Any account number is a one-of-a-kind identifier that helps you safeguard your personal information, funds, and assets. Your bank account number and your consumer account number, which allows you to pay your utility bills, are the two most prevalent types of account numbers.

The UAN number, like these account numbers, uniquely identifies and safeguards your EPF(Employee Provident Fund) deposits. It allows you to consolidate several PF accounts created for you by different employers into a single account that is solely available to you. In a manner, this unique identification mechanism acts as a virtual lock and key for your deposits, making it easier to access and check on your EPF.

If you are still processing all the information given, a detailed breakdown of the UAN number would certainly help you, so read on. We will explain the UAN number, its requirements, how to generate a UAN, features, benefits, and many more aspects around UAN.

What is a UAN number?

The Universal Account Number, or UAN, is a 12-digit identification number issued to both you and your employer and allows you to contribute to the EPF. The Employees' Provident Fund Organization generates and assigns this number given by the Ministry of Labour and Employment (EPFO). The EPFO allows you and your employer two distinct UAN numbers.

Regardless of how many jobs you change, the UAN produced once stays constant throughout the company's years in existence and during your work years. On notification of a job change, the EPFO will issue you a new member identity number (ID), which will be linked to your current UAN. You can request a member ID directly from EPFO or through your employer, who will then use your UAN to seek a new member ID from EPFO.

Why is a UAN Number needed in India?

You will be assigned a UAN number if you are a salaried employee in a firm that deducts and contributes to an Employee Provident Fund. This wasn't always the case when you were given multiple member IDs for each PF account opened by various companies.

Prime Minister Narendra Modi established the UAN mandate on October 1, 2014, to provide one canopy under which you can access all of your PF accounts and efficiently. UAN aims to simplify PF transactions by allowing you to manage all of your PF accounts in one location, regardless of how many companies you have worked for throughout your career. As a result, UAN not only makes accessing your PF much more organized and efficient, but it also saves you the time and effort of remembering different passwords and account details for multiple PFs.

How will UAN change things in India?

The Universal Account Number (UAN) assigned to you at the start of your career aids in the organization of all your concurrent PFs throughout time. It centralized the multiple IDs that link you to your employers. If you've worked as a paid employee since before 2014, you can use UAN to transfer your PF number. Here are a handful of UAN's features and benefits.

What is the rationale for the creation of a UAN number?

If you contribute a portion of your monthly payment to the EPF account, you will be assigned a Unique Identification Number. Previously, each Employee was given a unique but distinct number for each Provident Fund account created by several companies.

Employees may now access their EPF account more efficiently, thanks to the UAN number, which went into force on October 1, 2014.

This is because the UAN number enables you to manage all of your PF accounts from a single platform, regardless of how many times you change jobs throughout your career.

Even if you worked before 2014, you could use the UAN to transfer your PF account. As a result, you have safe and easy access to your PF accounts, and you don't have to remember passwords and account details as you did before the UAN debut.

How to check a UAN Number?

You may find out your UAN number in one of two methods. The first is to obtain it from your employer, and the second is to use the UAN site to locate it. Here's additional information about the procedure:

1. Inquiring with your employer about your UAN: In most cases, if this is your first job, your employer will inform you of your Universal Account Number. If you don't have a record of your UAN number, it will be written on your salary slip from the moment your employer begins deducting your income for PF contributions. This is the most frequent technique adopted by Indian businesses, allowing you to check your UAN immediately on your pay stub.

2. Log on to the UAN portal at www.unifiedportalmem.epfindia.gov.in/memberinterface to locate your UAN and then follow the below-mentioned steps:

(a) Go to the 'Know your UAN Status' option and choose it.

(b) You will then be prompted to input basic information such as your Aadhaar number, PAN number, and so on, or to fill out a form based on your PF number/member ID (you can ask your employer for these details).

(c) If you have a PF number or member ID, enter it and then select your state and EPFO office from the dropdown box.

(d) If everything else fails, look for your UAN number using your Aadhaar or PAN number.

