Have you ever wondered why businesses invest millions in factories, machinery, or software systems instead of just focusing on daily operational costs? The answer lies in Capital Expenditure (CapEx)—the backbone of long-term business growth. Unlike everyday expenses that keep a company running, CapEx is about building the foundation for future expansion, efficiency, and competitiveness.

Capital expenditure refers to the funds a company allocates toward acquiring, upgrading, or maintaining long-term assets such as property, equipment, or technology. These investments not only help businesses sustain operations but also enable them to scale faster, enter new markets, and strengthen profitability over time. Whether it’s building a new production plant or implementing advanced software, CapEx decisions directly shape a company’s future trajectory.

Understanding CapEx is crucial because it impacts cash flow, financial planning, and investor confidence. Different types of CapEx—ranging from expansion projects to compliance upgrades—serve unique purposes within a business. By analyzing examples and applying the CapEx formula, organizations can make informed choices about when and how to invest for maximum returns.

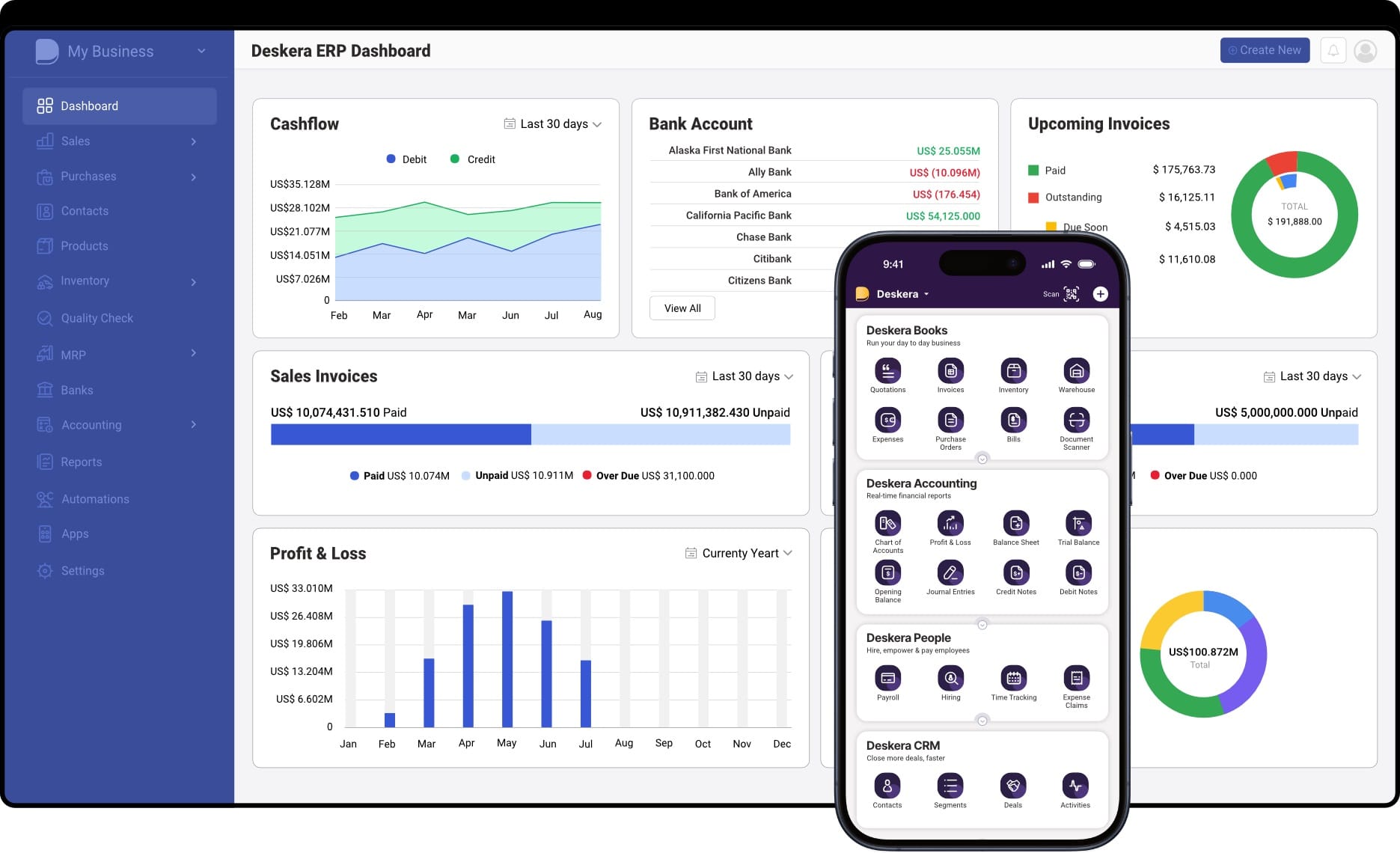

This is where modern solutions like Deskera ERP come into play. Deskera ERP helps businesses streamline their financial management, track expenses, and gain visibility into both operating and capital costs. With features like advanced reporting, AI-powered insights, and mobile accessibility, Deskera enables companies to plan, monitor, and optimize CapEx investments effectively. In turn, this ensures that businesses not only spend wisely but also align capital expenditure with long-term strategic goals.

What is Capital Expenditure (CapEx)?

Capital Expenditure (CapEx) refers to the funds a company uses to acquire, maintain, or upgrade its long-term assets such as buildings, machinery, technology, or infrastructure. These assets typically have a useful life of more than one year and are considered essential for expanding operational capacity or maintaining current productivity levels. Unlike operating expenses (OpEx), which cover day-to-day costs, CapEx is a long-term investment that supports business growth and efficiency.

CapEx includes not only the initial purchase of assets but also the expenses required to upgrade or keep them in working order. For example, constructing a new factory, upgrading IT systems, or purchasing delivery vehicles all fall under capital expenditure. These expenditures are recorded on the company’s balance sheet as assets rather than on the income statement as direct expenses. Over time, their value is reduced through depreciation (for tangible assets) or amortization (for intangible assets), spreading the cost across their useful life.

According to accounting standards like GAAP (Generally Accepted Accounting Principles), expenditures that enhance or extend the life of an asset beyond one accounting period are generally classified as CapEx. While most capital expenditures are tangible and non-consumable—such as property, plant, and equipment (PP&E)—certain intangible purchases, such as patents, licenses, or enterprise software, can also qualify.

