Have you ever wondered why some businesses manage to stay profitable even when tariffs rise and global trade tensions escalate? The answer lies not in avoiding tariffs altogether—since they are often unavoidable—but in adopting smart, proactive strategies that minimize risks while safeguarding margins. In today’s volatile trade environment, tariffs have become more than just a line item on financial statements; they are a critical factor shaping pricing, sourcing, and long-term competitiveness.

As we step into 2025, tariffs remain a key concern for businesses of all sizes. From manufacturers sourcing raw materials abroad to retailers importing finished goods, tariff fluctuations can disrupt supply chains, inflate costs, and shrink profit margins overnight. The World Trade Organization reports that tariff-related trade restrictions have risen steadily over the last decade, underscoring the urgent need for companies to be resilient and adaptive. Navigating this complex terrain requires both foresight and innovation.

This blog explores practical strategies businesses can use to counter the impact of tariffs while protecting their bottom line. From diversifying supply chains and optimizing pricing to leveraging technology and tapping into government incentives, each strategy is designed to help organizations not only survive but thrive in an uncertain global market. By preparing in advance, companies can turn tariff challenges into opportunities for efficiency, agility, and growth.

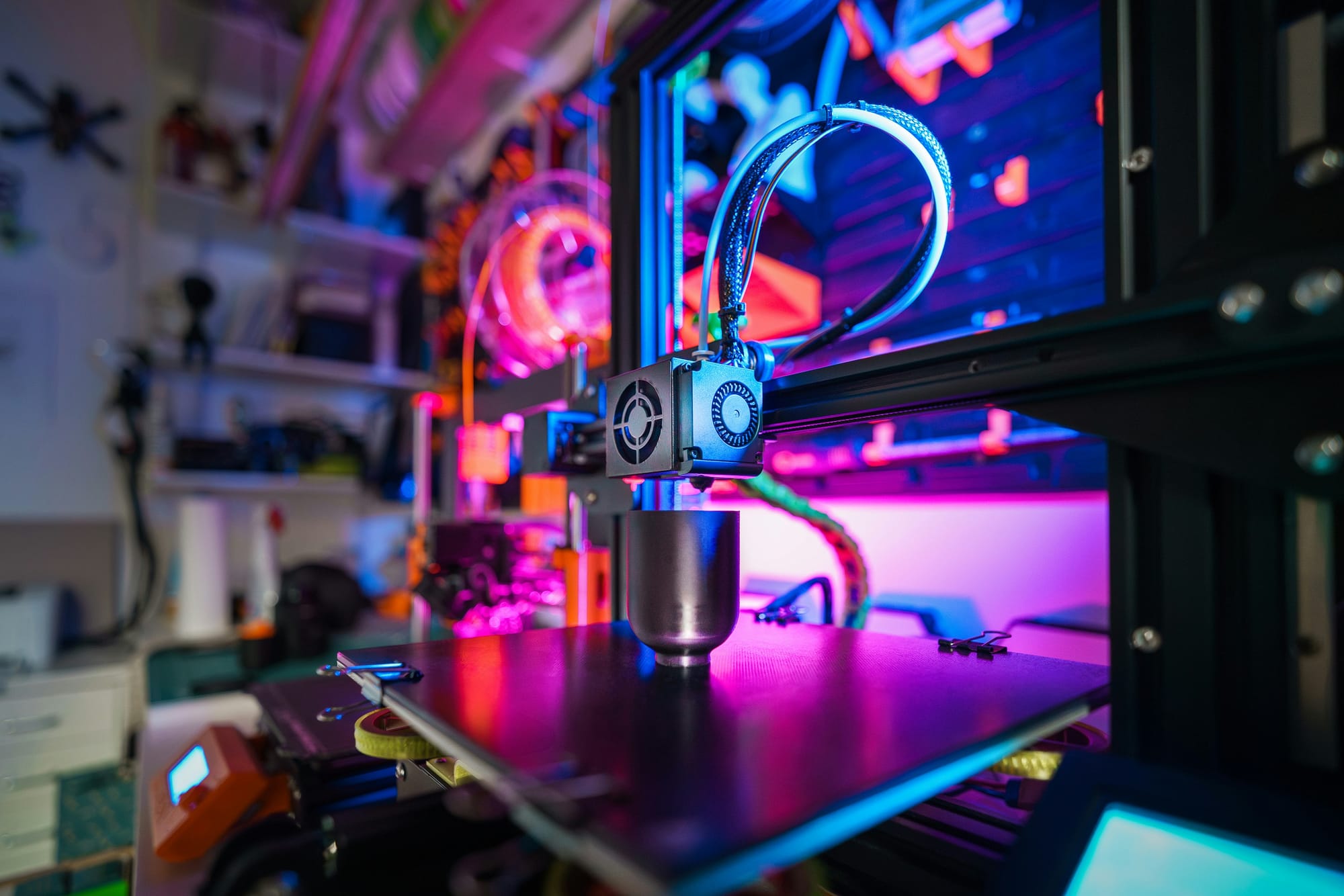

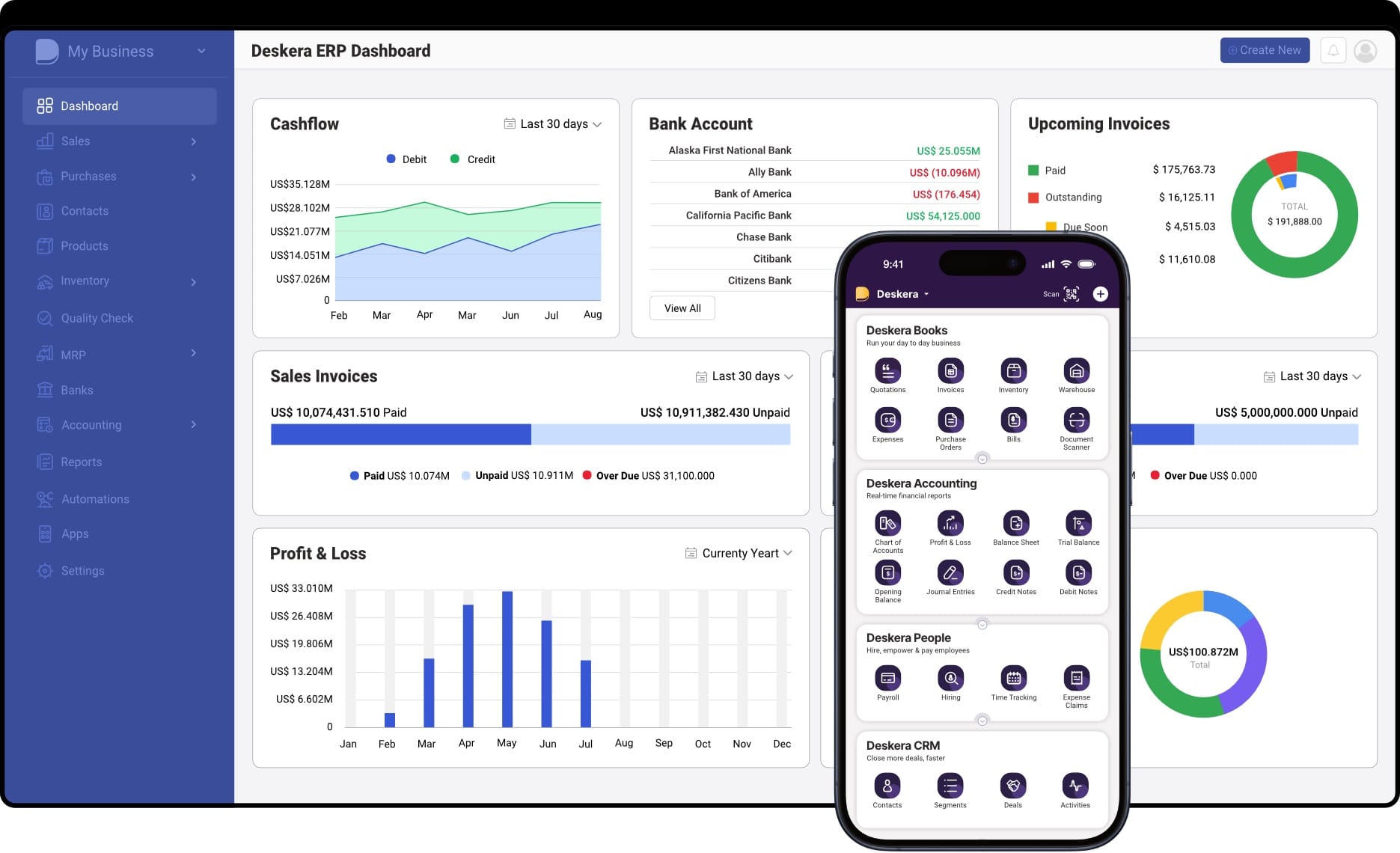

One of the most effective ways to build this resilience is through technology. Deskera ERP, for example, equips businesses with real-time visibility into supply chains, automated compliance reporting, and AI-driven forecasting tools that help predict tariff impacts before they hit. Its integrated platform empowers companies to streamline operations, manage costs more effectively, and make data-backed decisions—all of which are essential for staying profitable in a tariff-heavy landscape.

