The main difference between debit and credit is that debit entries increase the balance of an account, while credit entries decrease the balance.

What exactly does it mean when an account is debited and credited? Debit and credit make up the language of accounting. Any business transaction involves an inflow and outflow of money. It's not just about whether money is increasing or decreasing. It's about where the money is coming from and where it is going. This is where credits and debits come in. Together, they paint a picture in your accounting records, thereby letting you see the transaction as a whole.

Debit and credit are relevant to you if you're doing anything that requires you to understand the flow of money through transactions. You could be involved in handling the affairs and transactions of a business or in maintaining and monitoring the accounts. If you're running a business, a sound sense of debit and credit will help you gauge your company's financial situation and track its growth.

Debit and credit may seem like simple concepts, but there's more to these basics. For instance, why do debit and credit work differently in different types of accounts? This article will help you understand things like this and more. Get ready to learn about:

- What Are Debits and Credits?

- Debit and Credit in Double-Entry Accounting

- Debit vs. Credit: What is a Debit?

- Debit vs. Credit: What is a Credit?

- How Do Debit and Credit Work in Accounting?

- Debit and credit in asset accounts

- Debit and credit in liability accounts

- How Do Debit and Credit Work in Different Types of Accounts?

- Debit and Credit: What is the Balance Sheet Formula?

- Debit and Credit Payments: Debit Card vs. Credit Card

- What is a debit card?

- Pros of using a debit card

- Cons of using a debit card

- What is a credit card?

- Pros of using a credit card

- Cons of using a credit card

- Conclusion

- Key Takeaways

What Are Debits and Credits?

In accounting terms, every business transaction has to be recorded as a debit and credit. This is the case whether it's written in a physical ledger or accounting software.

Debits and credits are accounting entries that record whether a transaction is increasing the assets or liabilities of your business. In simple terms, a debit increases the assets of your business, and a credit increases the liabilities of your business.

For example, if a customer pays for a product in cash, that transaction is recorded in your accounts as a debit in the cash account because it increases the balance of the cash account and the cash account is an assets account.

Sounds simple, right? Well, there's more to it.

Debit and Credit in Double-Entry Accounting

In double-entry accounting, every transaction involves a debit and a credit. This is because every transaction is recorded in terms of the two accounts involved. Each transaction increases the balance of one account and decreases the balance of another account. These accounts represent different kinds of assets, liabilities, and revenue, such as cash, equipment, unpaid rent, and income from sales.

The double-entry method is used by most businesses because it shows the balance of assets and liabilities after every transaction. It is effective because it keeps the company's books updated at every stage so you can view the net income at any point.

Single-entry accounting only shows one dimension of a transaction, which can be misleading. Double-entry accounting reflects the complexity of different transactions and how they affect the various aspects of your business.

Debit vs. Credit: What is a Debit?

A debit is an accounting entry that shows an increase in an asset account (like a cash account) or an expense account (like rent or utility expense) and a decrease in liabilities.

For example, if a business buys a new tractor for $6000, its cash account is reduced by $6000, and its fixed assets are increased by $6000. This will be recorded as a credit for the cash account.

Debit vs. Credit: What is a Credit?

A credit is an accounting entry that shows an increase in liability (such as loans that have to be paid), equity (such as capital), or revenue (such as income from sales).

For example, when you pay rent for your company's workspace, you would enter it as a credit in your liability account.

How Do Debit and Credit Work in Accounting?

The first step to understanding how debit and credit function in accounting is to see how they work in asset accounts and liability accounts.

Debit and credit in asset accounts

When a transaction increases the balance of an asset account, it is recorded as a debit for that account. When a transaction decreases the balance of an asset account, it is recorded as a credit for that account.

For example, when a customer pays your business in cash, your cash increases. The transaction increases the balance of the cash account, which is an assets account. So you will record it as a debit to the cash account as it increases the balance of the cash account.

However, it also reduces the balance of the accounts receivable account. This account represents the payments that your business is going to receive. It is an asset account. A decrease in this means that the amount of cash your business is due to receive is less than before, so it represents a decrease in assets. This will be recorded as a credit to the accounts receivable as it decreases the balance.

So if the customer paid $100 in cash, here is how it will be recorded as a journal entry:

| Date | Account | Debit | Credit |

| 5/28/2022 | Cash Account | $100 | |

| 5/28/2022 | Accounts Receivable | $100 |

Remember that debits are always on the left side of the entry and credits are always on the right side.

Debit and credit in liability accounts

Debit and credit work differently in liability accounts. A debit has the effect of decreasing the value of a liability account and a credit increases the value of a liability account.

For example, let's say you take out a loan of $2000 and receive it in cash. This would increase your cash account by $2000.

However, it would also increase your loans payable by $2000. What does this mean? Your loan payable account is a liability account. It measures how much you owe, not how much you have. So the more you owe, the more the value of your loans payable account (and any liability account) will be.

