Have you ever wondered how some businesses consistently make smart decisions and stay ahead of the competition? The answer often lies in having the right guidance from an experienced business advisor. These professionals provide expert insights, helping companies navigate challenges, optimize operations, and plan strategically for growth. Whether it’s improving financial performance, streamlining processes, or exploring new markets, a business advisor can be the difference between business uncertainty and confident decision-making.

A business advisor is more than just a consultant—they become a trusted partner who understands your business goals, evaluates potential risks, and recommends strategies tailored to your needs. From analyzing financial statements to guiding marketing initiatives, they offer a holistic perspective that business owners might miss while managing day-to-day operations. With their expertise, businesses can avoid costly mistakes and make informed decisions that drive long-term success.

Choosing the right business advisor is crucial. It’s not just about hiring someone with experience or credentials; it’s about finding a professional who aligns with your company’s vision, culture, and objectives. A good advisor will ask the right questions, challenge assumptions, and provide actionable recommendations that lead to measurable results. Understanding what a business advisor does and how to select the right one is the first step toward achieving sustainable growth.

Smart tools like ERP.AI can also assist by automating routine operations, offering real-time insights, and supporting advisors with intelligent data to make faster, more informed decisions.

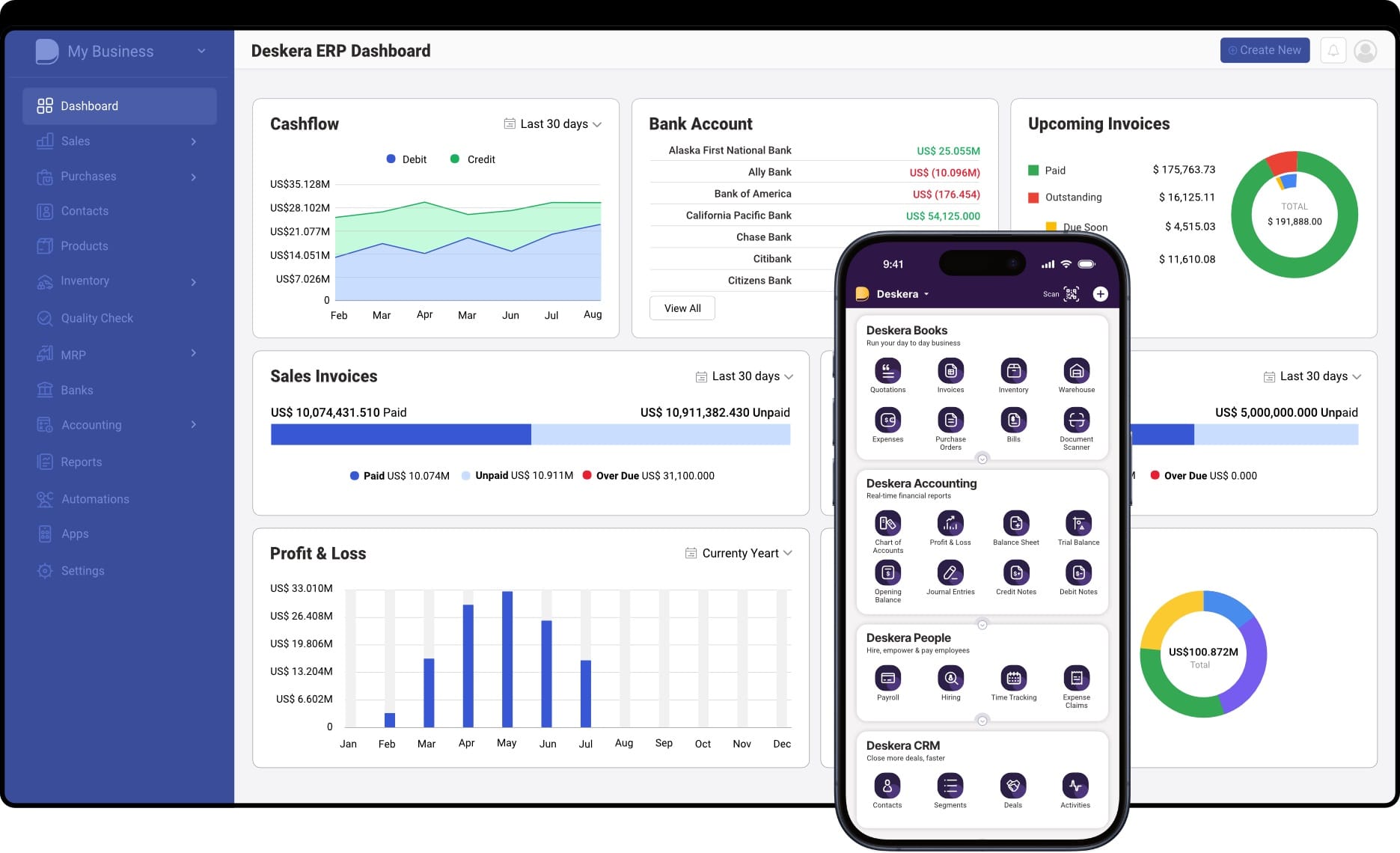

Tools like Deskera ERP can make working with a business advisor even more effective. By providing real-time data on finances, operations, and inventory, Deskera ERP allows advisors to make informed recommendations based on accurate insights. From forecasting cash flow to tracking key performance metrics, this all-in-one platform empowers businesses and their advisors to collaborate seamlessly, make smarter decisions, and accelerate growth.

What is a Business Advisor?

A business advisor is a seasoned professional who provides strategic guidance and expert advice to help businesses achieve their goals, improve efficiency, and stimulate long-term growth. They combine extensive knowledge of finance, marketing, operations, management, and industry trends to offer actionable solutions tailored to each business’s unique needs. Unlike a specialist who focuses on one area, a business advisor acts as a strategist capable of addressing multiple aspects of a company, from operations and marketing to financial planning and risk management.