What Are Tariffs?

Tariffs are taxes or duties imposed by governments on goods and services that are imported—and in some cases exported—across international borders. They have long been used as a tool of trade policy, shaping how countries interact with each other economically. For businesses, tariffs directly affect the cost of sourcing raw materials, manufacturing components, or importing finished products, making them a critical factor in profitability and competitiveness.

At their core, tariffs serve three main purposes:

- Protecting domestic industries: By making imported goods more expensive, tariffs encourage consumers and businesses to buy locally produced alternatives, safeguarding local manufacturers and jobs.

- Generating government revenue: In many economies, particularly developing countries, tariffs are an important source of income for national budgets.

- Exercising political influence: Tariffs can be used strategically in trade negotiations, disputes, or as leverage in global economic relations.

There are several types of tariffs businesses must be aware of:

- Ad Valorem Tariff: Charged as a percentage of the value of the imported good (e.g., 10% of the invoice price).

- Specific Tariff: A fixed fee imposed per unit of goods (e.g., $5 per kilogram of steel).

- Compound Tariff: A combination of both ad valorem and specific tariffs, providing governments with more control over trade protection.

The impact of tariffs extends far beyond border taxes. They influence supply chain decisions, product pricing, and even consumer demand. For example, a U.S. electronics importer may face higher costs due to tariffs on semiconductors, forcing them to either absorb the cost, raise prices, or shift suppliers. While domestic producers may initially benefit from reduced foreign competition, the ripple effects can increase costs across industries and ultimately reach the consumer.

In today’s interconnected global economy, understanding tariffs is not optional—it’s essential. Businesses that actively monitor tariff changes and integrate them into their risk management strategies are better positioned to remain competitive and profitable, even in uncertain trade environments.

Key Tariff Trends Across Industries

Tariffs are not impacting all sectors equally—each industry faces unique challenges depending on its reliance on imports, pricing flexibility, and consumer demand. By examining how different industries are responding, businesses can benchmark their own strategies and identify areas of opportunity.

Here are some of the most significant tariff-related trends across industries as we move into 2025:

Cosmetics and Pharmaceuticals

The cosmetics and pharmaceutical industries saw costs rise dramatically—up 103% from Q3 to Q4 2024—yet stock levels stayed unusually low. This signals that companies are exercising caution rather than overstocking, likely due to regulatory complexities and shorter product lifecycles. Businesses in this sector are balancing between higher costs and the risk of holding inventory that could quickly become obsolete.

Raw Materials (Steel, Timber, Aluminum)

Industries dependent on raw materials have responded differently. Many companies have quadrupled their usual inventory levels in anticipation of steeper tariffs. Steel and aluminum, in particular, remain highly tariff-sensitive due to their role in construction, automotive, and manufacturing. By stockpiling, businesses aim to secure stable input costs, though this ties up significant working capital and raises warehousing expenses.

Fashion and Accessories

Fashion brands are grappling with rising import costs throughout 2024, compounded by declining average order values. Unlike electronics, fashion companies face limited flexibility in passing costs onto consumers due to price sensitivity in their markets. As a result, many are exploring alternative sourcing hubs and leaner supply chains to stay competitive without eroding customer loyalty.

Food and Beverage

Margins in food and beverage continue to shrink, as companies struggle to pass additional tariff costs onto consumers who are already price-conscious. Unlike luxury goods, food demand is highly elastic, making significant price increases risky. Many businesses are focusing instead on operational efficiency, local sourcing, and product reformulation to protect margins.

Machinery and Automotive Parts

Manufacturers and suppliers in machinery and automotive parts adopted an aggressive approach in Q4 2024, purchasing massive inventories upfront—sometimes covering most of their 2025 stock requirements—to shield themselves from expected tariff hikes. While this secures supply, it raises concerns around overstocking and cash flow management if demand fluctuates.

