Are minimum wages fair for your job? The minimum wage is revised twice a year. The state government of Bihar has raised the minimum wage effective April 1, 2022. If you work in a private organization in Bihar, you should be aware of the Minimum Wages.

Let us learn more about the Bihar Minimum Wages Rules 1951 through this article. Following are the topics covered:

What is Minimum Wage?

The least amount or minimal wage a business pays to employees or workers for tasks completed in a certain time frame is known as minimum wages. Importantly, an individual contract or collective agreement cannot reduce the minimum wage.

Minimum wages are set by law or by an authority. The minimum wage act's goal is to ensure that no employee or worker is exploited in terms of remuneration by their employer. As a result, it attempts to eliminate any instances of workers being paid excessively low pay.

The minimum wage act focuses on reducing pay disparities between men and women, and hence is a social justice act. The basic goal of minimum wages is to reduce poverty and assist people in receiving the pay they deserve.

Bihar minimum wages rules 1951

The Minimum Wages Act of 1948 establishes minimum wage rates in various occupations that are included in the schedule. For the effective administration and supervision of the Minimum Wages Act, 1948, the Bihar government adopted the Bihar Minimum Wages Rules, 1951.

Applicability

• Under the Act and Rules, every employer must pay the minimum wages for the planned

• Under the Act and Rules, every employer must pay the minimum wages for the planned employments.

• Variable DA is fixed based on the Consumer Price Index of the previous calendar year, with provisions to fix hours of work, overtime, and overtime earnings.

• The State Level Minimum Wages Advisory Board advises on the setting of minimum wages in Bihar.

Latest Minimum Wages in Bihar w.e.f. 01-April-2022 were stated as follows:

CHAPTER I: Interpretation of Rules

Rules Interpretation

(1) These rules are known as the 1951 Bihar Minimum Wages Rules.

(2) They are applicable to the entire state of Bihar.

In these Rules, unless the context otherwise requires?

a) "Act" refers to the Minimum Wages Act of 1948;

(b) Removed from the list;

(c) 'Authority' means the authority established under Section 20's sub-section (1);

(d) 'Board' means the Advisory Board established under Section 7.

(e) The Chairman of the Advisory Board or Committee is referred to as the "Chairman."

(f) 'Committee' means a Committee appointed under clause (a) of subsection (1) of Section 5, which includes a sub-Committee;

(ff) A 'day' is a 24-hour period beginning at midnight.

g) "form" refers to the form attached to these Rules;

(h) "Inspector [2]" means a person appointed as an Inspector under Part 19;

( i) "Registered trade union" means a trade union registered under the Indian Trade Union Act, 1926;

(j) "Section" means a section of the Act; and (k) "Section 19" means a section of the Act.

(k) all other words and expressions used but not defined herein shall have the meanings ascribed to them by the Act.

CHAPTER II: Membership, Meetings & Staff of the Board and Committee

Members of the Committee's terms of office:

The term of office of the members of the committee shall be determined by the State Government as necessary to complete the investigation into the scheduled employment in question, and the State Government may fix such terms at the time of the committee's formation and may extend it as circumstances require.

Member of the Board's term of office:

(1) Except as otherwise stated in these Rules, the period of office of a non-official member of the Board is two years, beginning on the date of nomination:

Provided, however, that such Member shall continue to maintain office until his successor is nominated, notwithstanding the expiration of the specified two-year period:

Furthermore, the State Government may terminate a non-official Member's term of office earlier than the period mentioned above.

(2) A non-official member of the Board who is nominated to fill a casual vacancy serves for the remainder of the term of the member who nominated him.

(3) The official members of the Board will serve at the discretion of the State Government.

Nomination of Substitute Members

If a Member is unable to attend a meeting of the Committee or the Board, the State Government or the Body that nominated him may nominate a substitute in his place by sending a written notification to the Chairman of the Committee or the Board signed on its behalf and by such member. In relation to that meeting, such a substitute Member has all of the rights of a member.

Traveling allowance: A non-official member of the Committee, or the Board is entitled to travel and halting allowances for any journey undertaken in connection with his duties as such member, at the rates and under the conditions determined by the State Government from time to time.

Staff:

(1) The State Government may appoint a Secretary to the Committee, or the Board, and such personnel as it deems necessary, and may set their salaries and allowances, as well as their terms of service.

(2) (i) The Secretary shall be the Committee's or Board's Chief Executive Officer, as the case may be. He is welcome to attend meetings of the Committee, or Board, but he is not allowed to vote.

(ii) The Secretary will help the Chairman in calling meetings, keeping a record of the minutes of those sessions, and taking the required steps to carry out the Committee's or Board's decisions, as the case may be.

Members of the Committee and the Board are eligible for re-nomination.

Outgoing Members are eligible for re-nomination for positions on the Committee, or the Board on which they served.

Chairman and members of the Committee, or the Board, resign, and casual vacancies are filled.

(1) A member of the Committee or the Board other than the Chairman may leave his membership by giving written notice to the Chairman.

(2) A resignation is effective from the day of its acceptance or the expiration of 30 days from the date of resignation, whichever comes first.

(3) When a vacancy in the membership of the Committee, [14], or the Board arises or is likely to occur, the Chairman shall immediately report to the State Government. The State Government is responsible for filling the vacancy.

