It doesn’t matter if you’re living paycheck to paycheck or earning six figures a year, you need to know where your money is going if you want to have a handle on your finances.

How do you spend your month without running out of money?

How do you manage to cover your expenses with the limited amount in your pocket?

The answer to the above questions is the preparation of an effective and fluent budget system. A budget is a plan that represents an estimation of the income and expenses set for a particular period. Budgeting lies at the foundation of every financial reporting and planning.

For example, you get $3000 per month, so how are you supposed to pay for your electricity, telephone, insurance, groceries, debts, or other expenses, along with ensuring savings and investment?

Simple, by making a budget!

The budget also heads towards managing your finances through planning and decisions about financial health.

This article will discuss what we should do in general to improve financial soundness and stability through budgeting and personal finance rules that can help track and monitor progress. The concept of the budget includes:

- How to budget money

- Understanding the budgeting process

- What a Budget Does

- How to Make a Budget with detailed steps

- How to Use Your Budget

- Review and Tweak

- General Budgeting Tips

- The Best Budget Apps for 2021

How to Budget Money?

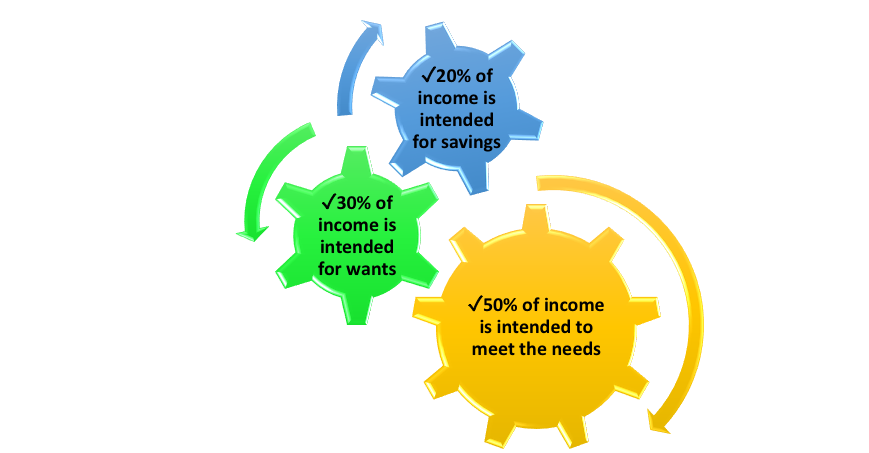

The preparation of the budget is based on the income received by the individual. The process of budget money is popularized as the 50/20/30 budget rule wherein.

✓50% of income is intended to meet the needs

✓30% of income is intended for wants

✓20% of income is intended for savings

Let's discuss the concept and allocation with the help of an example.

50% needs

Needs are the essentials that need to be paid or the things that are needed for survival. It

includes bills, payments, loans, groceries, health insurance, debts.

In short, it can be referred to as 'must-haves.'

30% wants

Wants can be described as a desire for the things that you wish to spend your money on. It includes expenses like watching movies, buying products, going to dinner, a vacation that gives you a sense of relaxation.

These are not needed and can be avoided.

20% savings

Savings means keeping aside a part of Income or investing it for future needs. It includes investing in stocks, mutual funds, and banks. The purpose of savings is to have enough funds to start with something new or meet the unforeseen liability.

So now,

Taking the above set example, if you earn $3000 per month, so based on the 50/30/20 rule, your allocation is described as follows.

And here you go!

Now you are set to begin and manage the month effectively.

Understanding the Budget Process

The process of creating the budget to manage personal finances is instructive. It's important to understand back and forth projections and estimates before preparing the same. Several factors like Income, statements, taxes, liability and savings are taken into consideration before setting up the budgeting plan.

Thus, to formulate the budget, you need to do the homework on the concepts and knowledge involved in the budgeting process.

