Funeral expenses claim form ESIC form 22 is being used to claim funeral expenses for ESIC members who have passed away. Employee State Insurance Scheme (ESI) provides a payout of a certain amount to dependents of deceased ESIC members for funeral expenses.

In today’s article, we’ll cover and discuss every aspect associated with funeral expenses for 22 and we'll also have a look at form 22 funeral expenses. Let’s take a look at what we’ll cover ahead:

- About ESI Scheme in India

- About ESI (Employee State Insurance Plan)

- Atal Bimit Vyakti Kalyan Yojna

- ESIC Family Members' Eligibility Age

- Funeral Expenses Enhancement

- Information to be included in Form 22 of the ESIC

- How many members of your family are protected by ESI?

- The attestation of any of the following persons is required on ESIC form 22

- Funeral Expenses Claim Form 22

- ESIC Advantages for Dependents and Family Members

- How Deskera Can Assist You?

Let’s Start!

About ESI Scheme in India

ESI Scheme in India The Employees’ State Insurance Corporation is a pioneer Social Security organization providing comprehensive social security benefits like reasonable Medical Care and a range of Cash Benefits in times of need such as employment injury, sickness, death, etc.

The ESI Act applies to premises/precincts where 10 or more persons are employed. The employees drawing wages up to Rs.21,000/- a month are entitled to health insurance cover and other benefits, under the ESI Act. The Act now applies to over 8.98 lakh factories and establishments across the country, benefiting about 3.43 crores family units of workers. As of now, the total beneficiaries population under ESI Scheme stands over 12.40 crores.

Ever since its inception in 1952, the ESI Corporation has, so far, set up 154 Hospitals, 1489/174 Dispensaries / ISM Units, 815 Branch/Pay Offices, and 63 Regional & Sub-Regional Offices.

About ESI (Employee State Insurance Plan)

Employee state insurance plan (ESI) is one of the most beneficial schemes for employees in India who earn less than Rs. 21000 per month in gross wage. Employees and their family members would be treated in ESIC facilities under the ESI programme.

In addition to treatment, the scheme provides numerous other benefits to members and their families. Here we shall learn about the ESIC advantages offered to the covered person's family members.

Atal Bimit Vyakti Kalyan Yojna

The ESI Corporation has approved a Scheme named "ATAL BIMIT VYAKTI KALYAN YOJNA" for Insured Persons (IP) covered under the Employees' State Insurance Act, 1948, in light of the change in employment patterns and the current employment scenario in India, which has transformed from long-term employment to fixed short-term engagement in the form of contract and temping. In the event of unemployment and while they look for a new job, this scheme provides a cash payment directly to their bank account. Separately, detailed instructions will be sent out, including eligibility requirements, application format, and so on.

ESIC Family Members' Eligibility Age

According to the ESIC Amendment Act 2010, the age limit for ESIC-dependent children has been raised from 18 to 25 years as of June 1, 2010.

Funeral Expenses Enhancement

The ESI Corporation has approved a proposal to increase the Funeral Expenses paid on the death of an insured person from the current Rs. 10,000/- to Rs. 15,000/-.

Aside from these, the meeting considered and approved roughly 35 other Agenda Items related to improving services/benefits to insured persons and other administrative matters.

Information to be included in Form 22 of the ESIC

The following information must be included on the ESIC funeral expense claim form:

- Name of the insured person ( deceased person)

- Relationship name of the deceased person.

- Date of death

- Age of the deceased person.

- ESIC IP number.

- ESIC funeral benefit amount 15000 Rs (maximum).

- Name and details of the claimant.

- Age of the claimant.

- Last worked job details.

- Signature of the claimant.

How many members of your family are protected by ESI?

ESIC family members do not have a specific number. ESIC medical treatment is available to the family members of insured persons who do not have a source of income.

