Bad debt expenses in the United States climbed by $617 million between 2015 and 2018 to roughly $56.5 billion, according to a recent research. However, inflation may be to blame rather than a lack of ability to collect.

If you own a firm or run a small business, you should offer a variety of payment options to your customers. Some buyers may be eager to pay in full for an item, while others may ask for payment in instalments. These flexible payment methods help to increase the number of customers who are prepared to buy your products again.

Instalments or debt are one of the most prevalent payment methods. An individual who has been sold items on credit is expected to pay the agreed-upon sum. If this does not occur, the seller will most likely lose money.

Table of contents

- What Is a Bad Debt Expense?

- Why Keep Track of Bad Debt Expense?

- How to write off your accounts receivables immediately?

- How do you know whether it’s time to write a bad debt off as uncollectible?

- Accounts Receivable: What Is It and Why Does It Matter?

- Finding the Bad Debt Expense

- How to Analyze Accounts Receivable?

- Understanding the Need for Financial Statements

- Which Financial Statement Is the Most Valuable to Shareholders?

- What Can You Learn From Financial Statements?

- How Is the Bad Debt Expense Recorded?

- Key Takeaways

What Is a Bad Debt Expense?

A bad debt expense is a financial transaction that your business records in its books to account for any bad debts it has given up trying to collect.

If you follow accrual accounting standards, you just have to report bad debt expense. Terrible debts are still bad if you apply cash accounting rules, but there's no income to reverse with a bad debt expenditure transaction because the bad debt was never recorded as revenue in the first place.

Make sure your books accurately reflect what's going on in your company and that your net income doesn't look to be bigger than it is. If you want to reduce your tax burden and avoid paying taxes on earnings you never made, accurately recognising bad debt expense is critical.

As previously stated, bad debt expense refers to the amount you have given up trying to recover from the buyer. As a result, a bad debt expense is a financial transaction you record in your accounting records to reflect all of the bad debts you've accumulated while selling your items.

Because some accounting rules must be followed, bad spending will not always be recorded. Only accrual accounting standards can be used to record the bad debt expense. However, if you use different accounting procedures, this does not indicate the debt is not bad.

If you follow the cash accounting concept, for example, it is not necessary to report the debt as an expense because the money was not recorded as revenue. As a result, there will be no need for a bad debt expense because there will be no reversal. A bad debt expense is incurred to reverse income that was recorded during the product's sale.

Why Keep Track of Bad Debt Expense?

You can receive a false idea if your company's income appears to be bigger than it is. Many businesses have incurred significant losses as a result of this period.

For example, a corporation may assume that it is making significant sales and, as a result, cease to be active in its marketing initiatives. This means that its items will not reach as many customers as projected, and the company may lose money.

Additionally, the amount of tax paid is determined by the company's revenue. If the company makes a lot of money, it will have to pay a lot of taxes. You don't want your company paying taxes on profits it doesn't have.

Keeping track of bad debt expense will also assist businesses in avoiding similar difficulties in the future. For example, if a customer refuses to pay owing to a disagreement over the product's quality, the company will find it simple to avoid bad debt expense in the future.

How to write off your accounts receivables immediately?

If you don't have a lot of bad debts, you'll probably write them off one by one whenever it's evident that a customer can't or won't pay.

In that scenario, just record a bad debt expense transaction equal to the account receivable's value in your general ledger.

How do you know whether it’s time to write a bad debt off as uncollectible?

According to the IRS, you should only write off bad debt expense after the amount outstanding is no longer likely to be paid. You must be able to show that you used reasonable measures to recover the bad debt expense. It might be time to write off the bad debt expense if you've tried to contact the customer by phone or set up a repayment plan.

Accounts Receivable: What Is It and Why Does It Matter?

Accounts receivable is a term that refers to the money that consumers owe a company for goods or services that have previously been supplied. Accountants classify accounts receivable as an asset on a company's balance sheet since the money is expected in the future. Most businesses, on the other hand, do not anticipate collecting 100% of their accounts receivable.

