Have you ever wondered how businesses keep track of fluctuating inventory costs without getting lost in the numbers? The answer lies in a simple yet powerful accounting method known as the Moving Average Cost (MAC). This technique helps companies determine a consistent cost per unit of inventory, even when purchase prices keep changing. By averaging costs over time, MAC smooths out price volatility and provides a clear picture of overall inventory value.

In today’s dynamic market, where raw material prices and supply chain costs can fluctuate daily, accurate cost tracking isn’t just a financial requirement—it’s a strategic advantage. Using the moving average cost method, businesses can maintain a stable view of their cost of goods sold (COGS), improve pricing strategies, and make more informed profitability decisions. It also helps prevent sudden cost spikes from distorting profit margins or inventory valuations.

Understanding the concept of moving average cost is crucial for both accountants and operations managers. It bridges the gap between day-to-day inventory movement and long-term financial accuracy. Whether you’re managing retail stock, manufacturing components, or raw materials, the MAC method can simplify your accounting process while ensuring compliance with standard valuation practices.

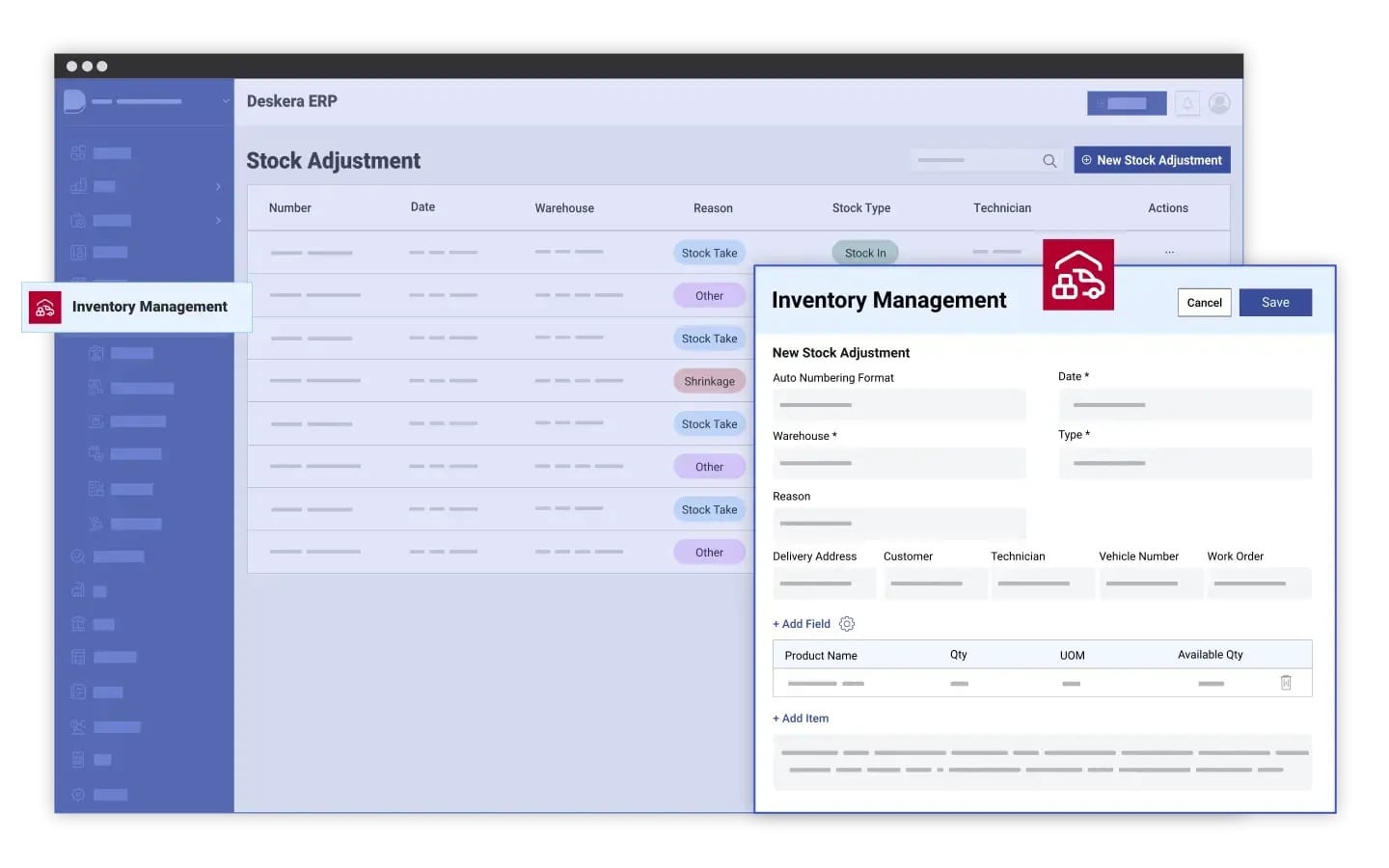

This is where Deskera ERP comes in. Deskera ERP automates the calculation of moving average costs, ensuring real-time accuracy and eliminating manual errors. Its integrated platform enables seamless tracking of inventory, procurement, and accounting data—all in one place. With AI assistant David, advanced reporting tools, and real-time analytics, Deskera helps businesses maintain transparency, control, and efficiency across every stage of inventory management.

What Are Moving Average Costs (MAC)?

The Moving Average Cost (MAC) is a widely used accounting method that determines the average cost of inventory items when their purchase prices vary over time. Instead of assigning each item its original purchase price, the MAC method calculates a weighted average cost that updates every time new inventory is added. This provides a consistent, real-time view of inventory valuation and helps businesses manage price fluctuations effectively.

