Businesses and even personal transactions are sometimes done using checks. Checks have been in use for a long time and are considered to be a convenient mode of transaction by most businessmen.

The only additional task related to them is the employer must send his employee to cash it within a specific time.

If he fails to remind his HR employee or any other professional who is in charge of taking the checks to the bank, they become stale-dated checks.

ERP.AI helps businesses track issued checks in real time, send automated reminders before expiration, and reduce the risk of checks becoming stale-dated through intelligent payment scheduling.

What are stale dated checks?

According to the official definition, stale-dated checks are those checks which are at least 6 months that are 180 days old. It means if the employer fails to encash an issued check even after half the year has passed, the bank teller might consider it stale-dated. However, it does not prevent the check clearance from the bank through other means than a teller professional in the bank organization.

What type of checks goes stale?

If you are a small businessman who has just entered the industry or a budding entrepreneur keen to enter the market, it is important for you to understand which type of checks are counted as stale-dated checks. As per the law, usually, the 6-month time frame for check clearance is applied to personal and business checks in the U.S. It means this is also applicable for the payroll checks which are commonly used to give the monthly pay stubs for employees or are the fees received from the clients.

Apart from that, an employer who has received checks from the US treasury such as federal tax refund can be counted as stale-dated checks. These checks have a time limit of 12 months after they are issued by the government of America. In contrast to this, the check received from the state government is considered to be valid for 6 months. The rule for the validity of checks issued by the state government can vary according to the state legislature in America.

As a result of the difference in the state rules, the time required for a check to become stale also varies for the various states in the U.S. Hence, as per the available information, the check can be considered stale if not cashed in the bank within 60 days or it might never be considered stale. This is also dependent on various factors and bank rules.

The employer must know that sometimes, the bank issuing the check gives an expiration date on the check itself. If the bank does this, it gives a clear idea about the date for both, the client and the service provider which makes the whole process less complicated.

How to understand if the check has gone stale?

A small business owner who has just started a business can find it quite difficult to understand which check is valid and which has gone stale if he does not ask his HR or concerned employee to deposit it in the bank. To have sound knowledge about stale-dated checks, the employer must have a fair idea about how to find out if the check has turned stale.

According to the bank rules, there are a few ways that can help him understand whether the business owner has stale-dated checks in position. He must also inform the employees to determine if the check is valid or has become stale. These are some of the ways in which he can check the validity of the check -

- See what date is written on the front side of the check. If the mentioned date is more than 180 days old, then it has gone stale.

- The employer can also understand stale-dated checks through the issuer's time limit. Usually, the banks provide preprinted instructional language on the checks that specify how long they are valid. This means it is written on some business checks clearly - “Not valid after 60 days”. However, an important point to note here is even if the time limit to encash the check has passed, the bank might still cash it to clear the dues to the recipient.

- The client-side of the business must have a hawk’s eye for the checks written for business transactions. He should regularly examine his business account to ensure that there are no outstanding checks to the service providers, specifically small business owners. The rule is the same for the client-side as well. If the bank in which he has a business bank account had not cleared checks for more than six months, then they would be counted as stale-dated checks.

Are these checks valid?

If the business owner fails to deposit his business checks in the bank within the notified time on them, they become stale. An important point here to note is even if these checks become stale, it does not imply they have become void and cannot be encashed. It means the bank needs to honor it. The only condition in this situation is the financial institution has a right over the refusal of the check.

Can stale dated checks be deposited?

The most common question which comes into the minds of a new business owner is can the stale-dated checks be deposited in the bank to get their project income if they have surpassed the written time limit. The possibility of clearance of the business amount lies with the bank itself.

While a bank can use its right to refuse the old-dated check and even return it the same to the original issues, it can also have a change of mind and even honor it for depositing the fees in the industrialist’s business account. Hence, an employer must consult with a bank professional before trying to encash the stale-dated checks and understand the bank’s policy for which the check has been drawn in the business.

Are there any risks involved?

The stale-dated checks come with their difficulties. Hence, a business owner and the client who is trying to make a transaction should be aware of the things he needs to know when encashing or depositing these checks. Here are a few things both parties must be aware of -

- The deposited check can be rejected by the bank even if it is accepted for deposit. It means the issued check can be rejected by the bank. In such a case, the client-side of the business might be required to pay the processing fee as the funds get withdrawn from his account but are not deposited in the business owner’s official company bank account.

- The stale-dated checks can also be returned to the issuing business owner if there are insufficient U.S. dollars in the account. It indicates a lack of funds. This can occur even if the entrepreneur has closed his account. Furthermore, if there are insufficient funds in the client’s account, it would bounce and it means the depositor will be still owing money and applicable fees for business as his transaction was not cleared for the industrialist.

- According to the information available, a business owner’s account can also become negative in certain circumstances. This happens when a third party tries to encash or even deposit the stale-dated checks from the account that handles business checks and the transaction occurs despite insufficient funds. When such a scenario occurs, the account holder’s account could be withdrawn as well as he might face bad times. He would be required to pay a fee if he fails to issue a stop-payment order to the bank which holds his business bank account.

What to do to avoid stale dated checks?

Stale-dated checks can be a big headache for both the client and the business owner if not timely checked. To avoid these potential headaches and other problems while handling the business, it is always better to follow these simple rules -

- The businessman must ask his HR personnel to deposit the check as soon as he has received it from the client to avoid problems later.

- Also, the business owner can ask for doing the transactions in cash which is a very old way as the world is now giving preference to cashless transactions.

- He can also take a step forward and the entrepreneur can request the client to do the business transactions by using an electronic payment method instead of checks.

