From more than 200 countries, the UAE is home to expatriates, contributing to economic development and the overall country's progress. The UAE government has launched the Wage Protection System (WPS) to make payments and wage distribution easier.

Let us find out what the WPS system is, how it works, and all other important information.

What is Wage Protection System(WPS) in the UAE?

The WPS was launched in 2019 and was developed by the Central Bank of the UAE and the Minister of Human Resources and Emiratisation(MOHRE).

In the UAE, the Wage Protection System (WPS) is an electronic salary transfer system that allows organizations in the private sector to pay their employee's wages via banks, bureau de change, and approved financial institutions.

The MOHRE offers private sector companies a secure database for creating salary files for their workforce. For wage distribution to the employees, companies will have to send these files to their respective banks. Based on their contract, each file holds crucial information about the employee's salary and allows MOHRE to ensure that all employees' dues are paid.

Goals and Objectives

This massive database ensures payment is made on the time of agreed-upon wages. In the UAE, the WPS will cover all registered institutions with MOHRE across different businesses in multiple industries.

The WPS is aimed at service offering to various categories of employees working in the private sectors. Below listed are some of the main goals:

- Commitment to secure employee's salaries.

- Secure employer's interests and provide a system that will reduce the time and effort required to pay employees due salaries.

- In the UAE, improve job security in the private sector, and work towards growing relationships and rights protection of employees and employers.

- Transparent and easy-to-use payment system.

- For the UAE Ministry of Labour, offering a reliable database is updated regularly as per the new wages data in the private sector.

- We are protecting employees and reducing labor disputes associated with wages.

Parties Involved For WPS (Wage Protection System) in the UAE

There are various stakeholders that the Wages Protection System targets; they include:

Employees or Workforce

Under the payroll of an organization, any individual under the private sector who works in return for the agreed wage, the employee needs to provide a valid labor card issued by the MOHRE.

Employers

In the UAE, the organization owners in the private sector registered with MOHRE and WPS.

Banks

The employer has a bank account that will include any bank, and the company relies on the bank account for wage transfers to all employees under its payroll.

Agents

It includes any banks, any other financial institutions, or bureau de change, which the Central Bank of the UAE authorized that offers salary payment via WPS. Regularly, the Central Bank of UAE updates its list with approved names and authorized agents.

Process For Employers to Register with WPS in the UAE

In the UAE, employer’s in the private sector can easily register for the Wage Protection System (WPS). On the MOHRE official website, the entire system is available where employers can register their accounts using the company information that the Minister provides. Then the employer’s can login to their accounts and update the list with,

- Bank account information.

- Employees list with details of the bank/agent the company works with.

- The agent/bank an employee has an account with.

- The date on which the salary needs to be paid.

Please note that according to the MOHRE guidelines, “Salary month cannot have a difference of more than one month from the dates chosen to pay the salary.” Furthermore, the guidelines also suggest, “whenever an employee joins or leaves a company, you will need to download a new employee list and attach it to the application.”

WPS Registration Requirements

- Hold an account with a UAE bank.

- Contract directly with a UAE bank, bureau de change, or financial institution authorized by the Central Bank to deliver the salary and wage payments.

- Agree to meet the deadlines for payment as set out in Ministerial Resolution no. 788 of 2009 and as amended by Ministerial Decree 739 of 2016.

- Transfer wages at least once a month within ten days of them becoming due, or more frequently and on specified dates, if stipulated within the worker’s contract.

- Agree to meet any expenses associated with WPS, which could include bank charges and other institutional fees. Companies are not allowed to pass these costs on to their employees.

