Working from a home office has become the new trend these days, owing to the pandemic conditions worldwide. One of the primary advantages of working from home is that you can readily cut down on business expenses from your taxes. IRS Form 8829 is used to calculate the expenses for the home-based business.

What is Form 8829?

Business owners use IRS Form 8829 to claim tax deductions for the business use of their homes. Business expenses that occur in the home can be deducted if:

- The portion of the home used exclusively for business is your principal place of business.

- The taxpayer meets with the clients, patients, or customers for business purposes.

- The space is used as a storage facility or a daycare centre

IRS Form 8829 allows you to claim a tax break for your home office. In case your business qualifies for your home office deduction, then you will have to file Form 8829 with your Schedule C, profit or loss from business.

Who Should Fill Form 8829?

If you are a small business owner or a self-employed taxpayer, then you may have to file Form 8829 in order to claim the home office deduction. According to the IRS, your workplace should be the primary place of your business. It should not be used for anything other than business.

In case you have a small home business space, then you may not have to file Form 8829 as a simplified option is available that enables you to calculate the square footage of your business space. It can maximum 300 square feet. Then you have to multiply it by $5 per square foot in order to get the deduction amount.

What do you Need to Fill Form 8829?

Before you file Form 8829, you will have to perform the following tasks:

Business-Space Calculation

The foremost thing to do is to calculate allowable business space in comparison with the total space of your home. You will have to get a clear idea of the total square footage of your home and the total square footage of your business space. In order to get a percentage of business use, you will have to divide the home business space by the total area of your home. For example, in case your home is 4,000 square feet, and your home business space is 400 square feet, then the percentage will be 10%.

Direct and Indirect Taxes

You will have to take a glimpse at all of your home business space deductions and then segregate them into direct and indirect expenses. Direct expenses refer to those expenses which are meant only for the business. These expenses include advertising costs, legal fees, payments to independent contractors or employees. These expenses are not listed in Form 8829, rather they are included in Schedule C.

Other direct expenses are home expenses that prove to be advantageous for the business part of your home. For example, installing internet service, upgrading the lighting system, etc. Indirect expenses are those expenses that are shared by both business space and the rest of the home. For example, general home repairs, utilities, etc.

Depreciation and Casualty Losses

You will have to gain information on depreciation for your home, particularly the value of the land and the cost of the building. In case you suffered from a casualty loss, from a disaster, then you can deduct a portion of that loss as your home business costs. For calculation, that amount of loss will be required.

How to Fill Out Form 8829?

Form 8829 is a bit tricky-that is why you need to be careful while filling out the form. If you face any difficulty while filling out Form 8829, then you can even consult a tax professional. Listed below are certain steps that can make your form filling task easy-breezy:

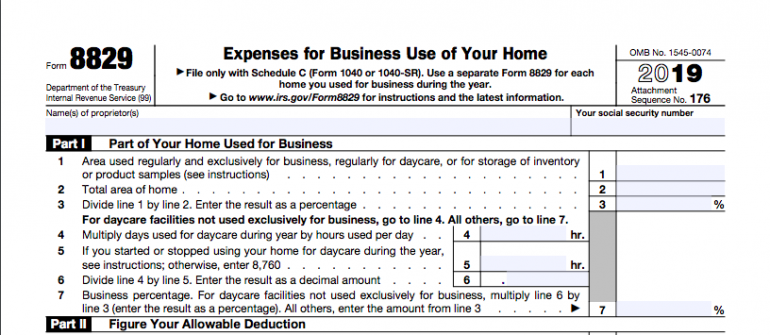

Part 1: Measure your Home Office

You will need to mention the percentage of the home used for business in Part 1. This percentage will be used in the entire form to segregate your expenses between personal and business.

For example, if your home is 2,000 square feet and your home office is 200 square feet, then the percentage will be 10%. It means that 10% of your home can be used for business. This percentage can be used to calculate indirect expenses such as rent.

In case you don’t run a daycare, then you will be only using lines one, two, three, and seven.

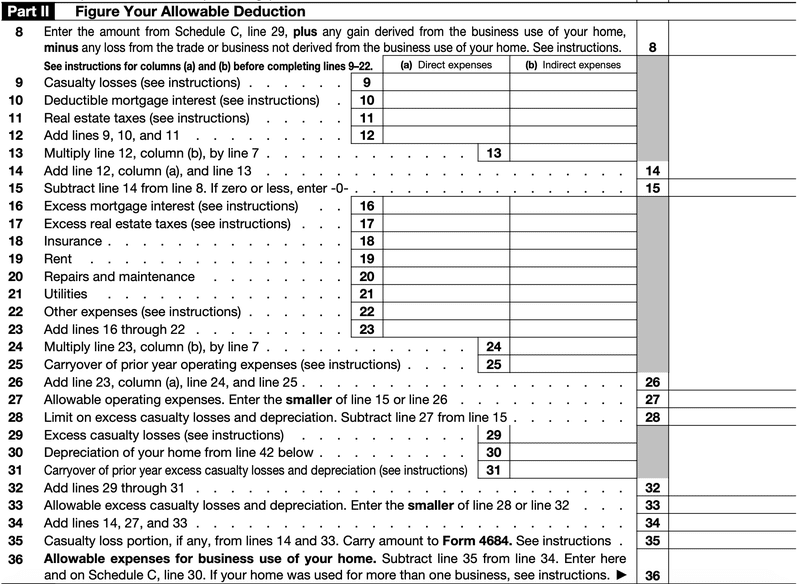

Part 2: Calculate your Allowable Deduction

This is an important part of Form 8829 where you can calculate the total home business expense deduction. Firstly, you need to enter operating expenses as either direct expenses or indirect expenses.