Cessation and restoration of membership

(1) A member of the Committee or the Board who fails to attend three consecutive sessions without good reason shall cease to be a member thereof, subject to the terms of sub-rule (2).

(2) A person who ceases to be a member under sub rule (1) is notified of his or her termination by a letter written to him by registered mail within fifteen days of the termination date. The letter will state that if he wishes to have his membership restored, he must apply within thirty days after receiving the letter.

If a majority of members present at the next meeting believe the reasons for failure to attend three consecutive meetings are adequate, the member will be restored to membership immediately after a resolution to that effect is adopted.

Disqualification:

(1) A person is disqualified from being nominated for, and serving on, the Committee or the Board, as the case may be, if he is declared to be of unsound mind by a competent court; or

(i) if he is an undischarged insolvent; or

(ii) if he has been convicted of an offence involving moral turpitude before or after the commencement of the Act.

(2) If there is any doubt as to whether a disqualification has occurred under sub-rule (1), the State Government's judgment is definitive.

Meetings: Subject to Rule 12, the Chairman may summon a meeting of the Committee or the Board, as the case may be, at any moment he sees fit:

The Chairman shall call a meeting within fifteen days of receiving a written requisition from not less than one half of the Members.

Notice of Meetings: The Chairman should determine the date, time, and location of each meeting, and a written notice containing the foregoing particulars, as well as a list of business to be done at the meetings, shall be issued to each member by registered mail at least fifteen days prior to the date fixed for each meeting:

Provided, however, that in the event of an emergency meeting, each member may only be given seven days' notice.

Chairman:

(1) The Chairman shall preside at Committee or Board meetings, as the case may be.

(2) In the absence of the Chairman, the members shall elect a member to preside over the meeting from among themselves by a majority of votes.

Quorum: No business shall be done at any meeting unless at least one-third of the members are present, as well as at least one representative of the employers and employees:

If no representative of the employers or employees attends a meeting, or if less than one-third of the members attend, the Chairman may adjourn the meeting to a date not later than seven days after the original meeting, and it shall then be lawful to conduct business at such adjourned meeting, regardless of the number or class of members present.

Disposal of business: All business shall be discussed at a meeting of the Committee, or the Board, as the case may be, and shall be decided by a majority of the Members present and voting, with the Chairman having a casting vote in the event of an equal number of votes:

Provided, however, that the Chairman may, if he so desires, direct that any matter be settled by the distribution of appropriate materials and the gathering of written opinions from the members:

Furthermore, no decision on any subject submitted under the first proviso shall be made unless a majority of the members support it.

Method of Voting: Ordinarily, voting is by show of hands, but if any member requests voting by ballot or if the Chairman so chooses, voting will be by secret ballot and conducted in the manner determined by the Chairman.

(1) The minutes of each meeting, including the names of the members present, shall be given to each member and the State Government as soon as feasible after the meeting, but no later than seven days before the next meeting.

(2) At the next meeting, the proceedings of each meeting shall be confirmed, with any revisions that may be deemed appropriate.

CHAPTER III: Summoning of witnesses by the Committee Or the Board& Production of Documents

Summoning of witnesses and production of documents:

(1) A Committee or the Board may summon any person to appear before it on a date specified therein and to produce any books, papers or other document and things in his possession or under his control relating in any manner to the inquiry.

(2) A summon under sub-rule (1) may be addressed to an individual or an organisation of employers or a registered Trade Union of workers and shall be issued under signature of the Chairman or any person authorized by him in his behalf.

(3) A summon under this Rule may be served?

(i) in the case of individual, by being delivered or sent to him by registered post;

(ii) in "the case of an employers' organisation or a registered Trade Union of workers, by being delivered or sent by registered post to the secretary or the principal officer of the organisation or Union, as the case may be.

(4) The provisions of the Code of Civil Procedure, 1908, relating to the summoning and enforcement of the appearance of witnesses and the production of documents shall, so far as may be apply to proceeding before a committee or the Board.

(5) All books, papers and other documents or things produced before a Committee or the Board in pursuance of a summon issued under sub-rule (1) may be inspected by the Chairman and independent members, and also by such parties as the Chairman may allow with the consent of the other party, but the information so obtained shall be treated as confidential and the same shall be made public only with the consent in writing of the party concerned :

Provided that nothing contained in this Rule shall apply to disclosure of any such information for the purpose of a prosecution under Section 173 of the Indian Penal Code (45 of 1860).

Expenses of witnesses: Any person summoned and appearing as a witness before the Committee or the Board is entitled to an allowance for expenses incurred in accordance with the scale in effect for the payment of such allowances to witnesses appearing in civil courts in the State at the time.

CHAPTER IV: Wage Calculation and Payment, Work Hours, and Holidays

Method of calculating the monetary value of earnings: In determining the value of wages paid in kind and essential items supplied at concession rates, the wholesale prices at the nearest market, to be chosen by the Inspector if there are more than one, shall be taken into account. This calculation must be done in accordance with any instructions published by the State Government from time to time.

Wage payment dates and circumstances, as well as the deductions that may be made from wages:

(1) (i)The wage period for any scheduled employment for which wages have been fixed shall not exceed one month, and the wages of workers in the employment shall be paid-

(a) in the case of establishments employing fewer than one thousand people, before the expiry of the seventh day; and

(b) in the case of other establishments, before the expiry of the tenth day, after the last day of the wage period for which the wages are payable.

