Employers in India are known for rewarding their employees if they have been employed with the company or business for a long time. It is believed that the loyalty of the workers must be awarded and hence, going by this principle, the entrepreneurs are known to show gratitude to the employees by giving them gratuity which is a monetary payment.

This is obtained by employees who have completed a minimum of 5 years. According to available information, the reason for resignation or exit from an employer does not matter and could range from a better job opportunity to age factor. Let us understand what is form n and its relation with gratuity in this article. We have covered the following points in this article -

- Payment of Gratuity Act, 1972

- How does Gratuity payment happen?

- What are the eligibility criteria for receiving gratuity for an employee?

- What are the different gratuity forms?

- What is form N?

- How to fill out the form N?

- Conclusion

- How Can Deskera Assist You?

- Key Takeaways

Payment of Gratuity Act, 1972

According to the Payment of Gratuity Act, 1972, gratuity is provided to employees who have been employed in factories, shop & establishments or even educational institutions which has atleast 10 or more individuals since the past 12 months. Moreover, the employer, shop or any other establishment must continue this even if the number of employees fall below 10 at any subsequent stage in the company or business.

The rule states that all the employees, irrespective of their status or salary are entitled to receive the gratuity if they have completed a minimum of 5 years of service. In case of a death of the employee or disablement due to some injury, there is no minimum eligibility period.

The formula to calculate gratuity is

Gratuity = Last wages * 15 * No. of services / 26

The employee is liable to receive gratuity at the time of retirement or when he resigns from the company. In situation where the employee passes away or becomes disabled, then his or her nominee is the rightful owner of gratuity. The law further says that if the nominee is a minor then the assistant labour commissioner will invest the gratuity amount into a term deposit in a nationalised bank unless the nominee becomes a major.

The employer must adhere to these rules during the time of payment. Also, when an employee is eligible for gratuity payment then he needs to apply for the same within a matter of 30 days from the date it becomes payable. If the employee fails to give it due to some valid reason, the employer cannot turn down the gratuity application form even if there is a delay.

The gratuity is available in both public and private sector.

How does Gratuity payment happen?

According to available data, the Gratuity Act passed in the year 1972 was formed to cover the employees that work in diverse fields such as factories, oil fields, ports, plantations, companies and even educational establishments with more than 10 employees.

As per the available information, in some cases, the employer or business owner pays gratuity to the employees from his own pockets. While in some cases, the employer ties up with insurance providers to provide group gratuity plans. The employee does not contribute to the gratuity amount he is going to receive post resignation or after retirement from the company. Moreover, the gratuity which insurance companies give to the employees is totally dependent on the clauses that have been attached with the group insurance scheme.

What are the eligibility criteria for receiving gratuity for an employee?

The gratuity can be received by an employee is he satisfies the any one of the following criteria -

- He must be eligible for superannuation

- The employee must have retired from the organization

- He must have resigned from the company after successfully completing at least 5 years with the same employer

- The employee passes away or suffers a sudden disability due to an accident or unexpected illness

What are the different gratuity forms?

Although the employees can file for gratuity only after resigning from office or when they are nearing retirement age, he should know the different forms under it. The different forms in gratuity are -

The various forms pertaining to gratuity are:

- Form A: Notice of Opening

- Form B: Notice of Change

- Form C: Notice of Closure

- Form D: Notice for excluding husband from family

- Form E: Notice of withdrawal of notice for excluding husband from family

- Form F: Nomination

- Form G: Fresh Nomination

- Form H: Modification or Nomination

- Form I: Application of gratuity by an employee

- Form J: Application for gratuity by a nominee

- Form K: Application for gratuity by a legal heir

- Form L: Notice for payment of gratuity

- Form M: Notice rejecting claim for payment of gratuity

- Form N: Application for direction

- Form O: Notice for appearance before the controlling authority

- Form P: Summons

- Form Q: Particulars of application under section 7

- Form R: Notice for payment of Gratuity

- Form S: Notice for Payment of Gratuity as determined by Appellate Authority

- Form T: Application for recovery of gratuity

- Form U: Abstract of the Act and Rules

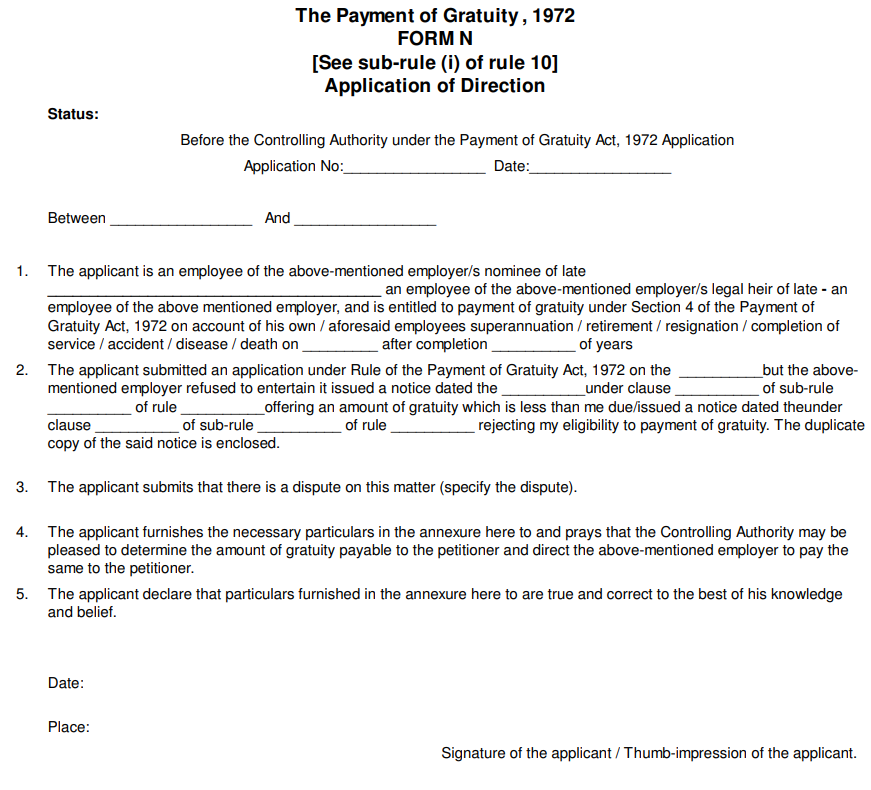

What is form N?

The form N can be filled by employee when an employer fails to accept his gratuity application the company. It is then using the employee can use form N to place an application in front of the controlling authority under the payment of gratuity act of India.

How to fill out the form N?

The employee can use form N to ensure his gratuity starts after notifying the concerned controlling authority. The steps to fill this form are as follows -

- He should note down the application number and date when he has filed this application. In the next part of this form, the employee must mention his full name and residential address. Once he has filled his details, he should write the employer details on the form N.

- In the next step of form N, the employee must mention the time when he was employed with the employer. He should also give details of his nominee in case of anything goes wrong to ensure the gratuity amount is deposited in nominee’s bank. He should then fill details on the form N such as about the different dates related to super annuation, the date he resigned from the organization. Moreover, the employee must mention the number of years he was employed with the company/ businessman/ employer. The form N also has details in case of accidental death or total disablement due to illness or accident. The employee filling it must provide the date of his accident or injury. In case of sudden demise, his nominee must give the appropriate details regarding the date of his death.

In the next section of form N, the applicant must the date when the gratuity application was submitted and date of refusal by the employer. He should state the clause, sub-rule or rule under which the employer has denied payment of gratuity to him.

Moreover, on the form N, the employee must mention the exact amount of his gratuity along with the date when he was entitled to receive it and also provide the date on which the notice was issued by the employer over refusal of the same. The employee must also attach a duplicate copy of the notice he has received from the employer. He should specify if he has received less amount in gratuity or none from the ex-employer.

3. In the next step of form N, the employee must tell the controlling authority about the dispute in his gratuity.

4. The applicant furnished the necessary particulars in the annexure hereto and prays that the Controlling Authority may be pleased to determine the amount of gratuity payable to the petitioner and direct the above-mentioned employer to pay the same to the petitioner.

