Whether you are a novice or an experienced entrepreneur, you must often get reminders from the Income Tax department to file your income tax returns on time. Form 16 is the most important document that you will come across in such situations. But do you know what exactly it is and why do you need it? Read this article to clear all your doubts related to Form-16.

What is Form 16?

Form 16 is the certificate issued under section 203 of the Income tax Act for tax deduction at specified rates on the salary you receive through the employers. The tax is deducted at an average rate, applicable to the employee, and is deposited on a monthly basis by the employer in the Income Tax department.

According to the rules, the employer will file a quarterly TDS return that will show details of the amount paid as well as tax deducted by them with respect to each employee. All these quarterly details are consolidated by the employers every year. Employers thereby issue a form known as Form 16 that has all the relevant details regarding this.

Why do you need Form 16?

Form 16 is essential as it has all the relevant details regarding the salary you receive through your employer including the taxability of these amounts. Furthermore, it certifies that the income tax on your income has been deducted at the source, and deposited with the Central government account.

Form 16 is one of the most important documents that is required for filing your Income Tax returns. It consists of most of the details required for filing your return.

It acts a proof that the taxes have been paid on time, and the income an employee earns from his/her salary is genuine, valid, and recorded with the Indian government.

Let’s take a look at some of the uses of form 16:

Helps in Filing Income Tax Returns

Form 16 helps in providing a complete breakup of your salary including bonuses and allowances along with details of your tax-saving investments declared by you to your employer. These details mentioned in Form 16 will help you file your income tax returns online.

Verify that the Employer Has Deposited TDS to the Government

Form 16 is issued only when your employer has deposited the TDS to the central government. It acts as proof that the employer hasn’t misused the amount deducted from your salary as TDS.

Compute your Tax Liabilities

While the responsibility of TDS is on the employer, it is your responsibility to pay taxes. Sometimes, the employer may deduct tax on the incorrect/suppressed information given by you. In such scenarios, you may have either underpaid your taxes or overpaid your taxes. Form 16 helps in computing your tax liabilities so that you can pay your remaining tax or seek a refund by filing your returns on time.

Credit Cards

When applying for a credit card, you need to provide Form 16 for the last 2 years. Through Form 16, credit card issuers get proof of the income of the applicant. They also get to know about the income tax liability. This information helps the credit card issuers to assess the financial position of the applicant. Many financial institutions use this certificate as a way to determine the credit limit for the borrower. If you have a higher income, you will get to avail a higher credit card limit.

Loans

When you apply for a home loan, personal loan, or vehicle loan, you may need to show income tax returns that you file. Form 16 provides a breakup of your salary and your tax liabilities which is required for loan application.

Form 16 provides an overview of your tax-saving investments and any other periodical investment schemes that may be drawing your money. It allows the lender to evaluate your financial health and your loan repayment capacity.

This can help to calculate how much loan amount they can provide to you, for what tenure, and at what interest rate. If you have a good financial statement, you will attract cheaper interest rates.

Helps in the Process of Getting a Visa

If you are planning to go abroad, foreign embassies and consulates may enquire about Form 16 for the last 2 years to know about your financial stability. This can help to evaluate whether you can manage your finances while travelling abroad.

Form 16 can also act as proof for income tax returns, mutual funds, or the sale of the property. If you have switched your job, then you can ask for Form 16 from your previous employer so that your next employer can easily access your tax liabilities.

Form 16 Eligibility Salary

As per the rules issued by the Indian Government, every salaried individual that falls under the taxable bracket is eligible for Form 16, which means that if your gross salary is above 2.5 lakhs per annum, you need to pay tax, and you are eligible for the Form 16. If an individual doesn’t fall in the taxable bracket, he/she will be exempted from tax deductions. In these cases, a company is no longer under the obligation to provide a Form 16 to these employees.

These days, however, many organizations issue a certificate to their employees depicting a consolidated picture of the earnings of the individual.