Business advisors often perform a thorough analysis of a company’s operations, identifying opportunities, potential risks, and areas for improvement. They offer recommendations in areas such as business development, product management, financing, restructuring, and overall management. By doing so, they help businesses make informed decisions, seize profitable opportunities, and plan for long-term success. Essentially, a business advisor serves as an extension of the business owner, bringing fresh perspectives and expertise where it’s most needed.

These professionals can work independently or as part of consulting firms, partnering with a range of clients across industries. They are particularly valuable in helping businesses navigate complex challenges, anticipate future problems, and implement strategies that drive growth. Their role often includes building a network of professional contacts, connecting businesses with resources or opportunities they might not have discovered otherwise.

Ultimately, a business advisor is more than just a consultant—they are a trusted ally who provides external insights, encourages strategic thinking, and supports decision-making processes. By leveraging their expertise, businesses can avoid costly mistakes, remain competitive, and focus on sustainable growth, ensuring long-term success in an ever-changing market.

Key Responsibilities of a Business Advisor

A business advisor wears many hats, providing guidance across multiple areas to help businesses thrive. Their responsibilities go beyond offering advice—they actively analyze, strategize, and support the implementation of solutions that drive growth and efficiency. Some of the key responsibilities include:

1. Strategic Planning and Goal Setting

Business advisors help companies define their vision, set realistic goals, and create actionable strategies. They evaluate current operations and market conditions to recommend long-term plans that align with the company’s objectives. By providing an external perspective, they help business owners make informed decisions that foster sustainable growth.

2. Financial Management and Budgeting

Managing finances effectively is critical for any business. Advisors assess financial health, analyze cash flow, and offer strategies for cost optimization, investment planning, and risk mitigation. Their insights ensure that businesses allocate resources efficiently and remain financially stable.

3. Operational Efficiency and Process Improvement

Business advisors identify inefficiencies in daily operations and suggest ways to streamline processes. They help implement systems, workflows, and best practices that improve productivity, reduce costs, and enhance overall business performance.

4. Market Research and Competitive Analysis

A strong understanding of market trends and competition is essential. Advisors conduct research to uncover new opportunities, evaluate market positioning, and develop strategies to stay ahead of competitors. This ensures that businesses can adapt quickly to changing market conditions.

