Employees can utilize the IRS Withholding Calculator to guarantee accurate federal income tax withholding. Form W-4 is a crucial form that lets you access information about your tax withholding.

It is vital for influencing your take-home salary, refund, and the due tax amount.

The IRS W-4 calculator assists you in determining the suggested withholding amount as well as any additional withholding that should be reported on your W-4 form. You must understand the relevance of Form W-4 and its purpose in the process of tax withholding.

This article crisply sums up the information you need about W-4 and your tax withholding calculator. Here is what more we shall learn:

- What is Form W-4?

- Importance of Form W-4

- What is IRS W-4 Calculator?

- Tax Withholding for Individuals

- Tax Withholding for Employers/Small Businesses

- Tax Withholding for Foreign Persons

- When not to use the IRS W-4 Calculator?

- When should you check your tax Withholding?

- Why should you check your tax Withholding?

- FAQs

- How can Deskera Help You?

- Key Takeaways

What is Form W-4?

Employees utilize the W-4 form, also known as the Employee's Withholding Certificate, to advise employers how much tax to withhold from each paycheck. Employers utilize the W-4 to calculate and remit certain payroll taxes on behalf of employees to the IRS and the state.

If you already have submitted a W-4 form to your company, you do not need to fill out the new one. Furthermore, you don't have to fill out a new W-4 each year, either. However, it is required when you start a new job or wish to change your withholdings at an existing position; you'll almost certainly need to complete a new W-4. In any case, it's a legitimate reason to go over your withholdings.

Importance of Form W-4

The importance of a W-4 form lies in figuring out how much federal income tax should be withheld from an employee's paycheck. Employees can fill out the form using the tables and worksheets. The employee's FIT (Federal Income Tax) withholding is then calculated using the form.

Be mindful of using the correct and updated tax tables in IRS Publication 15-T to figure out how much FIT to deduct from an employee's pay. Determine the employee's withholding amount using information from the employee's W-4 form and IRS tax tables.

What is IRS W-4 Calculator?

The Tax Withholding Estimator will allow you to determine if you need to modify your withholding with your employers by comparing that estimate to your present tax withholding.

The amount of federal income tax deducted from an employee's paycheck is referred to as withholding. The amount withheld by your employer from your regular pay is determined by two factors:

- The sum of your earnings

- The information given by you on Form W-4 to your employer

Tax Withholding for Individuals

Employees or individuals know that there is a part of their income that is kept away by the employers for deductions. Apart from the income, their bonuses, commissions, and pensions are also subject to taxation.

How does the IRS W-4 Calculator Work?

When you sit down to calculate your withholdings on an IRS W-4 calculator, these are the steps you will come across:

- Spend 5 to 10 minutes completing a short questionnaire about your personal and professional background

- Submit all the paystubs from all your jobs

- Previous year’s tax returns

- Information about your salary for the remaining year

- Deduction information for the current year

- Information about any additional income you may receive

The IRS W-4 calculator helps you with the following:

- Calculate the amount of federal income tax you'll be withholding

- See how the amount withheld affects your refund, take-home pay, or tax liability

- Choose an amount for projected withholding that works for you

This is to say that after you have used the calculator and arrived at a certain number, you can check and verify if it applies to your situation. The information you enter determines the accuracy of the results, so ensure that the data you enter is correct.

You will need to be ready with the following set of documents:

- Paychecks from every job, including those of your spouse

- Information regarding all the other sources of income such as side jobs, self-employment, investments, and so on

- Last year's or the most recent tax return

Tax Withholding for Employers/Small Businesses

Small businesses or employers can take support of the Income Tax Withholding Assistant. It is a spreadsheet that can assist businesses in determining how much federal income tax to withhold from their employee's paychecks. It will aid you in the transition to the new Form W-4 beginning in 2020 and forward.

If the employers regularly use Publication 15-T to calculate their employees' income tax withholding, using the Income Tax Withholding Assistant can be immensely beneficial. However, if the employers have deployed an automatic payroll system, they don't need to use the Assistant.

A crucial point here is that after 2022, the Income Tax Withholding Assistant will no longer be available. So, it is recommended that employers educate themselves on using the spreadsheets and tables in Publications 15-T.

How to use the Tax Withholding Assistant?

The Tax Withholding Assistant can help you arrive at the values by computing your employees’ tax withholding for 2022. Once your employees have filled and submitted the W-4 forms, you may use the values for calculating the withholdings.

The Assistant works well for the older and newer versions/formats of the W-4 form (there has been a change in the form in 2020).