Components of Form 16

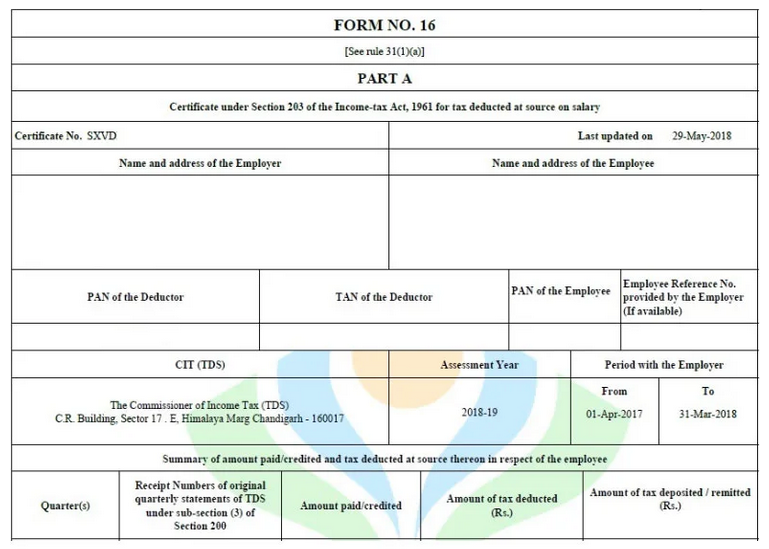

Form 16 essentially contains two parts: Part A and Part B

Part A of Form 16 contains the details of the tax deducted at source on salary. It is generated and downloaded from the TRACES portal by the employer.

Part A includes:

- Name and address of the employer

- PAN and TAN of the employer

- PAN of the employee

- Period of Deduction

- Applicable Previous Year

- Applicable Assessment Year

- Name and address of the employee

- Commissioner of Income Tax details

- Summary details of TDS deducted/paid

- Summary details of TDS deposited in Govt. account

- Details and amount of challan for tax deposit for particular AY

- Verification of details TDS deductor or authorized person

Part B includes the complete breakup of employee salary:

- Gross Value of salary (Section 17(1), 17(2) and 17(3))

- Exemption availed by the assessee under section 10

- Deductions on account of the standard deduction; entertainment tax; tax on employment

- Any other income reported by the employee

- Deductions under Chapter VI A (Series of Section 80)

- Details of Total Taxable Income,

- Details of tax on total income (includes slab rate, surcharges, and cess @ 4% on taxable income)

- Amount of Rebate Claimed (if any)

- Amount of Relief Claimed (if any)

- The tax payable amount and/or Refund (as applicable)

- Verification by TDS deductor (or authorized person) of details mentioned are true, accurate, and complete

If you want an accurate estimation of deductions and income of the employee, an employer has to obtain all related documents of insurance paid, expenditures, etc. made by the employee for an insurance policy, rent transaction receipts, and other income and expenditure proofs for preparation of Form 16.

It is the responsibility and duty of every employer to deduct TDS from the employee salary account, and issue him a Form 16 under Section 203(2).

The due date to issue Form 16 by every employer is on or before 15th June (subject to change) for the assessment year. You should note that if an employer does not issue Form 16 by the specified date, then they are liable to pay a penalty of Rs 100 per day till the date the default continues. However, the penalty should not exceed the amount of tax deducted.

How to file Income Tax Returns with Form 16 Online?

If you are filing income tax returns online for the first time, it can turn out to be a daunting task for you. However, once you are aware of the procedure, it can be done in just a few minutes.

Before you begin the process, you need to complete the preliminary tasks first. Firstly, you need to register and create an account with the Income tax website. The PAN number will be your User Id and your Date of Birth will be the password.

The next task is to generate Form 26AS. This form can be downloaded from the NSDL-TIN website. It will determine the details of TDS on multiple incomes including salary, and returns on investment, rent on property sale).