5. Risk Management and Compliance

Business advisors help companies identify potential risks—financial, operational, or regulatory—and provide solutions to mitigate them. They ensure that businesses remain compliant with laws and industry standards, minimizing the likelihood of legal or financial setbacks.

6. Opportunity Identification and Business Development

Beyond solving problems, advisors discover opportunities that business owners may not have considered. They assist in forming partnerships, exploring new markets, and developing products or services that drive revenue and growth.

7. Leadership Guidance and Mentoring

Advisors often guide business leaders in developing their management and leadership skills. They provide coaching, mentoring, and support in decision-making, helping owners and executives lead their teams more effectively.

8. Technology and Innovation Advice

With the business landscape rapidly evolving, advisors recommend tools, software, and technological solutions that can improve efficiency, reporting, and decision-making. They may suggest platforms like Deskera ERP to integrate operations, accounting, and analytics for smarter business management.

9. Networking and Professional Connections

Business advisors often leverage their extensive networks to connect clients with potential investors, partners, suppliers, or mentors. These connections can open doors to growth opportunities that the business may not have accessed independently.

10. Long-Term Sustainability Planning

Advisors focus not only on immediate growth but also on long-term sustainability. They help businesses anticipate future challenges, adapt to market shifts, and implement strategies that ensure enduring success.

11. Crisis Management Support

When businesses face unexpected crises—financial downturns, operational disruptions, or market shifts—advisors step in to provide critical guidance, helping companies respond effectively and minimize negative impacts.

Types of Business Advisors

Business advisors come in many shapes and specializations, each focusing on different aspects of a company’s operations and strategy. Understanding the types of advisors available can help business owners hire the right professional for their specific needs.

1. Financial Advisors

Financial advisors focus on managing a company’s finances. They provide guidance on budgeting, cash flow management, investment planning, funding strategies, and financial risk mitigation. Their expertise ensures that businesses remain financially stable and make decisions that maximize profitability.

2. Management Consultants

Management consultants specialize in improving operational efficiency and overall business performance. They analyze workflows, identify inefficiencies, and recommend strategies to streamline processes, reduce costs, and enhance productivity. These advisors are particularly valuable for businesses looking to scale or restructure.

3. Marketing Advisors

Marketing advisors help businesses develop effective marketing strategies, boost brand presence, and reach target audiences. They provide insights on customer behavior, competitive positioning, digital marketing, and advertising campaigns, ensuring that marketing efforts align with business goals.

4. Legal and Compliance Advisors

These advisors ensure that businesses comply with laws, regulations, and industry standards. They provide guidance on contracts, intellectual property, employment laws, mergers and acquisitions, and risk management, helping businesses avoid legal pitfalls and liabilities.

5. Industry-Specific Advisors

Some advisors have deep expertise in a particular industry, such as healthcare, technology, manufacturing, or retail. Their specialized knowledge helps businesses navigate sector-specific challenges, regulations, and opportunities, making them ideal for companies looking for targeted guidance.

6. Business Development and Strategy Advisors

These advisors focus on identifying growth opportunities, entering new markets, forming partnerships, and creating long-term strategies. They help businesses expand revenue streams and position themselves competitively in the market.

7. Sustainability and ESG Advisors

With increasing focus on environmental, social, and governance (ESG) practices, sustainability advisors guide businesses in adopting responsible practices. They help companies reduce environmental impact, implement socially responsible strategies, and comply with ESG regulations.

8. Technology and Digital Transformation Advisors

In today’s digital era, technology advisors help businesses integrate the right tools and platforms, including ERP systems like Deskera ERP, CRM solutions, or AI-powered analytics. They ensure that technology supports efficiency, decision-making, and business growth.

Skills of a Business Advisor

A successful business advisor combines knowledge, experience, and a diverse set of skills to guide businesses effectively. These skills allow them to analyze challenges, develop strategies, and provide actionable solutions that drive growth. Below are the essential skills every business advisor should possess:

1. Analytical Skills

Business advisors must be able to analyze financial statements, market trends, and operational data to identify patterns, risks, and opportunities. Strong analytical skills enable them to make informed decisions and provide insights that help businesses grow.

