In 2021, the Paycheck Protection Program (PPP) was established to help small businesses to keep their employees on payroll during the COVID-19 pandemic. The program has provided critical economic support to millions of businesses, and the forgiveness of PPP loans is a major part of this program.

In 2023, the PPP Loan Forgiveness Program will be available to eligible borrowers. This program will forgive all or part of the loan balance for those who meet the criteria. The forgiveness will be based on a borrower's use of the funds for eligible expenses such as payroll, rent, and utilities.

The Small Business Administration will also consider the number of employees retained and the amount of loan funds used for payroll costs when determining the level of forgiveness.

To be eligible for forgiveness, borrowers must follow certain guidelines. These include submitting an application with documents verifying payroll costs and other eligible expenses, as well as providing proof of employee retention. In addition, businesses must use at least 60% of the loan funds for payroll costs and maintain the same employee headcount and salary levels as before the loan was taken out.

The PPP Loan Forgiveness Program is a great opportunity for businesses to get relief from the financial burden of the pandemic.

In todays’ guide, we’ll learn and understand about PPP Loans in 2023, loan forgiveness and all its related concepts. Let’s take a look the table of content before we dive in:

- PPP Loans: An Overview

- PPP Loan Forgiveness

- Requirements for Loan Forgiveness

- PPP Loans: First Draw

- PPP Loans: Second Draw

- PPP Loans: Third Draw

- Forgiveness Term: First Draw

- Forgiveness Term: Second Draw

- Steps to Apply for PPP Loan Forgiveness

- SBA Loan Programs for Small Businesses

- Frequently Asked Questions (FAQs) Associated with PPP Loans in 2023

- In Summary

- How Deskera Can Assist You?

Let’s get started!

PPP Loans: An Overview

The Paycheck Protection Program (PPP) is a loan program that provides businesses with funds to cover payroll costs, rent, utilities, mortgage interest, and other expenses during the COVID-19 pandemic. The loans are provided by the Small Business Administration (SBA) through participating lenders. The loans are 100% guaranteed by the SBA, so if a business defaults, the SBA will cover the loan.

Businesses with 500 or less employees are eligible for PPP loans. PPP loans are also available to sole proprietors, independent contractors, and self-employed people. The maximum borrowing amount is $10 million, or 2.5 times the average monthly payroll expenditures. The loan has a maximum period of 10 years and a 1% interest rate.

Payroll expenses, including perks, rent and mortgage payments, utility bills, and other debt obligations can all be paid with the help of the loan. To qualify for loan forgiveness, businesses need to use at least 60% of the loan on payroll expenses. Funds must be used within 24 weeks of the loan origination date, and any unused funds must be repaid.

The loan forgiveness can be up to 100% of the loan amount, depending on how much is used for payroll costs. The proportion of loan forgiveness will be determined by the Small Business Administration (SBA) based on the difference between your actual payroll costs and the loan amount used for payroll costs.

In addition, the SBA may also forgive costs associated with certain property damage caused by civil unrest that occurred between May 25, 2020, and June 10, 2020. This includes damage to business property, real estate, and inventory.

Furthermore, you must apply for loan forgiveness with the lender that originated the loan. The lender will then submit the application to the SBA for review. The SBA will determine whether the loan is eligible for forgiveness and, if so, the amount of forgiveness.

Moreover, it is important to keep accurate records and documentation of all loan expenses to ensure that you are able to receive all of the loan forgiveness you are eligible for.

PPP Loan Forgiveness

The Paycheck Protection Program (PPP) Loan Forgiveness program is part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. It allows small business owners to get loans from the government to cover their payroll, rent, mortgage, and other expenses during the COVID-19 pandemic.

The loans are forgiven if the borrower meets certain requirements, such as using the loan proceeds to maintain payroll and other expenses. Furthermore, the loan forgiveness program is handled by the Small Business Administration (SBA) and is administered by authorized lenders.

