Are you wondering if you will get a stimulus check if you owe taxes? Or are you wondering if there is a possibility that the IRS will use it to pay off your debts?

If you want to be able to answer these questions accurately and get a complete understanding of the process, then this article is for you.

Typically, if you have any state or federal debts, then the IRS will take any refund amounts that you are to receive and use them to offset your post-due debts. This means that the IRS can automatically take your refund amounts to pay off your outstanding state taxes, child support payments, or student loans.

However, what you must keep in mind is that you will receive your stimulus check even if you owe taxes. The exception, however, is past-due child support payments.

To help you get a comprehensive understanding of stimulus checks and everything related to it, this article will cover the following topics:

- What is a Stimulus Check?

- Will I Get a Stimulus Check if I Owe Taxes?

- What are the Exceptions to the Stimulus Tax Rule?

- Are Stimulus Checks Tax-Free?

- How Might the Recovery Rebate Affect You?

- Who is not Eligible for Stimulus Checks?

- What Actions Can You Take if You are Worried About Not Getting a Stimulus Check?

- FAQs Related to Stimulus Checks

- How can Deskera Help You?

- Key Takeaways

- Related Articles

What is a Stimulus Check?

A stimulus check, also known as a government stimulus payment, is a financial payment provided by the government to individuals and households to help stimulate the economy during difficult times.

These payments are usually distributed during a recession or economic downturn in an effort to boost consumer spending and spur economic growth. In fact, when you spend this money, it drives revenues and boosts consumption at retailers and manufacturers and thus boosts the economy.

What you need to keep in mind is that the amount of a stimulus check is typically based on your income and may vary depending on the specific program or legislation that is being used to distribute the funds.

The check may be sent via mail or direct deposit to eligible individuals and households. The most recent stimulus check was authorized by the CARES Act and Economic Stimulus Act of 2020 during the COVID-19 pandemic.

Considering that the government gives you money, even if you did not pay anything in taxes, the stimulus payment is actually a refundable tax credit.

While normally, you will get money from tax credits when you file your tax return in April, during the COVID-19 emergency, the government wanted you to be able to use the money when you need it rather than waiting until next April to receive it. They thus made the necessary arrangements for the same.

While the traditional tax credits are a way in which you can decrease the amount of tax that you pay to the government, for most of the tax credits, you will not get a check.

This is because the IRS will make a note that you have paid too much tax. Then, this extra money will either be paid out to you in cash or used by the IRS to pay off your outstanding debts.

Stimulus checks are an important strategic tool in the hands of the government because research done by the National Bureau of Economic Research has found that the means of delivery of fiscal stimulus makes a difference to the overall spending patterns of consumers.

In fact, receiving a stimulus check increased consumer spending, thus, not only giving a lifeline to those who needed it but also boosting the economy.

However, it was also found that applying tax credits equal to the amount of money provided in a stimulus check did not have the same effect. This is because, in doing so, people could not spend the money on the things they needed, as some of it went to the payment of any outstanding debt. This led to lesser consumer spending, which in turn led to a smaller boost to the economy.

Thus, the IRS uses your previous tax returns to see whether you qualify for a stimulus check. However, you do not need to worry because once you file your 2020 taxes, the IRS will not ask for the money back from you.

Will I Get a Stimulus Check if I Owe Taxes?

Whether or not you will receive a stimulus check if you owe taxes depends on the specific circumstances of your tax debt. In general, if you owe taxes and have a balance due on your tax return, the IRS will offset your stimulus check against your outstanding tax debt.

However, if your debt is in collection with the IRS, your stimulus check may be intercepted to pay off the debt. If your debt is with a state or local government, your stimulus check may not be intercepted. Additionally, if your tax debt is below a certain threshold, you may still be eligible to receive a stimulus check.

It is also important to note that if an individual's stimulus check is intercepted to pay off their tax debt, they will not receive a refund for any remaining balance on their credit.

Therefore, it is important for individuals to check with the IRS or a tax professional to get a clear understanding of their specific situation and take action to potentially receive a stimulus check if they are eligible.