2. Communication Skills

Effective communication is critical. Advisors must articulate complex ideas clearly—whether through reports, presentations, or conversations—so that clients and teams can understand and act on their recommendations.

3. Problem-Solving Abilities

Advisors are often brought in to tackle complex problems. They use critical thinking, creativity, and strategic reasoning to develop innovative solutions tailored to the unique challenges of each business.

4. Industry Knowledge

A deep understanding of the industry, market trends, regulatory changes, and emerging technologies is essential. Advisors stay updated to ensure their advice is relevant and actionable.

5. Adaptability

The business landscape constantly evolves. A great advisor is flexible, capable of adjusting strategies to meet changing conditions, and ready to navigate uncertainty with confidence.

6. Strategic Planning Skills

Business advisors help define long-term goals, create actionable strategies, and align operational efforts with overall business objectives. Strategic planning ensures companies remain focused on sustainable growth.

7. Leadership and Management Skills

Advisors guide business leaders in decision-making, team management, and organizational development. They combine technical, conceptual, and interpersonal skills to maximize the effectiveness of management practices.

8. Financial Management Skills

Strong financial acumen is critical. Advisors assess budgets, cash flow, investments, and risks to help businesses allocate resources efficiently and remain financially stable.

9. Creative Thinking

Innovative solutions often come from thinking outside the box. Business advisors use creative approaches to solve unique problems, develop new strategies, and uncover opportunities that may not be immediately apparent.

10. Negotiation and Sales Skills

Business advisors often facilitate deals, partnerships, or funding opportunities. Skilled negotiation and understanding of sales and marketing principles help them structure agreements favorable to their clients.

11. Time Management Skills

Advisors manage multiple clients and projects simultaneously. Strong time management skills ensure they prioritize tasks, meet deadlines, and maintain high-quality advisory services.

12. Public Relations and Networking

Business advisors leverage professional networks to connect clients with partners, investors, and other opportunities. PR skills help them communicate effectively with stakeholders and enhance the company’s public image.

13. Integrity and Ethics

Trust is central to the advisor-client relationship. A credible business advisor demonstrates ethical standards, honesty, and transparency in all interactions.

Why Businesses Need a Business Advisor

Running a business in today’s fast-paced and competitive environment requires more than just passion and hard work. Business owners are constantly faced with complex decisions, changing market dynamics, financial pressures, and operational challenges.

While internal teams provide valuable insights, having an experienced business advisor can bring a fresh perspective, expert guidance, and strategic solutions that help a company grow sustainably and stay ahead of competitors. Business advisors are essential partners who add value across various aspects of business management.

1. Objective Perspective on Decision-Making

Business advisors provide an unbiased and external viewpoint that is free from internal politics or emotional biases. This objective insight allows business leaders to make informed decisions about expansion, investments, or operational changes. By evaluating risks and opportunities from an outsider’s perspective, advisors help businesses avoid common pitfalls.

2. Expertise Across Multiple Business Areas

Most businesses do not have experts in every function internally. Business advisors bring specialized knowledge in areas such as finance, marketing, operations, human resources, and strategic planning. Their multifaceted expertise ensures that recommendations are well-rounded and applicable to real-world business challenges.

3. Risk Mitigation and Problem Solving

Business advisors identify potential risks—financial, operational, regulatory, or market-related—and create strategies to mitigate them. They help businesses address unexpected challenges and provide actionable solutions to prevent losses or disruptions. Their problem-solving abilities ensure that issues are resolved efficiently, minimizing impact on business operations.

4. Identifying Growth Opportunities

One of the most valuable contributions of a business advisor is uncovering new opportunities that a company may not see internally. This can include exploring untapped markets, forming strategic partnerships, introducing new products or services, or identifying process improvements that boost revenue and profitability.

