The minimum wage in the Indian state of Haryana has been increased to ensure that workers in the state are provided with a fair wage for the work they do. This increase in the minimum wage is a victory for the working people of Haryana and will help to ensure a more equitable society for all.

Haryana, one of the wealthier states in India, has revised the minimum wage policy that has garnered attention and discussion among workers, businesses, and policymakers alike. The new policy, which came into effect on July 1, 2022, aims to improve the standard of living of workers by ensuring they receive fair wages for their labor.

This post breaks down the details and attempts to present it in a clear manner. Here is what we shall learn from this post:

- What is a Minimum Wage?

- Importance of Minimum Wages for Workers

- What is Haryana Minimum Wages Rules of 1950?

- What is the Minimum Wage Act of 1948?

- Haryana Minimum Wage Rates 2022

- Impact of Minimum Wages on Workers' Standard of Living, Employment, and Productivity

- Conclusion

- How can Deskera Help You?

- Key Takeaways

- Related Articles

What is a Minimum Wage?

Wages are defined in section 2 of the Minimum Wage Act as remuneration that can be expressed in monetary terms. Wages are specified for all government employees working at the federal and state levels.

However, as a special allowance in addition to the minimum payment, the wages cover the house rent allowance. The following allowances are not included as minimum wages under the Minimum Wage Act:

- The cost of living in a house, including utilities such as electricity and water.

- Contribution to a retirement or provident fund

- Value of any other amenities not specifically mentioned in the government order

- Payable of Gratuity on Discharge

- Special expenses incurred as a result of the nature of the job

Therefore, everything listed above—aside from the housing allowance—is excluded from minimum wages.

In other words, we can say that the government's minimum rate of wages for scheduled employments is as follows:

- The basic wage and housing allowance may vary depending on the cost of living index.

- The basic wage rate, with or without a house rent allowance, is determined by the employee's cost of living index number.

- All-inclusive rates for the basic wage with cost of living allowances and cash value of concessional material supply

Importance of Minimum Wages for Workers

Minimum wages are an important tool used by the government to protect vulnerable workers in India. Minimum wages set a legal floor on the wages paid to workers and ensure that wages are sufficient to meet basic needs. Minimum wages are also important in reducing wage inequality and helping to protect the most vulnerable workers.

Minimum wages also help to promote economic growth by increasing consumer demand and by making sure that workers have enough money to spend on goods and services. Furthermore, minimum wages can boost productivity by providing an incentive for employers to invest in better technology and training, as well as providing better working conditions for their employees.

Finally, minimum wages can help to reduce the gender pay gap by ensuring that workers are paid fairly for their work regardless of their gender.

What is Haryana Minimum Wages Rules of 1950?

Haryana adheres to the Punjab Minimum Wage Rules of 1950. The Minimum Wage Act of 1948 establishes minimum wage rates for certain occupations listed in the schedule. For the effective administration and monitoring of the Minimum Wages Act, 1948, the Punjab Government enacted the Punjab Minimum Wages Rules, 1950.

The rules include six chapters and twelve forms.

Chapter 1: Preliminary

1. Short title and extent:

- The Rules will be termed as the Punjab Minimum Wages Rules 1950.

- These will apply to the whole state of Haryana.

2. Interpretation

Interpretation - Unless the context requires otherwise, in these rules:

(a) "Act" refers to the Minimum Wage Act of 1948;

(b) 2 [x x x x]

(c) 'Authority' refers to the authority appointed under sub-section (l) of section 20;

(d) 'Board' refers to the Advisory Board appointed under section 7; and

(e) 'Chairman' refers to the Chairman of the Advisory Boards 3 [or] the Committee or sub-committee 4 [x x x x] or the Advisory Sub-Committee appointed under section 9;

(f) The term "Committee" refers to a Committee appointed under clause (a) of subsection (1) of section 5 and includes a sub-committee appointed under that section.

(ff) A 'day' is a 24-hour period beginning at midnight.

(g) 'form' refers to a form added to these rules.

(h) 'Inspector' refers to a person appointed as an Inspector under section 19;

(i)'registered trade union' refers to a trade union registered under the Indian Trade Unions Act, 1926;

(j)'section' refers to a section of the Act; and

(k) all other words and expressions used in this section but not defined shall have the meaning assigned to them by the Act.

Chapter 2: Membership, meetings and Staff of the Board and Committee

3. [Term of office of the Committee members] -

The term of office of the members of the Committee 3 [x x x] shall be such as the State Government considers necessary for completing the investigation into the employment in question, and the State Government may fix such terms at the time of the Committee 4 [x x x] and may, from time to time, extend it as circumstances require.

4. Board members' terms of office -

(1) Except as otherwise expressly provided in these rules, the term of office of a non-member of the Board shall be two years beginning on the date of his appointment: provided, however, that such member shall continue to hold office until his successor is nominated, notwithstanding the expiry of the said period of two years.

(2) A member of the Board who is nominated to fill a casual vacancy serves for the remainder of the term of the member in whose place he is nominated.

(3) The members of the Board serve at the pleasure of the State Government.

[5. Travel Allowance -

A member of the Committee or the Board is entitled to travel allowance and daily allowance at the rates set by the Government from time to time for any journey performed in connection with his duties as such member.]

6. Staff -

(1) The State Government may appoint a Secretary to the Board's Committee 1 [x x x x] and such other staff as it deems necessary, as well as fix the salaries and allowances payable to them and specify their terms of service.

(2) (i) The Secretary is the Chief Executive Officer of the Committee 2 [x x x x] or the Board, whichever is applicable. He may attend meetings of such Committee, 3 [x x x x x] or Board, but he may not vote at such meetings.

(ii) The Secretary shall assist the Chairman in convening meetings, keep minutes of such meetings, and take all necessary actions to carry out the decision of the Committee; 4 [x x x x x] or the Board, as the case may be.

7. Eligibility for renomination of members of the Committee [x x x x] and the Board -

An outgoing member shall be eligible for renomiantion for the membership of the committee, [xx x x], or the Board, of which he was a member.

8. Resignation of the Chairman and members of the Committee and the Board, as well as filling of casual vacancies -

(1) A member of the Committee or the Board other than the Chairman may resign his membership by giving written notice to the Chairman.

(2) The Chairman may resign in writing to the State Government.

(3) When a vacancy occurs or is likely to occur in the membership of the Committee, [x x x x x] or the Board, the Chairman must immediately notify the Government. The government will then take action to fill the vacancy.

9. Membership cessation and restoration -

(1) If a member of the Board's Committee 1 [x x xx] fails to attend three consecutive meetings, he shall, subject to the provisions of sub-rule (2), cease to be a member thereof.

(2) A person who ceases to be a member in accordance with sub-rule (1) shall be notified of such cessation by a letter sent to him by registered post within fifteen days of the date of such cessation. The letter states that if he wishes to have his hill members and ship restored, he must apply within thirty days of receiving the letter. If an application for restoration of membership is received within the specified time frame, it will be considered by Committee 2 [x x x x] or the Board, and if a majority of members present at the next meeting is satisfied that the reasons for failure to attend three consecutive meetings are adequate, the members will be restored to membership immediately after a resolution to that effect is adopted.

10. Disqualification -

(1) A person is disqualified from being nominated for and serving on the Committee 3.

[x x x x x] or the Board, as the case may be: I if he is declared to be of unsound mind by a competent court; (ii) if he is an undischarged insolvent; or (iii) if he has been convicted of a moral turpitude offence before or after the commencement of the Act.

(2) If there is any doubt as to whether a disqualification has been incurred under subrule (1), the decision of the State Government is final.

11. Meetings -

Subject to the provisions of Rule 12, the Chairman may call a meeting of the Committee, or the Board, as the case may be, at any time he sees fit:- Provided, however, that on a requisition in writing from not less than one-half of the members, the Chairman shall call a meeting within fifteen days of receipt of such requisition.

12. Meeting notice -

The Chairman shall fix the date, time, and place of each meeting, and a notice in writing containing the aforesaid particulars, as well as a list of business to be conducted at the meeting, shall be sent to each member by registered post at least fifteen days before the date fixed for such meeting:- Provided, however, that in the case of an emergent meeting, only seven days notice may be given to every member.

13. Chairman -

(1) The Chairman shall preside over meetings of the Committee 1 [x x x x] or the Board, as the case may be.

(2) In the absence of the Chairman at any meeting, the members shall elect one member by a majority of votes to preside at such meeting.

14. Quorum -

No business shall be transacted at any meeting unless at least one-third of the members, as well as at least one representative from each of the employers and employees, are present: -

If less than one-third of the members are present at any meeting, or if only one representative from each class of members is present, the Chairman may adjourn the meeting to a date not later than seven days from the date of the original meeting, and it shall then be lawful to conduct business at such adjourned meeting, regardless of the number of classes of members present].

15. Business disposal -

All business shall be considered at a meeting of the Committee 3 [x x x x x] or the Board, as the case may be, and shall be decided by a majority of the votes of the members present and voting. In the event of a tie, the Chairman shall have a casting vote:- Provided, however, that the Chairman may, if he so desires, direct that any matter be decided by the circulation of necessary papers and obtaining written opinions from the members;

Furthermore, no decision on any question referred to in the first provision shall be made unless supported by a two-thirds majority of the members.

16. Voting Method -

Voting shall ordinarily be by show of hands, but if any member requests ballot voting, or if the Chairman so directs, voting shall be by secret ballot, and shall be held in such manner as the Chairman directs.

17. Meeting proceedings -

(1) The proceedings of each meeting, including the names of the members present, shall be forwarded to each member and the State Government as soon as possible after the meeting and, in any case, not less than seven days before the next meeting.

(2) The proceedings of each meeting shall be confirmed with such modifications, if any, as the next meeting may deem necessary.

Chapter 3: Summoning of Witnesses by the Committee, and the Board and Production of Documents

18. Summoning of 1 [witnesses] and production of documents -

(1) In the course of an investigation, a Committee or the Board may summon any person to appear as a witness. Such summons may require a witness to appear before it on a specified date and to produce any books, papers, or other documents and things in his possession or control that are related in any way to the investigation.

(2) A summons issued under sub-rule (1) may be addressed to an individual, an employer organization, or a registered trade union of workers.

(3) A summons issued under this rule may be served in the following ways:

i) in the case of an individual, by being delivered or sent to him by registered post.

(ii) in the case of an employer's organization or a registered trade union of workers, by being delivered or mailed to the secretary or other principal officer of the organization or union, as applicable.

(4) The provisions of the Civil Procedure Code relating to the summoning and enforcement of witnesses and the production of documents shall, to the greatest extent possible, apply to proceedings before a Committee. 1 or the Board [x x x x x].

19. Witness expenses -

Any person summoned and appearing as a witness before the Committee or the Board is entitled to an allowance for expenses incurred in accordance with the scale in effect for payment of such allowances to witnesses appearing in civil courts in the State at the time.

Chapter 4: Computation and Payment of Wages, Hours of Work and Holidays

20. Omitted

21. [Terms] and condition of payment of wages and the deduction permissible from wages -

(1)(i) The wage period with respect to any scheduled employment for which it has been fixed shall not exceed one month, and the wages of a worker in such employment shall be paid:

(a) before the expiry of the seventh day in the case of establishments employing less than one thousand people; and

(b) before the expiry of the tenth day in the case of other establishments after the last day of the wage period in respect of which the wages are payable.

