The Tamil Nadu government has revised the Tamil Nadu factories rules of 1950. Among those aspects lies one of the most important term that every factory manager has to adopt and follow. And, that crucial term is known as 'Muster Roll.'

Every factory manager is bound to maintain a muster roll of all personnel working in the factory. It works according to a rule 103 modification concerning the maintenance of muster rolls and register in Form 25 (Muster roll and register of compensation holidays).

Moreover, the records must be established at the start of each period of work. Furthermore, the Manager must keep the muster roll available for review by the inspector at all times.

In today’s article, we’ll cover all aspects related to Muster roll and its association with Tamil Nadu Form 25. Let’s take a look on what we’ll cover ahead:

- Notification and Findings

- Statutes that Specify Muster Roll

- Important Definitions

- Understanding Muster Roll Format

- Different Types of Work Execution

- Muster Roll: Parts & Instructions

- Muster Roll Constituents

- Muster Roll Format

- Understanding Muster Roll Register

- Format: Muster Roll Register

- General Rules for Handling and Writing Muster Roll

- Common Irregularities

- How Deskera Can Assist You?

Let's Begin!

Notification and Findings

The Labour and Employment Department of Tamil Nadu announced notification No. SRO A-9/2021 G.O. Ms. No. 33 modifications to the Tamil Nadu Factories Rules, 1950 on March 24th, 2021, which covered the following amendments –

The adjustments are made to Rule 103, which states that "Maintenance of Muster Roll and Registers" has been replaced with a new provision in its entirety. The following are the most important findings:

- Every factory's manager is required to keep a muster roll of all of the factory's employees. Form No. 25 should be used to save it. The completion of the records at the start of each employment period is crucial.

- The manager must keep the muster roll in such a way that it is easily available for review by the investigator at all times, including during working hours and when any work is being done in the plant.

- The muster roll must be kept for three years after the last record has been made.

Statutes that Specify Muster Roll

The following statutes require muster rolls.

The muster roll and compensatory holiday register in Form No. 25 are intended to function the objectives of the registers and muster rolls specified in the following statutes:

1. The Contract Labor (Regulation and Abolition) Rules of Tamil Nadu were promulgated in 1975.

- As per rule 75, keep a record of contract labour employment in Form XXVI

- Wage Register on Form XXVII in accordance with clause

- (a) of sub-rule (1) of rule 78

- Advances, Damage or Loss Deductions, and Fines Register on Form XXIX as per clause (d) of sub-rule (1) of rule 78

2. The Inter-State Migrant Workers (Employment and Conditions of Service) Rules of Tamil Nadu were enacted in 1983.

- Form XIII of the Contractor's Workmen's Register, as required by law 49

- Muster Roll Register (Form XVII) in accordance with clause (a) of sub-rule (2) of rule 52

- Wage Register in Form XVIII in accordance with clause (a) of sub-rule (2) of rule 52

- Register of Damage or Loss Deductions in Form XIX, as required by clause (c) of sub-rule (2) of rule 52

- Wage Register in Form XVIII in accordance with clause (a) of sub-rule (2) of rule 52

- Fines Register in Form XX, as required by clause (c) of sub-rule (2) of Rule 52

- Advances Register in Form XXI, as required by clause (c) of sub-rule (2) of Rule 52

- Overtime Register in Form XXII, as required by clause (d) of sub-rule (2) of Rule 52

- Overtime Register in Form XXII, as required by clause (d) of sub-rule (2) of Rule 52

3. The Tamil Nadu Wage Payment Guidelines of 1937

- Keep a fines register in Form I as required by rule 3

- According to rule 4 Deductions in Form II for Damage or Loss Caused to the Employer by Employees' Negligence or Default

- As per regulation Rule 17 requires Advances to Employed Persons Register (Form III).

4. Minimum Wage Rules of Tamil Nadu, 1953

- Form I, Fines Register, as per rule 21 sub-rule (4),

- Form II, Deductions for Damage or Loss to the Employer Caused by the Employed Person's Negligence or Default, as per rule 21 sub-rule (4).

- Overtime Register for Workers in Form IV (sub-regulation (2) of rule 26 Rule

- sub-rule (5), mandates a Muster Roll in Form V. 27

- Employees' Register in Form XI, as per Rule 27 sub-rule (6)

5. Tamil Nadu Maternity Benefit Rules, 1967

Muster Roll on Form A as per sub-rule (1) of rule 3

6. National, Festival, and Special Holidays (Tamil Nadu Industrial Establishments) Rules, 1959

In accordance with rule 7, sub-rule (1), keep a record of national, festival, and special holidays in Form VI.