In simpler terms, moving average cost gives you an up-to-date estimate of how much each unit in your inventory is worth—based on both past purchases and the latest ones. It’s especially useful for companies that buy goods or materials frequently at different prices, such as manufacturers, wholesalers, or retailers. By continually recalculating the average cost per unit, MAC ensures your inventory and cost of goods sold (COGS) always reflect current market realities.

This method acts as a middle ground between FIFO (First-In, First-Out) and LIFO (Last-In, First-Out). While FIFO values stock based on the earliest purchases and LIFO uses the most recent, MAC blends all costs to offer a stable and balanced view of inventory value. The approach smooths out the effects of price volatility and prevents sudden swings in reported profits.

The Moving Average Cost method is particularly effective in perpetual inventory systems, where businesses continuously track stock levels and values. When implemented through modern ERP systems like Deskera ERP, MAC calculations are automated in real time—ensuring that every new purchase instantly updates your cost records. This not only saves time but also enhances accuracy and transparency in your financial reporting.

Example: How Moving Average Cost (MAC) Works

Let’s look at how the Moving Average Cost (MAC) method is applied in a real-world scenario using the correct formula:

MAC = (Previous MAC × Previous Quantity + New Purchase Cost) ÷ Total Quantity

Step 1: Initial Purchase

A company purchases 200 units of a product at $8 per unit.

- Previous MAC = $8

- Previous Quantity = 200 units

- Inventory Value = 200 × $8 = $1,600

At this point, the average cost per unit is $8.

Step 2: New Purchase Added

The company then buys 100 more units at $10 per unit.

- New Purchase Cost = 100 × $10 = $1,000

- Total Quantity = 200 (old) + 100 (new) = 300 units

Now, apply the formula:

New MAC = (8 × 200 + 1,000) ÷ 300 = 2,600 ÷ 300 = 8.67

New Moving Average Cost = $8.67 per unit

Step 3: Recording Sales or Consumption

If the company now sells or consumes part of this inventory, say 60 units, each unit will be valued at the current MAC of $8.67.