(ii) If any person's employment is terminated by or on behalf of the employer, his wages must be paid before the end of the second working day following the day his employment is terminated.

Provided, however, that upon receipt of a representation in respect of any scheduled employment or class or classes of employees in such employment, the Government may, after inviting public comment, notify any other wage periods or time limits for payment, which shall then apply to all or any class or classes of employees in such employment.

In such employment, there are various employee classes.

(iii) An employee's wages shall be paid without deduction of any kind, except those authorized by or under these employment may, after inviting public comment, notify any other wage periods or time limits for payment, which shall then apply to all or any class or classes of employees in such employment.

Explanation - For the purposes of these rules, any payment made by the employed person to the employer or his agent is deemed to be a deduction from wages.

(2) A deduction from a person's wages in a scheduled employment shall be of one or more of the following types:

(3)(i) Fines that may be imposed for any of the following reasons:

(a) Absence from duty without leave or sufficient cause (fine may be imposed only as an alternative to the deduction permissible under clause (ii) of sub-rule (2) of Rule 21),

(b) Negligence in work or neglect of work.

(c) Smoking on work premises, except where smoking is permitted.

(d) Entering or leaving, or attempting to enter or leave, the premises other than through the gate provided for that purpose.

(e) Absence from appointed work in the establishment without leave or sufficient cause.

(f) Violation of any rules or instructions for the upkeep and operation of any department, as well as its cleanliness.

(g) Damages to work in progress or other employer property,

(h) Interference with any safety devices installed on the premises.

(i) Distributing or displaying handbills, pamphlets, or posters on the premises without prior permission from the employer.

(j) Misconduct (fines may be imposed only as a substitute for a more severe permissible punishment).

(ii) absence from duty deductions.

(iii) deductions for damage or loss of goods entrusted to the employed person for custody, or for loss of money for which he is retired to account, where such damage or loss is directly attributable to his neglect or default.

(iv) deductions for housing provided by the employer or a State Government or any authority established by a State Government to provide housing accommodation.

(v) deductions for such employer-supplied amenities and services as the Government may authorize by general or special order.

Explanation - In this clause, the words "amenities and services" do not include the provision of tools and protective equipment required for the purpose of employment.

(vi) deductions for the recovery of advances or the adjustment of overpayments of wages: Provided, however, that such advances do not exceed the wages for two calendar months of the employed persons and that the monthly installment of deduction does not exceed one-fourth of the wages earned in the month.

(vii) income-tax deductions payable by the employed person.

(viii)deductions required by a court or other competent authority, (ix)deduction for subscriptions to and repayment of advances from any provident fund to which the Provident Fund Act, 1952, applies, or any recognized provident fund as defined in section 58-A of the Indian Income Tax Act, 1922, or any provident fund approved in this regard by the Government during the period of such approval.

(x) deductions for payments to co-operative societies or to a government-approved insurance scheme.

[(xi) deductions made with the written authorization of the employed persons (which may be given once generally and not necessarily every time a deduction is made, for the purchase of securities of the Government of India or any State Government or for deposit in any Post Office Savings Bank in furtherance of any such Government's saving scheme].

2 [(xii) deductions for rent of cattle sheds and stage provided by the employer].

3 [(xiii)deductions made with the written consent of:-

(a) the employed person, or (b) the President or Secretary of the registered Union of which the employed person is a member, subject to the terms and conditions prescribed for contribution to the National Defence Fund or any Defense Savings Scheme approved by the Central Government or the State Government.]

(3) Any person wishing to impose a fine on an employed person or make a deduction for damage or loss caused by him shall explain to him personally and in writing the act or omission or damage or loss in respect of which the fine or deduction is proposed to be imposed or made, and shall give him an opportunity to offer any explanation in the presence of another 1 [workman].

[(4)The amount of fine or deduction for damage or loss mentioned in subrule (3) is subject to such limits as the State Government may specify in this regard. All fines imposed and deductions made must be recorded in the registers maintained in 3 [Forms I and II]. These registers must be kept on the job site and kept up to date. When no fine or deduction is imposed or made on or from any employee during a wage period, a 'nil' entry is made across the body of the relevant register at the end of the wage period, indicating in precise terms the wage period to which the 'nil' entry relates.

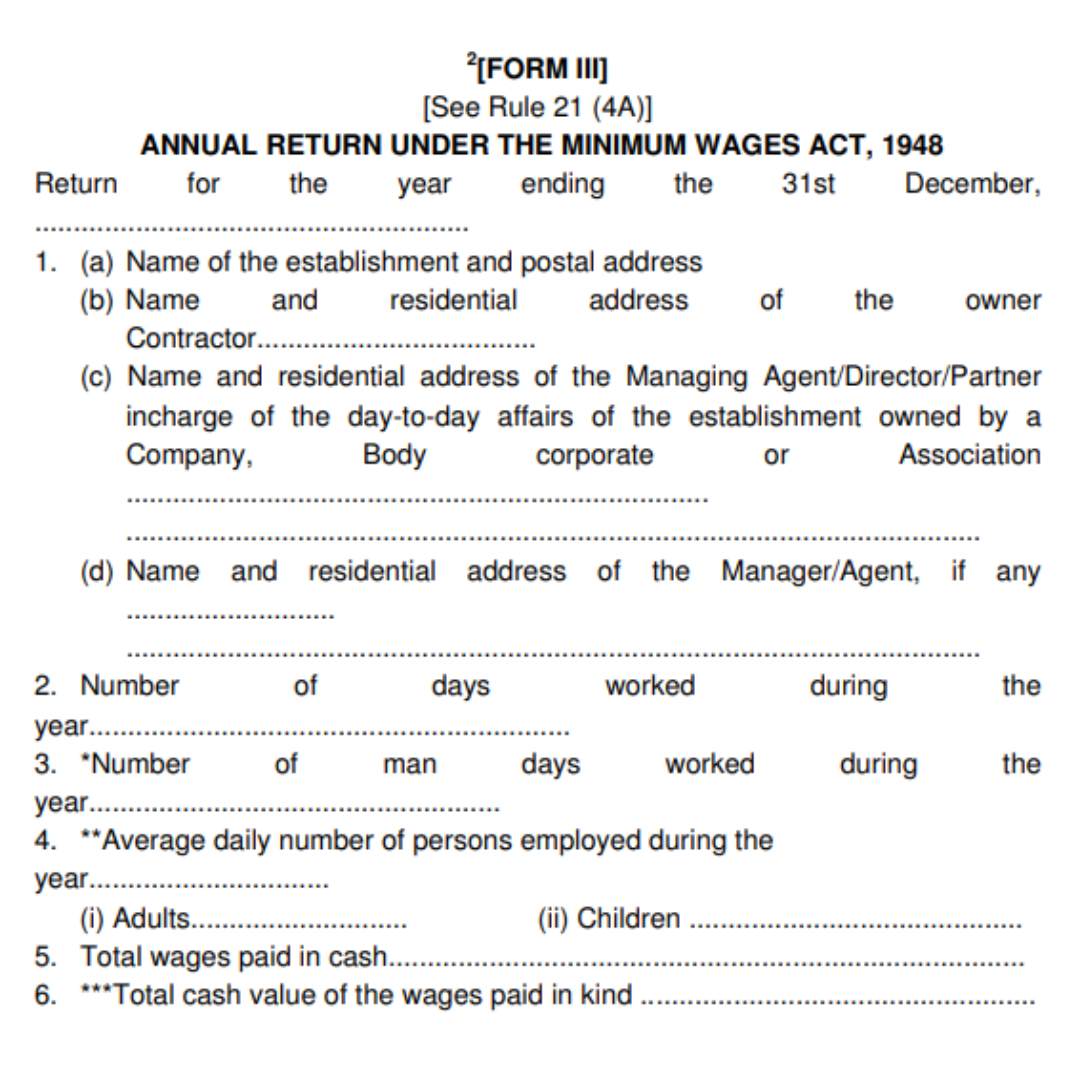

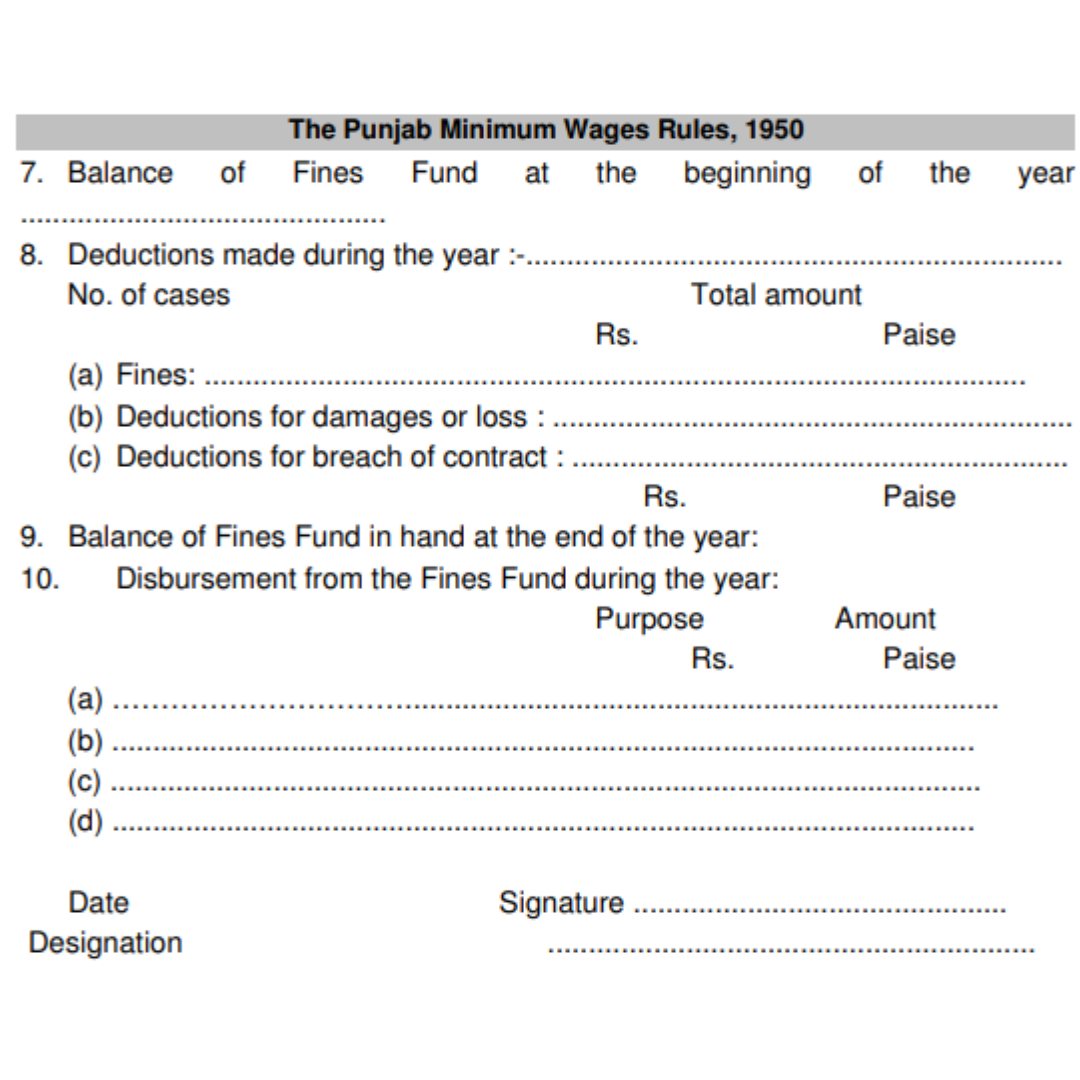

(4A)Every employer must send an annual return in Form III showing the deductions from wages to the Inspector by the 1st February following the end of the fiscal year to which it relates.

