Are you wondering, if there any laws related to Wages and Overtime Payment in Bihar? Well, the answer is yes. The state government of Bihar has raised the minimum wage effective April 1, 2022.

This also includes Form-X Register of Wages and Overtime Payment. This article will serve as a guide for the same. We will be covering the following:

Bihar minimum wages rules 1951

In a number of professions included in the schedule, the Minimum Wages Act of 1948 established minimum wage rates. The Bihar government adopted the Bihar Minimum Wages Rules, 1951, for the efficient administration and supervision of the Minimum Wages Act, 1948.

Applicability

- Every employer is required to pay the planned minimum wages under the Act and Rules.

- Every employer is required to pay the minimum wage in accordance with the Act and Rules for the planned employments.

- With provisions to fix hours of work, overtime, and overtime wages, variable DA is fixed based on the Consumer Price Index of the prior calendar year.

- Bihar's minimum salary is determined with the help of the State Level Minimum Wages Advisory Board.

Form X

Form X - Register of wages and overtime payment must be kept on file by all employers in the specified manner.

Form of register and records

(1) Every employer is required to keep a wage register in Form X on site.

(2) Every employer is required to give each employee a wage slip in Form XI at least one day before wages are paid out.

(3) On the register of wages and pay stubs, each employer must get the signature or thumbprint of each employee.

(4) The employer or any person designated by him in this regard must authenticate entries in the register of pay and wage slips.

(5) Every employer is required to keep a Muster Roll in Form V, with the caveat that the State Government may exempt any establishment or set of establishments from the application of this law.]

Weekly holidays

A worker is entitled to overtime pay at the rate specified in Rule 25 for work done on the day of rest.

Extra wages for overtime

(1) When a worker works at any job for longer than 9 hours on any given day or for more than 48 hours on any given week, he or she is entitled to overtime pay at twice the regular rate of pay:

With the proviso that extra compensation for overtime at one and a half times the regular rate of wages shall be payable to a worker working for more than 48 hours in any given week for employment in any mica works, lac manufacturer, or tea plantation:

Furthermore, nothing in this rule shall be interpreted to change the terms of the 1948 Factories Act.

The term "ordinary rate of earnings" refers to the base salary plus any additional benefits, such as the cash equivalent of benefits from the concessional sales of food and other items to the employee, to which the employee is now entitled, but does not include bonuses:

As long as:

(i) the total number of overtime hours worked in a quarter is no more than 50;

(ii) the total number of hours worked in a day, including rest periods, is no more than 12; and

(iii) the total number of hours worked in a day is no more than 10.

A "quarter" is defined as a period of three consecutive months starting on January 1, April 1, July 1, and October 1.]

(2) A Form IV Register documenting overtime compensation must be maintained.

Overtime

(1) When an employee, whose minimum rate of pay is set under this Act by the hour, the day, or by a longer wages period that may be prescribed, works on any given day longer than the number of hours that make up a normal working day, the employer must pay him for every hour or portion of an hour so worked in excess at the overtime rate set under this Act or under the law of the appropriate Government for the time being in force, whichever is higher.

(2) In any situation where the requirements of Section 59 of the Factories Act of 1948 are relevant, nothing in this Act shall affect how that section operates or its provisions.

Claims

(1) Any Workmen's Compensation Commissioner, any officer of the Central Government performing duties as a Labor Commissioner for any region, or any officer of the State Government not below the rank of Labor Commissioner for any region may be appointed by the appropriate Government by notification in the Official Gazette or any other officer with experience as a judge of civil court or as a stipendiary magistrate shall be the authority to hear and determine for any specified area all claims arising out of payment of less than the minimum rates of wages or in respect of the payment of remuneration for days of rest or for work performed on such days under clause (b) or clause (c) of sub-section (1) of Section 3 or of wages at the overtime rate under Section 14 to employees employed or paid in that area.

[Form X]

[Rule 26(1)]

Register of Wages

Maintenance of registers an records

(1) Every employer is required to keep the necessary registers and records that detail the personnel he employs, the tasks they complete for him, the pay they receive, the receipts they provide, and any other information in the format that may be prescribed.

(2) Every employer must display notices in the prescribed form with the prescribed particulars in the factory, workshop, or other location where the employees in the scheduled employment may be employed, or in the case of out-workers, in the factory, workshop, or other location that may be used to give them out-work.

(3) The appropriate Government may, by regulations made in accordance with this Act, provide for the issuance of wage books or wage slips to employees employed in any scheduled employment for which minimum rates of wages have been fixed and prescribe the procedures for how entries shall be made and authenticated in such wage books or wage slips by the employer or his agent.

AMENDMENTS

In section 18, after sub-section (3), add the following sub-section:-

(4) The appropriate Government may further provide, through rules formed according to this Act, for the issuance of identity cards and services certificates to employees engaged in any planned employment in the manner and with the information specified therein. [See Section 2 of Bihar Act 9 of 1988, effective as of 19-2-1988]

Inspectors

(1) By publishing a notice in the official gazette, the relevant government may designate individuals as Inspectors for the purposes of this Act and specify the local boundaries within which they are to carry out their duties.

(2) Within the local limits for which he is appointed, an Inspector may, subject to any rules enacted in this regard.