- Cost of Goods Sold (COGS) = 60 × $8.67 = $520.20

- Remaining Inventory = 300 – 60 = 240 units

- Inventory Value Remaining = 240 × $8.67 = $2,080.80

This process continues every time new inventory is added. Each purchase recalculates the moving average cost by blending the existing stock’s value with the new purchase’s cost.

Using the MAC method helps businesses maintain a smooth, consistent cost per unit that reflects both historical and recent prices—reducing volatility in cost reporting and profit analysis.

When managed through Deskera ERP, this entire process is automated. The system automatically updates MAC in real time after each purchase, sale, or return—ensuring accurate inventory valuation, seamless integration with accounting, and reliable financial reporting without manual recalculations.

Difference Between Weighted and Moving Average Cost

When it comes to inventory costing, weighted average and moving average are similar in principle but differ in timing and system usage.

- Weighted Average Cost (WAC) is used in a periodic inventory system.

- Moving Average Cost (MAC) is used in a perpetual inventory system.

In simple terms:

- WAC = Average cost is calculated at the end of a period (e.g., month or quarter).

- MAC = Average cost is recalculated after every purchase or sale.

Weighted Average Cost Example (Periodic Inventory)

A company purchased:

- 100 units in January @ $10 each

- 50 units in February @ $12 each

- 75 units in March @ $14 each

Total units: 225

Total cost: $2,550

Weighted Average Cost per unit = Total cost / Total units = 2,550 / 225 = $11.33 per unit

If 197 units were sold over the 3 months, the remaining inventory would be:

225 - 197 = 28 units

Ending inventory value = 28 × 11.33 = $317.99

Moving Average Cost Example (Perpetual Inventory)

January

- Bought 100 units @ $10 = $1,000

- Sold 48 units → Remaining: (100 - 48) × 10 = $520

MAC after January: $10.00 (no change since one purchase price)

February

- Bought 50 units @ $13

- New MAC = (52 × 10 + 50 × 13) / 102 = $11.47 per unit

- Sold 95 units → (102 - 95) × 11.47 = $80.29

March

- Bought 75 units @ $12

- New MAC = (7 × 11.47 + 75 × 12) / 82 = $11.95 per unit

- Sold 54 units → (82 - 54) × 11.95 = $334.60

Key Difference

Both WAC and MAC calculate an average cost per unit, but MAC provides real-time accuracy, while WAC offers simplicity for businesses that update inventory periodically.

Moving Average Cost vs. Other Valuation Methods

When it comes to valuing inventory, the Moving Average Cost (MAC) method isn’t the only option. Businesses often choose between MAC, FIFO (First-In, First-Out), and LIFO (Last-In, First-Out)—each offering unique advantages depending on pricing trends, industry type, and financial goals.

Understanding how these methods differ is essential to ensure accurate financial reporting and informed decision-making.

1. Moving Average Cost (MAC)

The Moving Average Cost method calculates the average unit cost each time new inventory is purchased. This running average ensures that both the cost of goods sold (COGS) and remaining inventory reflect a balanced, up-to-date valuation. It’s ideal for companies facing frequent price fluctuations, such as those in retail, manufacturing, or wholesale. MAC smooths out price volatility and simplifies accounting since every unit carries the same cost after each recalculation.

Best for: Businesses with continuous inventory purchases and moderate price fluctuations.

Key benefit: Simplifies tracking by maintaining a stable average cost for all items in stock.

2. FIFO (First-In, First-Out)

The FIFO method assumes that the oldest inventory items are sold first. As a result, the ending inventory on the balance sheet reflects the most recent purchase prices. In times of rising prices, FIFO tends to show lower COGS and higher profits since older, cheaper inventory is sold first. However, this may also lead to higher tax liabilities due to inflated profit margins.

Best for: Businesses that want to reflect the current market value of inventory, such as food or pharmaceutical companies.

Key benefit: Produces inventory valuations that closely mirror current market prices.

3. LIFO (Last-In, First-Out)

The LIFO method works the opposite way—it assumes the most recently purchased items are sold first. This approach is often used in environments with rising costs, as it results in higher COGS and lower reported profits, which can reduce taxable income. However, LIFO can undervalue inventory on the balance sheet, as older stock remains recorded at outdated prices.

