Have you ever wondered how long it actually takes for a business to turn its investments in inventory and operations into cash in hand? The answer lies in understanding the Cash Conversion Cycle (CCC)—one of the most important metrics for evaluating your company’s financial efficiency. CCC reveals how fast your business can convert purchased goods into revenue and eventually into liquid cash.

In today’s competitive environment, even profitable businesses struggle when cash is tied up too long in inventory or unpaid invoices. That’s why understanding and optimizing your CCC is critical. Whether you’re a manufacturer managing raw materials or a retailer dealing with rapid turnover, the CCC shows you exactly where your cash gets stuck—and how quickly you can free it up.

The Cash Conversion Cycle isn’t just a finance term; it’s a real-world indicator of operational health. It reflects the strength of your inventory management, receivables collection, and supplier payment strategy. A shorter CCC means better liquidity, smoother operations, and increased capacity to invest, expand, or navigate uncertainties. In other words, CCC is a key driver of working capital success.

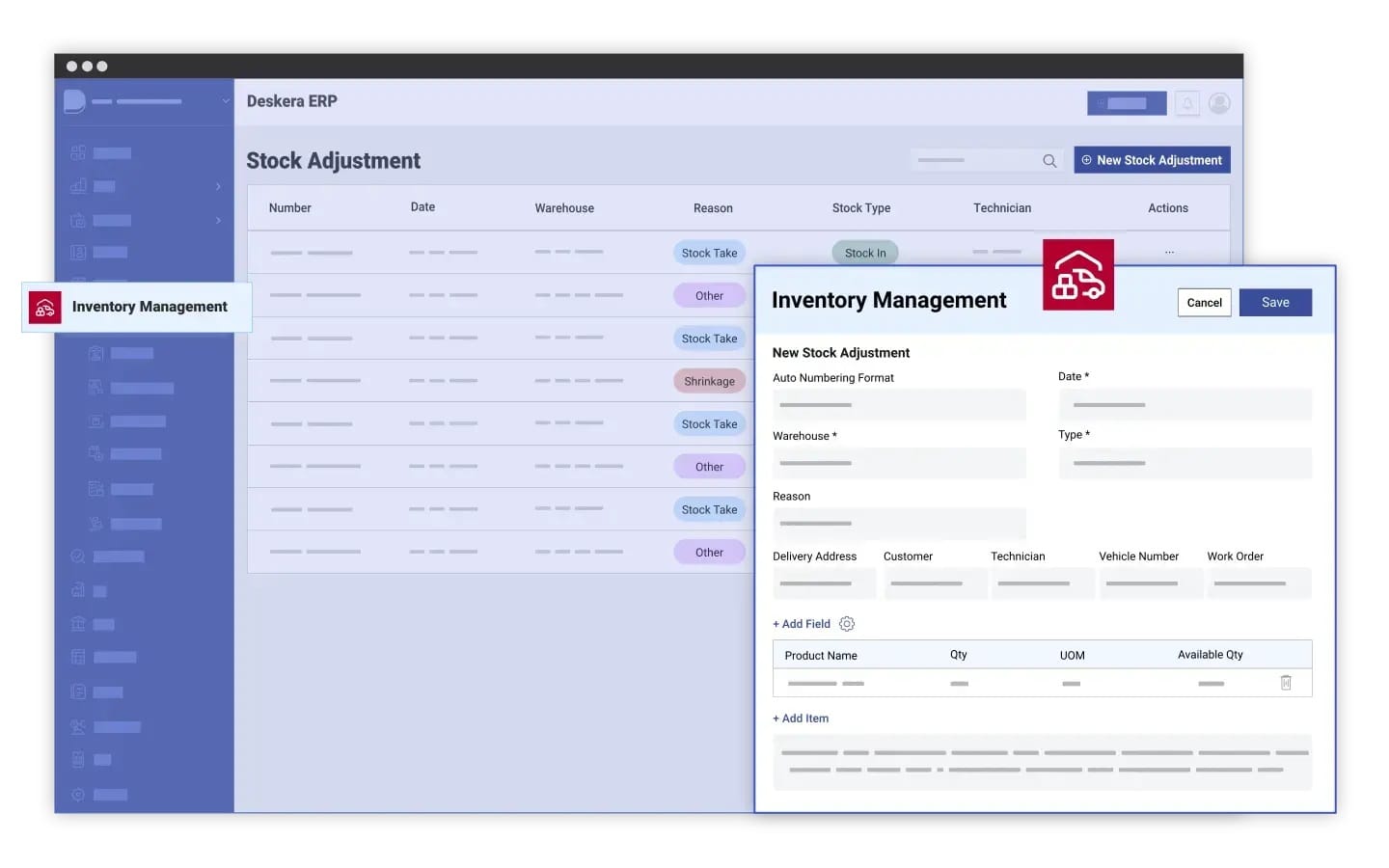

This is where Deskera ERP plays a transformative role. With its fully integrated modules for accounting, inventory, MRP, and sales, Deskera gives businesses real-time visibility into every component of the CCC. Automated invoicing, AI-driven reminders, smart inventory forecasting, and efficient payment scheduling help reduce delays and tighten control over cash flow. Plus, with mobile accessibility and the AI Assistant David, decision-makers can monitor and optimize CCC anytime, anywhere—making financial control more intuitive and proactive.

What Is the Cash Conversion Cycle (CCC)?

The Cash Conversion Cycle (CCC)—also known as the cash cycle or net operating cycle—is a key financial metric that measures how long it takes for a business to convert its investments in inventory and other operational resources into cash. In simple terms, it shows the number of days between paying suppliers for goods and receiving cash from customers after selling those goods. A shorter CCC means cash moves quickly through the business, reducing the time money stays tied up in inventory or accounts receivable.

CCC captures the full flow of a company’s operational activity: how fast it sells its inventory, how efficiently it collects payments from customers, and how long it takes to pay its suppliers. Because it reflects all three stages, the metric provides a clear view of working capital efficiency, liquidity health, and overall operational effectiveness. However, CCC should be analyzed alongside other financial metrics such as return on equity, as it does not provide a complete financial picture on its own.

The metric is calculated using three core components: Days Inventory Outstanding (DIO), Days Sales Outstanding (DSO), and Days Payable Outstanding (DPO). While DIO and DSO represent how long cash is locked into inventory and receivables, DPO indicates how long a business takes to settle its payables.

