If you are seeking to offer a fair and equal opportunity to your employees in terms of wages, then you would want to know about the minimum wages relevant to your industry in your state.

US labor law as well as a number of state and municipal legislation determine the minimum wage in the US. Employers are typically required to give employees the greatest minimum wage allowed by federal, state, and local legislation.

The Congressional Budget Office predicted in 2021 that raising the federal minimum wage gradually to $15 per hour by 2025 would help 17 million employees but also result in a 1.4 million reduction in employment. Additionally, it might raise wages for 10 million additional workers, elevate around 900,000 people out of poverty, raise prices, lead to a slight decline in overall economic production, and add $54 billion to the federal budget deficit over the following ten years.

Raising the minimum wage is a step toward providing a better life to the employees. Also, by keeping the wages in line with the increasing inflation and cost of living, employers can help bring a positive change to the employees’ lives. However, we must remember that the increase in minimum wages implies a higher payroll tax for employers.

What are the pros and cons of raising the minimum wage, and what are the other effects that it would come along with? There is a lot more that we shall uncover about the states that have raised the minimum wage and also learn about the pros and cons of raising the minimum wage.

- What is the Federal Minimum Wage?

- Pros of Raising the Minimum Wage

- Cons of Raising the Minimum Wage

- Handling the effects of raising minimum wage

- What are the changes to states' minimum wages

- State minimum wage rates in 2022 Vs. 2023

- States that will increase Minimum wages in 2023

- FLSA Regulations

- States to experience an increase of $15 minimum wage

- Which state has the highest minimum wage?

- Which state has the lowest minimum wage?

- Minimum wage raise in the US – FAQs

- How can Deskera help you?

- Key Takeaways

What is the Federal Minimum Wage?

The minimum wage rate, commonly referred to as a pay floor, is the lowest hourly wage that must be paid to employees. The minimum wage for workers in the public and private sectors, as well as in the federal and state governments, is set by the Fair Labor Standards Act (FLSA). Non-exempt workers must be paid at least the minimum wage or higher amount based on the rules set by the FLSA. The Act categorizes employees into several divisions, namely the regular employees, employees with disabilities, and tipped employees.

Some positions of employees are exempt and some are non-exempt under the Act.

Rights of the exempt employees

Under the FLSA overtime regulations, an exempt employee essentially has no rights. According to the FLSA, an exempt employee's only real rights are to receive their full base compensation throughout every work period in which they perform any job, subtracting any permissible deductions.

Nothing in the FLSA prevents an employer from mandating that exempt workers must adhere to a set schedule, or compensate for the time lost due to absences. The FLSA does not place any restrictions on how much labor time an employer may demand or anticipate from any employee, on any schedule.

Rights of non-exempt employees.

According to the FLSA, nonexempt workers are entitled to time and a half of their regular rate of compensation for each overtime hour they actually put in over the required amount.

Pros of Raising the Minimum Wage

Raising the minimum wage certainly implies a higher labor cost. However, if you can ignore that there are advantages that you shall be introduced to. Let’s look at the pros of raising the minimum wage.

Better Employee Retention

Greater compensation may assist businesses to retain their workers since employees have less motivation to search for higher-paying employment elsewhere. The organization may ultimately find it advantageous to lower staff turnover.

High turnover frequently results in increased expenditures for onboarding and training. Employers may be able to control some of the rising labor expenses with the money they save from increased employee engagement.

Improved Employee Performance

Employee productivity typically increases when employers make an investment in them by paying them the wage they deserve. After all, employees are the ones to make a difference in the overall performance of the company.

Organizations must understand how happy and satisfied employees can work responsibly and well to accomplish the company objectives. When the employees know that they are treated well, the results are going to show in their performance and the final customer relationships and loyalty. Raising pay may result in improved output and a decline in error rates.

