25 percent of your employee's disposable earnings (meaning, earnings after legally required deductions like payroll taxes, workers' compensation, or unemployment compensation premiums) can be garnished. Garnishments can usually be deducted from salaries without breaking minimum wage laws.

Involuntary Payroll Deductions include garnishments. The concept of involuntary deductions will be thoroughly demonstrated in this article. Here's what we shall cover:

• How Does Payroll Deductions Work?

• Involuntary payroll deductions

• What are voluntary deductions?

• Calculation of Involuntary Deductions According to the Earnings Configuration

• Are Payroll Deductions Before or After Tax?

Payroll Deduction

Payroll deduction is the process of withholding various sums from an employee's income for a variety of purposes such as retirement funds, tax payments, and so on. Deductions may be required or optional.

• Withholding varied amounts from an employee's paycheck to pay for taxes and employee welfare contributions is known as payroll deduction. Deductions might be voluntary or mandatory.

• Garnishment, state-local taxes, federal taxes, FICA tax, and other involuntary deductions might be pre-tax or post-tax, and they make up the difference between Gross and Net pay.

How Does Payroll Deductions Work?

Payroll deductions are used by employers to pay for tax liabilities deriving from an employee's salary. Medical taxes, social security taxes, and other taxes may be due.

The remaining portion of payroll deductions corresponds to employer contributions to employee welfare plans such as 401(k) retirement plans, pension plans, savings plans, healthcare plans, and other voluntary contributions.

Payroll deductions tables and online calculators are useful for accuracy and convenience of calculation. Payroll deduction tables are frequently used by employers to determine the exact values for federal tax and other deductions. Deductions for voluntary and involuntary deductions are made from gross compensation to arrive at net pay.

To achieve the same result, follow the instructions below.

• Pre-tax contributions to voluntary benefits such as health insurance, life insurance, and retirement plans will be deducted from gross pay.

• Medicare and Social Security taxes are withheld at 7.65% of adjusted gross salary. The company's Social Security rate is 6.2 percent, and the Medicare tax deduction has increased by 1.45 percent to 7.65 percent.

• Up to the maximum deduction, deduct.09 percent for supplementary Medicare tax.

• Deduct federal income tax using the IRS tax tables for that year and the employee's Form W-4.

• Based on the tax applicable to the individual state, deduct state and local taxes.

• Retirement plans, Roth IRA contributions, and other post-tax obligations must be subtracted from net pay garnishments.

If wages are garnished, the maximum deduction will be the lesser of:

• 25% of disposable income, or

• The amount by which the income exceeds 30 times the federal minimum wage.

Employees occasionally use an online payroll deductions calculator to figure out how their employer arrived at their net pay amount.

Involuntary payroll deductions

Involuntary payroll deductions are legal, illegal deductions from an employee's paycheck. Employers are obligated by law to withhold and remit certain sums to a state or federal agency. Failure to do so may result in fines and penalties.

Involuntary deductions are mandatory payroll deductions that employers must make and report to the IRS. The involuntary deductions are as follows:

• Federal, state, and local income taxes, as well as FICA;

• Child Support Orders

• Bankruptcy Proceedings

• Taxation levies

• Garnishments

Employers are obligated by federal and/or state law to take money from employees' paychecks and submit the money to various government agencies or authorities to pay off certain types of debts. Employees are not given the option to opt out of these deductions; rather, they are mandated by law.

Those made to satisfy debts for federal taxes, child support, creditor garnishments, bankruptcy orders, student loan garnishments, and federal agency loan garnishments are examples of involuntary deductions. To avoid substantial penalties for noncompliance, employers must be well-versed in all facets of these types of directives.

Federal, state, and local income taxes, as well as FICA;

Federal Insurance Contribution Act Deductions (FICA)

Each pay period, deductions for Social Security contributions are made based on a percentage of an individual's wage specified by the federal government. On behalf of the individual, the university also contributes an equal amount to FICA. Medicare contributions are deducted from each pay period and are based on a percentage of an individual's wage decided by the federal government.

