GST is an indirect tax that replaced many indirect taxes such as the excise duty, VAT, services tax, and so on, with the idea of ‘one nation, one tax’. Goods and services are divided into five different tax slabs for collection of tax: 0%, 5%, 12%, 18% and 28%.

However, petroleum products, alcoholic drinks, and electricity are not taxed under GST and instead are taxed separately by the individual state governments, as per the previous tax system.

Another thing to remember about GST is the GST Return. A registered person/business has to file a document or report containing details about the income to the tax authorities every calendar month. This document or statement is known as GST Return.

The GST Return should include purchases, sales, output GST on sales, and input tax credit. This return needs to be filled with the tax administrative authorities to pay the tax to the Government. It is essential for every business registered under GST to file GST returns.

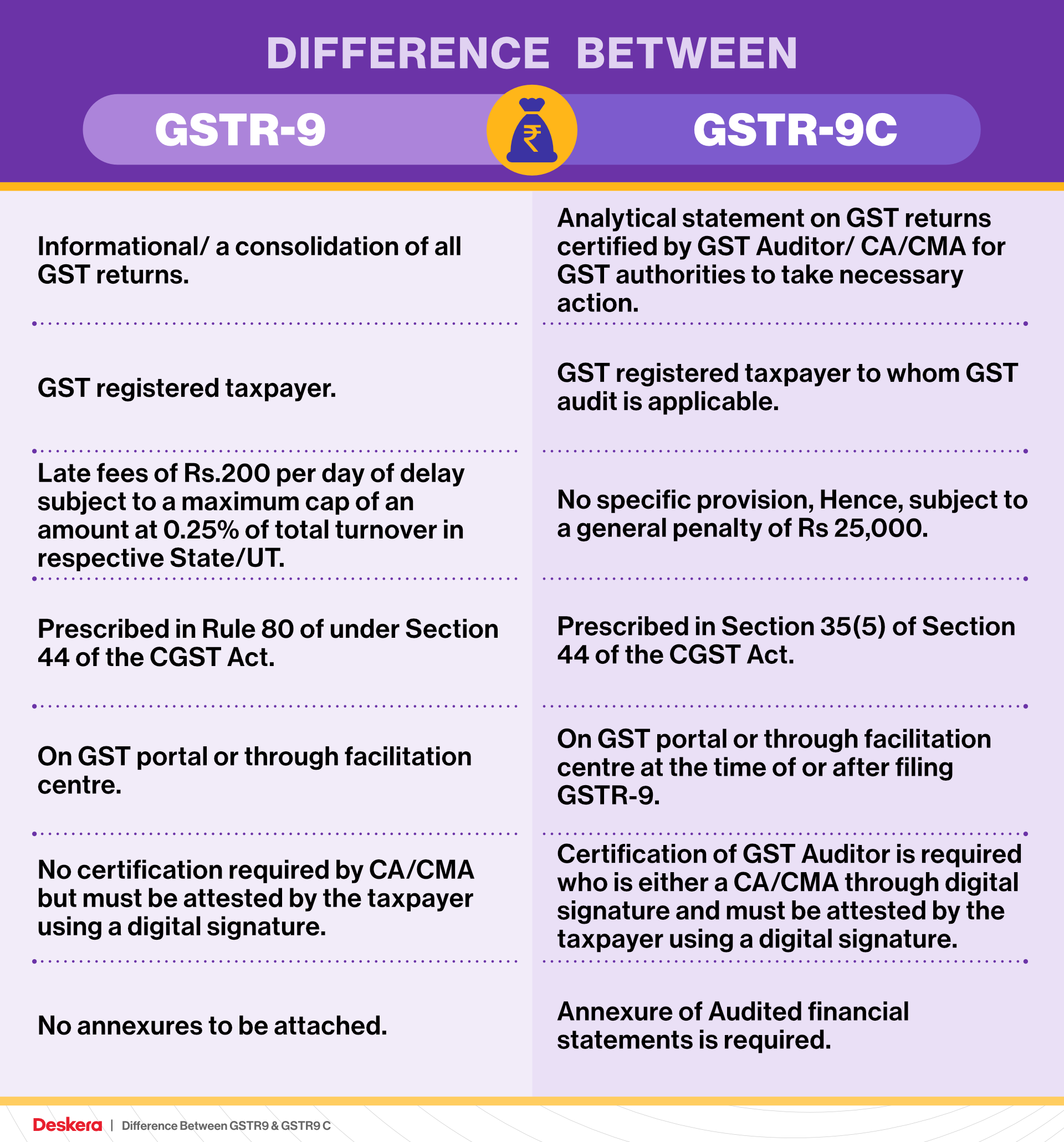

There are different types of GST Returns and in this article we will try to draw a difference between the two popular ones- GSTR9 & GSTR9 C. Let us start by noting down the definitions of GSTR9 & GSTR9 C.

