If you’re managing a small business, you probably don’t have a lot of spare time to deal with accounting. And as a result, accounting becomes more of an afterthought, rather than an essential business activity.

However, keeping track of your business’ finances and accounting is extremely important. Without organized documentation, your business is open to a number of errors, such as unbalanced ending amounts or unsettled taxes.

To avoid these issues, your finances need to go through what’s known as the accounting cycle. This cycle accurately records every cent passing hands through the business.

In our guide, we’ve covered all you need to know about the accounting cycle. Read on to learn about:

- What Is the Accounting Cycle?

- What Are the 9 Steps in the Accounting Cycle?

- How to Automate the Accounting Cycle Using Accounting Software

What Is the Accounting Cycle?

The accounting cycle is a multi-step process that analyses and records your financial data.

The process starts when a transaction occurs, and finishes when that transaction is included in the financial statements.

Financial statements are a well-structured summarization of your transactions.

It’s called a cycle because these steps are standard and they repeat themselves at the end of each accounting period. An accounting period usually corresponds to the business fiscal year.

Before getting into the how-tos of the accounting cycle, however, you should understand why the process is essential to your business.

Why Is The Accounting Cycle So Important?

We already learned that the accounting cycle keeps your documents neat and orderly. This allows you to have accurate and professional recordings of your finances.

But why exactly do they need to be so well-organized? For three main reasons:

- To help you analyze the performance of your business. Financial statements give you an eagle-eye view of your business’ finances. They allow you to calculate how effective a past financial strategy has been, or how much money to use for future spending.

- To help you raise more money for your business. If your business is planning on raising money in the future, you will be required to present accurate financial statements to your potential investors. And the only way to have accurate financial statements is by following the accounting cycle to the T.

- It allows your business to be in compliance with federal regulations and accounting standards. These are sets of principles, which as a business owner, you are obligated to follow.

For instance, the government expects you to publish your financial results and pay taxes accordingly to the profit. The accounting cycle accomplishes exactly that.