CapEx is a critical measure for both internal financial planning and external investor evaluation. It signals how much a company is investing in its future operations. Industries like manufacturing, oil and gas, telecommunications, and utilities are typically more capital-intensive and show higher CapEx levels. Investors often analyze CapEx trends to assess whether a company is maintaining, expanding, or strategically repositioning its business for long-term competitiveness.

Difference Between CapEx and Operational Expenses (OpEx)

While Capital Expenditure (CapEx) and Operational Expenses (OpEx) both represent business spending, they serve very different purposes and are treated differently in accounting. Understanding the distinction is vital because it affects cash flow, tax treatment, and how a company’s financial health is evaluated.

1. Purpose

- CapEx is focused on long-term investments—purchasing, upgrading, or maintaining assets that will provide value for more than one year.

- OpEx covers the routine, day-to-day costs of running a business, such as salaries, utilities, rent, and office supplies.

2. Accounting Treatment

- CapEx is capitalized, meaning it is recorded on the balance sheet as an asset. Its cost is spread across multiple years through depreciation (for tangible assets) or amortization (for intangible assets).

- OpEx is expensed immediately in the income statement within the same accounting period in which it is incurred.

3. Time Horizon

- CapEx has a long-term impact on the company’s capacity, efficiency, and competitiveness.

- OpEx ensures the smooth functioning of daily operations but does not directly add to future capacity.

4. Examples

- CapEx: Buying new machinery, constructing a building, investing in ERP software, acquiring patents.

- OpEx: Paying employee salaries, electricity bills, routine equipment servicing, marketing costs.

5. Impact on Cash Flow

- CapEx appears in the cash flow from investing activities section of the cash flow statement.

- OpEx is reflected under cash flow from operating activities.

Quick Comparison Table: CapEx vs. OpEx

Types of Capital Expenditure (CapEx)

Capital expenditures are not one-size-fits-all; they serve different purposes depending on a company’s stage of growth, strategy, and operational needs. Broadly, CapEx can be divided into categories based on whether it supports business expansion, asset upkeep, or strategic initiatives.

Understanding these types helps businesses and investors assess whether a company is focused on sustaining existing operations, pursuing aggressive growth, or aligning with long-term objectives.

1. Maintenance CapEx

Maintenance CapEx refers to the funds allocated to keep existing assets in working condition and prevent productivity losses. These expenditures don’t necessarily expand capacity but ensure that operations continue without disruption.