Electronics and Appliances

Interestingly, electronics and appliance companies are among the few sectors that successfully increased profit margins despite tariffs. They achieved this by passing additional costs to customers, who often prioritize functionality and innovation over price sensitivity. Strong brand loyalty in this sector has enabled companies to maintain profitability, even in the face of higher import duties.

Additional Observations Across Sectors

- SMEs vs. Large Enterprises: Smaller businesses often lack the capital to hedge with bulk purchases, leaving them more exposed to sudden tariff hikes.

- Shift Toward Nearshoring: Many industries are actively relocating production closer to end markets to reduce tariff risks and transportation costs.

- Digital Transformation: Companies that leverage ERP and predictive analytics tools are better positioned to model tariff impacts and adjust strategies quickly.

Understanding these industry-specific trends allows businesses to assess whether their responses align with market leaders or expose them to greater risks. Companies that proactively adapt their supply chain, pricing, and inventory strategies will be in the strongest position to navigate 2025’s evolving tariff landscape.

How Do Tariffs Affect Prices?

Tariffs have a direct impact on pricing by increasing the cost of imported goods and raw materials. This ripple effect forces businesses to make difficult decisions: either absorb the added expenses and reduce profit margins or pass them along to customers in the form of higher retail prices.

While large corporations may have the financial flexibility to cushion these shocks, small and medium-sized businesses (SMBs) face tougher challenges in balancing competitiveness with profitability.

Below are the key ways tariffs affect prices across different scenarios:

Increased Import Costs and Margin Pressure

Tariffs immediately raise the cost of bringing goods into a country. For businesses, this creates margin pressure—especially if their products rely heavily on imported inputs. Absorbing these costs can preserve market share but directly cuts into profits, making it unsustainable in the long run.

Challenges for Small and Medium-Sized Businesses

Unlike large corporations with financial reserves, SMBs often operate on thinner margins. They face a difficult choice: either sustain razor-thin profitability by absorbing tariff costs or risk losing customers by increasing prices. In many cases, this puts SMBs at a disadvantage in markets dominated by bigger players.

Impact on Customer Behavior and Loyalty

When tariffs lead to higher retail prices, customers may feel they are paying more for the same product, which can erode confidence and loyalty. Price-sensitive buyers are particularly quick to switch to alternatives or local competitors, making it harder for businesses to maintain their customer base.

Risk of Escalating Trade Wars

Tariffs don’t always exist in isolation. When one country imposes tariffs, the affected nation often retaliates with its own. This back-and-forth can escalate into a trade war, further increasing costs for importers and exporters. As tariffs multiply, businesses struggle to remain price competitive both domestically and internationally.

How Can Tariffs Affect Businesses?

Tariffs don’t just influence the cost of goods at the border—they ripple through nearly every aspect of business operations. From pricing and profitability to supply chain resilience and global competitiveness, the effects can be both immediate and long-term. While large corporations may be able to adapt with financial reserves, diversified suppliers, or stronger bargaining power, small and medium-sized businesses (SMBs) often face sharper consequences.

Here are the key ways tariffs can affect businesses:

Higher Cost of Goods and Strained Margins

One of the most direct effects of tariffs is higher import costs. For SMBs operating on slim margins, even modest tariff increases can significantly erode profitability and strain cash flow. Unlike larger corporations, smaller businesses may lack the ability to negotiate favorable terms with vendors or diversify their supplier base.

In competitive sectors like retail, steep tariffs can force price hikes that customers may be unwilling to pay—risking lost sales and reduced market share. For instance, U.S. tariffs on Chinese imports have raised costs across electronics, consumer goods, and industrial components, leading to higher shelf prices for everyday items.

