Mr. Paramvir Singh was transferred from his private MNC job in Amritsar to another one in the same company in Assam. He received his salary statement, in which he saw a minor deduction stated as Professional Tax. He had not seen such a deduction in his payslips while he was working in the same company in Punjab. He wanted clarity on professional tax and wanted to know how the compliance and PT registration through Form IA and other different forms work.

Here we will learn about the Professional Tax in Assam, understand its applicability, and see how Form IA is used for its registration. The Assam State Tax on Professions, Trades, Callings and Employment Act, 1947 (“Assam PT Act”) levies a tax on professions, jobs, employments, trades, and callings in Assam.

Table of Contents

- About Form IA under Assam Professional Tax, 1947

- The Tax Slab Rate for PT in Assam for which Form IA Registration is required

- About the Registration process using Form IA under Assam Professional Tax, 1947

- Compliance of Form IA under Assam Professional Tax, 1947

- Sample of Form IA – Certificate of Registration as PT Act in Assam

- Other Compliances under the Assam Professional Tax, 1947

- Conclusion

- Key Takeaways

About Form IA under Assam Professional Tax, 1947

The Assam Professional Tax, 1947 is officially under the Assam Tax on Professions, Trades, Callings and Employment Act, 1947 (“Assam PT Act”) which was enacted to impose taxes on employment, trade, jobs/professions, and labor covering the entire state of Assam. Profession tax is levied by the state government on income from work or employment and collected through the state corporate tax authorities.

It is the responsibility of the employer to withhold the professional tax from the income of the employees and file it with the state government. The employer also must submit the tax return in the prescribed format along with the required documentation regarding tax payment to the tax authorities within the prescribed period.

The amount of professional tax withheld/paid by employees varies from state to state based on the records set by each state. Professional taxes are collected only in some states. Some union states and territories are not subject to this tax.

The Tax Slab Rate for PT in Assam for which Form IA Registration is required

|

Monthly Wages/Salaries of employees in INR per month |

Tax Rate in INR per month |

|

Up to 10,000 |

NIL |

|

From 10,001 to 14,999 |

150 |

|

From 15,000 to 24,999 |

180 |

|

From 25,000 and above |

208 |

About the Registration process using Form IA under Assam Professional Tax, 1947

Form IA is filled to register for the Professional Tax in Assam, which is deducted from the salary of individuals who are working in a commercial activity, or are in a job or contract, or who operate in whole or in part or even through an agent. They are required to pay taxes for each fiscal year.

- The current professional tax rate in Assam is Rs 250 per year for the lower-income bracket and Rs 2,500 per year for the higher-income bracket

- Form IA is the application for a certificate of registration which is based on subsection (1) of Section 5A of Form I. Applicants who have a job in the jurisdiction of another assessment body must submit a separate application for registration to each institution for their workplace in the jurisdiction of that institution

- The resident authority will provide the applicant with a Form IA registration certificate upon receipt of the application for registration and will confirm that the application is valid and that the applicant has provided the required details

- If the review body determines that the application is inappropriate or does not provide the information necessary for Form IA registration, it will submit a request for review to the applicant or provide further information in Form IA as requested. After reviewing the revised Form IA application or additional information, as applicable, the Resident Authority will scrutinize Form IA and issue proof of registration

- A Form IA application for a certificate of registration must be submitted by subsection (2) of section 5A of Form. Applicants with multiple jobs in the country will only receive one Form IA registration certificate

- If the person applying for the Form IA registration has more than one office in the State, the applicant must apply for all such offices and in that application according to the Regulation. One of these establishments is designated as a commercial establishment. Thereafter, such an application is submitted from the main business location to the rating agency under its jurisdiction

- Upon receipt of the application in the second Form IA, the assessment body will request additional information or supporting documents that may be required to determine the amount of tax payable by the applicant, according to the schedule annexed to the law

- After reviewing the Form IA application and any additional information or evidence that may be provided, the assessor will issue the IIA form registration certificate

- If the applicant has multiple workplaces in the country, in addition to a copy of the main place of work, if there are additional workplaces, the applicant must be provided with multiple copies of the certificate