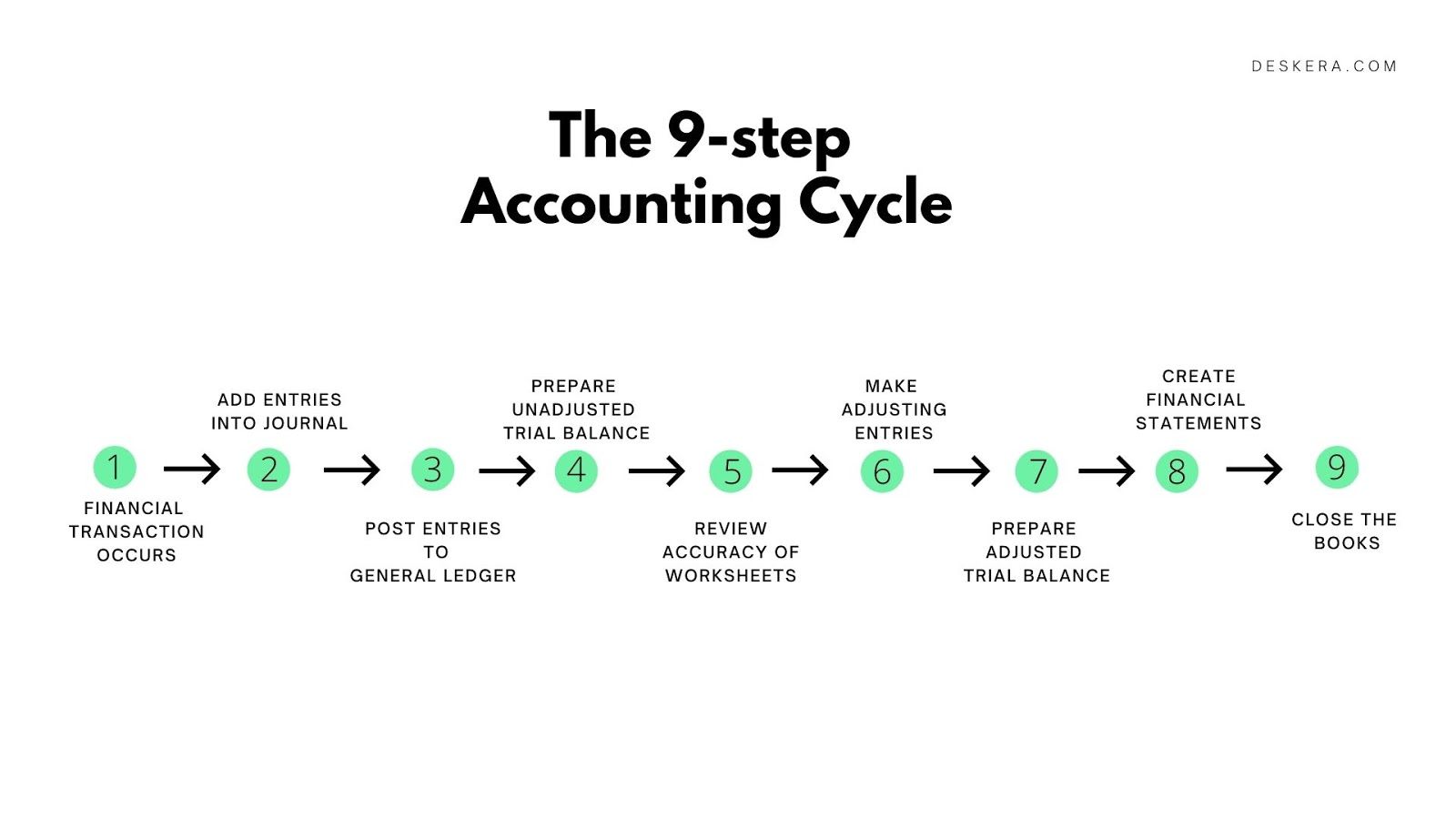

What are the 9 Steps in the Accounting Cycle?

The steps of the accounting cycle vary between six to nine, depending on who you ask.

For instance, accounting specialists are used to the process, so they usually prefer taking the shorter road.

However, to make things simple, we’re going to guide you through all nine steps one by one.

Step 1 - Financial Transaction Occurs

The accounting cycle starts when a transaction takes place. This happens when the financial position of the business changes.

Meaning that for there to be a transaction, either assets, liabilities, or the owner’s equity have to increase or decrease.

What does each of these accounts represent?

- Assets are resources of the business, such as cash or equipment.

- Liabilities are your obligations, like wages, debt, or taxes.

- The owner’s equity is your ownership of the business's assets. These include any investments or drawings you make.

If none of the accounts above change, the activity isn’t a financial transaction.

Example of a transaction: A business receives $1,300 in cash from customers for the programming services it has provided.

Not an example of a transaction: A business hires two new employees in the accounting department.

Although the employees will receive wages in the future, there’s not a financial transaction going on the moment they’re hired.

Step 2 - Make a Journal Entry for the Transaction

Next, the transaction is entered into a journal entry. A journal entry affects two accounts, where one is debited and the other credited. In accounting, this is called double-entry bookkeeping.

What are debits and credits? Words used to describe the double-sided nature of financial transactions. Debit is cash flowing into an account, and credit is cash flowing out of it.

In double-entry, they must always balance in the end. It’s accounting law that if money goes into one account, it has to come out of another.

Still a bit unclear? Don’t worry, we’ve made a cheat sheet to ease the process.

In the table below you’ll see all the types of accounts, along with the corresponding changes for debit and credit.

Let’s see how the transaction from the example above would look like as a journal entry.

So, the example described that a business received $1,300 for their services.

Both the Cash and Revenue accounts increase. Meaning, Cash will be debited for $1,300, and Revenue credited for $1,300.

Want to learn how to make journal entries? Check out our full guide with examples.

Step 3 - Post Entries To The General Ledger

Once the journal entry has been created, the next step in the accounting cycle is posting.

Posting is the transfer of journal entries to the general ledger.

The general ledger is essentially the backbone of your accounting system. It acts as a central repository for all the accounting data that is stored in each separate account.

This step allows you to monitor your finances by account while also keeping track of the entire financial activity. The chart of accounts differs from business to business, though. It really depends on how detailed you (the owner) want your ledger to be.

The usual types of accounts include cash, equipment, prepaid insurance, drawings, service revenue, rent expenses, and more.

Here’s what the previous journal entry would look like posted in the Ledger.

CASH

SERVICE REVENUE

Step 4 - Unadjusted Trial Balance

To double-check whether debits equal credits, we use what is called the unadjusted trial balance.

This is a list of all of the accounts from the general ledger along with their balances. The process is typically done at the end of an accounting period.

The purpose of the trial balance is to check for possible errors. With that being said, there are limitations to it, though.

A trial balance doesn’t guarantee that your finances are completely free of mistakes. Even if the columns equal, there could still be an inaccuracy. For example, a trial balance could equal even if a transaction isn’t journalized, or an entry is put in twice.

There are three simple steps to preparing an unadjusted trial balance:

- List the accounts and their balances.

- Find the total to the credit and debit columns.

- Check if the columns are equal.

For the sake of our example, we’ll assume that the end of the accounting period is September 30th. This is how the Trial Balance would look like.

