Employers and employees, both alike have questions about ICHRA. What exactly is it and how each one benefits from it?

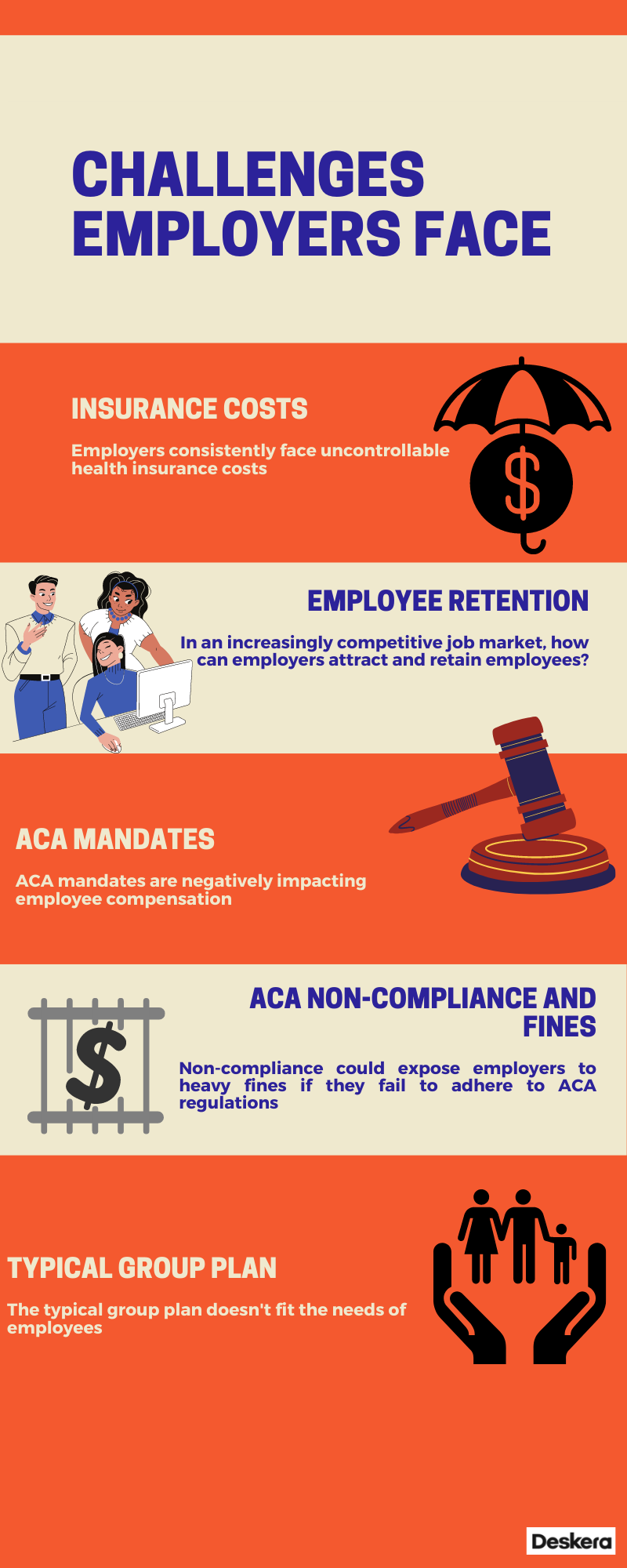

There are numerous obstructions and challenges that employers face today when it comes to insurance. Insurance growing expensive by the day, retaining the employees, and many such issues bother the employers.

Health Reimbursement Arrangement (HRAs) were not allowed to cover individual health policies after the Affordable Care Act (ACA) was passed in 2011. A QSEHRA (Qualified Small Employer HRA) would be available to only small employers in 2017 to assist their employees in covering individual policies.

So, what could be the best bet? What should be the employer’s choice so that they do not find it too expensive, plus keep the employees happy and secured as well?

It was only in 2019, that the employers were offered the option of offering HRAs that can cover individual policies under the Individual Coverage Health Reimbursement Arrangements (ICHRAs).

Let’s dive deeper to know more about ICHRA along with these points:

- What is an HRA?

- What’s an ICHRA - Individual Coverage HRA plan?

- What are ICHRA Benefits?

- What are ICHRA Rules?

- How does ICHRA work?

- Which organizations can offer an ICHRA?

- Which employees are eligible for ICHRA?

- ICHRA Vs. Other HRAs

- What does an ICHRA cover?

- Is ICHRA considered income?

- Can the employer offer ICHRA and group plans?

- FAQs

What is an HRA?