Let’s check the steps involved while using the Assistant:

- Indicate how often you will be paying your employee

- Indicate which version of Form W-4 the employee should use (before 2020 or after the change)

- Obtain information from the employee’s W-4 form and fill in the blanks with the requested information

- Make a copy of the spreadsheet. Then save it with the name of the employee

- Open each employee's Tax Withholding Assistant spreadsheet for each pay period and input the wage or salary amount for that pay period. The spreadsheet will then show you how much federal income tax you should withhold

Tax Withholding for Foreign Persons

A foreign person's income from the United States is subject to a 30% tax in the United States. The tax is usually withheld from the payment given to the foreign individual (nonresident Alien withholding).

Here is the detailed information on the tax withholding for foreign persons:

Withholding on Payments of U.S. Source Income to Foreign Persons Under IRC 1441 to 1443 (Form 1042)

A foreign person's income from the United States is subject to a 30% tax in the United States. If an Internal Revenue Code section offers a lower rate, or if the foreign person's country of residency and the United States has a tax treaty, a reduced rate may be applicable. The tax is deducted from the payment given to the foreign individual in most cases (NRA withholding).

The expression NRA withholding is used in this context to describe withholding required under Internal Revenue Code sections 1441, 1442, and 1443. In general, NRA withholding refers to the 30% withholding requirement on payments of U.S. source income, as well as the submission of Form 1042 and Form 1042-S. The NRA may withhold payments to all foreign parties, including nonresident alien individuals, foreign companies, and governments.

Speaking of NRA here does not involve withholding occurring under the Internal Revenue Code section 1445 or 1446 or 1446(f). However, it does include FATCA or the Foreign Account Tax Declaration Act provisions under the codes 1471 to 1474.

When not to use the IRS W-4 Calculator?

There are certain scenarios in which the IRS W-4 tool may not be useful. Let’s discuss those scenarios:

- You receive a pension but do not have a job

- Your citizenship status is a nonresident alien

- You have a complicated tax situation

You receive a pension but do not have a job

Form W-4P is used by U.S. citizens, resident aliens, or their estates who receive pensions, annuities, or other deferred compensation to inform payers of the correct amount of federal income tax to withhold.

In this case, you will be estimating your withholding with the help of the new Form W-4P. The form is for withholding certificates for pensions or annuity payments.

Your citizenship status is a nonresident alien

In the case you hold the nonresident alien status, then you will need Notice 1392, which offers insight into the instructions for the nonresident aliens. It is called the Supplemental Form W-4 Instructions for Nonresident Aliens.

You have a complicated tax situation

Having a complicated tax scenario may include long-term capital gains, alternative minimum tax, or qualified dividends. You can take help from Publication 505 for Tax withholding and estimated tax. This book describes the two techniques for paying federal income tax on a pay-as-you-go basis: withholding and estimated tax.

When should you Check your tax Withholding?

You must check your tax withholding every year. However, this is especially important if you have undergone a major change in your life. Your major life changes could be any of the mentioned here:

- New occupation or job

- Major income change

- Marriage

- Purchasing a home

- Birth in the family or adopting a kid

Furthermore, if your tax withholding changes mid-year, then you must check your tax withholding at the end of the year and make adjustments in accordance with the new W-4.

Why should you Check your tax Withholding?

Check your withholding for a variety of reasons, including the following:

- It can safeguard you from having too little tax withheld and being surprised with a tax bill or penalty next year.

- It may be possible to adjust your tax withholding in advance, resulting in a larger paycheck and a lower refund at tax time.

FAQs

In this section, we shall be moving through the tax withholding calculator FAQs.

Q: What has changed in the new W-4 form?

A: Earlier, the employers withheld less from employees' paychecks if they claimed additional withholding allowances. Employees could claim allowances on their W-4 form previously to reduce the amount of federal income tax taken from their paychecks. The IRS changed the W-4 form as a result of the 2017 Tax Cuts and Jobs Act.

The new W-4, which became effective in 2020, still requires primary biographical information but no longer includes a list of allowances. Employees must now claim dependents or use a deductions worksheet if they want to reduce their tax withholding.

Q: What impact does your W-4 have on your take-home pay?

A: Your employer receives IRS Form W-4 and fills it out, so they know how much tax to withhold from your paycheck. Your W-4 can affect your take-home pay in one of two ways. If you desire a larger refund or a lower sum due at tax time, you'll have more tax withheld from your paycheck and have less take-home pay. You'll have less withheld in case of a higher paycheck, but you'll get a smaller refund or owe more amount at tax time.

Q: Is it essential for me to complete a new W-4?

A: The new revised Form W-4 makes calculating your withholding easier, especially if you have several jobs, the child tax credit, or other tax benefits. Therefore, withholding is calculated based on your filing status and the standard deduction for the year when you use the revised Form W-4.

Q: What is the best way to fill out my W-4?

