Employment Rate in India increased to 42.40 percent in the fourth quarter of 2020 from 40.90 percent in the third quarter of 2020.

Labour in India refers to employment in the economy of India. In 2020, there were around 501 million workers in India, the second largest after China. Out of which, agriculture industry consist of 41.19%, industry sector consist of 26.18% and service sector consist 32.33% of total labour force.

Labour welfare fund, also popularly known as LWF, refers to all facilities provided to workers to enhance and develop their social security, working conditions, and standard of living. Several legislatures have been combined and enacted into a law focused solely on worker welfare, known as the Labor Welfare Fund or the LWF Act.

Table of Contents

- What is the Labor Welfare Fund - LWF?

- Application of LWF in Different States & Union Territories

- How should one calculate the deductions for unemployment allowance funds in different states?

- Maharashtra LWF Regulations

- Kerala and its LWF-related rules

- Tamil Nadu Labor Welfare Fund – LWF Regulations

- Gujarat and its LWF rules

- Karnataka Regulations on LWF Scheme

- West Bengal LWF Ordinance

- Delhi Rules for LWF Scheme

- Haryana LWF Regulations

- Andhra Pradesh LWF Regulations

- How does the Labor Welfare Fund – LWF help workers?

- Benefits of Labor Welfare Fund (LWF) for Employers

- How does the process work?

- The Not Applicable States

- Labor Welfare Fund (LWF) Expenditure

Introduction

The Labor Welfare Fund (LWF) is maintained and managed by individual state institutions, and this LWF is considered a statutory contribution managed by individual state agencies. The state employment office determines the amount and frequency of donations. Transfer contributions and periodicity vary from state to state.

In some states like Haryana, Andhra Pradesh, Karnataka, and Tamil Nadu, the periodicity is annual, whereas, in some states like Maharashtra, Gujarat, and Madhya Pradesh, it is necessary to donate in June and December.

What is the Labor Welfare Fund - LWF?

Work welfare is assistance in the form of money and necessities to those in need. It provides workers with amenities and facilities to enhance their working conditions. The LWF includes a variety of benefits, services, solutions, and facilities that employers provide to their employees. Such facilities are provided through donations from employers and employees.

However, contribution rates may vary from state to state. The Labor Welfare Fund (LWF) is a fund funded by employers, workers, and in some states, the government. The objective of these welfare funds - LWF is to provide medical, housing, educational, and recreational facilities for workers and their dependents.

Distinct Labour Welfare Fund Act – LWF and Labour Welfare Fund Rule are framed for different states & Union Territories

- Andhra Pradesh

- Chandigarh

- Chhattisgarh

- Delhi

- Goa

- Gujarat

- Haryana

- Karnataka

- Kerala

- Madhya Pradesh

- Maharashtra

- Odisha

- Punjab

- Tamil Nadu

- Telangana

- West Bengal

How should one calculate the deductions for unemployment allowance funds in different states?

Since the system is governed by individual states, applicable rules are also determined by individual states and Union Territories. Also, if you have offices in multiple states, you need to be able to monitor rule changes to avoid penalties. The system provides the amount to deposit, when and how often one needs to deposit, and penalties for violations.

Maharashtra LWF Regulations

This program applies to all companies with 5 or more employees registered in Maharashtra. In Maharashtra, the amount must be paid semi-annually. Therefore, payments from 1st Jan to June 30th, which is the 6th month, must be made by July 15th. Similarly, payments for the six months ending December 30 must be made by January 15.

This means that contributions need to be deducted from employee wages in June and December. Again, the scheme is two slabs (for all employees except managers).

- For all employees with incomes of Rs 3000 or less, the employee contributes Rs 6 and the employer makes a triple contribution. For workers with an income of fewer than 3000 rupees, the payment is 24 rupees.

- For every employee who earns Rs 3001 or higher, the employee contributes Rs 12, and the employer contributes three times that amount. Therefore, for employees over 3001 rupees, the deposit amount is 48 rupees.

Penalties for violations of LWF Maharashtra

- For the first breach, you may be sentenced to 3 months in prison and/or a fine of up to Rs 500.