[(5) The fine imposed under sub-rule (3) shall be used only for purposes beneficial to employees approved by the State Government.]

(6) Nothing in this rule shall be construed to modify the provisions of the Payment of Wages Act of 1936.

22. Publicity to the minimum wage fixed under the Act -

Notices 1 [in form IXA] containing the minimum rates of wages fixed together with [abstracts of] the Act, the rules made there-under and the name and the address of the

Inspector shall be displayed in English and 3 [Hindi in Devi Nagri Script] in the employment 4 [at the main entrances to the establishment and its office] and shall be maintained in a clean and legible condition. Such notices shall also be displayed on the notice boards of all Sub-Divisional and District Offices.

[23. Weekly day of rest -

(1) Subject to the provisions of this rule, an employee in a scheduled employment for which minimum wage rates have been fixed under the Act shall be allowed a day of rest every week, referred to as "the rest day"] which is normally Sunday, but the employer may designate any other day of the week as a rest day for any employee or class of employees in that scheduled employment:

Provided that the employee has worked in the scheduled employment for the same employer for at least six days in a row;

Furthermore, the employee shall be informed of the day fixed as the rest day, as well as any subsequent change in the rest day, before the change is implemented by displaying a notice to that effect in the place of employment at the location specified by the Inspector in this regard.

[Explanation - To compute the continuous period of not less than six days specified in the first provision of this sub rule:

(a) any day on which an employee is required to attend for work but is only paid an attendance allowance and is not given work;

(b) any day on which an employee is laid off on payment of compensation under the Industrial Disputes Act, 1947.

(c) any day on which the employee was on leave 7 [or] which was a holiday granted by the employer, with or without pay, during the six days immediately preceding the rest-day; shall be deemed to be a day on which the employee worked.]

(2) No such employee shall be required or permitted to work in a scheduled employment on the rest day unless he has or will have a substituted rest day for a whole day on one of the five days immediately preceding or following the rest day; provided, however, that no substitution shall be made resulting in the employee writing for more than ten days consecutively without a rest day for a whole day.

(3) If, in accordance with the preceding provisions of this rule, an employee writs on a rest day and is given a substituted rest day on any of the five days before or after the rest day, the rest day shall be included in the week in which the substituted rest day occurs for the purpose of calculating weekly hours of work.

(4) An employee shall be paid for the rest day at the rate applicable to the next preceding day, and if he works on the rest day and is given a substituted rest day, he shall be paid for the rest day on which he worked, i.e. the overtime rate and wages for the substituted rest day at the next preceding day's rate; -

Provided, however, that where the employee's minimum daily rate of wages as notified under the Act has been calculated by dividing the minimum monthly rate of wages by twenty-six, or where the employee's actual daily rate of wages has been calculated by dividing the monthly rate of wages by twenty-six, and such actual daily rate of wages is not less than the employee's notified minimum daily rate of wages, no wages for the rest day shall be payable. and if the employee works on the rest day and has been given a substituted rest day, he shall be paid only for the rest day on which he worked, and if any dispute arises as to whether the daily rate of wages has been worked out as aforesaid, the Labor Commissioner may, on application made to him in this behalf, decide the same after giving the parties concerned an opportunity to make written representations.

Furthermore, in the case of any employee subject to a piece rate scheme, the wages for the rest day or, as the case may be, the rest day and the substituted rest day shall be such as the 1 [Haryana] State Government may prescribe by notification in the Official Gazette, having regard to the minimum rate of wages fixed under the Act in respect of the scheduled employment.

Explanation - In this sub-rule, 2 [next preceding day] refers to the last day on which the employee worked, which precedes the rest day or the substituted rest day, as applicable, and where the substituted rest day falls on a day immediately following the rest day, the next preceding day refers to the last day on which the employee worked, which precedes the rest day.

(5) The provisions of this rule apply to employees who are scheduled to work in jobs other than agriculture.

(6) The provisions of this rule shall not operate to the detriment of any more favorable terms to which an employee may be entitled under any other law or under the terms of any award, agreement, or contract of service, and in such a case, the employee shall be entitled only to the aforementioned more favorable terms.

Explanation - For the purposes of this rule, "Week" refers to a seven-day period beginning at midnight on Saturday night.

24. Number of hours or work which shall constitute a normal working day—

(1) A normal day shall consist of the following hours: (a) in the case of an adult, 9 hours; (b) in the case of a child, 4 hours.

(2) An adult worker's working day shall be scheduled in such a way that it does not exceed 12 hours on any given day, including any rest breaks. 3 [In a scheduled employment, the period of work on any day shall be so fixed that no continuous period of work shall exceed five hours, and no worker shall be required or allowed to work for more than five hours unless he has had an interval for rest of at least half an hour on the expiry of the period of work.

1 [(2-A) Working hours, including overtime, may not exceed 10 hours per day or 60 hours per week, provided that total overtime does not exceed

50 hours over a three-month period.]

(3) In the case of an adolescent, the number of hours of work shall be the same as that of an adult or a child if he is certified to work as an adult or a child by a competent medical practitioner approved by the State Government.

2 [x x x x x x x x].

(4) The provisions of sub-rules (1) to (3) are subject to such modifications as the State Government may notify from time to time.

(5) Nothing in this rule is intended to modify the provisions of the Factories Act of 1948.

24A. Night Shifts -

Where a worker in a scheduled employment works on a shift that extends past midnight,

(a) a holiday for the entire day for the purposes of rule 23 shall in his case mean a period of twenty-four consecutive hours beginning from the time when his shift ends; and

(b) the following day in such a case shall be deemed to be the period of twenty-four hours beginning from the time when such shift ends, and the hours after midnight during which such worker was engaged in work shall be counted towards the previous day.

25. Extra wages for overtime-

(1) Where an employee in a scheduled employment is governed by the provisions of the Factories Act or any other enactment prescribing overtime wages, he shall receive overtime wages at the rates so prescribed.

(2) When a worker works in an employment for more than the number of hours of work constituting a normal working day prescribed in rule 24 3 [or for more than 48 hours in a week], he is entitled to overtime pay - (a) in the case of employment in agriculture, at one and a half times the ordinary rate of wages;

1b [x x x x x].

2 [(c)in the case of any other scheduled employment, at twice the regular wage rate.]

Provided, however, that the Government may, upon receipt of representation in respect of any scheduled employment of class or classes of employees in such employment, notify any other rate of payment of extra wages for overtime in respect of any scheduled employment or class or classes of employees in such employment after inviting public comments.

Explanation - The term "ordinary rate of wages" refers to the basic wage plus such allowances as the cash equivalent of the advantage accruing from the concessional sale of food grains and other articles to the person employed as the person employed is currently entitled to, but does not include a bonus.

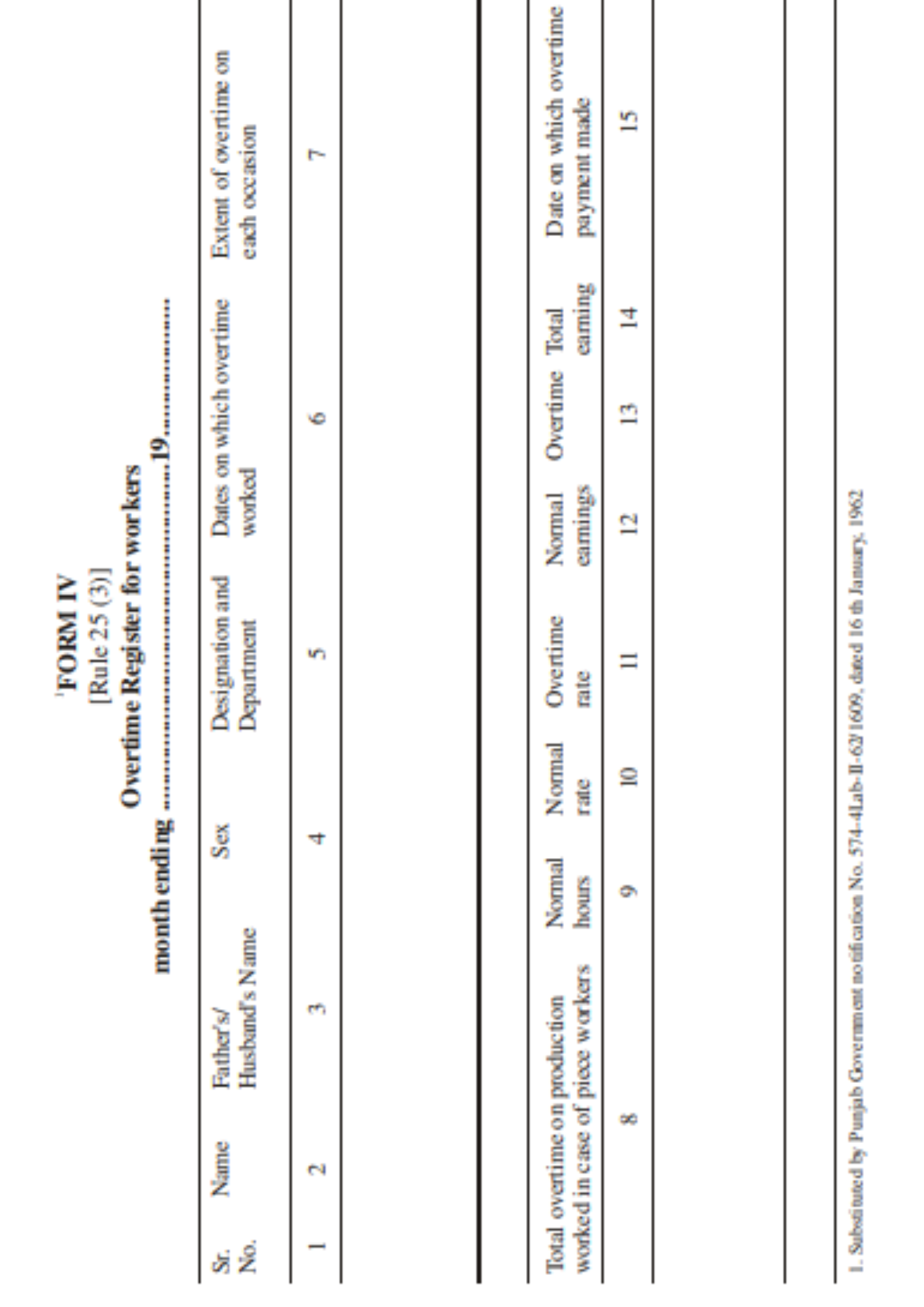

[(3) Every employer shall keep a register of overtime in Form IV, in which entries under the columns specified therein shall be made as and when overtime is worked in any establishment. The register must be kept at the worksite and kept up to date. When no overtime is worked in any wage period, a 'nil' entry is made across the body of the register at the end of the wage period, indicating in precise terms the wage period to which the 'nil' entry relates].