Thus, while in usual scenarios where the IRS will take any refund amounts you receive to offset your federal or state debts like outstanding student loans, child support payments, or state taxes, it does not work in the same manner as a stimulus check.

This is because the stimulus money is designed to give a lifeline to those in need of it as well as to give a boost to the economy. This means that you will receive a stimulus check even if you have outstanding debts, and the IRS will not use it to offset what you owe to the government.

However, you can always use your stimulus check to pay down your tax debts. But it would make sense to do this only if your basic needs are already taken care of.

What are the Exceptions to the Stimulus Tax Rule?

The general rule is that the IRS will not use your stimulus check to offset what you owe the government. Thus, you will not be denied a stimulus check just because you are behind on your tax bills.

However, the only exception to the stimulus tax rule is past-due child support payments. This means that if you owe past-due child support, then you will get a notice from the Bureau of Fiscal Service that will let you know that a portion or possibly all of your stimulus check will go toward paying off your child support debt.

Are Stimulus Checks Tax-Free?

Stimulus checks are indeed a tax-free boost from the government. This thus means that if you receive a stimulus check, you will not have to pay any tax on it. In fact, you will not even have to report it on your tax return as an income.

Thus, a stimulus check is not considered to be taxable income. The implication of this is that the payment of the same will not reduce your refund or even increase the amount that you owe to the government when you file your 2020 tax return.

In fact, considering that the stimulus payment is actually a refundable tax credit, the government will give you money even if you do not pay them anything in taxes.

How Might the Recovery Rebate Affect You?

Now, if you did not receive all of the stimulus money that you were entitled to receive in 2020, then that means that you may be eligible to claim the Recovery Rebate Credit when you file your tax returns. This will give you access to the stimulus money that you missed out on last year.

However, what you must keep in mind is that the Recovery Rebate Credit is not a check, but rather more of a traditional tax credit. This means that Recovery Rebate Credit is a way of decreasing the amount of tax that you pay to the government, in turn leading to you having more disposable income.

Thus, if you claim Recovery Rebate Credit, you will not get a check, but rather, the IRS will make a note that you have paid too much tax, which can then be used by them to pay your outstanding debts.

Who is not Eligible for Stimulus Checks?

Certain individuals who are not eligible for the stimulus check are:

- Individuals who are not U.S. citizens

- Individuals who do not have a Social Security number

- Individuals who are claimed as a dependent on someone else's tax return.

- Additionally, if an individual's income is above a certain threshold, they will not be eligible for the stimulus check.

What Actions Can You Take if You are Worried About Not Getting a Stimulus Check?

One action that you can take if you owe taxes and you are worried about not receiving a stimulus check is to set up a payment plan with the IRS. The IRS offers several options for individuals to pay off their tax debt over time, including the installment agreement and the offer in compromise.

By setting up a payment plan, individuals can potentially receive a stimulus check, as the IRS will not intercept the payment to pay off their tax debt.

Another action that you can take is to request a hardship status. If you are facing financial hardship, such as unemployment or medical bills, then you may be eligible for hardship status. This will allow you to temporarily postpone your tax debt and potentially receive a stimulus check.

If you are one of those individuals who are self-employed or have recently lost his or her job, then you can also check your eligibility for the Earned Income Tax Credit (EITC).

The EITC is a refundable credit that can help low- and moderate-income taxpayers, including those who owe no taxes, and it can also help them to get a bigger stimulus check.

FAQs Related to Stimulus Checks

- Who qualifies for the stimulus check?

Individuals who make up to $75,000 per year and couples who make up to $150,000 per year will receive the full $1,200 stimulus check. The amount of the check decreases for individuals making more than $75,000 and couples making more than $150,000, and those with an adjusted gross income over $99,000 and $198,000, respectively, will not receive a check.

- When will I get my stimulus check?

The Internal Revenue Service (IRS) has started sending stimulus checks out, but the date that you will receive your check depends on several factors, including when you filed your taxes, whether you are receiving your refund by mail or direct deposit, and whether you have already provided the IRS with your banking information.