7. Industrial Establishments (Conferment of Permanent Status to Workmen) Rules, Tamil Nadu, 1981

Workmen's Register in Form I, as per rule 6 sub-rule (1)

8. Payment of Subsistence Allowance Rules, Tamil Nadu, 1981

Employees who have been suspended are listed in Form No. 1 in accordance with Rule 3.

9. The Rules of the Tamil Nadu Labour Welfare Fund, 1973.

As per regulation 29, keep a record of wages in Form B and a record of fines and unpaid accumulations in Form C.

Important Definitions

Following we have discussed some crucial definitions associated with labour laws. Let;s have a look:

Contractor:

An individual, in the framework of an establishment, who approves to do tasks for the establishment through contract labour. So, the contractor not just supplying items or goods of production to the firm, but also supplying contract labour for any job performed by the establishment, including a subcontractor

Principal Employer:

When any individual has been nominated as the factory manager under the Factory Act, 1948. Then, that individual is the principal employer.

In addition, the owner or holder of a factory is also the principal employer. It refers to those individuals who are in charge of the establishment's direction, supervision, and monitoring in any other setting.

Workman:

Any person hired in or in conjunction with the work of any company is referred to as a ‘workman.’ Further, workmen have to undertake any semi-skilled, skilled, or unskilled manual, technical, supervisory, or clerical work for hire or reward whether the contracts of employment are specified or implied.

However, it do not include the following :

1. A person who works primarily in a management or administrative function,

2. who, when working in a leadership role, receives a monthly remuneration in excess of Rs.500/- or who, by way of power conferred in him or the nature of the tasks attached to the office, performs management functions or

3. Someone who receives any object or material to be processed from the principal employer or someone duty on the part of the principal employer.

Understanding Muster Roll Format

The Muster Roll format can be accessed on a variety of websites. A muster roll register is essentially an employment attendance record for a certain worksite and time period.

Furthermore, it can also be used as a receipt to claim payments or funds from the concerned official for wage payment. In general, completing a certain task would necessitate a large number of muster rolls.

Moreover, the Muster Roll Register explains how to authenticate muster rolls for a single completed workplace, that is, one where work has been completed and proper remuneration has been received.

The muster roll format entails four steps: acquiring the muster rolls; "consolidating" the various muster rolls to determine how many days each worker has worked at this work area and how much he or she has been compensated; checking this relevant data with the labourers themselves, and inspecting the information from their job cards, if any exist.

Different Types of Work Execution

Methods for Task Execution are carried out by the department or by contractors. Contract labour is frequently utilized to finish complicated and crucial tasks that require a high degree of consistency in job quality.

This strategy necessitates meticulous planning and supervision to ensure that the result of labors and machinery is proportional to the amount spent.

Therefore, it is important to ensure that the contractor's work is completed in compliance with the agreement's plans, specifications, time schedule, labourer’s availability, and other terms.

Furthermore, the following are the several approaches for completing the work:

1. Contract methods

2. Work order

3. Piece work agreement

4. Employment of labor on muster roll

Muster Roll: Parts & Instructions

A muster list is used to compensate daily labourers. Excluding regular and work-charged institutions, all employees of various departments for the execution of works are referred to as casual labour. "Muster rolls" are used to calculate their wages.

Furthermore, the supervisor or the authorized agents keep a Muster Roll of the labourers' attendance.

Moreover, muster rolls are generated according to the rules. The Nominal Muster Roll form is made up of two parts.

Part I:

Part I of the N.M.R. form has certain sections to record all aspects of details. These sections include inputting the names of the labourers, their designations, their fathers' identities, their attendance details, wage rates, and the overall sum payable for each labour.

As a receipt, the N.M.R form allows you to insert the total amount of the muster, your signature, or your left hand thumb impression.

Moreover, the individual who carried out the N.M.R form must sign it at the bottom before submitting it to A.E / D.E.E., which confirms the details and delivers the payment.

Part II:

In this part of the muster roll is being utilized to document the name of the task, as well as the amount of work completed in circumstances where the job may be measured.

This part will also include information such as the number of measuring books and the sheets where the measurements are recorded. Moreover, if the work cannot be measured, a note to that effect is made on the record.

The following are some crucial instructions for Muster roll preparation:

- Making multiple copies of muster roll must not be prepared.

- Different muster rolls are prepared for each payment month.

