Due to its proximity to Delhi, the Capital of India, Haryana is a prime spot for conducting business. No wonder many shops and commercial establishments prefer setting up their facilities in the state.

If you want to set up a shop or commercial establishment in Haryana, you have to fill the Form F Statement for Registration of Establishments, also known as Form F, Haryana, and submit it to the Inspector appointed under Section 19 of the Haryana Shops and Commercial Establishments Act, 1958.

Haryana Form F Statement for Registration of Establishments, also known as Form F, Haryana, is part of the Haryana Shops and Commercial Establishments Act and Rules, which is similar to the Punjab Shops and Commercial Establishments Act and Rules, 1958.

The Punjab Shops and Commercial Establishments Act 1958 is also referred to as Act No. 15 of 1958.

This article explains all subsections of the Haryana/Punjab Form F Statement for Registration of Establishments or Form F, Haryana, so that you can fill out the form correctly and submit it to the Inspector appointed under the Act.

For convenient understanding, this article on Form F, Haryana, has been divided into the following subsections:

- What is the Haryana Form F Statement for Registration of Establishments or Form F, Haryana?

- Which Compliance Forms Does a Shop or Commercial Establishment Owner Need to Fill?

- Which Shop or Commercial Establishment Owners Need to Submit Form F, Haryana?

- Which Establishments are Exempted from Filling Form F, Haryana?

- Form F, Haryana - How to Fill the Form

- Conclusion

- Key Takeaways

What is the Haryana Form F Statement for Registration of Establishments or Form F, Haryana?

Haryana Form F Statement for Registration of Establishments or Form F, Haryana, is part of the Haryana Shops and Commercial Establishments Act and Rules, which is similar to the Punjab Shops and Commercial Establishments Act and Rules, 1958.

Section 13 of the Punjab Shops and Commercial Establishments Act 1958 and Rule 13 of the Punjab Shops and Commercial Establishments Rules 1958 contain the rules regarding the Form F Statement for Registration of Establishments or Form F, Haryana.

In Form F, Haryana, all shop and commercial establishment owners in the Indian State of Haryana must declare the information needed to register the shop or commercial establishment as per the rules prescribed in Section 13 of the Punjab Shops and Commercial Establishments Act 1958 and Rule 13 of the Punjab Shops and Commercial Establishments Rules 1958.

In Form F Statement for Registration of Establishments or Form F, Haryana, the owner of a shop or commercial establishment in Haryana must enter the following information:

- Name and parentage of employer

- Name of Manager, if any

- Name of the establishment

- Full Postal address of the establishment

- Nature of Business

- No. of employees, if any (Young persons and Other persons)

- No. and date of previous registration certificate surrendered

- Date

- Signature of employer

After the owner of a shop or commercial establishment in Haryana fills out and submits Form F, Haryana, along with the prescribed fee, to the Inspector appointed under the Punjab Shops and Commercial Establishments Act 1958, the Inspector verifies and issues the Registration Certificate to the concerned employer.

According to Section 13(2)(iii) of the Punjab Shops and Commercial Establishments Act 1958, the employer must renew the Registration Certificate before 31st March after the completion of three (3) years from the date of obtaining/ renewing the certificate.

However, the employer may demand a grace period of thirty (30) days for renewing the registration.

The prescribed fee for submitting Form F, Haryana is mentioned in Rule 13(1) of the Punjab Shops and Commercial Establishments Rules 1958.

Which Compliance Forms Does a Shop or Commercial Establishment Owner Need to Fill?

Besides Form F Statement for Registration of Establishments or Form F, Haryana, all shop and commercial establishment owners in Haryana must fill out and submit the following forms:

- Form A - Intimation of working hours & intervals

- Form B - Display of Notices

- Form C - Register of employee

- Form D - Register of Wages of employees

- Form E - Register of Deductions

- Form G - Form of change of information

- Form H - Registration of Establishment

Which Shop or Commercial Establishment Owners Need to Submit Form F, Haryana?

According to the Punjab Shops and Commercial Establishments Act and Rules 1958, all shop and commercial establishment owners in the Indian State of Haryana must fill out the Form F Statement for Registration of Establishments or Form F, Haryana and submit it to the Inspector.

According to Section 2(iv) of the Punjab Shops and Commercial Establishments Act 1958, commercial establishment refers to any premises where a business, profession, or trade is conducted primarily for profit. It also includes all printing or journalistic establishments and places where stock trading, insurance broking, or banking is done.

All theaters, cinema halls, hotels, restaurants, and boarding/ eating houses are also considered ‘commercial establishments.’

According to Section 2(xxv) of the Punjab Shops and Commercial Establishments Act 1958, ‘shop’ refers to any office, godown, warehouse, store room, or sale depot associated with any trade or business.

However, if the workers of a commercial establishment receive benefits as per the Factories Act 1948, those shops will not come under the purview of the Punjab Shops and Commercial Establishments Act 1958.

Which Establishments are Exempted from Filling Form F, Haryana?

According to Section 3 of the Punjab Shops and Commercial Establishments Act 1958, Central, State, or Local Government offices, the Reserve Bank of India, railway administration, tramway, postal services, railway dining cars, and lawyers’ offices do not need to fill Form F Statement for Registration of Establishments or Form F, Haryana.

Form F, Haryana - How to Fill the Form

The following paragraphs explain each subsection of the Form F Statement for Registration of Establishments or Form F, Haryana. Form F, Haryana is a mandatory compliance form that all shop and commercial establishment owners in Haryana must fill out and submit to the Inspector appointed under the Punjab Shops and Commercial Establishments Act 1958.