Best for: Businesses operating in inflationary markets (where prices consistently rise).

Key benefit: Helps reduce tax burden during periods of increasing costs.

4. Comparing the Three Methods

In summary, Moving Average Cost offers a middle ground between FIFO and LIFO. It avoids extreme variations in profits and valuations while maintaining a consistent cost flow that simplifies reporting.

For modern businesses using Deskera ERP, the MAC method is particularly efficient—Deskera’s automated inventory module recalculates average costs instantly with each transaction, ensuring real-time accuracy and compliance across your financial records.

When Should Businesses Use Moving Average Costs?

Choosing the right inventory valuation method can make a big difference in how accurately your business tracks costs and reports profits. The Moving Average Cost (MAC) method is ideal for companies that need real-time visibility into their inventory value and cost of goods sold. It works best in a perpetual inventory system, where every purchase and sale instantly updates inventory records.

Let’s look at the key scenarios when businesses should use the Moving Average Cost method.

1. High Transaction Volume

Businesses that deal with frequent buying and selling of inventory benefit greatly from MAC. Since the average cost updates automatically after every transaction, it ensures that both COGS (Cost of Goods Sold) and inventory valuations remain accurate throughout the accounting period.

2. Fluctuating Purchase Prices

When purchase prices vary often due to supplier costs or market conditions, MAC helps reflect the most current cost. Unlike methods that recalculate costs periodically, MAC adjusts instantly after each purchase, offering a more precise and timely reflection of inventory costs.

3. Continuous Inventory Tracking

For companies using ERP or real-time inventory management systems such as Deskera ERP, MAC is an excellent choice. It ensures that every sale or production order automatically uses the latest average cost per unit, reducing manual effort and improving accuracy.

4. Detailed Financial Reporting

Because MAC continually updates with each transaction, businesses gain up-to-date cost data for accurate reporting, forecasting, and profit analysis. This helps finance teams make better-informed decisions regarding pricing, budgeting, and inventory control.

5. Suitable for Manufacturing and Retail Sectors

Industries such as manufacturing, FMCG, and retail—where large quantities of goods move in and out daily—benefit most from MAC. It provides a reliable and dynamic approach to inventory costing, especially when materials and finished goods frequently fluctuate in price.

Use Moving Average Cost when your business:

- Operates on a perpetual inventory system

- Faces frequent price fluctuations

- Requires real-time cost visibility

- Relies on automated ERP tools for continuous inventory tracking

With solutions like Deskera ERP, businesses can easily automate MAC calculations, ensuring inventory values remain accurate and up-to-date for smooth financial management.

Advantages of Using Moving Average Cost

The Moving Average Cost (MAC) method is widely used in inventory accounting because it offers both simplicity and accuracy. By continuously updating inventory values after each purchase, MAC gives businesses a real-time view of their inventory costs—helping them make informed decisions about pricing, procurement, and profitability.

Let’s explore the key advantages of using the Moving Average Cost method.

1. Accurate Inventory Valuation

The MAC method ensures that inventory is valued based on the average cost of all units available, rather than relying on the oldest or newest purchase prices. This provides a more realistic and consistent reflection of the true cost of inventory. Accurate valuation is crucial for financial statements, cost of goods sold (COGS) reporting, and profit analysis.

2. Smoothing Over Price Fluctuations

Industries that experience frequent changes in raw material costs can benefit from MAC’s price-smoothing effect. By averaging costs over time, MAC reduces the impact of sudden price changes on inventory valuation. This leads to more stable financial reporting and prevents large swings in profit margins due to short-term price variations.

3. Mitigating Inflation or Deflation Effects

During periods of inflation or deflation, MAC helps businesses maintain a balanced view of inventory costs. It accounts for both past and recent purchase prices, minimizing the distortion caused by rising or falling prices. This makes it easier to track cost trends and understand the real impact of market conditions on profitability.