So you will record it as a credit to your loans payable account. The value of the loans payable account is increasing with that credit. The entry would be:

| Account | Debit | Credit |

| Cash Account | $2000 | |

| Loans Payable | $2000 |

How Do Debit and Credit Work in Different Types of Accounts?

There are different types of accounts in double-entry accounting. Debit and credit work differently based on which type of account it is. Keep reading to understand how.

Asset accounts

Assets consist of what your business owns that is of value. This would include tangible things like cash, vehicles, and equipment as well as intangible things like claims and rights that are of monetary value. Cash accounts, accounts receivable, and inventory are some examples of asset accounts.

A debit increases the balance of an asset account. A credit decreases the balance of an asset account.

Liability accounts

Liabilities are what your business has to pay. They represent the amounts that your business owes to other people or entities. Loans, taxes, and rent are examples of liabilities

A debit marks a decrease in a liability account. A credit marks an increase in a liability account.

Equity accounts

Equity represents the net value of your business. It is the difference in the value of its assets and your liabilities. It tells you the amount or worth that would be left of your assets after you pay off all your liabilities. For this reason, it is said to be the true value of your business. An example of an equity account is common stock.

A debit represents a decrease in an equity account while a credit represents an increase in an equity account.

Revenue accounts

Revenue is the income that your business earns. This could be through sales of goods and services or through investments or interest accrual.

A debit brings a decrease in a revenue account while a credit brings an increase in a revenue account.

Expense accounts

Expenses are the costs your business incurs to keep operating. These would include expenses incurred as a part of its regular activities as well as the expenses involved in running the business. For example, the cost of salaries, the cost of advertising, or the cost of equipment purchases.

A debit brings an increase in an expense account. A credit brings a decrease in an expense account.

Debit and Credit: What is the Balance Sheet Formula?

A debit (increase) to any account is always accompanied by a corresponding credit (decrease) to a different account or a different sub-account. To understand why, you have to understand this basic balance sheet concept. A balance sheet shows the assets, liabilities, and equity of your business at a certain point in time.

- Assets represent things that your business owns that are a source of value or revenue

- Liabilities represent what your business owes and will have to pay

- Equity is the difference between assets and liabilities and shows the actual value of your business

The balance sheet formula is: Assets = liabilities + equity

What this means in terms of debits and credits is that debits (assets) must stay in balance with credits (liabilities and equity). When a customer pays $100 to the business, there is a debit of $100 in the cash account, which shows an increase in assets by $100. There is a corresponding credit of $100 in the accounts payable, which show an increase in liabilities by $100. How is it an increase in liabilities? Simply put, $100 worth of assets will have to go out from this asset account and so that becomes a liability of $100.

In terms of the formula:

$100 increase in assets = $100 increase in liabilities + $0 change in equity

This is why every debit (increase in assets and decrease in liabilities) has an equal and opposite credit (decrease in assets and increase in liabilities) in a different account or sub-account.

Debit and Credit Payments: Debit Card vs. Credit Card

Debit cards and credit cards represent different ways of making payments and accessing funds. It is important to understand the difference between credit cards and debit cards so that you can choose the most suitable option for making purchases or borrowing money.

What is a debit card?

A debit card is linked to a checking account or savings account. Debit cards allow you to conveniently access funds so you can spend money without having to withdraw cash or write a check. You can use a debit card to make purchases at stores or online or withdraw cash from an ATM or do regular banking transactions.

When you use your debit card, the money is either debited from your account at once or held by the bank in case it is a larger purchase amount. This can take longer if the bank notices any red flags in the transaction or your account. A debit card is a convenient substitute for paying by check or actual cash. The age requirement for getting a debit card varies from bank to bank, but most banks require that you be at least 18 years old.

Pros of using a debit card

A debit card is a good payment option if you are concerned about limiting your spending. This is because it is linked to your bank account (savings or checking account) so you can only spend the money you have there. Another advantage of using a debit card is that you don't have to pay interest, unlike a credit card.

However, debit cards also come with an overdraft facility. If your bank account has an overdraft, the amount you can access with your debit card would go up to the extent of the overdraft. An overdraft is essentially like borrowing money from the bank. What it means is that you can withdraw or spend money that exceeds the amount in your account up to the amount of the overdraft. This helps avoid situations like a bounced check or a declined payment.

However, you have to pay interest on the overdraft. What happens is that when you withdraw beyond the amount in your account, your bank pays the excess amount. You will then have to repay that amount along with interest charges.

Cons of using a debit card

The overdraft option for a debit card is not a great idea as a matter of habit or for regular spending. Since it is like a temporary loan, banks charge a high rate of interest for this facility.

In case your debit card is stolen and funds are withdrawn from your account, it can be a lengthy process to retrieve the funds and you risk losing more money, as compared to theft of your credit card.