What is GSTR 9?

GSTR 9 is an annual return to be filed yearly by taxpayers registered under GST. It consists of details regarding the outward and inward supplies made/received during the relevant financial year under different tax heads i.e. CGST, SGST & IGST and HSN codes.

It is a consolidation of all the monthly/quarterly returns (GSTR-1, GSTR-2A, GSTR-3B) filed in that year. Though complex, this return helps in extensive reconciliation of data for 100% transparent disclosures.

What is GSTR 9C?

The GSTR 9C is an audit form that was introduced on September 13, 2018. It must be filed annually by taxpayers with a turnover above 2 crores and it must be certified by a CA. It is basically a reconciliation statement between the annual returns filed in GSTR-9 and the taxpayer’s audited annual financial statements.

The form will contain the taxpayer’s gross and taxable turnover according to their accounting books, reconciled with the corresponding figures after consolidating all of their GST returns for the financial year, and any difference revealed by the reconciliation. The difference, and the reason for it, should be mentioned explicitly. A GSTR-9C must be issued for every GSTIN.

Now that we have a basic understanding of what is GSTR 9 and GSTR 9C, let us find out the difference between the two.

Difference Between GSTR 9 and GSTR 9C

GSTR 9

- Informational/ a consolidation of all GST returns

- GST registered taxpayer

- Casual Taxable Person Non-Resident Taxable Person Input Service Distributor Unique Identification Number Holders Online Information and Database Access Retrieval (OIDAR) Service providers Composition Dealers Persons subject to TCS or TDS provisions.

- Late fees of Rs.200 per day of delay subject to a maximum cap of an amount at 0.25% of total turnover in respective State/UT.

- Prescribed in Rule 80 of under Section 44 of the CGST Act.

- Consolidated summary details of the turnover, ITC and tax paid, late fees as per the GST returns filed between April of FY beginning and March of FY end along with its amendments made between April of next FY beginning and September of next FY. Further, declaration of demands/ refunds, supplies from composition dealers, Job works, goods sent on an approval basis, HSN wise summary of outward and inward supplies, late fees payable is required to be reported wherever applicable.

- No certification required by CA/CMA but must be attested by the taxpayer using a digital signature.

- No annexures to be attached.

- Also, the maximum penalty for failing to file the GSTR-9 return cannot exceed 0.25% of total turnover in the respective state/union territory.

Note: GSTR-9C is dependent on GSTR-9 Annual Return. And hence the annual return must be filed first. Also, taxpayers must remember that the return can be filed only once and there are no provisions to revise this return.

GSTR 9C

- Analytical statement on GST returns certified by GST Auditor/ CA/CMA for GST authorities to take necessary action.

- Prescribed in Section 35(5) of Section 44 of the CGST Act

- GST registered taxpayer to whom GST audit is applicable.

- Those persons mentioned under the column for GSTR-9 including a registered person whose aggregate turnover in an FY is less than Rs.2 crore upto 2017-18 and Rs.5 crore for FY 2018-19 and 2019-20.

- 31st December of next FY, either with or after filing GSTR-9.

- No specific provision, Hence, subject to a general penalty of Rs 25,000.

- On GST portal or through facilitation centre at the time of or after filing GSTR-9.

- Reporting of reconciliation needed between turnover, tax paid and ITC. Report on Auditor’s recommendation of any additional tax liability.

- Certificate by GST Auditor/ CA/ CMA.

- Certification of GST Auditor is required who is either a CA/CMA through digital signature and must be attested by the taxpayer using a digital signature.

- Annexure of Audited financial statements is required.

GST Easy with Deskera Books

Deskera is all you need for GST registration online. From helping you set up your company in India to helping you create invoices, and send invoices immediately. With Deskera books you can generate beautiful invoice templates from the system without the need to design your template from scratch. Deskera will help you to calculate your GST in a hassle free way.

Want to manage your finances and budgets, Deskera can help you. Be it invoicing, inventory, CRM, accounting, or HR & payroll, you will get all the required information at Deskera.

With the help of Deskera’s blogs, you can easily get a better understanding of various business topics such as All about GST Compensation Cess, Understanding HSN Codes & SAC Codes Under India GST etc.

Deskera Books can help you gain an understanding of online invoicing, accounting & inventory that can be quite beneficial for your business. Deskera works on a cloud-based business model to simplify business functioning.

It reduces the admin time while also increasing efficiency. Deskera Books can be quite advantageous for you if you want to improve your cash flow and budgeting for your business. Here is a quick tutorial on how to set-up your GST with Deskera books.

Related Articl