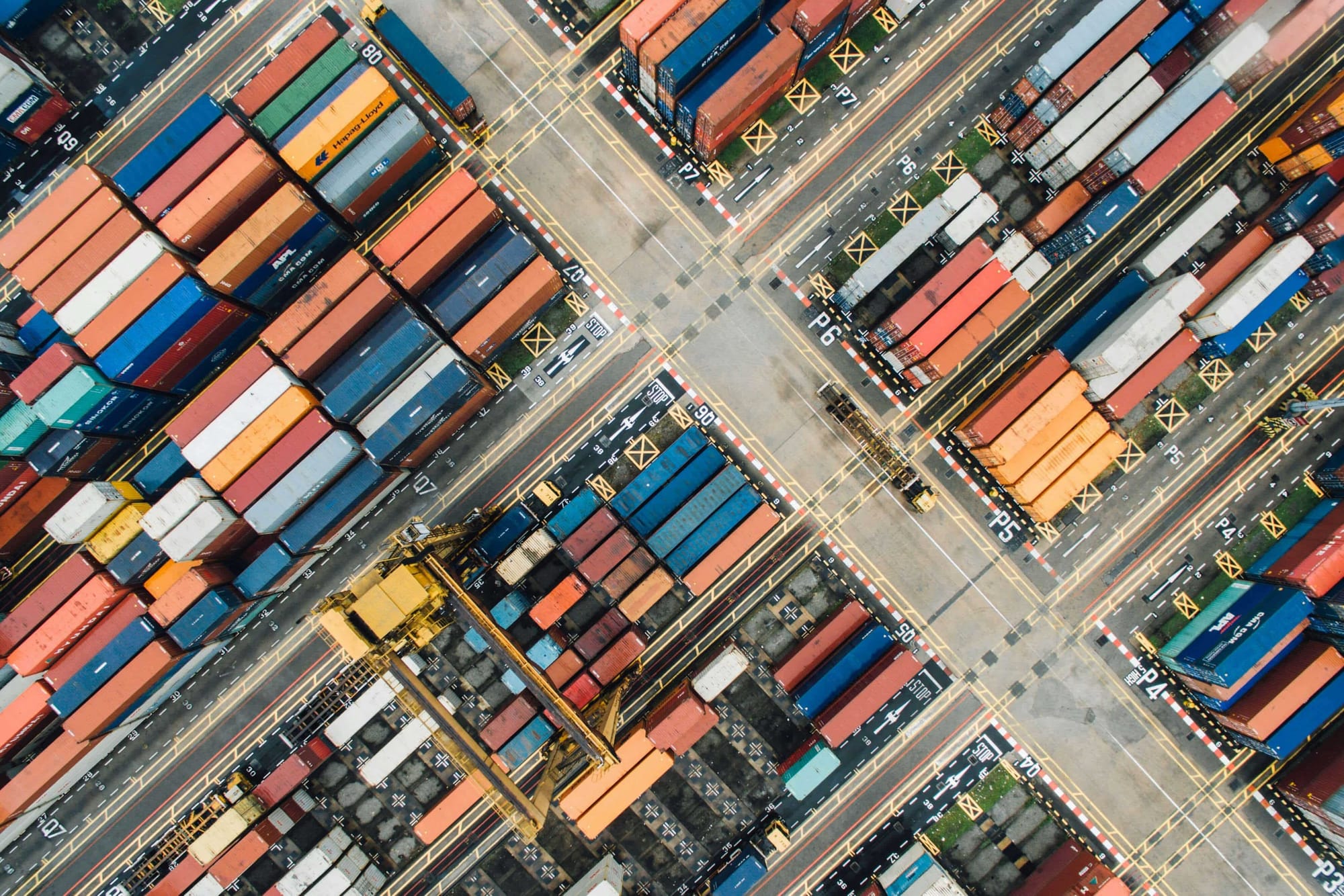

Supply Chain Disruptions

Tariffs often cause ripple effects across global supply chains. New trade barriers can delay shipments at customs, alter shipping routes, or even push suppliers to exit unprofitable markets.

Large businesses typically have the leverage to adjust sourcing or negotiate better deals, but SMBs with tighter supply chains may lack flexibility. If suppliers withdraw, businesses may be forced to scramble for replacements—often facing longer lead times and higher costs in the process.

Reduced Global Competitiveness

Tariffs don’t only affect imports; they also invite retaliation. Reciprocal tariffs from other countries can make a business’s exports more expensive for international buyers.

This weakens competitiveness in foreign markets, especially against local producers not burdened by added duties. For businesses with global ambitions, tariffs can limit opportunities to expand customer bases abroad, making it harder to scale in a cost-effective way.

Increased Operational Complexity

Beyond financial impacts, tariffs add new layers of complexity to operations. Businesses must stay updated on shifting trade policies, comply with evolving customs regulations, and adjust financial forecasts to account for new costs.

For SMBs with limited administrative resources, managing these complexities can divert attention from growth initiatives and innovation.