Once this is done, you need to download the ITR1 form by logging into the income tax website if your income from your salary/pension for the financial year is less than 50 lakhs. Download ITR2 if your annual income is more than 50 lakhs.

How to fill Form 16 for IT Return Online?

Once your ITR form is downloaded, it needs to be filled with the following details (refer to Form 16)

- Employee Name, PAN, complete address, DOB, email id, and phone number

- Unreported details by the employer can be obtained from Form 16 and Form 26AS.

- Tax deduction details (amount, date, etc.), self-assessment advance tax details, if any

- All bank details

Fill in the Income Details

Once you fill the ITR form, you must fill in the income details and provide the validation with the help of the required set of documents.

Tax Liability Calculation

After the income details have been mentioned, the system will automatically calculate the tax liability. If not done, the tax details will have to be inserted manually.

Tax Paid and Verification Tabs

A tab will display the tax paid, to be paid, or to be refunded. This section must be filled with bank details and the declaration must be verified.

ITR File Submission

Make sure you re-check the details and then upload the file by clicking the button below.

Generating the ITR-V

The ITR-V will be generated and sent to the given email id automatically. The ITR-V is an acknowledgement and verification document.

Return e-Verification

After submitting the ITR successfully, the link to e-verify the details will be shown. However, you need to check it carefully and save it for future references.

It is imperative for you to prepare and submit your return, even if your employer didn’t deduct any tax, or failed to issue a Form 16.

In case you switched your job during the year, try to include income from all your employers, regardless of whether Form 16 was issued.

In case you are a self-employed individual, you may not be able to acquire Form 16. In such a scenario, you should submit your ITR, and show it as your income proof.

What to do When you have Worked with More Than One Employer?

If you have worked with one employer during the year, Form 16 will be issued by that employer for the full financial year. It will contain the details of tax deducted and deposited for all the quarters of the financial year.

However, in case you have worked with more than one employer during the financial year, each of the employers will issue Form 16 for the period for which you were employed with each of them. However, part B of Form 16 may be issued by each of the employers or the last employer as per the choice of the taxpayer.

What are the Penalties Related to Form 16?

Let’s take a look at some of the penalties related to Form 16:

- If Form-16 is not issued by the employer to the employee, under Section 272A 2(g) of the Act, a penalty of Rs 100/ per day will be issued until the default continues.

- For the non-deduction of TDS, causing delay or non-issue of Form 16, the employer will be charged with the penal interest of 1% on the tax payable per month from the date from which the actual tax was to be deducted to the actual date of deduction under Section 201A.

- In case of non-payment after deduction of TDS, causing delay/incorrect issue of Form 16 deduction, a penalty interest of 1.5 % on the tax amount payable per month would be charged from the date of deduction to the actual date of payment from the employer under Section 201(1A).

- For failure or furnishing incorrect information in TDS return causing the incorrect issue of Form 16, the penalty from Rs. 10,000 extendable to Rs. 1 lakh under Section 271H shall be levied.