(ii) If an employee's employment is terminated by or on behalf of the employer, the employee's wages must be paid by the end of the second working day following the date of termination.

(iii) An employed person's pay shall be paid to him without any deductions other than those authorized by or under these Rules.

(iv) All wage payments must be made on a working day.

(2)For the purposes of these Rules, any payment made by the employed person to the employer or his agent is considered a reduction from wages. A person engaged in a scheduled employment may be subject to one or more of the following deductions from his or her wages:

(i) a fine [in respect of such acts and omissions on the part of the employed person as the State Government may specify by general or particular order in this regard;]

(ii) absence from tax deductions;

(iii) deductions for damage to or loss of goods expressly entrusted to the employed person for custody, or for loss of money for which he is required to account, where such damage or loss is directly attributable to his neglect or default;

(iv) deductions for employer-provided housing [for the State Government or any authority established by the State Government to provide housing accommodation;]

(v) deductions for such employer-provided facilities and services as the State Government may authorize by general or specific order.

The supply of tools and protective equipment essential for the purpose of employment is not included in the term "amenities and services" in this clause.

(vi) deductions for the recovery of advances or the adjustment of overpayments of wages: Provided, however, that such advances do not exceed an amount equal to the employed person's wages for two calendar months, and that the monthly installment of deduction does not exceed one fourth of his wages earned in that month;

(vii) deductions required by a court or other competent authority;

(viii) deductions necessary by order of a court or other competent authority;

(ix) deductions for subscriptions to, and payment of advances from, any Provident Fund to which the Provident Fund Act, 1925 applies, or any recognized Provident Fund as defined in Section 58A of the Indian Income-Tax Act, 1922, or any Provident Fund approved in this regard by the State Government during the period of approval;

(x) deductions for payment to co-operative societies or a scheme of insurance approved by the State Government;

(xi) deductions for any savings scheme authorized by the State Government with the written consent of the employed person;

(xii) deductions for the recovery or adjustment of amounts other than wages paid in error to the employed person in excess of what is due to him:

Unless the employee has provided his assent in writing to such deduction, the inspector or any other authority authorized by the State Government in this regard must first approve the deduction in writing.

(3) Any person who wishes to impose a fine on an employed person or make a deduction for damage or loss caused by him must explain the act or omission, or the damage or loss, for which the fine or deduction is proposed to be imposed or made to him personally and in writing, and give him the opportunity to offer any explanation in the presence of another person. He will also be informed of the amount of the fine or deduction.

