FSLA classifies employees as "exempt" or "non-exempt." You may have encountered these words in job advertising or overheard them in conversation. Don't worry if you're not sure what they signify. Understanding labour regulations may be difficult, especially if you are new to the job.

In this article, we've defined these words to assist you in understanding the difference between exempt vs non-exempt employees. So, keep on reading!

Here are the points covered in this article:

- What is an exempt employee?

- What is a nonexempt employee?

- What is the difference between exempt vs non-exempt employees?

- Benefits of an exempt employee

- Benefits of a nonexempt employee

- Does exempt vs. nonexempt matter?

- What’s better- exempt or non-exempt?

Let’s Begin!

What is an exempt employee?

The phrase exempt employee refers to workers defined by the Fair Labor Standards Act (FLSA). It does not entitle exempt employees to overtime pay or the minimum wage.

- Exempt workers work on a salary rather than hourly, and their employment is executive or professional.

- The Fair Labor Standards Act governs the specifics and standards affecting exempt and non-exempt employees.

- The FLSA exempts the following employment categories:

- Professional

- Administrative

- Executive

- Outside sales

- Computer-related.

- The specifics vary by state, but they are exempt if an employee fits into one of the following categories, is salaried, and makes at least $684 per week or $35,568 per year.

Till now, you must have got basic idea of what exempt employees are. Now, let’s look at what non-exempt employees are.

What is a non-exempt employee?

Non-exempt employees are eligible for the federal minimum wage and overtime compensation. The federal government computes overtime pay as one and a half times the employee's hourly rate for each hour worked over a typical 40-hour workweek.

- Non-exempt employees are often blue-collar, hourly-rate employees who are paid 1.5 times their hourly rate for overtime.

- Exempt employees must earn at least $684 per week or $35,568 per year. Non-exempt employees often make less than this amount. However, this is not always the case. The thresholds may differ from one state to the next.

- The FLSA specifies the rights of non-exempt employees, which were recently updated and came into effect on January 1, 2020.

With that, let's look at the difference between exempt vs non-exempt employees.

What is the difference between exempt vs non-exempt employees?

This table illustrates the distinctions between exempt vs non-exempt employees:

You must be clear about the difference between exempt and non-exempt employees. Now, let's look at some benefits of hiring exempt and non-exempt employees.

Benefits of an exempt employee

Here are some benefits of hiring an exempt employee:

You are not required to pay overtime

When you recruit exempt employees, you will not be required to pay overtime regardless of how many hours they work every week. Exempt employees' pay is not affected by how much time they work.

You can presume that they have greater experience

Exempt employees typically bring more expertise to the table than non-exempt competitors, and knowledge is increasingly viewed as a critical organizational advantage. If you need highly trained workers, the exempt path may be your best choice.

You can delegate additional authority to them

Exempt personnel are the ones you'll rely on to get your firm through the hiccups that come with essential events like corporate mergers, conferences, and seasonal deadlines. Not only are they the backbone of your company, but you may also ask them to work longer hours without expecting more income.

Benefits of a non-exempt employee

Here are some benefits of hiring a non-exempt employee:

Certain companies rely on non-exempt staff to function.

The FLSA may exempt most office workers, which means practically every employee whose primary job involves physical labour is non-exempt. Non-exempt personnel are widespread in the manufacturing, construction, and maintenance industries, to name a few. Non-exempt personnel also includes retail staff who engage directly with customers in-store.

Non-exempt workers may accept lower pay rates.

A person with the title of head of business development–almost certainly an exempt post—will almost surely want high compensation. Non-exempt workers' employment is connected with less expensive labour. Hiring non-exempt employees may save you money on labour expenditures.

But does the difference between exempt vs non-exempt employees matter in practical situations? Let’s find out.

Does exempt vs. nonexempt matter?

Understanding the difference between exempt and non-exempt employees is critical for compliance with the FLSA.

To stay compliant, especially in terms of overtime pay, you should know whether administrative employees' time must be tracked and paid similarly to custodial staff.

Another essential takeaway from the contrast between administrative and custodial staff is that the job, not the applicant, determines FLSA exemption status.

That is why, rather than considering the requirements and advantages of exempt vs non-exempt personnel afterwards, consider them while reviewing your employment needs.

If you don't want to monitor overtime and pay time and a half–the typical overtime pay rate for any work over 40 hours in the great majority of the United States–to workers who work over 40 hours per week, create your job requirements to meet exemption standards.

Alternatively, if the work is consistently non-exempt and you don't want to pay overtime, try recruiting many part-time employees or independent contractors.

So, which one is better: exempt vs non-exempt employee? Let's find the answer in our next section.