You might question why firms continue to provide goods and services without requiring payment in advance, given the risk of non-payment.

A business can benefit from selling its goods and services on credit when dealing with regular and loyal consumers. It may be able to increase sales while lowering transaction costs. Instead of processing several little payments, the company can invoice loyal clients regularly.

The issue arises when accounts receivable show money due by untrustworthy clients. Customers may fail to pay their bills, causing the company to take a loss. Businesses base their financial reporting on the premise that not all of their accounts receivable will be paid by consumers to account for this risk. This section is known as the provision for bad debts by accountants.

At first glance, it's tough to tell whether a company's accounts receivable are symptomatic of proper or improper business procedures. Only via rigorous examination can investors get this knowledge, bad debt expense.

Finding the Bad Debt Expense

Because a bad debt expense is comparable to other business expenses, it will be recorded in the general ledger. The bad debt expense appears in the income statements under selling, general, and administrative costs (SG&A). Because bad debt expense is recognised as one of the operational costs, it is documented in this part.

Calculating the bad debt expense

In other circumstances, the bad debt expense may be so large that the corporation is unable to keep track of it. The good news is that many approaches make calculating this bad debt expense simple. Allowance, writing off accounts receivables, and the accounts receivable ageing method are the most widely employed approaches, bad debt expense.

The allowance method

If the majority of your business transactions are done on credit, it's crucial to plan for bad debts. The allowance approach is the best way to figure out these costs. This strategy entails setting aside money for bad debts. This is also known as a reserve for questionable debts.

The reserve is the amount set aside to cover potential future bad debt expenses. Because the likelihood of bad debts is significant, it is critical to plan. If you do not agree to pay this price, your company is likely to suffer significant losses and may go bankrupt.

What is the precise amount that should be set aside as a bad debt expense? How to calculate bad debt expense is a subject that many individuals ask themselves. To calculate the amount of bad debt expense, most businesses utilise the bad debt expense percentage calculation.

Formula for bad debt expense

The reserve amount should be determined before bad debt expense arise, so it is always an estimate. Divide past bad debt expense by past credit sales to get this proportion.

Total bad debts / Total credit sales Equal percentage of bad debt

After you've calculated the proportion of bad debt expense, you'll need to calculate the amount of bad debt expense that could be incurred this year. Because it is difficult to forecast whether or not a person will pay their obligation, the amount of bad debt expense cannot always be accurately predicted. The reserve amount will be high in some circumstances and insufficient in others to cover the debts incurred.

The current year's bad debt expense is calculated by multiplying the bad debt expense percentage by the expected credit sales.

For the current year, bad debt expense equals bad debt expense percentage X projected credit sales.

This strategy may be unreliable if you haven't been in business for a long time. It is perfect for people who have been in business for a long time and have developed a pattern. It will be difficult to estimate the bad debt expense if a large debt is also distorting the percentage of debt that has been incurred over time.

Writing off accounts receivables

When a company does not have a lot of bad debt expense, this strategy is quite reliable. This allows companies to wipe off debts one by one. When the company is certain that the company will not pay, it writes off the bad debt expense. In this situation, firms can easily keep up with the number of bad debts expense.

A basic transaction must be recorded in the ledger account of the company. The recorded bad debt expense is equal to the amount recorded on the account receivable.

Bad debt should only be reported once it is evident that it will never be paid, according to the IRS. In that instance, you must show that you have tried all reasonable steps to recover the amount of the loss.

If you have not been able to contact the buyer or work out a payment arrangement with them, the bad debt expense will never be paid. As a result, it might be written off as a bad debt expense.

Accounts Receivable Aging Method

The strategy involves categorising receivable accounts by age and assigning a percentage based on the likelihood of collection. As a result, it is best suited for businesses that have been in operation for a long time and have developed a distinct pattern in their accounts receivables. The percentage is calculated using the company's historical debt collection history.