To be eligible for loan forgiveness, PPP borrowers must use at least 60% of the loan proceeds for payroll costs, including salary, wages, tips, and benefits. At least 40% of the remaining loan proceeds must be used for other qualifying expenses, such as rent, utilities, and mortgage interest. Moreover, the borrower must also maintain employee and compensation levels for at least eight weeks and make payments on time.

Furthermore, PPP debts are entirely forgiven if all conditions are met. To be qualified for a PPP debt forgiveness, borrowers must adhere to the following requirements and follow the recommended steps to complete the application process.

Any forgiveness provided for inaccurate information is treated as taxable income by the IRS when it evaluates the PPP loan forgiveness allowance.

Requirements for Loan Forgiveness

You must fulfil a number of conditions before the SBA may forgive your PPP loan. Between eight and twenty-four weeks after the date of loan disbursement—the day you actually received the money—any of the following occurred:

- Employee and compensation levels are maintained.

- The loan gains are used to cover payroll costs and other permitted charges. Specific protective equipment, supplier costs, employer-provided group insurance premiums, property damage, and operational costs are now included in the list of "qualified expenses" for the Second Draw PPP loan in 2021.

- Payroll costs, which include payments for wages, cash tips, salaries, vacation, family, parental, medical, or sick leave, health benefits, and state and municipal taxes imposed on employee remuneration, must have been covered by at least 60% of the loan proceeds.

- You must have maintained or restored your full-time employee headcount and salary levels for each employee as of February 15, 2020.

- You must have maintained the salaries and wages of your employees during the loan period at least equal to the salary or wages in effect as of February 15, 2020.

- You must have not reduced the number of employees or the salary or wages of employees by more than 25% during the loan period.

- You must have used the loan proceeds to cover eligible non-payroll costs, such as interest on mortgages, rent, utilities, and covered operations expenditures.

- To request loan forgiveness, you must submit a request to your lender.

- The number of full-time equivalent employees on payroll and pay rates must be supported by papers, such as state income, payroll, and unemployment insurance forms as well as IRS payroll tax filings.

- For the eight weeks following the date of the loan origination, you must present proof of payments for covered mortgage obligations, covered rent obligations, and covered utility obligations.

- You must attest that the information provided is accurate and that any money used to request forgiveness was used to pay rent, utilities, employee salaries, or mortgage interest.

PPP Loans: First Draw

First-draw, or initial PPP loan applicants, were qualified for up to $10 million after receiving financial authorization. Loan amounts were calculated by multiplying the business's annualized average monthly payroll by 2.5. Payroll sums are not included in the total loan amounts when calculating:

- Fringe benefits

- Employees with a permanent residence outside of the United States

- Sick pay and family leave compensation

- Wages for employees that have exceeded $100,000 in annual salary

- Payments to independent contractors

- Workers’ compensation fees

- Federal employment taxes paid or withheld between February 15, 2020, and June 30, 2020.

The PPP Flexibility Act of 2020, which altered the regulations regulating PPP loans and added $310 billion in investment, was signed into law on June 5th, 2020. The new PPP guidelines offered a specified deferral period, extended the maturity dates of PPP loans, and addressed PPP loan forgiveness in greater detail.

PPP Loans: Second Draw

Drawing for the second round of PPP loans up to $2 million were made available to borrowers who had used up all of the money from the initial round of PPP loans. The terms of the Borrower's First Loan must apply to the Second Draws.

Furthermore, PPP borrowers qualified for the second draw of PPP loans if they could show declining gross receipts from 2019 to 2020, had 300 or fewer employees, and used all of the money from the first draw.

PPP Loans: Third Draw

After the funds allocated for the first two rounds of PPP loans had been spent, President Joe Biden signed the Consolidated Appropriations Act (CAA) of 2021 into law on December 27, 2020.

The CAA made several improvements and modifications to the CARES Act's paycheck protection programme, including adding $284 billion in funds for PPP loans.

The Consolidated Appropriations Act also included provisions to promote borrower access to loan forgiveness as well as funding for particular lending institutions, including:

- For loans issued by minority depository institutions and community development financial institutions, $15 billion in funds will be protected (CDFI).