(4) Nothing in this rule is intended to modify the provisions of the Factories Act of 1948.

[25A. Part-time] 4 Employees -

Where an employee is employed on a part-time basis by one or more employers and his minimum wage is fixed by the day, he shall be entitled to claim, on a pro-rata basis, wages from each employer from whom he works in a given day or less than the normal working day.

26. Register and record format. -

(1) Every employer shall keep a wage register -2[at the work site] in such form as the State Government may specify and shall include the following particulars:

(a) the minimum wages payable to each person employed;

(b) the number of days each employed person worked overtime for each wage period;

(c) the gross wages of each person employed for each wage period;

(d) all deductions made from wages, with an indication of the types of deductions mentioned in sub-rule (2) of rule 21; and

(e) the wages actually paid to each person employed for each wage period and the date of payment.

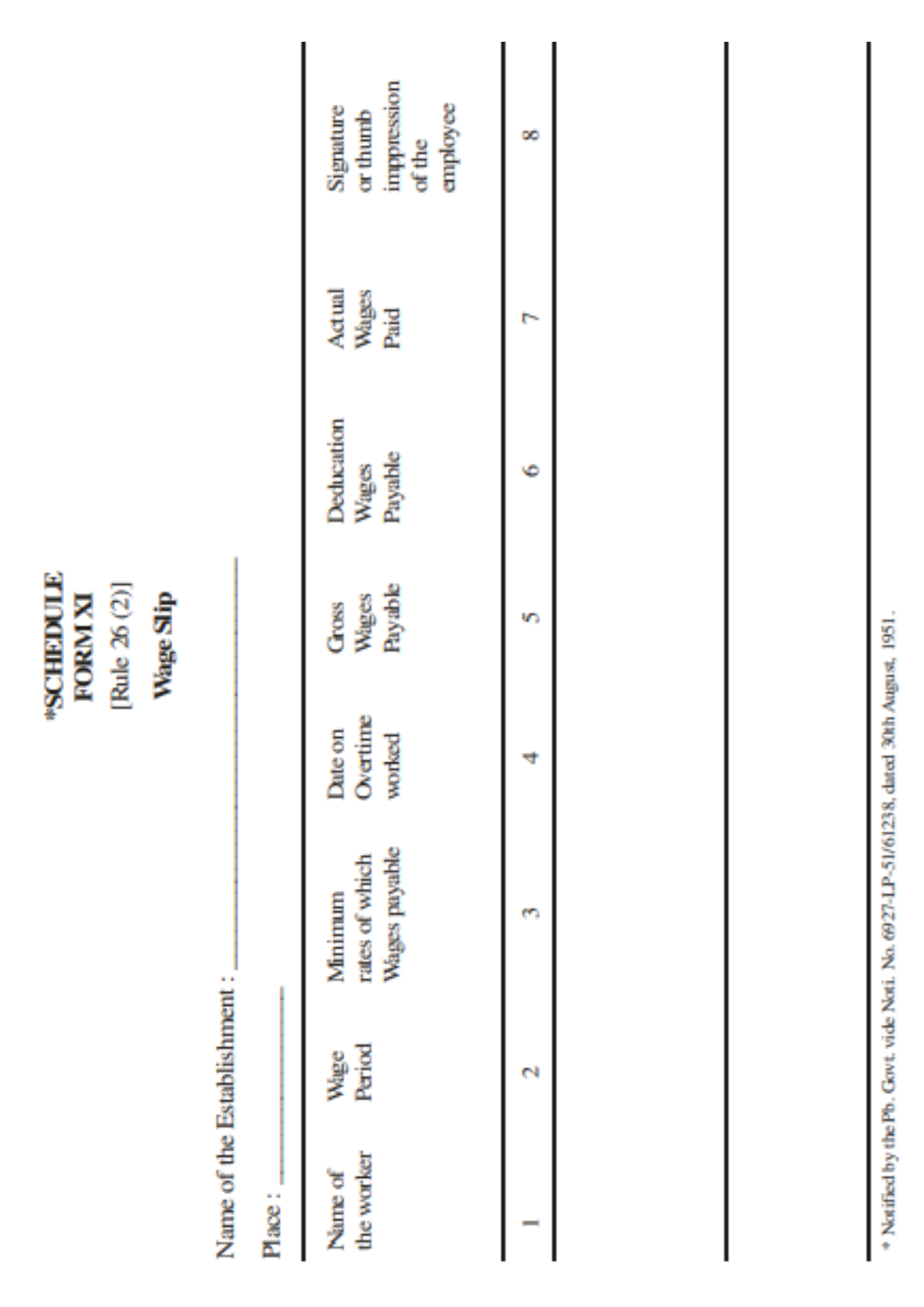

(2) Wage slips containing the aforementioned particulars and such other particulars as the State Government may notify shall be issued by every employer to every person employed by him at least a day prior to wage disbursement.

(3) Every employer must obtain the signature or thumb impression of each employee on the wage book and wage slip.

(4) Entries in wage books and wage slips must be authenticated by the employer or a person authorized by him.

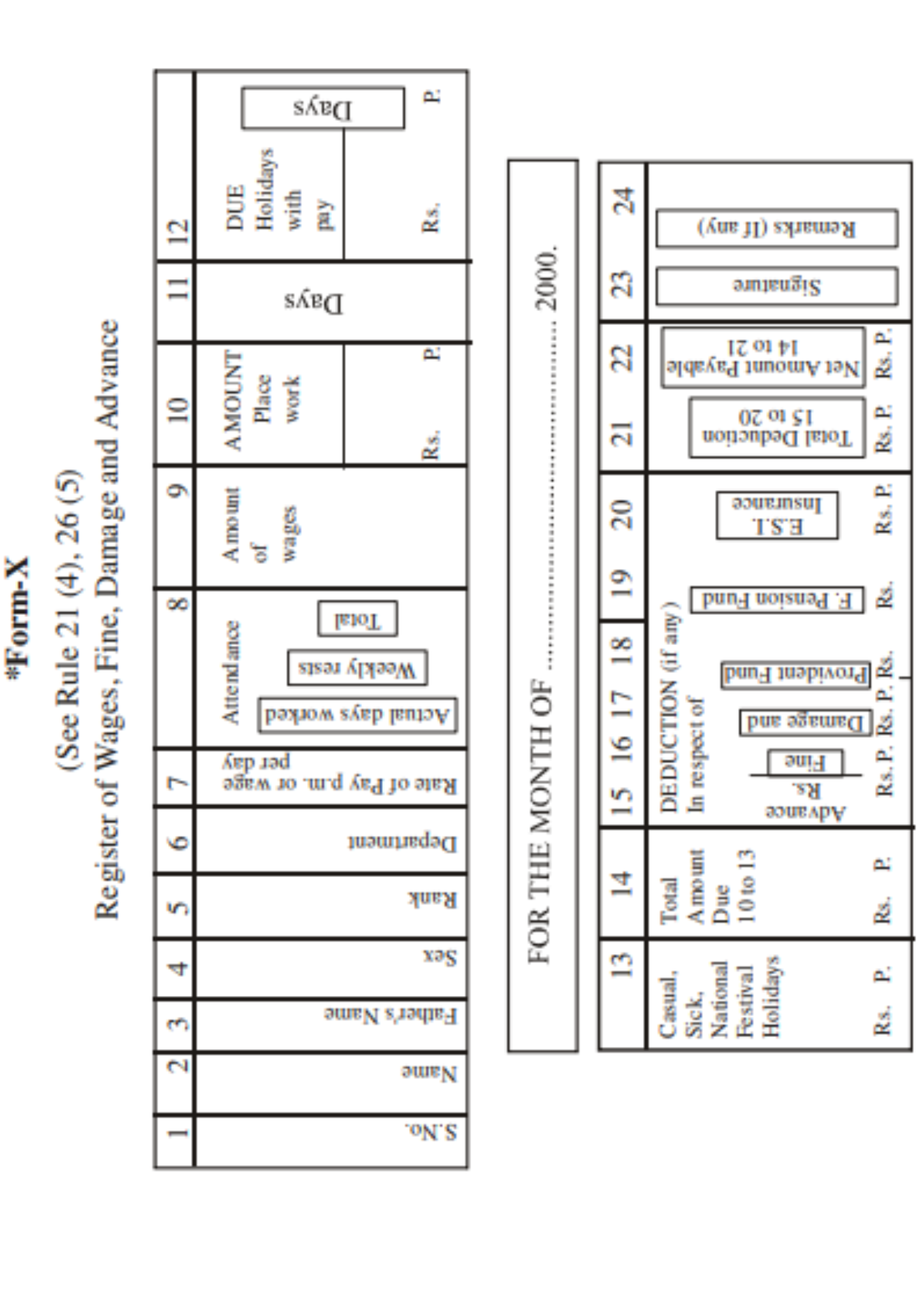

(5) Every employer is required to keep a muster roll. 1 [on the job] and kept in Form X. (Substituted by amendment dated July 4, 2000)

[(6)Notwithstanding anything in this rule, an alternative suitable form in lieu of any of the forms prescribed under this rule may be used with the prior approval of the Labour Commissioner, Punjab, where a combined form is to avoid duplication of work for compliance with the provisions of any other Act or rules framed thereunder.]

Provided, however, that the Government may, if sufficient cause is shown, exempt any scheduled employment or any units of such employment, conditionally or otherwise, from the observance of any of the requirements under this rule, or may vary these requirements, in respect of the employees or a class or classes of employees in such employment, by notification in the Official Gazette.