(e) Your name, date of birth, mobile phone number, and captcha code are also required for both methods.

(f) When you've finished filling out the form, click 'Get Authorization Pin.'

(g) The PIN will be sent to your phone number right away.

(h) To view the UAN button, enter the PIN and click 'Validate OTP.'

Select the UAN button to get your Universal Account Number as an SMS message to your mobile phone.

What are the Features and Benefits of UAN?

The following are some of the characteristics and advantages of the Universal Account Number:

- UAN makes it easy to discover all of your PF account information in one location. It also consolidates all PF and KYC information onto a single platform.

- Employers can use your Universal Account Number to look into your Provident Fund history

- It is simple to activate your UAN number using your bank account and personal information.

- You can send and withdraw PF funds at any time using this unique number.

- On the UAN web portal, you and your employer may manage your PF account.

- The employer can check and confirm your PF request using the UAN site. The PF deduction/contribution can also be appropriately submitted here by the employer.

- Because your UAN account is connected to your KYC information, and only you as an employee have access to it.

- This number is independent of all employers and serves as a one-of-a-kind identifier for you.

- You may use UAN to monitor your PF balance, status claims, and much more, essentially managing your whole PF account.

- You can keep track of the amount credited by the employer each month, as well as deductions and accumulated interest, using this identification number.

How does UAN benefit employees?

You profit from UAN in the following ways, in addition to simple access and a more efficient process via the UAN portal:

- You may check your PF balance at any moment from the convenience of your own home.

- Your UAN is safe, as your KYC authenticates it and is connected to your Aadhaar, and you may check your PF balance by sending a simple SMS using your smartphone.

- Your UAN number is your identification number, not one assigned by your company.

- Based on your KYC information, you are the only one who can access the account.

- You can monitor your PF account to check whether your employer credits your account monthly based on your deductions.

How to generate a UAN number, and what are the requirements?

Your first employer will request a few papers from you to get your UAN number. This is a one-and-done procedure. This number does not change once it is generated and remains with you throughout your employment years.

Documents required to generate a UAN number:

The papers you'll need to generate your UAN are listed below.

- Account number, IFSC code, and branch name.

- Your proof of identification, such as a driver's license, passport, voter ID, Aadhaar, or SSLC book.

- Any picture ID evidence that includes your current residence, such as a recent utility bill in your name, a rental/lease agreement, a ration card, or any other photo ID proof that includes your current address.

- It is necessary to have a PAN card and an Aadhaar card.

- If you already have an ESIC account, you can use it.

Suppose your employer does not produce the UAN number for you but continues to make PF contributions and deductions. In that case, you can go to the UAN site and generate your own UAN number by following the steps outlined above. This will also allow you to determine whether your company has contributed to your PF account all along.

What is the procedure for activating a UAN number?

You may activate your UAN number once it has been given to you or you have generated it by following the procedures below:

- Select the 'Activate UAN' option from the UAN portal.

- Activate your UAN number using the created UAN, PAN, or Aadhaar number on the UAN activation page.

- Enter your personal information, including your phone number, after picking one of the three options below.

- The number you supplied will get a verification PIN.

- To activate your UAN, enter this pin and click 'Authorize and Activate.

You may utilize the EPFO App to activate your UAN number and monitor your PF accounts in addition to the UAN portal. For this, you need to download UMANG (Unified Mobile Application for New-age Governance), which includes UAN as one of its 213 government services. To discover more about UMANG, go here. You may get UMANG for Android and iOS by visiting the website, going to the App/Play Store, or calling 9718397183. You may also use a regular SMS to activate UAN. Text EPFOHO UAN to the number 7738299899. Merely choose the choices and respond to the messages you receive once the message has been properly delivered. You will be notified of the UAN activation within minutes.

What can you do with your UAN?

Your UAN number may be used for various activities, including maintaining and tracking your PF balances and withdrawing cash as needed. This number significantly enables you to streamline the organization and administration process using the UAN member portal or the EPFO App.

What are the facilities provided on the UAN member portal?