A: The W-4 calculator will help you figure out if you'll get a refund or owe money at tax time. The W-4 calculator indicates how to fill out your W-4 after you're satisfied with your expected outcome. Changes to your W-4 may take a few weeks to appear on your paycheck, depending on your employer.

Q: How can I update my W-4 to get a tax refund?

A: It's vital to remember that receiving a tax refund implies you paid too much federal income to the IRS during the year.

You can use the W-4 withholding calculator to figure out how to alter your withholdings. The simplest approach to get a higher refund is to change your W-4 to have even more money deducted from your paycheck. Your refund will be larger if your take-home income is lower. It is, nevertheless, possible to maximize your paycheck while still receiving a tax refund.

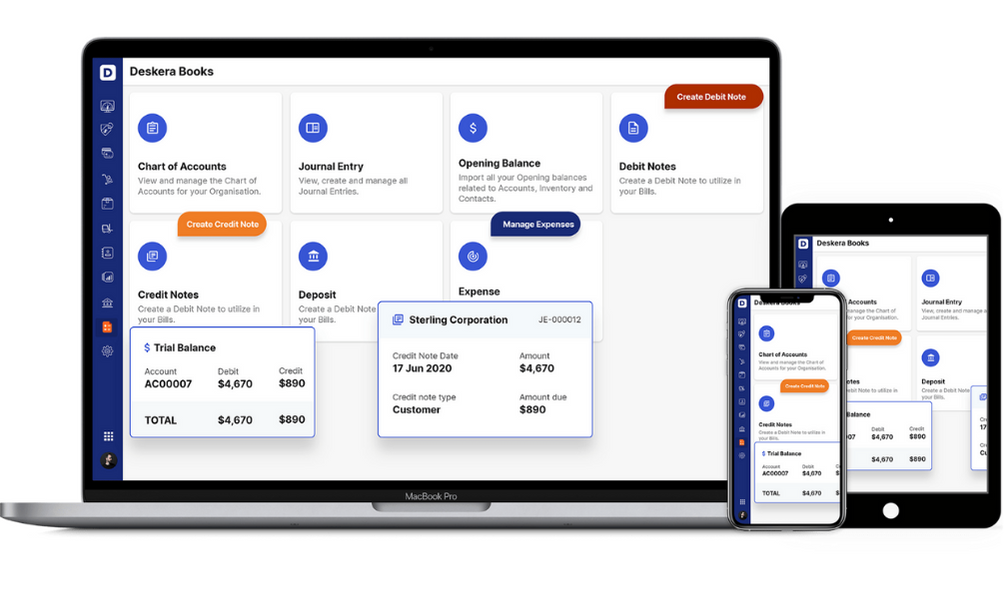

How can Deskera Help You?

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

Points to be noted from the article are as follows:

- Employees can utilize the IRS Withholding Calculator to guarantee accurate federal income tax withholding. Form W-4 is a crucial form that lets you access information about your tax withholding

- Employees utilize the W-4 form, originally known as the Employee's Withholding Certificate, to advise employers how much tax to withhold from each paycheck

- The objective of a W-4 form is to figure out how much federal income tax should be withheld from an employee's paycheck

- The amount of federal income tax deducted from an employee's paycheck is referred to as withholding. The amount withheld by your employer from your regular pay is determined by two factors: the sum of your earnings and the information you provide on Form W-4 to your employer

- While calculating tax withholding, the first step is to spend approximately 10 minutes answering certain questions regarding income and some personal questions

- Submit all paystubs, previous year’s tax returns, information about your salary for the remaining year, deduction information for the current year, information about any additional income you may receive are some of the other information you will need to provide

- IRS W-4 calculator helps you see how the amount withheld affects your refund, take-home pay, or tax liability

- It also helps you choose an amount for projected withholding that works for you

- You do not require to use the W-4 calculator if you receive a pension but do not have a job OR your citizenship status is a nonresident alien, OR you have a complicated tax situation

- You must check your tax withholding every year or when you have had a major life change such as marriage, childbirth, adoption, and so on

- Checking your tax withholding can safeguard you from having too little tax withheld and being surprised with a tax bill or penalty next year

- The new W-4, which became effective in 2020, still requires primary biographical information but no longer includes a list of allowances. Employees must now claim dependents or use a deductions worksheet if they want to reduce their tax withholding

- The new revised Form W-4 makes calculating your withholding easier, especially if you have several jobs, the child tax credit, or other tax benefits

- Your W-4 can affect your take-home pay in one of two ways. If you desire a larger refund or a lower sum due at tax time, you'll have more tax withheld from your paycheck and have less take-home pay. You'll have less withheld in case of a higher paycheck, but you'll get a smaller refund or owe more amount at tax time

- The simplest approach to get a higher refund is to change your W-4 to have even more money deducted from your paycheck. Your refund will be larger if your take-home income is lower

Related Articles