5. The applicant declares that the particulars furnished in the annexure hereto are true and correct to the best of his knowledge and belief.

Date……………. Signature of the applicant/thumb impression of the applicant.

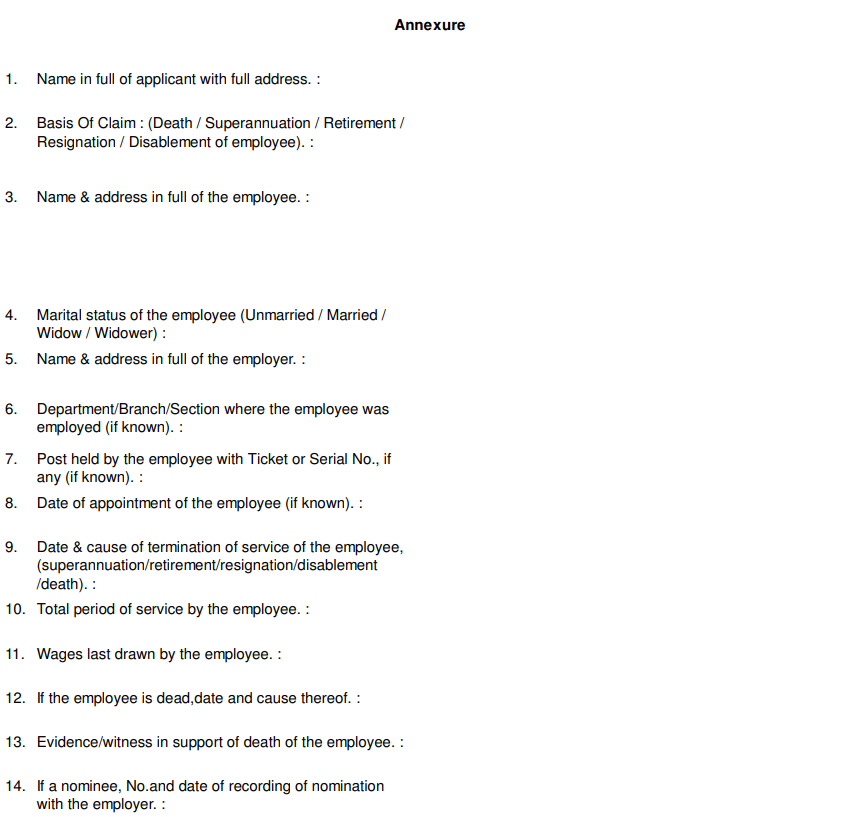

In the annexure of form N, the employer must fill the folliowing details -

1. Name in full of applicant with full address.

2. Basis of claim

(Death/superannuating/Retirement/Disablement of employee)

3. Name and address in full of the employee.

4. Marital status of the employee

(Unmarried/married/widow/widower)