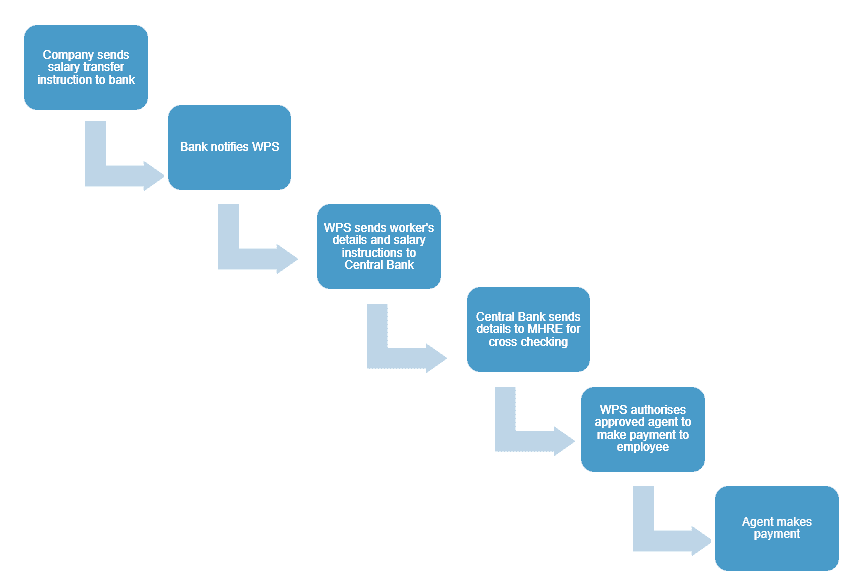

The WPS Payment Process

Once the account has been successfully registered, the next step is to process the payment with the following steps,

Step 1- With an approved bank or an agent, the employer has to open a bank account if he does not already have a bank account based in the UAE.

Step 2 - With the bank or agent, the employer needs to sign a WPS agreement.

Step 3 - In the UAE, the bank or agent notifies the WPS, which sends the details of an employee’s wages and salary transfer via an electronic system to the UAE Central Bank.

Step 4- For cross-checking, the UAE Central Bank forwards all details to MOHRE.

Step 5 - To the employer’s bank or agent, WPS issues an authorization to pay the employee wages.

Step 6 - The bank then transfers the salary to the employee’s bank account.

How to Withdraw Salary From WPS?

In the UAE, below mentioned are the different ways to withdraw your salary from WPS,

Withdraw Through WPS Card

In the UAE, to withdraw salaries, employees without a relevant bank account can opt for a WPS card. Moreover, companies registered with WPS can easily tie-up with money exchange in the UAE, offering a cost-effective WPS-compliant payroll solution. To the employees, these exchanges provide fund transfer facilities and salary disbursements. The exchanges also issue the WPS card and can be used all over emirates across different locations.

Through ATM Machine

The employees with a relative bank account in the UAE with an ATM card can withdraw the salary; the process is straightforward. Then, the bank sends the notification of the salary transfer, with which you have a personal account. It can be through SMS or via email.

WPA Penalties on Companies Failing to Pay Employee Wages

If a company withheld employee wages, the WPS in the UAE has some strict penalties. Listed below are the penalties the company might face for non-payment of dues.

Penalties for Enterprises Employing over 100 Employees

In the UAE, if a small medium-sized private company, with over 100 employees, fails to pay the employee salary, not exceeding the period of 10 days, then they are liable for below penalties,

- Starting from the 16th day from the date of delay in wages, the company will not get any work permits.

- For more than a month from the due date, companies that have delayed wages will be referred to the judicial authorities for further measures.

- In the UAE, if the owner of the company has another registered office with WPS, then the same penalties will be applicable to them.

- The owners will not be allowed to register for any other company.

- Bank guarantees of employees will be liquidated.

- The company will have to face low grading to the third category

- Workers will be allowed to search for other job opportunities.

If the wages are delayed for over 60 days a fine of AED 5,000 per employee (whose wage has been delayed) will be charged up to a maximum fine of AED 50,000 for multiple employees.

WPS Penalties for Companies With a Workforce Less Than 100 Employees

In the UAE, if a small to medium company with less than 100 employees, within 60 days from the due date, fails to pay employee salaries, then they are liable to the below-mentioned penalties,

- Work permits issuing a ban

- For further proceedings referral to court

- The company will be liable to fines by MOHRE.

If the company fails to pay wages twice in one year, MOHRE will apply the same penalties mentioned for bigger firms with more than 100 employees.

Key Takeaways

We have covered the below points to understand the Wage Protection System (WPS) in the UAE.

- What is Wage Protection System(WPS)

- Goals and Objectives

- Parties Involved For WPS (Wage Protection System) in the UAE

- Process For Employers to Register With WPS in the UAE

- WPS Registration Requirements

- The WPS Payment Process

- Methods To Withdraw Salary From WPS

- WPS Penalties on Companies Failing to Pay Employee Wages

Deskera provides an automated solution for all your payroll needs, just input your employee information, compliance details, select your pay schedule, and that is all. Make payroll a breeze for your organization. Spend more time on your most valuable asset, people, not the administration work that comes along with it.

Sign up for a free trial of Deskera People now!