A payroll tax is a percentage of a worker's salary withdrawn by a business and paid to the state on their behalf. The IRS levies taxes on employee pay, salaries, and tips. IRS withdraws federal payroll taxes directly from employees' wages and remits them to the state.

Payroll in Utah is more uncomplicated than in many other states. Utah has a flat income tax, making calculating the withholding amount from employee paychecks simple. Nevertheless, it also has some special HR requirements that you must follow.

If you follow the steps below, learning how to calculate and file Utah payroll tax will be an easy task.

Table of Content:

- Utah Payroll Laws, Taxes & Regulations

- Utah State Taxes

- Income Taxes

- Employer Unemployment Taxes

- Workers' Compensation

- Utah Minimum Wage

- Calculating Overtime

- How to Do Payroll Taxes in Utah

- Paying Employees

- Bottom Line

Let's Start!

Utah Payroll Laws, Taxes & Regulations

Payroll in Utah necessitates the calculation of Utah payroll taxes and adherence to all federal and state employment rules. With a few exceptions, most employers in the United States need to pay FICA taxes.

The current FICA tax rate for Social Security is 6.2 percent, while the Medicare tax rate is 1.45 percent. These taxes will be paid by both the employer and the employee, with each paying 7.65 percent of the total Social Security and Medicare taxes.

There are three main components of Utah Payroll Taxes:

1. Utah State Taxes

Utah, like most states, has taxes that businesses must pay and withhold from employees' paychecks. However, employees in Utah are not subject to municipal taxes.

2. Income Taxes

While we don't suggest calculating withholding and taxes for your employees by hand, Utah makes payroll significantly straightforward by having a flat income tax. For all Utah employees, the current income tax rate is 4.95 percent.

3. State Employer Unemployment Taxes (SUTA)

In Utah, all companies must pay SUTA taxes. The current pay base is $38,900, with rates ranging from 0.2 to 7.2 percent. The majority of new Utah firms will pay a SUTA rate of 1.2 percent.

Workers' Compensation

Every Utah business with one or more workers needs to have workers' compensation coverage. Workers' compensation insurance compensates employees who get injuries during the job by covering the costs of medical care and lost pay. The average price is around 78 cents for $100 of payroll processed.

Utah Minimum Wage

The federal minimum wage is $7.25/hour. Therefore, companies must pay at least $2.13 per hour to tipped employees if their tips bring them to the hourly minimum wage. If this is not the case, the corporation must compensate for the difference.

Calculating Overtime

The overtime regulations in Utah work on the FLSA, which requires all companies to pay employees 1.5 times their usual hourly salary for hours worked more than 40 in a workweek. To assure the accuracy of your overtime estimates, use an overtime calculator.

How to Do Payroll Taxes in Utah

Here's a quick primer on how to conduct payroll in Utah.

Step-1: Establish your company as an employer.

New businesses need to use the federal Electronic Federal Tax Payment System (EFTPS) to get the latest Federal Employer Identification Number (FEIN). To pay federal taxes, you must have your FEIN.

Step-2: File a business registration with the state of Utah.

You must register on the Utah OneStop Registration portal when starting a new firm. The Utah Department of Commerce runs the website. Additionally, any firm that pays workers in Utah needs to enroll with the State Tax Commission.

Step-3: Design your payroll procedure.

If your company is new, you must create a payroll process from the ground up. You'll need to establish when and how often you'll pay staff and what payment options you'll provide.

Step-4: Have staff complete the necessary forms.

During the onboarding process, you must have each employee complete payroll documents. In addition, every employee is required to undergo I-9 verification. New workers must also have a completed W-4 and, if applicable, direct deposit authorization on file.

Step-5: Go over timesheets and approve them.

You must collect timesheets many days in advance to conduct payroll correctly. Reviewing your nonexempt workers' timesheets allows you to talk with anyone if they have made a mistake.

Step-6: Determine the employee's gross compensation and taxes.

We do not suggest calculating Utah payroll taxes by hand. Tax computations can get complicated, and even minor errors can result in hefty fines and penalties. However, you may use payroll software, a calculator, or even Excel to perform basic calculations.

Step-7: Pay employee salaries, benefits, and taxes.