4. Simplicity and Ease of Implementation

One of MAC’s biggest advantages is its straightforward formula and application. It eliminates the need to track the cost of every individual purchase or batch, unlike FIFO or LIFO methods. This simplicity makes MAC easy to implement, understand, and automate—especially when integrated into ERP systems.

5. Real-Time Cost Visibility

Since MAC updates automatically with every purchase or sale, it offers real-time insight into inventory costs. Businesses can quickly assess how price changes affect margins and adjust pricing strategies or reorder plans accordingly. This is especially beneficial for companies using Deskera ERP, where real-time inventory tracking and cost recalculations are automated.

6. Enhanced Forecasting and Decision-Making

MAC supports better cost forecasting and financial planning. By understanding average costs over time, managers can predict future material expenses, set competitive product prices, and identify cost-saving opportunities. The consistent data MAC provides makes strategic decision-making more reliable.

7. Streamlined Costing for Large Inventories

For businesses managing hundreds or thousands of SKUs, MAC simplifies the otherwise complex task of assigning costs to each unit. By using one continuously updated average cost per item, companies can avoid manual cost tracking and significantly reduce accounting errors in high-volume inventory environments.

8. Supports Perpetual Inventory Systems

The MAC method integrates seamlessly with perpetual inventory systems, where inventory records are updated in real-time. Each purchase, sale, or adjustment automatically recalculates the average cost, ensuring that financial data remains accurate and synchronized across purchasing, production, and sales departments.

9. Improved Profit Margin Analysis

With continuous cost updates, businesses gain a clearer picture of true profit margins. MAC enables companies to analyze margins based on the most recent costs rather than outdated prices, helping them identify underperforming products and adjust pricing or purchasing strategies quickly.

10. Reduction in Accounting Complexity

Unlike FIFO or LIFO, which require tracking individual batches and layers, MAC uses a single average cost that applies to all units in stock. This reduces the complexity of calculations, simplifies reconciliation, and minimizes the potential for discrepancies during audits or inventory reviews.

11. Compatibility with ERP and Accounting Software

Modern ERP solutions such as Deskera ERP make it easy to automate MAC calculations. This compatibility not only saves time but also ensures data consistency across financial statements, cost of goods sold, and production reports—without manual intervention or the risk of human error.

12. Better Cash Flow Planning

Since MAC provides a realistic and stable view of inventory value, it helps businesses forecast cash flow requirements more accurately. Companies can better plan for upcoming purchases, production costs, and seasonal demands, maintaining a healthier balance between working capital and inventory levels.

13. Facilitates Compliance and Reporting

Because MAC provides consistent and auditable cost data, it helps businesses comply with accounting standards (like GAAP or IFRS) that require transparent and defensible inventory valuation methods. This makes it easier to prepare reliable financial statements and pass external audits with confidence.

The Moving Average Cost method combines accuracy, stability, and simplicity—making it ideal for modern businesses that manage large, fluctuating inventories. With ERP tools like Deskera ERP, companies can automate MAC calculations, gain real-time cost insights, and ensure that every financial decision is backed by precise, up-to-date data.

Limitations of Moving Average Cost

While the Moving Average Cost (MAC) method offers simplicity and real-time inventory valuation, it’s not without its challenges. Because it constantly updates with every purchase and sale, the average cost per unit can fluctuate frequently—sometimes leading to inaccuracies if not properly managed.

Let’s look at the key limitations businesses should consider before fully adopting the MAC approach.

1. Constantly Changing Figures

One major drawback of MAC is that the cost per unit continually changes with each transaction. While this dynamic nature provides up-to-date data, it can also make financial reporting more complex. Sudden changes in supplier pricing or unusual purchase costs can cause significant variations in the moving average, making it harder to compare financial performance across periods.