Examples include replacing outdated machinery, renovating existing facilities, or upgrading aging software systems. While not as flashy as growth investments, maintenance CapEx is essential to preserving operational efficiency and reliability.

2. Growth CapEx

Growth CapEx is aimed at expanding a company’s capacity, entering new markets, or boosting long-term revenue potential. These investments often signal an aggressive growth strategy and a forward-looking business model.

Common examples include constructing a new factory, opening additional retail locations, launching new product lines, or acquiring advanced technologies. High levels of growth CapEx usually indicate that a business is in an expansion phase.

3. Strategic CapEx

Strategic CapEx focuses on investments that serve broader business goals beyond simple maintenance or expansion. These expenditures are often tied to achieving competitive advantage, complying with regulations, or diversifying product offerings.

Examples include acquiring a competitor, investing in environmentally sustainable technologies, or implementing enterprise-wide ERP software. Unlike growth or maintenance CapEx, strategic investments are often more transformative in nature.

4. Expansion CapEx

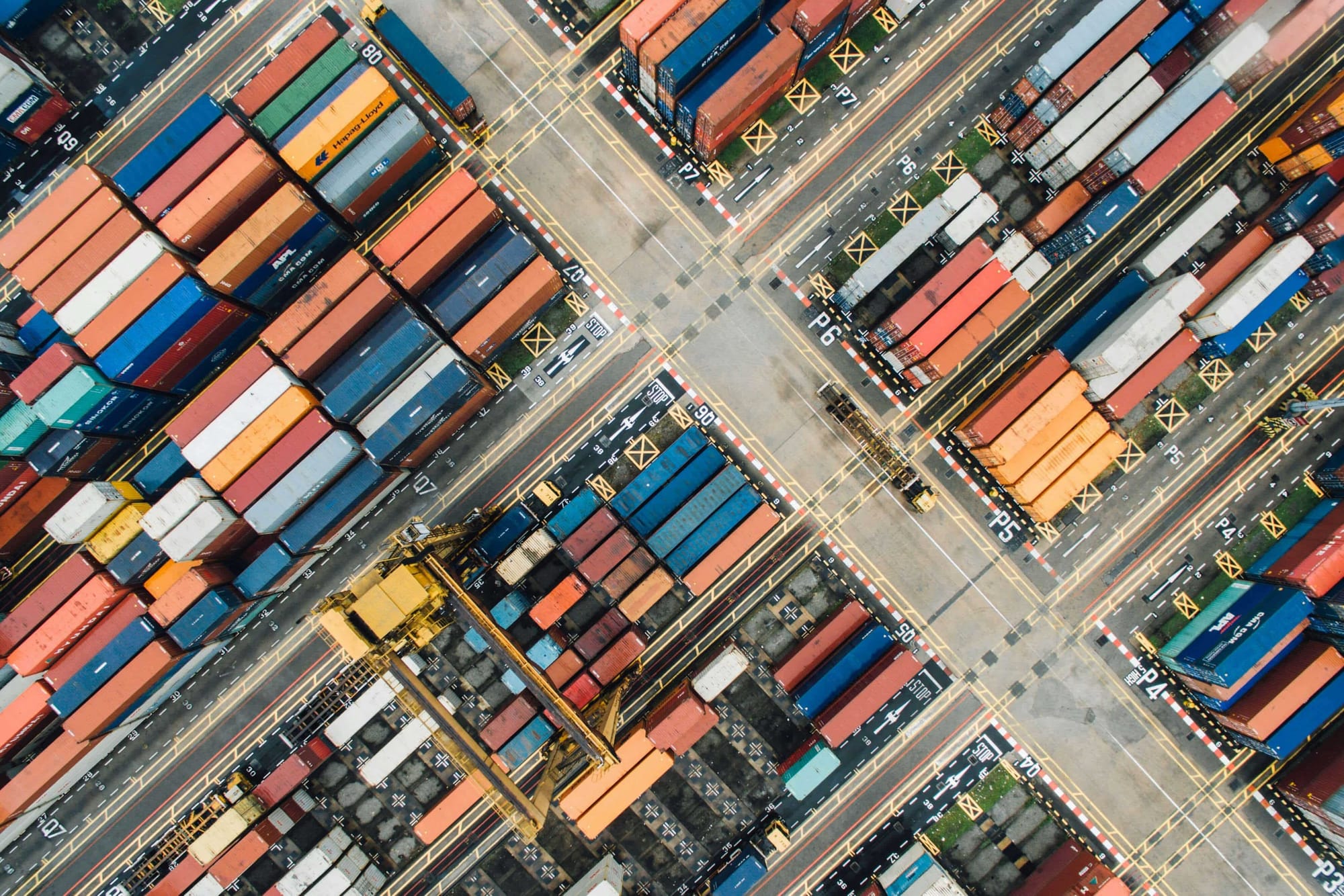

Expansion CapEx involves investments made to expand a business’s capacity or reach. This may include acquiring new property, building additional facilities, setting up new production lines, or entering new markets and geographic locations.

For example, a manufacturer building a new plant in another city is engaging in expansion CapEx, as it increases the company’s long-term revenue potential.

5. Replacement CapEx

Replacement CapEx refers to investments in new assets that replace or enhance outdated or inefficient ones. Companies may upgrade machinery, equipment, or IT systems with newer, more effective models.

For instance, replacing old delivery trucks with fuel-efficient ones reduces operating costs while ensuring smoother business operations.

6. Research and Development (R&D) CapEx

R&D CapEx involves expenditures directed toward innovation, product development, and technological progress. Companies may invest in developing new systems, experimenting with advanced technologies, or revamping existing product lines.

For example, pharmaceutical companies allocating funds to develop a new drug or tech firms building a next-gen AI model fall under this category.

7. IT and Technology CapEx

IT and Technology CapEx encompasses spending on digital and technological infrastructure. This can include servers, software licenses, cloud computing, data centers, and cybersecurity systems.

With the growing importance of digital transformation, many companies are allocating substantial CapEx budgets to IT, ensuring scalability, security, and competitive advantage.

8. Tangible vs. Intangible CapEx

CapEx can also be classified based on the type of asset being acquired.

- Tangible CapEx involves physical, long-term assets like property, plant, equipment, vehicles, or IT hardware.