(a) enter, at all reasonable hours, with such assistants (if any), being persons in the service of the [13] [Government] or any local or other public authority, as he thinks fit, any premises or place where employees are employed or work is distributed to out-workers in any scheduled employment in respect of which minimum rates of wages have been fixed under this Act, for the purpose of inspecting any register, record of wages, or notices required to be kept or displayed by or for the benefit of the Government.

(b) investigate any person he finds in such a location who, in his reasonable opinion, is an employee working there or an employee to whom work is being distributed there;

(c) demand that anyone assigning work to others and any assignee's provide any information that is within his power to provide, including names and addresses of the individuals to, for, and from whom the work is assigned or received, as well as information regarding the payments to be made for the work;

(d) if he has grounds to think that an employer has committed a crime under this Act, seize or make copies of any registers, records of wages, or notices, or portions thereof; and

(e) exercise any other powers that may be prescribed.

(3) According to the Indian Penal Code, every Inspector shall be considered a public official (45 of 1860).

(4) Anyone requested by an inspector to produce any item or provide any information pursuant to subsection (2) shall be regarded legally obligated to do so in accordance with sections 175 and 176 of the Indian Penal Code (45 of 1860).

AMENDMENTS

(1) In section 19, in sub-section (2), The following clauses should be added after clause

(d), specifically:

(dd) take or accept statement from guardian of such employees who, due to certain physical or mental disabilities (deaf, dumb, etc.), cannot give statement about payment of wages less than the minimum rates of wages fixed for that employee's class of work, or less than the amount due to him under the provision of the Act;

(ddd) any application made in accordance with subsection (2) of section 20 of the Act before any authority chosen in accordance with subsection (1) of that section.

Payment of minimum rates of wages

(1) The employer shall pay to each employee engaged in a scheduled employment under him wages at a rate not less than the minimum rate of wages fixed by such notification for that class of employees in that employment, without any deduction except as may be authorized within such time and subject to such conditions as may be prescribed, where in respect of any scheduled employment a notification under section 5 [10] is in force.

(2) The 1936 Payment of Wages Act's provisions are unaffected by anything in this section (4 of 1936).

AMENDMENTS

In section 12, after sub-section (1), insert the following sub-section, namely:--

(1A) If, immediately prior to the issuance of a notification under section 5 fixing or revising the minimum rates of wages in respect of any scheduled employment, wages at a rate higher than the rate so fixed or revised were payable either by contract or agreement, or under any other law then in effect, then, in spite of anything contained in this Act, wages at such higher rate shall be payable to the employees in such scheduled employment, and the wages so paid shall be considered the minimum rates of wages for the remainder of the Scheduled Employment.

How Deskera Can help You?

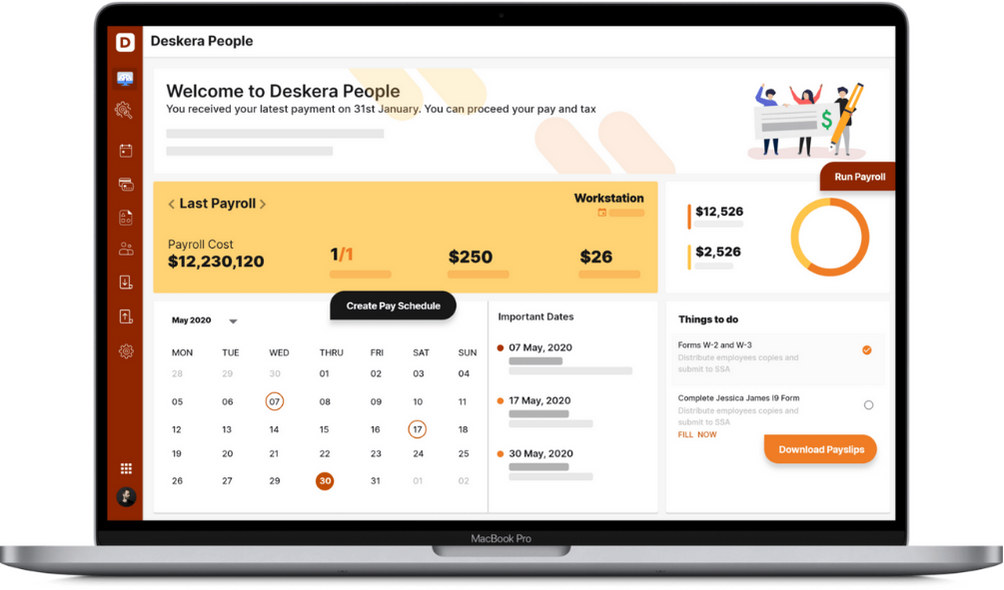

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key Takeaways

- Minimum wages are the smallest sum or minimal compensation that a firm pays to employees or workers for work accomplished within a specific amount of time. Importantly, the minimum wage cannot be lowered by a contract or collective agreement.

- Laws or authorities set the minimum salary. The purpose of the minimum wage act is to prevent employers from underpaying their employees or workers. As a result, it tries to get rid of any instances where workers are paid too little.

- Each meeting's date, time, and location are set by the chairman, and a written notice with these details as well as a list of the business to be discussed at the meeting must be sent to each member by registered mail at least fifteen days before the meeting's scheduled date. However, in the case of an emergency meeting, only seven days' notice may be given to all members.

- The minimum wage act is a social justice law since it aims to lessen the income gaps between men and women. Reducing poverty and assisting people in receiving the money they deserve are the two main objectives of minimum wages.

Related Articles