On behalf of the individual, the university also contributes an equal amount to Medicare. Most employees and companies are required to pay FICA taxes under the Federal Insurance Contributions Act (FICA). These deductions are used to help pay for Social Security and Medicare.

The Social Security Tax benefits retirees and the disabled in particular. Paying social security taxes increases your credit for benefits.

FICA tax contributions are equal for both employers and employees. FICA is deducted from an employee's paycheck at a rate of 7.65 percent, with 6.2 percent going to the Social Security tax and 1.45 percent to the Medicare tax.

Federal Income Tax Withholding

Each pay period, federal income tax withholding deductions are made. The amount is determined by the individual's salary and the exemptions claimed on his or her federal tax form W-4.

Failure to submit a Form W-4 to the payroll office will result in the IRS withholding the maximum amount allowed by law. In each pay period, the wage bracket method or the percentage method are the two federal income tax withholding techniques. You can find them in IRS Publication 15-T.

Child Support Orders

The state's child support division may force non-custodial parents to pay a percentage of their income in child support. The state's mandate, which may vary from state to state, is used to compute child support payments.

Furthermore, we use the term 'income' loosely because one state's child support percentage may be calculated on gross income (income before deductions), while another state's child support percentage may be calculated on net income (income after deductions). Commission or part-time job may or may not be considered by states.

Maximum percentage of states that can apply are the Consumer Credit Protection Act mandates that states take no more than half of an employee's disposable (after-tax) income if the individual supports a spouse and/or other child. The maximum is 60% if the employee is not supporting another spouse or child.

In the enforcement of child support withholding orders imposed against noncustodial parents, HR and payroll departments play a critical role.

In recent years, increased government efforts to collect unpaid child support have compelled employers to comply with a greater number of child support withholding orders in less time. In order to be compliant, HR and payroll professionals must be well-versed in a complicated mix of federal and state laws, rules, and processes.

Orders of Bankruptcy

Individual bankruptcies are divided into two categories: Chapter 7 and Chapter 13. In Chapter 7 bankruptcy, the debtor relinquishes all rights to most of his or her property and assets, as well as the obligation to repay creditors. Because payroll deductions are not necessary, payroll professionals are usually unaware that an employee has filed Chapter 7.

The individual agrees to repay all or part of their debt in a Chapter 13 bankruptcy. As a result, the bankruptcy judge has the authority to order a percentage or fixed cash amount of payroll deduction from an employee's net or gross salary. These are the most typical involuntary payroll deductions she encounters.

If an employee files for bankruptcy, the employer will almost certainly receive a court order directing the employer to deduct specified amounts from the employee's salary in order to meet the order. Most, but not all, other forms of garnishment orders must be put on hold immediately until the bankruptcy order is satisfied.

Tax Levies

Almost everyone in the United States owes taxes. When you don't pay, the taxing authority has the authority to levy your paycheck. State and federal taxes are the two sorts of levies.

State levies differ from one another. Because the Consumer Credit Protection Act does not prescribe a ceiling, most states allow the taxation agency to collect the employee's net wages. Payroll professionals will receive Form 668-W, which helps determine the employee's take-home pay, and Form 668-D, which shows how long the levy will persist, when it comes to federal levies.

Employers must cooperate with federal tax levies imposed by the Internal Revenue Service (IRS) on employees who fail to pay their taxes.

The employer must immediately begin withholding from the employee's salary and remit the withholding to the IRS in accordance with the levy order. To ensure compliance and avoid substantial employer fines, specific procedures must be followed when handling an order.

Garnishments

If an employee is subject to a court-ordered creditor garnishment to pay off a debt, the employer must take the appropriate amount from the employee's earnings.

When there are several garnishments against one employee, employers must know how to compute withholding, the order of priority, and when to obey state law. Wage garnishments are a type of forced deduction that includes the following items.

1. IRS levies

2. Child Support and Alimony

3. State Tax Levies

4. Student Loan Garnishments

5. Garnishment by Creditors

If the employee has overdue bills, wage garnishments will be made. A court order or government agency directives will provide more information to the employer about this deduction.