15 Strategies to Mitigate the Effect of Tariffs and Improve the Bottom Line

Successfully navigating tariffs requires thoughtful planning and a mix of operational, financial, and technological strategies. Below are 15 detailed approaches businesses can use to minimize risks, protect margins, and strengthen resilience against tariff shocks.

1. Assess Your Exposure and Plan Scenarios

The first step in managing tariff risk is understanding your level of exposure. Map your supply chain to identify which goods, components, and raw materials are most affected by tariffs. Go beyond direct imports to include packaging, logistics, and subcomponents that could be indirectly impacted.

Run multiple scenarios based on potential tariff increases, modeling how they affect cost of goods, cash flow, and profit margins. This allows you to prioritize vulnerable areas and prepare contingency strategies in advance. Using ERP systems with forecasting capabilities helps simulate outcomes and guide smarter business decisions.

2. Diversify Suppliers and Products

Relying heavily on one supplier or one tariff-heavy market makes businesses vulnerable. Mitigate this by diversifying your supplier base across multiple countries or regions with lower duties. Sourcing from nearshore or domestic partners can sometimes balance higher costs with reduced shipping times.

Additionally, diversify your product portfolio—introducing alternatives that use less tariff-impacted materials. This not only cushions your operations against tariff spikes but also creates flexibility when negotiating terms with suppliers. Over time, diversification builds resilience, ensures continuity, and provides a competitive edge in fluctuating trade environments.

3. Adopt Dynamic Pricing Models

Raising prices across the board can alienate customers, especially price-sensitive buyers. Instead, adopt dynamic pricing strategies tailored to your customer base.

Segment your market—passing on costs selectively, offering bundled packages, or providing value-added services to justify slightly higher prices. Regularly benchmark competitor pricing to remain competitive and avoid overpricing.

For B2B businesses, consider using long-term contracts with pricing flexibility clauses to share tariff-related risks with clients. This strategy allows businesses to safeguard their profit margins without losing customer loyalty, while making pricing adjustments more strategic rather than reactive.

4. Strengthen Inventory and Demand Planning

Tariff volatility often drives businesses to stockpile critical goods before tariff hikes. While forward buying can save costs, it risks overstocking if demand falls short. The key is balancing strategic buffers with accurate demand forecasts.

Use historical data, market trends, and digital forecasting tools to predict sales more effectively. Smart planning ensures you build safety stock for high-risk items while minimizing waste.

Optimizing reorder points, supplier lead times, and inventory turnover helps maintain profitability, even under tariff pressure. Businesses with robust demand planning can outmaneuver competitors by staying flexible and cost-efficient.

5. Improve Operational Efficiency

When tariffs drive costs upward, offset them by finding efficiencies within your operations. Review workflows for redundancies, renegotiate vendor contracts, and implement lean practices across procurement and logistics.

Technology-driven automation in finance, HR, or manufacturing can lower overhead and free resources for tariff-related contingencies. Encourage cross-functional collaboration between procurement, operations, and finance to identify bottlenecks and eliminate waste.

The savings generated from improved efficiency can help absorb tariff costs without heavily impacting margins. By embedding efficiency into operations, businesses create long-term resilience against trade fluctuations.

6. Manage Financial and FX Risks

Tariffs often go hand in hand with currency volatility, amplifying costs. For example, if your imports are priced in USD and your local currency weakens, costs rise even further.

Businesses can hedge this risk through forward contracts, currency swaps, or multi-currency accounts. These financial tools protect against sudden FX swings that compound tariff burdens.

Additionally, accounting methods like Moving Average Cost (MAC) or Last-In-First-Out (LIFO) can optimize how tariff-related expenses are recorded, smoothing out cost fluctuations. Proactively managing financial risks helps businesses maintain cash flow stability and minimize shocks to the bottom line.

7. Leverage Foreign Trade Zones (FTZs) and Bonded Warehousing

Businesses that rely heavily on imports can minimize tariff exposure by utilizing foreign trade zones (FTZs) or bonded warehouses. These facilities allow companies to store imported goods without immediately paying duties. Tariffs are only applied when goods enter the domestic market, and exports may bypass tariffs altogether.

This provides greater cash flow flexibility and helps defer or reduce costs. Companies that import raw materials for processing and then re-export finished goods particularly benefit from this strategy. Leveraging FTZs not only reduces tariff costs but also strengthens supply chain agility by giving businesses more options.