- Do I need to apply for the stimulus check?

No, you do not have to apply for the stimulus check. The IRS will automatically send you the payment if you meet the eligibility requirements.

- How will I receive the stimulus check?

Most people will receive their stimulus check via direct deposit. If you do not have a direct deposit set up with the IRS, you will receive a physical check in the mail.

- What if I haven’t filed my 2019 taxes yet?

You can still receive a stimulus check even if you haven’t filed your 2019 taxes yet. The IRS will use your 2018 tax return to determine your eligibility and payment amount.

- How much money will I receive?

Most people will receive a $1,200 stimulus check, but the amount could be less depending on your income. Individuals who make up to $75,000 per year and couples who make up to $150,000 per year will receive the full $1,200. The amount of the check decreases for individuals making more than $75,000 and couples making more than $150,000, and those with an adjusted gross income over $99,000 and $198,000, respectively, will not receive a check.

- Do I have to pay taxes on the stimulus check?

No, the stimulus check is not taxable income.

- Can I use my stimulus check to pay off my debt?

Yes, you can use your stimulus check to pay off debt. However, it is important to note that the stimulus check is not a loan and must be used for its intended purpose.

- Can I get a stimulus check if I receive Social Security?

Yes, most people who receive Social Security will be eligible for the stimulus check.

- What if I have not received my stimulus check?

If you have not received your stimulus check, you should contact the IRS or check the status of your payment online. You may also need to provide additional information to the IRS in order to receive your payment.

- Can I get a stimulus check if I am unemployed?

Yes, most people who are unemployed will be eligible for the stimulus check.

- Do I need to be a US citizen to receive a stimulus check?

Yes, you must be a US citizen or legal resident to receive the stimulus check.

- Will I get a stimulus check if I owe back taxes?

Yes, you can still receive a stimulus check even if you owe back taxes.

- Will I get a stimulus check if I receive a pension or Social Security?

Yes, most people who receive a pension or Social Security will be eligible for the stimulus check.

- How often will I get a stimulus check?

The first round of stimulus checks is a one-time payment. It is unclear whether there will be additional stimulus checks in the future.

How can Deskera Help You?