On the UAN member portal, you'll find a variety of services. You may use your UAN member login information to access various services via the UAN member site as a UAN member. The available facilities are as follows:

- UAN Card is available for download.

- UAN Passbook is available for download.

- A list of your prior member IDs is available.

- You can change your KYC information at any moment.

- You can verify your eligibility online.

- You can change your personal information.

- If you haven't already, you can link your UAN to your Aadhaar number.

- You might ask for a PF transfer, a partial PF withdrawal, or a complete PF withdrawal.

What are the methods of checking PF balance with UAN?

1. Using the EPFO Portal to Check Your PF Balance Select the 'For Employees' link under 'Our Services' on www.epfindia.gov.in. A page for the Member Passbook Facility will appear. You will be able to access your passbook instantly after entering your UAN number and password, depending on your credentials. The passbook function will not be available to members of establishments that are exempt under the EPF Scheme, 1952.

2. Use the SMS facility to check your PF balance by texting EPF01-10 UAN to 7738299899. Once the message has been properly delivered, keep picking choices and responding to the messages you get, and you will receive your balance through SMS within minutes.

3. Using the Missed Call Facility, check your PF balance. Give a missed call from your registered mobile number to 011-22901406, and the balance information will be delivered to you as an SMS.

4. Verify the PF Balance How to Use the UMANG App Download the EPFO app and select "Employee Centric Services" from the menu. Log in with your UAN and the OTP provided to your phone number. Then you may check your EPF account, file a claim, or keep track of any claims you've filed.

How to link an Aadhaar Card with UAN?

The government has made linking your Aadhaar data to your UAN obligatory. If you did not connect your Aadhaar updates when you joined UAN, you could do so now by following a few simple steps online using this site or offline using an application form.

Linking Aadhaar card to UAN (Offline)

EPFO has created an Aadhaar Linking Application Form, which you must complete with your UAN, Aadhaar number, and other personal information. With this form, you must also attach self-attested copies of your UAN card, PAN card, and Aadhaar card. After that, you may submit all of your paperwork to EPFO field offices or Common Services Centres (CSC). Your Aadhaar will be connected to your UAN after it has been validated and registered, and you will be notified through SMS.

Linking Aadhaar card to UAN (Online)

To link your Aadhaar on the website, input your UAN and cellphone number to get an OTP. You'll be prompted to input your Aadhaar number and gender after providing the proper OTP. To successfully produce and validate your Aadhaar, choose the OTP verification following this step. Click 'Submit' when you're finished. Within 15 days, your Aadhaar and UAN will be connected.

How has UAN made EPF management simple?

When it comes to managing your PF account, the UAN may be pretty useful:

- Throughout an employee's career, the UAN is applicable or transferable. Because all previous versions are connected to a single UAN, you may give multiple employers your UAN and PF account data.

- By enrolling on the EPFO member site, you can obtain a UAN card.

- Employees can upload scanned KYC papers to the platform, which the employer can check.

- The UAN also aids in the tracking of claim transfers through the EPFO site.

- The PF balance may be checked via UAN by downloading the passbook from EPFO's website.

- Due to the universal linkage of PF accounts, the UAN makes it simple to maintain PF accounts.

How to Use a UAN to Transfer EPF Accounts?

The following is the procedure for transferring a PF account using the UAN:

- Check your PF eligibility and ensure all of your current and past employers' data are on EPFO's website.

- Upload your digital signature to the internet.

- To file a transfer online, you must first create an account on the EPFO website.

- Select the option to transfer your account after logging into the EPF member portal.

- Complete all three sections of the form.

- Click "Get OTP" after selecting the attesting authority and member ID/UAN.

- Your registered cellphone number will get an OTP. To proceed, enter this OTP.

- Your form will be sent, and you will receive a tracking number.

- Take a printout of the transfer form and provide it to your present boss.

How to link multiple EPF accounts with UAN?

Your UAN number was created to consolidate all of your Provident Employee Funds into a single number. The EPFO markets this unified system as "one employee, one EPF account." By using the EPFO site, you can add up to ten PF accounts to this same system.