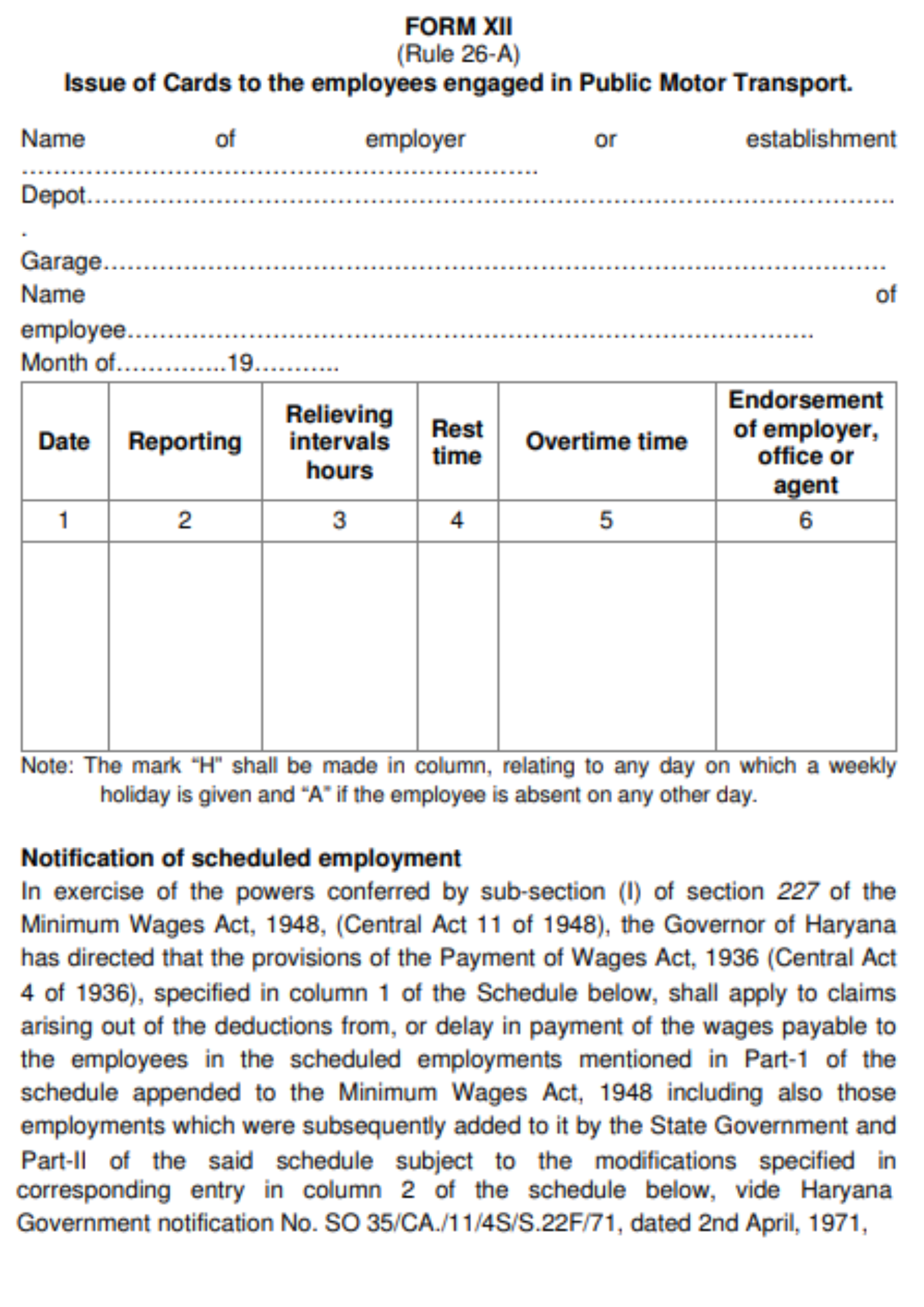

[26-A. Employers to provide cards to employees, engaged in public motor transport -

(1) Every driver, conductor, or other employee in public motor transport shall be provided with a card in Form X at the beginning of each month, which may be in 1 [Hindi or English, whichever is understood by such employees] or in the language understood by such employees.

(2) The card shall be in the custody of such employee for one month and then returned to the employer, who shall keep it for three years.

(3) The entries in such card must be made in the employee's presence each day by the employer or any person authorized by him in that capacity, and the employee must produce the card whenever it is required for this purpose.

(4) If the employee loses his card, the employer shall, for a fee of 2 [fifty paise], provide him with another card duly completed within a week.

[Explanation - A public motor transport undertaking is one that transports passengers, goods, or both by road for hire or reward, and includes a private carrier.]

[26B. Preservation of Registration -

A register required to be maintained under rules 21(4), 25(3), and 26(1), as well as the muster roll required to be maintained under rule 26(5), shall be preserved for three years after the date of the last entry made therein.

26C. Production of registers and other records

- All registers and records required by these rules to be kept by an employer must be produced on demand before the Inspector.

Provided, however, that where an establishment has been closed, the Inspector may require the production of the registers and records in his office or any other public place as close to the employer as possible."]

Chapter 5: Claims Under The Act

27. Application -

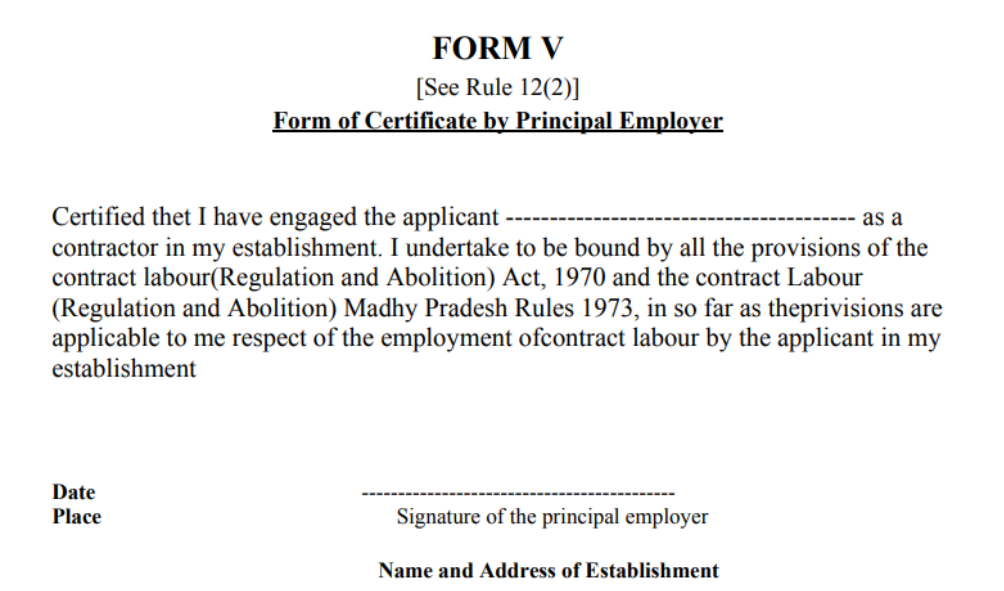

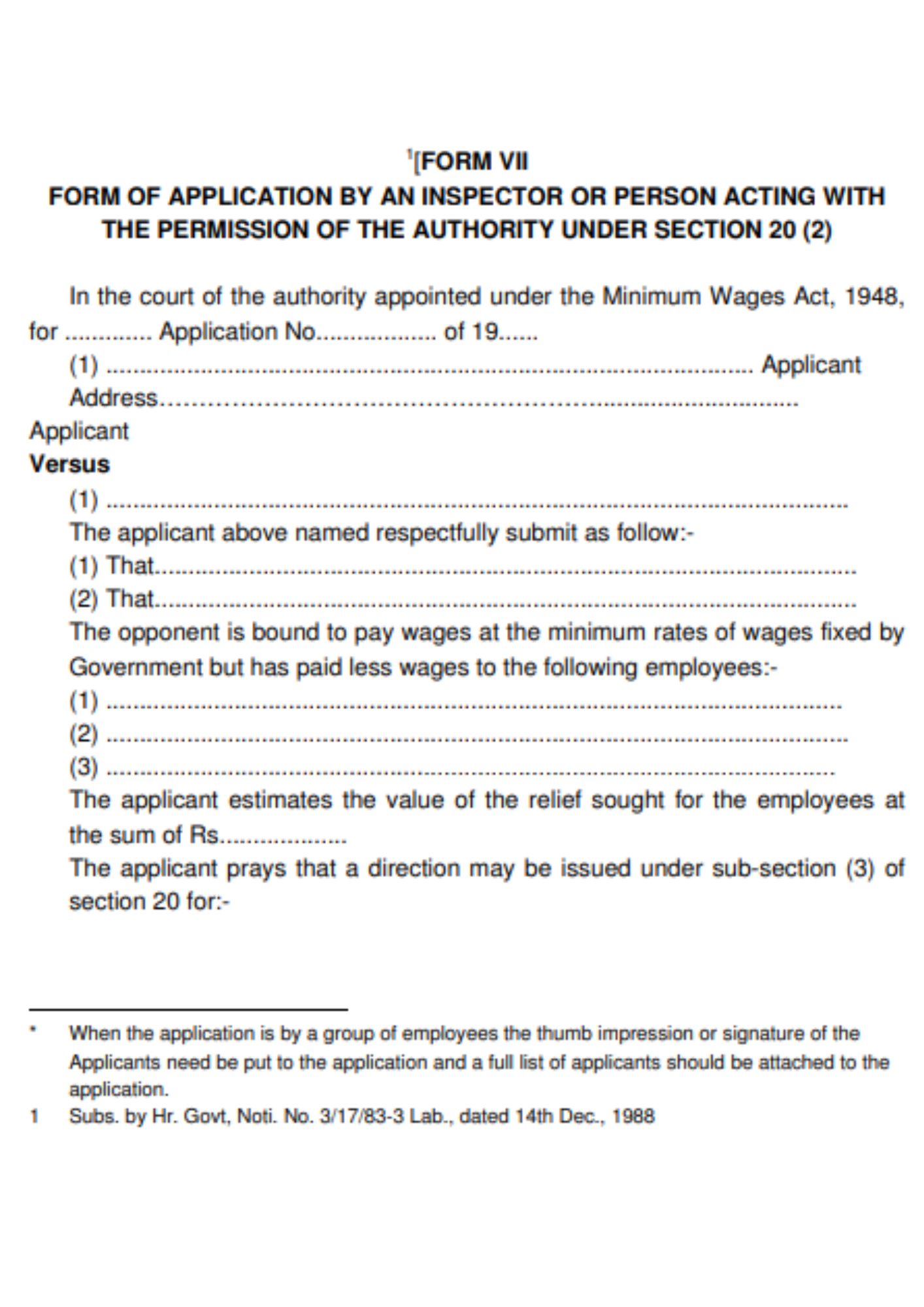

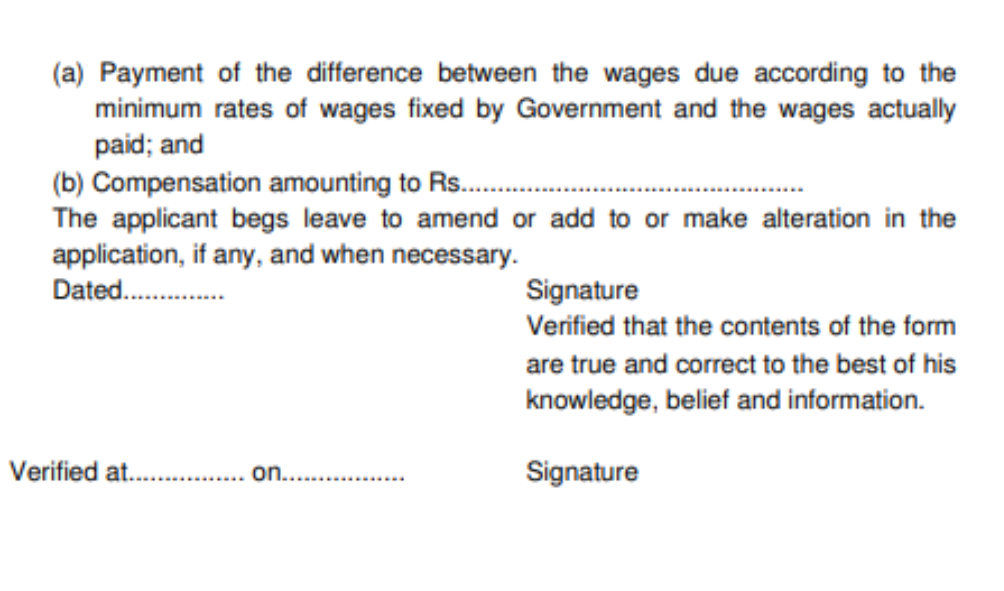

An application made by or on behalf of an employed person or group of employed persons under subsection (2) of section 20 or subsection (1) of section 21 must be made in duplicate in forms VI and VII, as applicable.

