Do you know 96% of private employers offer holiday pay to their employees?

Whether it is Christmas or Thanksgiving, holidays bring about excitement and joy in everyone. How about extending this excitement further? Wondering how? Holiday pay is the answer. It acts as a gift from the employers that allow the employees to take time off and still earn their normal wage. This happens because FLSA (Fair Labor Standards Act) doesn’t require employers to pay for time not worked.

However, there are many employers who recognize the value of their employees’ contributions and reward them with paid time off on federal holidays including vacation time, sick days, etc.

Some employers even choose to pay their employees who work on holidays, time-and-a half or even double time, even though no law requires them to do so.

For example, your employee Ron usually earns $200 a day. In case your company has a holiday pay policy and designates Labor Day as a paid holiday, then Ron would still make $200 on Labor Day even though he didn’t work that day.

We will cover the following topics in this article:

- What is Holiday Pay?

- Who is eligible for holiday pay?

- How does holiday pay work?

- How to calculate holiday pay?

- What are the benefits of holiday pay?

- Are seasonal workers or part-time workers entitled to holiday pay?

- How to set up a holiday pay policy?

- How can Deskera Help You?

- Key Takeaways

What is Holiday Pay?

Be it a government-declared holiday, maternity leave, or sick time off, holiday pay is a paid time-off. You can receive holiday pay as soon as you become an employee. There is no waiting period in this case as compared to the vacation pay. However, part-time or seasonal workers may not be eligible for holiday pay. When declared by a governing entity such as the federal government or state government, it is considered a holiday. Labor Day, Thanksgiving, Christmas, and Martin Luther King Day are some examples of holidays.

There are certain cases when companies provide the opportunity to their employees to work on holidays and pay them cash for the missed day off. This usually happens in a services industry where someone is required to be there at all times, or when the workload is so high that it cannot be completed without working through the holiday. Salaried employees are not provided this opportunity as they are paid the same amount in every pay period, despite the presence of any holidays.

Who is eligible for holiday pay?

Any employee who works on a holiday is eligible to receive holiday pay, even though that pay is not more than the normal pay rate. However, employers have the right to offer higher pay rates on special holidays as an incentive to the employees.

How does holiday pay work?

Holiday work generally works the same as normal pay, however, there are some exceptions which have been listed below:

Overtime: In case you have non-exempt employees working more hours than normal during the holiday season (but not on the holiday itself), they will be granted overtime pay for any hours over 40 each week. According to the Fair Labor Standards Act, overtime pay will be at a rate not less than time and one-half their regular rates of pay.

Time and a half: Even though it is not legally required, you can still offer time-and-a-half pay as an employer on some specific holidays in order to boost the morale of the employees to work on those days.

Bonuses: As an employer, you can even offer bonuses to the employees around the holidays. Such bonuses act as a gift to the employees and can be given based on the years of service, base salary, performance of the employees, etc.

No special rules or laws comply related to holiday pay. However, you need to follow all state and federal employment laws. These laws do not demand any special considerations for paying employees during holidays, except the overtime for non-exempt employees.

How to calculate holiday pay?

If you are getting paid for the day off:

Firstly, you need to calculate the hourly pay for the employee. For this, you can consider the salary of the last month and the number of hours worked in the last month. This way you will be able to calculate hourly pay. To calculate the hourly pay, you need to divide the salary of the last month by the number of hours worked by the employee.

Hourly Pay = Previous Month’s Salary /Number of Hours Worked

Once, you calculate the hourly pay of the worker, you will have to calculate the number of hours not worked on a day off and then calculate the pay based on such hours.

Holiday Pay = Hourly Pay × Number of Hours not Worked on day off

Most companies pay their employees on day offs normally without asking them to work on the day off. The above calculation was done for such companies or employers.

If you are getting rewarded for working on the day off

You as an employee can also get extra holiday pay by working on holidays for which you can earn double or pay time-and-a-half. Let’s take a look at the steps to calculate it:

Firstly, you need to find out the normal pay an employee gets per hour for his work. earns per hour worked. To calculate this, you need to divide the last month’s salary by the number of hours worked last month.

Normal Per Hour Pay = Previous Month’s Salary/ Hours Worked Previous Month

Once this is done, you need to note the number of hours worked on the day off so that it can be calculated.

Once you know the eligible hours, i.e. the hours worked on the day off and the hourly pay, it is easy to calculate holiday pay. The total pay for eligible hours can be multiplied by 1.5 (time and a half) or 2 (double time) according to the rules set by the employer.

Holiday Pay = Normal Per Hour Pay × Hours Worked on Day Off × 1.5 or 2

Example

In August 2019, John got $7000 as his monthly salary by working around 6 hours a day. In September 2019, there is a government holiday in the 3rd week of the month, but the employer decides to provide holiday pay during this time. To calculate the value of the holiday pay, you need to first calculate the number of work hours in August 2019.