5. Enhancing Operational Efficiency

Operational inefficiencies can significantly affect a business’s bottom line. Advisors assess workflows, management practices, and systems to identify bottlenecks. By recommending improvements and streamlining processes, they help businesses reduce costs, save time, and enhance productivity.

6. Long-Term Strategic Planning

Business advisors help companies develop and execute long-term strategies. They work with leaders to set realistic goals, align business operations with vision, and plan for sustainable growth. Strategic planning ensures that businesses are prepared for future challenges and opportunities, rather than reacting reactively.

7. Financial Guidance and Resource Optimization

Managing finances is one of the biggest challenges for any business. Advisors assist with budgeting, cash flow management, investment planning, and financial risk assessment. Their guidance ensures resources are allocated effectively, and businesses maintain financial stability while pursuing growth initiatives.

8. Mentorship and Leadership Development

Advisors often act as mentors for business owners and management teams. They provide leadership guidance, coaching, and feedback that improves decision-making, team management, and overall organizational performance. This helps leaders grow alongside their business.

9. Leveraging Technology and Business Tools

In the digital age, technology is a critical factor for business success. Advisors help implement tools such as Deskera ERP to integrate accounting, operations, inventory, and analytics. These platforms provide real-time data, enabling more accurate decisions and efficient collaboration between teams and advisors.

10. Networking and Industry Connections

Business advisors often bring extensive networks of industry contacts, investors, and potential partners. These connections can create opportunities for collaborations, funding, and growth that a business might not achieve independently.

11. Staying Ahead of Market Trends

Advisors monitor market trends, competitor strategies, and regulatory changes. This proactive approach helps businesses adapt quickly, maintain a competitive edge, and capitalize on emerging opportunities before others do.

12. Crisis Management and Contingency Planning

During challenging times, such as economic downturns, supply chain disruptions, or sudden operational crises, advisors provide crucial guidance. They help companies develop contingency plans, respond to emergencies, and minimize negative impacts on operations and finances.

How to Hire the Right Business Advisor

Finding the right business advisor is a critical decision for any company. The ideal advisor not only possesses expertise but also aligns with your business goals, company culture, and long-term vision. Hiring the wrong advisor can result in wasted resources, misaligned strategies, or missed opportunities. The following steps will help you select the right advisor for your business needs.

1. Assess Your Business Needs

Before searching for an advisor, identify the areas where your business needs the most support. Determine whether you require guidance in finance, operations, marketing, strategic planning, technology integration, or overall business growth. Clearly defining your objectives will help you target advisors who specialize in those areas.

2. Evaluate Qualifications and Experience

Look for advisors with relevant experience in your industry and a proven track record of helping businesses achieve tangible results. Review their educational background, certifications, and past client successes. Experience in businesses of similar size or stage can be particularly valuable.

3. Check Compatibility and Communication Style

An advisor should be someone you can work closely with and trust. Evaluate their communication style, approach to problem-solving, and willingness to listen. A strong rapport ensures smooth collaboration and that recommendations are understood and implemented effectively.

4. Verify References and Case Studies

Request references from past clients and examine case studies of their work. This helps you gauge the advisor’s credibility, reliability, and ability to deliver results. Speaking directly with previous clients provides insights into their working style and the outcomes they achieved.

5. Consider Cost vs. Value

Understand the advisor’s fee structure—whether hourly, retainer-based, or project-specific. While cost is important, focus on the value they bring to your business. An experienced advisor may have higher fees but can provide strategies that yield far greater returns than the investment.

6. Look for Strategic Thinking and Problem-Solving Skills

A good advisor should not just provide advice but also demonstrate strategic thinking and problem-solving abilities. They should analyze complex situations, anticipate challenges, and recommend innovative solutions that align with your business goals.

7. Assess Their Network and Resources

Advisors often bring valuable connections that can benefit your business. Check if they have a network of professionals, potential partners, or investors that can support your growth initiatives. A well-connected advisor can open doors to opportunities that would otherwise be inaccessible.

8. Evaluate Technological Knowledge

In today’s business landscape, advisors who understand digital tools and platforms are particularly valuable. An advisor familiar with ERP systems like Deskera ERP can provide insights backed by real-time business data, helping you make informed decisions and streamline operations efficiently.