While there are these solutions available in almost all the industries today, the industrialist must timely review his bank statements every month to ensure the written checks do not go stale. By doing a regular examination of the transactions, even the small businessman can spot the checks that haven’t been encashed easily. Once he has identified the checks that are approaching the six-month mark, he can easily contact the concerned recipient and ask him to collect the funds with appropriate bank procedures.

What to do if a business owner notices stale dated checks in his books?

Having a bookkeeper or accountant in the organization can be a great help to the employer. When a bookkeeping or accounting professional notices that a check might become stale-dated after its period ends, he would rightly connect with the business owner and even encourage him to encash the check before its period ends.

A few points to be noted about the stale-dated checks are -

- If the company fails to encash the check, the business owner has to go through the escheatment process and he shall lose the cash.

- In a case where the entrepreneur commits about the loss of the stale-dated check, he needs to sign and issue a new one. Also, he must issue a stop payment notice for the old check to avoid its wrong use

With a stop payment notice, the bank employee who is responsible for handling your accounting transactions ensures that the check becomes void. It prevents the other business owner who is on the client-side of the table from cashing old and new checks, thereby maintaining transparency in the business.

3. Stop payments are an essential factor as they highlight why bookkeeping is necessary for the success of your business.

What to do for stale dated checks?

A business owner must define a clear company policy to outline how his organization handles the stale-dated check. Under this policy, he must ensure the check received is deposited in the bank within a month. Furthermore, the policy must state the rules about the action to be done if the recipient does not cash the amount that you have issued in business. A practical company policy can be established in an organization as per the state laws.

How AI Prevents Errors and Optimizes Payment Management

AI-powered platforms flag outstanding payments, automate check reconciliation, and notify teams about expiration risks. By tracking transactions in real time, AI reduces the likelihood of outdated payments being recorded or cleared.

AI also suggests next steps—whether it’s voiding stale checks, reissuing payments, or updating vendor information. With smart reminders and automated workflows, businesses improve their accounts payable accuracy and stay compliant with financial regulations.

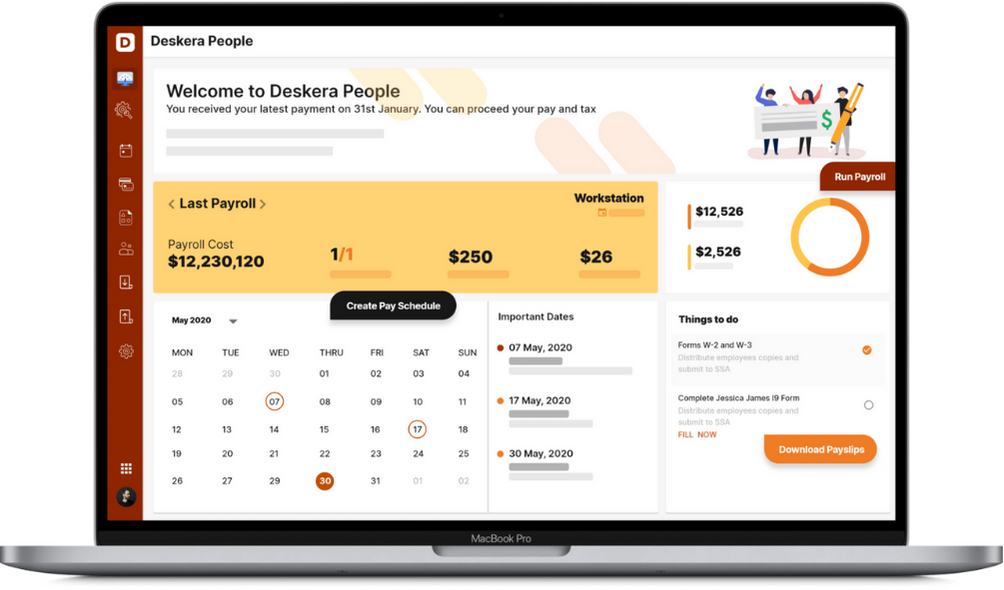

How Deskera Can Assist You?

As a business, you must be diligent with the employee payroll system. Deskera People allows you to conveniently manage payroll, leave, attendance, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- A check that is issued 6 months earlier but not deposited in the bank becomes a stale-dated check for both sides in the business.

- The business owner must ensure stale-dated checks are notified to the service provider for cancellation and to ensure there is no transaction debit to the company account. It makes sure that there is no loss of pay from the client-side of the business.

- Usually, the bank provides checks with a written period that makes the depositor and even the entrepreneur understand the validity of a check. It is written in small and legible letters on the front side of the check.

- To avoid the complications related to these checks, the employer must insist on his accounting professional or the HR department depositing the check as soon as they are received in the bank.

- There are many risks associated with stale-dated checks. The bank can reject them even after they are deposited before the actual transaction occurs. This could be because of issues related to the processing fee, insufficient funds in the account or even if the third party tries to encash the check.

- The business owner must call the bank and issue a stop payment notice if there have been any complications related to the stale-dated checks.

- Using payroll software and proper bookkeeping records can make sure that the checks for an employer and even business provider do not become stale. It means the transaction is completed well before time and further complex issues can be avoided

- Stale-dated checks are outdated checks issued to the bank after the payment date has expired. Hence, an employer must be very cautious about issuing checks for different departments including payroll and other business areas. Being proactive and timely checking the banking transactions can assist the business owner in avoiding these checks and even guarantee less complexity in his professional life. Deskera is a one-stop solution to handle the payroll of your employees and makes use of cutting edge technology to handle business transactions at the touch of your fingertips.

Related Articles