28. Authorization -

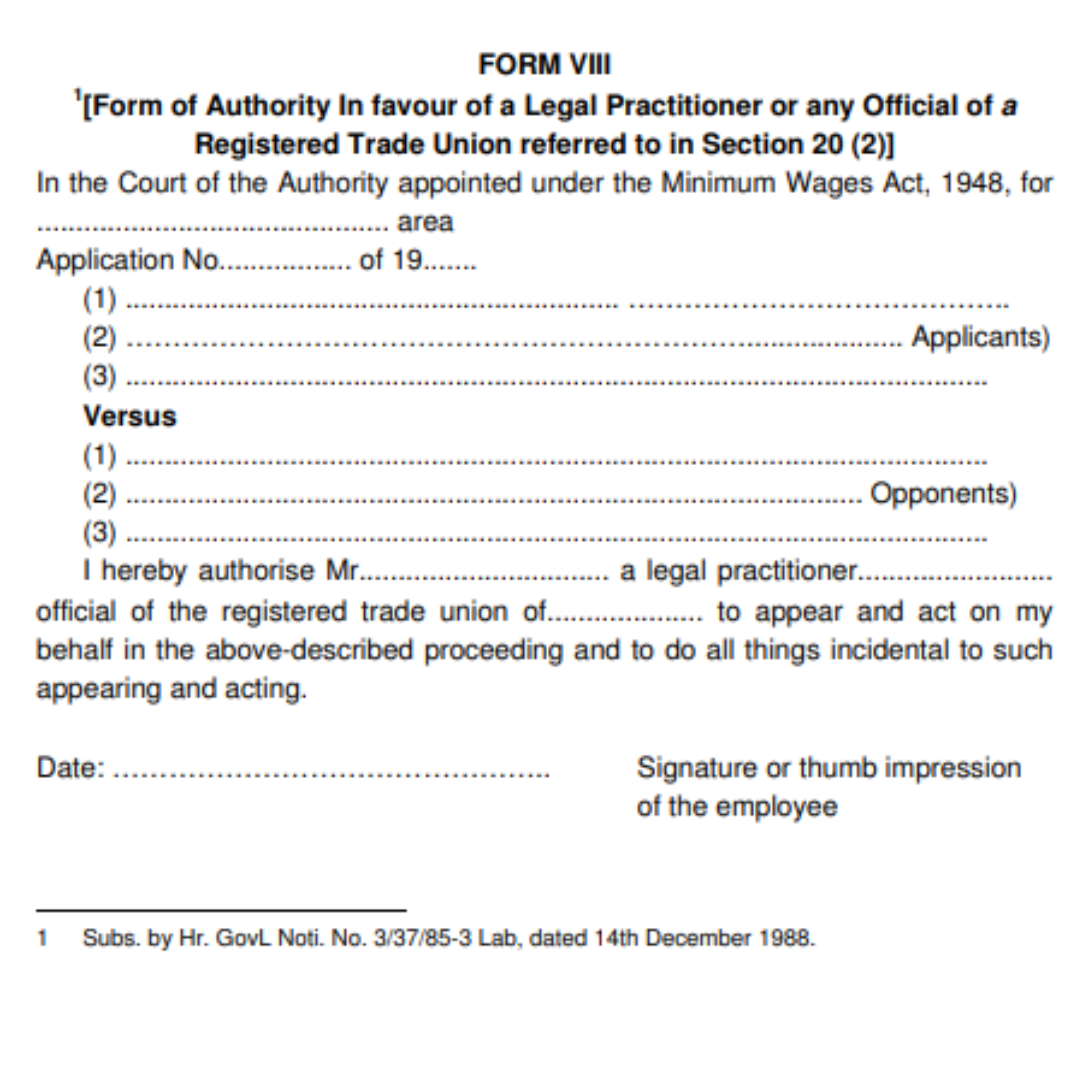

The authority to act on behalf of an employed person or persons under sub-section (2) of section 20 or sub-section (1) of section 21 shall be granted in form VIII by an instrument to be presented to the Authority hearing the application and shall form part of the record.

29. Appearance of Parties -

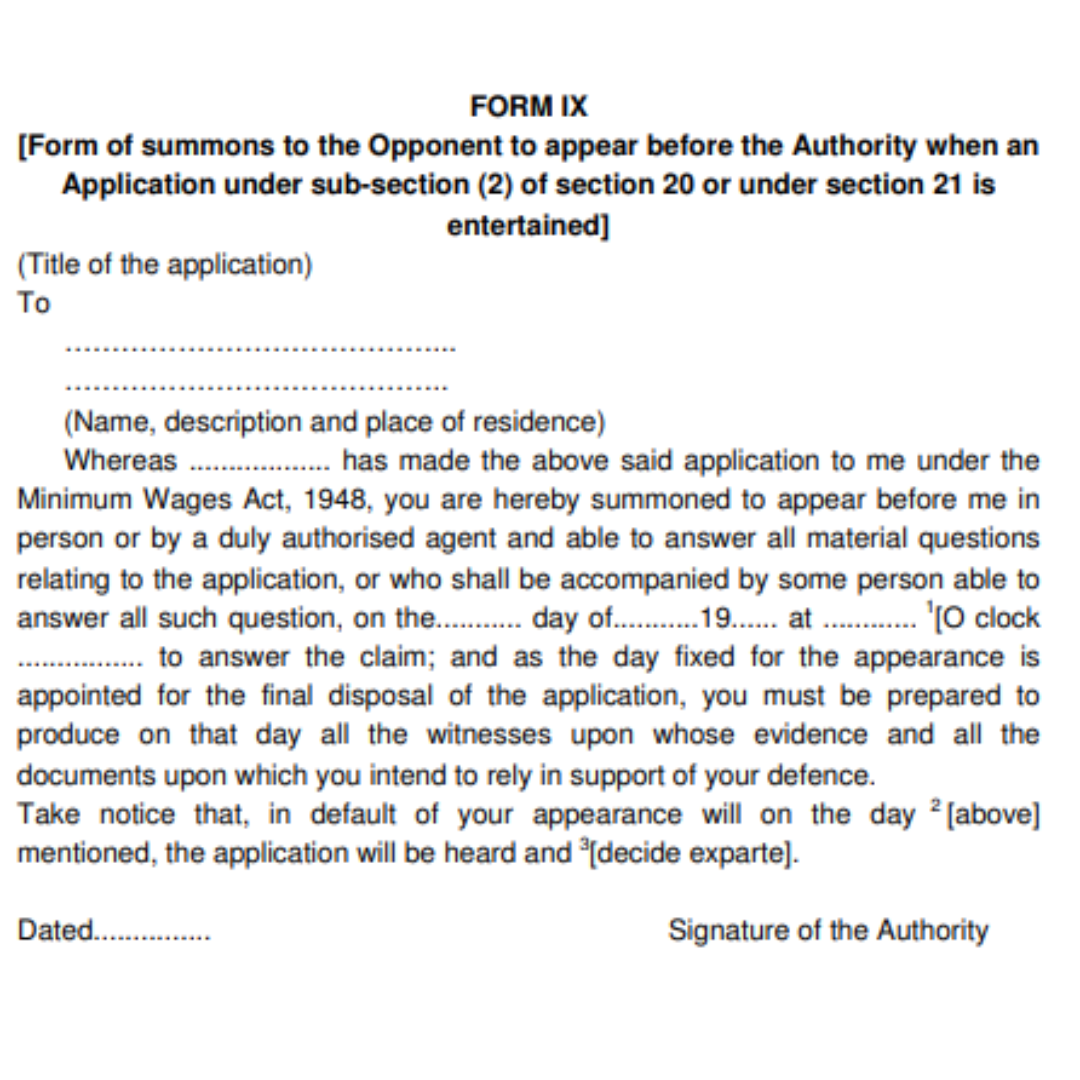

(1) If any application under sub-section 20 or section 21 is entertained, the Authority shall serve on the employer a notice in form IX to appear before him on a specified date with all relevant documents and witnesses, if any, and shall inform the applicant of the dates so specified.

(2) If the employer or his representative fails to appear on the specified date, the authority has the authority to hear and decide the application ex parte:

(3) If the applicant or his representative does not appear on the specified date, the authority has the authority to dismiss the application.

(4) An order passed under sub-rule (2) or (3) may be set aside if sufficient cause is shown by the defaulting party within one month of the date of the said order, and the application shall then be re-heard after service of notice on the opposing party of the date fixed for re-hearing in the manner specified in sub-rule (1).

Chapter 6: Scale of Cost in Proceedings Under the Act

30. Costs -

(1) For reasons to be recorded in writing, the Authority may direct that the costs of any proceeding pending before it do not follow the event.

(2) Among the costs that may be awarded are: (i) court-fee expenses; (ii) witness subsistence expenses; and (iii) attorney fees.

[(iii) Advocates fees of Rs. 100/-; provided, however, that the Authority in any proceeding may reduce the fees to a sum not less than fifty rupees or, for reasons to be recorded in writing, increase them to a sum not exceeding two hundred and fifty rupees.]

(3) Where there is more than one 2 [Advocate] or more than one applicant or opponent, the authority may, subject to the aforementioned limitations, award to the successful party or parties such costs as it deems appropriate.

31. Court-fees -

The court-fee payable in respect of proceedings under section 20 shall be: (i) one rupee for each application to summon a witness; (ii) one rupee for each application made by or on behalf of an individual.

Provided, however, that the Authority may, if it believes the applicant is a pauper, exempt him entirely or partially from payment of such fees:

FORM I: Register of Fines

FORM II: Rule 21(4): Register of deduction for damage or loss caused to the employers, by the neglect or default of the employed persons

Furthermore, no fee shall be charged: (a) from agricultural employees; or (b) in respect of an application made by an Inspector:

[Provided, however, that the Government may reduce the scale of courtfees in respect of any scheduled employment by notification.]

FORM III: ANNUAL RETURN UNDER THE MINIMUM WAGES ACT, 1948

FORM IV: OVERTIME REGISTER FOR WORKERS

FORM V: Rule 26 (5): Muster Roll

FORM VII: FORM OF APPLICATION BY AN INSPECTOR OR PERSON ACTING WITH THE PERMISSION OF THE AUTHORITY UNDER SECTION 20 (2)

FORM VIII 1 [Form of Authority In favour of a Legal Practitioner or any Official of a Registered Trade Union referred to in Section 20 (2)]

FORM IX [Form of summons to the Opponent to appear before the Authority when an Application under sub-section (2) of section 20 or under section 21 is entertained]

FORM IXA: Sec Rule 22, Notices, Abstract of the Minimum Wages Act, 1948 and the Rules made thereunder;

- Whom he Act affects

- The Act affects to persons engaged on scheduled employments on specified class of work in respect of which minimum wages have been fixed.