- Dependant Unmarried Daughter Up to 25 Years

- Minor Dependent Son Up to 25 Years

- Dependant Infirm Son

- Spouse

- Dependant Infirm Unmarried Daughter

- Dependant Father

- Dependant Mother

- Minor Brother ( When there are no parents)

- Minor Sister (When there are no parents)

Family Definition As Per ESIC Act 1948:

According to the ESIC Act 1948, “family” means all or any of the following relatives of an insured person, namely:

(i) a spouse;

(ii) a minor legitimate or adopted child dependent upon the insured person;

(iii) a child who is wholly dependent on the earnings of the insured person and who is —

- receiving education, till he or she attains the age of twenty-one years;

- an unmarried daughter;

(iv) a child who is infirm by reason of any physical or mental abnormality or injury and is wholly dependent on the earnings of the insured person, so long as the infirmity continues;

(v) dependent parents, whose income from all sources does not exceed such income as may be prescribed by the Central Government;

(vi) in case the insured person is unmarried and his or her parents are not alive, a minor brother or sister wholly dependent upon the earnings of the insured person;

The attestation of any of the following persons is required on ESIC form 22

- Workmen’s compensation commissioner.

- Officer of revenue or judicial or magisterial departments.

- Municipal commissioner.

- Head of Gram Panchayat under the official seal of panchayat or MLA / MP.

- Gazetted officer of state / central govt/member of the local committee / regional board

The claimant must provide his or her ESIC Pehchan card, as well as a funeral claim form, to their local ESIC branch office.

Funeral Expenses Claim Form 22

Funeral expense claim form ESIC form 22 is employed to claim funeral expenses for ESIC members who have passed away. Employee State Insurance Scheme allows dependents of deceased ESIC members to receive a sum of Rs 15000 for funeral expenses (W.E.F 1 March 2019). Within six months of the insured person's death, family members must file a claim for ESI funeral expenses.

Furthermore, in order to receive funeral expenses spent by an insured person, a nominee and, in their absence, the eldest surviving member of the insured person's family must submit a claim in the manner provided.

If the minor is under the age of 18, the guardian should sign the Claim Form on his or her behalf and then add the following below his or her signature.

You can learn how to fill out ESIC form 22 and see an example filling out ESIC form 22 here.

ESIC Advantages for Dependents and Family Members

Following we have discussed some advantages for dependents and family members. Let’s learn:

Expenses for Funerals

The dependents or the person who administers the final rites of an insured individual are entitled to a funeral charge of ten thousand rupees.

To claim ESIC funeral expenditures, the deceased member's relatives must submit ESIC funeral expenses claim form 22 along with the deceased member's ESIC Pehchan card to an ESIC branch office within 6 months of the conclusion of the final ceremonies.

There is a slew of other benefits that ESIC provides to its members. However, the three benefits described above are mostly for the insured person's family members.

Medical Insurance Benefits

Both the insured individual and their family members will be eligible for ESIC medical treatment in ESIC dispensaries and hospitals from the day they join the ESIC scheme. Even if employees retire or become permanently incapacitated, they can still get medical care by paying an annual token fee of 120 rupees to the ESIC.

By presenting the ESIC Pehchan card or the ESIC temporary ID card, family members of insured persons can receive treatment at their ESIC dispensary (print counterfoil).

Dependent Benefits

When an insured person dies as a result of a work injury or occupational hazard, the dependents of the deceased covered person will receive 90 percent of their wages as monthly payments.

To claim ESIC dependents benefits, dependents of dead members must submit an ESIC dependent benefit claim form along with the deceased member's ESIC Pehchan card to an ESIC branch office.

How Deskera Can Assist You?