If a business intends to account for bad debt, it must be certain of the exact amount owed. The overall bad debt expense is calculated by multiplying the estimated percentage by the total amount of receivable accounts during the chosen period.

Because it relies on estimates, this strategy may not be 100 percent effective. A large debt may make it difficult to foresee future bad debt during specific periods. In this circumstance, the company may be forced to make faulty arrangements.

Direct Write-Off vs. Allowance Method

There are two approaches to identifying bad debt expenses. Uncollectible accounts are written off immediately at expense using the direct write-off method as they become uncollectible. In the United States, this procedure is utilised for income tax purposes.

While the direct write-off approach accurately records the number of uncollectible accounts, it violates the accrual accounting matching principle and widely accepted accounting rules (GAAP). According to the matching principle, expenses must be matched to relevant revenues in the same accounting period as the revenue transaction.

As a result, bad debt expense is computed using the allowance approach, which estimates the dollar amount of uncollectible accounts at the same period as revenue is earned.

How to Analyze Accounts Receivable?

Analysts have devised a variety of approaches for determining the underlying quality of a company's accounts receivable over time.

The accounts receivable-to-sales ratio is one of the simplest approaches accessible. This ratio, which is calculated by dividing the company's accounts receivable by its sales, allows investors to determine how much of the company's sales have yet to be paid for by consumers at any one time. A larger number indicates that the company may be having trouble collecting money from its clients.

Another straightforward technique is to look at how the company's allowance for bad debts has changed over time. Although it is sometimes included in the balance sheet, this allowance is usually stated in the notes to the financial statements.

If the tolerance for bad debts has grown significantly, the company may be experiencing a structural problem with its capacity to recover payments from clients.

At the same time, substantial drops in the provision for bad debts may suggest that the company's management has been forced to write down whole accounts receivable.

Financial Statements

Other analysis approaches are more demanding. In the notes to the financial statements, for example, specific clients with outstanding obligations may be included. Collect these names and investigate each debtor's creditworthiness independently. The possibility of each customer repaying their percentage of the business's accounts receivable can then be calculated.

Although this study can provide useful information, it can also be time-consuming due to the complexity of determining creditworthiness.

Analyzing the degree to which a business's debtor customers are diverse by industry sector is a more accessible way of measuring the quality of its accounts receivable.

In the case of an economic downturn impacting that industry, a business whose accounts receivable are owed by customers concentrated within that sector may be vulnerable to default.

A company whose accounts receivable are owed by a diverse client base, on the other hand, may be less vulnerable, based on the assumption that a downturn in one sector will not have a significant impact on the repayment rate of its accounts receivable as a whole.

As a result of this logic, investors may regard a company as reasonably safe if each of its debtor customers owes only a small fraction of its accounts receivable. Under these circumstances, a client default would be unlikely to have a substantial impact on the company's overall financial situation.

Finally, analysing the extent to which each of the clients is passed late on their payments is a standard approach to investigation. This strategy, known as ageing accounts receivable, might help answer the question of whether specific clients have had troubles in the past. This technique, like most others, produces more useful results when investors use data from a longer period.

Increasing Profits by Measuring Company Efficiency

Analyzing a company's inventories and receivables is a dependable way of determining whether or not it is a smart investment. Companies stay efficient and competitive by reducing inventory levels and collecting money owing to them quickly.

Efficiency ratios measure how efficiently a business manages its assets and liabilities to maximise earnings. Efficiency ratios are used by shareholders to determine how effectively their investments in the company are being used.

Inventory turnover, accounts receivable turnover, accounts payable turnover, and the cash conversion cycle are some of the most widely used efficiency ratios.

Getting Goods off the Shelf

As an investor, you want to determine if a company's inventory has too much value. Companies can't stock a lifetime supply of every item since they don't have enough money to invest in inventory.

They must sell the things they have created or obtained from vendors to generate revenue to pay bills and return a profit. Inventory turnover refers to how rapidly merchandise is moved from the warehouse to customers.