It’s important to note that CCC is most relevant for companies that buy, manage, and sell physical inventory. Businesses in retail, manufacturing, distribution, and wholesale rely heavily on it to evaluate how effectively they manage cash. In contrast, companies without physical inventories—such as software firms or consulting businesses—do not use CCC as a primary metric. However, for product-based businesses, CCC remains a powerful indicator of how efficiently investment turns into cash and how quickly financial returns are realized.

Formula for Calculating the Cash Conversion Cycle (CCC)

Understanding the formula behind the Cash Conversion Cycle (CCC) is essential for evaluating how efficiently a company converts its investments in inventory and operations into cash. The CCC measures the total number of days it takes to clear inventory, collect receivables, and pay suppliers. It links three key working capital components, all measured in days. A shorter CCC indicates faster cash recovery and stronger liquidity, while a longer CCC suggests cash is tied up for extended periods, affecting operational flexibility.

The standard formula used to calculate the CCC is:

CCC = DIO + DSO – DPO

To fully understand this formula, it’s important to break down each component—Days Inventory Outstanding (DIO), Days Sales Outstanding (DSO), and Days Payable Outstanding (DPO). Each plays a distinct role in determining how long cash remains tied up inside the business.

Days Inventory Outstanding (DIO)

Days Inventory Outstanding represents the average number of days a company holds inventory before selling it. It measures how efficiently a business turns inventory into sales. A lower DIO indicates faster inventory turnover, which is beneficial because it frees up cash sooner.

Formula: DIO = (Average Inventory / Cost of Goods Sold) × 365

Key points about DIO:

- It reflects inventory liquidity and demand forecasting accuracy.

- Lower DIO = quicker sales cycle and reduced holding costs.

- Since inventory is a short-term asset, DIO is treated as a positive value in the CCC calculation.

Days Sales Outstanding (DSO)

Days Sales Outstanding measures the average number of days it takes a company to collect payments from customers after a sale. It indicates how quickly receivables convert into cash. A low DSO means the business collects payments faster, improving cash flow.

Formula: DSO = (Average Accounts Receivable / Total Credit Sales) × 365

Key points about DSO:

- It tracks the collection efficiency of credit sales.

- Lower DSO = faster inflows and better liquidity.

- Like DIO, DSO is a short-term asset and is added as a positive value in the CCC formula.

Days Payable Outstanding (DPO)

Days Payable Outstanding measures the average number of days a company takes to pay its suppliers. Unlike DIO and DSO, DPO reflects cash outflow behavior. A higher DPO indicates that the business holds onto its cash longer before making payments.

Formula: DPO = (Average Accounts Payable / Cost of Goods Sold) × 365

Key points about DPO:

- It tracks how long the company delays payments to suppliers.

- Higher DPO improves liquidity but must be managed without damaging supplier relationships.