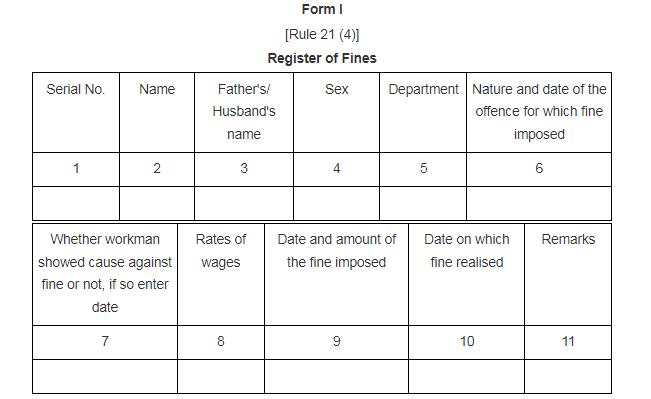

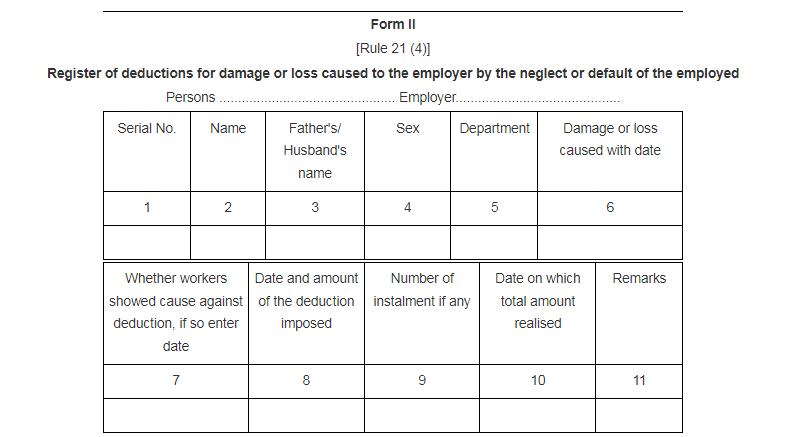

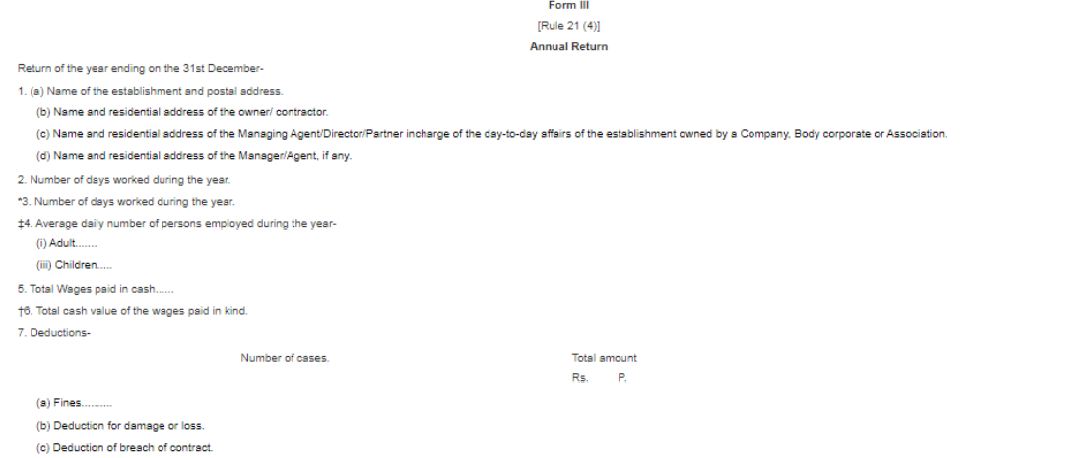

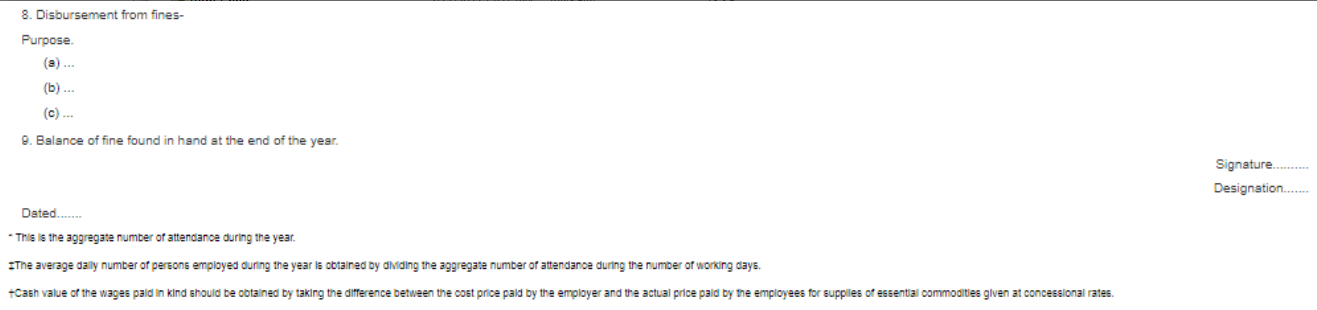

(4) Sub-rule (3) specifies the amount of fine or deduction that may be imposed by the State Government or any officer authorized by them in this regard. All such deductions and realizations must be noted in a register maintained in Forms I, II, and III, if applicable.

[An employer in respect of employment in a registered factory shall furnish a return in Form III to the Chief Inspector of Factories, Bihar, within a time limit as may be notified by the State Government, and an employer in respect of employment other than in a registered factory shall furnish a return in Form III to the Labor Officer of the district to which it relates.]

(5) The fine imposed under sub-rule (3) shall be used [in line with the State Government's or any officer authorized by them in this regard's directives.]

(6) The provisions of the Payment of Wages Act, 1936 are not affected by this Rule.

Publicity to the Minimum Wages fixed under the Act:

[(1) Notices containing the minimum rates of wages fixed under the Act, together with relevant extracts from the Act, and Rules framed there under, and the Inspector's address shall be displayed by every employer in Hindi and in a language understood by the majority of the workers in the employment at a conspicuous place in every factory, workshop, or place where the employees are employed, or in the case of out-workers, where out-workers are employed.

These notices must be kept in clear and legible condition. All Sub-divisional and District offices must post such notices on their bulletin boards.]

Weekly holidays: Unless otherwise permitted by the State Government, no worker shall be required to work in a scheduled employment on the first day of the week (hereinafter referred to as the said day), unless he has or will have a full-day holiday on one of the three days immediately before or after the said day, [for which he shall receive payment equal to his average daily wages during the preceding week:]

Provided, however, that a worker is free to work on a day of rest, but not for more than 10 days in a row without taking a full day off.

If any worker works on the said day and has had a holiday on one of the three days immediately before it, the said day shall be included in the preceding week for the purposes of computing his weekly hours of work.

A week is defined as a period of seven days that begins at midnight on Saturday and ends at midnight on Sunday.

(2) On the day of rest, a worker is entitled to overtime compensation at the rate set forth in Rule 25.

Number of hours of work that make up a typical working day: [(1) A typical day is defined as (a) 9 hours in the case of an adult; (b) 4 hours in the case of a child; and (c) 6 hours in the case of an adolescent.]

(2) An adult worker's working day must be scheduled in such a way that it does not exceed twelve hours on any one day, including any rest intervals.

(3) An Inspector designated under the Act may order that an employee whose age cannot be determined only by appearance be examined by any Medical Officer or Administrative Medical Officer employed by the Employees State Insurance Corporation, who will certify the employee's age. For each such employee, such Medical Officer shall be allowed to charge a fee of Rs. 4 (four rupees), which shall be paid by the employer.

(4) Wages proportionate to hours worked shall be paid to the nearest five paisa multiple to an employed person who has worked for less than a typical working day:

If such a person works for more than three quarters of a standard working day, he is considered to have worked for the entire day.