The inventory turnover ratio indicates how many times a firm sells and restocks its inventory in a given period, or how many days it takes the company on average to sell out its inventory.

Higher inventory turnover rates are generally regarded as positive, indicating strong sales, but too frequent turnover could imply inefficient ordering or a company's inability to meet requests on time.

Consider Walmart, the world's largest retailer, which is famed for its ultra-efficient operations and cutting-edge supply chain system, which keeps inventories to a bare minimum. Inventory sat on shelves for an average of 40 days in fiscal 2011. Walmart, like most companies, does not disclose inventory turnover figures to investors, but they can be derived from financial records.

Trend-Spotting

Remember, though, that knowing the amount at any one time isn't enough. Investors want to know if the days-to-sell inventory figure is improving or deteriorating with time. Calculate at least two years' worth of quarterly inventory sales statistics to obtain a good understanding of the trend.

If you notice a clear pattern in the data, you should investigate why. Investors would be delighted if the number of inventory days decreased as a result of improved inventory control. Products, on the other hand, maybe fly off the shelves faster merely because the manufacturer is lowering its prices.

It's not always a bad thing if inventory days are increasing. When launching a new product to the market or anticipating a busy sales period, companies typically allow stocks to build up. If you don't expect a noticeable boost in demand, however, the increase may result in unsold goods collecting dust in the stockroom.

Collecting bad debt expense

The money owed to a corporation by its clients is known as accounts receivable. The speed with which a business collects what it owes might reveal a lot about its financial performance. If a company's collection period is lengthening, it may indicate future troubles.

Customers may be given credit extensions by the corporation to record higher top-line sales, but this can lead to problems later on, especially if customers are under a liquidity constraint. It's best to get money right away rather than wait, especially since certain bad debt expense may never be paid.

The faster a firm collects payments from its clients, the more cash it has to pay for merchandise and equipment, employees, loans, and, most importantly, dividends and growth prospects.

The accounts receivable turnover ratio is a measure of a company's efficiency in collecting sales revenue on schedule. Companies with payment terms of 30 to 60 days and who get paid promptly have accounts receivable turnover percentages of 6 to 12. Payment-collection issues can be indicated by low ratios.

Accounts Payable Turnover Ratio

The accounts payable turnover ratio is a short-term liquidity metric that measures how well a company manages its cash outflows, particularly when it comes to paying creditors.

Higher ratios are preferred because they indicate that the corporation can maintain cash on hand for longer. However, a business must strike a balance between good credit and avoiding late payment fines.

The cycle of Cash Conversion

The Cash Conversion Cycle combines inventory, accounts receivable, and accounts payable turnover rates to provide a more comprehensive picture of a company's ability to manage its cash inflows and outflows.

A faster CCC indicates greater financial management. If a company's CCC is too slow, the issue can usually be recognised within days of inventories, receivables, or payables outstanding.

Assessing Efficiency

When both inventory days and the collection period are reduced, it's good news. Still, that isn't enough to properly comprehend how a business operates. You must compare the company to other industry participants to determine true efficiency.

Let's compare Walmart to Target Stores, another huge publicly traded retailer, in 2003. The distinctions are striking. During that time, Walmart's inventory turnover averaged 40 days, while Target's inventory turnover took roughly 61 days. In just three days, Walmart had received the money.

Target, on the other hand, took nearly 64 days to receive its funds, owing to its reliance on slow-to-collect credit card sales. Using competitors as a baseline, as Walmart demonstrates, can help investors get a better understanding of a company's true efficiency.

Even yet, if investors don't do their homework, comparing data might be misleading. Just though one firm's figures are lower than its competitors' does not indicate it will function more efficiently. It is necessary to consider business models and product mix. Industries have different inventory cycles.

Remember that these efficiency methods mostly apply to businesses that manufacture or sell things.