- Because accounts payable is a liability, DPO is subtracted in the CCC formula.

Putting It All Together: The CCC Formula

After calculating DIO, DSO, and DPO, they are combined using this standard formula:

CCC = DIO + DSO − DPO

- DIO and DSO are added because they represent the time that cash remains tied up in inventory and receivables.

- DPO is subtracted because delaying payments extends the business’s ability to hold onto cash.

This formula is also referred to as the net operating cycle, as it tracks the entire journey of inventory from purchase to cash collection, minus the time the company benefits from supplier credit.

Example of CCC Calculation

Let’s consider a company with the following metrics:

- DIO: 23 days

- DSO: 16 days

- DPO: 13 days

Using the CCC formula:

CCC = 23 + 16 − 13

CCC = 26 days

This means the business takes 26 days to convert its investment in inventory and receivables into cash flow.

A longer CCC indicates slower cash movement and potential liquidity pressure, while a shorter cycle suggests better working capital efficiency and stronger operational performance.

Factors That Influence the Cash Conversion Cycle

The Cash Conversion Cycle (CCC) is not a fixed metric—it shifts depending on internal processes, market conditions, and operational strategies. Several factors can either shorten or lengthen the CCC, directly impacting a company’s cash flow, liquidity, and working capital efficiency. Understanding these factors helps businesses identify where delays occur and which areas need improvement.

Below are the key factors that significantly influence the CCC:

1. Inventory Management Efficiency

How efficiently a company manages and moves its inventory plays a major role in determining Days Inventory Outstanding (DIO).

- Accurate demand forecasting

- Optimized reorder points

- Fast inventory turnover

- Lean inventory principles

- Quality control and production efficiency

Businesses that keep excess stock or face frequent stockouts often experience longer DIO, while streamlined inventory processes help reduce it.

2. Sales and Order Fulfillment Speed

The ability to convert orders into delivered products quickly affects how soon revenue can be recognized.

- Faster order processing

- Reliable supply chain coordination

- Minimal production bottlenecks

- On-time delivery performance

Efficient fulfillment reduces the time inventory sits unsold, thereby shortening the CCC.

3. Credit Policies and Receivables Management

Days Sales Outstanding (DSO) depends heavily on how a business handles customer credit.

- Credit terms offered to buyers

- Customer payment behavior

- Strength of collections process

- Use of digital invoicing and automated reminders

Flexible or extended credit terms may boost sales but tend to increase DSO, lengthening the CCC.

4. Supplier Payment Terms and Negotiation Power

Days Payable Outstanding (DPO) is influenced by how long a company can take to pay suppliers without penalties.

- Negotiated payment terms (30, 60, or 90+ days)

- Supplier relationships and bargaining power

- Industry norms for credit periods

- Early payment discounts

Longer payment terms extend DPO, helping reduce the CCC—provided supplier trust isn’t compromised.

5. Production and Operational Efficiency

Operational delays increase both DIO and DSO.

- Manufacturing lead times

- Equipment uptime and automation

- Workforce efficiency

- Quality defects or rework cycles

Streamlined operations help companies move goods faster and shorten their overall CCC.

6. Industry and Business Model

CCC varies widely across industries:

- Retail and FMCG have low CCC due to fast-moving inventory

- Manufacturing often has higher CCC due to long production cycles

- Service businesses may have no CCC at all (no physical inventory)

Understanding industry norms helps benchmark performance accurately.

7. Market Demand and Economic Conditions

Shifts in demand directly influence sales and stock movement.

- High demand → faster inventory turnover → lower DIO

- Low demand → slow-moving stock → higher DIO

Economic downturns may also delay customer payments, increasing DSO.

8. Pricing Strategy and Sales Mix

The type of products sold affects how quickly inventory converts:

- High-value, slow-moving goods tend to increase DIO

- Low-cost, fast-moving goods reduce DIO

- Heavy reliance on credit sales can increase DSO

Diversifying products or optimizing pricing improves CCC stability.

9. Cash Flow Policies and Financial Controls

Strong financial oversight ensures the CCC remains healthy.

- Clear receivables follow-up protocols

- Real-time cash flow tracking

- Automated accounting and ERP systems

- Internal policies for procurement and payment discipline

Companies with better controls typically enjoy more manageable CCC timelines.

10. Use of Technology and Automation

Digital tools significantly improve CCC components:

- ERP systems for real-time visibility

- Automated invoicing and payment reminders

- AI-based demand forecasting

- Inventory tracking via barcodes or RFID

- Supplier portals for faster order management

Modern tools help reduce manual errors and speed up the entire cash cycle.