A debit card is not suitable for emergencies or very large payments when you don't have the required funds in your account.

A debit card does not allow you to purchase on credit. The entire amount will be deducted from your account at the time of the transaction.

What is a credit card?

A credit card is a card that you can use to make payments or purchases (online or in a store) and it can also be used to make cash withdrawals, which are called cash advances. Credit cards allow you to access funds on a credit basis. What this means is that you are borrowing money and then paying back the money at a later stage along with the applicable interest charges. Credit cards are debt instruments, unlike debit cards. They are linked to a line of credit offered by the issuer of the card.

Pros of using a credit card

Credit cards are a great way to borrow money when you need to. This gives you more time to pay for your purchases if you don't have the funds available at the time of the purchase.

Credit cards provide better protection to you from fraud or theft of your card. This is because there is usually a limit on your liability for any money lost by fraud or theft. Credit card companies also have better-tracking systems for fraud and theft.

Another advantage of using credit cards is that you can keep your money in your bank account or in an investment where it can accrue interest, since you don't have to pay up then and there. In other words, you gain the benefit of time and the interest that comes with it. What's more, you can pay off your credit card dues without paying any interest as long as you pay before the due date.

Using credit cards helps you build a credit history and a credit score. This is useful for various instances like when you are applying for a loan or a mortgage as your creditworthiness will be used to assess your application.

Unlike debit cards, you need to apply for credit cards. Banks and financial institutions will assess your creditworthiness and will permit you a certain credit limit based on that. The better your creditworthiness, the higher your credit limit will be.

Cons of using a credit card

Credit cards can lead to excessive spending because they give you the sense of having a large amount at your disposal. They allow you to spend more than you have in your account and this can lead to a problem of debt. You also have to pay high interest rates on the credit, if you fail to pay back the amount by the due date.

Conclusion

Ultimately, debit and credit allow you to track the flow of money across the different segments or types of accounts of your business. Understanding how debit and credit function in transactions will help you keep tabs on your business finances. It will help you read and make sense of your financial documents and accounting records and keep track of your company's transactions.

Debit cards and credit cards offer different possibilities for your transactions and payments. Knowing the difference between them will help you make the right decision as to which payment is best for your funding needs.

How can Deskera Help You?

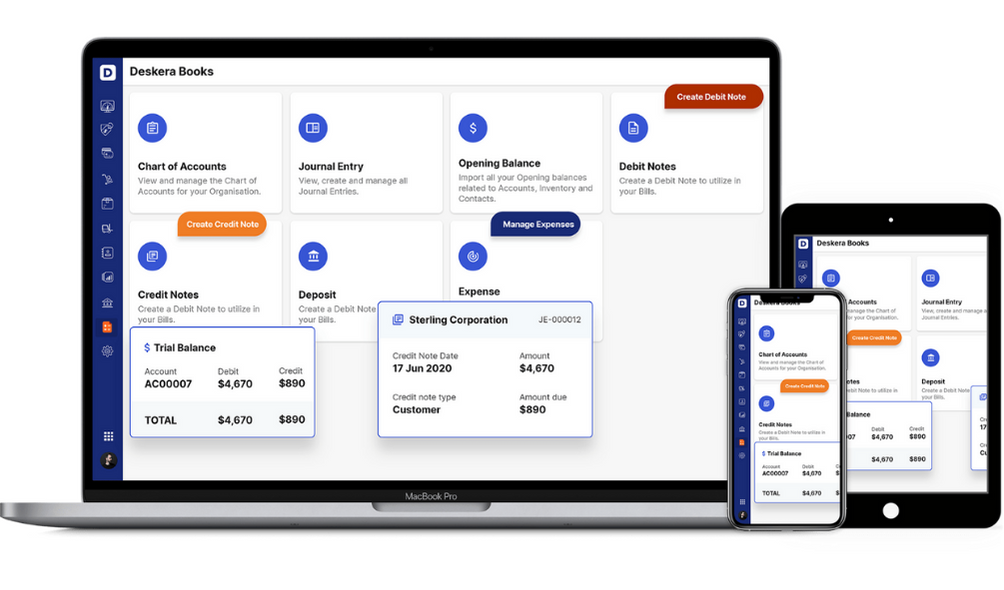

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

- Every business transaction has to be recorded in the form of an accounting entry as a debit and a credit

- A debit shows an increase in assets and a decrease in liabilities

- A credit shows an increase in liabilities and a decrease in assets

- A debit (increase) to any account is always accompanied by a corresponding credit (decrease) to a different account or a different sub-account

- A debit has the effect of increasing an asset account or an expense account

- Credit has the effect of increasing a liability account or a revenue account or an equity account

- Debit cards and credit cards represent different ways of making a payment

- Knowing the difference between credit cards and debit cards will help you choose the most suitable option for making purchases or borrowing money

Related Articles