Here's how to combine all of your PF accounts into one UAN number:

1. Keep your UAN number, current EPF account number connected to the UAN number, and KYC data like bank account number, IFSC code, Aadhaar number, and PAN card number available to start the procedure.

2. Your present employer must confirm and approve all of the following data:

- Begin by going to www.epfindia.gov.in/site en/ and following the procedures outlined below.

- To access 'For Employee' services, go to the main menu and select the 'Our Services' option.

- Under the services tab, choose 'One Employee. One EPF Account.'

- To generate an OTP, provide the needed information.

- To go to the input EPF ID page, enter the OTP you received on your registered mobile number linked to your UAN.

- Now type in your previous EPF ID, agree to the declaration, and click submit.'

- Your IDs will be connected, and you will get a notification on your registered phone number.

UAN numbers are a convenient method to keep track of your PF funds and will assist you in keeping your money safe throughout your career until you need to partially or withdraw it. Using the UAN site and app to manage and oversee your cash is also beneficial for going the digital path.

What to do if you need further assistance with UAN?

On EPFO's website, a separate UAN helpdesk is accessible, with distinct sections dedicated to different visitor issues. Help and Claim are the two main categories. Employees and employers can use 'Help' to answer questions about EPFO office locations, UAN, Services, Grievances, and other topics. The term 'Claim,' on the other hand, refers to the different claim forms available to users, such as the Composite Claim Form (Aadhar) and so on. Members can use this help desk, which is open 24 hours a day, to answer their questions and problems.

Why is UAN important?

The Employee Provident Fund (EPF) has been digitized, and all EPF-related services are now available online. It is thus necessary to obtain a UAN to access EPF information and services. Employees can use the UAN to do various EPF-related tasks online in a short amount of time. Including EPF withdrawal, EPF transfer from one account to another, checking EPF account statements, accessing EPF account passbooks, and applying for a loan against EPF.

How can Deskera help?