8. Enhance Compliance and Risk-Based Contracting

Tariff regulations are often complex and subject to frequent change. Non-compliance risks fines, delays, or even reputational damage. Businesses should invest in compliance systems that ensure accurate documentation, proper classification codes, and country-of-origin labeling.

Additionally, review supplier and customer contracts to include tariff-adjustment clauses, outlining how costs are shared if tariffs change. This proactive risk-sharing arrangement reduces disputes and ensures predictable outcomes.

By combining robust compliance with smart contracting, businesses stay ahead of regulatory changes and minimize exposure to unforeseen tariff burdens.

9. Explore New Markets for Growth

If tariffs reduce competitiveness in one region, expand into markets with fewer barriers. Research countries with favorable trade agreements, lower tariffs, or more predictable policies. Diversifying revenue streams across multiple geographies cushions against localized tariff shocks.

To succeed, adapt your offerings to meet local needs—accepting local payment methods, pricing in local currencies, and tailoring products to cultural preferences.

Exploring new markets not only offsets tariff losses but also unlocks growth opportunities. Over time, a diversified global presence builds resilience and positions your business for sustainable success.

10. Invest in Technology for Smarter Decision-Making

Digital transformation is a powerful defense against tariff uncertainty. Tools like Deskera ERP provide businesses with real-time visibility into costs, supplier performance, and inventory levels. Automation minimizes manual errors, accelerates reporting, and strengthens demand forecasting.

AI-driven analytics can also identify cost-saving opportunities and optimize supplier selection. For SMBs, adopting cloud-based ERP systems ensures affordability while providing enterprise-grade capabilities.

By harnessing technology, businesses make faster, data-driven decisions that reduce risks and improve profitability—even in volatile tariff environments. Technology isn’t just a support system; it’s a competitive advantage.

11. Optimize Product Design and Materials

One overlooked strategy is redesigning products to use materials that are less tariff-exposed. For example, substituting a tariff-heavy metal with a locally available alternative can reduce costs without sacrificing quality. Standardizing designs across multiple products also enables greater flexibility in sourcing.

In industries like fashion or consumer electronics, businesses can experiment with modular designs that simplify manufacturing and reduce dependency on single suppliers. Optimizing product design isn’t just about cost savings—it creates long-term agility and shields the business from sudden tariff spikes.

12. Collaborate with Industry Peers

Collaboration can be a powerful way to manage tariff pressures. Businesses can form consortiums to share warehousing, logistics, or supplier contracts—allowing them to achieve economies of scale. For SMBs, partnering with other companies in the same sector can improve negotiating power with suppliers or carriers.

Industry associations also play a vital role in lobbying for favorable tariff policies, offering insights into regulatory changes, and providing platforms for collective problem-solving. Collaboration transforms tariffs from an isolated challenge into a shared one, making it easier to navigate as a community.

13. Strengthen Customer Relationships and Loyalty

When tariffs force businesses to increase prices, strong customer relationships can make the difference between losing and retaining buyers. Focus on enhancing customer loyalty through superior service, transparent communication, and personalized experiences.

Educating customers on the reasons behind price adjustments can build trust and reduce resistance. Loyalty programs, discounts for repeat buyers, or added-value services can further soften the impact of price hikes. By prioritizing customer retention during tariff-driven challenges, businesses maintain stable revenue streams and protect their long-term market position.

14. Embrace Nearshoring and Local Manufacturing

Relocating production closer to the target market can significantly reduce exposure to tariffs and shipping costs. Nearshoring—sourcing from nearby countries—often balances higher production costs with lower logistics and duty expenses.

Some companies may even benefit from reshoring, or bringing manufacturing back home, to eliminate tariff risks altogether.

While this requires upfront investment, the long-term benefits include supply chain stability, reduced lead times, and improved control over production quality. For businesses facing consistent tariff pressure, nearshoring or local manufacturing can be a game-changer.

15. Engage in Active Policy Monitoring and Advocacy

Tariff policies can shift quickly with changing political landscapes. Businesses that actively monitor trade negotiations and government updates are better prepared for sudden changes. Assigning a dedicated team or leveraging industry associations for updates ensures you don’t get caught off guard.

Additionally, engaging in policy advocacy—sharing your business concerns with lawmakers—can help shape fairer trade policies. For SMBs, staying informed is as critical as any financial or operational strategy. Active engagement ensures businesses respond to tariffs proactively rather than reactively, strengthening resilience in the long run.