- $15 billion in guaranteed funds are available for institutions with assets under $10 billion.

Entrepreneurs were eligible to apply for the third round of PPP loans offered by the CAA, regardless of whether they had previously applied for a first PPP loan or were doing so for the first time.

On behalf of the federal government, the SBA supplied funds for the third round of PPP loans, which were also completely guaranteed by that organization. The loans had no requirement for collateral or personal guarantees, a fixed interest rate of 1%, and a five-year repayment period.

The initiative was terminated on May 31, 2021, as the remaining loan monies from the third round of funding were used up.

Forgiveness Term: First Draw

The small firm must satisfy the following requirements in order to be qualified for a first draw PPP loan forgiveness during the 8 to 24-week coverage period following disbursement:

- Maintain the same staffing levels and pay scales.

- 60% of the loan's earnings were utilized to cover payroll expenses.

- The entire loan amount was used to promote entrepreneurship via payroll costs or other legal company charges.

Forgiveness Term: Second Draw

Loan forgiveness is feasible for second draw candidates who obtained up to an extra $2 million in funding, provided that the company meets the same criteria as first draw candidates.

Steps to Apply for PPP Loan Forgiveness

Following we've listed crucial steps to apply for PPP loan forgiveness in detail. Let's learn them:

1. Determine Eligibility:

To qualify for PPP loan forgiveness, businesses must meet certain criteria. Moreover, it is important to understand the requirements and eligibility before applying for forgiveness.

2. Consult with the PPP Loan's Lender:

Some lenders participate in direct forgiveness, in which case the borrower must make an application through the SBA website. Furthermore, if your lender declines to participate in direct forgiveness, you must finish the loan application procedure with them.

3. Gather Documentation:

Collect all documents needed for the loan forgiveness application. The SBA may require bank statements, receipts, or other evidence of paid payroll expenses as well as any other qualifying operating expenses, like mortgage and utility payments, that show how the average payroll calculations were totaled as part of the loan forgiveness approval process.

3. Calculate Amount of Forgiveness:

Calculate the amount of forgiveness you are eligible for. This amount is based on how you used the loan funds and other criteria.

4. Submit Application:

Send your application to the loan's original lender. Include the amount of forgiveness you are requesting along with the necessary supporting paperwork.

Check the following documents that you need:

- Rent or lease payments for a business: Include proof of the acceptable payments in the form of canceled checks or receipts, together with a copy of the most recent leasing agreement.

- Cancelled checks, account statements, copies of invoices and receipts, utility payments for business.

- Payment receipts, lender account statements, or a copy of the lender's amortization schedule must be sent with payments for business mortgage interest.

- Operation-related costs: Copies of paid invoices, orders, or purchase orders, as well as evidence of valid payments in the form of invoices, cheques that have been cashed, or account statements.

- Copies of contracts, orders, or purchase orders that were in force prior to the covered period, as well as paid invoices, orders, or purchase orders, and receipts, voided checks, or account statements attesting to the legitimacy of the payments, are all included in the supplier's costs, with the exception of those for perishable goods.

- Property damage costs: To prove that some expenses were incurred as a result of uninsured property damage brought on by vandalism or theft that took place in 2020, you'll need copies of the paid invoices, orders, or purchase orders, as well as receipts, cancelled checks, or account statements.

- Copies of paid invoices, orders, or purchase orders, proof of payment in the form of receipts, voided checks, or account statements, and documentation proving the costs were incurred for the following are all acceptable forms of proof for worker protection charges. the COVID-19 user guide

5. Return all Applications and Forms:

After assembling your supporting documentation, submit all the completed forms that your lender or the SBA portal have asked. Furthermore, if you require assistance, speak with your lender or a nearby small business development center.

6. Keep Monitoring the Application:

Keep an eye on the application; if more information is needed, your lender will let you know. Your lender will also let you know when a decision about your request for forgiveness has been made.