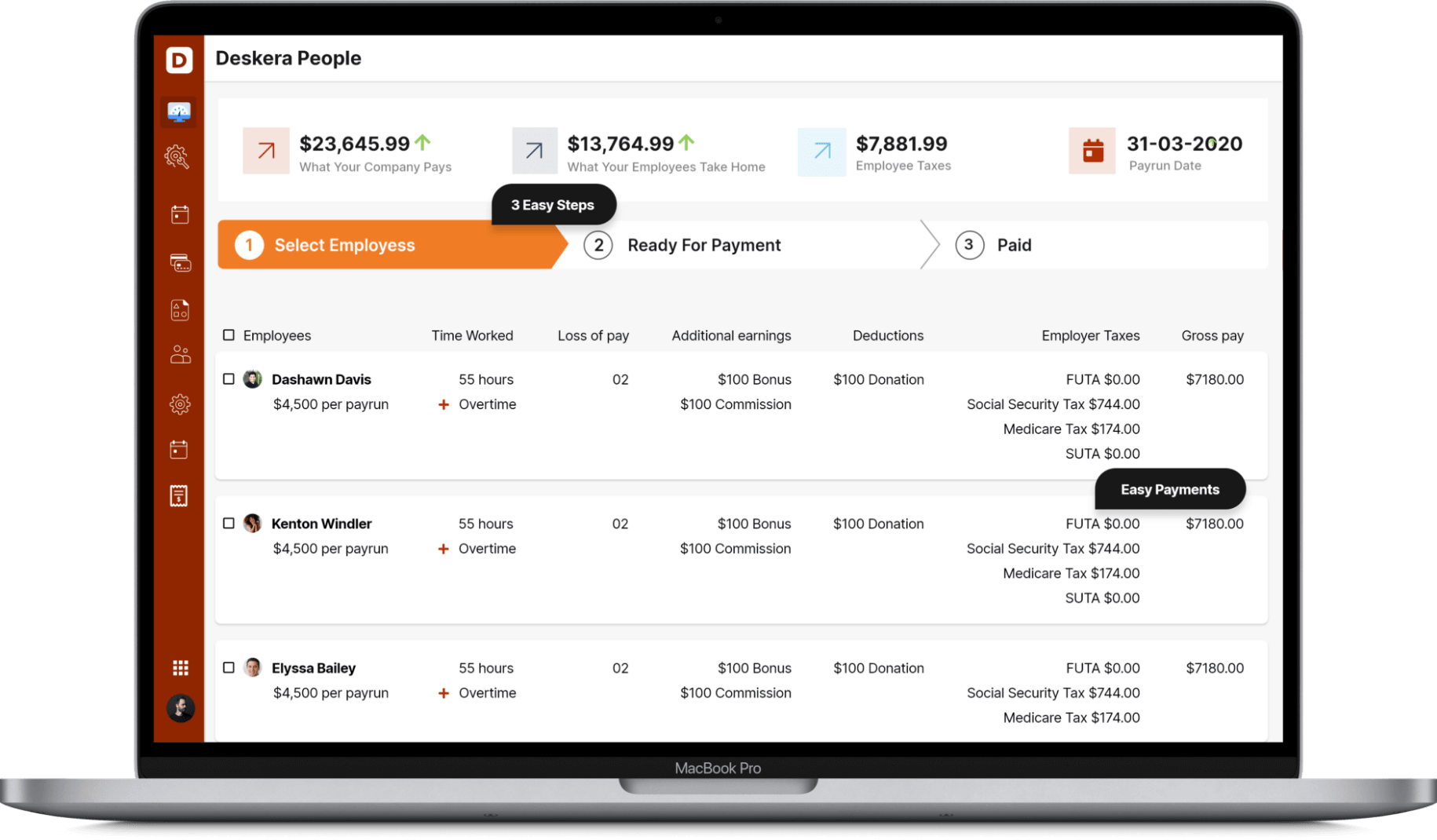

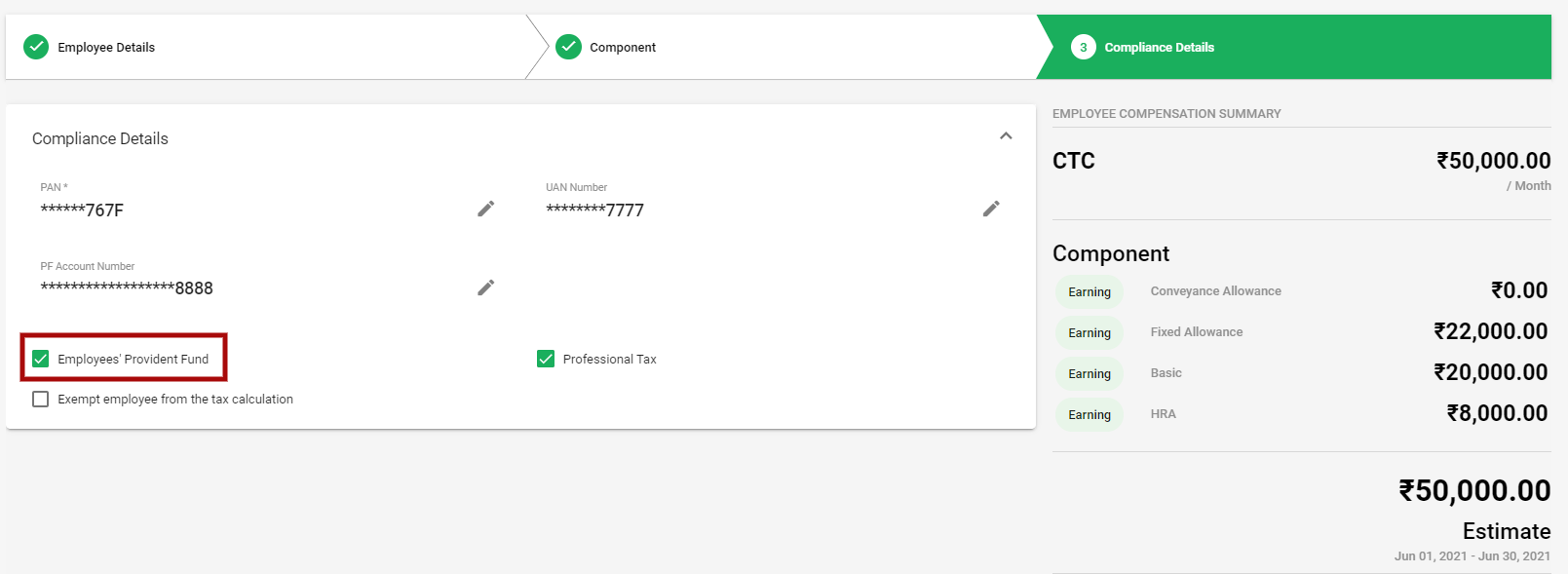

Deskera HRMS is all in one; it has many functions that will come in handy. To start with, you have excellent payroll software that will ease out the payroll process of your company. And the best part of the Deskera HRMS is you can do it in just three steps. Simply add employees to the system, select the amount to be paid, and pay them off.

You can generate payroll and payslips in minutes using Deskera People. You can also file and manage your taxes using Deskera People. Deskera is an online cloud platform that can helps you organize your business, your employees and with handling your tax filings. Apart from helping you process your monthly payruns, Deskera People also handles your employees’ Income Tax saving investments.