- Intangible CapEx includes non-physical assets that add long-term value, such as patents, licenses, software, or significant research and development (R&D) projects. For example, developing proprietary software or acquiring an exclusive license can qualify as intangible capital expenditure.

By analyzing the makeup of a company’s CapEx, stakeholders can gain insights into its strategy. Heavy spending on maintenance may point to an aging infrastructure, while significant growth CapEx signals expansion. Strategic and intangible investments often reveal a forward-thinking approach designed to secure competitive advantage over time.

Examples of Capital Expenditure (CapEx)

The nature of capital expenditure varies by industry, but most companies allocate CapEx toward acquiring or upgrading assets that generate long-term value. These purchases or improvements are capitalized on the balance sheet rather than expensed immediately, as they provide benefits for years to come.

Below are some common examples of capital expenditures:

1. Property and Buildings

Investments in real estate or permanent structures are among the most common forms of CapEx. This includes buying land, constructing new offices or warehouses, or renovating existing facilities. For instance, building a new manufacturing plant or expanding a corporate office qualifies as CapEx, since the asset supports business growth over multiple years.

2. Equipment and Machinery

Purchasing or upgrading machinery and tools is essential, especially in manufacturing industries. Examples include production lines, heavy equipment, or specialized industrial tools. Costs often extend beyond the purchase price to include installation, testing, and shipping. Replacing outdated machinery with more efficient models is also considered CapEx.

3. IT Infrastructure and Software

Modern businesses frequently invest in technology assets such as servers, data centers, networking systems, or enterprise software like ERP platforms. Large-scale software upgrades and digital transformation projects are classified as CapEx if they provide long-term value. For example, implementing a cloud-based ERP or upgrading company-wide IT systems fits this category.

4. Vehicles

Many companies purchase vehicles for business operations, such as delivery vans, corporate cars, construction vehicles, or even aircraft. For instance, a logistics company investing in a new fleet of trucks would classify this as capital expenditure. In some cases, vehicles may also be leased, though leased assets have different accounting treatment under new standards.

5. Furniture and Fixtures

Although smaller in scale, furniture and fixtures—such as office desks, retail displays, or kitchen equipment for restaurants—are also examples of CapEx when they exceed the capitalization threshold. These assets contribute to long-term usability and are depreciated over time.

6. Upgraded or Replacement Assets

Significant improvements or replacements of existing assets also fall under CapEx. For example, upgrading a factory’s assembly line with advanced robotics or modernizing an office’s IT infrastructure can extend the useful life of assets and enhance efficiency.

