Are you considering convertible notes as a means of raising investment funds for your company? Or are you a seed investor looking to invest in a company but want to delay its valuation till a later date when it would be possible?

In either of the cases, you are at the right place, for this article will be your complete guide on convertible notes- the go-to investment vehicle for both parties.

Convertible notes have become a very popular and frequently used method by start-ups to raise capital. In fact, between 2010 and 2016, the volume of rounds including debt instruments has grown by c.4x, out of which convertible notes have become the preferred fundraising instruments in the seed rounds of many start-ups.

A convertible note is a type of short-term debt that converts into equity, usually in conjunction with a future financing round. This means that when an investor loans money to any start-up, instead of getting back his principal amount with interest, he or she would receive equity in the company.

This highlights the primary advantage of convertible notes, which is that it does force the investors and issuers to determine the value of the company when they do not really have many bases for its valuation, for example, when they are investing in a company that is still in the ideation phase. In such cases, the valuation of the company will be determined in its Series A financing, by which time there would be more data points to base the valuation upon.

However, there is more to convertible notes, and it is crucial for you to understand it all as a founder as well as an investor in order to make well-informed decisions. Thus, the topics that will be covered in this article are:

- What is a Convertible Note?

- What is a Senior Convertible Note?

- Key Terms of Convertible Notes

- Convertible Notes are Hybrid of Debt and Equity

- Equity vs. Debt vs. Convertible Notes

- Who Should Use Convertible Notes?

- What Happens When Convertible Notes Mature?

- Pros of Convertible Notes

- Cons of Convertible Notes

- How Can Deskera Help?

- Key Takeaways

- Related Articles

What is a Convertible Note?

A convertible note is a type of short-term debt that converts into equity and is, therefore, an investment vehicle that is most often used by seed investors who wish to invest in start-ups but at the same time wants to get its valuation delayed until a later round of funding or milestone when there would be more data to use as reference.

Convertible notes are those loans that are structured to be converted into equity at a later point in time. When the company reaches a specific milestone, most often during later funding round, is when the outstanding balance of the loan is automatically converted into equity (common or preferred shares). Thus, convertible notes are part of the start-up’s original preferred stock financing.

Also, in order to compensate or reward the angel investor for the additional risk that they took by investing in the earlier rounds, convertible notes are given with additional clauses like caps and or discounts.

In fact, when evaluating the opportunity of investing in convertible notes, investors determine the returns on investment and its profitability through the discount rate, interest rate, valuation cap, and maturity date of the convertible note.

What is a Senior Convertible Note?

A senior convertible note is a type of debt security that comes with the option of being able to choose when the note will convert into a predefined number of shares. Thus, a senior convertible note is one that will take priority over all the other debt securities that the company may have issued.

Thus, just like other types of debt instruments, senior convertible notes offer the investors the ability to accumulate interest on their investments, but instead of being repaid in cash, they are repaid in equity.

Key Terms of Convertible Notes

Some of the key terms as well as parameters that you should be well aware of while evaluating a convertible note are:

Discount Rate

This refers to the valuation discount that you would receive, as compared to the other investors in the subsequent financing round. This will compensate for the additional risk that an investor bore by investing earlier. Thus, through the conversion discount, the investor will be able to buy more shares with their investment than later investors.

For example, if an investor invested $100,000 with a 20% discount rate, and if the company does another round of fundraising and raises money at $1 per share, the investor will receive stock at $0.80 per share. This thus means that instead of getting 100,000 shares of the company had they waited and participated in the later rounds of investing, the investor would receive 125,000 shares of the company stock.

Valuation Cap

A valuation cap is also a reward for bearing the risk earlier on. It refers to the effective capping of the price at which the convertible note of an investor will convert into equity. Through this, it will provide the convertible note-holders with equity-like upside if the company takes off out of the gate.

The valuation cap is alternatively known as the conversation cap. For an investor, the lower the valuation cap, the better are the terms for the investors.

For example, if an investor made a two-million-dollar investment in a start-up, and the company is later valued at $100 million, then that investor’s equity would be approximately 2%. However, if the valuation cap for the company is $10 million and they have made a two million dollars investment, then the investor has 20% equity in the company, which is a much higher stake as compared to the 2%.

