To earn a dollar, you need to spend one! Says the Matching Principle.

With businesses across the globe relying on this concept, they must also figure out a way to report and record it. In other words, they need to apply the matching principle of accounting, which says that to generate revenue, businesses have to incur expenses.

The article will take you through the various other components of the matching principle to make it more straightforward. Here we go:

- What is the Matching Principle?

- How Does the Matching Principle Work in Accounting?

- What is Revenue Recognition?

- Benefits of Matching Principle?

- Challenges in Matching Principle?

- Matching Principle Example

What is the Matching Principle?

Being a part of GAAP - Generally Accepted Accounting Principles, the matching principle determines the causal relationship between spending and earnings. Expenses incurred for business operations (business expenses) must be accounted for in the same period as revenue derived from those operations. It acknowledges that to earn revenue, businesses must spend money.

Businesses adjust the balance sheet using the matching principle, which sets forth how and when adjustments are made. This fact is the fundamental of Accrual accounting which uses the matching principle. If there is no causal link between the expense and future revenue, it may be recorded immediately without adjusting entries.

How Does the Matching Principle Work in Accounting?

The matching principle is designed to maintain balance and consistency across the financial statements (income statements and balance sheets). To put it simply, it works like this:

- The income statement records expenses at the same time as related revenues are earned

- The balance sheet shows liabilities at the end of the accounting period

- It is best to report expenses that are not directly related to revenues in the same period during which they are incurred

It is sometimes difficult to determine where expenses result in revenue when recognized early or late. A distorted financial statement could mislead investors about the financial health of an organization. This implies that if expenses are recognized too early can reduce net income. Likewise, if you discover it too late, it will reduce your net income.

The matching principle applies a combination of accrual accounting as well as the concept of revenue recognition. This brings us to understand the concept of revenue recognition.

What is Revenue Recognition?

Simply put, revenue recognition implies the earning of revenue by a business. When a company has received the payment in their account, it is called revenue recognition.

In cash basis accounting, revenue is recognized when the money is received in the business's bank account, irrespective of when the goods or services were sold. In accrual accounting, the revenue is recognized even before the cash has been received by the business.

Revenue Recognition Principle

The revenue recognition principle states that the businesses recognize and record revenue when it is earned irrespective of when they receive the payment. Consequently, the company does not have to wait for the payment from the clients to record and recognize the revenue.

Benefits of Matching Principle?

Accrual accounting uses the matching principle to illustrate a company's operations more accurately on its income statement. On the other hand, income statements need to be clear and uniform, instead of clumped and inconsistent. This aspect lets the investors get a better idea about how the business has been performing. Investing in businesses based on these metrics will provide investors with a better sense of their economic performance. Therefore, matching the two sides becomes significant.

However, it is essential to analyze the cash flow statement along with the income statement. There are times when the companies report more significant accounts payable obligation later on; which is why the investors need to closely assess the timings of the cash flows and the cash balance with the business.

Benefits of the matching principle can be stated as follows:

- All the financial statements including balance sheets, income statements show consistency

- The depreciation cost can easily be dispensed over time

- Reduces errors while reporting profits

- Offers more apparent accuracy while presenting the organization’s economic position

Challenges/ Limitations in Matching Principle

There are instances where the matching principle may not be the best choice. The companies that adopt the accrual method of accounting may not want to apply the matching principle. Here are the reasons why they may do so:

- They may find it more challenging to apply the principle as there is no cause-and-effect relationship between the expenses and revenue

- The principle may not work well of the revenue is spread out across a period of time

Despite having stated the limitations of the matching principle, we must say that such instances are rare. The essential purpose of the matching principle is to balance out the two sides- expenses and revenue, and depict a precise picture of the financial health of the company.

Matching Principle Example

Let’s assume that in 2015, Company ABC generated $2,000,000 in revenue.

They purchased $1,000,000 worth of inventory in 2015, of which $100,000 remained on hand at the end of the year.

In the income statement, the cost of sales should be shown as:

$1,000,000 - $100,000 = $900,000

In 2015, the company should have earned $1,100,000 in gross profit:

$2,000,000 - $900,000 = $1,100,000

You should only deduct the amount of expenses in a period that correspond to the revenue earned during that period. In light of the fact that $100,000 worth of inventory will be sold next period, they shouldn't be deducted from revenue for the current period.

How can Deskera Help You?