7. Intangible Assets

Not all CapEx is physical. Intangible assets such as patents, licenses, trademarks, and proprietary software are also considered capital expenditures. For instance, acquiring a software license valid for ten years or purchasing intellectual property rights provides enduring economic benefits and is therefore treated as CapEx.

By analyzing a company’s CapEx examples, investors and analysts can better understand its strategic priorities. Heavy spending on property and machinery may indicate expansion, while investments in IT and intangible assets often point to innovation and digital transformation.

CapEx Formula and Calculation

Capital expenditures appear in the cash flow statement (investing activities), while their accumulated value (minus depreciation) is reported under fixed assets on the balance sheet. Depreciation linked to these assets is shown as an expense in the income statement. Together, these statements give a complete picture of how much a company is spending on long-term investments.

How to Calculate Capital Expenditures

To calculate CapEx, you need two things:

- The beginning and ending balance of Property, Plant, and Equipment (PP&E) from the balance sheet.

- The depreciation expense from the income statement.

Formula:

CapEx = (PP&E at end of period – PP&E at beginning of period) + Depreciation expense

This formula helps account for both the change in assets and the depreciation applied during the year.

Example of CapEx Calculation

Let’s say a logistics company invested in delivery vehicles and upgraded its warehouse technology in 2024.

- PP&E at the beginning of 2024: $120,000

- PP&E at the end of 2024: $150,000

- Depreciation expense during 2024: $15,000

Step 1: Calculate the change in PP&E

150,000–120,000=30,000150,000 – 120,000 = 30,000150,000–120,000=30,000

Step 2: Add depreciation back

30,000+15,000=45,00030,000 + 15,000 = 45,00030,000+15,000=45,000

Total CapEx for 2024 = $45,000

This means the company spent $45,000 on long-term investments such as vehicles and technology upgrades.

Importance of Capital Expenditure (CapEx)

Capital expenditure is more than just spending on physical or intangible assets—it’s a strategic lever that influences growth, efficiency, and financial sustainability. Below are the key reasons why CapEx is crucial for any business:

1. Drives Long-Term Growth

CapEx fuels business expansion by enabling companies to scale operations, build new facilities, or enter untapped markets. For example, a manufacturing company investing in a new production plant is essentially securing its ability to meet rising demand in the future.

Such investments often require large upfront spending but create sustainable revenue streams over many years. Without continuous CapEx, a business may stagnate, lose relevance, and eventually fall behind competitors who are actively expanding.

2. Enhances Operational Efficiency

Operational efficiency is vital in competitive industries where even small inefficiencies can reduce profit margins. By investing in advanced machinery, digital solutions, or automation systems, businesses streamline workflows, cut waste, and minimize downtime.

For example, upgrading old production lines to automated systems reduces human error and increases throughput. While the upfront cost is high, the long-term benefits in terms of reduced maintenance costs, faster delivery, and higher productivity make CapEx a critical enabler of efficiency.

3. Improves Asset Value and Lifespan

CapEx preserves the value of existing assets while extending their useful life. Replacing outdated infrastructure or upgrading facilities not only prevents sudden operational breakdowns but also boosts overall asset performance.

For example, refurbishing an office building with modern energy-efficient systems not only enhances employee productivity but also improves the resale or leasing value of the property.

These improvements increase the company’s balance sheet strength and reduce the risk of financial losses due to premature asset failures.

4. Strengthens Competitive Advantage

In fast-evolving industries, companies that invest in innovation, R&D, and digital transformation gain a strong competitive edge. CapEx in areas such as proprietary technology, product development, or smart manufacturing creates differentiation that competitors may struggle to replicate.

For instance, tech companies investing heavily in AI or cloud infrastructure gain market leadership because they deliver faster, smarter, and more reliable solutions. Strategic CapEx ensures that a business does not merely survive but thrives against rivals in the long run.

5. Boosts Investor and Stakeholder Confidence

Investors view capital expenditure as a clear indicator of a company’s growth potential and long-term stability. Regular and well-planned CapEx investments reflect management’s confidence in the company’s future.

For example, when a retail chain invests in new store locations, it signals that demand is strong and growth opportunities are abundant. This builds trust among shareholders and can even increase stock valuations. Stakeholders—including employees and suppliers—also see CapEx as a commitment to sustainable success.