- For the second and subsequent imprisonment, it may be extended to a maximum of 6 months and/or a fine of up to Rs 1000. If the fine is only once, the fine must be Rs 50 or higher.

Kerala and its LWF-related rules

Startups that are registered in Kerala and have two or more employees must be registered in the system. Here they have to pay the amount monthly. Therefore, the amount deducted from one month must be paid by the 5th day of the following month. The amount paid is to all workers except managers, apprentices, and part-time workers, where the employee contributes Rs 4 per month and the employer pays Rs 8.

Penalties for violating

Kerala LWF regulations - When the inspector is prevented from performing his duties Imprisonment for up to 6 months and/or a fine of up to 500 rupees.

Tamil Nadu Labor Welfare Fund – LWF Regulations

If your company is located in Tamil Nadu and has 5 or more employees, you need to have your company registered in the system. In Tamil Nadu, you have to pay annually at the beginning of the following year. The payment for the period from January 1st to December 31st must be done by January 31st of the following year.

- For all employees (excluding managers and employees with incomes of Rs 15,000 or more), the amount paid is Rs 20 for employers and Rs 10 for employees. (Therefore, total Rs 30 for each employee)

Penalties for disruption of inspector duties or failure to present relevant documents to Tamil Nadu:

- For the first offence, there's imprisonment that may be extended to 3 months and/or a fine that may be extended to Rs.500

- For the second and subsequent violations, you will be punished with imprisonment for up to 6 months and/or a fine of up to 1000 rupees.

- If the fine is only once, the fine must be Rs.50 or higher.

Gujarat and its LWF rules

In Gujarat, the amount must be paid semi-annually. Therefore, payments till June 30th - 6th month must be made by July 15th. Similarly, payments for the six months ending December 30 must be made by January 15. This means that contributions need to be deducted from employee wages in June and December. This is necessary if the company has 10 or more employees. For all employees, the employee contributes Rs 6 and the employer contributes three times which is Rs 18.

Penalties related to payment and records management in Gujarat

The person will be punished with a fine of over 2000 rupees. If the breach is ongoing, you will be fined up to Rs 1000 per day for the duration of the breach.

Karnataka Regulations on LWF Scheme

If your company is registered in Karnataka and has 50 or more employees, you will need to enrol in the program. These contributions should be made annually. This must be done before the 15th of the following year (that is, January 15th). For all employees, the employee contributes Rs 20 and the employer contributes three times as much which is Rs 60.

Penalties for non-contribution in Karnataka

- For the first breach, you may be sentenced to 3 months in prison and/or a fine of up to Rs 500

- For the second and subsequent violations, you will be punished with imprisonment for up to 6 months and/or a fine of up to Rs 1000. Even if there is only one fine, the fine will be Rs 50 or higher.

West Bengal LWF Ordinance

If your company has more than 10 employees, you should donate every six months. This means that for the 6 months leading up to June 30th, payments must be made by July 15th. Similarly, payments for the six months ending December 30 must be made by January 15. For all employees (except managers or employees with incomes of Rs 1600 or more), you must pay Rs 3 from your employee and Rs 15 from your employer.

Penalties for interfering with the duties of inspectors in West Bengal

- For the first offence, imprisonment and/or a fine of up to 500 rupees that can be extended up to 3 months

- For the second and subsequent violations, imprisonment for up to 6 months and/or a fine of up to Rs 1000. Even if there is only one fine, the fine will be Rs 50 or higher.

Delhi Rules for LWF Scheme

Startups with 5 or more employees enrolled in Delhi must be enrolled in the program. You need to donate every 6 months. Contributions are paid semi-annually per employee on June 30th and December 31st each year at the employee's expense.

The employer is responsible for making donations for 6 months by July 15th and January 15th each year. All employees (excluding those who work in managerial positions or are working in managerial positions and earn only Rs over 2500 per month) are required to pay Rs 0.75 Paisa per employee share, and the employer pays Rs 2.25. That makes Rs 1.50 per employee every 6 months. The amount of Delhi as a matching contribution is equal to twice the employee contribution.

Haryana LWF Regulations

All startups registered in Haryana must be enrolled in the program. Here, the amount is paid monthly.

The worker contribution rate is 0.2%, of salary or compensation with the upper limit of Rs 25. The employer's contribution rate is twice that of such employees.