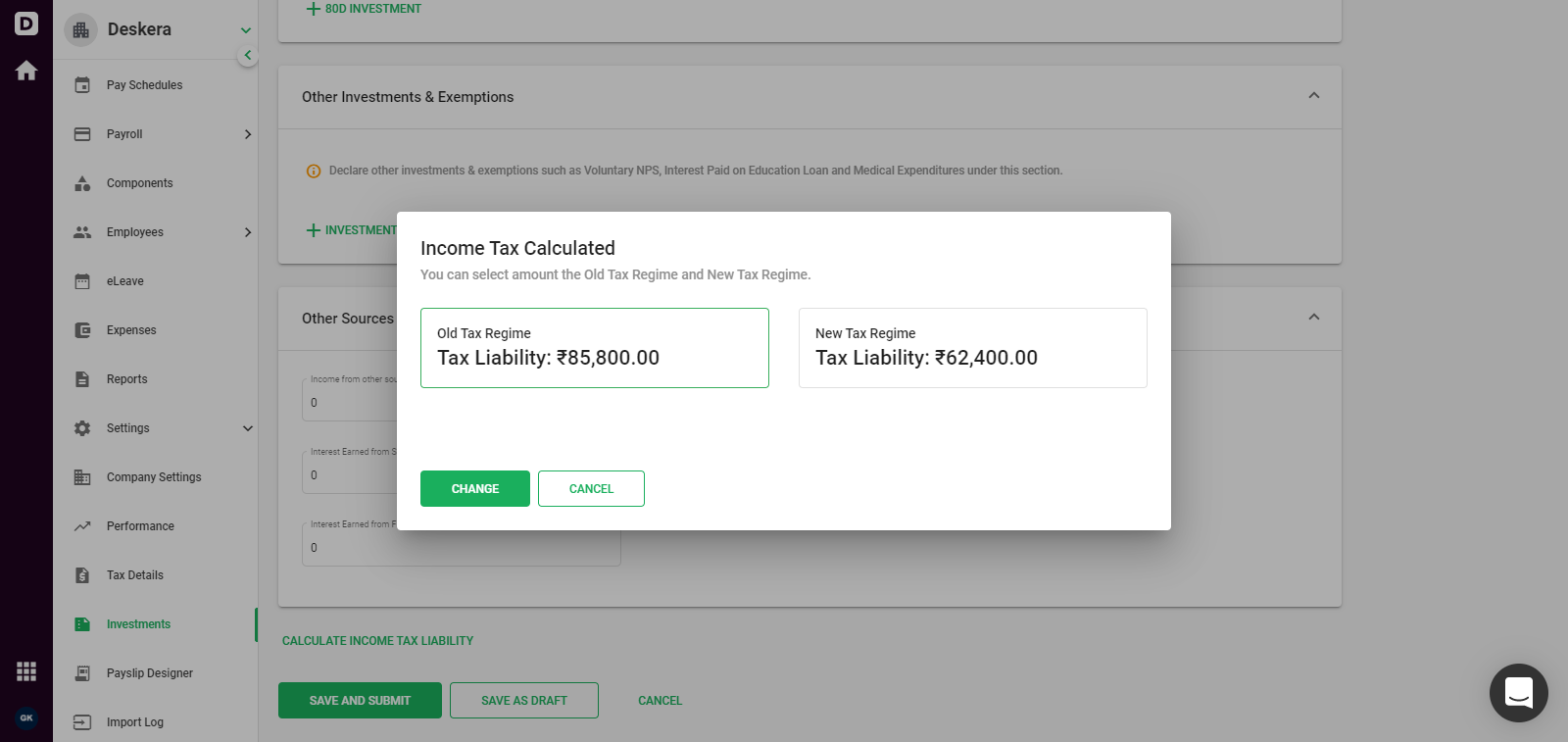

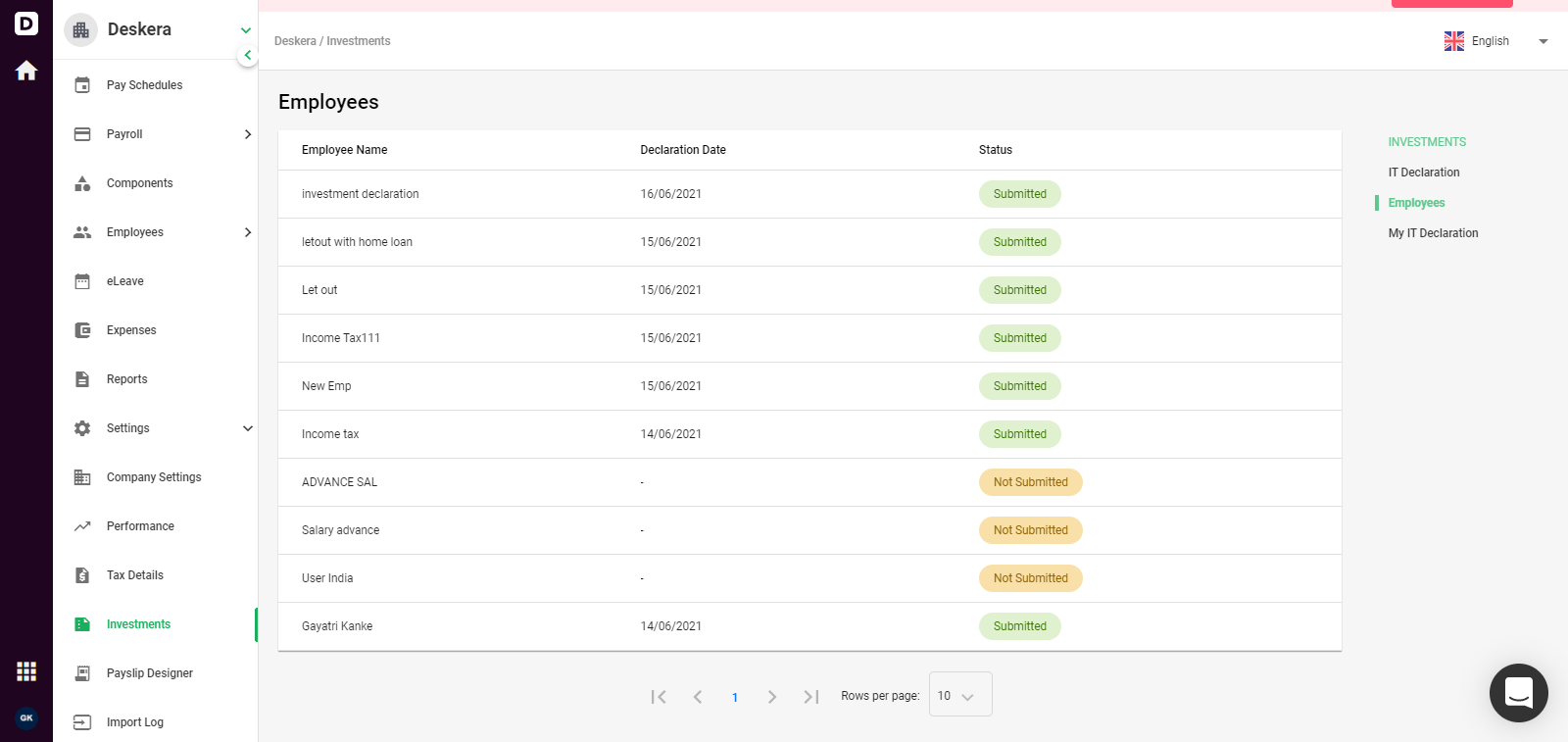

A 15-day free trial will enable you to become familiar with the enterprise features. Deskera People provides you with an amazing HRMS system that helps you manage your employees from end to end. From managing payroll, employee onboarding, leave and attendance management, deskera also helps you with salary management. Using Deskera People, you can file your Income Tax or IT declaration and Proof of Investment(POI) using the platform.

Deskera People simplifies the process of filing an ITR. Your organization's needs can be met with a customized plan designed by Deskera. Easy-to-use Deskera's tax software can help you file your taxes in no time. Business owners with any type of tax filing requirement can rely on the system. Employees can declare their proposed investments and anticipated expenses through the IT declaration.

Employees can declare the investments that they have made and submit proofs for the same, and Deskera People will auto - calculate the Income Tax based on the type and amount of each investment. The main incentive for employees’ to declare their investments is that it reduces their net taxable income, thereby decreasing the amount they need to pay as Income Tax.

Once the IT Declarations are submitted by all the employees, the employers can view the status of these submission. Other than payroll management, Employee Provident Fund (EPF) and EPS contribution are also calculated in Deskera People. With Deskera People, you can accurately and automatically calculate the EPF and EPS contribution for both employee and employer.

All you need to do is access one dashboard, and you have all your employee information aligned together. The People Dashboard depicts all the pertinent information like the cost of the previous pay run and estimates of the upcoming one.

It also illustrates the year-to-date cost in a graphical interface. The calendar embedded in the Dashboard helps you identify the upcoming pay run dates for you to take action.