An HRA or the health reimbursement arrangement is an employer-funded benefit plan allowing participants to pay for approved healthcare expenses. An Individual Coverage HRA is one among the many categories of Health Reimbursement Arrangement plans.

Excepted Benefits HRA (EBHRA), Group HRA, Retiree HRA, and Qualified Small Employer HRA( QSEHRA) are some of the other categories of HRA that the employers may offer.

What’s an ICHRA - Individual Coverage HRA plan?

Since 2019, employers have had the option of providing an HRA that covers non-group policies. These non-group policies are called ICHRA or Individual Coverage HRA.

Simply put, ICHRA is a federal regulation that gives employers the option to offer their employees an allowance of tax-free money per month to purchase health insurance tailored to their particular needs.

Along with providing for out-of-pocket expenses, ICHRA also provides direct support to help businesses with 50 or more employees comply with the Affordable Care Act or ACA.

All sizes of businesses are permitted to offer the benefit, so long as employees do not choose between a group insurance plan and the ICHRA. The employer may have more control over how much they can reimburse an employee with these programs. This means that the employers can now choose who to offer and how much to offer based on factors like their own expenditure limits and the various employee classes.

As a result, even large companies can use ICHRAs to satisfy their ACA insurance mandates, as long as they make enough contributions so that their employees can afford to purchase individual coverage.

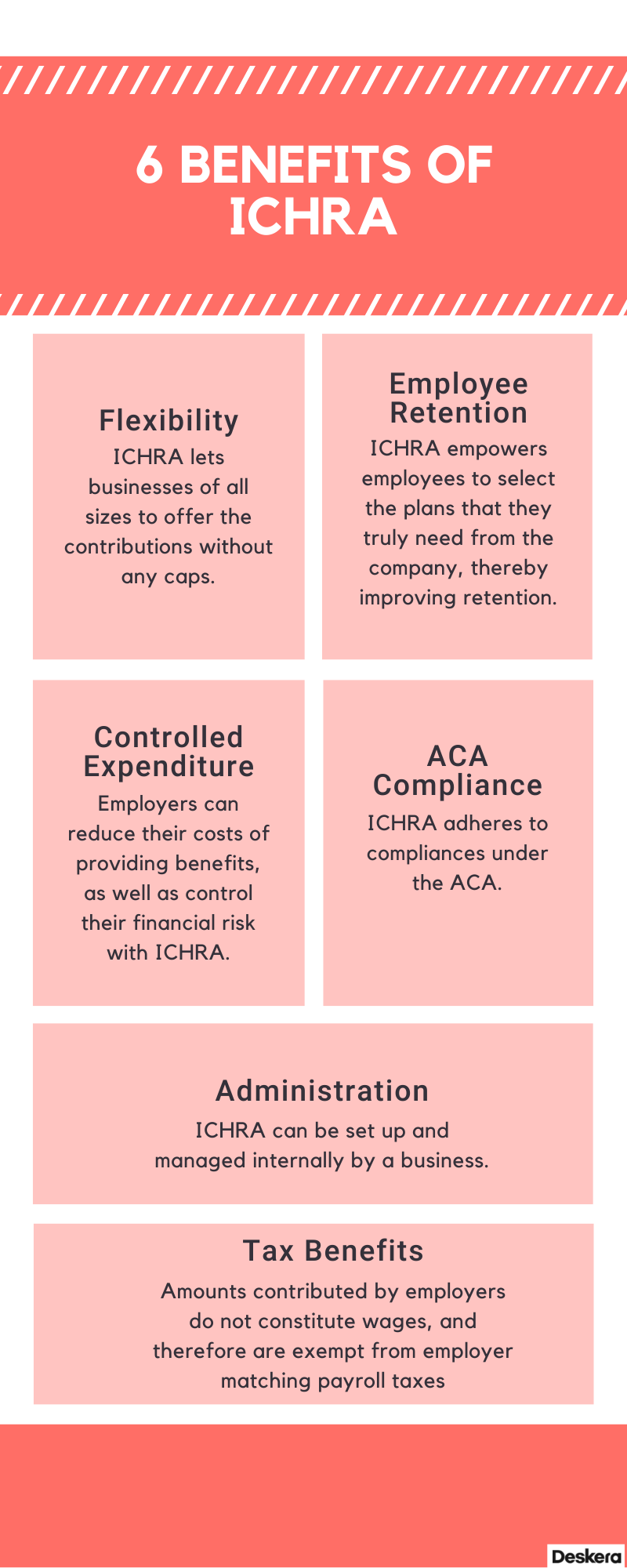

What are ICHRA Benefits?