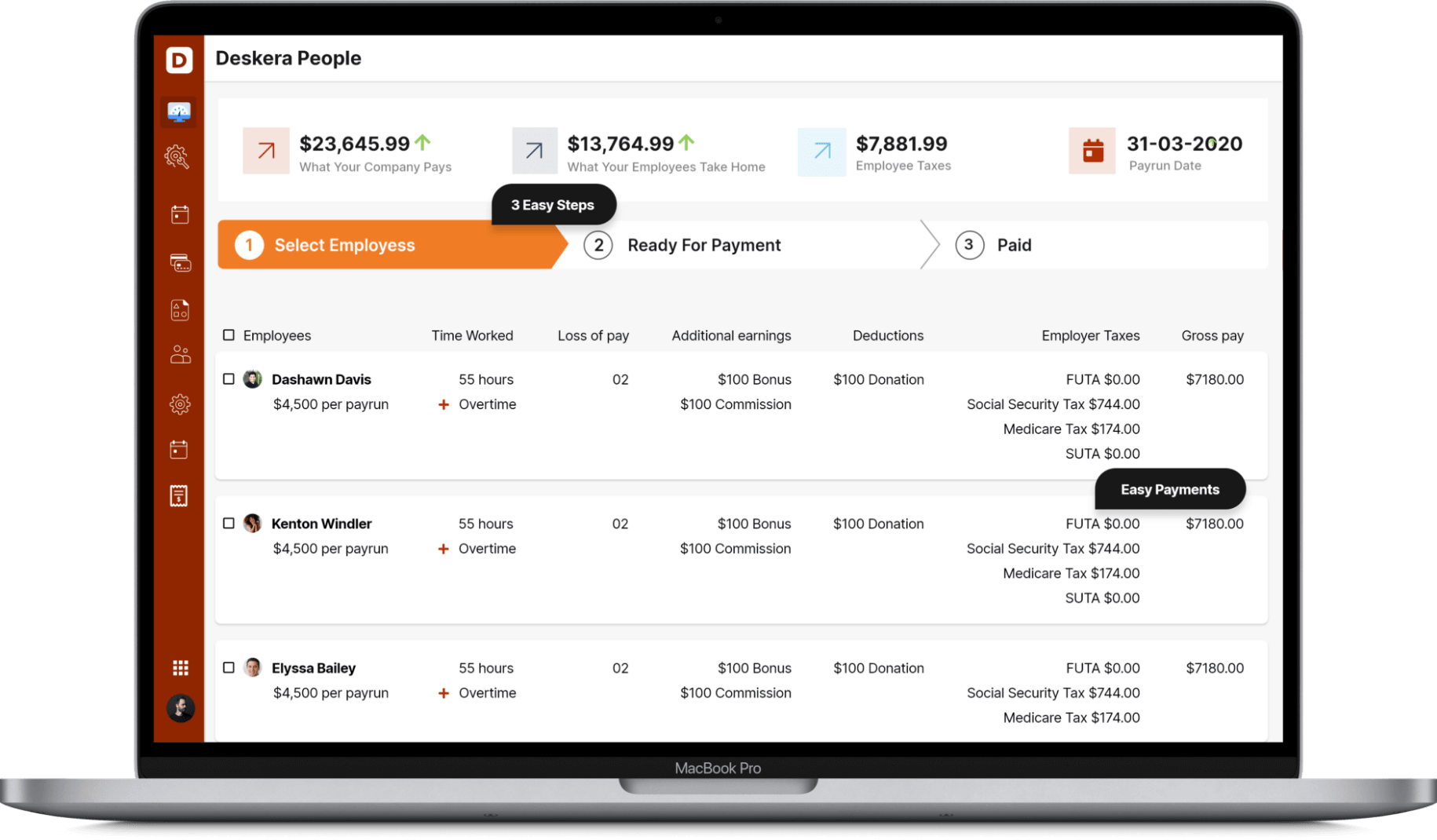

How can Deskera Help You with Filing Tax Easily?

You can generate payroll and payslips in minutes using Deskera People. You can also file and manage your taxes using Deskera People. Deskera is an online cloud platform that can helps you organize your business, your employees and with handling your tax filings. Apart from helping you process your monthly payruns, Deskera People also handles your employees’ Income Tax saving investments.

