Four levels of plans are available in the Marketplace, namely Bronze, Silver, Gold, and Platinum. Each of these categories covers a different percentage of your expenditure. People find it very convenient to shop for plans when they are segregated into different types.

Individuals who wish to purchase a plan covering 90% of their bills can opt for the Platinum plan. It is the most expensive plan but covers almost all the major bills. On the other hand, the Bronze is the least expensive and covers only about 60% of your medical bills. There is much more to learn about all these health insurance, and we shall be learning about them shortly.

For everyone keen to learn and understand these plans, this article will help you in the process. Here is all that we will be covering in this post:

- What is the Marketplace?

- What are the Metal tiers?

- What do the health insurance metal levels mean?

- What does metal tier cost sharing imply for you?

- How does Actuarial value work?

- What are the Costs you actually pay?

- How do you sign up for a metal tier plan?

- Top 5 Considerations when Shopping at Marketplace

- FAQs

- How can Deskera Help You?

- Key Takeaways

What is the Marketplace?

The Health Insurance Marketplace reopened for operation on November 1, 2015, as part of the Affordable Care Act (ACA) or Obama Care. Marketplace provides the buyers and their families with all the available options and lets them know about the different costs at which the plans are available.

They can compare and choose the plan that best suits their requirements on a single page. Citizens of thirteen states can purchase plans from their Marketplace. Other states partner with the federal body (HealthCare.gov) and are governed by it. From the chart presented here, you can collect all the information about your preferred plan pertaining to your location and state.

Apart from knowing about the best plans, the Marketplace also enables you to learn about your qualification for federal subsidies. It is crucial to know that these subsidies are available only through the Marketplace. Besides, the subsidies can be instrumental in letting you avail a type of coverage.

It is a simple process to open an account and fill out an online application on the relevant state’s portal during open enrollment. Marketplace, thus, enables you to view all the existing options and check if you are eligible for any subsidies.

However, you must note that irrespective of the state of your residence, you can choose a health plan based on how you wish to divide the bills. This is where the four tiers or the metal levels come into the picture. We shall be discussing them in the upcoming sections.

What are the Metal Tiers?

The exchange or the marketplace health plans are segregated into four categories depending on how you wish to split your health care expenses. These categories are referred to as the tiers: Platinum, Gold, Silver, and Bronze. This section helps us understand the difference between the Bronze, Silver, Gold, and Platinum health plans.

Cost sharing is a phenomenon that lets you and your insurer split the costs of your health coverage. The difference between these metal tiers or classes is the way in which the insurance companies split bills with the customers. Each tier has a cost split that is averaged out. The typical cost-sharing breakdown that consumers and insurers will pay is listed in the table below.

Platinum Plan

As the table indicates, the Platinum plans will cover you for the maximum amount. However, these plans will be necessary for people who have a lot of medical expenses lined up. So in other words, not many people would require these plans.

However, if affordability is not an issue and there are a lot of medical services you are seeking, then Platinum is the way to go.

Gold Plan

Although this plan is premium, the benefits may justify the prices. It's dependable, cost-effective, and keeps you protected. The Gold plans offer the best solutions for people who are aware that they will have various healthcare needs, such as pregnancy and more rigorous health management. Monthly premiums will be higher, but your deductible will be lower. As a result, you'll spend less on any procedures or illnesses.

Silver Plan

These plans are more comprehensive and will allow you to travel beyond state boundaries, but they aren't ideal for every situation. Silver plans often offer a lower deductible and out-of-pocket limit compared to the Bronze plans. They encompass all prescription medicines as well as the majority of doctor's appointments.

If you are someone who requires only preventive care instead of the more serious medical needs, then Silver plans could prove to be immensely advantageous.

Bronze Plan

If you are someone who requires to see the doctor once in a blue moon, then the bronze plan could just be the right option for you. Something like a yearly check-up or a prescription drug does not need you to have a heftier plan.

Bronze plans allow you to keep a minimal coverage at the lowest premiums. However, if you need anything beyond primary preventive care, then your expenses could rise as you would be paying entirely from your side.

While most people opt for a bronze plan, you must introduce yourself with the term out-of-pocket maximum. It is better to know what you are signing up for than regret it later.

What do the health insurance metal levels indicate?