Why the Cash Conversion Cycle Matters for Businesses

Understanding the Cash Conversion Cycle (CCC) is more than a financial best practice—it’s a strategic advantage. Whether you’re a startup owner, a growing retailer, or a manufacturing leader, CCC directly influences your liquidity, financing opportunities, operational efficiency, and long-term business sustainability. Below are the core reasons why CCC is crucial for business success.

Improving Supplier Relations

A business with a healthy, well-managed CCC naturally builds trust with suppliers. Suppliers assess a company’s liquidity before offering credit terms. If your CCC is long—indicating slow cash recovery—they may hesitate to extend credit or offer favorable terms due to perceived risk.

However, maintaining a shorter, efficient CCC signals strong liquidity, disciplined working capital management, and reliable repayment ability. This strengthens supplier relationships, opens the door to extended credit periods, bulk discounts, and priority fulfilment, ultimately improving supply chain resilience.

Obtaining Business Finance

Banks, lenders, investors, and financial institutions study the CCC closely before offering business loans, credit lines, or equity investments. A shorter CCC reflects strong liquidity and predictable cash flows—key factors that assure lenders you can meet repayment obligations.

For inventory-based businesses such as retailers, wholesalers, and manufacturers, CCC is especially important. While it isn’t the only metric evaluated, lenders combine CCC with profitability, debt ratios, and cash flow statements to determine creditworthiness. The healthier your CCC, the easier it becomes to secure financing at competitive rates.

Knowing How Much Finance to Seek

Understanding your CCC also helps you determine how much funding your business actually needs. When business owners know how long cash is tied up in inventory and receivables, they can accurately calculate financing requirements for operations, growth, or expansions.

Instead of borrowing too much (leading to unnecessary interest costs) or too little (resulting in cash crunches), CCC provides clarity on optimal working capital needs. This makes financial planning more grounded, strategic, and risk-averse.

Evaluating Business Performance

The CCC is a powerful indicator of operational efficiency:

- A low CCC means the business is converting inventory into cash quickly—signifying strong demand forecasting, effective sales cycles, and efficient collections.

- A high CCC indicates possible issues such as excess inventory, slow-moving stock, delayed invoice payments, or inefficiencies in operations.

Business leaders use CCC to pinpoint bottlenecks, refine inventory practices, accelerate receivables, and negotiate better payables terms. By monitoring CCC trends over time, they can identify performance shifts early and take corrective action swiftly.

Cash Flow Indicator

CCC is one of the best real-time indicators of your liquidity position. A shorter CCC shows the business consistently maintains liquid assets and can fund daily operations—from paying salaries and utilities to replenishing stock and fulfilling customer orders.

Financial institutions also pay attention to CCC because it signals the company’s risk exposure. A long, deteriorating CCC may indicate:

- cash flow shortages,

- late customer payments,

- overstocking issues,

- or weak working capital controls.

Understanding and improving CCC ensures your business avoids liquidity crises and maintains operational continuity.

Working Capital Management

CCC provides valuable insights into how efficiently a company manages its working capital. It helps identify areas for optimization such as:

- reducing excess inventory,

- shortening customer payment cycles,

- improving supplier payment strategies,

- and balancing cash inflows and outflows.

By improving these areas, companies free up cash that can be reinvested into growth, product development, or market expansion.

Liquidity Management

Liquidity is the lifeblood of any business, and CCC directly impacts it. A shorter CCC boosts liquidity, enabling companies to:

- meet short-term obligations with ease,

- respond to emergencies,

- seize unexpected opportunities, and

- reduce reliance on external financing.

Healthy liquidity also improves a company’s resilience during economic downturns, market disruptions, or supply chain delays.

Profitability Analysis

A shorter CCC not only improves cash cycles but also enhances profitability. When businesses generate cash faster:

- they reinvest earlier into growth initiatives,

- reduce interest expenses from borrowing less,

- react quickly to market opportunities,

- and improve shareholder value.

A long CCC, conversely, locks capital in inventory and receivables, limiting the ability to scale or invest.

Operational Efficiency

Breaking down CCC components—DIO, DSO, and DPO—reveals where operational inefficiencies may be hiding:

- Slow inventory turnover

- Inefficient order fulfilment

- Poor credit control

- Weak supplier management

Addressing these improves productivity, reduces carrying costs, and enhances competitive advantage.

Investor and Creditor Perception

Investors and creditors view CCC as a reflection of management effectiveness and financial health. A strong CCC signals:

- disciplined operations,

- reliable cash flow cycles,

- strong risk management,

- and sustainable growth potential.