6. Supports Compliance and Risk Management

CapEx also plays a key role in helping businesses comply with legal and industry regulations while managing operational risks. For example, investing in modern safety equipment, cybersecurity systems, or eco-friendly manufacturing plants helps companies avoid legal penalties and reputational harm.

Such investments also minimize risks such as data breaches, accidents, or environmental violations, which can otherwise result in costly lawsuits and business disruptions. In this way, CapEx safeguards both short-term operations and long-term viability.

7. Encourages Innovation and R&D

Innovation is the backbone of long-term success, and CapEx enables businesses to allocate funds toward research and development.

Companies in pharmaceuticals, technology, or automotive industries often rely on CapEx to create new products, improve existing offerings, and build intellectual property such as patents or proprietary systems.

While R&D spending may take years to deliver tangible results, the long-term returns in terms of product leadership, customer loyalty, and revenue growth can be transformative for the business.

8. Provides Better Financial Planning Insights

CapEx decisions give management and investors a clear picture of the company’s financial strategy and capital allocation priorities. By analyzing capital expenditures, stakeholders can assess whether funds are being directed toward growth, maintenance, or diversification.

For instance, high CapEx in expansion projects suggests aggressive growth strategies, whereas maintenance-focused CapEx might indicate a mature business. These insights help in financial forecasting, budgeting, and performance evaluation, ensuring that resources are aligned with strategic goals.

9. Improves Employee Productivity and Morale

Employees perform better when they work with modern tools, efficient systems, and safe infrastructure—all of which require CapEx investments.

For example, upgrading office spaces, implementing advanced collaboration platforms, or investing in ergonomic furniture can significantly enhance employee morale and productivity.

When employees feel supported with the right resources, they deliver higher output and show stronger loyalty to the organization. Thus, CapEx indirectly influences not just operations but also workforce retention and satisfaction.

10. Increases Business Valuation

Ultimately, consistent and well-planned capital expenditure can significantly enhance the long-term value of a business. By increasing operational capacity, improving efficiency, and securing competitive advantages, CapEx boosts both tangible and intangible assets on the balance sheet.

A company with modern infrastructure, robust IT systems, and valuable intellectual property is often valued higher in mergers, acquisitions, or capital raising. In short, CapEx lays the groundwork for long-term wealth creation for shareholders and owners alike.

Challenges of Capital Expenditure (CapEx)

While capital expenditure is essential for growth and sustainability, it comes with its own set of challenges. These hurdles can impact cash flow, decision-making, and long-term returns if not carefully managed.

Below are the major challenges associated with CapEx:

1. High Upfront Costs

CapEx typically involves substantial upfront investment, which can strain cash flow and liquidity. For small and medium-sized businesses, this often means relying on loans or equity financing, increasing financial risk. Large expenditures also tie up significant capital for long periods, leaving less flexibility to respond to unexpected needs or market opportunities.

2. Long Payback Periods

Unlike operational expenses, the benefits of CapEx are realized over years, sometimes even decades. This long payback period makes it difficult to measure immediate returns and requires businesses to forecast demand and performance far into the future. If projections turn out to be inaccurate, the company may struggle to justify the investment.

3. Risk of Misallocation

Poorly planned or misaligned CapEx projects can result in underutilized assets or wasted resources. For example, building a new facility without adequate demand projections may lead to idle capacity. Strategic missteps in CapEx allocation can lock businesses into unproductive assets, reducing overall profitability and competitiveness.

4. Uncertainty and Market Volatility

CapEx decisions are often made under uncertain conditions, such as fluctuating demand, changing consumer preferences, or economic downturns. Market volatility can quickly erode the expected returns on investment. For instance, a company investing in new technology may find it obsolete within a few years due to rapid innovation cycles.

5. Financing and Debt Burden

Securing funds for CapEx often involves debt financing, which increases interest obligations and financial leverage. High levels of debt can reduce a company’s credit rating and make it harder to secure additional funding. In worst-case scenarios, poorly planned CapEx can push businesses into financial distress.

6. Regulatory and Compliance Risks

Certain CapEx projects, such as infrastructure, energy, or IT investments, must meet strict regulatory standards. Failing to comply can result in project delays, fines, or even shutdowns. For example, a manufacturing plant expansion might require environmental approvals, which can prolong timelines and increase costs.