Most health plans available through your state's Marketplace are categorized into four metal tiers. Each metal type signifies how supportive and considerate the coverage will be. As the metal value increases, the efficacy of the plan also increases in terms of offering coverage. Bronze represents the lowest level of coverage whereas Platinum is the most significant level of protection.

There is a fifth type of plan that the companies often provide. It is called the Catastrophic plan.

What is a Catastrophic plan?

The catastrophic plan is a plan that covers a tiny number of primary care visits each year. Usually, they cover at least 3 primary care visits before the deductibles are met. Beyond this, the coverage is available only for people under the age of 30. They are offered at very low premiums and high deductibles.

Catastrophic plans can provide respite in emergencies such as an accident or an injury. People over the age of 30 can avail of this plan only when they have an affordability exemption.

If you are eligible for a premium tax credit, opting for a Bronze or Silver plan could be fruitful.

Deductibles in the case of a catastrophic plan are incredibly high. Once you have paid the deductibles, the insurer pays the remaining amount without any copays or coinsurance.

What does metal tier cost sharing imply for you?

The health insurance metal table reveals the percentages shared between you and the insurer. This way, it makes it easy to analyze the best-suited plan for you and your family. The category of plan that needs you to pay more money from your pocket would not be a wise option if you need medical facilities more frequently. However, they are a good option for you if you are sure that you will not require medical facilities too frequently.

The cost-sharing percentages do not imply the actual cost you pay for the medical expenses. In fact, they indicate the average cost that your insurer pays throughout the year for those services. This percentage is called the Actuarial Value. We have discussed the details of the actuarial value in the next section.

The effective costs that you shall pay over the year depend greatly on your insurance plan and the services you have utilized. We can understand this through an example.

Let us assume you have a Bronze insurance plan, so you will be covered for 60% of your medical care. This will be a good choice if you do not have too many medical visits. Therefore, you will be paying for 40% of the medical expenses you incur.

However, if you have an ailment requiring frequent visits to the physician, this plan may not be the ideal choice. In that case, opting for a Gold or a platinum plan will be a wiser decision.

How does Actuarial value work?

The percentage of total average expenditures that a health insurance plan will pay for covered benefits for a year is called actuarial value.

The Affordable Care Act mandated that plans begin grouping themselves according to pre-determined actuarial values of 60%, 70%, 80%, and 90%. This segregation or grouping was done to make it easier for customers to analyze and evaluate the plans based on their requirements. Large group plans, which the employers mostly offer, are exempt from the tiers; however, they must have an actuarial value of 60%.

To develop the actuarial values, the insurance companies compute and add up all of the possible expenses that a customer will be paying. These costs include copays, deductibles, and coinsurance.

The actuarial value of a plan, on the other hand, is just the average amount you will pay. You may pay a higher or smaller percentage of your total charges. Your real expenditure will vary depending on your plan and the services you utilize throughout the year.

What are the Costs you actually pay?

So far in the article, we have understood that while you may have an insurance plan, there is a certain amount that you will have to bear from your own pocket. The amount may vary based on the kind of insurance plan you have chosen. For avoiding any surprises at the end of the process, it is essential you understand these costs and ensure you check the details of your plan closely.

This section will take you through the prices that you will be paying.

Premiums

The monthly installments or the amounts you pay to keep the insurance coverage activated are called the premiums. What you pay as premiums depends on the type of plan you choose. The Bronze plans have the lowest premiums, though.

It must be noted that the lower premium plans will lead you to pay the maximum amount from your pocket before the insurance plan takes over.

Copays

The flat sum that you pay from your pocket every time you avail of specific health services is called a Copay. So, from the table, your copays will be the highest when you select the Bronze plan.

Deductible

The amount paid upfront from one’s own pocket before the insurance company starts to pay for the availed medical services is called a deductible. For a better understanding, assure your deductible to be $2,500. This implies that you will be paying $2,500 before your insurance plan takes over and pays for your medical expenses.

Of all the metal tiers, Bronze is the plan that requires you to pay the highest amount of deductible; and Platinum has the lowest. In other words, you will pay the maximum out-of-pocket in the Bronze plan and the minimum in the Platinum.