With Deskera, you can also add and deduct salary components easily without much hassle. Simply set up employee bonuses, voluntary deductions, taxes, and so on. Deskera also develops extensive reports on your payroll, taxations, and all you need to know about your company. As a result, you are always prepared for any inspections taking place or if you have to go through any specific information.

Key Takeaways

- A UAN is a one-time user account number.

- UAN makes it easier to link a member's several EPF accounts.

- The KYC papers that need to be supplied for UAN connection include a member's PAN, Aadhaar, and bank account data.

- Through digitally validated KYC, previous EPF accounts can be linked.

- Through an Aadhaar-enabled UAN, EPF services may be accessed directly.

- The EPFO assigns UAN to members who have made at least one contribution since January 2014

- EPF members who do not have a UAN and have not made any contributions since January 2014 can ask the EPFO to assign one

- A member must register their cellphone number with the EPFO to activate their UAN. They can change the cellphone number associated with their UAN at any time.

- Any Indian citizen, regardless of whether or not they are a member of the EPF, can apply for a UAN

- Members with an Aadhaar-enabled UAN can submit EPF claims to the EPFO directly. Members do not require to approach their employers for attestation of claims.

- All UAN-enabled member services accept online applications

- EPF members who often move occupations and locations will benefit from UAN-enabled member services

- After signing on to the Unified Portal, EPF members can obtain their UAN card from their online account

- When moving employment, members with UAN should give their KYC and UAN to the new business. The auto-transfer of the member's prior EPF accounts will be made more accessible due to this

Related Articles