7. Receive Approval or Denial:

After reviewing your application, the lender will decide whether to grant or reject your request for forgiveness.

8. Appeal Denial or Request Additional Documentation:

If your application is denied, you can appeal the decision or request additional documentation.

9. Repay Unforgiven Amount:

If your application is approved, you will only have to repay the amount that was not forgiven. The amount you will owe will depend on the type of loan you have and the terms of the forgiveness program.

SBA Loan Programs for Small Businesses

SBA loans are backed by the U.S. Small Business Administration, much like PPP loans are. The government guarantee lowered the lender's risk even though the money was offered by an SBA-approved lender.

There are guidelines for the acceptable uses of the money as well as the conditions and interest rates of specific SBA loan programmes. This type of finance is preferred by small business owners who are eligible for SBA loans because it has more flexible eligibility requirements, lower interest rates, and smaller down payments.

Microloans

The SBA microloan programme is a financing option for small businesses and some nonprofit childcare centers. The $50,000 maximum loan amount may be used to finance any business need. It further includes working capital, inventory costs, starting and growth costs, and equipment purchases.

Disaster Loans

The SBA Economic Injury Disaster Loan (EIDL loan) funding programmes were developed to help small business owners that experienced revenue losses as a result of the outbreak. The EIDL programme is no longer accepting new applications.

7(a) Loans

The 7(a) loan programme is the most well-known SBA business financing programme. Working capital from SBA 7(a) loans can be used to cover costs for running a firm, settle current debts or business credit cards, or fund major acquisitions like furniture and equipment. Borrowers may be approved for loan fees of up to $5 million if they satisfy the following requirements:

- run a business that is profitable.

- have less than 500 employees and a sizable stock investment in the business.

- Have all other financial commitments supported by the government current.

Merchant Cash Advance (MCA)

A merchant cash advance (MCA) leverages the borrower's receivables as collateral to guarantee the cash advance. An MCA is an agreement between a business owner and a lender. It varies from a loan in that future credit card sales or other business revenues are sold to the lender in exchange for an upfront lump sum payment. MCAs provide a quick finance option for any business that expects future credit card or debit card earnings.

504 Loans

The SBA 504 loan programme is often known as the CDC loan programme because the funding is given through certified development corporations (CDCs).

The program's objective is to provide long-term financing choices to small business owners so they may promote economic growth and create jobs in disadvantaged areas. CDC/504 loans can be issued to qualified borrowers for up to $5 million per project with a maximum of three projects permitted, or $16.5 million in cash.

Term Loan

The borrower receives a big sum of money up front and repays the loan over a predetermined length of time in a typical business loan known as a term loan. Consider term loans if you're looking for funding up to $500,000 with regular payback conditions.

Variable term loan interest rates fluctuate with market rates, while fixed term loan interest rates remain constant for the course of the loan. Term loans can be used for operating capital, growth, maintenance, or significant acquisitions and may require a down payment or a personal guarantee from the borrower.

Frequently Asked Questions (FAQs) Associated with PPP Loans in 2023

Following, we've discussed some crucial frequently asked questions (FAQs) associated with PPP loans in 2023. Let's take a look:

Que 1: In 2023, will there be a New PPP loan?

Answer: It is improbable that there will be another paycheck protection programme in 2023, despite the fact that it is impossible to predict with certainty what the federal government's future goals will be.

According to PPP data published on the SBA.gov website, small businesses and independent contractors obtained 11.4 million PPP loans in 2020 and 2021. 9.4 million people requested loan forgiveness. Of the $790 billion distributed through the PPP loan scheme, $680 billion in forgiveness was asked for.

The Covid-19 pandemic's long tail is still having an effect on business owners and independent contractors, therefore it's still possible that another request for further cash will be made. In the event that extra money becomes available for PPP loans, the Covid-19 Resource will be updated online with its most recent data and resources.

Que 2: What other financing options are available to small business owners?

Answer: As new PPP loans are presently not an option for the majority of small business owners, you may be asking if it is too late to get financial assistance to sustain the success of your company.