2. Potential for Inaccurate Pricing

Because MAC directly affects product costing, any temporary price fluctuation—for example, during supply shortages or seasonal demand—can skew the calculated average. This can lead to inaccurate product pricing if selling prices are automatically tied to inventory costs. Businesses may unintentionally overprice or underprice products, affecting competitiveness and profit margins.

3. Skewed Material Valuation

Fluctuations in purchase costs can also impact material valuation. If one unusually high or low purchase influences the moving average, it may not reflect the true ongoing cost of materials. As a result, inventory valuation and profitability analysis could become distorted, especially in volatile markets.

4. Limited Historical Insight

The MAC method emphasizes current costs and doesn’t retain historical cost layers, unlike FIFO or LIFO methods. This lack of historical tracking can make it difficult to analyze cost trends or understand how past purchase prices have evolved over time—important information for long-term planning and cost control.

5. Not Ideal for Highly Volatile Markets

For industries where raw material prices change dramatically and frequently, MAC can produce unstable or misleading averages. Since the method continuously recalculates costs, short-term price spikes can distort valuations, resulting in unpredictable COGS (Cost of Goods Sold) and financial statements.

6. Manual Adjustments May Be Required

Although MAC is automated in most ERP systems, manual intervention might be needed during periods of market disruption or irregular purchases. Businesses must occasionally override system-calculated averages to prevent distorted valuations—adding extra work and potential for human error if not managed carefully.

7. Complexity in Multi-location or Multi-currency Operations

For businesses operating across multiple warehouses or countries, maintaining a single moving average cost can be challenging. Differences in freight costs, currency exchange rates, and local taxes can create inconsistencies in valuation, making it difficult to achieve a unified financial picture.

The Moving Average Cost method provides efficiency and accuracy in stable environments, but it requires careful oversight in volatile markets. To overcome these limitations, businesses can use ERP systems like Deskera ERP, which automate MAC calculations, adjust for irregularities, and offer audit trails to ensure transparency and consistency across all inventory locations.

How to Implement Moving Average Cost in Your Business

Implementing the Moving Average Cost (MAC) method can significantly enhance how your business manages inventory valuation and cost control. However, successful adoption requires proper setup, consistent tracking, and the right technology to automate calculations.

Here’s a step-by-step guide to implementing MAC effectively in your organization.

1. Assess Your Business Needs

Before implementing MAC, determine whether it aligns with your inventory operations. If your business experiences frequent inventory movements, fluctuating material costs, or operates under a perpetual inventory system, the MAC method is an ideal fit. However, for businesses with limited transactions or periodic accounting, a weighted average approach might be more suitable.

2. Choose the Right Inventory System

The MAC method requires real-time updates to calculate accurate costs after every purchase or sale. That’s why it’s best implemented with a perpetual inventory system, where stock levels and costs are automatically adjusted. Manual spreadsheets can introduce errors and inconsistencies, so investing in reliable inventory management or ERP software is essential for accuracy and efficiency.

3. Establish a Standard Calculation Method

Set clear internal guidelines on how the MAC formula will be applied:

Formula: MAC = (Previous MAC × Previous Quantity + New Purchase Cost) ÷ Total Quantity

Ensure that all team members involved in inventory management understand how to apply this formula consistently. Regular training and documentation help maintain uniformity across departments.

4. Integrate with ERP or Inventory Management Software

Automating MAC calculations reduces human error and ensures real-time cost accuracy. With advanced ERP platforms like Deskera ERP, the system automatically recalculates the moving average after each transaction—purchase, sale, or return. Deskera also integrates purchasing, sales, and accounting data, ensuring that your COGS, balance sheets, and inventory reports always reflect the latest costs.

5. Maintain Accurate and Timely Data Entry

Since MAC depends heavily on real-time data, every inventory movement must be recorded accurately and promptly. Encourage your team to update purchases, returns, adjustments, and sales without delay. Even small errors or missing entries can lead to incorrect average costs, impacting financial reporting and decision-making.