ICHRA benefits employers and employees in several ways. Let's learn about the benefits in this section:

Flexibility

The best part about ICHRA is that businesses of any size can now offer any amount they want to contribute without any caps. They can also select who and how much to provide based on the employee class. This kind of flexibility was not available earlier to the employers.

Employee retention

Earlier when the insurance plans came in a single size (or as a standard plan for all) irrespective of the needs and requirements of the employees, they didn’t meet anyone’s expectations. Now, when employees come from various walks of life, they have varying needs; some need an HRA for themselves, some want their family also to be covered; and therefore, it becomes essential to provide them with a custom-made plan. This is now possible with ICHRA which allows the employers a lot of flexibility; thereby enhancing employee retention.

ACA Compliance

There are various ACA mandates that ICHRA complies with. It takes into account the components such as geographic location and employee age along with their income to estimate their overall affordability. The ICHRA benefit is only available to employees who have individual market health coverage. This, in turn, implies ACA compliance.

Controlled Expenditure

Employers can now take charge of their financial risks and expenses while looking to provide benefits to their employees. With the norm of a year-over-year increment in the premiums, ICHRA lets the employers choose the amounts they want to offer, irrespective of how large or small the amount is. They are free to offer an amount they are comfortable with. They can now have a predetermined reimbursement limit.

Tax Efficient

There are multiple advantages ICHRA offers in terms of tax benefits.

- As a result, the reimbursement amounts are not wages or salaries and are beyond the scope of being taxable. This works as an advantage for both, the employer as well as the employee

- Moreover, these reimbursements are qualified business expenditures as they are being used for covering the health and welfare of the employees

- Furthermore, the employee is entitled to pretax deductions for amounts owed above what the employer contributes. A company that offers this option may allow the whole individual policy to be tax-free

Administration

An excessive amount of effort goes into managing the businesses' health plans. With ICHRA, however, businesses can manage it internally and conveniently. Working with an ICHRA administrator will provide you with a favorable outcome if you're looking to eliminate record-keeping worries, manage constantly changing ICHRA requirements, or protect your privacy. A dedicated ICHRA administrator can also introduce your employees to the new ICHRA platform and answer their questions.

What are ICHRA Rules?

Let's now learn about the ICHRA rules and guidelines which must be strictly adhered to:

- Employees of an organization can receive ICHRA contributions from their employer only

- Purchasing items that the IRS does not approve is considered taxable income and must be reported on your tax return

- The employers can contribute varying amounts to different classes of employees in their organization including full-time, part-time, seasonal, salaried, and hourly employees

- Companies can offer group insurance to some classes of employees and ICHRAs to other classes of employees. ICHRA is for the class of employees that are not covered by the group plan

- Depending on the employee's age or family size, employers can vary contributions within a class

- With ICHRA, healthcare plan premiums can be paid which is not possible in the case of HSAs (Health Savings Account) and FSAs (Flexible Spending Account or Arrangement)

- A company that offers an ICHRA cannot offer a Qualified Small Employer HRA (QSEHRA) or an Excepted Benefits HRA (EBHRA)

- Losing individual health coverage disqualifies you from applying for an ICHRA

How does ICHRA Work?

Employers offer an ICHRA to employees as a monthly tax-free allowance. They then purchase the individual health insurance they want. Following this, the companies reimbursed the purchase amount up to their allowance amount.

An ICHRA is a health reimbursement settlement that is integrated into an individual health insurance policy. ICHRAs are available to organizations of any size and it has no caps on the allowance amounts. Additionally, it allows employers to assign different amounts to different categories of employees.

Here's a breakdown of the ICHRA's workflow:

- Employers determine the allowance

- Employees purchase healthcare products/services

- Employees submit documentation

- Employers review documents and reimburse

Employers determine the allowance

Under an ICHRA, employers set aside a monthly allowance of tax-free money for their employees to spend on individual health insurance and any other healthcare expenses. The amount of allowances is not capped. An employer may offer different amounts of allowances to different types of employees, including the following:

- Full-time

- Part-time

- Seasonal

- Salaried

- Hourly

- Temporary Staff in Staffing Companies

- Staff employed under Collective Bargaining Agreements

- Employees on a waiting list

- Employees who work outside the country

- Any combination of two or more of the above

Employees purchase healthcare products/services

Employees buy healthcare products and services based on their personal requirements. This also includes individual health insurance policies. For a complete list of expenses that an HRA covers, IRS publication 502 can guide you.

