Mutual funds are one of the most popular investment vehicles in the United States, offering individual investors an easy and accessible way to participate in the financial markets.

According to the Investment Company Institute, as of 2020, over 9,000 mutual funds were available in the US, with total assets under management reaching nearly $21 trillion.

This staggering figure highlights the importance of understanding the basics of mutual funds and their potential as a valuable component of an investment portfolio.

Mutual funds are pools of money from many investors that professional investment managers manage. These managers use the combined funds to invest in a diversified portfolio of stocks, bonds, and other securities.

This provides individual investors with exposure to a broad range of assets, and the benefits of professional management, without having to make each investment decision on their own.

This article will dive into the world of mutual funds, exploring their types and benefits. By the end of this article, you'll have a solid understanding of mutual funds and their potential as a valuable component of your investment portfolio.

So, buckle up and get ready to learn about mutual funds, understand the basics, and discover their potential for growing your wealth over time, whether you're a seasoned investor or just starting out.

Here's what we shall cover in this post:

- What is a Mutual Fund?

- How Does Mutual Fund Work?

- Benefits of Investing in Mutual Funds

- Risks of Mutual Fund Investing

- Cost of Investing in Mutual Funds

- Future of Mutual Fund Investing

- Conclusion

- Key Takeaways

What is a Mutual Fund?

A mutual fund is a type of investment that pools money from multiple investors to purchase a variety of securities. The goal of a mutual fund is to provide investors with a diverse portfolio of investments and the potential for higher returns compared to individual investments.

- The portfolio of investments is managed by a professional fund manager who makes investment decisions on behalf of the investors.

- The value of an investor's share in the fund is determined by the fund's net asset value (NAV), which is calculated daily based on the value of the underlying investments.

- Investing in a mutual fund has several benefits, including professional management, diversification, and access to a wide range of investments.

- By pooling money from multiple investors, a mutual fund allows individuals to invest in a diverse portfolio of investments that they may not have access to individually.

Additionally, investors can benefit from their expertise and experience because a professional fund manager manages the fund.

Types of Mutual Funds

- Equity Funds: Equity funds, also known as stock funds, invest in a portfolio of stocks. These funds provide exposure to the stock market and offer the potential for higher returns compared to other types of mutual funds. Equity funds can be further broken down into subcategories, such as large-cap, mid-cap, and small-cap, based on the size of the companies in which they invest.

- Bond Funds: Bond funds invest in a portfolio of bonds and are typically considered to be less risky than equity funds. Bond funds can provide a steady stream of income through the regular interest payments received from the bonds in the portfolio. There are also different types of bond funds, including corporate bond funds, government bond funds, and high-yield bond funds.

- Index Funds: Index funds are a type of equity fund that aims to track the performance of a specific stock market index, such as the S&P 500. These funds provide broad exposure to the stock market and can be a cost-effective way to invest in the stock market. Because index funds simply track an index, they do not require the expertise of a fund manager and typically have lower investment fees compared to other types of mutual funds.

- Money Market Funds: Money market funds are mutual funds that invest in short-term debt securities, such as Treasury bills and commercial paper. These funds are considered low-risk and provide a steady income stream. Money market funds are often used as a place to park cash in a short-term, low-risk investment.

- Target-Date Funds: Target-date funds are a type of mutual fund that invests in a diversified portfolio of investments and automatically adjusts the investment mix over time to become more conservative as the target date approaches. These funds are designed for investors who are saving for a specific goal, such as retirement and do not want to manage their investments actively.

- Sector Funds: Sector funds invest in a specific sector of the economy, such as technology, healthcare, or energy. These funds can provide more focused exposure to a particular industry and offer the potential for higher returns compared to a more diversified fund. However, they are also considered to be higher risk as they are more susceptible to market fluctuations in a specific sector.

How Does Mutual Fund Work?

Pooling of Funds

A mutual fund works by pooling money from multiple investors to purchase a variety of securities. The money from each investor is combined to create a more significant investment pool, which is then used to purchase a diverse portfolio of investments.

By pooling funds, mutual fund investors can gain exposure to a variety of investments that they may not have access to individually.

Professional Management

The portfolio of investments in a mutual fund is managed by an experienced fund manager who makes investment decisions on behalf of the investors. The fund manager is responsible for researching and selecting investments that meet the fund's investment objectives.

They also monitor the performance of the investments and make adjustments as necessary to ensure that the fund remains aligned with its investment objectives.

Investment Objectives

Each mutual fund has its own investment objectives, which are based on the types of investments the fund invests in and the goals of the investors. For example, a stock fund may have an investment objective of long-term growth, while a bond fund may have an investment objective of income and stability.

Understanding a mutual fund's investment objectives is essential for investors who want to choose a fund that aligns with their investment goals.