(5) In the case of agricultural employees, the provisions of sub-rules (1) to (4) are subject to such adjustments as the State Government may notify from time to time.

[(5A) On any given day, no child shall be hired or permitted to work for more than four hours; and]

(6) Nothing in this Rule will be construed to prejudice the Factories Act of 1948. (LXIII of 1948).

Night shift. - When a worker in a scheduled establishment works a shift that extends past midnight, (a) a holiday for the whole day for the purposes of Rule 23 means a period of 24 consecutive hours beginning when his shift ends, (b) the following day shall be deemed to be a period of 24 hours, beginning when such shift ends at the hour of midnight, during which such worker was employed in work shall be counted towards his previous day.

Extra wages for overtime: [(1) When a worker works for more than 9 hours on any given day or for more than 48 hours in any given week, he is entitled to overtime pay at double the regular rate:

Extra wages for overtime at one and half the standard rate of wages should be payable to a worker working for more than 48 hours in any week in any mica works, lac manufacturer, or tea plantation:

Furthermore, nothing in this Rule is intended to affect the provisions of the Factories Act of 1948.

The term "ordinary rate of wages" refers to the basic earnings plus any allowances, including the cash equivalent of the benefits accruing from the concessional sale of food grains and other products to the person employed, that the person employed is entitled to at the time:

Provided, however, that

(i) the total number of hours worked over-time in any quarter should not exceed 50;

(ii) the total number of hours worked on any day shall not exceed 10; and

(iii) the total number of hours worked on any day shall not exceed 12 hours.

[A "quarter" is defined as a period of three consecutive months commencing on January 1st, April 1st, July 1st, and October 1st.]

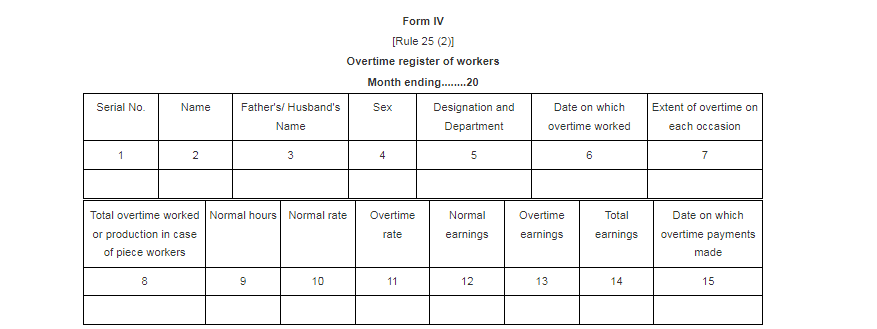

(2) In Form IV, a register of overdue payments must be kept.

Form of register and records:

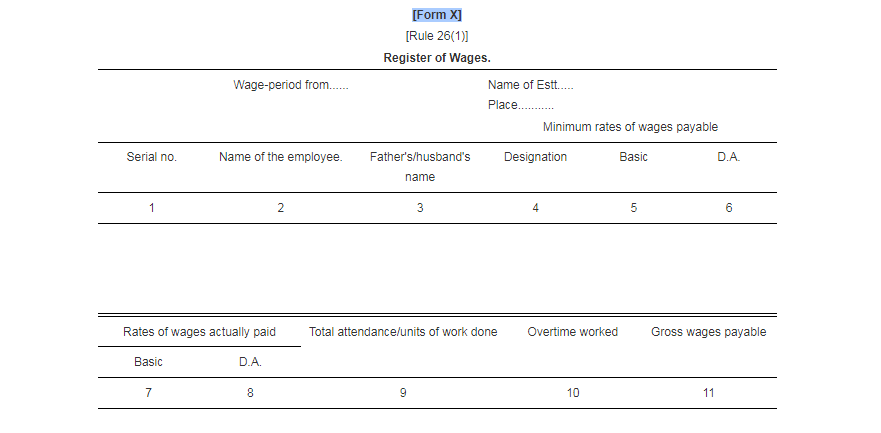

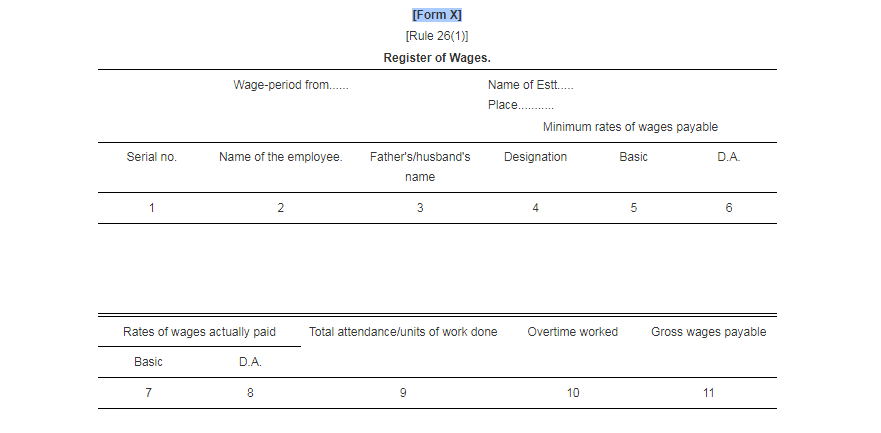

(1) Every employer must keep a wage register in Form X on the job.