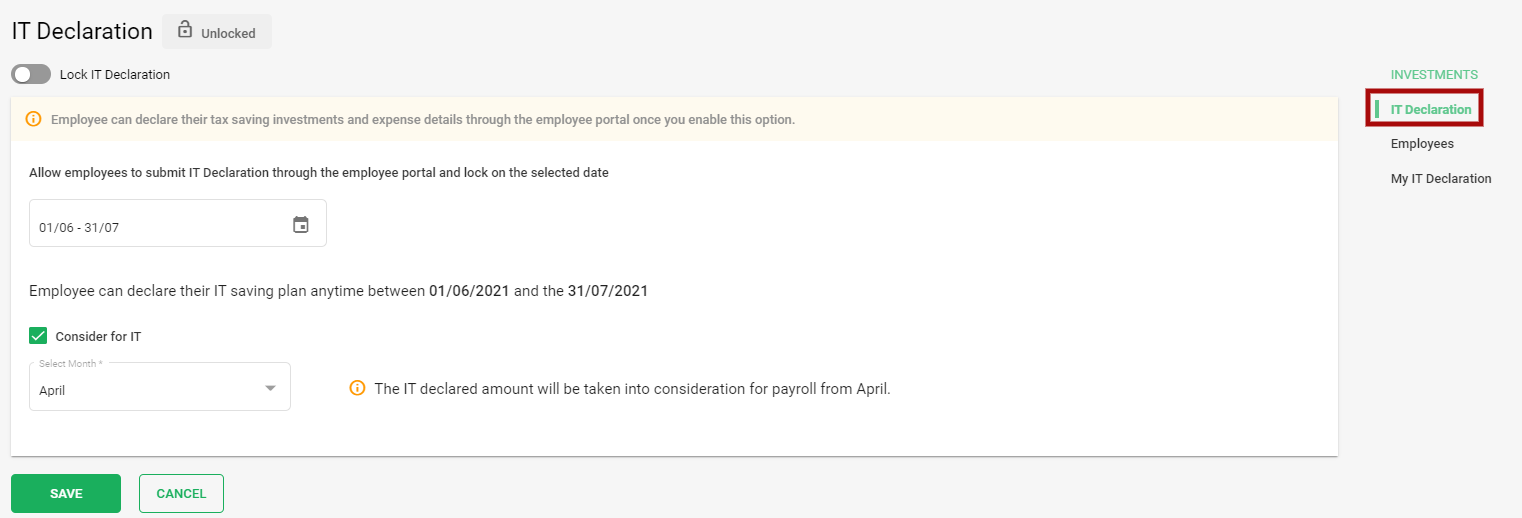

A 15-day free trial will enable you to become familiar with the enterprise features. Deskera People provides you with an amazing HRMS system that helps you manage your employees from end to end. From managing payroll, employee onboarding, leave and attendance management, deskera also helps you with salary management. Using Deskera People, you can file your Income Tax or IT declaration and Proof of Investment(POI) using the platform.

Deskera People simplifies the process of filing an ITR. Your organization's needs can be met with a customized plan designed by Deskera. Easy-to-use Deskera's tax software can help you file your taxes in no time. Business owners with any type of tax filing requirement can rely on the system. Employees can declare their proposed investments and anticipated expenses through the IT declaration.