A surge in Goods and Services Demand

For lower-income households raising the minimum wage would have a positive effect on these households. They shall be in a better position to take care of their basic necessities. This can result in a rise in the demand for goods and services. Therefore, increasing the minimum wage might help the economy by fueling it.

Cons of Raising the Minimum Wage

Employers have a growing concern about raising the minimum wage. They fear that there are bound to be negative impacts on the business, and an increase in labor costs is one of them. Let’s look at them here.

Increased Cost of Labor

Every employee making between $7.25 and $15 will receive a raise until their pay reaches the new federal minimum wage as mentioned in the Raise the Wage Act of 2021. Employers will be accountable for raising wages for all workers, not just those making $7.25. Additionally, employers might feel obliged to increase wages for workers currently making more than the minimum wage, which would raise labor expenses.

This will be extremely difficult for the businesses that are operating on meager profit margins.

Tough Times for Inexperienced workers

When the states raise the minimum wages, the businesses would likely want to get the maximum out of their investment in the raised wages. This simply implies that the new workers, the ones who have no experience and the lesser-skilled workers will be turned down any job opportunities.

Employers are going to find it more cost-effective to hire a more experienced person owing to the increased wages and therefore, this could mean dire consequences for a lot of people. This will also include the teenagers looking for jobs, the younger workforce with basic skills, and the part-timers; all of whom would be the most affected.

Slashed Employment

When employers are encountering increased labor costs, they are bound to limit the number of hirings and also cut down the number of existing staff. The number of people losing their jobs might be on the rise, and the number is expected to tower to almost 1.5 million workers.

While this can be true for all businesses, irrespective of the size, the small businesses may receive small business loans, which may offer some degree of respite. However, if the process remains sustainable for them is something to be thought upon.

Handling the effects of raising minimum wage

Raising minimum wage and the subsequent rise in the labor cost are situations all employers need to handle. Amidst these times, employers need to derive strategies that shall help them look at the brighter side of things and implement changes in their organization to let the business happen the way it did.

What are these strategies that you can adopt to sail through the rough patch till everything falls in line? Let’s take a look.

Work on the business model to attract more customers

When you are faced with challenging situations, you know it is time to innovate. Device new campaigns, offer incentives (for service-based businesses) and do all that it takes to get more customers on board.

Some examples of this could be offering an extended warranty on the products you sell, if yours is a service-based business (like a salon or restaurant) you can offer incentives that attract more attention.

Check if you can reduce Employee hours

If yours is a business that does not require full-time employees working in the firm, you can cut down the number of hours they work, as a means to save on some dollars. However, you need to ensure that cutting down the time does not affect the overall productivity and the output of the business.

This is an area where you can explore and try out new means to enhance your profit. Another cost-saving measure you can take is trimming the employee benefits you offer. This may not go down well with your employees, but it can help small businesses from being cornered completely.

Automating some positions in your firm

See if there are positions in your company that can be automated to save costs. The advancements in technology and the various apps developed to help businesses are often one-time investments. You may only be required to pay yearly for an extension of the service. This could help you save costs effectively.

Automation as a method to save costs can be instrumental in lowering startup costs as well. Automating positions can ultimately prove to be a cost-efficient option considering how much you pay your employees currently. For example, if you are paying $15 per hour to one employee, you can easily estimate the cost you will incur if you opt for software to complete the same task. Chances are that the software could emerge as a much cheaper option.

Consider hiring contractors

Working with independent contractors can again help save labor costs. These are on-call positions and you can get them on board only when you need their services. This can be effective in cases where your business does not need permanent services for certain roles.

For example, you are into the food business and need a website to display some images of food items on your menu. You may not need a dynamic web page that needs to be updated too often. So, in such a case you can hire a graphic designer who looks into the project till completion and is paid when completed. You can skip hiring a permanent employee and save costs.

Increase Product Prices

The employers or business owners can rework the selling price of their products to counter the increased labor costs. It is essential to study the markets and learn about the prices your competitors are offering. If you notice a difference, you can increase the costs slightly.