Because software companies and companies that sell intellectual property, as well as many service businesses, do not keep inventory daily, the inventory days statistic is of little use for examining these businesses. You can, however, use the days' receivables calculation to see how well these businesses collect what they owe.

Understanding the Need for Financial Statements

Financial statements are accounting documents that demonstrate a company's financial activity and performance. The Securities and Exchange Commission in the United States requires companies to submit their financial statements on a quarterly and annual basis (SEC).

The SEC keeps an eye on markets and businesses to ensure that everyone follows the same laws and that markets run smoothly. The SEC requires precise rules when producing financial reports so that investors can easily assess and compare one company to another.

Financial Ratios Financial ratios assist investors in deciphering the massive amount of financial data reported by businesses. A ratio is nothing more than a tool for analysing data and comparing it to other firms and reporting periods.

Financial ratio analysis examines individual financial line items in a company's financial statements to determine how well it is functioning. Profitability, debt, management effectiveness, and operational efficiency are all determined by ratios. It's vital to remember that financial ratio outcomes are frequently misinterpreted by investors.

Individual ratios should be utilised in conjunction with other measures and analysed against the wider economic backdrop, even though financial ratio research provides insight into a company. Some of the most frequent financial ratios used by investors to interpret a company's financial statements are listed below.

Profitability Ratios

Profitability ratios are a set of financial indicators that reflect how successfully a company earns profits in comparison to its expenses. Investors should be cautious about making broad comparisons.

Instead, they will compare ratios from previous periods to gain a clearer idea of how well a company is doing. When comparing the fourth quarter of this year to the same quarter last year, for example, the result will be better.

Return on Investment

Many investors use the return on equity (ROE) ratio to determine a company's capacity to generate money from its owners' equity or assets. Companies issue stock to raise funds and then invest it back into the business.

The amount that would be returned to shareholders if a company's assets were liquidated and all debts were paid off is known as shareholders' equity. The higher the return on investment (ROI), the better the company's performance because it generates more money for each dollar invested.

Margin of Profit

The efficiency of a company's basic financial performance is measured by its operating profit margin. The revenue generated by a company's fundamental business operations is known as operating income. Although the operating margin is defined as the profit from core operations, it excludes costs like taxes and debt interest.

As a result, because it removes any earnings owing to ancillary or exogenous events, the operating margin provides insight into how successfully a firm's management is running the company.

For example, a firm could generate revenue by selling an asset or a division, inflating earnings. That sale would be excluded from the operating margin. Finally, operating profit is the portion of revenue that can be used to pay creditors, shareholders, and taxes.

Current Ratio

The current ratio is the most generally used liquidity ratio, which displays current assets divided by liabilities and informs shareholders about the company's efficiency in utilising short-term assets to fund short-term liabilities.

Cash and accounts receivables, or money owing to the company by consumers, are examples of short-term assets. Inventory and accounts payables, which are short-term debts due by the company to suppliers, are examples of current liabilities.

Higher current ratios indicate that the company effectively manages its short-term liabilities and generates adequate cash to run its business. The current ratio determines whether a business can pay its debts within a year. It can also be beneficial in giving shareholders an indication of a company's ability to create cash when needed.

Debt Ratios

Financial ratios show a company's debt condition and whether or not it can handle its current debt as well as debt servicing charges like interest. Debt covers both borrowed capital from banks and company-issued bonds.

Investors buy bonds, and firms receive the money from the bonds upfront. The corporation must repay the amount borrowed when the bonds mature.

There may not be enough cash generated to pay investors if a company has too many bonds due in a certain period of the year. To put it another way, it's critical to know that a corporation can not only pay its debt interest but also meet its bond maturity date commitments.

The ratio of Debt to Equity

The debt-to-equity (D/E) ratio, which is determined by dividing total liabilities by stockholders' equity, indicates how much financial leverage a company has. A high debt-to-equity ratio implies that a corporation has heavily relied on bad debt expense to fund its expansion.