What’s better- exempt vs non-exempt employee

Some workers would prefer to be employed in non-exempt roles to ensure they're compensated for every working hour. Others value the freedom that comes with paid work. In a nutshell, that is all up to you.

For example, most non-exempt employees will hold a higher standard for casual time. Exempt employees may usually spend a respectable amount of time at the watercooler without incurring the boss's anger; non-exempt employees' time is more strictly regulated. It only permitted specified breaks at specific periods during the workday.

Exempt employees are often paid more than non-exempt employees since they are expected to fulfil duties regardless of the number of hours necessary. Exempt personnel are usually expected to remain late or come in early if necessary to accomplish the job. Employees who are not exempt often work only the number of hours specified.

And that's everything you need to know about exempt vs non-exempt employees. Now let's look at some of the most frequently asked questions about exempt vs non-exempt employees.

Frequently Asked Questions

1: What is FLSA?

The Fair Labor Standards Act (FLSA) specifies minimum wage, overtime pay, record-keeping, and youth employment standards for employees in the private sector and those employed by the federal, state, and municipal governments.

2: What Are the Drawbacks of Working as an Exempt Employee?

The most significant drawbacks are that it does not entitle you to overtime or minimum wage. Depending on your employer's attitude, you may work long hours to complete an overloaded work portfolio with little option for more compensation or lowering the stress caused by the long hours. In a nutshell, you're at the mercy of your employer.

3: Is it possible for an employee to be both salaried and non-exempt?

Yes, an employee can be "salaried, non-exempt," which means they are paid a weekly wage (or whatever the company pays) and are eligible for overtime compensation for any hours worked over 40 per week. Non-exempt employees are not required to be paid hourly; they can be paid in various ways, including commission, salary, hourly, and so on, as long as the remuneration meets minimum wage criteria.

How Can Deskera Assist You?

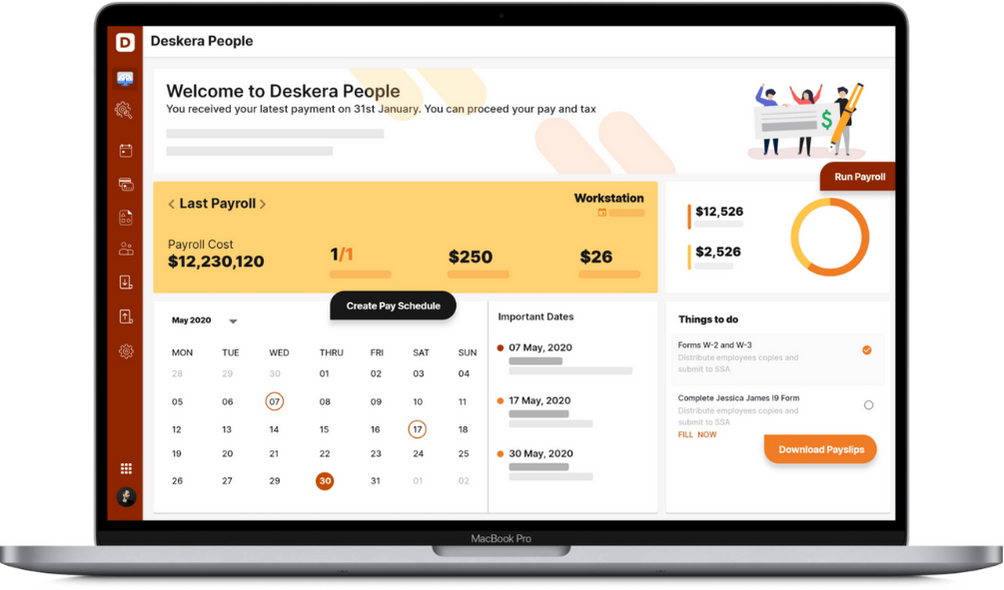

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- The Fair Labor Standards Act governs the specifics and standards affecting exempt and non-exempt employees.

- An exempt employee does not earn overtime compensation or is not eligible for the minimum wage.

- The FLSA exempts the following employment categories: professional, administrative, executive, outside sales, and computer-related.

- Non-exempt employees are often blue-collar, hourly rate employees who must be paid 1.5 times their hourly rate for overtime.

- Exempt employees must earn at least $684 per week or $35,568 per year. Employees who are not exempt are often paid less than this amount. However, this is not always the case. The thresholds may differ from one state to the next.

- Exempt employees are distinguished from non-exempt employees, who are required to be paid at least the minimum wage and overtime while working more than the regular 40-hour workweek.

- Exempt employees are paid on a salary rather than an hourly basis, and their employment is executive or professional.

- The rights of non-exempt employees are specified in the Fair Labor Standards Act (FLSA), which was recently updated and will go into effect on January 1, 2020

Related Articles