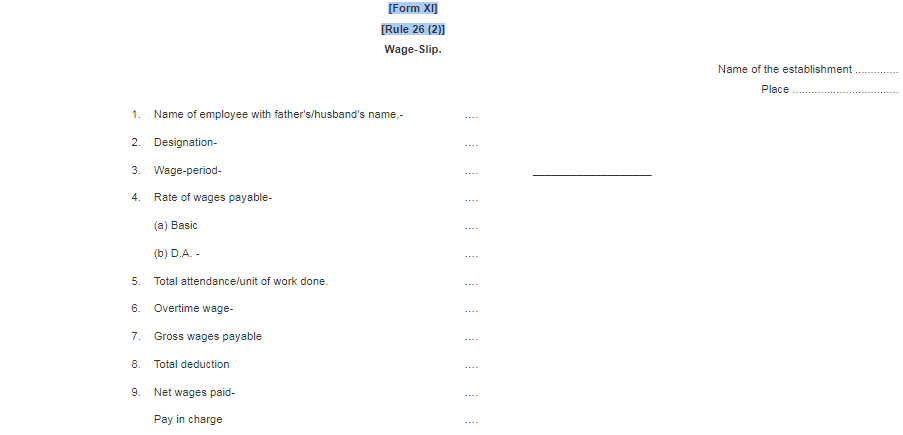

(2) Every employer must issue a wage slip in Form XI to every individual employed by him at least one day before salaries are disbursed.

(3) On the wage register and wage slip, every employer must get the signature or thumb impression of each employee.

(4) The employer or any person authorized by him in this regard must validate entries in the wage record and wage slip.

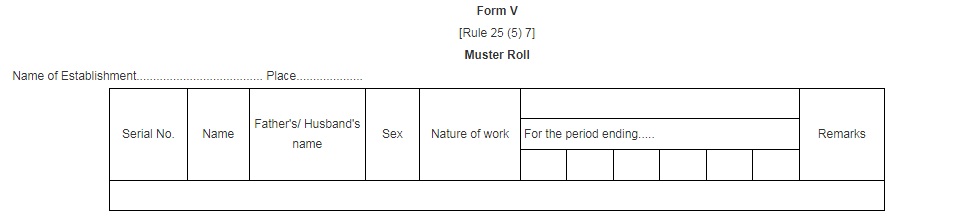

(5) Every employer must keep a Muster Roll in Form V: Provided, however, that the State Government may exempt any business or type of establishments from the application of this rule.]