Trial Balance

However, in actual business, there’s more than one transaction going on. So the trial balance would most likely look something like this:

Trial Balance

Step 5 - Review the Accuracy of the Worksheets

This step is only necessary when the ending balance doesn’t match up. Accounting errors usually happen from mathematical slips, incorrect posting, or inaccurate transcriptions. Whatever the scenario, a bookkeeper needs to find out where the error took place.

For example, if debit amounts to $800 and credit to $1,300, there’s $500 a bookkeeper should correct.

With accounting software, on the other hand, it’s a lot harder to make mistakes. And even if you do, the software automatically spots it and notifies you of a mismatch.

Step 6 - Make Adjusting Entries

After finishing with corrections, the next step is to make adjustments.

Adjusting entries update previously recorded journal entries. Their purpose is to ensure that the financial statements only have up-to-date and relevant information.

There are three main types of adjusting entries, deferrals, accruals, and estimates.

Deferrals are money you spend, before getting any actual revenue or service. They include prepaid expenses and unearned revenues.

A prepaid expense is when you pay now for a future asset, like insurance. While unearned revenue is cash received before doing the work, and it’s recorded as a liability. An example would be your yearly newspaper membership.

Accruals, on the other hand, are revenues and expenses you haven’t immediately recorded.

Accrued revenue is cash earned but not yet received. If a customer delays payment for a month, that transaction is recorded as accrued revenue. Accrued expenses are the opposite, so expenses made but not yet paid. A common example is not paying your workers the salary until the end of the month.

Lastly, we have estimates. Estimates are made for non-cash items when you can’t identify the exact value of them.

A typical estimate of a business is the depreciation expense. This expense is made for long-term assets, like vehicles or equipment. Since the exact cost machinery suffers can’t be measured in cash, there’s a formula that estimates that depreciation. That amount is then separated over many accounting periods, depending on how long the asset's useful life is.

Step 7 - Prepare An Adjusted Trial Balance

Now that you’re done with making adjusting entries, it’s time to put them in a new trial balance. This is once again done to prove that debits and credits balance in the end.

The adjusted trial balance has all of the data your business needs to prepare financial statements.

Below you can see how the before unadjusted trial balance looks like fully adjusted.

The changes are highlighted in red.

Adjusted Trial Balance

September 30th, 2020

Step 8 - Create Financial Statements

It’s finally time for the much-awaited financial statements. This step of the process is pretty straightforward because you already have the needed data on the adjusted trial balance. All that’s left to do is transfer it.

There are four main financial statements that businesses prepare.

First comes the income statement which includes two accounts: revenue and expenses.

Its purpose is to show you how much profit the business has generated. From that answer, you then evaluate how well your business performed in that accounting period.

After finding the net income of the business, the next step is preparing the owner’s equity statement. There you have to list the owner’s investments and withdrawals, as well as the net income and expenses. The goal is to show you how much your financial contribution to the company has changed, and why.

The third document is the balance sheet, where you display assets, liabilities, and owner’s equity. It tells you whether or not the business has enough assets to meet its financial duties.

Last but not least, is the cash flow statement. This document presents the business’s inflows and outflows of cash. It divides the money based on the three main activities where it comes from: operating, investing, and financing.

Here are our transactions from the adjusted trial balance displayed in all four statements.

Income Statement

For the Month - Ended September 30th, 2020

Owner’s Equity Statement

For the Month - Ended September 30th, 2020

Balance Sheet

September 30th, 2020

Statement of Cash Flows

For the Month Ended September 30, 2020

Step 9 - Closing The Books

The accounting cycle isn’t over just yet. The last step is to make closing entries.

When closing its books, a business divides accounts into two groups: temporary and permanent.

These are done to reset the temporary accounts for the upcoming accounting period and to move the balances to permanent accounts.

Temporary accounts include all revenues, expenses (which added together make up the income summary), and the owner’s drawings accounts. These are the accounts that close, meaning they get zeroed out.

Permanent accounts cover assets, liabilities, and the owner’s capital accounts. Instead of closing, the business transfers its balance into the next accounting period.

A closing entry is posted through the four following steps:

- Close revenues to the income summary

- Close expenses to the income summary

- Close the income summary to the owner’s capital.

- Close the owner’s drawings to the owner’s capital.

Let’s solve an example. Assume your business has the following:

- Drawings $10,000

- Capital $50,000

- Net income $15,000

Here’s how the closing entries would look like:

How to Automate the Accounting Cycle Using Accounting Software

Manually handling your finances can be a tiring and time-consuming process. That’s why most business owners avoid the struggle by using accounting software.

We know what you’re thinking, isn’t software even more complicated to manage?

Usually, that’s the case, but we at Deskera prioritize small business accounting. Our program is specifically developed for you, to easily manage and supervise the accounting cycle of your business.

