing the Central Employer Registration process, you become eligible to log in to the OLRE portal to register your Digital Signature and get the DSC

- You can apply for the PF Code after registering your DSC; DSC is mandatory to submit fresh OLRE applications

The DSC Registration Process

After completing the Central Employer Registration process and obtaining the username and password, the employer must register their Digital Signature and generate the Digital Signature Certificate (DSC). Follow these steps to register the Digital Signature:

- Open EPFO’s official website

- Enter the username and password in the appropriate boxes

- Click on ‘DIGITAL CERTIFICATE’

- Click on ‘REGISTER CERTIFICATE’

- Enter the employer’s details

- The portal will auto-populate the employer’s name and mobile number. The mobile number cannot be edited. However, the employer’s name is editable. Click on ‘Next’ to select the DSC Type

- If you select the ‘USB Token’ option, you have to accept and run the pop-up window that appears

- Insert the DSC USB Token into the USB Port

- Click on ‘Select this certificate’

- Enter the DSC’s PIN details and click on ‘OK’

- Check the ‘View Digital Signature’ screen

- You can now click on the ‘Apply For Code’ tab in the menu bar and choose the ‘Fill Application Form’ to generate the PF Code

Conclusion

Central Employer Registration is a mandatory compliance form according to the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. Completing the Central Employer Registration process is crucial to generate the DSC and PF Code required to remit the PF dues on the EPFO portal.

How can Deskera Help You?

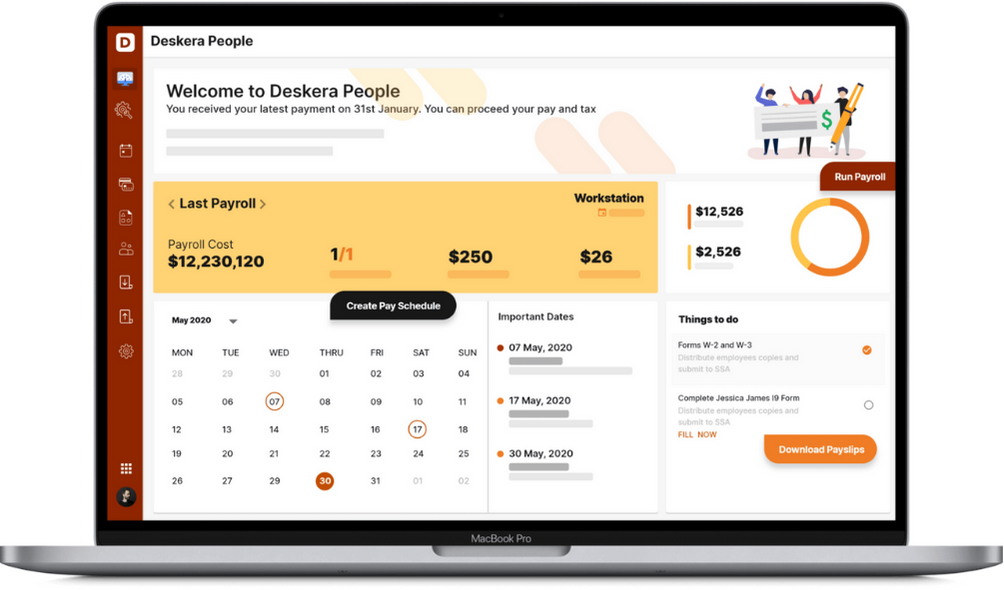

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. With features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning, and uploading expenses, and creating new leave types, it makes your work simple.

Key Takeaways

- Central Employer Registration is part of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952

- The Employees’ Provident Funds and Miscellaneous Provisions Act 1952, of which the Central Employer Registration is a part, is a social legislation that aims to create a retirement corpus for salaried professionals working in Indian companies, establishments, factories, and organizations

- Employers willing to register their establishment or factory need to visit the Online Registration of Establishments (OLRE) portal to fill out and submit the Central Employer Registration

- According to the Employees’ Provident Funds and Miscellaneous Provisions Act 1952, possessing a PF Code, which comes after Central Employer Registration, is mandatory for employers before deducting any PF contribution from employees

Related Articles