CHAPTER V: Claims under the Act

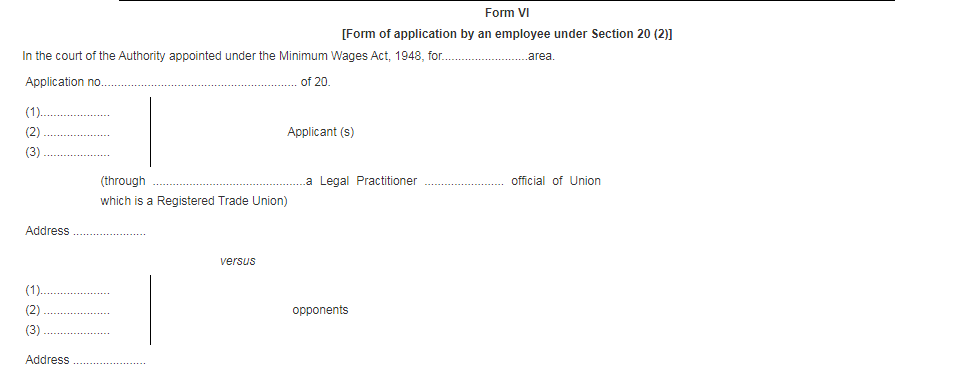

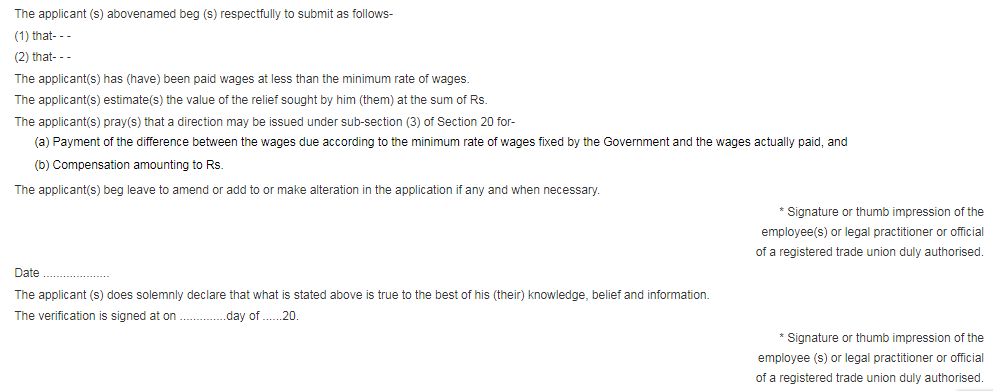

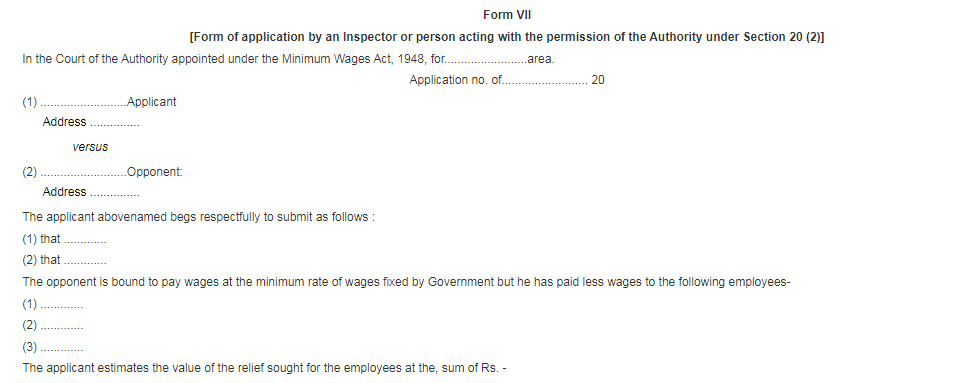

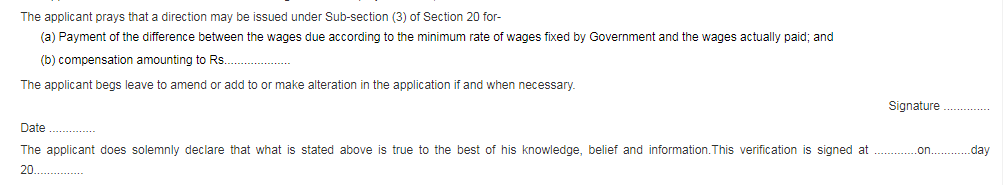

Application: An application filed by or on behalf of an employed person or group of employed individuals under paragraph (2) of Section 20 or subsection (1) of Section 21 must be made in duplicate on Forms VI and VII, as applicable.

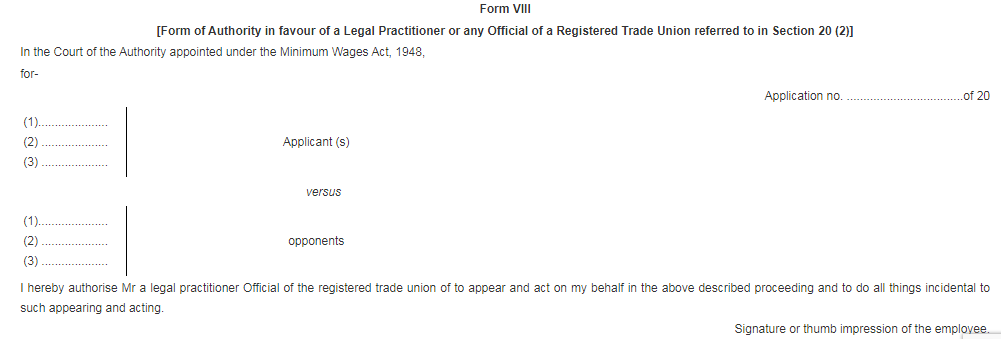

Authorization: The authority to act on behalf of an employed person or persons is granted in Form VIII by a document that is delivered to the Authority hearing the application and becomes part of the record.

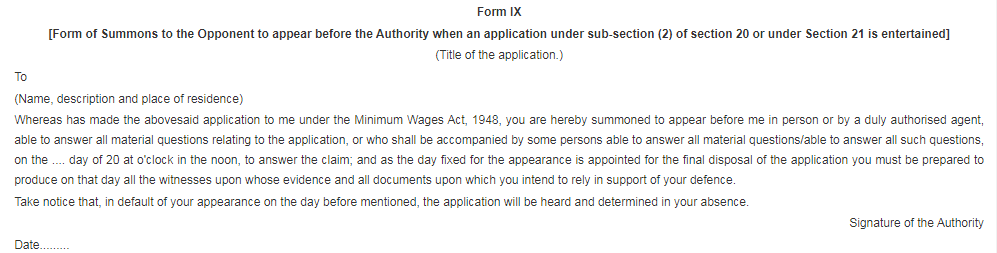

Parties' appearance: (1) If an application under Section 20 or 21 sub-section (2) is granted, the Authority shall serve on the employer a notice in Form IX to appear before him on a specified date with all relevant documents and witnesses, if any, and shall notify the appellant of the date so specified by registered mail or special messenger.

(2) The Authority may hear and decide the application ex-parte if the employer or his representative fails to appear on the stated date.

(3) The Authority may dismiss the application if the applicant or his agent fails to appear on the appointed date.

(4) An order made under sub-rule (2) or (3) may be set aside if the defaulting party shows sufficient cause within one month of the date of the order, and the application shall be reheard after service of the notice on the opposing party on the rehearing date, in the manner specified in sub-rule (2). (1).

CHAPTER VI: Costs in procedures brought under the Act:

Costs: (1) The Authority may direct that the costs of any proceeding ongoing before it do not follow the event for reasons to be specified in writing.

(2) The costs that may be awarded are:

(i) court fees;

(ii) subsistence money to witnesses; and

(iii) Pleader's fee of ten rupees, provided that the Authority, in any proceeding, may reduce the fee to a sum not less than five rupees or increase it to a sum not exceeding twenty-five rupees for reasons to be recorded in writing.