Direct transfer is the best method of paying your staff. However, cash and paper cheques are also viable possibilities. You can pay your federal and state taxes online in Utah. If you use a benefits provider like Deskera, the company should partner with you to make deductions easy, automatic, and electronic.

Step-8: Make a backup of your payroll records.

Keeping business documents for your organization is a wise habit. For example, businesses in Utah need to retain a record of all hours worked and earnings paid to each employee for at least three years, including their name, address, and date of birth. This is similar to the record-keeping requirements of the Fair Labor Standards Act.

Step-9: Submit payroll tax returns to the federal and state governments.

You must pay all the Utah state taxes to the appropriate state agency on the due date. The due date is quarterly and can be done online at the Utah State Tax Commission website. You can pay federal taxes online using the EFTPS on a semi-weekly or monthly schedule.

Please remember that reporting deadlines and submitting employment taxes are not the same. You only submit taxes quarterly on Form 941 or annually on Form 944, regardless of your payment plan.

Step-10: Finish your year-end payroll reports.

Payroll in Utah entails more than merely paying employees regularly. Every year, you must file payroll reports, which contain all W-2 forms and 1099 forms. You must distribute these forms to workers by January 31 of the following year.

Paying Employees

According to Utah law, you must pay non-salaried employees at least twice a month. Your business can choose to pay workers more often, but you must maintain consistent paydays. Every corporation also has to pay employees within ten days of the conclusion of the pay period.

Salaried employees in Utah are subject to different restrictions than hourly workers. For example, if you pay a yearly salary to your staff, you can pay them only once a month if you choose.

Employers in Utah are also permitted to pay employees using one of the following methods

- Cash

- Check written on paper

- Direct deposit is only permissible if the employee has given written permission

- Payroll card, only if the employee agrees in writing

Bottom Line

The state of Utah has a flat income tax but no local taxes. But, this does not imply that you should compute your company's payroll taxes by hand, as this might result in costly errors. In addition, there are no state-specific payroll forms, and the HR rules are straightforward. Therefore, Utah is one of the smoothest states to handle payroll.

How Can Deskera Assist You?