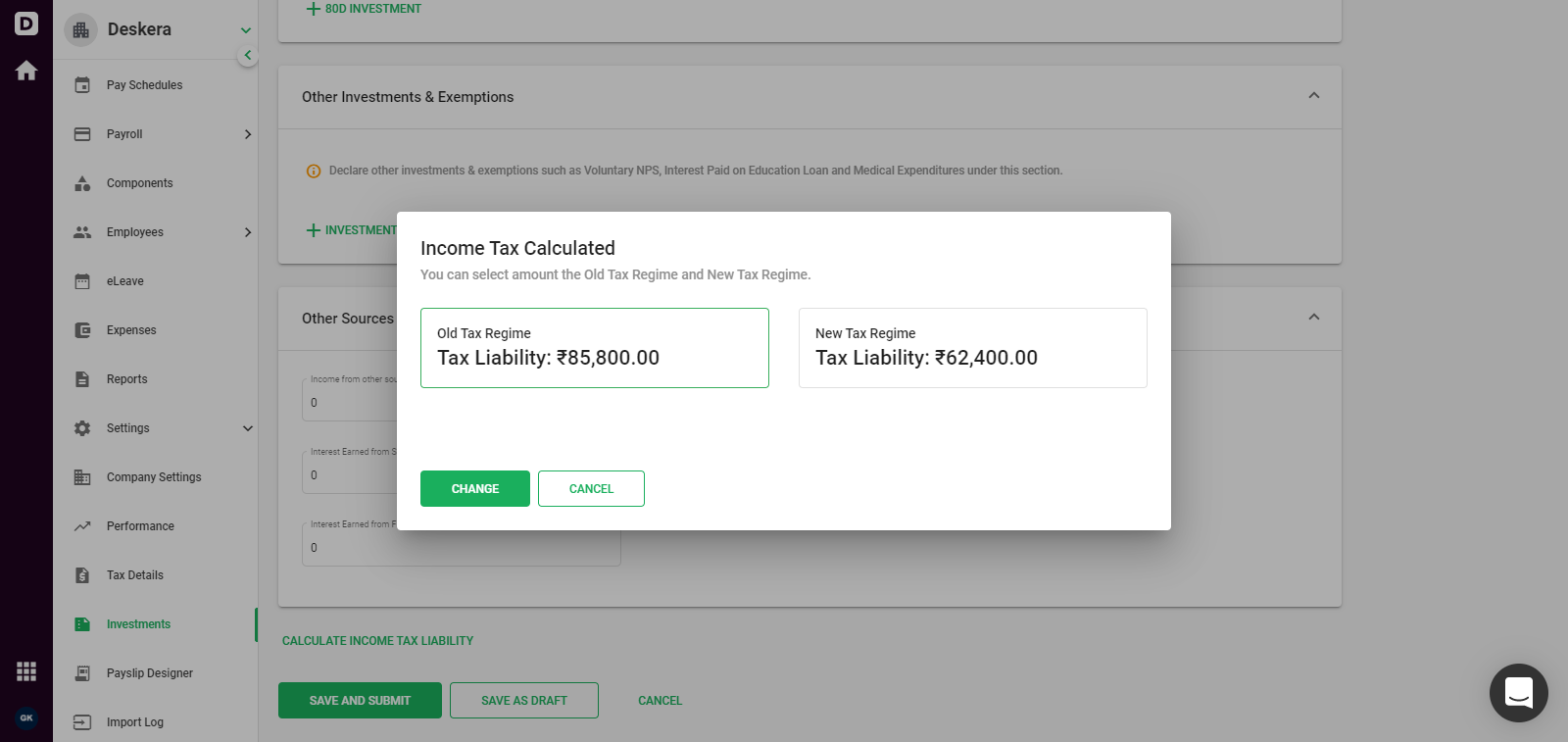

Employees can declare the investments that they have made and submit proofs for the same, and Deskera People will auto - calculate the Income Tax based on the type and amount of each investment. The main incentive for employees’ to declare their investments is that it reduces their net taxable income, thereby decreasing the amount they need to pay as Income Tax.