6. Regularly Review and Reconcile Inventory

Periodic reviews ensure that your MAC calculations remain accurate. Conduct inventory audits, compare system records against physical stock, and reconcile discrepancies. This helps verify that your moving average values align with actual market conditions and supplier prices.

7. Monitor Cost Trends and Adjust Pricing Strategies

After implementation, use the MAC data to gain insights into cost trends and profitability. If average costs rise consistently, you may need to review pricing strategies or negotiate better supplier rates. Deskera ERP’s built-in analytics and dashboards make it easy to monitor cost movements and make informed business decisions.

Implementing the Moving Average Cost method isn’t just about applying a formula—it’s about creating a systematic, technology-driven approach to inventory valuation. With Deskera ERP, businesses can automate MAC tracking, ensure continuous accuracy, and gain the visibility they need to make data-driven pricing, purchasing, and production decisions.

Common Mistakes to Avoid When Using Moving Average Cost

While the Moving Average Cost (MAC) method simplifies inventory valuation and enhances cost accuracy, it can still lead to errors if not implemented or maintained correctly. Many businesses make small mistakes that eventually distort their inventory value, cost of goods sold (COGS), or pricing strategy.

Here are some of the most common mistakes to avoid when using the Moving Average Cost method.

1. Ignoring Timely Data Updates

The MAC method depends on real-time inventory updates. If purchases, sales, or returns aren’t recorded immediately, the calculated average cost becomes outdated and inaccurate. Delayed entries can lead to incorrect COGS, flawed profit margins, and unreliable financial reports. Using an automated system like Deskera ERP helps eliminate this issue by ensuring all transactions update instantly.

2. Mixing Up Costing Methods

Some businesses accidentally combine MAC with other valuation methods like FIFO or Weighted Average Cost (WAC). Switching between methods without a consistent approach can cause discrepancies in inventory valuation and confusion in accounting records. Always ensure that your business uses a single costing method consistently across all departments and accounting periods.

3. Failing to Reconcile Inventory Regularly

Without regular reconciliation between physical stock and system records, the moving average cost may not reflect true inventory levels. This mismatch can result in overstated or understated costs. Performing periodic inventory audits ensures your system’s MAC values align with actual stock on hand.

4. Overlooking Price Fluctuations and Abnormal Purchases

The MAC formula equally considers all purchases, including unusually high or low prices. If your business makes a one-time bulk purchase at a much higher cost, it can skew the moving average and distort valuations. Monitor for such irregularities and, when necessary, adjust manually or use ERP alerts (like those in Deskera ERP) to flag abnormal pricing changes.

5. Using Manual Calculations or Spreadsheets

Relying on manual calculations in spreadsheets increases the risk of human error. Even small formula mistakes can significantly impact your moving average costs over time. Implementing an automated ERP system ensures that every purchase and sale automatically recalculates the MAC with precision and consistency.

6. Not Accounting for Multi-Location or Multi-Currency Complexities

For businesses operating across multiple warehouses or countries, failing to account for freight, exchange rates, and local taxes can lead to inaccurate average cost calculations. Deskera ERP solves this challenge by automatically consolidating costs across locations and currencies, ensuring a unified and accurate cost view.

7. Ignoring the Impact on Pricing and Profit Margins

Since MAC directly influences product pricing and gross margins, not reviewing cost trends regularly can lead to poor pricing decisions. If costs rise gradually but prices remain unchanged, profitability suffers. Regularly analyze MAC data and use insights from your ERP dashboards to adjust prices strategically.

Avoiding these common mistakes is crucial for maintaining accurate and reliable inventory valuations under the Moving Average Cost method. By automating calculations, maintaining timely updates, and integrating all operations through Deskera ERP, businesses can ensure that their moving average costs remain precise—supporting better financial control and smarter decision-making.

How Deskera ERP Simplifies Moving Average Costing

Implementing the Moving Average Cost (MAC) method manually can be challenging, especially for businesses managing high transaction volumes or multiple inventory locations. That’s where Deskera ERP steps in — offering a comprehensive, automated solution to simplify and streamline the entire costing process.