You will have to mention your profit from Schedule C, line 29. Once the profit is entered, you will have to mention the direct and indirect expenses from line 9 to line 11 for the following:

- Casualty losses

- Deductible mortgage interest

- Real estate taxes

From line 16- line 31, you will have to deduct other expenses including:

- Excess mortgage interest paid

- Excess real estate taxes

- Insurance

- Rent

- Repairs and maintenance

- Utilities

- Other operating expenses

- Depreciation

- Excess casualty loss

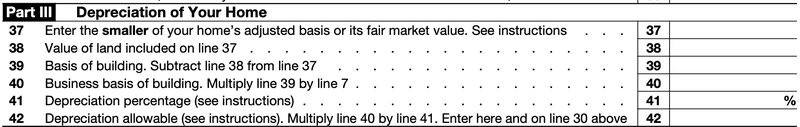

Part 3: Depreciation of your Home

This part deals with calculating the percentage of depreciation on your home. This can be included in the deduction calculation. To calculate this, you will have to understand the adjusted basis of your home or fair market value. Then you have to enter whichever one is less on line 37. The next step to do is to segregate the value of the land (line 38) and the value of the home (line 39). This happens because depreciation is taken only on the building, and not on the land.

Once this is done, you are required to enter the depreciation percentage from the instructions on line 41. Then, you will have to multiply the percentage by the basis (value of your home). This way you’ll calculate your allowable depreciation deduction. That amount can be taken and entered on line 30.

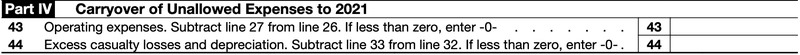

Part 4: Carryover of Unallowed Expenses

In case your business expenses are more than your gross income, then your deduction for business use of your home gets limited. In such cases, you can carry over your excess expenses into the next year.

Where to Get Form 8829?

You can find IRS Form 8829 on the IRS website. You can fill the form online or print it out. You can even download a copy.

Tips for Filing IRS Form 8829:

Let’s take a look at some of the tips that you should keep in mind while filing IRS Form 8829:

Measure your Home Office Accurately

The form mainly depends on the business percentage of your home. That is why it is important to fetch accurate measurements of your home office. You need to measure the part of the home that implies deduction. You can take a look at the total square footage of your home on the county records. This will help you make the process speedy.

Prepare a List of Direct and Indirect Expenses

Sometimes you can forget what kind of direct or indirect expenses you want to claim. That is why it is important to keep a track record of both expenses, direct and indirect expenses. So, this way it will become easier for you while filling out the form.

Opt for a Simplified Approach

In 2013, the IRS launched a new way of calculating the home office deduction. This is known as the simplified method. Under this method, you no longer have to keep extra receipts or make extensive calculations, rather you need to make a standard deduction of $5 for every square foot of office space, up to 300 square feet. So, the maximum deduction that can be done is $1500.

What are ‘other expenses’ on your Form 8829?

The regular expenses that every business has, refer to the ‘other expenses.’ They are not related to your home business tax deduction. Advertising, supplies, making payments to the employees etc. are some of the examples of ‘other expenses.’ You are required to total these expenses from your Schedule C, and then include these into line 22 of Form 8829. Once total expenses are calculated, it helps to determine the limits on home business deductions.

What does the Recovery Period Mean on Form 8829?

The recovery period refers to the number of years for which the asset can be depreciated. Every asset has a different recovery period. In case you use your home for business purposes, then the recovery period for depreciation will be 39 years.

Key Takeaways

- IRS Form 8829 is used by small business owners or self-employed taxpayers who run a business out of their home

- According to the IRS, your workplace should be the primary place of your business. It should not be used for anything other than business

- Before you fill the Form 8829, you will have to measure the business space in your home office, calculate direct and indirect expenses, and gather information on depreciation for your home

- IRS Form 8829 has four parts. Part 1 requires you to measure your home office, Part 2 requires you to calculate your allowable deduction, Part 3 allows you to calculate the depreciation for your home, Part 4 allows you to determine additional expenses that can be carried over to the next year

- IRS Form 8829 is present on the IRS website

- There are certain things to keep in mind while filling out Form 8829

- Since the form mainly depends on the business percentage of your home, make sure you measure it accurately

- Prepare a list of direct and indirect expenses so that they are readily available while filling out Form 8829

- You can go for a simplified method if you don’t want to get involved in extensive calculations

- The regular expenses that every business has, refer to the ‘other expenses.’ Advertising, supplies, making payments to the employees, etc. are some of the examples of ‘other expenses

- The recovery period refers to the number of years for which the asset can be depreciated

Related Articles