Submitting documentation of the expenses

After the expenditure, the employees must submit all the receipts and proof to the employer. All bills and explanations of the benefits of the insurance firm are also included.

Employers review and reimburse

Having reviewed the documents and verifying them for accuracy, the employer reimburses up to the limit of their allowance amount. It must be known that these reimbursement amounts are tax-free for both the employees as well as the businesses.

A significant point to know here is that the ICHRA is only available to employees and their families with qualified individual health insurance plans. In the case where the employees or their families lose the individual coverage, they shall not be eligible to receive reimbursements further.

Another significant point is that ICHRA has restrictions on premium tax credits. The employee is no longer eligible for premium tax credits if he or she participates in the ICHRA. Due to this, employees may choose not to participate in the ICHRA if their allowance amount is low enough for any policy to be considered unaffordable and not provide the minimum value required by the ACA.

Which Employees are eligible for ICHRA?

ICHRA requires employees to have individual health insurance coverage. Coverage options include on-exchange or off-exchange policies, Medicare Parts A and B, and Medicare Part C. Employees can be covered either by their own policy or through a family member's policy.

Employers may also extend eligibility to their employees' spouses and dependents as long as they meet the same qualifications. They can determine the amount of contributions based on the class of the employees.

- Full-time employees: The employees that work as permanent employees of the firm. They complete the stipulated number of hours per week to fulfill the criteria to be called permanent or full-time employees

- Part-time employees: Employees who have lesser number of hours as compared to the full-time employees, but work for the dedicated number of hours for a part-time employment

- Seasonal employees: These are workers who are hired for a short period of time

- Temporary employees working for a staffing firm: Though they work temporarily for the organization, these employees are formally employed by a staffing firm

- Salaried employees: These employees are paid annually and are not entitled to overtime

- Hourly employees: These are people who are paid by the hour and have the possibility of earning overtime

- Employees covered under a collective bargaining agreement: They have a signed agreement between the company and their union regarding terms and conditions of employment and other related aspects

- Employees in waiting period: Employees currently in a waiting period for health benefits are in this category. Generally, employers can implement a 90-day waiting period

- Employees working abroad: They are based outside the United States

- Based on the rating area: They live outside of the rating area of individual health insurance for the organization

- Combining two or more classes: Employers can also combine two or more of the classes explained above

Which Organizations can offer an ICHRA?

Organizations of all sizes can provide ICHRA. However, to be able to offer ICHRA, the business must refrain from offering QSEHRA or other HRA.

This is to say that the organization can offer a group health insurance policy but can’t offer both ICHRA and a group insurance policy at the same time to the same class of employees. For clearer understanding, a company that offers ICHRA to its part-time employees and group health plan to its full-time employees; however, they cannot offer both ICHRA and group plan to their full-time employees.

ICHRA Vs. Other HRAs

To assess which HRA will work the best for your business, you must understand understand the basic differences between ICHRA and other HRAs. Here’s a section that provides you the differences between ICHRA, Qualified Small Employer Health Reimbursement Arrangement (QSEHRA), and Group Coverage Health Reimbursement Arrangement (GCHRA). This will help you have a piece of summarized information to gauge the perfect HRA you need:

Limitations on the Size of the Business

Employee Eligibility

Limitations on the Allowance Amount

Group Policy Prerequisites

Coordination of premium tax credits

FAQs

Let’s take a quick look at some of the most commonly asked questions.

Q: What are IRS-approved healthcare expenses under ICHRA?

A: Some of the eligible expenses are stated as follows:

- Visit the family doctor, dental and vision facilities, hospital services

- Medicare A if you are not covered under Social Security

- Medicare B and D

- Drug addiction or alcohol addiction treatment

- Nursing services

- Eyeglasses, hearing aids, crutches, and many such healthcare products are included.

Referring to the complete list of eligible healthcare products on the IRS publication 502 page can give you a clearer idea.

Q: Is ICHRA considered Income?

A: ICHRA reimbursements are not observed as employee wages and therefore, it is not considered as an income.

Q: Do I still qualify for premium tax credits if I use an ICHRA?

A: No. You cannot collect premium tax credits if you are an employee covered under ICHRA. However, there are some exceptions.

Q: What is an ICHRA's affordability calculation?

A: For health insurance to be considered affordable, it must not exceed 9.78% of a worker's household income.

Q: Is it possible to modify the allowance amount after launch?

A: Like a traditional group health insurance plan, the ICHRA sets the benefit design for the entire year. Employees' decision to opt in or out of ICHRA's benefit design is directly impacted by the allowance amount.