Interest Rate

When an investor lends money to a company, often the convertible notes will accrue interest as well. The difference here is that instead of the accrued interest being paid in cash, this amount will be added to the principal amount, thereby increasing the number of shares issued upon conversion. Usually, the interest rates for convertible notes are low.

Maturity Date

The maturity date is the date at which the convertible note becomes due, and the company has to repay it.

Conversion Provisions

Convertible notes’ primary purpose is to convert into equity in the future. For this, one of the most common methods of conversion is qualified financing, wherein the convertible note is converted into equity only after a subsequent equity investment exceeds a certain threshold. At this point in time, the original principal plus the accrued interest is converted into shares of whatever new equity was just sold.

In addition to being a recipient of the benefit of accrued interest, which lets them purchase more shares than they would have been able to have, had they waited and invested the same amount of money in the equity round of financing, convertible notes also come with several other perks (as discussed above) as a compensation for investing earlier.

In cases where the qualified financing does not take place before the maturity date of the convertible notes, there is also a provision according to which the notes automatically convert to equity at a set valuation on the maturity date.

Convertible Notes are Hybrid of Debt and Equity

While originally convertible notes are structured as debt instruments, they come with a provision that allows them to be converted into an equity investment at a later date at the amount that is principal plus accrued interest.

Due to this, convertible notes facilitate quicker original investment with lower legal fees for the company at the time. However, ultimately, it gives the investors the economic exposure of an equity investment.

Equity vs. Debt vs. Convertible Notes

Who Should Use Convertible Notes?

Convertible notes are ideal investing instruments for those start-ups that are in their early stages and high-growth phase. Such a company should make sure to start talking with potential angel investors for the seed funding so that when it is ready for a round of funding, the company will have a valuation, and the convertibles won’t be of concern.

Preferably, convertible notes should be used by such companies because they are debts before converting into equity. In order to satisfy this debt, the company needs to be growing rapidly and on the path towards a priced round for the convertible notes to create value for investors.

This has to happen quickly because if it does not, and the convertible note matures, then the company would be liable to repay the debt along with interest if the investor chooses not to extend the maturity date.

In addition to seed start-ups in high growth phases, convertible notes are also preferred by those start-ups who want to secure funding quickly. Considering that convertible notes are just a loan, they can be carried out with a promissory note. This is unlike standard equity agreements, which involve a detailed term sheet and is, therefore, a time-taking process for securing funding.

Also, securing funds through convertible notes is easier and more simple because they do not need a business valuation or the complexities involved with a price round with stock issuance.

Hence, by resorting to the usage of convertible notes, the business would be able to get financing in the early stages of your business- even if it is in the ideation phase or product development phase. Later, when there is factual data like growth rates, sales, customers, financial KPIs, and relevant business metrics, is when the investor and the business will determine the value of the business.

In the case of investors, convertible notes are preferred by them when they are keener on getting access to the equity of a company at a heavily discounted rate over getting their loan repaid. Convertible notes are those high-risk investments from which investors expect big rewards that will bring high returns on investment.

What Happens When Convertible Notes Mature?

Ideally, investors, as well as the company, count on the convertible notes getting converted into equity by the time it matures. If everything goes well, then this would be the scenario within a year or two of the issue date of the convertible note. In fact, the maturity date of the convertible notes acts as a big incentive for ensuring that the next equity financing round of the company happens as per the schedule.

Thus, in the case of companies that are acquired before the maturity date of their convertible notes or have chosen not to raise any equity funding, they risk disappointing their early investors even if they pay back the loan. Thus, though this is a rare occurrence, it is advisable to have this possibility covered in the convertible note. Many convertible notes include a standard 2x payout term to cover this.

In contrast, if a company is not on track to convert or repay the loan by the maturity date, then they have a couple of options with themselves. These are:

- The investors may be willing to extend the maturity date of the convertible note with the hope that the funding will be secured with more time.

- The investors may be willing to renegotiate the terms of their convertible note. This might involve them asking for a more considerable discount or a lower cap.