- No employee may give up his rights by contract or agreement that purports to reduce the Act's minimum wage rates.

II. Definition of Wages

1. "Wages" refer to all remuneration payable to an employee upon completion of his employment contract. It does not include:

(i) the cost of any house accommodation, light, water, medical attendance, or any other amenity, or any service provided by general or special order of the appropriate government.

(ii) contribution paid by the employer to any Pension Fund or Provident Fund or under any Social Insurance scheme;

(iii) travel allowance or the value of any travel concession;

(iv) sum paid to the employee to defray special expenses incurred as a result of his employment;

(v) gratuity on discharge

2. The minimum wage may include:

(i) a basic wage rate and a special allowance known as the cost of living allowance;

(ii) a basic wage rate with or without a cost of living allowance and the cash value of any concession, such as supplies of essential commodities at concession rates; and

(iii) an all-inclusive wage rate that includes the basic wage rate, the cost of living allowance, and the cash value of any concession, if any.

3. The minimum wages payable to employees of scheduled employments notified under section 5 read with section 3 or as revised from time to time\sunder section 10 read with section 3 may be:

(a) a minimum time rate;

(b) a minimum piece rate;

(c) a guaranteed time rate;

(d) an overtime rate.

varying with (1) different scheduled employments, (2) different work classes, (3) different localities, (4) different wage periods, and (5) different age groups.

III. Computation and Conditions of Payment

Every employee engaged in scheduled employment under him shall be paid at a rate not less than the minimum wage rate fixed for that class of employee.

The minimum wage required by this Act shall be paid in cash, 1 [x x x x x].

Wage periods shall be established for the payment of wages at intervals of not more than one month.

Wage must be paid on a working day within seven days of the end of the wage period, or ten days if 1,000 or more people are employed.

A discharged employee's wages must be paid no later than the second working day following his discharge.

If an employee is employed on any day for a period less than the normal working day, he is entitled to be paid for a full normal working day if his failure to work is not due to his unwillingness to work but to the employer's failure to provide him with work for that period.

When an employee performs two or more classes of work, each of which has a different minimum wage, the employer must pay such employee wages that are not less than the minimum wage in effect for each such class. Where an employee is employed on piece work for which a minimum time rate rather than a minimum piece rate has been established, the employer must pay such employee wages that are not less than the minimum time rate.

IV. Hours of work and holidays

The number of hours which shall constitute a normal working day shall be: (a) in the case of an adult, 9 hours.

(b) 412 hours in the case of a child.

An adult worker's working day, including rest periods, shall not exceed twelve hours on any given day.

2 [Employers must provide an employee with a day of rest with pay every week. Normally, Sunday is the weekly day of rest, but any other day of the week may be designated as such. No employee shall be obligated to Work on a rest day unless he is paid overtime for that day and is also allowed a substituted rest day with wages (see rule 23).

When a worker works more than nine hours on any given day or more than forty-eight hours in any given week, he is entitled to overtime pay in scheduled employment other than agriculture 1 [x x x x x] at twice the ordinary rate of pay.

V. Fine and deductions

Except as authorized by or under the rules, no deductions from wages may be made. Deductions from wages must be of one or more of the following types:

(i) Fines - An employed person shall be personally and in writing explained the act or omission for which the fine is proposed to be imposed, and shall be given an opportunity to offer any explanation in the presence of another 3[workman]. He will also be informed of the amount of the fine. It shall be such as the State Government of 2 [Haryana] may specify, and it shall be used in accordance with the State Government of Haryana's directions.

(ii) Absence from duty deductions.

(iii) Deductions for damage to or loss of goods entrusted to the employee's custody, or for money lost for which he is obligated to account, where such damage or loss is directly attributable to his neglect or default. The employed person shall be informed personally and in writing of the damage or loss for which the deduction is proposed, and shall be given the opportunity to offer any explanation in the presence of another person. He will also be informed of the amount of the said deduction. It shall be such as may be specified by the State Government of Haryana.

(iv) deductions for housing provided by the employer;

(v) deductions for such employer-supplied amenities and services as the State Government may authorize by general or special order.

These will not include the supply of tools and protective equipment required for the purposes of employment;

(vi) deductions for the recovery of advances or the adjustment of over-payment of wages; such advances shall not exceed an amount equal to wages for two calendar months of the employed persons, and the monthly installment of deductions shall not exceed one-fourth of the wages earned in that month;

(vii) deductions of income-tax payable by the employed persons;

(viii)deductions required by a court or other competent authority; (be)deductions for subscriptions to and repayment of advances from any provident fund;

(x) deductions for payment to co-operative societies or an insurance scheme approved by the Government of the State of Haryana.

VI. Maintenance of Registers and Records

Every employer must keep a wage register that includes the following information for each pay period for each employee:

(a) the minimum wage rates payable.

(b) The number of days worked in overtime.

(c) The gross wages;

(d) all wage deductions.

(e) The actual wages paid and the date of payment

Every employer is required to provide each employee with a wage slip containing the prescribed information.

Every employer must obtain the signature or thumb impression of every employee on the wage book and wage slips.

The employer or his agent must properly authenticate entries in wage books and wage slips.

Every employer is required to keep a muster Roll in the form prescribed.

Every employer shall keep in such places as the Inspector may designate, notice in 1 [Hindi and English language] of the following particulars in a clean and legible form: -

(a) The minimum wage.

(b) Excerpt from the Act and the Rule promulgated thereunder.

(c) The Inspector's name and address.

VII. Inspections

Any Inspector may enter any premises and exercise inspection powers (including the examination of documents and the taking of evidence) as he deems necessary to carry out the purposes of the Act.

VIII. Claims and Complaints

If an employee is paid less than the minimum wage set for his class of work, or less than the amount due to him under the provisions of this Act, he has six months to file an application with the authority designated for that purpose.

An application that has been delayed beyond this period may be admitted if the authority is satisfied that the applicant had sufficient cause for not submitting the application within the specified time frame.

Any lawyer or official of a registered trade union. Inspector under the Act or other person acting with the permission of the Authority can make the complaint on behalf of an employed person.

A single application may be submitted by or on behalf of any number of employees from the same factory whose wages have been delayed.

A complaint regarding less payment of notified wages under Section 21 of the Act may be filed in court only with the Authority's approval within one month of such approval.

A complaint under Section 22 of the Act may be made to the court only by or with the sanction of an Inspector within six months of the alleged date of the offence.

IX. Action by the Authority

The authority may order the payment of the amount by which the minimum wages payable exceed the amount actually paid, as well as compensation up to ten times the amount of such excess. In cases where the excess is paid before the application is decided, the Authority may direct payment of compensation. If a malicious or vexatious complaint is filed, the authority may levy a fine of not more than Rs. 50/- on the applicant and order that it be paid to the employer.

Every direction issued by the Authority is final.

X. Penalty for offence under the Act

Any employer who fails to pay any employee the amount due to him under the provisions of this Act, or who violates any order of rules governing normal working days or weekly holidays, shall be punished with imprisonment of either description for a term not exceeding six months, or with a fine not exceeding five hundred rupees, or with both.

Any employer who fails to keep a register or record required by section 18 is subject to a fine of up to five hundred rupees.

XI. Minimum Rates of Wages Fixed

Name of undertaking……………

Serial No. Category of employees Minimum Wages

……………………………………………….

XII Name and address of the Inspector(s)

Name Address

………………………………………………..

FORM X: Register of Wages, Fine, Damage and Advance

FORM XII (Rule 26-A) Issue of Cards to the employees engaged in Public Motor Transport.

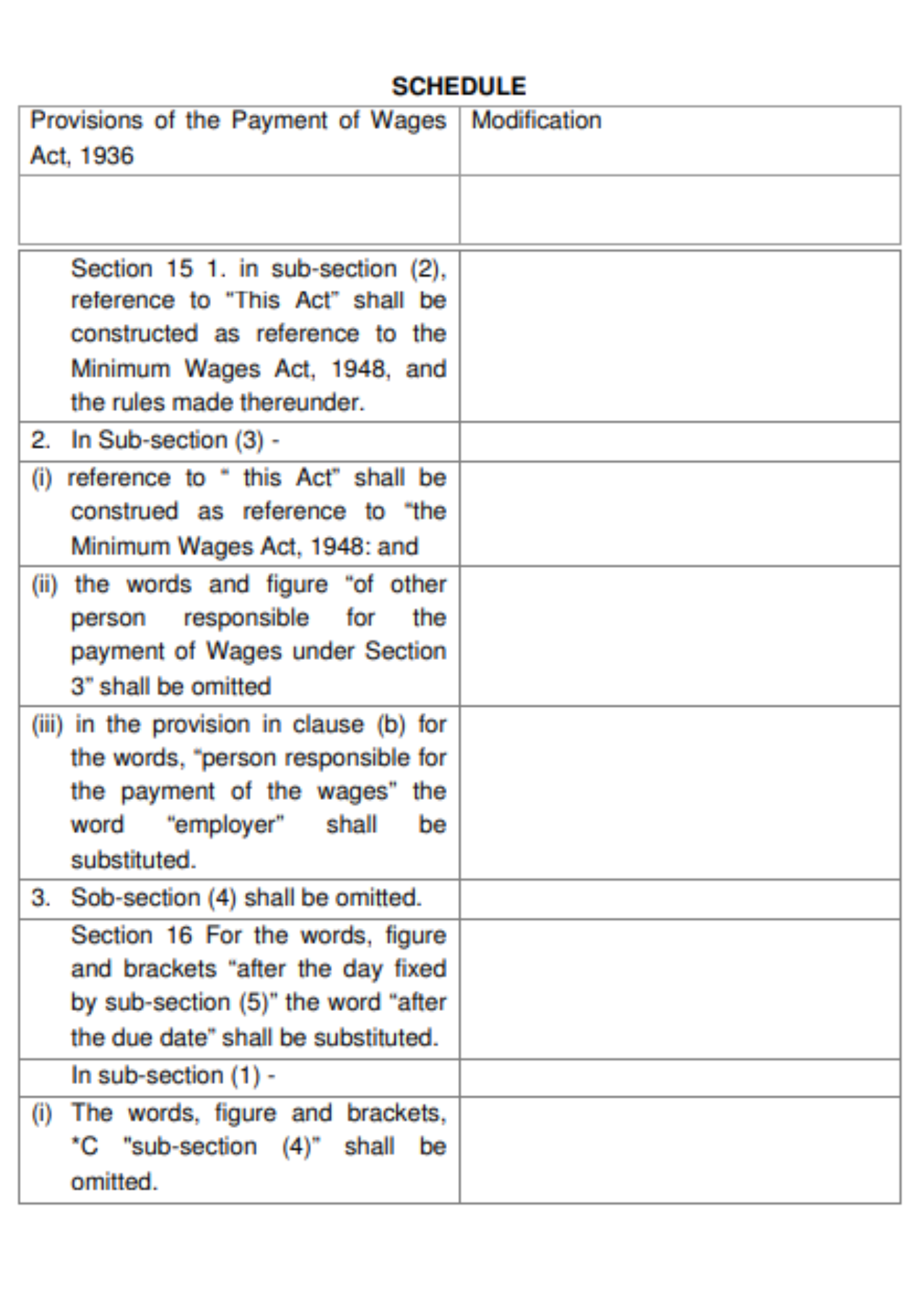

SCHEDULE

Scheduled Employments The following employments are declared as Scheduled Employments by the Haryana Govt. as per Section 27 of Minimum Wages Act, 1948:-

- Agricultural Employments. Machine Tools and General Engg. including electrical goods industry.