This builds confidence among financial stakeholders and improves your credibility in the market.

Competitive Standing

Comparing your CCC with industry benchmarks helps evaluate your position in the market. A shorter CCC than competitors indicates stronger efficiency and cash discipline, giving your business a competitive edge through:

- faster restocking,

- better customer fulfilment,

- and more aggressive growth strategies.

Growth Capacity

By understanding how quickly your business generates cash, you can determine how much self-funded growth your operations can support. A healthy CCC enables expansion into:

- new markets,

- new product lines,

- automation initiatives,

- or technology upgrades.

It reduces dependency on external financing and improves long-term sustainability.

Risk Exposure

A deteriorating CCC highlights risks such as delayed payments, rising inventory costs, and inefficiencies in collection cycles. Monitoring CCC helps businesses proactively identify:

- cash flow gaps,

- debtor risks,

- supply chain disruptions,

- or liquidity concerns.

This allows owners to implement safeguards before problems escalate.

What Is a Good Cash Conversion Cycle (CCC)?

A “good” Cash Conversion Cycle doesn’t come with a universal number—and that’s because every industry, business model, and operational structure functions differently. Instead of aiming for one ideal figure, businesses should assess what a healthy CCC looks like for their sector and track how it changes over time. Below are the key considerations that define a good CCC and how businesses can interpret this metric effectively.

Shorter CCC Is Generally Better

Across most industries, a shorter CCC is considered good. This means the company efficiently converts inventory into sales, collects cash quickly, and strategically delays payments to suppliers without harming relationships. A shorter CCC indicates:

- Strong inventory turnover

- Effective credit and collection policies

- Better bargaining power with suppliers

- Higher liquidity and cash availability

Simply put—a short CCC reflects strong working capital management and healthier cash flow.

Industry Standards Matter

A CCC is only meaningful when viewed within an industry context. Benchmarking is essential because different industries have different inventory cycles, production lead times, and customer payment norms.

- Retailers: Usually have very short CCCs because inventory moves fast and many sales are cash-based.

- Manufacturers: Tend to have longer CCCs due to extended production cycles and higher inventory volumes.

- Large online retailers (e.g., Amazon): Often have negative CCCs because they collect payments upfront while paying suppliers later.

There is no single perfect CCC, but lower is generally better relative to your industry average.

Trend Evaluation Is More Important Than One-Time Numbers

Instead of trying to hit an absolute target, companies should focus on whether their CCC is improving or deteriorating.

- Decreasing CCC: Indicates better working capital management and efficiency improvements.

- Increasing CCC: Suggests operational inefficiencies such as slow-moving inventory, delayed customer payments, or poor supplier negotiations.

Management performance can often be assessed by how consistently they reduce or stabilize the CCC over time.

Comparison With Competitors

A CCC is most insightful when compared to companies of similar size and industry. A lower CCC than competitors may indicate:

- Better inventory forecasting

- Faster fulfilment

- Stronger collection processes

- More favorable supplier terms

A high CCC compared to industry peers, however, may signal inefficiencies or weaker market positioning.

Seasonality Impacts CCC

Seasonal businesses often experience fluctuating CCCs due to variations in inventory and sales cycles:

- Before peak seasons: Businesses stock up → DIO rises → CCC increases.

- During peak seasons: Sales surge but collection times may vary → impact on DSO.

- Post-season: Payment terms may extend if vendors offer seasonal flexibility → DPO changes.

A rising CCC during peak periods is normal. What matters is how quickly it stabilizes afterward.

Positive vs. Negative CCC

- Positive CCC: Normal for most businesses. Cash is tied up in operations, but efficient management keeps the cycle short.

- Negative CCC: Rare but highly advantageous. The business receives cash from customers before paying suppliers, effectively turning operations into a source of cash.

A negative CCC is usually seen in businesses with:

- Rapid inventory turnover

- High sales volume

- Strong supplier negotiation power

- Prepayment or immediate payment from customers

This is a hallmark of exceptional operational efficiency.

Interpreting High vs. Low CCC

High CCC

A high CCC signals that cash is tied up too long. It may indicate:

- Slow inventory movement

- Poor demand forecasting

- Lengthy credit periods for customers

- Inefficient collection processes

- Cash flow strain or liquidity issues

High CCC also suggests the company might struggle to meet short-term obligations without borrowing.

Low CCC

A low CCC indicates strong efficiency, including:

- Fast inventory turnover

- Quick and disciplined customer collections

- Strategic use of supplier credit

- Healthy cash flow and operational discipline

Low CCC often leads to better profitability and reduced financing needs.