However, you will have to tread carefully on this path. If you increase the prices too soon and by a lot of margins, it could result in repelling your customers. This could further hamper the growth prospects of your business.

Also, let your customers know that there has been a rise in the prices. You can also let them know the percentage rise. Apart from informing the customers, this step will also help you maintain goodwill with your customers, which would aid in boosting customer relationships and brand loyalty.

This could be an effective measure if you work out all the things carefully; eventually, it shall reap results to help you save costs.

What are the changes to States' Minimum Wages in 2023?

It can be difficult for firms with workers in many states to stay on top of all the minimum wage changes. There are twelve states that will still comply with the federal minimum wage, despite the fact that some are on a path for annual hikes to eventually reach $15 an hour.

Although the $7.25 federal minimum wage has been unchanged since 2009, more than a dozen states will continue to raise their minimum pay for hourly workers beginning in 2023.

State minimum wage rates in 2022 Vs. 2023

The chart in this section provides the different wages as applicable in 2022 and 2023. Also, the businesses that offer health insurance to their employees are eligible for paying $1 less.

States that will increase Minimum wages in 2023

In 2023, the minimum wage is increasing in 13 states as mentioned in the following::

- California

- Connecticut

- Delaware

- Florida

- Illinois

- Massachusetts

- Michigan

- Missouri

- Nevada

- New Jersey

- New Mexico

- Rhode Island

- Virginia

FLSA Regulations

The FLSA regulates most jobs. There are some that are not regulated by it. While still covered by the FLSA, some jobs are regarded as "exempt" from its requirements regarding overtime pay.

What are the Exceptions to the FLSA's protections?

The FLSA overtime regulations may fully exempt some jobs from coverage. There are two basic categories of total exclusion. The Act itself explicitly prohibits some occupations. For instance, many agricultural laborers, as well as employees of movie theaters, are exempt from the FLSA's overtime regulations.

Another kind of exclusion pertains to positions covered by a certain federal labor statute. Generally speaking, the FLSA does not apply to a job if it is covered by another federal labor statute.

States to experience an increase of $15 minimum wage

The following states have approved laws requiring the minimum wage to be $15 by 2023 and beyond.

- Connecticut in 2023

- Delaware in 2025

- Florida in 2026

- Illinois in 2025

- Maryland in 2025

- Massachusetts in 2023

- New Jersey in 2024

- Rhode Island in 2025

- Virginia in 2026

Which state has the highest minimum wage?

With $15, California has the highest minimum wage in the country. However, only companies with 26 or more employees are subject to this pay. A close second comes Washington at $14.49. It is the state's highest minimum wage that all businesses must adhere to. The three states with the highest minimum wages in 2023 will be Massachusetts, Connecticut, and California. Washington, D.C. has the highest minimum wage of $15.20; yet, it will not be considered as it is not a state.

Which state has the lowest minimum wage?

Georgia and Wyoming are the two states with the lowest minimum wages. Both are at $5.15. However, firms in Georgia and Wyoming that are subject to the Fair Labor Standards Act are still required to pay employees the $7.25 Federal minimum wage.

Minimum wage raise in the US – FAQs

Q: Is there a rise in the Federal Minimum wage in 2023?

A: No, the Federal Minimum wage does not increase in 2023 and stands at $7.25 since 2009.

Q: Who qualifies for FSLA exemptions?

A: Executives, administrators, highly skilled professionals, and computer programmers who are salaried employees may be eligible for FSLA exemptions. If a salaried employee earns more than $455 per week ($27.63 per hour) and meets certain other requirements, the FSLA minimum wage and overtime requirements may not be applicable.

Manual laborers and employees of public services like police, firefighters, and EMTs are not covered by this exemption.

How can Deskera Help You?