Coinsurance

Once you have hit your deductible, your insurance company may still not pay all your bills, and you may have to pay a percentage of that amount. This amount is referred to as coinsurance.

Example: If you have subscribed for 20% coinsurance, you will be paying 20% of each of your medical expenses after your deductible is exhausted. Following this, your insurance company pays the balance of 80%.

Out-of-pocket maximum

We know that your insurance company steps in once you have paid a certain amount or the threshold amount. This amount is known as the out-of-pocket maximum. The out-of-pocket is the highest for the Bronze plan, as we know by now.

Types of Health Insurances

As we know, different types of health insurance provide various kinds of services and have different levels of coverage. Let's see the most common types of health insurance:

- Health maintenance organizations (HMOs)

- Exclusive provider organizations (EPOs)

- Preferred provider organizations (PPOs)

- Point-of-service (POS) plans

Speaking of health insurance, you have a few alternatives. However, if you are unsure about which qualified plan is best for you, below is a brief description of each of these.

How do you sign up for a metal tier plan?

An Open Enrollment Period is a time when you can purchase and sign up for the metal tier plan of your choice.

What is an open enrollment period?

The open enrollment period allows you to buy the health plan for the next year. The open enrollment period was established to ensure that the health insurance mandate was enforced. Despite the fact that the requirement is no longer in effect, consumers who purchase health insurance through the Marketplace must wait until this period to do so.

The Obamacare open enrollment period generally runs from November 1 to December 15, but because of the coronavirus outbreak, the Biden Administration has prolonged the 2021 open enrollment period to January 15.

If you want to purchase health insurance outside of open enrollment or beyond the time limit, then you will have to qualify for Special Enrollment. For someone to qualify and be eligible, it is vital they undergo QLE or Qualifying Life Experience. The QLE refers to major occurrences changes in your life such as marriage, a new employment opportunity, birth, etc.

Top 5 Considerations when Shopping at Marketplace

Before setting out on your journey of selecting a metal tier at the Marketplace, here are some important considerations that can be helpful in the long term:

Expensive Plans pay a higher portion of your medical bills

You must understand that your premiums will be the highest in the case you have selected a higher-priced plan. In return, your plan will be to pay a higher portion of the medical bills or services you have taken.

All Marketplace plans cover you for the 10 essential health benefits prescribed by ACA

The plans differ on the basis of the plan level, and therefore, you will be splitting the cost according to the level of the plan selected. Regardless of the plan you have selected, all the health plans offer you the same essential benefits. All the plans also let you obtain vital medical care facilities.

So, whether it is your annual check-up, routine sonographies, or getting an emergency room, all the plans cover you for these facilities.

Plans in the same metal level may exhibit different coinsurance and deductibles

You must know at the time of signing up for a tier that plans in the same metal tier may have different deductibles and coinsurance. So, assuming you have signed up for a plan in the Gold tier, you may have different deductibles and coinsurance amounts but the same out-of-pocket amount.

It is recommended you read all the mentioned guidelines closely so that you know the tentative amounts you would be paying later.

You may receive financial help for buying a health plan

If you are looking to obtain financial help for purchasing a qualified health plan, then federal financial assistance from the Federal government can step in help.

Copays to your rescue

As most health plans have copays, you can relax and count on them. While the copays vary from one plan to the other, it is still great to share the bills rather than paying out-of-pocket altogether.

FAQs

Like any other topic, the topic of the metal tier includes a lot of questions that frequently cause trouble. This section addresses those questions.

Q: Why are health plans designated by different metals?

A: The metal signifies how expensive or generous a certain plan is going to be. Platinum is the most expensive, which implies a plan with higher premiums, whereas Bronze being the cheapest metal on the list, implies a cheaper plan (a plan with lower premiums).

Q: How can I know which tier a plan belongs to?

A: Most of the time, the plan’s name carries the information about the tier to which it belongs. So, be cautious and attentive towards the name of the plan. If it does not carry the name, check with the company.

How can Deskera Help You?