9. Set Clear Expectations and Goals

Define what you expect from the advisor in terms of deliverables, timelines, and areas of focus. Clear expectations help both parties align and ensure that the advisory relationship produces measurable results.

10. Start with a Trial or Short-Term Engagement

Before committing long-term, consider starting with a trial project or short-term engagement. This allows you to assess the advisor’s approach, effectiveness, and compatibility with your team before making a significant commitment.

How AI Automates and Streamlines Business Operations

From finance and HR to supply chain and customer service, AI-driven tools can handle tasks such as data entry, invoice processing, payroll management, and demand forecasting with high accuracy and speed.

It can also analyze real-time data to detect patterns, optimize workflows, and recommend improvements—leading to faster decision-making and reduced operational costs. In essence, AI not only simplifies day-to-day activities but also builds a more agile and responsive business environment.

How Deskera ERP Can Help You

In today’s fast-paced business environment, having accurate data, streamlined processes, and real-time insights is crucial for making informed decisions. This is where Deskera ERP comes in. As an all-in-one enterprise resource planning platform, Deskera ERP helps businesses integrate key operations, track performance, and collaborate seamlessly with advisors, enabling smarter strategies and sustainable growth.

1. Streamlined Operations

Deskera ERP centralizes core business functions like accounting, inventory management, human resources, and sales. This integration eliminates silos, reduces manual errors, and improves efficiency, allowing business advisors to focus on strategic guidance rather than operational firefighting.

2. Real-Time Financial Insights

With Deskera ERP, businesses can access up-to-date financial data, including cash flow, expenses, and revenue reports. This enables advisors to make accurate recommendations based on current business performance, identify potential risks, and plan effective financial strategies.

3. Improved Decision-Making

The platform offers advanced analytics and reporting tools that allow business owners and advisors to monitor KPIs, analyze trends, and forecast growth. With these insights, advisors can guide companies to make data-driven decisions and implement strategies that maximize profitability.

4. Efficient Collaboration

Deskera ERP enables seamless collaboration between business owners, management teams, and advisors. Shared dashboards, task management features, and automated workflows ensure everyone has access to the same information, fostering transparency and alignment in decision-making.

5. Scalability and Flexibility

As your business grows, Deskera ERP scales with you. Advisors can leverage the platform to support expansion plans, optimize resources, and implement new strategies without the need for multiple disconnected tools. Its flexibility ensures that business processes remain efficient and adaptable to changing needs.

6. Risk Management and Compliance

The system helps track compliance-related tasks, monitor financial transactions, and maintain accurate records. Advisors can use this information to ensure the business meets regulatory requirements and proactively address potential risks.

7. Strategic Planning Support

By providing a clear view of operational and financial performance, Deskera ERP enables advisors to develop long-term strategies and growth plans. With real-time insights, businesses can confidently make decisions that align with their vision and objectives.

Key Takeaways

- A business advisor is a strategic partner who provides expert guidance across finance, marketing, operations, and management to help businesses grow sustainably and make informed decisions.

- Business advisors analyze challenges, identify opportunities, mitigate risks, and provide actionable solutions that enhance operational efficiency, financial stability, and long-term growth.

- Different types of advisors—such as financial, marketing, management, legal, industry-specific, and technology advisors—offer specialized expertise tailored to the unique needs of a business.

- Effective business advisors combine analytical, strategic, problem-solving, communication, financial, and leadership skills to guide businesses through complex challenges and opportunities.

- Business advisors bring an objective perspective, uncover growth opportunities, mitigate risks, enhance efficiency, and provide long-term strategic planning that helps businesses stay competitive and sustainable.

- Hiring the right advisor involves assessing business needs, evaluating experience, checking compatibility, verifying references, and setting clear expectations to ensure a productive and results-driven partnership.

- Deskera ERP supports business advisors by providing real-time data, streamlined operations, advanced analytics, and collaboration tools, enabling data-driven decisions, improved efficiency, and sustainable growth.

Related Articles