5. Name and address in full of the employee

6. Department/Branch/Section where the employee was last employed (if known)

7. Post held by the employee with Ticket or Serial No. if any (if known).

8. Date of appointment of the employee (if known)

9. Date and cause of termination of service of the employee (Superannuating retirement/resignation/disablement/death)

10. Total period of service by the employee.

11. Wages last drawn by the employee.

12. If the employee is dead, date and cause thereof.

13. Evidence/witness in support of death of the employee.

14. If a nominee, No. and date of recording of nomination with the employer.

15. Evidence /witness in support of being a legal heir, if a legal heir.

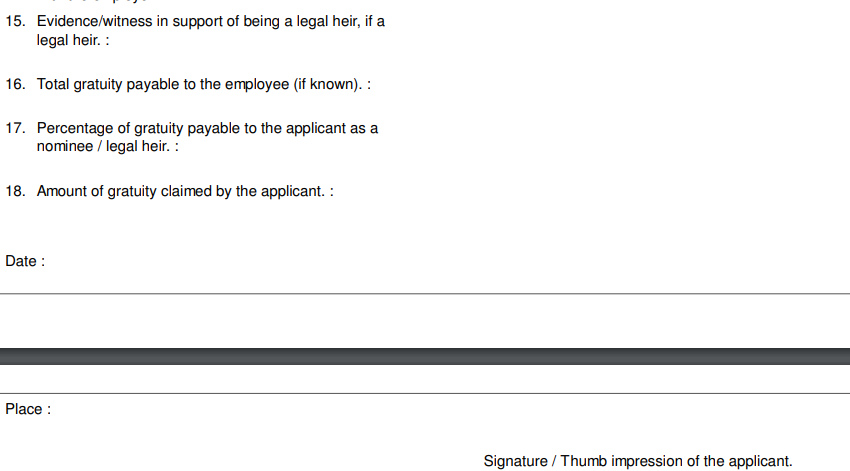

16. Total gratuity payable to the employee (if known).

17. Percentage of gratuity payable to the applicant as a nominee/legal heir.

18. Amount of gratuity claimed by the applicant.

Place:

Date: Signature/ thumb impression of the applicant.

Conclusion

The gratuity amount is given to employees who have served a miimum of 5 years with the same employer. The employer should give the amount when he fills the form N post retirement or after the employee quits the service. In case of the demise of the employee or a disability due to illness or accident, his nominee can file the form N and ask for gratuity amount from the employer. When the employer refuses gratuity payment, the employee must connect with labour commissioner or the controlling authority to ensure the amount is deposited in his bank account.

How Can Deskera Assist You?

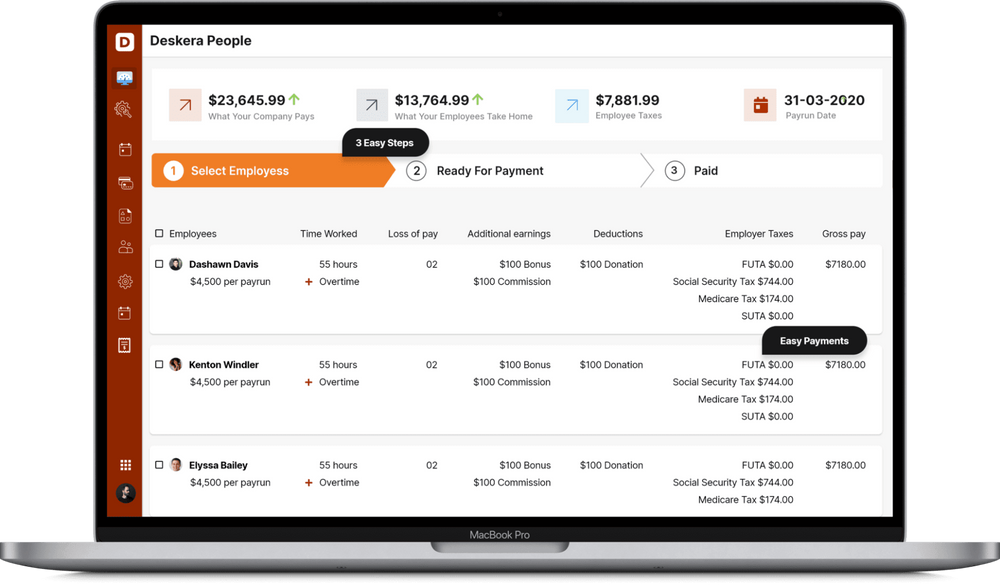

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

- Gratuity is given to employees who have worked a minimum of 5 years with the same employer in India. This payment is done after the employee retires from the post or decides to resign from the job irrespective of the reason.

- The employees from different sectors such as factories, shops, educational and other establishments can fill the form N to claim gratuity from the employer.

- The formula to calculate gratuity is - Gratuity = Last wages * 15 * No. of services / 26

4. The employee must give in all details to the labour commissioner through form N after recieving a refusal of gratuity by the employer. He should fill in the necessary details on the form. In case of his untimely demise or illness, the nominee of the employee can raise a complaint through this form to tell about less amount received or no gratuity received.

5. The applicant must give proper details of his resignation, date of notice received from the employer, gratuity amount, work done, last wages etc. while filling this form and submit it to the labour commissioner.

Related Articles