However, the good news is that there is a financing option that can help your business, regardless of whether the pandemic, inflation, or another circumstance was the cause of your financial instability.

In Summary

The Paycheck Protection Program (PPP) has been a lifeline for small businesses during the pandemic. The program has provided over $525 billion in loans to small businesses in the United States, helping to keep millions of jobs intact and keep businesses afloat.

After the Small Business Administration stopped accepting applications on August 8th, the programme has already come to an end.

Small businesses might get loans up to 2.5 times their typical monthly payroll costs through the PPP programme. These loans were then forgiven if the business spent the funds on payroll, rent, mortgage interest, and utilities.

The program was incredibly successful, with over 5.2 million loans approved. These loans kept millions of jobs intact and allowed small businesses to continue operations.

Overall, the conclusion of the PPP program is a bittersweet moment for many small businesses. While the program has been incredibly successful in keeping businesses afloat, it has now come to an end and many small businesses will now be on their own. It is unclear what the future holds for these businesses, but it is clear that the PPP program has been an invaluable source of support for them.

The paycheck protection programme provided financial security to millions of small company owners who were harmed by the pandemic. Many of those borrowers were successful in having all of their PPP loans forgiven. When new PPP loan requests will start to be accepted by the SBA is currently unknown, thus there may not be another round of funding at this time.