Garnishments mandated by law

Garnishments are the term for legally compelled compulsory deductions. Unpaid taxes, child support orders, creditors, bankruptcy orders, and unpaid college loans may all be demanded. In general, an involuntary deduction amount is deducted from a person's disposable income.

Individuals' disposable earnings are estimated by subtracting mandatory tax deductions and other voluntary deductions, such as retirement, from their gross earnings. The amount of wages that can be garnished is limited by law. According to federal and state regulations, the payroll office is responsible for assessing the amount and priority of garnishments.

Without going to court, federal government agencies can issue garnishment withholding orders against the wages of individuals who have failed to pay a non-tax debt owed to the agency.

The statute, like other types of involuntary withholding with which businesses must comply, sets a limit on how much can be withheld to satisfy such orders and forbids discrimination against employees who are subject to such orders.

When an employer receives a federal agency debt garnishment order, unlike other sorts of orders, the withholding limitations vary if an employee is already subject to certain other forms of withholding orders.

Garnishment Disputes

When a court or government agency issues a garnishment order, the university is required to comply with the order and withhold and remit the amount asked, up to the maximum amount allowed by law.

The university may not stop withholding until it obtains a new order from a court or government agency, or until it has fully satisfied the original order. If the garnishment is challenged in court and overturned, the employee should request that a revised order be given to the payroll office.

Garnishment Notification to Employees

Almost always, the employee has been advised by the court or a government agency of a pending garnishment.

Some garnishment orders require the university to notify the employee that the garnishment order has been received, while others do not. The payroll office follows all legal regulations and notifies the employee when necessary.

Garnishments on student loans

If an employee has fallen behind on loan payments, the employer may be obligated to deduct from the employee's earnings according to one or more student loan garnishments. The statute, like other types of forced withholding orders, sets a limit on how much can be withheld and bans the employer from discriminating against the employee.

What are voluntary deductions?

Payroll deductions that an employee has elected to have taken out of their salary are known as voluntary deductions.

These can include, as illustrated in the example paycheck below:

• Pre-tax contributions and deductions such retirement funds, health insurance, and commuting benefits.

• Post-Tax Deductions and Contributions, such as charity contributions, post-tax retirement accounts, such as an ROTH 401(k), and contributions to 529 college savings programs

Employers and employees must comply with complicated withholding and filing rules, so it's advisable to work with a CPA or payroll provider to ensure your payroll deductions are handled correctly.

This is not intended to be tax advice. Consult a CPA or tax professional for specific advice, as tax rules change over time and vary by location and industry.

Calculation of Involuntary Deductions According to the Earnings Configuration

You specify how to handle and pay it during the Earnings element definition. Involuntary deductions are calculated differently depending on the settings you specify.

Settings that Affect the Deduction Processing in the Payroll Run

You can customize how the payroll run processes and pays your Earnings components using the element template. What you choose here may have an impact on how the payroll system handles any connected involuntary deductions.

Are Payroll Deductions Before or After Tax?

Post-tax deductions are deductions made from employee paychecks after tax deductions have been made. They lower net compensation while not lowering the overall tax burden.

• Post-tax deductions may be available for garnishments, Roth IRA retirement plans, disability insurance, union dues, and charity gifts.

• Pre-tax deductions are deductions made from employee paychecks before tax deductions. Because they are not included in gross salary, they lower the overall tax burden.

• Pre-tax deductions may be available for medical and dental benefits, 401(k) retirement plans (for federal and most state income taxes), transportation, health insurance, and group-term life insurance.