Determining Net Asset Value (NAV)

The value of an investor's share in a mutual fund is determined by the fund's net asset value (NAV). The NAV is calculated daily based on the value of the underlying investments in the fund.

When an investor buys or sells shares in a mutual fund, the transaction is based on the NAV of the fund at the time of the transaction.

Buying and Selling Shares

Investors can buy and sell shares in a mutual fund just like they would any other type of investment. To buy shares, an investor sends money to the mutual fund company and specifies the fund they want to invest in.

To sell shares, the investor requests to redeem their shares and the mutual fund company sends the investor the proceeds from the sale.

Fees and Expenses

Like any investment, mutual funds come with fees and expenses. These can include management fees, sales charges, and operating expenses. Investors should be aware of the fees associated with a mutual fund before investing, as these fees can reduce the fund's overall returns.

Benefits of Investing in Mutual Funds

Mutual funds are a popular investment option that offers investors a range of benefits. By pooling money from multiple investors, mutual funds provide access to a diverse portfolio of investments and the expertise of a professional fund manager. This section will discuss the key benefits of investing in mutual funds.

- Diversification

One of the main benefits of investing in mutual funds is the ability to achieve diversification in a single investment. By pooling money from multiple investors, mutual funds can purchase a variety of investments, such as stocks, bonds, and real estate, that would be difficult or impossible for an individual investor to access on their own.

This diversification can reduce the risk of an investment portfolio and provide greater stability over the long term.

- Professional Management

Another benefit of investing in mutual funds is a fund manager's professional management. The fund manager is responsible for researching and selecting investments that meet the fund's investment objectives and monitoring the investments' performance.

This professional management can ensure that the fund stays aligned with its investment objectives and can potentially lead to higher returns.

- Convenience:

Investing in mutual funds is a convenient way for investors to access a diverse portfolio of investments. Unlike individual investments, mutual funds can be purchased and sold with just a few clicks, making it easy for investors to manage their investment portfolio.

In addition, mutual funds typically have low minimum investment requirements, making them accessible to a wide range of investors.

- Potential for Higher Returns:

By pooling money from multiple investors and investing in a diverse portfolio of investments, mutual funds have the potential to provide higher returns compared to individual investments.

This is because mutual funds can benefit from economies of scale and the expertise of a professional fund manager. Additionally, mutual funds can provide access to investments that may offer higher returns, such as emerging market stocks or real estate, that may not be available to individual investors.

- Liquidity:

Another benefit of investing in mutual funds is the liquidity they provide. Investors can easily buy and sell shares in a mutual fund, allowing them to access their money as needed. This is in contrast to individual investments, such as real estate, which can be more difficult to sell quickly.

- Lower Costs:

Investing in mutual funds can also be a cost-effective way to build a diversified investment portfolio. This is because mutual funds have lower investment minimums than individual investments and can benefit from economies of scale, resulting in lower investment fees and expenses.

How to Choose the Right Mutual Fund for Your Investment Portfolio?

Investment Goals: One of the most important factors to consider when choosing a mutual fund is your investment goals.

Do you want to grow your wealth over the long term, generate income, or preserve your capital? Different types of mutual funds are designed to meet different investment goals, so choosing a fund that aligns with your goals is essential.

Risk Tolerance: Your risk tolerance is another crucial factor to consider when choosing a mutual fund. Some funds are more aggressive and offer the potential for higher returns, but also come with higher risk.

Other funds are more conservative and offer more stability but come with lower returns. It is crucial to choose a fund that matches your risk tolerance.

Fund Performance: It is also essential to consider a mutual fund's past performance when choosing a fund for your portfolio. However, it is crucial to keep in mind that past performance is not necessarily indicative of future results.

It is also essential to look at the fund's risk-adjusted returns and consistency of performance over time.

Fund Manager and Investment Philosophy: A mutual fund's fund manager and investment philosophy can also impact its performance. A good fund manager with a well-established investment philosophy can help guide the fund through market ups and downs.

It is vital to research a mutual fund's fund manager and investment philosophy before making an investment.

Diversification: Diversification is an essential aspect of investing and can help reduce the risk in your portfolio.

By investing in a variety of different types of mutual funds, you can achieve a well-diversified portfolio. It is essential to consider the types of investments a mutual fund holds and ensure that it fits well with the rest of your portfolio.

Risks of Mutual Fund Investing

Mutual funds are a popular investment option for many people, offering the potential for growth and diversification. However, like any investment, mutual funds come with risks that investors need to be aware of. This section will discuss some of the key risks of investing in mutual funds.

Market Risk

One of the biggest risks of investing in mutual funds is market risk, also known as the risk of loss due to market fluctuations. This risk applies to all investments, including stocks, bonds, and mutual funds. When the market goes down, the value of your mutual fund investments may decrease, and you may lose some or all of your money.