- Unauthorized input or tampering should be difficult while keeping a daily record of attendance and times.

- Depending on local circumstances and norms, workers may be paid more than once a month.

- Payment should be made as soon as feasible after the muster roll has been cleared.

- A record of unpaid wages must be kept as a track of salaries that have not been paid.

- The hand receipt is used to track subsequent payments of overdue wages. The muster roll and the register of unpaid wages both make a note of the situation.

- Unpaid wages must be referred to the divisional office after three months.

- When the divisional engineer makes payments, the divisional engineer reviews the muster rolls. It works with relation to records in the measurement book to the degree of 50% in the sub-divisional and 50% in the division office.

Muster Roll Constituents

According to the law, each employer must keep a muster roll with all employees' income or wage information in the manner prescribed by the law, which includes the following information:

- Factory or Establishment Name and Address

- Contractor's Name and Address (if any)

- Year and Month

- Principal's/Name Employer's and Address

- Place of employment

- Name of the Employee

- Name of the employee's father or husband

- Employee id number

- Gender

- Designation/Department

- ESI number

- Date of Joining

- PF number

- Number of days that are payable

- Details about your salary or wage (component-wise)

- Deductions in detail (component-wise)

- Employee or Receiver's Signature or Thumb impression

- Net Salary or Wages payable

Muster Roll Format

Check the following section that shows the format of Form 25 muster roll and register of compensatory holidays:

Form 25

[Prescribed under rules 77(4), 103]

MUSTER ROLL AND REGISTER OF COMPENSATORY HOLIDAYS.

For the Period From_____ To______

Name and Address of the Factory:

Festival Holidays Approval No. and Date:

Approved Festival Holidays:

Registration No:

Understanding Muster Roll Register

The employer maintains a Muster Roll Register that contains information such as joining and service details.

However, when it comes to female employees, the employer must keep a register with precise information about female employees. This information must define who was on maternity leave.

Furthermore, it includes details such as the date of delivery and the amount of maternity benefit paid and so on. When the Inspector asks for it, the employee must produce it.

Format: Muster Roll Register

Following we have provided the specimen or format of muster roll register. Have a look:

General Rules for Handling and Writing Muster Roll

Following we have listed some crucial instructions on how you need to handle and write a muster roll. Let’s learn:

According to following rules, you must prepare the muster roll:

- A single Muster Roll or multiple Muster Rolls can be utilized for the same task.

- At the start of each day's work or day, the availability of labour should be recorded with (*) and the absence with (A).

- In part -1 of the muster roll, the labourers' daily attendance, absenteeism, and penalties, if any, are recorded.

- Laborers may be paid multiple times each month, but each payment necessitates the creation of a new muster roll.

- The daily presence, absenteeism, and penalties, if any, of the workers must be recorded in part -1 of the muster roll.

- A Muster Roll payment should be made by the SDO (Sub-Divisional Officer) in the availability of a subordinate who can attest to the payment as "paid in my presence to the proper individual."

- The BDO shall be verified as "Paid by me Rs................on..............." after the payment has been done.

- The outstanding items should be noted on the Muster Roll's Part-2.

- Salaries that haven't been paid in three months should be made aware of the executive engineers.

- If the requirement of the project cannot be quantified, a note to that extent is written on the Muster Roll: "Work not susceptible of measurement."

- At the conclusion of the muster, the following certificate shall be filed: "Certified that the workers listed on the Muster Roll were truly hired by me on government projects."

Common Irregularities

Inconsistencies on the Muster Roll are widespread and should be minimized:

- Laborers engaged on a Muster Roll who are not classified by class.

- Duplicating and tampering with original entries.

- 3) The Sub-Ordinate in-Charge does not sign the Muster Roll every day.

- There is a divide between the muster roll and daily update.

- Delay in the Muster Roll's passage and payment.

- The progress of the job in part -3 of the Muster Roll was incorrectly recorded.

How Deskera Can Assist You?