For better understanding, let's look over to the following points that can help you to understand the process deeply:

- Figure out your income after tax

- Choose a budget plan that suits you

- Track your schedule and progress

- Use automation for savings

- Readjust and Revisit the plan accordingly

1. Figure out your income after tax

An individual receives gross income, and additionally, expenses like tax, insurance premium, liability are deducted. So, to figure out your actual Income, it's essential to calculate net income for budget purposes.

For example, if you receive $40000 as your gross income and after actual payments, you are left with $20000, so consider $20000 to create your budget.

It will help you evaluate the process well and give yourself an accurate picture of your income and expenses. Also, if you earn passive Income, then also add and subtract the costs associated with it.

2. Choose a budget plan that suits you

You can choose many budget plans, but it's crucial to select the right one for you that can cover all your needs, wants, and savings for unforeseen liabilities. There are two types of a budget plans that are commonly used are

- Zero budget plan, i.e., 50:30:20 rule

- Envelope system, i.e., the method relies on cash and unfolds itself as per months

3. Track your schedule and progress

Track your schedule and spendings on a daily, weekly, fortnightly, or monthly basis. You can use budgeting tools for your convenience

4. Use automation for savings

It is recommended to automate your savings that you have allocated for a different purpose right at the start. With automation, the amount will automatically be set aside for your spending without putting in minimal effort from your end. You can take the help of accountability partners or online support groups for assistance and manage your budget accordingly.

5. Readjust and Revisit the plan accordingly

Income, expenses, wants, and desires are not stable. They keep on changing and evolving. So you need to make sure that you readjust and revisit your plan accordingly and make changes as and when required.

You can figure out by yourself the level of extensiveness required to understand the budget process.

Once you have got the command, you can hold it right!

"Budget is not just about numbers; it's an expression of values and aspiration."

What does a Budget do?

A budget is a simple spending plan and is also regarded as a financial blueprint of an individual. A budget performs multiple roles to provide you and your family a reality check and enhance security.

The role of the budget covers the following points:

- Helps to eye on long term vision

- Helps to prepare for contingencies and emergencies

- Keep track of spending activities

- Helps to ensure practicality

- Enhances right approach

1. Helps to eye on long term vision

A budget helps you to plan and figure out your goals. For example, if you plan to go on a vacation or buy an expensive item soon, the budget can help you work over your vision by enhancing savings and spending control.

This can help you to keep your hands full at that time with proper planning.

2. Helps to prepare for contingencies and emergencies

Contingencies and emergencies don't have a fixed time to arrive at your doorstep. It can come anytime. God, for a bit, if any unusual things happen around, there are chances of a cash crunch that can affect you from within.

So, your budget should provide these funds that can cover your six months living expenses. We pray that these situations don't happen with anyone, but the funds can at least make your survival smooth if they do.

3. Keep track of spending activities

Building a budget helps you figure out your spending habits and provide a note of unnecessary spending.

For example, why pay 500$ for ten pairs of black shoes if there's a requirement for one.

With a budget, you can rethink the suitable habits for you and refocus on your goals.

4. Helps to ensure practicality

A budget helps you ensure practical decisions and makes you aware not to spend on the money you don't have at current. With a budget, you know your level and will try to spend within that reach rather than making impractical decisions.

5. Enhances right approach

If you spend randomly without giving a thought, it's more likely that you won't be having money and will be stressed over how you will pay your bills. Don't let the actions of today affect your tomorrow.

So, always invest your time preparing a budget and taking control of your money wisely to avoid any financial issues.

These were the reasons for enhancing the role and preparation of the budget.

How to Make a Budget with detailed steps

After understanding the budget process, let's roll up the sleeves and get ready to crunch numbers with the detailed steps to prepare a realistic budget for you:

Step 1: Embrace the Ongoing Process of Budgeting

Step 2: Calculate Your Monthly Income

Step 3: Add Up Your Necessary Expenses

Step 4: Add "Pay Yourself" Line Items

Step 5: Plan for Your Discretionary Expenses

Step 6: Compare and Adjust

Step 7: Implement and Track Your Spending

Step 8: Adjust your habits if necessary

Let's discuss the steps in detail for better understanding:

1. Embrace the Ongoing Process of Budgeting

The first step in preparing the budget involves a basic understanding of the budget concepts. The step consists of studying financial sites and concepts that can prove to be a good starting point for developing an economic sense.