- Cinema Industry,

- Saw Mills and Timbers Trade Industry.

- Cotton Ginning and Pressing Industry.

- Textile Industry.

- Glass, Glass fire and glass Processing Industry.

- Public Motor Transport.

- Tanneries and Leather Manufactory.

- Rice Mills, Flour Mills and Dal Mills.

- Rubber Industry.

- Operation of Tubewell Industry.

- Local Authority.

- Woolen Carpet Making of Shawal Weaving establishment run by powerloom or Handloom.

- Shops and Commercial Establishments.

- Tailoring and Stitching & Embroidery Establishments.

- Public Works Departments (Irrigation).

- Oil Mills.

- Khandsari, Gur & Shaker Industry.

- Private Printing Presses.

- Non-fenous Metal Rolling and Re-Rolling Industry (ii) Brass, Copper and Aluminimum, utensils making Industries.

- Scientific Industry.

- Chemical and Distillery Industry.

- Contractors Establishment of the Forest Deptt.

- Electroplating using salts or Chromium Nickel or any other compound and connected buffing and polishing Industry.

- Ferrous Metal Rolling and Re-Rolling Industry,

- Construction & Maintenance of Roads, Building Operation.

- Stone Breaking and Stone Crushing.

- P.W.D. (Public Health).

- Ayurvedic and Unani Pharmacies.

- Potteries Ceramics and Refractory Industry.

- Automobile Repair Workshop.

- Paper, Card Board and Typewriter Ribbon Industry.

- Asbestos Cement Factories & Others Cements Products.

- Petrol & Diesel oil Pumps.

- Foundries with or without attached machine shop.

- Ready-made garments.

- Food Products, Dairy Products, Grain Mill Products and Bakery Products.

- Soap in any form, other washing products, synthetic detergents and cosmetics.

- Co-operative credit and service society and mini banks.

- Forestry or any other development work related there to.

- Packing Industry.

- Rags cleaning and Sorting.

- Bricks-kilns.

- Private Coaching classes, schools and including nursery school and technical institutions.

- Any Shops and Commercial Estts. other then covered under any of the entries in the schedule.

- Hospitals and Nursings.

- Electronics and Allied or incidental Industry.

- Any manufacturing process where in manufacturing process as designed under section 2 (k) of the Factories Act, 1948 is carried out and which is not covered under any entry to the schedule part-I and part-D of the Minimum Wages Act, 1948.

- Plastic Industry.

- Employment in Transport Industries loading and unloading processing Industry.

- Any Tobacco (including Bidi making) manufacturing (Does not exist in Haryana.)

What is the Minimum Wage Act of 1948?

In 1948, the Central Legislative Assembly passed the Minimum Wages Act '1948, which established minimum wage rates for certain types of employment. The provisions of the Act are intended to achieve the goal of social justice for workers employed in scheduled employment by establishing a minimum wage for them.

In other words, the Act seeks to establish statutory minimum wages in order to prevent labor exploitation. Following its passage, the Act provided blue-collar workers with a sense of equality and justice, and it was guided by the standards recommended by the Fair Wage Committee.

Objectives of the Minimum Wages Act'1948

The Act's primary goal is to ensure that the government recognizes labor's rights. The following are the goals of the Minimum Wage Act of 1948:

- To make workplace labor exploitation illegal

- To guarantee the minimum wage to all blue-collar employees in the organized sector

- To ensure that the Act is applied to as many organized sector employees as possible

- To give the government the authority to set minimum wages and revise them every five years based on the country's economic situation

- To protect the employee so that they can meet their needs, maintain their health, and be comfortable

The Minimum Wage Act of 1948 applies to entities that employ 1,000 people in their respective Indian states. Furthermore, the Act does not apply to employees working in an undertaking owned by the Central Government or with its consent.

Haryana Minimum Wage Rates 2022

Haryana minimum wage has been revised in various occupations as defined in the Government Notification dated 21.10.2013 and is based on the Working Class Cost of Living Index Number; also known as Consumer Price Index number.

Wage adjustments are made every six months, on January 1 and July 1. This is done after taking into account the average rise or fall in the Haryana State Working Class Cost of Living Index Number for the half-year periods ending in December and June, respectively.

The average Working Class Cost of Living Index Number or the Consumer Price Index number was 2958.90 at the end of December 2021, and it will rise to 3015.10 over the following six months to the end of December 2021.

As a result, the total Consumer Price Index number has increased by 56.20. There is 100% neutralization of the rise or fall in the CPI number on a pro-rata basis, as per the notification issued on October 21, 2015, and incorporated on November 1, 2015.

As a result, a 1.90% increase in the prevailing basic pay of workers working in various categories and scheduled employments (as per notification dated 21.10.2015) is determined under Section 5 (2) of the Minimum Wage Act. As a result, the minimum wages in various categories and scheduled employments notified by the State of Haryana in 21.10.2015 are payable as of 01.07.2022 as follows.

Furthermore, there will be a 1.90% increase in the current monthly and daily minimum wages for workers in the Brick Kiln Industries. Now, the minimum wage in the state of Haryana for various categories of workers working in Brick Kiln Industries is fixed and payable beginning on July 1, 2022, as follows:

All employers are directed to fully implement the revised minimum wage as of July 1, 2022, and arrears must also be paid as of that date.

Impact of Minimum Wages on Workers' Standard of Living, Employment, and Productivity

The Minimum Wages Act of 1948 is an important piece of legislation in India. The introduction and implementation of minimum wage has far-reaching implications for the country’s labor force.

Effect on Standard of Living

The Act seeks to ensure that all workers in India are paid a minimum wage so as to provide them with a decent standard of living. The implementation of a minimum wage has had a positive impact on the standard of living of workers in India.

It has helped to raise wages, which has resulted in an improvement in the quality of life for many of the country’s low-income workers. The minimum wage has also served to reduce income inequality, as it has provided workers with a living wage that is in line with the cost of living in India.

Effect in Employment

The introduction of a minimum wage has also had a positive impact on employment in India. By raising wages, it has incentivized employers to hire more workers and encouraged them to invest in training and development of their employees. This has resulted in a more productive and skilled workforce, which is beneficial for the economy as a whole.

Effect on Productivity

Finally, the implementation of a minimum wage has had a positive effect on productivity. By ensuring that workers are paid a fair wage, employers are incentivized to invest in training and development, which can result in increased productivity and efficiency. This, in turn, can result in higher profits, which can be invested back into the business, leading to further growth.

Overall, the Minimum Wages Act of 1948 has had a positive impact on workers’ standard of living, employment, and productivity in India.

Conclusion

In conclusion, the Minimum Wages Act in Haryana has been aimed at creating a more equitable and secure work environment for workers in the state. It has ensured that the workers in Haryana are paid fair wages that allow them to support their families and lead a better quality of life.

The implementation of the Act has also helped to reduce poverty and improve the overall standard of living in Haryana.

How can Deskera Help You?

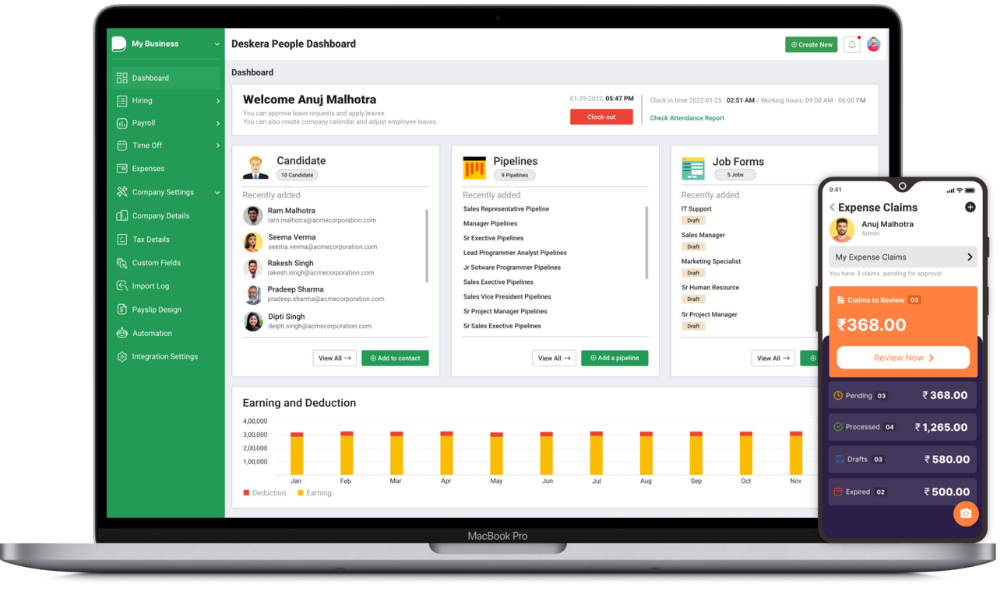

Deskera People is human resources software that helps businesses manage employee data and track performance. It helps businesses manage employee attendance, payroll, benefits, recruitment, and other HR functions. It also offers analytics and reporting to assist you in making better decisions.

Deskera's various modules are suitable for businesses of all sizes, from small start-ups to large corporations. It provides businesses with a simple, unified platform to manage their operations more effectively and efficiently.

Deskera Books for automated accounting and invoice generation.

Deskera CRM provides exceptional customer relationship management.

Deskera ERP provides exceptional and cost-effective enterprise resource planning.

Deskera MRP for assisting manufacturers in optimizing their administrative tasks, among other things!

Key Takeaways

- The minimum wage in the Indian state of Haryana has been increased to ensure that workers in the state are provided with a fair wage for the work they do.

- Minimum wages are an important tool used by the government to protect vulnerable workers in India.

- Minimum wages set a legal floor on the wages paid to workers and ensure that wages are sufficient to meet basic needs.

- Minimum wages are also important in reducing wage inequality and helping to protect the most vulnerable workers.

- In 1948, the Central Legislative Assembly passed the Minimum Wages Act '1948, which established minimum wage rates for certain types of employment. The provisions of the Act are intended to achieve the goal of social justice for workers employed in scheduled employment by establishing a minimum wage for them.

- The Act seeks to establish statutory minimum wages in order to prevent labor exploitation. Following its passage, the Act provided blue-collar workers with a sense of equality and justice, and it was guided by the standards recommended by the Fair Wage Committee.

- To protect the employee so that they can meet their needs, maintain their health, and be comfortable and to protect them from exploitation are some of the top objectives of the Minimum Wages Act.

Related Articles