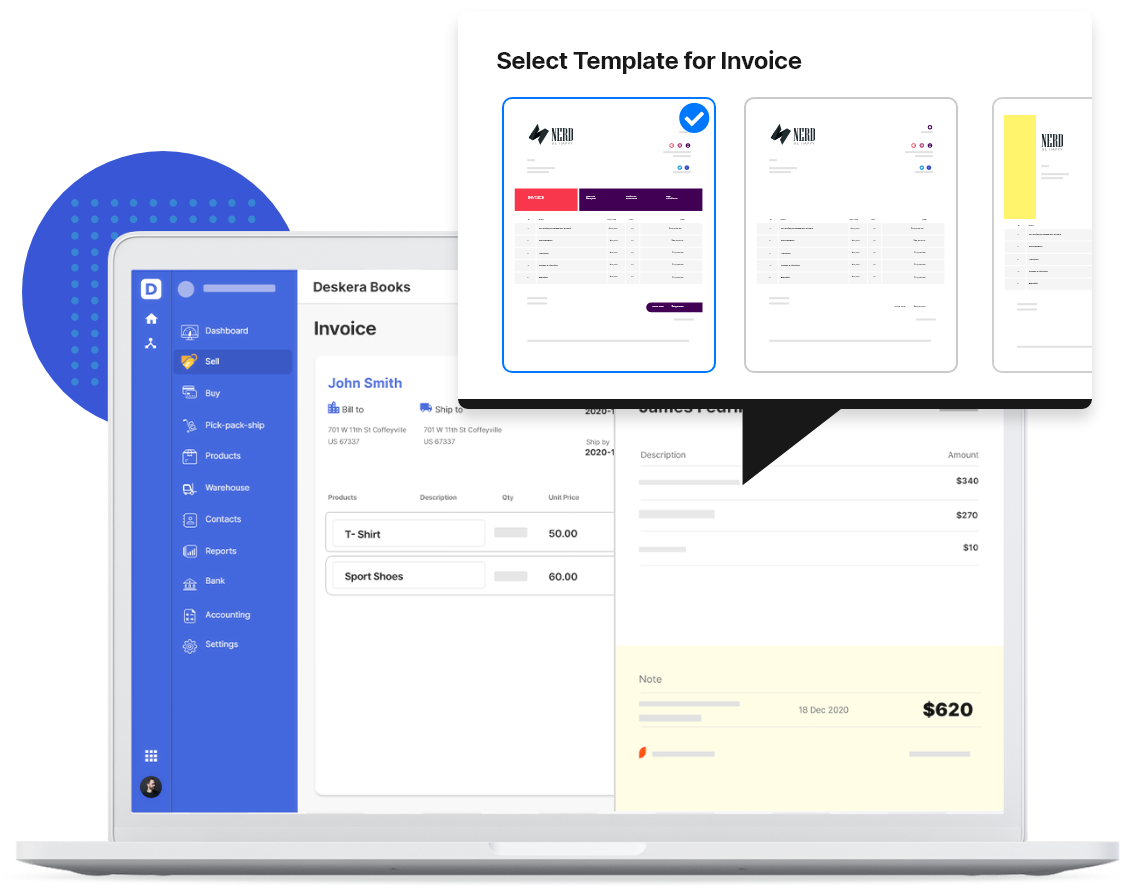

Here’s a quick walkthrough of some of Deskera’s main features.

You can use Deskera to integrate directly with your bank account or multiple bank accounts. This means that when you make an expense or payment, the software automatically creates a journal entry and adds it to the appropriate ledger account.

You can easily create and send custom invoices. The template below allows you to choose which client you’re billing, where the goods are being shipped to (if it applies), the due date, the product with its description, and the discount amount. The software also automatically calculates the tax amount.

Oversee and create reports. The reports section lets you view and edit your inventory, taxes, sales, finances, and purchases whenever you need to. And finally, you can create and view any financial statement with the click of a button.

Still not convinced cloud accounting with Deskera is what your business needs?

Try the software out yourself, with our completely free trial. No credit card required!

Key Takeaways

And that’s a wrap! Hope you enjoyed our complete guide on the accounting cycle.

For a quick recap, let’s go through the key points we’ve covered:

- The accounting cycle is a nine step-by-step process that begins with a transaction and ends with creating financial statements. It typically repeats itself every new accounting period.

- The accounting cycle steps go as follows:

- The financial transaction occurs

- Record it as a journal entry

- Post the entry into the general ledger

- Prepare the unadjusted trial balance

- Review the accuracy of the worksheets

- Make adjusting entries

- Prepare the adjusted trial balance

- Create financial statements

- Close the books

- You can use online accounting software like Deskera to automate the accounting cycle, and easily manage your finances.

Related Articles