Employees would have to recalculate the affordability of the benefit if the allowance amount were to change, which would require them to opt in or out again. Individual coverage HRAs may not provide multiple opportunities for participants to opt in or out of the benefit throughout a plan year.

Conclusion

We must understand that the ICHRA funds do not belong to the employees although they can use them when needed. Yet, if there are any unused funds, they would remain with the employer. If your company's plan allows it, you may be able to carry over to the next year.

You must maintain a record of all the details and documentation. File your claims right in time without causing any delay. All these steps will help you get the best out of your ICHRA plan.

From the employer’s perspective, we have seen how ICHRA could prove to be advantageous. From permitting flexibility to saving considerable numbers of dollars, employees must also recognize how ICHRA encompasses multiple gains.

How can Deskera Assist You?

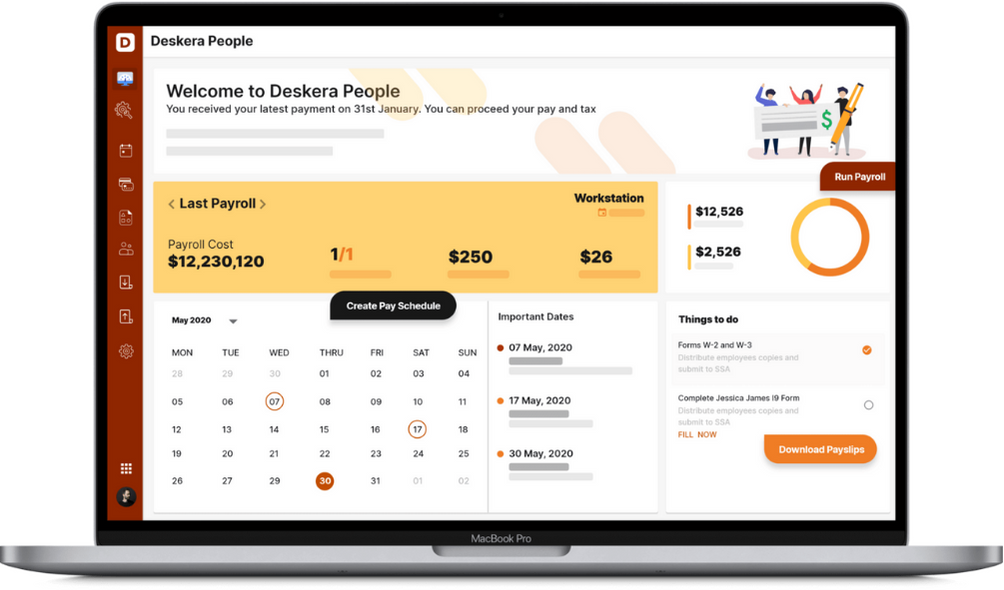

Deskera People is a software that lets you manage payroll, leave, attendance, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

The key points from the article will help you refresh what we have seen:

- An HRA or the health reimbursement arrangement is an employer-funded benefit plan allowing participants to pay for approved healthcare expenses

- ICHRA is a federal regulation that gives employers the option to offer their employees an allowance of tax-free money per month to purchase health insurance tailored to their particular needs

- Along with providing for out-of-pocket expenses, ICHRA also provides direct support to help businesses with 50 or more employees comply with the Affordable Care Act or ACA

- All sizes of businesses are permitted to offer the benefit, so long as employees do not choose between a group insurance plan and the ICHRA

- This means that the employers can now choose who to offer and how much to offer based on factors like their own expenditure limits and the various employee classes

- Flexibility, tax benefits, controlled expenses, employee retention, ACA compliance are some of the benefits of ICHRA

- Employees of an organization can receive ICHRA contributions from their employer only

- Purchasing items that the IRS does not approve is considered taxable income and must be reported on your tax return

- Companies can offer group insurance to some classes of employees and ICHRAs to other classes of employees

- A company that offers an ICHRA cannot offer a Qualified Small Employer HRA (QSEHRA) or an Excepted Benefits HRA (EBHRA)

- Losing individual health coverage disqualifies you from applying for an ICHRA

- Employers determine the allowance for ICHRA fund after whicih the employees purchase health products. After the purchase, employees submit the proof or documentation and obtain reimbursement once the employer approves

- Organizations of all sizes can provide ICHRA but must refrain from offering QSEHRA or other HRA

- ICHRA reimbursements are not observed as employee wages and therefore, it is not considered as an income

- You cannot collect premium tax credits if you are an employee covered under ICHRA. However, there are some exceptions

- For health insurance to be considered affordable, it must not exceed 9.78% of a worker's household income

Related Articles