Andhra Pradesh LWF Regulations

If your company is enrolled in Andhra Pradesh and has more than 20 employees, you will need to enrol in the program. This must be done by January 15th (next year) each year. • For all employees (except managers or employees with incomes of Rs 1600 or above), you must pay Rs 30 from the employee and Rs 70 from the employer.

Penalties for violations

- Up to 3 months imprisonment for the first violation. There is also a fine of up to Rs 500

- Second and subsequent imprisonment may be extended to a maximum of 6 months and/or a fine of up to Rs 1000. If the fine is only once, the fine must be Rs 50 or higher

How does the Labor Welfare Fund – LWF help workers?

The Labor Welfare Fund (LWF) is managed by the Labor Department, which offers a variety of welfare programs to workers and provides support in the below-mentioned areas:

- Improving living standards

- Providing nutritious food, educational facilities, and scholarships to employees' children

- Medical facilities for private and public sector workers and their families

- Discounted rates and regulated housing facilities

- Providing better working conditions

- Facilities for workers and employees such as commuting (transportation), vocational training programs, excursions and tours, libraries, reading rooms, leisure facilities at work, etc.

- Providing social security

- Medical care, measures for specific industries, arrangements for secondary employment such as for women and the unemployed

The amount of the fund, the number of donations, and the periodicity are determined by the Workers Welfare Institute of each state. Contributions can be made monthly, semi-annually (semi-annual), or annually (annual) at a prescribed amount and remitted to the responsible vocational welfare fund in the prescribed form by the legally required deadline.

Benefits of Labor Welfare Fund (LWF) for Employers

- Sophisticated work relationships

- Improve work efficiency

- Improving morale

- Improving mental and moral health

- Better outlook for employers

- Social benefits

How does the process work?

Contributions to the Employment and Welfare Fund can be made annually, semi-annually, or monthly. The frequency may vary depending on country-specific law. If the frequency is semi-annual, the deduction period is further divided into two consecutive periods on the date specified by national law. The employer must deduct from the employee's salary and submit it in the prescribed format to the Board of Directors of the Employment Welfare Fund by the due date.

The Not Applicable States

- Andaman and Nicobar Islands

- Arunachal Pradesh

- Assam

- Bihar

- Dadra and Nagar Haveli

- Daman and Diu

- Himachal Pradesh

- Jammu and Kashmir

- Jharkhand

- Ladakh

- Lakshadweep

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Puducherry

- Rajasthan

- Sikkim

- Tripura

- Uttar Pradesh

- Uttarakhand

The Labor Welfare Fund (LWF) Act does not apply to all categories of employees working in a company. It depends on salary and employee designation. In addition, the total number of employees must be checked before this law is enacted. The scope of the law based on the number of employees may vary depending on the law of each country.

Labor Welfare Fund (LWF) Expenditure

In general, the funds of the fund can be used by the board to cover costs related to:

- Educational institution for workers' children

- Medical facilities for both private and public employees to provide medical facilities to employees and their families

- A transportation facility for workers to commute to work

- Recreational facilities such as music, dance, drama, games, sports, and painting are usually provided to employees to create a healthy work environment

- Housing facilities in this program provide loans to industrial workers to build housing at preferential rates