Pros of Convertible Notes

The pros of convertible notes are:

Fast and Simple Financing

From a legal perspective, financing through convertible notes is simpler to document. This also means that from the legal perspective, they also tend to be less expensive and that the rounds can be closed more quickly. This is because the investors, as well as the company, delay some of the trickier details that are involved with other funding mechanisms.

For example, in a round of equity funding, numerous corporate documents like certificates of incorporation, operating agreements, shareholder agreements, voting agreements, etc., would be required. Such complex and time-consuming documents would not be required in order to secure funding through the convertible notes.

Delays Valuation

Raising funding through convertible notes instead of through equity gives the company a chance to delay its own valuation to a period when they would have more data to base it upon. This advantage is particularly attractive to those seed-stage companies that do not yet have a strong track record of their product and services and of their revenue. Convertible notes are thus used frequently in the accelerator investments of the seed-startups.

To compensate for this delay in their valuation, companies offer a discount on the equity prices that will be set later, thus giving the investors an opportunity to buy more equity at the same investment amount than they would have been able to, had they not invested in the early stages of the company.

Delays Payments

For several reasons, many companies need to raise some amount of funding between larger rounds of equity. For completing these types of transactions, convertible notes are an ideal funding mechanism.

Additionally, by using convertible notes, the start-ups will not have to worry about making payments to the investors while they are growing. This would support a stronger cash flow and open the avenues for healthier financial statements like balance sheets and profit and loss statements, with possibilities for higher net profit ratio, gross profit margin, and stronger customer loyalty as well as customer retention.

Cons of Convertible Notes

The cons of convertible notes are:

Giving Away Equity

One of the biggest drawbacks associated with using convertible notes as a funding mechanism is that you would be giving away your company’s equity at the maturity date. Thus, if, as a business owner, you are unsure whether you want to give away the ownership of your business while it is still in its start-up phase, then convertible notes are not the right type of funding mechanism for you.

Risk of the Start-up Not Raising Subsequent Equity Financing

One of the other major drawbacks associated with convertible note financing is that a company might not be able to raise subsequent equity financing or might even choose not to. Thus, if the note matures but does not convert, the company will have to repay its loan, and in certain cases, they might not have the income available for it. One of the best ways for a company and its investors to avoid this scenario is by having a clear plan for success as well as failure.

Future Complexities in Regards to Benefits Given with Convertible Notes

The majority of the convertible notes issued in the seed-funding phase of the start-up include a valuation cap and an automatic conversion price. Thus, while the business owner is delaying the valuation of its company, what cannot be ignored is that often the valuation cap and conversion price effectively acts to anchor the price negotiations of the next round.

Now, even if the company’s investors are willing to pay for a big uptick in valuation from the note valuation cap, the business might find itself in strange situations like the new investors trying to force the convertible note-holders to adversely amend their terms so that they can close the deal when it is more beneficial to them.

How Can Deskera Help?