Deskera ERP is designed to help businesses maintain accurate inventory valuation, eliminate manual errors, and provide real-time visibility into cost movements. Here’s how it simplifies moving average costing across your operations.

1. Automated Cost Calculations

With Deskera ERP, you don’t have to manually recalculate the moving average every time a new purchase or sale occurs. The system automatically updates the average cost per unit after every inventory transaction — whether it’s a purchase, return, or adjustment. This ensures that your COGS and inventory values always reflect the latest and most accurate cost data.

2. Real-Time Inventory Valuation

Deskera’s real-time inventory tracking allows businesses to instantly view updated stock levels and cost valuations across warehouses or locations. Every movement in or out of inventory triggers an immediate recalculation of the moving average cost, helping finance and operations teams make quick, informed decisions without waiting for end-of-period updates.

3. Seamless Integration with Accounting and Sales

Deskera ERP connects your inventory, sales, and accounting modules, ensuring that every transaction is recorded accurately across all departments. When inventory costs change, those updates flow automatically into your financial statements, balance sheets, and profit and loss reports — keeping your books precise and audit-ready at all times.

4. Simplified Multi-Location and Multi-Currency Management

For businesses operating in multiple warehouses or countries, Deskera ERP makes moving average costing effortless. It handles multi-location inventory tracking and multi-currency transactions, automatically converting and updating costs based on exchange rates and local taxes. This unified system prevents valuation discrepancies and maintains global financial consistency.

5. Data Accuracy and Auditability

Deskera ensures that all cost calculations are transparent and traceable. Its detailed transaction logs provide a clear audit trail showing when and how average costs were updated — a key requirement for compliance with accounting standards like GAAP and IFRS.

6. Actionable Insights and Cost Analysis

Deskera ERP comes with built-in reporting and analytics dashboards that allow you to visualize trends in material costs, monitor cost fluctuations, and identify opportunities for savings. With accurate MAC data, managers can forecast inventory costs, adjust pricing strategies, and enhance profitability with confidence.

7. AI-Driven Assistance with “David”

Deskera’s intelligent assistant, David, further simplifies costing management. It can help users generate reports, analyze cost trends, and even notify you of unusual price fluctuations or changes in your moving average costs — saving time and improving decision-making.

By automating calculations, ensuring data consistency, and providing real-time cost visibility, Deskera ERP eliminates the complexities of managing moving average costing manually. With its integrated modules, intelligent insights, and AI-driven support, Deskera empowers businesses to maintain accurate inventory valuations and make smarter, faster financial decisions.

Key Takeaways

- The Moving Average Cost method helps businesses maintain stable and consistent inventory valuations by recalculating the average cost of items after every purchase, reducing the impact of price volatility.

- The MAC is calculated by dividing the total cost of goods available for sale by the total number of units available. Each new purchase automatically updates this average, ensuring real-time accuracy in cost tracking.

- Businesses that experience frequent price fluctuations or maintain continuous inventory updates—such as manufacturers, wholesalers, and retailers—benefit most from this method’s accuracy and stability.

- MAC smoothens cost fluctuations, simplifies accounting, ensures consistent pricing, and provides accurate cost data for decision-making—making it ideal for dynamic inventory environments.

- The MAC method may lead to inaccuracies during extreme market fluctuations, abnormal purchase prices, or supply chain disruptions, requiring manual adjustments for accuracy.

- Implementing MAC effectively involves using integrated ERP systems, maintaining timely transaction updates, and regularly reviewing cost trends to ensure accurate financial reporting.

- Avoid mixing costing methods, delaying data updates, ignoring price anomalies, or relying on manual calculations. Automation through ERP systems like Deskera ensures accuracy and consistency.

- Deskera ERP automates MAC calculations, tracks inventory movements in real time, and provides detailed cost analysis—eliminating manual errors and simplifying valuation across multiple warehouses.

Related Articles