Although the minimum wage aims to safeguard employees from mistreatment, it has failed to keep up with inflation. According to the Economic Policy Institute, employees on the minimum wage in 2017 made approximately 27% less than their contemporaries over 50 years ago.

If the minimum wage had been increasing at the same pace as average salaries in the United States from 1968, it would have been $11.62 in 2017.

However, the minimum wage is $15,080 per year if you work 40 hours/ week per year. That is higher than a single person's federal poverty line but not for a two-person family. This article will look at minimum wage, a history of minimum wages in the USA, and federal and state minimum wages for tipped and non-tipped employees.

Table of Contents

- What is the Minimum Wage?

- History of the Minimum Wage

- What Is the Current Federal Minimum Wage?

- State-Wise Minimum Wage Legislation in 2021

- What is the Distinction between a Minimum Wage and a Tipped Wage?

- How Can Deskera Assist You?

- Frequently Asked Questions

- How can Deskera Help You?

- Key Takeaways

Let’s Start!

What is the Minimum Wage?

The minimum wage is the legal minimum compensation that businesses can pay their employees. The goal of minimum-wage regulations is to keep employers from maltreating their workers.

The minimum wage should give enough revenue to support a living wage, including enough food, clothes, and housing. As of January 2022, the national minimum wage in the United States is $7.25 per hour.

The minimum wage varies by state and city. Employees have a higher federal or local minimum wage. As of January 1, 2022, California has the highest state rate of $15 or $14 for firms with fewer than 26 employees.

History of the Minimum Wage

In 1938, the FLS Act founded the first minimum wage in the USA. It was enacted as part of President Franklin D. Roosevelt's New Deal to safeguard workers during the Great Depression.

The Depression had reduced their salaries to pennies per day for many. So Roosevelt established a minimum wage of $0.25 per hour. During the Great Depression, fierce competition prompted businesses to cut wages and work longer hours to stay in business.

Child labor was another big concern. According to a survey conducted by the United States Department of Labor (DOL) Children's Bureau at the time, 25% of 449 American children polled worked 60 hours or more each week. As public interest in the topic rose, President Roosevelt summoned a special legislative session in 1937 to address the minimum wage establishment issues.

The FLSA not only created the minimum wage but also prohibited abusive child labor and, as a consequence, restricted the workweek to 44 hours.

The minimum wage was adjusted numerous additional times by the United States Congress. By 1956, it had risen to $1 per hour. However, the FLSA only extended to employees within state lines.

In 1961, Congress expanded the Act to cover retail and service workers and employees in public transit, manufacturing, and truck stops. In addition, the FLSA covered state and local government personnel and those in service businesses, including garment factories, motels, and agriculture.

What Is the Current Federal Minimum Wage?

While several states have passed laws mandating a $15 minimum wage, the federal minimum wage stands at $7.25.

President Joe Biden made the $15 minimum wage a campaign objective and has continued to press for a federal mandate since taking office. Just after Biden assumed office, Democratic senators sponsored the Raise the Wage Act of 2021, which would more than raise the federal minimum wage to $15 by 2025.

In 2019, a bill introduced cleared the Congress but died in the Senate.

Your state's minimum wage rules may also be different. If the minimum wage in your local area is higher than the national minimum wage, you should pay the higher rate to eligible workers.

State-Wise Minimum Wage Legislation in 2022

We've included the minimum wages for each state or the cities with independent minimum salaries if there are fewer than five.

Note: It is not an exhaustive list of every city, county, and municipality's minimum salary, and you may need to investigate other legal factors. For example, check if local regulations apply and each state's tipped minimum wage limits.

What is the Distinction between a Minimum Wage and a Tipped Wage?

The federal minimum wage applies to your employees if you fit into at least one of the following categories:

· You have at least two workers

· You hire domestic helpers such as housekeepers, chefs, and nannies

· Your company generates at least $500,000 in sales or services

· Your company is a hospital, school, preschool, or government institution that offers medical or nursing services

· Your company engages in interstate commerce like selling items over state borders or collaborating with persons or businesses in other states

You could also have employees who are not subject to minimum wage laws and rules. Depending on their work, they may even be exempt on certain weeks and nonexempt on others.

The personnel listed below may be exempt, but we recommend speaking with an employment lawyer first.

· Farmworkers working on tiny farms

· Temporary and leisure employees: If your firm only operates for seven months or less each year, or if your average revenues for half of the previous calendar year were less than 33.33 percent of the average revenues for the other half of the year

· Workers in executive, administration, technical, and management positions

Another significant group of workers who do not earn the minimum wage are tipped employees. The FLSA establishes a minimum payment of $2.13 for waiters and other tipped workers, as long as the tips and hourly salaries total the federal minimum wage. Your employee must also make more than $30 in tips each month.

If the sum of your tips and hourly pay falls short of the statutory minimum wage of $7.25 per hour, you must make up the shortfall.

How Can Deskera Assist You?