It's crucial, though, to compare debt-to-equity ratios among companies in the same industry. Manufacturing enterprises, for example, are more debt-intensive because they must purchase expensive equipment or assets. Other industries, such as software or marketing, may, on the other hand, have less bad debt expense.

Inventory Turnover

The inventory or asset turnover ratio shows how many times a company's inventory is sold and replaced in a given period. The outcomes of this ratio should be compared to industry averages.

Low inventory turnover ratios suggest low sales and surplus inventory, resulting in overstocking. High ratio values usually suggest good inventory management and great sales.

Dividend Yield

The dividend yield ratio compares the number of dividends a firm pays out each year to the price of its stock. The dividend yield is the return on investment derived only from dividends. Dividends are significant because many investors, including retirees, seek stable income from their investments.

Dividend income can assist offset, at least partially, any losses incurred as a result of owning the stock. The dividend yield ratio is a calculation of the amount of cash flow received for every dollar invested in the stock.

Which Financial Statement Is the Most Valuable to Shareholders?

There is no one most significant financial statement because the balance sheet, income statement, and statement of cash flows all contain critical information.

Furthermore, many ratios calculated utilising fundamental analysis will pull data from several places on distinct statements. For example, ROE incorporates data from both the income statement and the balance sheet.

What Can You Learn From Financial Statements?

The financial accounts of a firm reveal information about its financial situation, profitability, and development prospects. Financial statements taken together allow analysts to perform fundamental analysis to assess a stock's worth and development potential. Financial statements might sometimes indicate financial instability or accounting irregularities.

Investors value financial statements because they can reveal a great deal about a company's revenue, expenses, profitability, debt burden, and ability to pay short- and long-term financial obligations. Three primary financial statements are available.

How Is the Bad Debt Expense Recorded?

It's critical to keep track of bad debts that have occurred or are expected to arise so that you can plan for the future. Two methods for recording are available. The first approach is to write off bad loans as quickly as possible. The second technique is to figure out how much money should be set aside as a bad debt reserve.

Write off method

As previously stated, this debt is recorded after all attempts to collect the bill have failed. The accounts receivable is reported as a credit, whereas the bad expense debt is recorded as a debit. This entry will erase the debt from the balance sheet. As a result, the corporation will not appear to have lost money.

However, this strategy may cause income to be misstated in different reporting periods. When a bad debt entry is made in a journal from a different era than the sales entry, something happens.

In most circumstances, firms would take a long time to collect a debt, resulting in multiple journal entries. This is only allowed when registering a small sum that has no significant impact on the company.

Recording for the allowance method

As previously stated, the allowance approach entails estimating the amount of dubious debt to set a reserve amount. This sum is set at the end of the fiscal year as part of the current year's business plans. The corporation creates an account called the allowance for questionable accounts.

This account shows the amount that is estimated to represent the entire amount of bad debt. The proportion of sales or the account receivable ageing method is used to determine the amount to be recorded in the accounts. The credit for the dubious account is made on the accounts payable side, while the debit is made on the debit side.

The allowance method is an accounting strategy that allows businesses to account for anticipated losses in their financial statements to avoid overstating prospective earnings. A corporation will estimate how much of its receivables from current period sales it expects to be delinquent to avoid an account overstatement.

A corporation does not know which accounts receivables will be paid and which will default because no substantial time has gone by since the transaction. As a result, a provision for questionable accounts is made based on an expected value.

Bad debts expense will be debited, and this allowance account will be credited. When both balances are included on the balance sheet, the allowance for doubtful accounts is a contra asset account that nets against accounts receivable, reducing the overall value of receivables. This limit can build up over time and be changed depending on the account balance.

There are two main approaches for determining the dollar amount of uncollectible accounts receivables. To determine predicted losses to delinquent and bad debt, statistical modelling such as default likelihood can be used to estimate bad debt expense.

The statistical calculations might make use of previous data from both the company and the industry. As the age of the receivable grows, the specific percentage will normally increase to represent growing default risk and decreasing collectibility.