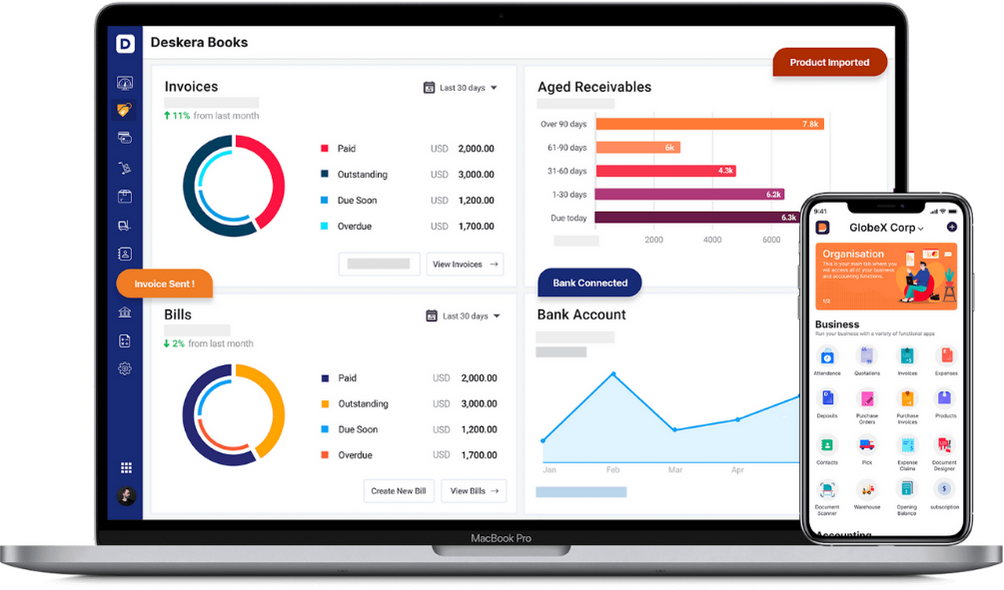

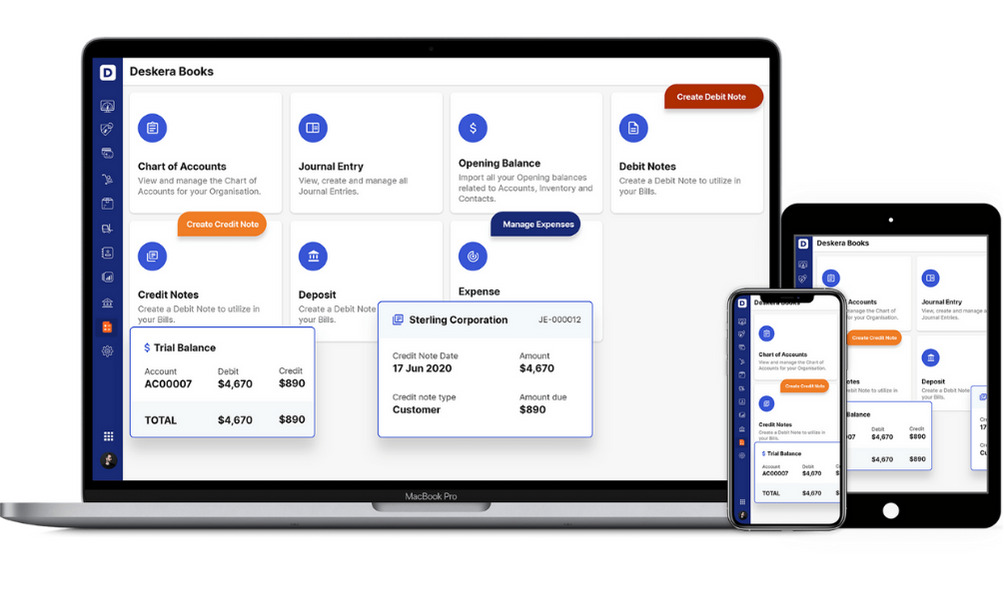

Deskera Books simplifies accounting for you and enables easy handling of online accounting and invoicing applications. With the tool, you can now access all your financial documents in one place, including invoices, expenses, and all your contacts.

If yours is a startup, then this platform is certain to impress you with its excellent enterprise features. Now, you can save your effort and time, and focus on the core aspects of your business rather than handling the mundane tasks.

Deskera also offers out-of-the-box templates that tend to uncomplicate your job with well-designed features. There are templates you can use to create quotes, purchase orders, back orders, bills, and payment receipts.

Dropshipping business owners can now expect to relax a bit with the platform making it convenient for them to create drop ship orders based on customer orders.

Another tool from Deskera is Deskera People that aims to expedite your regular tasks. Tasks like hiring, payroll, leaves, attendance, etc. are now a breeze owing to the tool.

Key Takeaways

Here are key points that we have learned from the article:

- The matching principle determines the causal relationship between spending and earnings

- Expenses incurred for business operations must be accounted for in the same period as revenue derived from those operations

- It acknowledges that to earn revenue, businesses must spend money

- When a company has received the payment in its account, it is called revenue recognition

- Consistent financial statements, reduced errors, better accuracy are some of the benefits of the matching principle

Related Articles