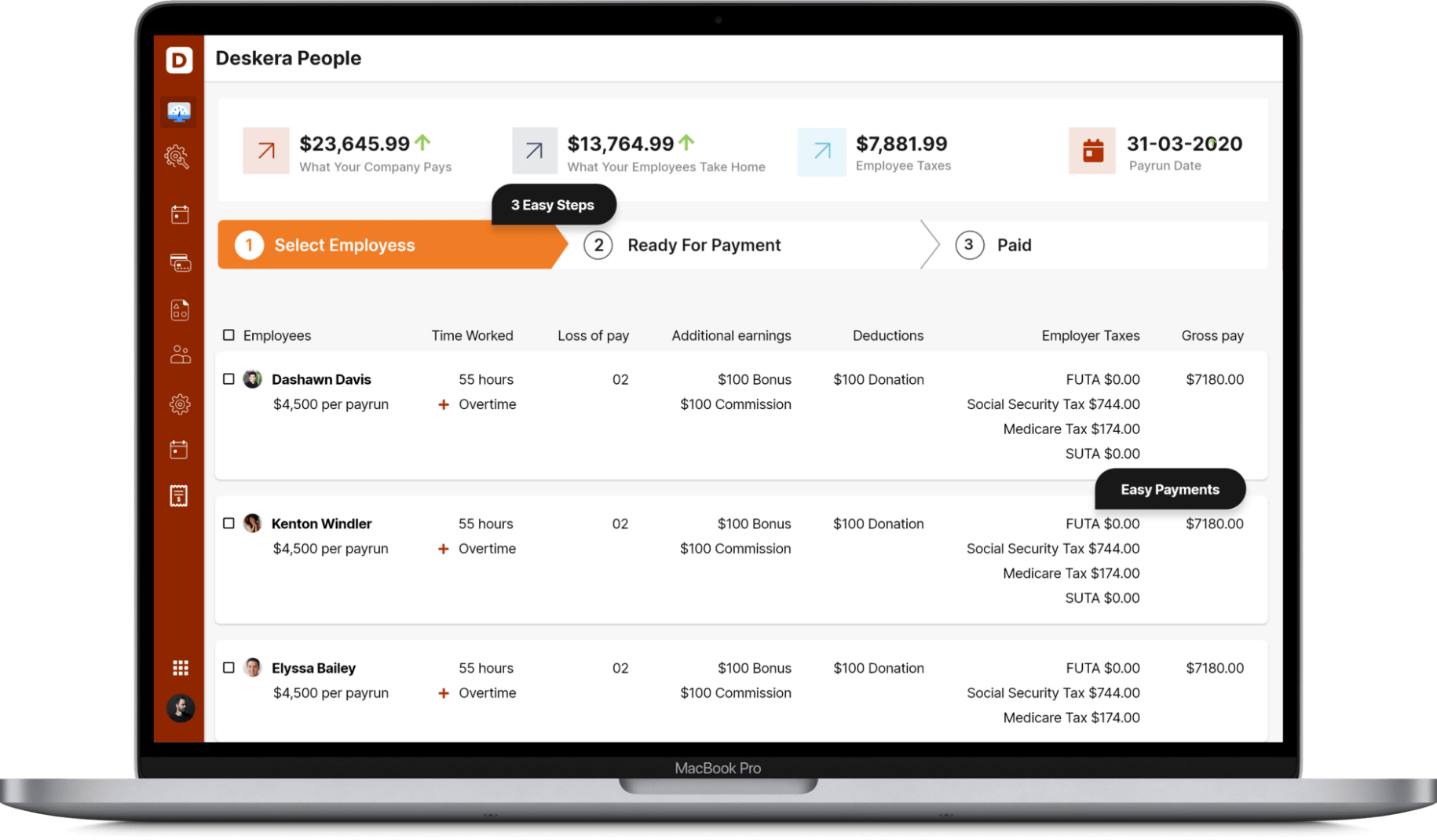

How Deskera Can help You?

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key takeaways

- Both the employer and the employee have no influence over involuntary deductions. By law, the employer must deduct a specific amount from the employee's wages and return it to a person or government agency to repay the obligation.

- Employers make several different forms of payroll deductions from employees' earnings, in addition to the mandated deductions for federal, state, and local taxes.

- The information on W-4 and the employee's gross pay are used to calculate the mandatory payroll deductions for federal income tax. The income tax withholding tables in IRS Publication 15-T can be used to compute the amount withheld from an employee's paycheck.

- Employees with inquiries about deductions for employee benefits such as health insurance and dental insurance can contact the Office of Human Resources. Please contact the payroll office with any questions about FICA, Medicare, state and federal income taxes, or legally imposed garnishments.

Related articles