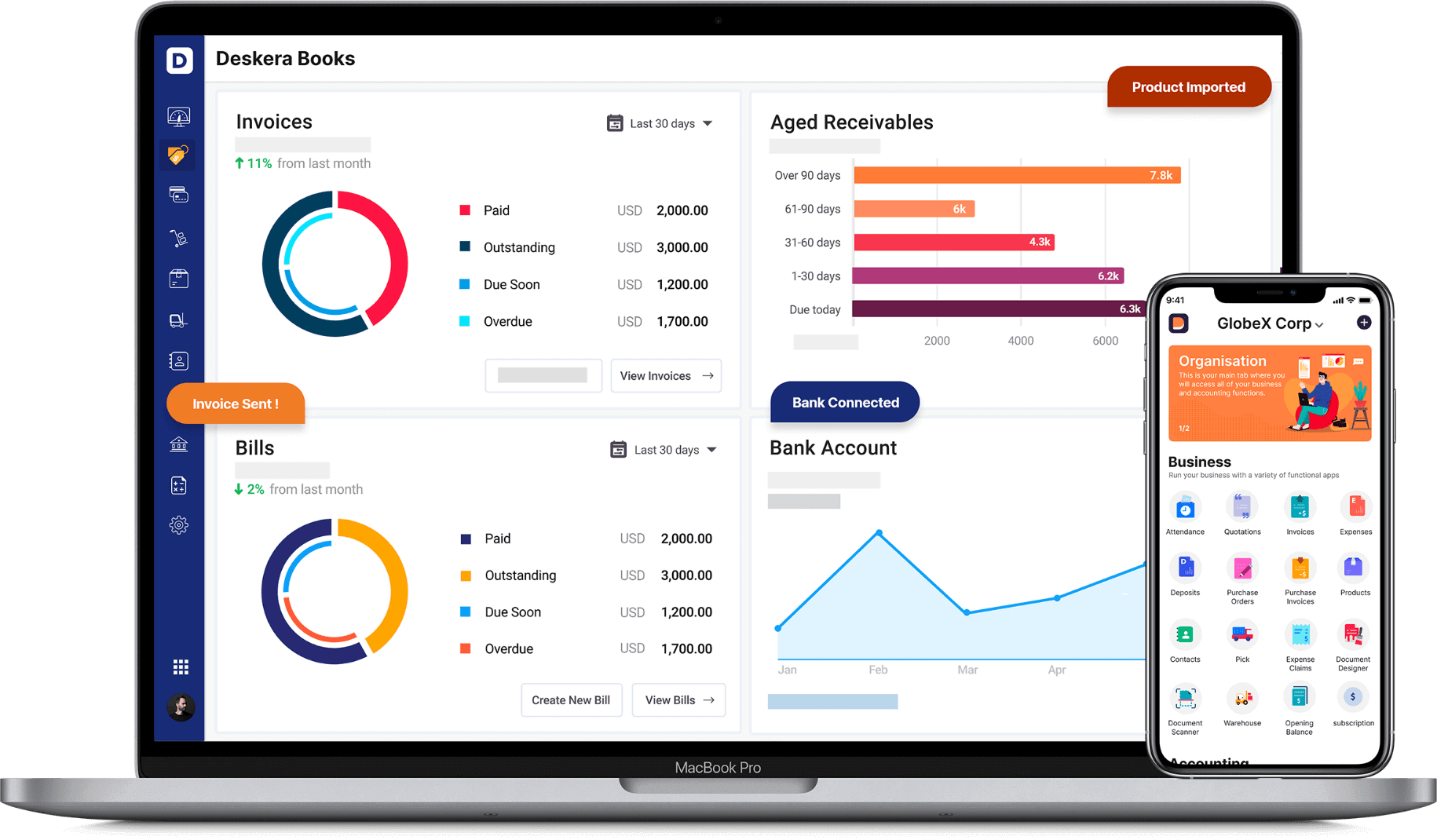

Deskera Books is cloud-based accounting software that can be accessed from anywhere, at any time. Deskera Books is a boon for all businesses as it lets you focus on other business operations like marketing, customer service, and more, while it does all the behind the scenes heavy lifting like managing your chart of accounts, journal entries, general ledger, and tracking of all changes via audit trail.

With Deskera Books, you would also be able to access all your financial statements like trial balance and income statement online. Its dashboard will give you insights into all the key business operations.

Thus, with Deskera Books, you will be able to better manage your funds from convertible notes and secure the future equity financing of your business by making the current operations automated and efficient.

Key Takeaways

Convertible notes are an excellent funding mechanism is used by the right company and the right investors. This means that start-ups who are in their seed as well as high-growth phase, and investors who want a stake in the company’s equity, rather than having their loans repaid, are ideal participants of this type of funding.

The high-risk, high-reward model of the convertible notes gives the start-ups an opportunity to raise their seed funding even before they have the resources to get Series A financing. While in the case of investors, they get higher equity in the company than they would have been able to otherwise obtain with the same investment amount at the equity funding, wherein they no longer have the benefits of being an early investor through convertible notes.

However, considering its multiple pros and cons and high-risk model, it is important that the company as well as the investors lay down a plan that addresses the successes as well as the failures of the company, and therefore in its ability or disability to meet the maturity date of convertible notes.

Related Articles