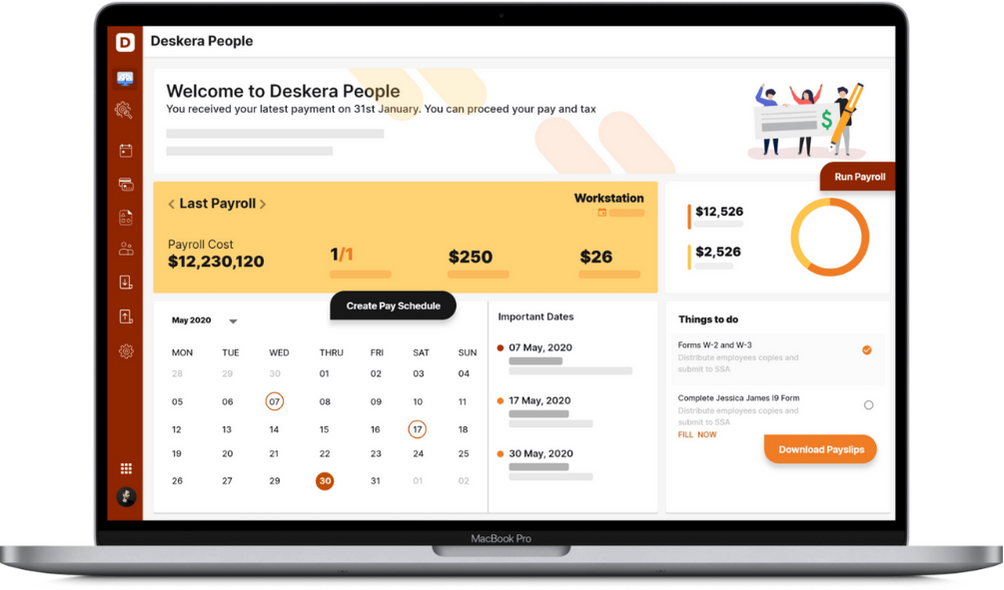

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

The article was aimed at clearing our doubts and understanding the difference between Bronze, Silver, Gold, and Platinum health plans. The key points from the article are as follows:

- Four levels of plans are available in the Marketplace, namely Bronze, Silver, Gold, and Platinum. Each of these categories covers a different percentage of your expenditure

- The Health Insurance Marketplace reopened for operation on November 1, 2015, as part of the Affordable Care Act (ACA) or Obama Care

- Marketplace provides the buyers and their families with all the available options and lets them know about the different costs at which the plans are available

- Apart from knowing about the best plans, the Marketplace also enables you to learn about your qualification for federal subsidies. It is crucial to know that these subsidies are available only through the Marketplace

- The exchange or the marketplace health plans are segregated into four categories depending on how you wish to split your health care expenses. These categories are referred to as the tiers: Platinum, Gold, Silver, and Bronze

- Cost sharing is a phenomenon that lets you and your insurer split the costs of your health coverage

- The Platinum plans will cover you for the maximum amount. However, these plans will be necessary for people who have a lot of medical expenses lined up

- The Gold plans offer the best solutions for people who are aware that they will have various healthcare needs, such as pregnancy and more rigorous health management. Monthly premiums will be higher, but your deductible will be lower

- Silver plans often offer a lower deductible and out-of-pocket limit compared to the Bronze plans. They encompass all prescription medicines as well as the majority of doctor's appointments

- Bronze plans allow you to keep a minimal coverage at the lowest premiums. However, if you need anything beyond primary preventive care, then your expenses could rise as you would be paying entirely from your side

- The catastrophic plan is a plan that covers a tiny number of primary care visits each year. Usually, they cover at least 3 primary care visits before the deductibles are met. Beyond this, the coverage is available only for people under the age of 30

- The cost-sharing percentages do not imply the actual cost you pay for the medical expenses. In fact, they indicate the average cost that your insurer pays throughout the year for those services. This percentage is called the Actuarial Value

- The Affordable Care Act mandated that plans begin grouping themselves according to pre-determined actuarial values of 60%, 70%, 80%, and 90%

- Premiums, Copays, Deductibles, Coinsurance, Out-of-pocket maximum are some of the costs the insured person needs to pay in the process of utilizing a health plan

- An Open Enrollment Period is a time when you can purchase and sign up for the metal tier plan of your choice

- The open enrollment period allows you to buy the health plan for the next year. The open enrollment period was established to ensure that the health insurance mandate was enforced. It is not in effect but the consumers who purchase health insurance through the Marketplace must wait until this period to do so

Related Articles