You also need to choose the best program that fits your needs and find a system that works well for you.

2. Calculate your Monthly Income

The second step is to assess your monthly income. If you get in cash, then deduct the expenses to determine your net monthly income; otherwise, if you receive through cheque or bank, the taxes are already deducted. If you are self-employed or earn passive Income, include it in your total net Income for evaluation. This process is also essential when considering how to show proof of income without pay stubs, as accurate calculation of your monthly earnings ensures you have reliable financial records for verification.

3. Add up Your necessary expenses

Write down and create a list of all your necessary expenses that you are obliged to pay from your Income. The list of expenditures includes loan payment, insurance, interest, transportation, groceries, personal care, entertainment, or utilities.

You can take the help of receipts, bank statements to track down the spendings and understand the money to be kept aside for such expenses.

4. Add "Pay Yourself" Line Expenses

Pay Yourself expenses means keeping some part of money each month into your account without any interference. It can be your recurring deposits with banks, money set aside for anticipated expenses like taxes, vacations, or insurance. The steps involve setting up that amount separately in the budget.

5. Plan for Your Discretionary Expenses

Discretionary expenses mean expenses that are not essentials, and an individual can survive without them. In short, these are not needs and can be defined as unnecessary spendings.

If you feel that the want of a particular item or service is not needed, for now, it's better to not spend on those expenses. If you are doing so, plan out accordingly such that you don't spend too much on the same.

6. Implement and Track Your Spending

After you are done with the budget-making steps, the next big thing is implementing the plan and tracking your overall spendings for the month. You can also get to know about your limits before expenditure and help to analyze the outcomes well.

7. Compare and Adjust

At the end of every month, you can get proof of all your expenses, spendings, and gain. In this step, you can introspect everything and measure your performance. It gives you a chance to compare your recordings within your month and analyze whether you stick to the budget or not!

It will help you know the differences in overspending and underspending of money to adjust accordingly.

8. Adjust your habits accordingly

The budget is quite flexible to allow you to change and modify your habits accordingly. In this last step, you will be clear of your spending habits and will be given enough time to adjust your practices based on the situation. Some more and some less is a part of the process, so take your time!

Well, the whole process is complete now from start to end.

Also, if you find the above process a bit challenging to understand, you can follow a different alternative with the same process in five easy steps.

Alternate Budgeting Steps

Let us look at a simplified budgeting steps. It includes:

- Calculate your Income

- Create a List of Monthly Expenses

- Determine Fixed and Variable Expenses

- Total Your Monthly Income and Expenses

- Make Adjustments to Expenses

1. Calculate your Income

Calculate the net income received from your salary/payments

2.Create a list of Monthly Expenses

These are the expenses that you will undergo during the month. By creating a list, you get clear of the costs of the month

3. Determine Fixed and Variable Expenses

Fixed expenses are mandatory expenses that need to be paid for each time, like your interest, bills, or payments.

On the other hand, variable expenses are expenses that change as per months like entertainment, dining, gifts.

In this step, you can assign value to these expenses and prepare the budget accordingly

4. Total your monthly income and expenses

Total your income with your expenses,

If Income is higher than expenses, then you are at a good start and

If Expenses are more elevated than Income, then this draws your attention.

5. Make Adjustments to Expenses

After you are done with the evaluation, find areas where you can reduce spending. Reducing doesn't mean consolidating in one go, but reduce as per your will and effectiveness.

And you are done!

Whether you follow a detailed process or a short cycle, the purpose of the budget remains the same. You will get the same information and insights needed to run your personal finances well.

How to Use Your Budget?

After you are done preparing your budget, the next thing to do is look after the categories and track down your expenses assigned to each category.

For example, if you have set aside $400 for groceries or $200 for entertainment, you can keep in mind the budget before spending. With the same budget system, you can record your expenses and totals.