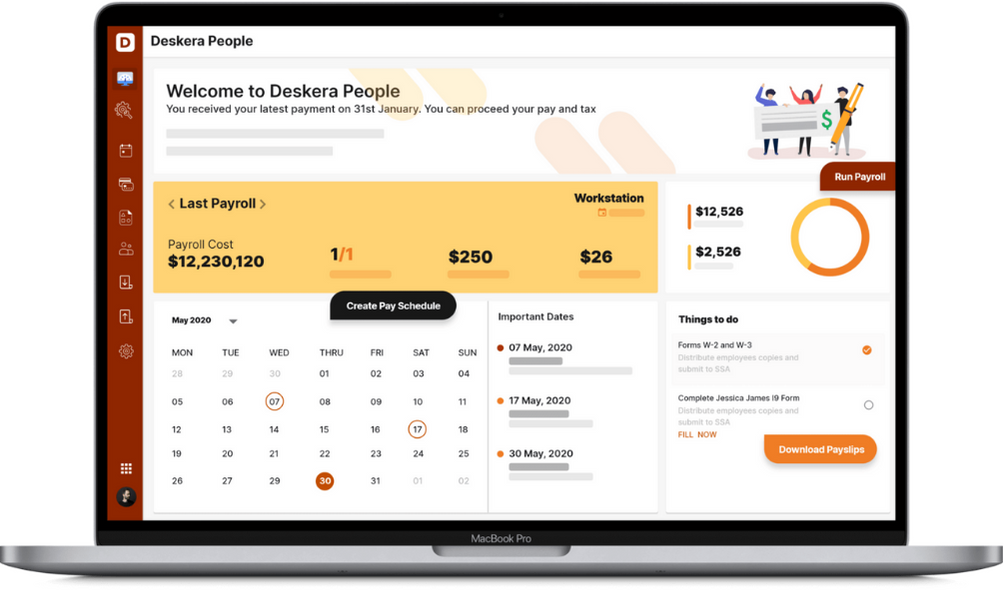

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. Easily generate pay slips for your employees and simplify your payroll management with Deskera People. It also digitizes and automates HR processes including hiring, expenses, payroll, leave, attendance, and more.

Final Takeaways

We've arrived at the last section of this guide. Let's have a look at some of the most important points to remember:

- Funeral expenses claim form ESIC form 22 is being used to claim funeral expenses for ESIC members who have passed away. Employee State Insurance Scheme (ESI) provides a payout of a certain amount to dependents of deceased ESIC members for funeral expenses.

- The ESI Act applies to premises/precincts where 10 or more persons are employed. The employees drawing wages up to Rs.21,000/- a month are entitled to health insurance cover and other benefits, under the ESI Act.

- The ESI Corporation has approved a Scheme named "ATAL BIMIT VYAKTI KALYAN YOJNA" for Insured Persons (IP) covered under the Employees' State Insurance Act, 1948, in light of the change in employment patterns and the current employment scenario in India, which has transformed from long-term employment to fixed short-term engagement in the form of contract and temping.

- Employee state insurance plan (ESI) is one of the most beneficial schemes for employees in India who earn less than Rs. 21000 per month in gross wage. Employees and their family members would be treated in ESIC facilities under the ESI programme.

- The ESI Corporation has approved a proposal to increase the Funeral Expenses paid on the death of an insured person from the current Rs. 10,000/- to Rs. 15,000/-

- ESIC family members do not have a specific number. ESIC medical treatment is available to the family members of insured persons who do not have a source of income.

- ESIC family members do not have a specific number. ESIC medical treatment is available to the family members of insured persons who do not have a source of income.

- In order to receive funeral expenses spent by an insured person, a nominee and, in their absence, the eldest surviving member of the insured person's family must submit a claim in the manner provided.

- If the minor is under the age of 18, the guardian should sign the Claim Form on his or her behalf and then add the following below his or her signature.

- To claim ESIC funeral expenditures, the deceased member's relatives must submit ESIC funeral expenses claim form 22 along with the deceased member's ESIC Pehchan card to an ESIC branch office within 6 months of the conclusion of the final ceremonies.

- Both the insured individual and their family members will be eligible for ESIC medical treatment in ESIC dispensaries and hospitals from the day they join the ESIC scheme. Even if employees retire or become permanently incapacitated, they can still get medical care by paying an annual token fee of 120 rupees to the ESIC.

- When an insured person dies as a result of a work injury or occupational hazard, the dependents of the deceased covered person will receive 90 percent of their wages as monthly payments.

- When an insured person dies as a result of a work injury or occupational hazard, the dependents of the deceased covered person will receive 90 percent of their wages as monthly payments.

Related Articles