A bad debt expense can also be calculated using a percentage of net sales based on the company's previous bad debt experience. Companies adjust the allowance for credit loss entry regularly to match the current statistical modelling allowances.

To manage your costs and expenses you can use many available online accounting software.

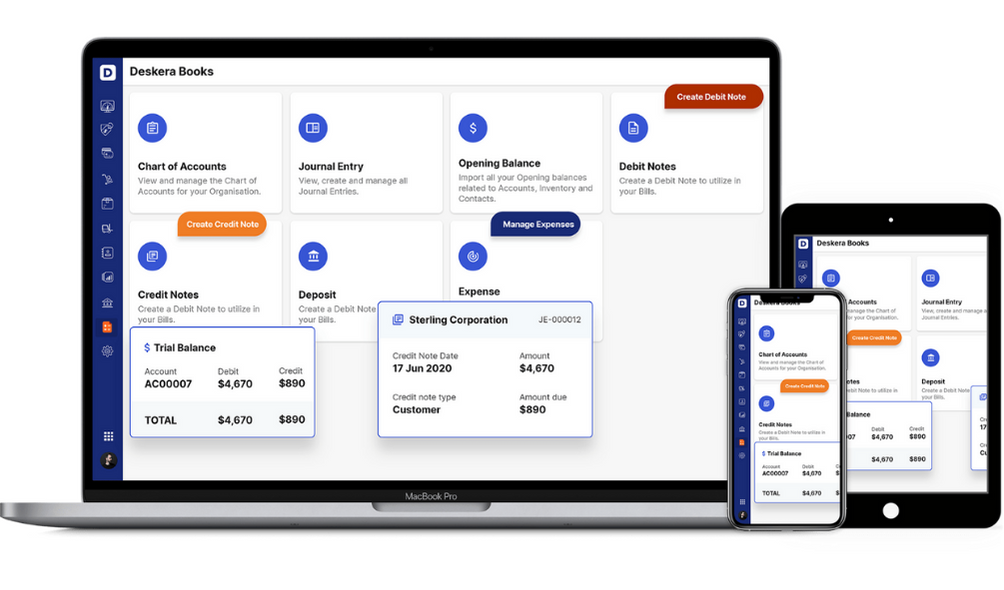

How can Deskera Help You?

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

· A bad debt expense is a financial transaction that your business records in its books to account for any bad debts it has given up trying to collect. If you follow accrual accounting standards, you just have to report bad debt expense.

· Terrible debts are still bad if you apply cash accounting rules, but there's no income to reverse with a bad debt expenditure transaction because the bad debt was never recorded as revenue in the first place.

· You can receive a false idea if your company's income appears to be bigger than it is. Many businesses have incurred significant losses as a result of this period.

· For example, a corporation may assume that it is making significant sales and, as a result, cease to be active in its marketing initiatives. This means that its items will not reach as many customers as projected, and the company may lose money.

· If you don't have a lot of bad debts, you'll probably write them off one by one whenever it's evident that a customer can't or won't pay. In that scenario, just record a bad debt expense transaction equal to the account receivable's value in your general ledger.

· A business can benefit from selling its goods and services on credit when dealing with regular and loyal consumers. It may be able to increase sales while lowering transaction costs. Instead of processing several little payments, the company can invoice loyal clients regularly.

· If the majority of your business transactions are done on credit, it's crucial to plan for bad debts. The allowance approach is the best way to figure out these costs. This strategy entails setting aside money for bad debts. This is also known as a reserve for questionable debts.

· There are two approaches to identifying bad debt expenses. Uncollectible accounts are written off immediately at expense using the direct write-off method as they become uncollectible. In the United States, this procedure is utilised for income tax purposes.

· A corporation does not know which accounts receivables will be paid and which will default because no substantial time has gone by since the transaction. As a result, a provision for questionable accounts is made based on an expected value.

Related Articles