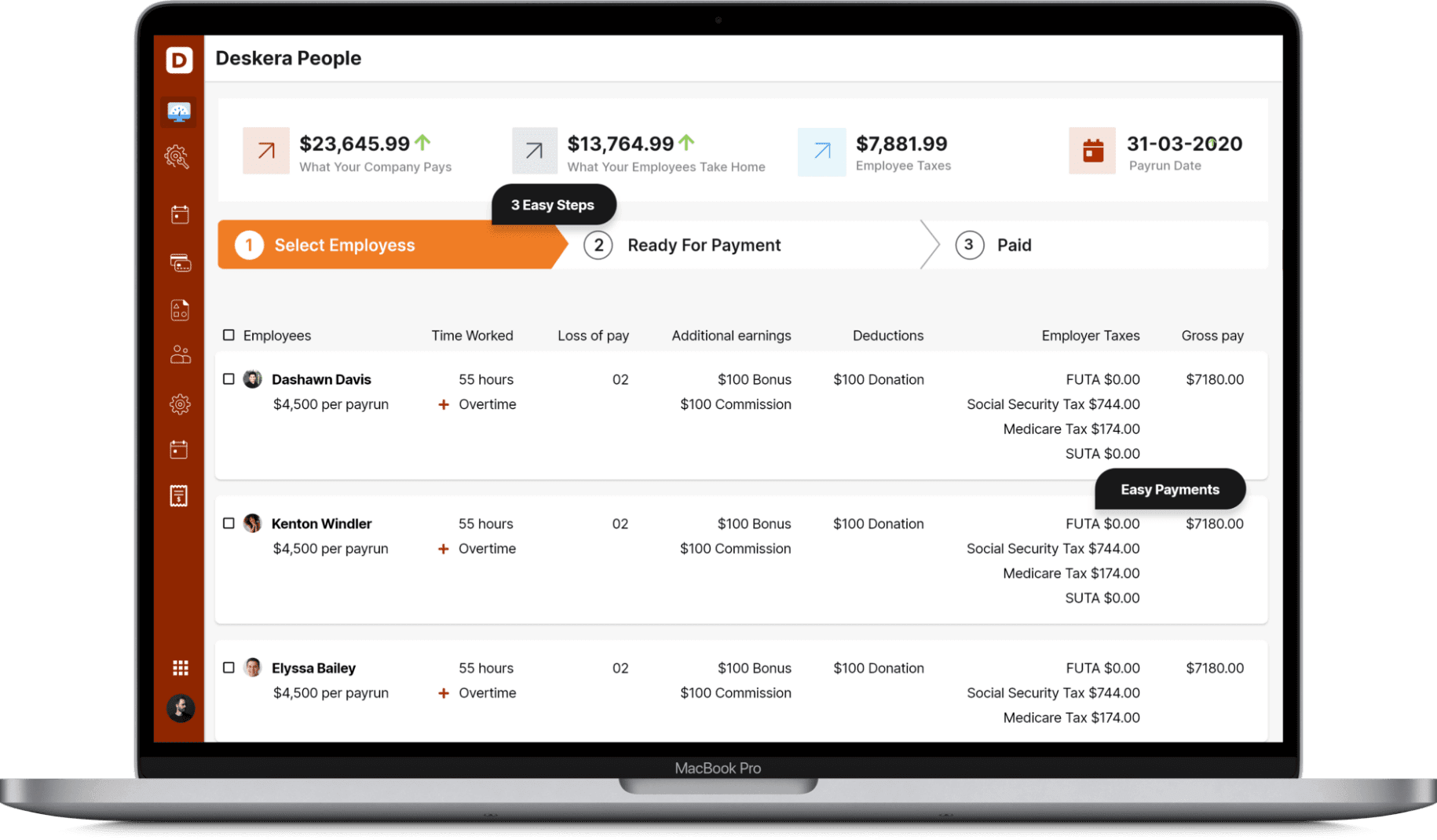

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more.

Simplify payroll management and generate payslips in minutes for your employees.

In addition to a powerful HRMS, Deskera offers integrated Accounting and CRM Software for driving business growth.

Final Takeaways

We have finally reached the end section of this detailed guide. Let’s take a look at some of the crucial points for future reference:

- Every factory's manager is required to keep a muster roll of all of the factory's employees. It should be kept in Form No. 25.

- The muster roll must be kept for three years after the last record has been made.

- When any individual has been nominated as the factory manager under the Factory Act, 1948. Then, that individual is the principal employer.

- Workmen have to undertake any semi-skilled, skilled, or unskilled manual, technical, supervisory, or clerical work for hire or reward whether the contracts of employment are specified or implied.

- The Muster Roll format can be accessed on a variety of websites. A muster roll register is essentially an employment attendance record for a certain worksite and time period.

- The supervisor or the authorized agents keep a Muster Roll of the labourers' attendance.

- According to the law, each employer must keep a muster roll with all employees' income or wage information in the manner prescribed by the law

- When it comes to female employees, the employer must keep a register with precise information about female employees. This information must define who was on maternity leave.

Related Articles