7. Depreciation and Obsolescence

All CapEx assets eventually depreciate, which reduces their book value over time. Rapid technological changes make assets obsolete faster than anticipated, forcing businesses to replace or upgrade earlier than expected. This adds unplanned financial strain and reduces the expected ROI of CapEx investments.

8. Complex Planning and Forecasting

CapEx projects require detailed financial planning, demand forecasting, and cost-benefit analysis. Inaccurate assumptions—such as overestimating demand or underestimating costs—can lead to major financial setbacks. This complexity makes CapEx decisions highly challenging, especially in industries with fast-changing dynamics.

9. Impact on Short-Term Profitability

Large capital investments often reduce short-term profitability because of increased depreciation and financing costs. While the long-term benefits may be substantial, businesses must balance CapEx with the need to deliver consistent short-term results to shareholders and stakeholders.

10. Project Execution Risks

Even well-planned CapEx projects face risks during execution, such as construction delays, supply chain disruptions, labor shortages, or unexpected cost overruns. These execution challenges can inflate budgets, extend timelines, and reduce overall returns, making it critical to have strong project management in place.

In summary, while CapEx is essential for driving growth and efficiency, businesses must overcome significant financial, operational, and strategic challenges to ensure that investments deliver the desired long-term value.

Best Practices for Managing Capital Expenditures (CapEx) in Businesses

Managing capital expenditures effectively is crucial for ensuring that investments deliver long-term value without jeopardizing financial stability. Since CapEx projects involve large sums of money and long payback periods, businesses must adopt structured processes to minimize risks, maximize returns, and align investments with strategic goals.

Below are the best practices companies should follow:

1. Define Clear Objectives and Success Metrics

Before committing to any capital project, businesses should establish clear objectives and success criteria. This includes identifying the project’s scope, expected ROI, strategic purpose, and timeline for realizing benefits.

For example, if a company invests in new machinery, success may be defined in terms of increased production capacity, reduced downtime, or cost savings. Setting these parameters upfront ensures accountability and provides benchmarks against which project outcomes can be measured.

2. Standardize Business Case Development

Every CapEx project should be backed by a well-structured business case that outlines its rationale, expected returns, risks, and alternatives. Standardizing the format for these proposals ensures consistency, making it easier for decision-makers to compare projects objectively.

A strong business case should cover both quantitative benefits (such as projected revenue growth) and qualitative benefits (such as improved brand reputation). This approach helps prioritize projects that best align with organizational strategy.

3. Explore Financing Options Strategically

Deciding whether to use internal funds, loans, or equity financing is a critical step in CapEx planning. Businesses must weigh factors like interest rates, repayment terms, cash flow implications, and the depreciation period of the asset.

For instance, financing through debt may free up cash for other priorities but could increase financial risk. A thorough financial analysis helps ensure that the chosen funding method supports the company’s long-term stability.

4. Foster Transparent Communication Across Teams

In large organizations, multiple departments—finance, operations, IT, and management—may be involved in CapEx projects. Establishing clear communication channels ensures alignment and prevents mismanagement.

Tools like dashboards or project management software can centralize critical information, allowing stakeholders to track progress and outcomes in real time. This collaboration fosters accountability and helps ensure that expected business results are achieved.

5. Conduct Scenario Planning and Risk Analysis

CapEx projects are exposed to uncertainties like market changes, regulatory shifts, or economic downturns. Performing scenario planning helps businesses anticipate “what if” situations and prepare alternatives.

For example, if demand projections fall short, can the project be scaled back? Or if financing becomes costlier, can the project still deliver acceptable returns? Scenario planning minimizes risks and ensures that investments remain viable under changing conditions.

6. Leverage Accounting and ERP Software

Technology plays a vital role in managing CapEx efficiently. Using robust accounting or ERP software like Deskera ERP allows businesses to streamline planning, budgeting, and reporting.

Automated tools reduce errors, ensure accurate depreciation tracking, and provide real-time insights into cash flow. This not only improves compliance but also empowers businesses to make data-driven decisions about current and future capital investments.

7. Perform Post-Implementation Reviews

Once a CapEx project is completed, businesses should conduct a thorough review to evaluate its performance compared to initial projections. This includes analyzing whether costs, benefits, and timelines were met, as well as identifying gaps in execution.

These reviews are crucial for organizational learning, as they highlight what worked and what didn’t, ultimately improving the effectiveness of future capital expenditure projects.