The above concept is explained well with the following table:

Recording these expenses can help you track records and evaluate overall spending. With this, you can get to know how you have performed with your spending. This will help you adjust and manage things more enhanced, giving you the flexibility to amend the budget accordingly.

Review and Tweak

It is pretty standard that an individual's priority changes and shifts based on the situation, jobs, makeover, or family commitment. Sticking to one budget that works for all is not at all recommended.

Your current goals should meet the realities of who has planned for the future.

Budgeting opens the room to review the future and allows you to tweak budget categories to see where you can adjust your goal by prioritizing one thing over the other.

For example, suppose you wish to go on a trip after four months. In that case, you can mold the budget accordingly and set priorities for necessary expenses rather than spending on entertainment or dining. With this money, you can save the amount for future and use, therefore.

Remember,

"Your budget should meet your needs, not the other way round."

General Budgeting Tips

People who budget their personal finances in a proper way practice smart spending in their routine. The budgeting process requires a few steps to get started, but to manage the budgeting, you need a few handy tips to stick to that make your everyday lives smoother.

The following list contains ten best budgeting tips to manage the personal finances:

- Start and plan ahead of the month to set a realistic budget.

- Set yourself with the right tools to ensure success from the beginning. The right set of tools helps to visualize and track your spendings.

- Keep a record of your bills and receipts to use for reference. This can also come in handy for tax as well as reimbursement purposes.

- Always try to prioritize debt payment to save money and reduce financial stress. Not only does it help to increase your credibility, but it also maintains your score.

- Always make sure to save as per the 50/30/20 rule. Think of saving as a prerequisite for the future.

- If there is a significant expense coming up, then plan your budget accordingly based on the date that you wish to make a purchase and then divide the price my amount you have

- Always make sure to have a provision for contingencies and unforeseen liabilities under the emergency fund. Don't use the fund as an excuse for spending.

- Set up realistic and SMART goals that are achievable within the stipulated period.

- You can observe a no spend weekday to stay within your budget and spend only on necessities as required.

- Don't be very harsh on yourself. You can enjoy things and still manage money by keeping things clear in your mind.

Remember,

"Budgeting isn't about limiting yourself- it's about making the things that excite you possible."

The Best Budget Apps for 2021

The word “B” in the budget stands for budgeting apps. The role of budgeting apps is to automatically track your spendings by simply linking your bank account and tracking purchases from there. Due to the demand, many companies have created different applications, but there is a list of the top four best budget apps for you to install for the year 2021.

The list of the budget app is as follows:

- Mint

- Zeta

- Trim

- Charlie

1. Mint

Mint app is a financial software company that helps to create a budget based on your spending habits. The app splits your expenses into categories and does all the hard work for you.

It also makes it easy to use and known for a better understanding of finances on a large scale

2. Charlie

Charlie is an application best known to make budgeting easy for beginners by providing helpful information. The application also has a chatbot system wherein you can ask questions and clear your doubts from their chat system.

3. Zeta

Zeta stands out and displays your individual and shared finances in one place. It also helps to send reminders and communicate about your finances

4. Trim

Trim application analyses the bills and automatically helps to reduce bill payments. It also has added features like bill negotiation that trims your amount and provides the usual spendings required from your end.

You can experiment with the different types of applications and choose the best fit for you.

Key Takeaways

In this article, we discussed each and every concept related to budgeting for personal finances. With this, you are clear about the approaches and system involved while preparing an actionable budget.

Let’s take a look at key snippets of the article.

- A budget is a plan that represents an estimation of the income and expenses set for a particular period.

- The 50/30/20 rule of budgeting

- Understanding of the budget process includes understanding of budget concepts and formulation

- A budget serves different purposes from enhancing right approach to helping in long term vision

- The eight step guide to prepare and effective budget plan

- Alternative, five step guide to prepare budget

- How to use your budget

- Ten General Budgeting tips to manage personal finances

- Mint, Zeta, Charlie and Trim are the best apps to maintain budget

Related Links