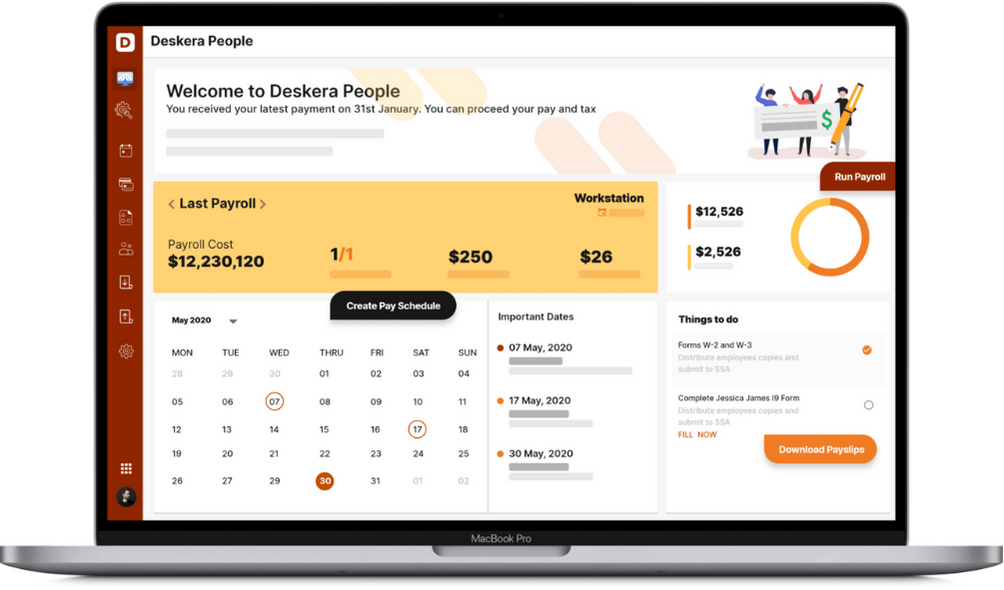

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- The minimum wage in many states is higher than the federal minimum.

- The minimum wage rates for some city, county, and state government employers and businesses are greater than the federal minimum.

- There may be further exemptions to the standard wage in some states, and a separate minimum wage for small businesses has been established in several of them.

- For their employees, many businesses have established a minimum wage that is higher than the government amount.

- The minimum wage rate, commonly referred to as a pay floor, is the lowest hourly wage that must be paid to employees. The minimum wage for workers in the public and private sectors, as well as in the federal and state governments, is set by the Fair Labor Standards Act (FLSA).

- Although the $7.25 federal minimum wage has been unchanged since 2009, more than a dozen states will continue to raise their minimum pay for hourly workers beginning in 2023.

- The businesses that offer health insurance to their employees are eligible for paying $1 less.

- In 2023, the minimum wage is increasing in 13 states that including California, Connecticut, Delaware, Florida, Illinois, Massachusetts, and Michigan, among others

- The FLSA regulates most jobs. There are some that are not regulated by it. While still covered by the FLSA, some jobs are regarded as "exempt" from its requirements regarding overtime pay.

- Better employment retention, improved employee performance, and a surge in demand for goods and services are some of the advantages of raising the minimum wage.

- Increased cost of labor, slashed employment, and tougher times for inexperienced candidates are some of the cons of increasing the minimum wage.

- Amidst raising the minimum wage, employers need to derive strategies that shall help them look at the brighter side of things and implement changes in their organization to let the business happen the way it did.

- Working on the business model to attract more customers, reducing employee hours, automation, hiring contractors, and increasing product prices are some of the ways in which employers can strategize things to let the business remain unaffected by the raised minimum wage.

- States to approve laws requiring the minimum wage to be $15 by 2023 and beyond include Virginia, Connecticut, Maryland, New Jersey, Florida, and Delaware, among others.

- With $15, California has the highest minimum wage in the country.

- The three states with the highest minimum wages in 2023 will be Massachusetts, Connecticut, and California

- Georgia and Wyoming are the two states with the lowest minimum wages. Both are at $5.15.

Related Articles