(3) When there are many pleaders, applicants, or opponents, the Authority may, subject to the aforementioned, give the prevailing party or parties such expenses as it deems appropriate.

Court fees: The court fee payable in respect of proceedings under Section 20 shall be:

(i) one rupee for each application to summon a witness;

(ii) one rupee for each application made by or on behalf of an individual:

Provided, however, that the Authority may exempt the applicant wholly or partly from payment of such fees if the Authority believes the applicant is a pauper:

Furthermore, no fees shall be charged:

(a) from persons employed in agriculture; or

(b) in relation to an application filed by an Inspector.

Forms

This section contains all of the forms required by the Act.

How Deskera Can help You?

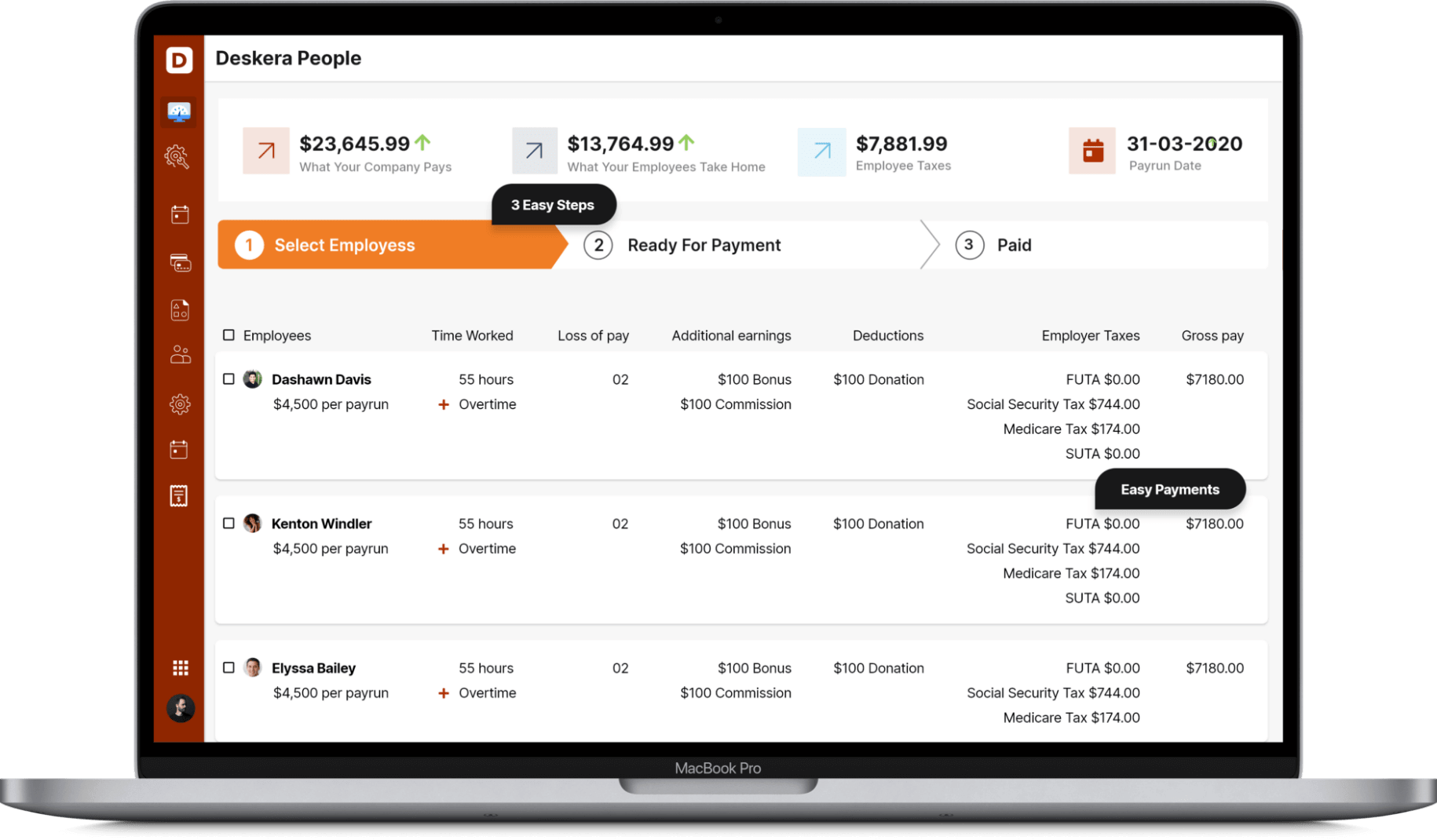

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key takeaways

- The Department of Labor Resources' Labor Wing enforces numerous labor laws and helps workers receive pay that are not less than the minimum wages set by the department twice a year, as required by the Minimum Wages Act of 1948.

- If a weekly wage is defined, monthly wages are calculated as 4.33 times. If an hourly wage is given, it is calculated as 4.33 times the standard hours per week.

- A non-official member of the Committee or the Board is entitled to travel and halting allowances for any journey undertaken in connection with his duties as such member, at the rates and conditions determined by the State Government from time to time.

- Under various labor laws, the Department of Labor Resources determines gratuity, bonus, compensation, and other benefits to organized workers. Apart from enforcing labor rules, the department also administers social security programs for migrant workers, unorganized employees, construction workers, and other disadvantaged members of society.

Related articles