CCC as a Reflection of Management Quality

CCC trends offer a valuable window into management capability:

- Steadily decreasing CCC: Shows strong operational oversight, good forecasting, efficient credit control, and disciplined cash flow management.

- Increasing CCC: May indicate deeper issues such as poor decision-making, weak working capital controls, operational bottlenecks, or demand misalignment.

Regular analysis of CCC helps leadership identify problems early and implement corrective measures.

What Is a Negative Cash Conversion Cycle?

A negative Cash Conversion Cycle (CCC) occurs when a business receives cash from customers before it needs to pay its suppliers. In simple terms, the company is operating using its suppliers’ money instead of its own. This means the business converts inventory into cash faster than the time it takes to settle its accounts payable—creating a cash-flow advantage.

When the CCC is negative, the business enjoys immediate liquidity, stronger working capital, and the ability to scale operations without additional financing. This is often seen in large retailers and e-commerce companies where customers pay upfront, and suppliers offer extended payment terms.

Why a Negative CCC Matters

A negative CCC is considered a sign of exceptional financial and operational efficiency. It shows that the company:

- Collects payments quickly (or even upfront)

- Manages inventory rapidly or keeps minimal stock

- Negotiates favorable credit terms with suppliers

With more cash available at all times, the business can reinvest in growth, reduce debt, or build resilience against market fluctuations.

Example of a Negative CCC in Practice

Think of an online retailer that receives customer payments instantly during checkout. However, it pays its suppliers 30–60 days later and holds minimal inventory because products ship from third-party warehouses. Since cash comes in first and cash leaves later, the company maintains a negative cycle, boosting liquidity.

Who Typically Has a Negative CCC?

Industries with strong demand and predictable turnover often achieve it, such as:

- E-commerce brands

- Supermarkets

- Fast-fashion retailers

- Subscription-based businesses

- Companies using drop-shipping or just-in-time (JIT) models

Achieving a negative CCC is challenging but highly rewarding, as it reduces dependence on external financing and strengthens long-term financial stability.

Common Mistakes Businesses Make With the Cash Conversion Cycle (CCC)

Even though the Cash Conversion Cycle is a powerful metric, many businesses unintentionally make errors that distort their cash-flow visibility and slow down operational efficiency.

Here are the most common mistakes companies make when managing (or mismanaging) their CCC:

1. Overestimating Inventory Needs

Many companies stock more inventory than required, assuming it prevents stockouts. In reality, excess inventory increases holding costs, ties up cash, and lengthens the CCC. Poor demand forecasting, lack of real-time visibility, and manual tracking often worsen the problem.

2. Inefficient or Slow Accounts Receivable Processes

Delayed invoicing, manual billing, and weak follow-up systems significantly extend the receivables period. When customers are not reminded or incentivized to pay on time, the CCC increases—impacting liquidity and working capital.

3. Paying Suppliers Too Early

Some businesses pay vendors immediately—even when they have favorable terms. This prematurely reduces cash availability. Not leveraging full credit periods is one of the most avoidable mistakes that elongates the payable portion of the CCC.

4. Not Negotiating Better Supplier Terms

Failing to revisit or renegotiate supplier payment terms leaves money on the table. Businesses often overlook opportunities to extend credit periods, secure discounts, or switch to suppliers offering more flexible payment schedules.

5. Using Manual, Fragmented Systems

Spreadsheets, manual logs, and disconnected tools create data inaccuracies and delays. Without an integrated ERP system, it becomes difficult to track inventory days, receivables aging, and payables timelines—leading to faulty CCC calculations.

6. Ignoring Cash Flow Forecasting

Businesses sometimes focus only on profit without forecasting cash movement. This causes blind spots, where companies are unaware of upcoming cash gaps or liquidity pressures—resulting in a poorly managed CCC.

7. Misunderstanding What a “Good” CCC Looks Like

Some businesses compare their CCC to companies in different industries without considering turnover patterns. Since CCC benchmarks vary widely, using irrelevant comparisons leads to incorrect conclusions and misguided decisions.

8. Not Monitoring CCC Frequently

Tracking the CCC once a year (or only during annual audits) is a critical mistake. Markets, demand patterns, and supplier behavior change constantly. Without regular monitoring, inefficiencies go unnoticed until they become cash-flow crises.

How to Improve Your Cash Conversion Cycle (CCC)

Improving—or more accurately, reducing—your Cash Conversion Cycle (CCC) is one of the most effective ways to strengthen liquidity, enhance operational efficiency, and ensure smoother day-to-day business functioning. Because CCC reflects how quickly you turn cash invested in inventory into cash received from customers, optimizing it requires taking strategic actions across inventory, receivables, and payables.