- If the holder of a registration certificate issued under this standard wishes to modify the certificate, he must apply to do so on Form I, specifying the details he wishes to modify and the reason for doing so. The document is presented to the assessment body. The authorities can make changes to the registration certificate that the evaluator deems necessary if the reasons given are satisfied. Upon receipt of this application, the evaluating authorities will determine the amount of tax that the applicant will have to pay according to the schedule provided by law and the applicant will be informed of the year in which the evaluating authorities are required to apply the modified rate. The necessary adjustments must be made to the Form IA registration certificate under the signature of its indicated date

- A registration certificate Form IA issued under this rule can be revoked by the resident authorities after it has been confirmed that the employer to whom the certificate was issued is no longer an employer, or if he has died or is no longer responsible for paying the fees

- The owner of the Form IA registration certificate must visibly show the registration certificate at work

- In the event of loss, damage, or breakage of the Form IA or registration certificate issued under this Rule, the owner of this certificate will be responsible and he must apply to the assessment body for an exact copy of that authority. The original and the copy thus issued must have a "duplicate" certificate

- The certificate issued by a person to the employer under the second condition of Section 5 may need to be on Form IIB or IIC

Compliance of Form IA under Assam Professional Tax, 1947

- Refunds - Commissioners are required to make an annual announcement by publication in the News-Press and instruct all persons and employers legally responsible for paying taxes to self-register using Form IA and to submit returns and pay taxes

- All legally registered employers as specified under Form IA file a monthly tax return on Form III showing the wages and salaries paid for the previous month of the month and the withholding tax on the last day of each month

Sample of Form IA – Certificate of Registration as PT Act in Assam

Inclusions of Form IA – Certificate of Registration as PT Act in Assam

THE ASSAM PROFESSIONS, TRADES, CALLINGS AND EMPLOYMENTS TAXATION RULES, 1947 FORM-IA

- This form comes under rule 10(2)

- The form must contain the Certificate of Registration No

- The first thing should be the name of the Individual or employer who is filling the Form IA, or the name of the Firm, association, establishment, company, society, or corporation

- The location of the establishment or the owner must be specified

- If the owner of the establishment has any other additional place of work in the state it should be mentioned in the certificate along with all the associated addresses of the workplaces

- The Form IA certificate needs to have information on the Returns which will be filled by the employer for each month before the last day of the next month.

- The tax calculated needs to be paid monthly and the challan should be attached to the return

- Class of persons and Rate of tax should be specified in the Form IA

- The following conditions need to be specified in Form IA - Salary and wage earners whose monthly salaries and wages are-

- Less than Rs. 1334 - Nil

- Rs. 1,334 or more, but less than Rs. 1,666 - Rs. 12 per mensem

- Rs. 1,666 or more, but less than Rs. 2,083 - Rs. 16 per mensem

- Rs. 2,083 or more, but less than Rs. 2,500 - Rs. 20 per mensem

- Rs. 2,500 or more, but less than Rs. 2,916 - Rs. 29 per mensem

- Rs. 2,916 or more, but less than Rs. 3,333 - Rs. 38 per mensem

- Rs. 3,333 or more, but less than Rs. 3,750 - Rs. 42 per mensem

- Rs.3,750 or more, but less than Rs. 4,166 - Rs. 51 per mensem

- Rs.4,166 or more, but less than Rs. 5,000 - Rs. 59 per mensem

- Rs.5,000 or more, but less than Rs. 5,833 - Rs. 68 per mensem

- Rs.7,500 or more, but less than Rs. 6,666 - Rs. 76 per mensem

- Rs.6,666 or more, but less than Rs. 7,500 - Rs. 85 per mensem

- Rs.7,500 or more, but less than Rs. 8,333 - Rs. 93 per mensem

- Rs.8,333 or more, but less than Rs. 10,000 - Rs. 106 per mensem

- Rs.10,000 or more

Form IA should be sealed by the stamp of the establishment and the inspector along with the date, designation, place, and signature of the applicant.