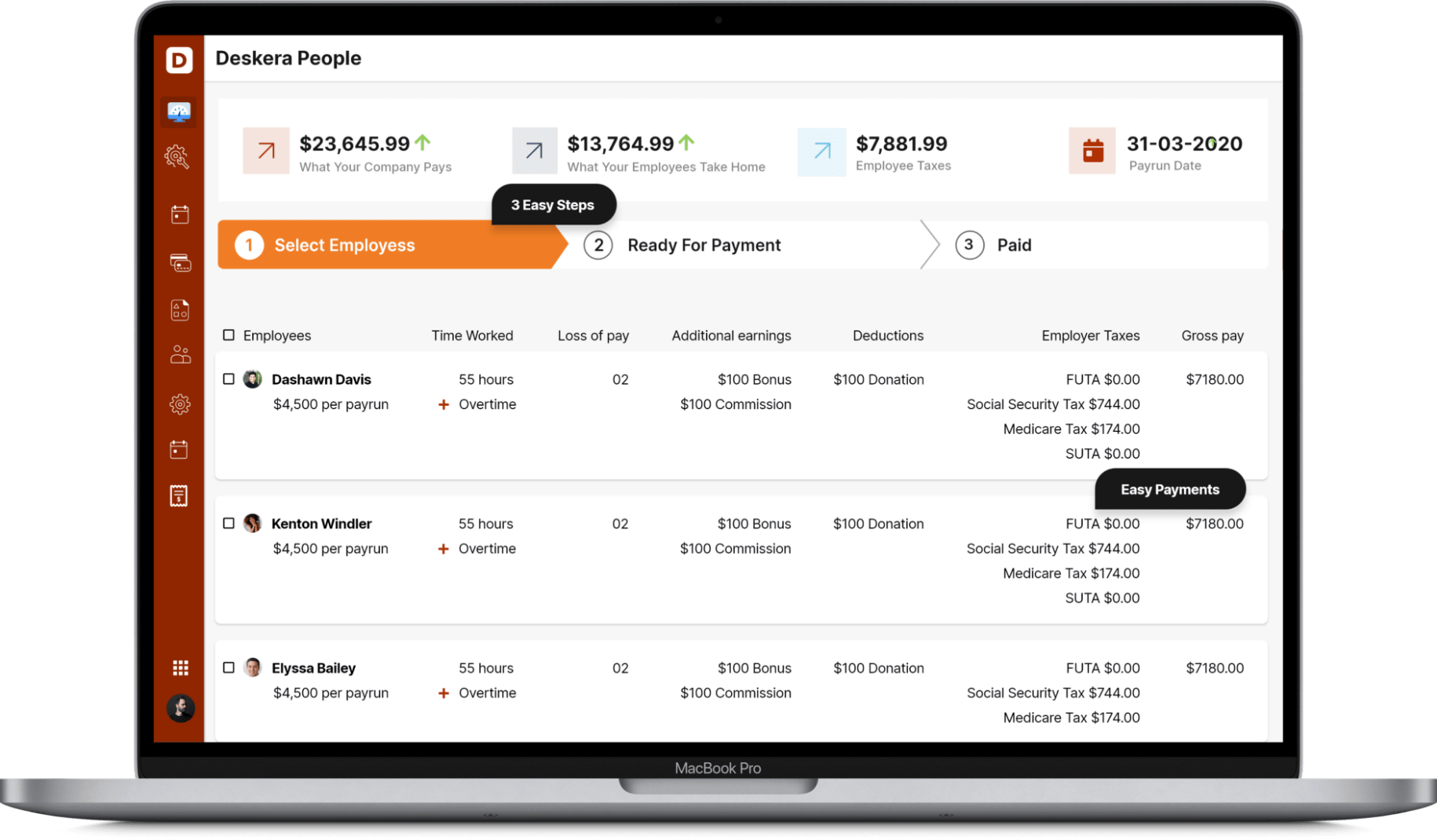

Deskera People make it simple to handle leave, attendance, payroll, and other processes so that you can focus on growing your business. For example, creating payslips for your employees is now simple since the platform also automates and digitizes HR tasks.

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Frequently Asked Questions

What are the Child Labor Laws in Utah?

Utah does not restrict children between the ages of 16 and 17 in their working hours or days in Utah. But, 14-15 years old kids can only work for three hours on school days. However, they can work up to eight hours daily and 40 hours per week on non-school days.

Do I need to file Form W-4?

While Utah collects state income tax, the state does not have its W-4 form. Instead, employees should complete the federal W-4 form. There are no additional state payroll forms in Utah.

What are the requirements for Utah New Hire Reporting?

Every company in Utah needs to report new hires and rehires to the Utah Department of Workforce Services within 20 days of the employee's first day of work. This information, which must contain the employee's name, address, and Social Security number, is used to enforce child support obligations.

Key Takeaways

- Payroll in Utah is more uncomplicated than in many other states. Utah has a flat income tax, making calculating the withholding amount from employee paychecks simple.

- Payroll in Utah necessitates the calculation of Utah payroll taxes and adherence to all federal and state employment rules.

- Most employers in the United States need to pay FICA taxes. The current FICA tax rate for Social Security is 6.2 percent, while the Medicare tax rate is 1.45 percent.

- There are three main components of Utah Payroll Taxes:

- Utah State Taxes.

- Income Taxes

- State Employer Unemployment Taxes (SUTA)

- Every Utah business with one or more workers needs to have workers' compensation coverage. The average price is around 78 cents for $100 of payroll processed.

- Utah's minimum wage is $7.25/hour.

- The overtime regulations in Utah work on the FLSA, which requires all companies to pay employees 1.5 times their usual hourly salary for hours worked more than 40 in a workweek.

- How to Do Payroll Taxes in Utah:

- Establish your company as an employer.

- File a business registration with the state of Utah.

- Design your payroll procedure.

- Have staff complete the necessary forms.

- Go over timesheets and approve them.

- Determine the employee's gross compensation and taxes.

- Pay employee salaries, benefits, and taxes.

- Make a backup of your payroll records.

- Submit payroll tax returns to the federal and state governments.

- Finish your year-end payroll reports.

- Non-salaried employees must be paid at least twice a month, according to Utah law. Your business can choose to pay workers more frequently, but you must maintain consistent paydays.

- The state of Utah has a flat income tax but no local taxes.

Related Articles