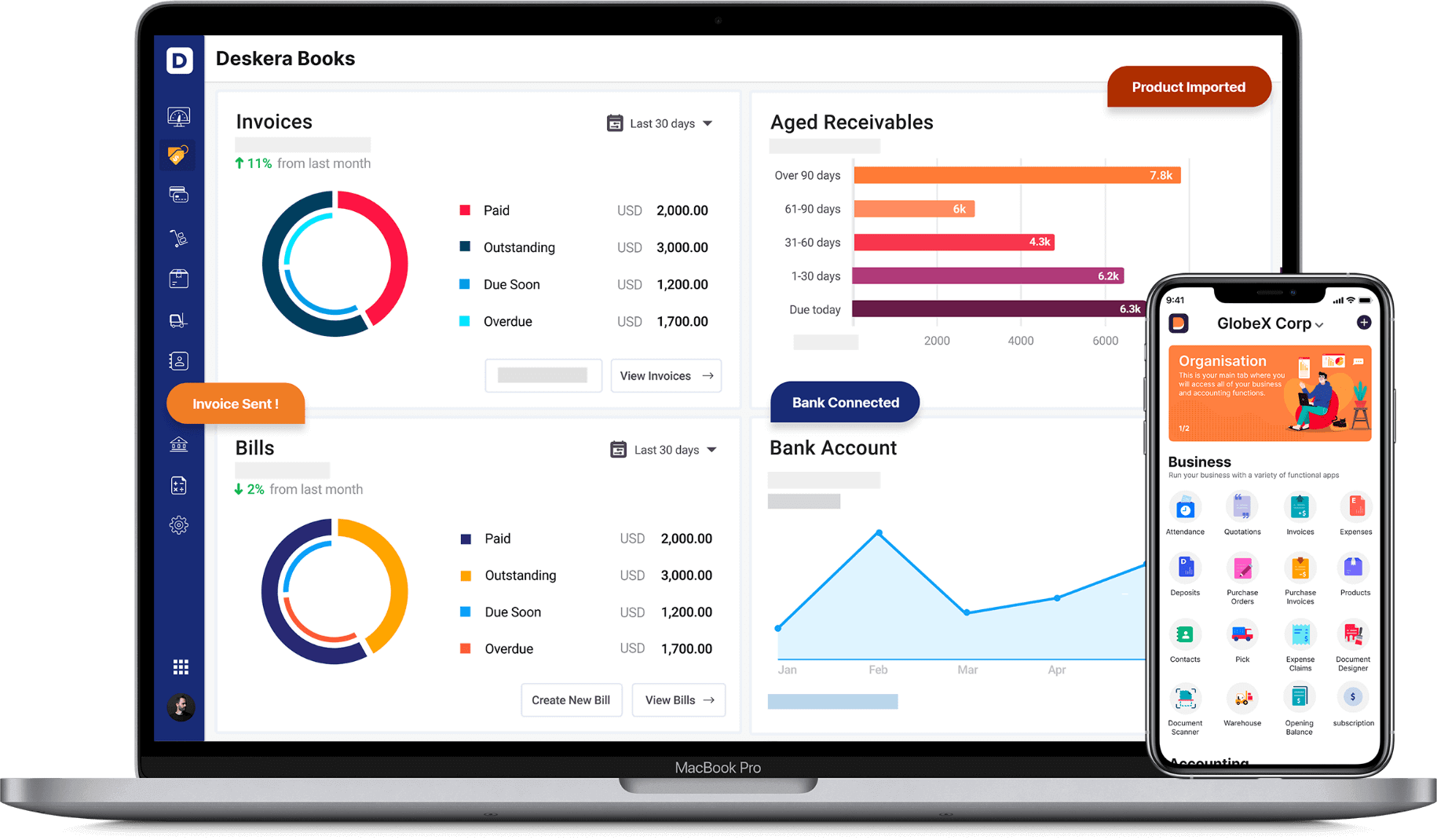

Deskera Books is an online accounting system that will automate several of your accounting tasks, including calculation, payment, and reporting of taxes. Thus, accounting and filing not only becomes a lot easier but also more efficient, thereby saving you from penalties.

Deskera Books will not only keep all your financial records, statements, data, and reports in one place, but it will also let you give access to your account to your accountant or tax professional by sending them an invite link.

In fact, Deskera Books comes with pre-configured tax codes, charts of accounts, and even accounting rules as needed to be followed in the USA. This will thus ensure that you are accurately calculating your federal income tax liabilities. It will also help you in fulfilling all the required forms and adhere to the deadline for it all.

Lastly, through the dashboard of Deskera Books, you will be able to monitor your financial analytics.

Key Takeaways

A stimulus check is a non-taxable cash payment sent to qualifying Americans by check, direct deposit, or debit card. You can use this money however you deem fit, and you will not have to repay it to the government, even if you get more of it.

Stimulus checks are also known as Economic Impact Payments and Recovery Rebate Credits.

Whether or not you will receive a stimulus check if you owe taxes depends on the specific circumstances of your tax debt. In general, if you owe taxes and have a balance due on your tax return, the IRS will offset their stimulus check against your outstanding tax debt.

However, there are certain circumstances in which you may still be eligible to receive a stimulus check, such as if your debt is with a state or local government or if you have a low income.

Also, the only exception to stimulus tax rules is the past-due child support payments, in which case, all or part of your stimulus check will go toward paying off your child support debt.

Lastly, stimulus checks are not considered to be taxable income and are, in fact, a refundable tax credit given by the government to the citizens of the USA.

However, if you are claimed as dependent on someone else’s tax return or if your income is above a certain threshold, then you will not be eligible for stimulus checks.

While Deskera Books will not be able to help you with stimulus checks directly, they will definitely be able to help you with your tax filing, reporting, and calculations. This, in turn, will help you determine your eligibility for stimulus checks and whether you will get it or it will be used for paying off debt.

Related Articles