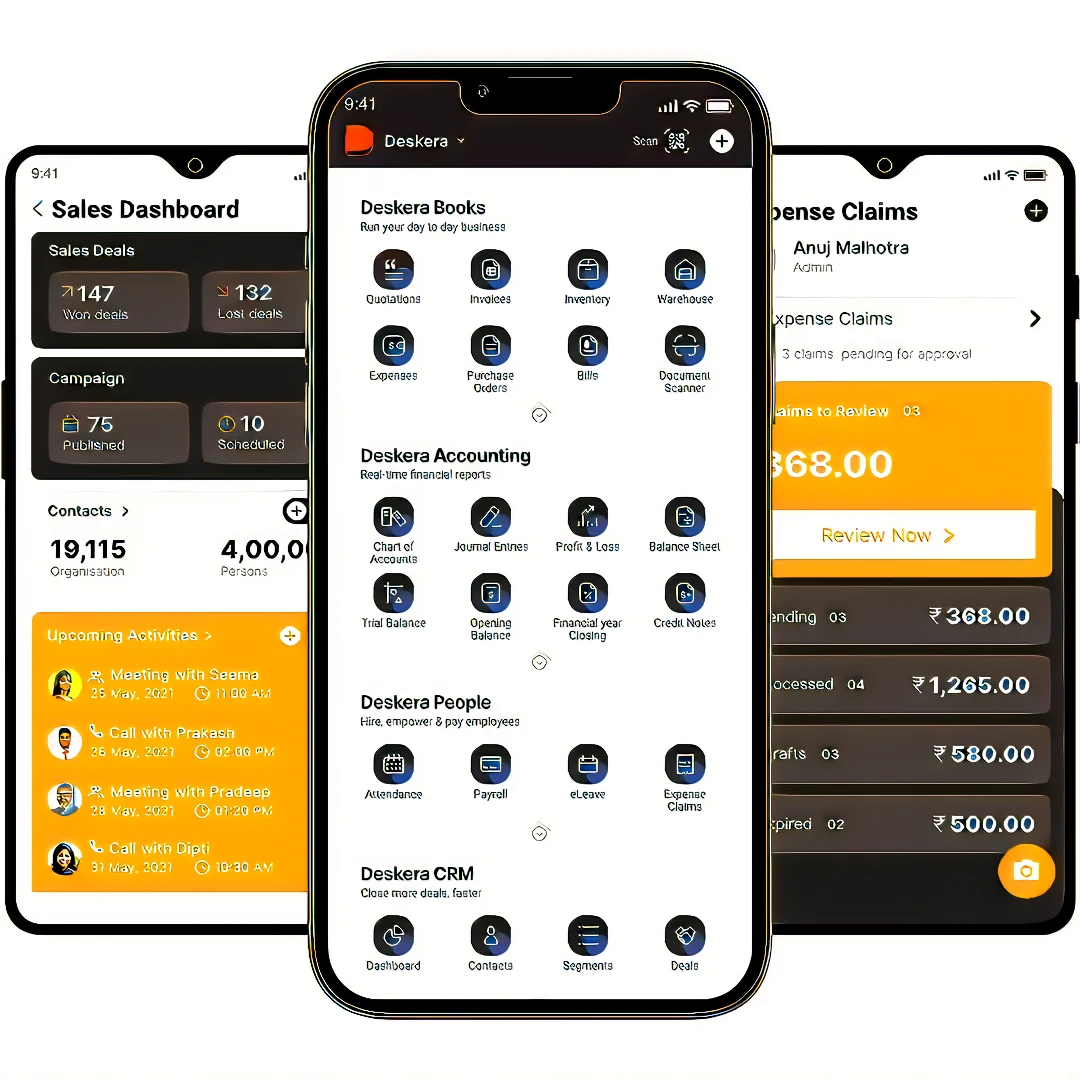

How Deskera Can Assist You?

Deskera's integrated financial planning tools allow investors to better plan their investments and track their progress. It can help investors make decisions faster and more accurately.

Deskera Books enables you to manage your accounts and finances more effectively. Maintain sound accounting practices by automating accounting operations such as billing, invoicing, and payment processing.

Deskera CRM is a strong solution that manages your sales and assists you in closing agreements quickly. It not only allows you to do critical duties such as lead generation via email, but it also provides you with a comprehensive view of your sales funnel.

Deskera People is a simple tool for taking control of your human resource management functions. The technology not only speeds up payroll processing but also allows you to manage all other activities such as overtime, benefits, bonuses, training programs, and much more. This is your chance to grow your business, increase earnings, and improve the efficiency of the entire production process.

Final Takeaways

We've arrived at the last section of this guide. Let's have a look at some of the most important points to remember:

- The Paycheck Protection Program (PPP) is a loan program that provides businesses with funds to cover payroll costs, rent, utilities, mortgage interest, and other expenses during the COVID-19 pandemic. The loans are provided by the Small Business Administration (SBA) through participating lenders. The loans are 100% guaranteed by the SBA, so if a business defaults, the SBA will cover the loan.

- Payroll expenses, including perks, rent and mortgage payments, utility bills, and other debt obligations can all be paid with the help of the loan. To qualify for loan forgiveness, businesses need to use at least 60% of the loan on payroll expenses. Funds must be used within 24 weeks of the loan origination date, and any unused funds must be repaid.

- The loan gains are used to cover payroll costs and other permitted charges. Specific protective equipment, supplier costs, employer-provided group insurance premiums, property damage, and operational costs are now included in the list of "qualified expenses" for the Second Draw PPP loan in 2021.

- Entrepreneurs were eligible to apply for the third round of PPP loans offered by the CAA, regardless of whether they had previously applied for a first PPP loan or were doing so for the first time. On behalf of the federal government, the SBA supplied funds for the third round of PPP loans, which were also completely guaranteed by that organisation.

- Some lenders participate in direct forgiveness, in which case the borrower must make an application through the SBA website. If your lender declines to participate in direct forgiveness, you must finish the loan application procedure with them.

- The SBA microloan programme is a financing option for small businesses and some nonprofit child care centres. The $50,000 maximum loan amount may be used to finance any business need, including working capital, inventory costs, starting and growth costs, and equipment purchases.

- The SBA Economic Injury Disaster Loan (EIDL loan) funding programmes were developed to help small business owners that experienced revenue losses as a result of the outbreak.

- The SBA 504 loan programme is often known as the CDC loan programme because the funding is given through certified development corporations (CDCs). The program's objective is to provide long-term financing choices to small business owners so they may promote economic growth and create jobs in disadvantaged areas.

Related Articles