How Can Deskera ERP Help You Mitigate the Risks of Tariffs?

Navigating tariffs isn’t just about absorbing costs—it’s about making smarter, faster, and more informed business decisions. Deskera ERP provides the tools businesses need to adapt to tariff changes, protect profit margins, and remain competitive in global markets. Here’s how it can help:

1. Real-Time Cost Visibility

Deskera ERP gives you full visibility into landed costs—including duties, freight, and tariffs. By tracking real-time cost fluctuations, businesses can understand how tariffs affect their margins and make immediate adjustments to pricing, purchasing, or sourcing strategies.

2. Smarter Inventory and Demand Planning

With built-in demand forecasting and inventory optimization, Deskera helps businesses avoid both overstocking and shortages. You can strategically stock up before tariff hikes while preventing excess capital from being tied up in unused inventory.

3. Multi-Currency and Financial Risk Management

Tariffs often coincide with currency fluctuations. Deskera’s multi-currency support allows you to transact in local or supplier currencies, reducing FX risk. It also supports accounting methods like Moving Average Cost (MAC), helping you spread tariff costs more effectively.

4. Supplier Diversification and Procurement Insights

Deskera ERP centralizes supplier data, enabling businesses to compare costs, lead times, and tariff exposure across vendors. This makes it easier to diversify suppliers, negotiate better terms, and pivot quickly when tariff rules change.

5. Compliance and Documentation Accuracy

Tariffs often come with strict customs requirements. Deskera ERP automates invoicing, documentation, and record-keeping, ensuring accurate reporting and compliance with tariff regulations. This reduces delays, fines, and administrative burdens at customs.

6. Data-Driven Decision-Making with AI Assistant (David)

Deskera’s AI-powered assistant, David, helps businesses simulate different tariff scenarios, analyze impacts on cash flow, and recommend cost-optimization strategies. With actionable insights at your fingertips, businesses can respond proactively rather than reactively.

7. End-to-End Supply Chain Visibility

From procurement to logistics and sales, Deskera ERP offers a unified view of your operations. This integration ensures you can track how tariffs affect each stage of the supply chain, empowering you to take corrective actions quickly.

With Deskera ERP, businesses don’t just survive tariff shocks—they turn them into opportunities for efficiency, resilience, and smarter growth.

Key Takeaways

- Tariffs are government-imposed taxes on imports or exports that increase the cost of goods crossing borders.

- While they aim to protect domestic industries, tariffs often lead to higher costs for businesses and consumers.

- Understanding tariff basics helps companies prepare for potential cost fluctuations and trade restrictions.

- Different industries experience tariffs uniquely—cosmetics and pharmaceuticals face steep cost hikes, while electronics often pass costs onto customers.

- Raw material and machinery sectors hedge risk by stockpiling inventory, whereas food and fashion struggle with shrinking margins.

- Benchmarking against industry-specific trends allows businesses to align their strategies with real-world market responses.

- Tariffs raise import costs, pressuring businesses to either absorb the expense or pass it to customers.

- Small businesses are more vulnerable, as raising prices risks losing price-sensitive buyers.

- Trade wars can escalate costs further, creating a cycle of rising prices and reduced competitiveness.

- Tariffs erode profit margins, strain cash flow, and hit SMBs hardest due to limited flexibility.

- Global supply chains may be disrupted, forcing businesses to seek new suppliers and face longer lead times.

- Export competitiveness suffers as retaliatory tariffs make products costlier abroad, reducing global growth opportunities.

- Assess exposure by mapping supplier costs and modeling tariff scenarios.

- Diversify suppliers and explore alternative materials to reduce dependency on high-tariff markets.

- Use dynamic pricing models, inventory forecasting, and financial planning to offset tariff-related risks.

- Additional strategies like foreign trade zones, bonded warehousing, and tax optimization provide further cost control.

- Expanding into new markets and managing currency risk also help protect profit margins.

- Deskera ERP offers real-time cost tracking, demand forecasting, and inventory planning to stay ahead of tariff hikes.

- Multi-currency support and smart accounting methods help businesses reduce FX and financial risks.

- Supplier diversification tools and compliance automation improve resilience and reduce tariff-related delays.

- AI-powered insights from Deskera’s assistant, David, guide smarter decision-making with scenario simulations.

- End-to-end visibility enables businesses to adapt quickly, turning tariff challenges into opportunities for efficiency.

Related Articles