Number of work hours in August=31 days X 6 hours/day=186 hours

Now, normal per hour pay=8000/6 (last month’s salary/hours worked last month’s holiday pay)

=$43.01 per hour

Number of hours not worked on day off=6 hours

Therefore, holiday pay= Hourly pay X number of hours not worked on day off

=43.01 X 6= 258.06

What are the benefits of holiday pay?

There are various benefits of providing holiday pay. Let’s take a look:

Overtime opportunity: Employees get the opportunity of overtime on the holidays which allows them to earn one-and-a-half or double the amount of normal pay rate.

Payment for the Day Offs: Payment will be given to the employees even on the day off.

Vacation Flexibility: Employees get the opportunity to spend quality time with their families and go on vacations.

The reward for Hard Work: Holiday pay acts as a reward for the employees for their hard work and consideration for the company. This helps to encourage the employees so that they can continue their work with more zeal and vigor.

Are seasonal workers or part-time workers entitled to holiday pay?

Most of the seasonal or part-time workers do not get holiday pay. The pay structure of seasonal workers is usually mentioned in their contract before onboarding. However, some employers offer a higher wage on holidays only to incentivize employees to work on those days.

How to set up a holiday pay policy?

For employers, there are no legal requirements to offer holiday pay, you can easily choose the days that qualify for holiday pay. However, most employers follow the federal holidays’ list.

You need to note down the specifications of your policy and communicate the details clearly to your company. You can even put it in writing in your employee handbook.

There are some important details that need to be included:

- You need to be clear about who all employees are eligible for holiday pay.

- Keep a note of the dates that are designated as paid holidays

- If you want to provide any special pay rates or bonuses for employees who have to work on designated paid holidays

- If paid holidays fall on the weekend, then how to go about it?

Make sure the employees who qualify for overtime pay are paid that overtime rate in case they work overtime during your company’s designated paid holidays, despite the fact whether you have included a special holiday pay rate or not.

How can Deskera Help You?

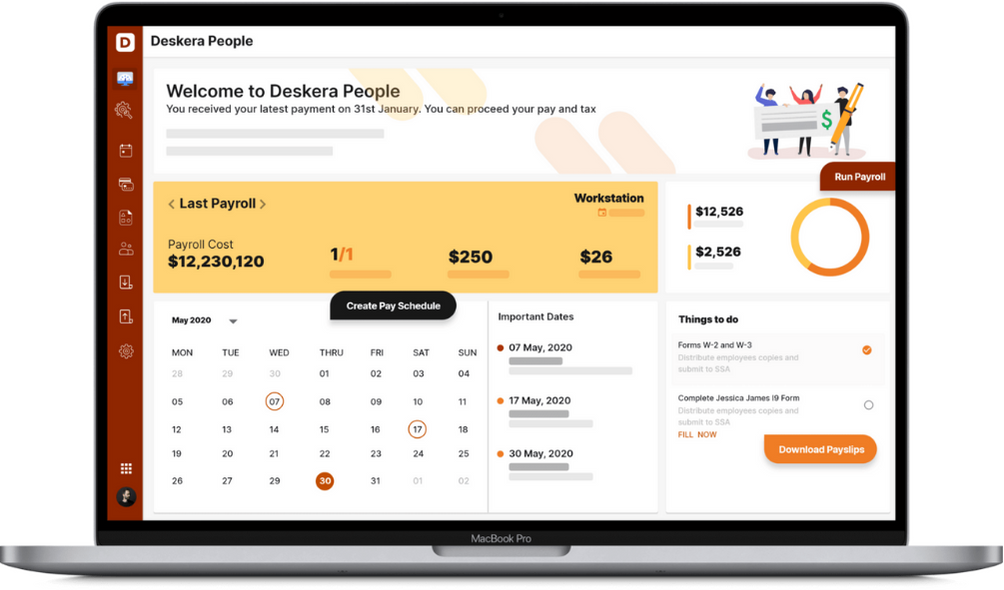

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- Holiday pay is a paid time-off for holidays

- Any employee who works on a holiday is eligible to receive holiday pay, even though that pay is not more than the normal pay rate

- Holiday work generally works the same as normal pay, however, there are some exceptions such as overtime, time-and-a-half, and bonuses

- There are various steps to calculate holiday pay. Firstly, you need to calculate hourly pay, then you will have to calculate the number of hours not worked on a day off and then calculate the pay based on such hours

- Holiday Pay = Normal Per Hour Pay × Hours Worked on Day Off

- There are a plethora of benefits of holiday pay such getting overtime opportunities, payment for the day offs, vacation flexibility, and reward for the hard work

- Most of the seasonal or part-time workers do not get holiday pay. The pay structure of seasonal workers is usually mentioned in their contract before onboarding

- As an employer, you can easily set up a holiday pay policy as they are no legal requirements involved in it. However, you need to keep a note of some important details that need to be included in the holiday pay policy

Related Articles