A shorter CCC means you can reinvest in growth faster, rely less on external financing, and avoid the cash flow crunches that often derail business operations. Below are detailed, actionable strategies to reduce your CCC sustainably and responsibly—without hurting supplier relationships or customer experience.

1. Reduce DIO: Convert Inventory Into Sales Faster

Lowering your Days Inventory Outstanding (DIO) reduces the time cash remains locked in unsold stock. A company can significantly shorten its CCC by improving how inventory is purchased, stocked, and sold.

Strategies to Decrease DIO:

- Implement Just-in-Time (JIT) inventory systems to avoid overstocking and reduce holding costs.

- Improve demand forecasting using sales trends, seasonality analysis, and market indicators.

- Enhance inventory visibility through automated tracking and real-time stock monitoring.

- Eliminate slow-moving items by discounting or bundling them to free up tied capital.

- Optimize reorder points and safety stock to ensure you only buy what’s necessary.

- Increase product turnover with better merchandising, pricing strategies, and promotional campaigns.

Reducing inventory days improves cash inflow speed and prevents working capital from getting stuck in surplus or obsolete stock.

2. Reduce DSO: Collect Customer Payments Faster

Lowering Days Sales Outstanding (DSO) means accelerating your accounts receivable collections. This brings cash into the business sooner and strengthens liquidity.

Strategies to Decrease DSO:

- Invoice customers immediately when goods are delivered or services completed.

- Automate invoicing and reminders to close the gap between sale and payment.

- Offer early-payment incentives such as small discounts to encourage prompt settlement.

- Tighten credit approval processes to ensure customers have a good payment history.

- Shorten payment terms from 45–60 days to 30 days or less, where appropriate.

- Take deposits or upfront payments for large orders or custom work.

- Actively follow up with customers on overdue invoices through structured collection processes.

Efficient receivables management enhances business liquidity and reduces the risk of bad debts.

3. Increase DPO: Extend the Time Taken to Pay Suppliers

Increasing Days Payable Outstanding (DPO) improves CCC by delaying cash outflows—while still maintaining ethical and healthy supplier relationships.

Strategies to Increase DPO:

- Negotiate longer payment terms with suppliers (e.g., from 30 to 45 or 60 days).

- Pay invoices as close to the due date as possible, not earlier unless discounts apply.

- Consolidate purchases to gain better leverage for extended terms.

- Use supply chain finance or early-payment programs, where suppliers receive early payment from a third party while the buyer pays later.

However, it’s important to be cautious: pushing out payables too far can harm suppliers’ own CCC and create supply-chain instability. Ethical working capital management seeks a win-win scenario.

Supply chain finance becomes especially useful here, ensuring that suppliers get paid early—even if you extend your own payment period.

4. Improve Cash Flow Management

Efficient cash flow management aligns inflows and outflows to avoid shortages and ensure operational continuity.

Best practices include:

- Accurate cash flow forecasting to anticipate shortages or surpluses.

- Tracking inflows and outflows closely to understand spending behaviors.

- Ensuring liquidity buffers to handle unexpected expenses.

- Using automation tools to improve transparency and reduce manual errors.

Strong cash flow management naturally supports a healthier CCC over time.

5. Strengthen Inventory, Receivables, and Payables Processes With Automation

Automation is a major catalyst for CCC improvement across all components:

- Automated invoicing → reduces DSO

- Automated payables scheduling → optimizes DPO

- Real-time inventory management → reduces DIO

- Data-driven forecasting → prevents overstocking or stockouts

Modern ERP systems like Deskera tie all these functions together to dramatically improve working capital efficiency.

6. Maintain Strong Supplier and Customer Relationships

A CCC is not isolated—it reflects how you interact with your partners.

Good practices:

- Collaborate with suppliers for flexible terms during high-demand seasons.

- Build mutual trust to negotiate better payment or delivery schedules.

- Maintain clear communication with customers regarding payment expectations.

- Offer multiple payment channels for convenience and faster collections.

A balanced approach ensures CCC improvements without damaging relationships or supply continuity.

7. Monitor and Benchmark Your CCC Regularly

A CCC that declines year-over-year indicates strong management performance. One that rises consistently signals inefficiencies that require immediate attention.

Effective monitoring involves:

- Comparing current CCC to past performance

- Benchmarking against industry competitors

- Evaluating internal processes across inventory, sales, and procurement

- Reviewing macro factors like seasonality and demand shifts

Because CCC varies by industry and business model, regular benchmarking ensures you’re performing competitively.