Other Compliances under the Assam Professional Tax, 1947

Form I – This includes form IA and is about Application or Amendment for Certificate of Registration

Form II - Application or Amendment for a Certificate of Enrolment

Form IIA – This form is the Certificate of Enrolment

Form IIB – This certificate should be filled by each employee and submitted to his respective employer

Form IIC – This certificate should be filled by each person who is working for more than one employer

Form III – This form is about the Return that should be filled (primarily by the employer)

Form IIIA – This is an application to gain permission to provide returns for a quarter, six months, or a year

Form IV – This form is for the statement of Recovery

Form V – Any kind of information that is required should be filled in this form

Form VI – If an enrolled person is defaulting in any way, this form acts as a notice to the defaulter

Form VII – If anyone shows cause against non-enrollment, this form acts as a notice for the same

Form VIIA – This form is the assessment order

Form VIIB – This form acts as the notice of demand

Form VIIC - Challan

Form VIICC - Challan

Form VIID – This form is the assessment Register

Form VIII - Refund Voucher

Form IX - Refund Register

Conclusion

The Profession tax is similar to income tax but is levied by the state government. Not every state or Union Territory in India levies this tax. In the state of Assam, this professional tax is imposed under the Assam Professional Tax, 1947, and should be paid by anyone employed or even self-employed.

Form IA is about the registration certificate of the professional tax that is paid either by an individual or by an establishment which needs to be properly displayed within the premises and shown to the inspector whenever asked for. This tax is levied on all types of employment, trade, and work and is taxed based on the income earned. Professional tax is a deductible amount under the Income Tax Act 1961 and is collected by each state's tax department and ultimately sent to the local government fund.

How can Deskera Help You?

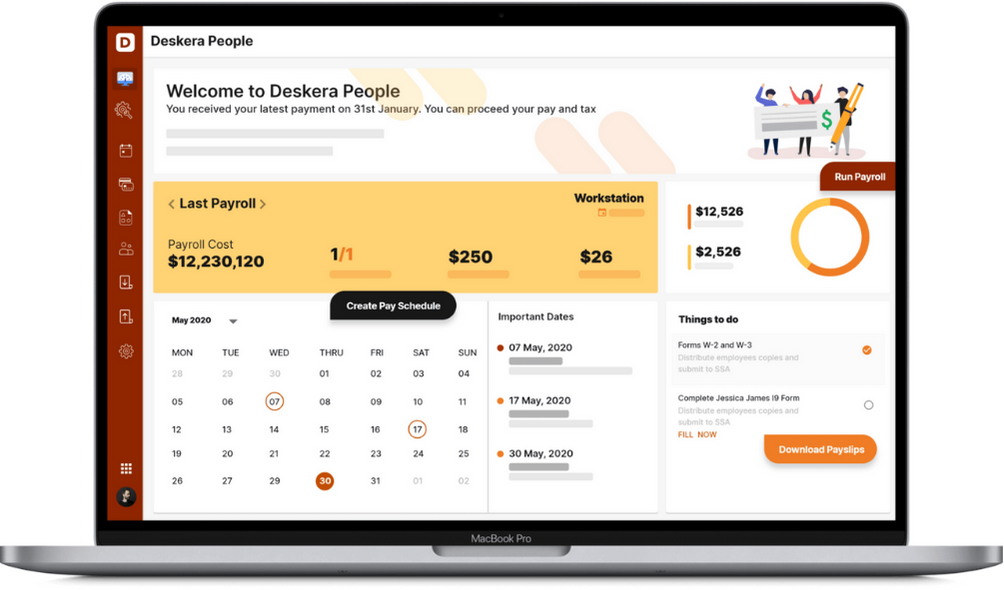

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. With features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning, and uploading expenses, and creating new leave types, it makes your work simple.

Key Takeaways

- The calculation of professional taxes varies from state to state, but the maximum limit is set at 2500 rupees per year

- Each state in India applies its laws and regulations to the regulation of professional taxes based on a slab system on the resident's income

- The employer responsible for withholding professional tax from an employee's salary or wages must apply for a registration certificate Form IA

- The form IA application form must be submitted within the indicated deadlines. If the employer does not show up within the prescribed period, he is obliged to pay a fine, or imprisonment

- The employer must obtain both form IA certificates to pay his own individual personal income tax and to pay the professional tax on behalf of the employee

- Registering for professional tax in Assam using form IA is easy and can be done online

- Professional tax registration form IA is important for all entrepreneurs, professionals, and traders. It is for the welfare and well-being of the country. Any delay in registering or paying the professional tax in Assam will only result in penalties

- You must register using form IA for professional tax payments within 30 days of starting your business, legal entity, or practice. The application must be submitted to the competent authorities

- There are two types of corporate tax certificates that an employer must obtain after successful registration - Certificate of Registration using form IA and Certificate of Enrolment using form II

Related Articles