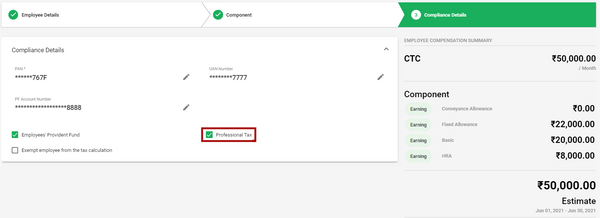

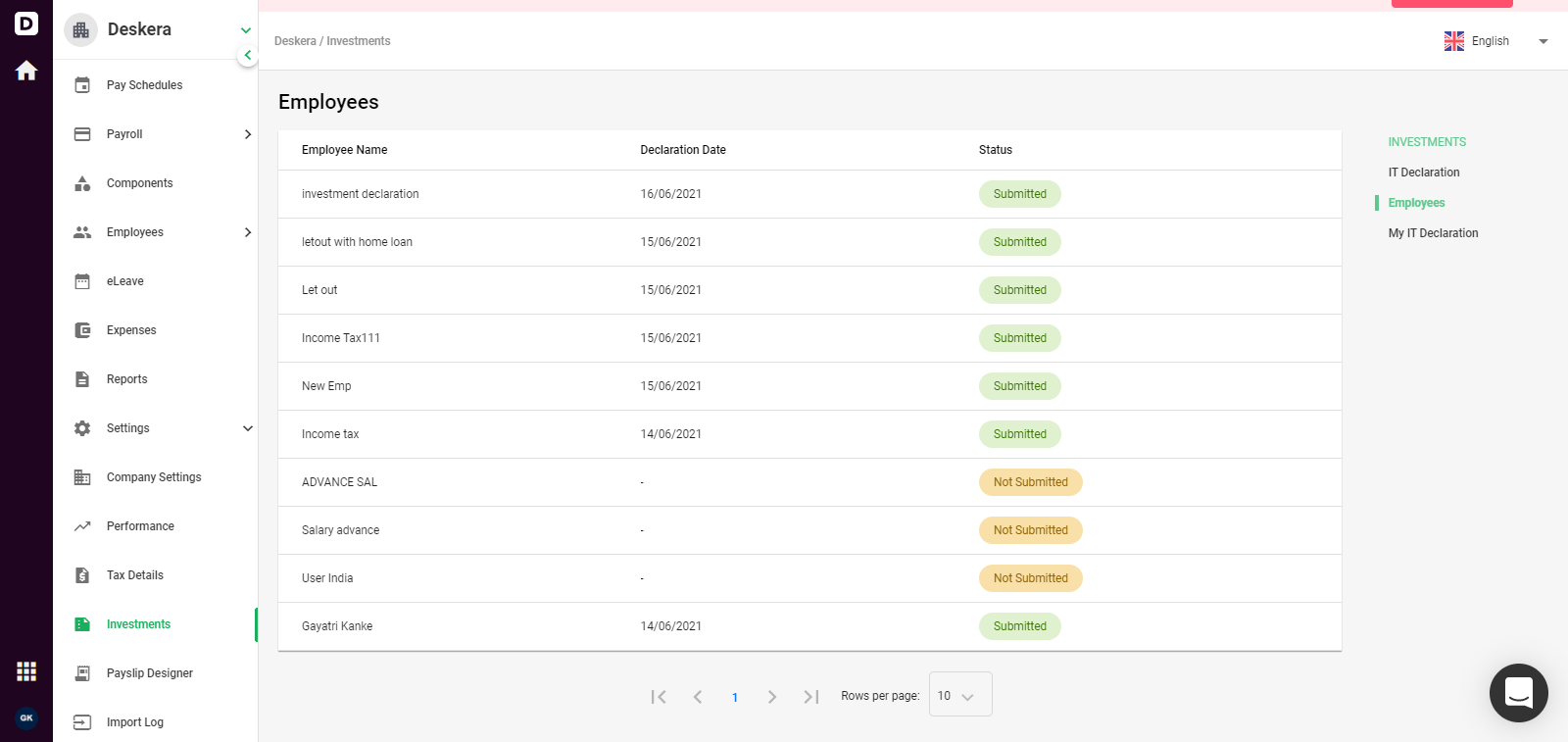

Once the IT Declarations are submitted by all the employees, the employers can view the status of these submission. Other than payroll management, Employee Provident Fund (EPF) and EPS contribution are also calculated in Deskera People

Key Takeaways

- Form 16 is the certificate issued under section 203 of the Income tax Act for tax deduction at specified rates on the salary you receive through employers.

- Form 16 is essential as it has all the relevant details regarding the salary you receive through your employer including the taxability of these amounts.

- The article talks about the eligibility salary to fill Form-16.

- Form 16 consists of Part A and Part B.

- The article talks about the procedure to file income tax returns with the help of Form-16. It also highlights the procedure to file Form-16 for IT return.

- In this article, we have also discussed the penalties related to Form 16.

- Deskera is the best platform that can help you in filing income tax, accounting, invoicing, and a lot more

Related Articles