- Excursions, tours, travel

- Housing transactions and side businesses for women and the unemployed

- Reading room and library

- Job training

- Nutritious food for employees' children

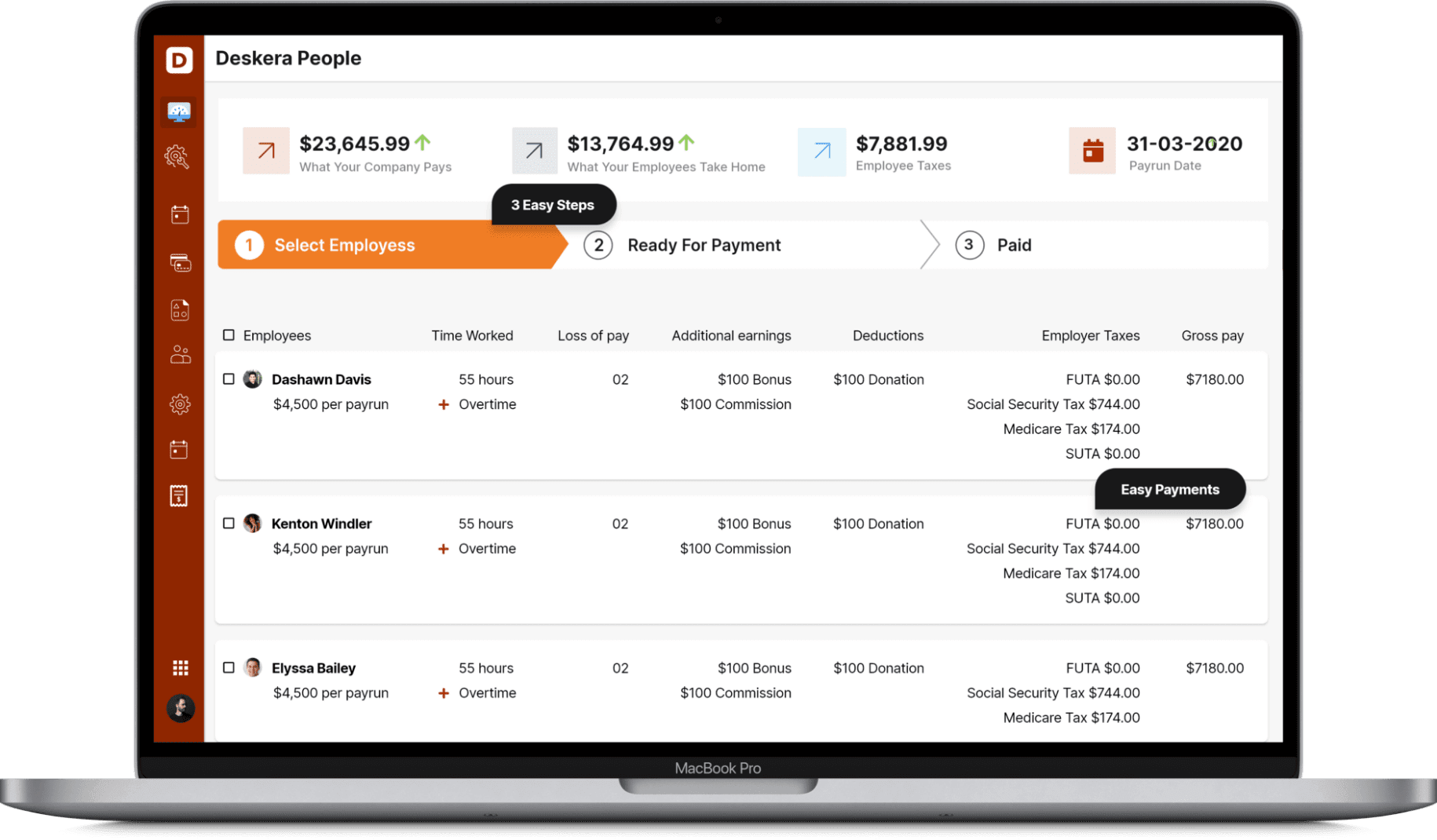

How Deskera Can Assist You?

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more.

Simplify payroll management and generate payslips in minutes for your employees.

In addition to a powerful HRMS, Deskera offers integrated Accounting and CRM Software for driving business growth.

Conclusion

The Labor Welfare Fund (LWF) is a statutory contribution managed individually by the state authorities. This tax or accumulated fund is for the advantage of employees and workers in unorganized sectors. When managing a company's salary, you need to understand the different aspects of LWF and how it applies. In other words, LWF rules vary from state to state. It is very important to pay attention to various legislative changes.

Key Takeaways

- The Labor Welfare Fund (LWF) is an initiative of the Government of India to support and improve the living conditions of unorganized sectors

- Of the 36 states and Union Territory, only 16 enforced the law

- Under the LWF Act, the employer must make certain contributions on behalf of the company and the employees. This depends on the state in which the business operates

- Contributions, due dates, and fines for not paying contributions vary from state to state

- The applicability of the LWF depends on the state in which the company is registered

Related Articles