Improving your cash conversion cycle is not about manipulating a single metric—it’s about optimizing the entire chain of inventory, receivables, and payables. When done well, it strengthens liquidity, boosts profitability, reduces financing needs, and equips the business to handle growth and uncertainty.

How Deskera ERP Helps Businesses Improve Their Cash Conversion Cycle

Optimizing the Cash Conversion Cycle requires accurate data, streamlined operations, and real-time visibility across inventory, sales, receivables, and payables. Deskera ERP brings all these elements together in one unified platform—helping businesses shorten their CCC, unlock liquidity, and boost operational efficiency. Here’s how Deskera ERP supports each component of the cycle:

1. Speeds Up Inventory Turnover With Real-Time Visibility (Improves DIO)

Deskera ERP provides end-to-end inventory control that helps businesses maintain the right stock levels at the right time.

- Real-time tracking of stock across warehouses

- Automated reorder points and low-stock alerts

- Batch and serial tracking for better control

- Demand forecasting to prevent overstocking or stockouts

By reducing excess inventory and eliminating slow-moving stock, Deskera helps companies lower their Days Inventory Outstanding (DIO) and move materials faster through the cycle.

2. Accelerates Receivables Collection Through Automation (Improves DSO)

Delayed receivables are one of the biggest reasons for a long CCC. Deskera ERP minimizes delays through automated, error-free processes:

- Auto-generated invoices right after goods are delivered

- Payment reminders and follow-up notifications

- Digital payment options for faster settlement

- Real-time receivables aging reports

With these tools, businesses reduce Days Sales Outstanding (DSO) and convert sales into cash more quickly.

3. Optimizes Payables Management Without Hurting Supplier Relationships (Improves DPO)

Deskera ERP helps businesses make smarter use of supplier credit without delaying payments unnecessarily.

- Centralized dashboard for all vendor bills and due dates

- Alerts on upcoming payments

- Ability to schedule payments strategically

- Historical insights to negotiate better credit terms

By maximizing credit periods and avoiding early or late payments, companies can improve Days Payable Outstanding (DPO) and maintain healthier cash flow.

4. Provides Unified, Real-Time Financial Insights

Deskera ERP integrates accounting, sales, inventory, and procurement data—making it easy for businesses to calculate and monitor their CCC at any time.

- Automated CCC calculation using DIO, DSO, and DPO

- Real-time dashboards with cash flow forecasts

- AI-powered insights to highlight inefficiencies

- Seamless drill-downs to analyze root causes

This helps leadership make faster, data-driven decisions to shorten the cycle.

5. Eliminates Manual Errors With Automation & AI Assistant “David”

Manual processes slow down CCC performance. Deskera automates workflows across departments and supplements them with its AI assistant, David:

- Auto-suggestions for inventory reordering

- Smart alerts for delayed receivables

- AI-driven insights on working capital trends

- Automated report creation for finance teams

This reduces operational bottlenecks and ensures financial accuracy.

6. Enhances Collaboration Across Teams

The CCC depends on coordination between procurement, inventory, sales, finance, and warehousing. Deskera ERP enables:

- Centralized access to shared data

- Task automation and approvals

- Real-time communication tools

- Seamless integration with CRM and manufacturing modules

Improved collaboration leads to faster processes and a more efficient cash cycle.

Deskera ERP helps businesses shorten their Cash Conversion Cycle by controlling inventory more efficiently, accelerating receivables, optimizing payables, and providing real-time insights through automation and AI. This results in improved liquidity, better working capital management, and a more resilient financial position.

Key Takeaways

- The Cash Conversion Cycle measures how quickly a business can convert its investments in inventory and receivables into actual cash—making it a crucial metric for assessing liquidity and operational efficiency.

- Understanding DIO, DSO, and DPO helps businesses identify exactly where delays are happening—whether in inventory turnover, customer payments, or supplier payments.

- A shorter CCC improves cash flow, strengthens working capital, and supports smoother day-to-day operations, especially for growing businesses.

- Industry type, product seasonality, supplier relationships, inventory models, and credit policies all play significant roles in lengthening or shortening the CCC.

- Businesses can reduce their CCC by selling inventory faster, collecting payments sooner, extending supplier payments responsibly, and adopting strong cash flow management practices.

- A negative CCC indicates that a company gets paid by customers before paying suppliers—creating strong liquidity and demonstrating excellent operational efficiency.

- Frequent errors include overstocking, weak receivables follow-up, inconsistent payment practices, lack of forecasting, and relying too heavily on manual processes.

- Deskera ERP reduces CCC by automating invoicing, improving inventory turnover, optimizing payables, accelerating collections, and delivering real-time financial insights through a unified platform.

Related Articles