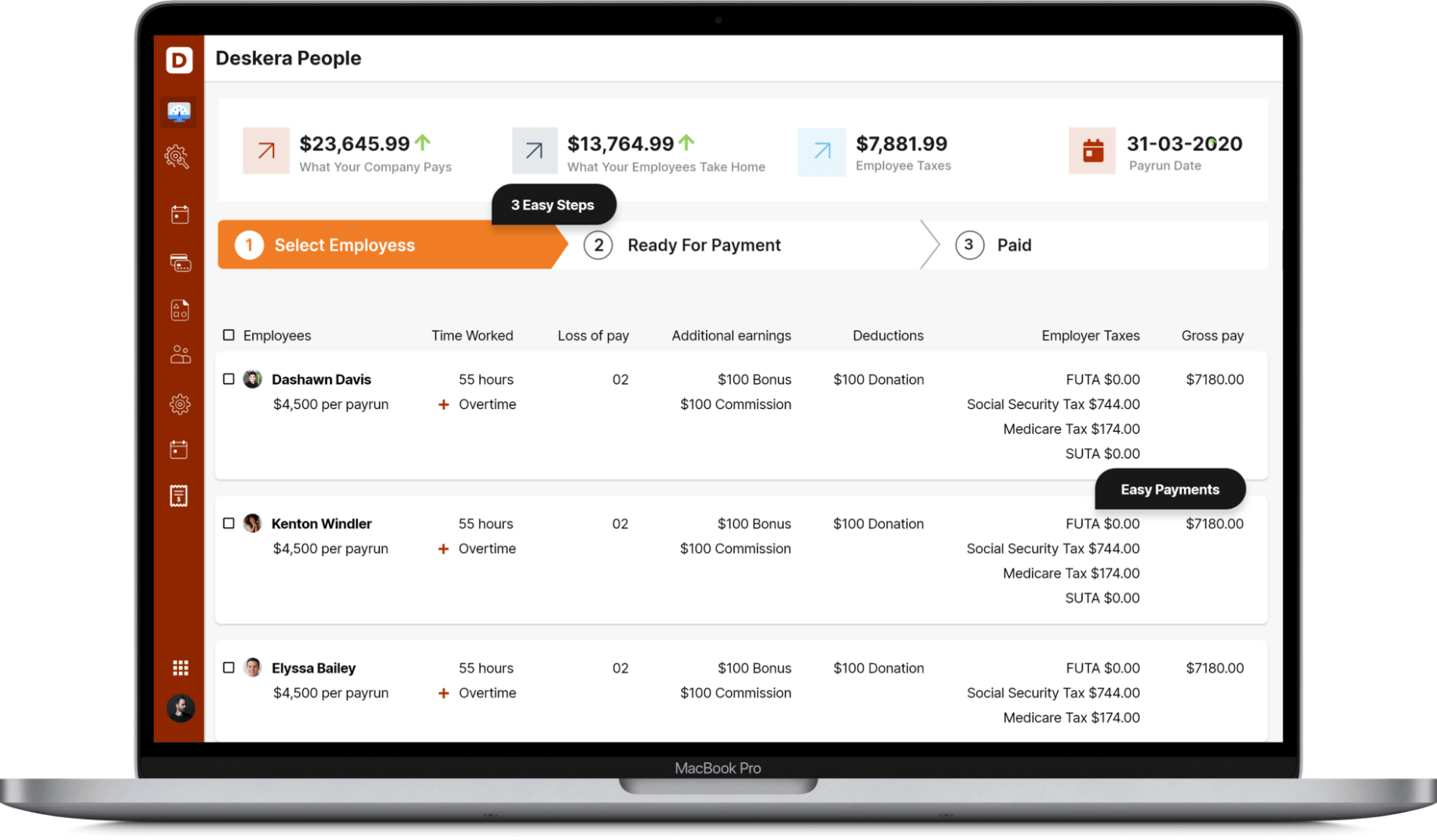

Payroll and staff management are critical components of every business. Deskera People may be an appropriate option if you are seeking for a comprehensive and automated application to manage payroll, personnel, costs, and contractor administration.

Frequently Asked Questions

How many individuals are working on a minimum wage?

In 2020, 1.1 million people in the United States earned the minimum wage or less, accounting for 1.5 percent of all hourly-paid jobs.

Is it possible to support a household on minimum wage?

Working 40 hours/week at the minimum pay will bring in $15,080 only before taxes. For a family of two or more individuals, this is below the national poverty line. It is also less than the national average for a one-bedroom apartment in 2020, which is $1,621 per month, or $19,452 per year.

How long has the minimum wage been constant?

Since 2009, the national minimum pay has been $7.25 per hour. To have the same spending power as minimum-wage employees in 2009, employees should have been getting $9.57 in December 2021, thanks to inflation.

How can Deskera Help You?

Deskera People is a cloud-based software that will help to create and assign custom pay components to an employee in light of your requirements.

Deskera People provides all the employee's essential information at a glance with the employee dashboard. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

Deskera People will distinguish those components assigned to the employee and naturally compute the wages taking in the specific conditions which can be designed in each component like pre and post-tax deductions.

To learn more about Deskera and how it works, take a look at this quick demo:

Key Takeaways

· Although the minimum wage aims to safeguard employees from mistreatment, it has failed to keep up with inflation.

· The minimum wage is the legal minimum salary that businesses can pay their workers.

· As of January 2022, the national minimum wage in the United States is $7.25 per hour.

· The minimum wage varies state-wise. Employees get the higher the federal or local minimum wage.

· In 1938, the FLS Act launched the first minimum wage in the USA. It was enacted as part of President Franklin D. Roosevelt's New Deal to safeguard workers during the Great Depression.

· While several states have passed laws mandating a $15 minimum wage, the federal minimum wage stands at $7.25.

· We have included the list of state-wise minimum wages for tipped and non-tipped employees under the section "State-Wise Minimum Wage Legislation in 2021."

· A tipped employee works in employment where they regularly get more than $30 in tips per month.

· A tipped worker's employer is only obligated to pay $2.13 per hour in direct wages if that amount, together with tips, equals or exceeds the federal minimum wage.

Related Articles