In essence, disciplined planning, transparent communication, strategic financing, and technology-driven monitoring are the keys to successful CapEx management. By following these practices, businesses can minimize risks, optimize resources, and ensure that capital investments deliver sustainable long-term value.

How Can Deskera ERP Help You Manage Capital Expenditure (CapEx)?

Managing capital expenditures effectively requires more than spreadsheets—it demands real-time visibility, accurate forecasting, and streamlined approvals. Deskera ERP provides a comprehensive suite of tools that make CapEx management more efficient, transparent, and aligned with business goals. Here’s how:

1. Centralized CapEx Planning and Budgeting

Deskera ERP enables businesses to create detailed budgets for capital projects and track them against actual spending. By centralizing all CapEx planning in one system, decision-makers can easily allocate resources, prioritize projects, and ensure that every investment aligns with long-term strategic goals.

2. Real-Time Financial Tracking

With Deskera’s integrated accounting features, companies gain real-time visibility into capital expenditure flows. This allows CFOs and finance teams to monitor PP&E purchases, asset depreciation, and project-related cash flows directly within the ERP system, ensuring financial accuracy and transparency.

3. Automated Depreciation and Asset Management

Tracking asset depreciation is crucial for accurate CapEx reporting. Deskera ERP automates depreciation schedules, ensuring compliance with accounting standards while eliminating manual errors. Businesses can see the net book value of assets at any time, making financial reporting smoother and more reliable.

4. Workflow Automation for Approvals

Large CapEx projects often involve multiple stakeholders. Deskera ERP supports workflow automation, making approval processes faster and more consistent. This reduces bottlenecks, enforces accountability, and ensures that projects only move forward when they meet pre-defined criteria.

5. Scenario Planning and Forecasting

Deskera’s reporting and analytics tools allow businesses to run “what-if” scenarios to understand the potential impact of capital investments under different market conditions. This empowers leadership teams to make data-driven decisions, assess risks, and adapt CapEx strategies as circumstances evolve.

6. Seamless Integration Across Departments

Capital projects usually touch multiple departments, from finance to operations. Deskera ERP integrates all functions into a unified platform, allowing for smooth collaboration. For example, operations can update project progress while finance tracks expenditure, ensuring all teams stay aligned.

7. Post-Implementation Reviews and Insights

Once a capital project is complete, Deskera ERP provides reporting features to compare projected versus actual outcomes. This helps businesses evaluate ROI, identify cost overruns, and extract lessons for future capital expenditure projects.

Deskera ERP transforms CapEx management from a manual, error-prone process into a streamlined, data-driven strategy that balances growth opportunities with financial discipline.

Key Takeaways

- Capital expenditure (CapEx) refers to the funds businesses invest in acquiring, upgrading, or maintaining long-term assets such as buildings, machinery, and technology. It highlights a company’s commitment to building future value, expanding capacity, and sustaining operations, making it a critical indicator of financial health and growth potential.

- CapEx comes in various forms, including expansion, replacement, maintenance, R&D, and IT/technology investments. Each type plays a unique role—whether it’s fueling growth, upgrading outdated assets, ensuring operational efficiency, fostering innovation, or strengthening digital infrastructure. Understanding these types helps businesses align spending with strategic objectives and long-term value creation.

- Capital expenditures (CapEx) are calculated using the formula: CapEx = PP&E (current) – PP&E (prior) + Depreciation. Understanding this helps businesses measure investments in long-term assets and track how much is being spent on growth-related projects.

- CapEx reflects how committed a business is to growth, modernization, and long-term stability. Higher CapEx often signals expansion and competitiveness, while lower CapEx may suggest cost control or limited resources.

- CapEx plays a vital role in driving business growth, improving efficiency, enhancing competitiveness, and ensuring compliance. It provides the foundation for innovation, customer satisfaction, and long-term profitability.

- Managing CapEx comes with hurdles such as high upfront costs, forecasting risks, regulatory issues, and balancing short-term liquidity with long-term investments. Addressing these challenges requires careful planning and financial discipline.

- Sound project management, clear communication, standardized business cases, scenario planning, and post-implementation reviews are essential best practices. Businesses must also evaluate financing options and leverage accounting software for accurate tracking.

- Deskera ERP simplifies CapEx management through centralized budgeting, real-time financial tracking, automated depreciation, workflow approvals, and advanced forecasting. It also enables cross-department collaboration and post-project reviews, ensuring investments deliver maximum ROI.

Related Articles