To

The Inspector of Shops and Commercial

Establishment__________ Circle

In this subsection of Form F, Haryana, the owner of a shop or commercial establishment needs to mention the Circle in which the shop exists/ will exist.

Name and parentage of employer

In this subsection of Form F, Haryana, the owner of a shop or commercial establishment needs to mention the employer's name and parent’s name. If the owner and employer are the same, the name and details entered will be the same. Be careful while filling out this section since any mistake will get printed on the Registration Certificate.

Name of Manager, if any

In this subsection of Form F, Haryana, the owner of a shop or commercial establishment needs to mention the name of the manager responsible for the daily operations of the concerned shop or commercial establishment. If there is no manager, this section can be left blank.

Name of the Establishment

In this subsection of Form F, Haryana, the owner of a shop or commercial establishment needs to mention the name of the shop or commercial establishment. Check the spelling since this will be printed on the Registration Certificate.

Full Postal address of the Establishment

In this subsection of Form F, Haryana, the owner of a shop or commercial establishment needs to write the full address, including the city and PIN code, of the concerned shop or commercial establishment.

Nature of Business

In this subsection of Form F, Haryana, the owner of a shop or commercial establishment needs to mention the nature of business carried out on the premises. The business must be among those enlisted in Section 2 of the Punjab Shops and Commercial Establishments Act 1958.

No. of Employees, if any (Young persons and Other persons)

In this subsection of Form F, Haryana, the owner of a shop or commercial establishment needs to mention the total number of employees. The employer must mention the total number of young employees and the total number of other persons separately.

No. of and Date of Previous Registration Certificate Surrendered

In this subsection of Form F, Haryana, the owner of a shop or commercial establishment needs to specify the details of the previous registration certificate (if surrendered). Here, the owner must mention the number and date of the previous registration certificate.

Date

In this subsection of Form F, Haryana, the owner of a shop or commercial establishment needs to mention the date of submitting the form.

Signature of Employer

In this subsection of Form F, Haryana, the owner/ employer of a shop or commercial establishment must provide their signature.

Besides the sections mentioned above, Form F, Haryana also contains a section to be filled in by the authority. The concerned authority (Inspector) will verify the details, check whether the prescribed fee has been paid or not, and mention the reference number and date on which the shop or commercial establishment gets registered. After this, the Inspector will sign the filled Form F, Haryana.

Conclusion

Form F Statement for Registration of Establishments or Form F, Haryana must be mandatorily filled out by the owners of shops and commercial establishments operating in the Indian State of Haryana and submitted to the Inspector appointed under the Haryana/ Punjab Shops and Commercial Establishments Act 1958.

The Inspector issues the Registration Certificate after verifying Form F, Haryana, after which the shop or commercial establishment owner becomes free to carry out any business, trade, or profession mentioned in the form.

How can Deskera Help You?

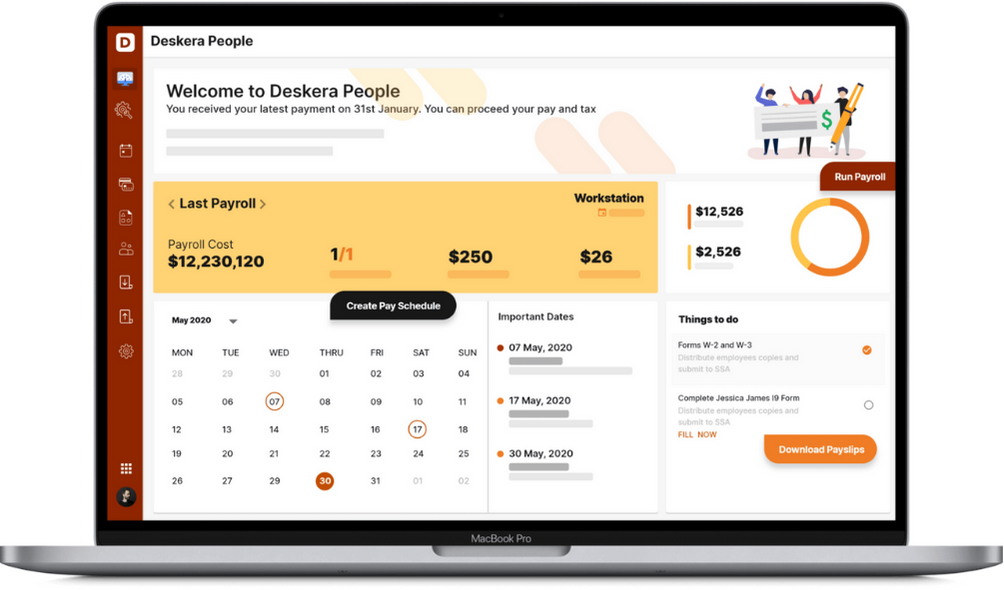

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. With features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning, and uploading expenses, and creating new leave types, it makes your work simple.

Key Takeaways

- If you want to set up a shop or commercial establishment in Haryana, you have to fill the Form F Statement for Registration of Establishments, also known as Form F, Haryana, and submit it to the Inspector appointed under Section 19 of the Haryana Shops and Commercial Establishments Act, 1958

- Section 13 of the Punjab Shops and Commercial Establishments Act 1958 and Rule 13 of the Punjab Shops and Commercial Establishments Rules 1958 contain the rules regarding Form F, Haryana

- After the owner of a shop or commercial establishment in Haryana fills out and submits Form F, Haryana, along with the prescribed fee, the Inspector verifies and issues the Registration Certificate to the concerned employer

- The prescribed fee for submitting Form F, Haryana is mentioned in Rule 13(1) of the Punjab Shops and Commercial Establishments Rules 1958

Related Articles