Credit Risk

Credit risk is the risk of loss due to the failure of a borrower to repay a loan. This risk is particularly relevant for mutual funds that invest in bonds. If a bond issuer defaults on its obligations, the value of the bond may decrease, and the value of the mutual fund that holds that bond may also decrease.

Interest Rate Risk

Interest rate risk is the risk of loss due to changes in interest rates. This risk is particularly relevant for bond mutual funds, as changes in interest rates can impact the value of bonds.

When interest rates rise, the value of existing bonds may decrease, leading to a decrease in the value of the mutual fund that holds those bonds.

Manager Risk

Manager risk is the risk of loss due to the fund manager's investment decisions. Mutual funds are managed by professionals who make investment decisions on behalf of the fund's investors.

However, the performance of a mutual fund can be impacted by the investment decisions of the fund manager, and if the manager makes poor investment decisions, the value of the fund may decrease.

Expense Risk

Expense risk is the risk of loss due to the fees and expenses associated with investing in a mutual fund. Mutual funds charge fees and expenses to cover their operating costs, and these fees and expenses can impact the returns of the fund.

Before investing in a mutual fund, it's essential to understand the fees and expenses associated with the fund and how they may impact your returns.

Cost of Investing in Mutual Funds

Management Fees

Management fees are the fees charged by mutual funds to cover their operating costs, including salaries and benefits for the fund managers and other employees.

These fees are typically a percentage of the assets in the fund and are deducted from the fund's returns before they are distributed to investors. The management fee for a mutual fund can range from 0.25% to 2.5% or more of the assets in the fund.

Operating Expenses

Operating expenses are the other costs associated with operating a mutual fund, including marketing, administration, and recordkeeping expenses. These expenses are also typically a percentage of the assets in the fund and are deducted from the fund's returns before they are distributed to investors.

Operating expenses for a mutual fund can range from 0.2% to 1.5% or more of the assets in the fund.

Sales Loads

Sales loads are fees charged by some mutual funds when you buy or sell shares in the fund. Load mutual funds can be either front-end load funds, where you pay a fee when you buy shares, or back-end load funds, where you pay a fee when you sell shares.

Sales loads can range from 4% to 8% of the amount you invest and can significantly impact your returns over time.

Redemption Fees

Redemption fees are fees charged by some mutual funds when you sell shares in the fund before a certain period of time. Redemption fees are typically used to discourage short-term trading and cover the costs of selling shares.

Redemption fees can range from 1% to 2% of the amount you sell and can significantly impact your returns if you sell your shares within a short period.

Account Fees

Account fees are fees charged by some mutual fund companies to cover the costs of maintaining your account, including recordkeeping and administration. Account fees can include fees for account maintenance, transfer of assets, or termination of your account.

These fees can vary widely between mutual fund companies and can range from a few dollars per year to several hundred dollars per year, depending on the size of your investment.

Future of Mutual Fund Investing

Increased use of technology

One of the key trends in the world of mutual fund investing is the increased use of technology. Many mutual fund companies now offer online and mobile platforms that allow investors to manage their portfolios, research mutual funds, and make trades from anywhere at any time. This increased use of technology has made mutual fund investing more convenient and accessible for many people.

Focus on ESG investing

Another trend in mutual fund investing is the focus on Environmental, Social, and Governance (ESG) investing. ESG investing involves investing in companies with strong records in environmental sustainability, social responsibility, and corporate governance. Many mutual fund companies now offer ESG-focused funds, allowing investors to align their investments with their values.

Increased use of robo-advisors

A growing number of investors are turning to robo-advisors for help with their investments, including mutual funds. Robo-advisors are digital platforms that use algorithms to manage portfolios and provide investment advice. They offer a low-cost, convenient option for many investors who may not have the time or expertise to manage their own portfolios.

Growth of passively managed funds

Passively managed funds, which track a specific index rather than being actively managed by a fund manager, have been growing in popularity in recent years. These funds are often less expensive than actively managed funds and have the potential to provide similar returns. This trend towards passively managed funds is expected to continue in the future.

Integration of sustainable investing strategies

Sustainable investing, which involves investing in companies that positively impact the environment and society, is another trend that is expected to continue to grow in the future. Many mutual fund companies now offer sustainable investing options, allowing investors to align their investments with their values while still pursuing financial returns.

FAQs About Mutual Funds

How do mutual funds make money?

Mutual funds make money through the management fees and expenses that are charged to investors. Additionally, mutual funds may also generate income through dividends and interest payments on the securities held in the fund.

How often can I buy or sell shares in a mutual fund?

You can buy or sell shares in a mutual fund at any time, although some mutual funds may have restrictions on when and how you can buy or sell shares.

What is a mutual fund's NAV?

NAV stands for Net Asset Value, which is the value of a mutual fund's holdings divided by the number of outstanding shares. The NAV is calculated at the end of each trading day and is used to determine the price at which investors can buy or sell shares in the mutual fund.

How Deskera Can Assist You?

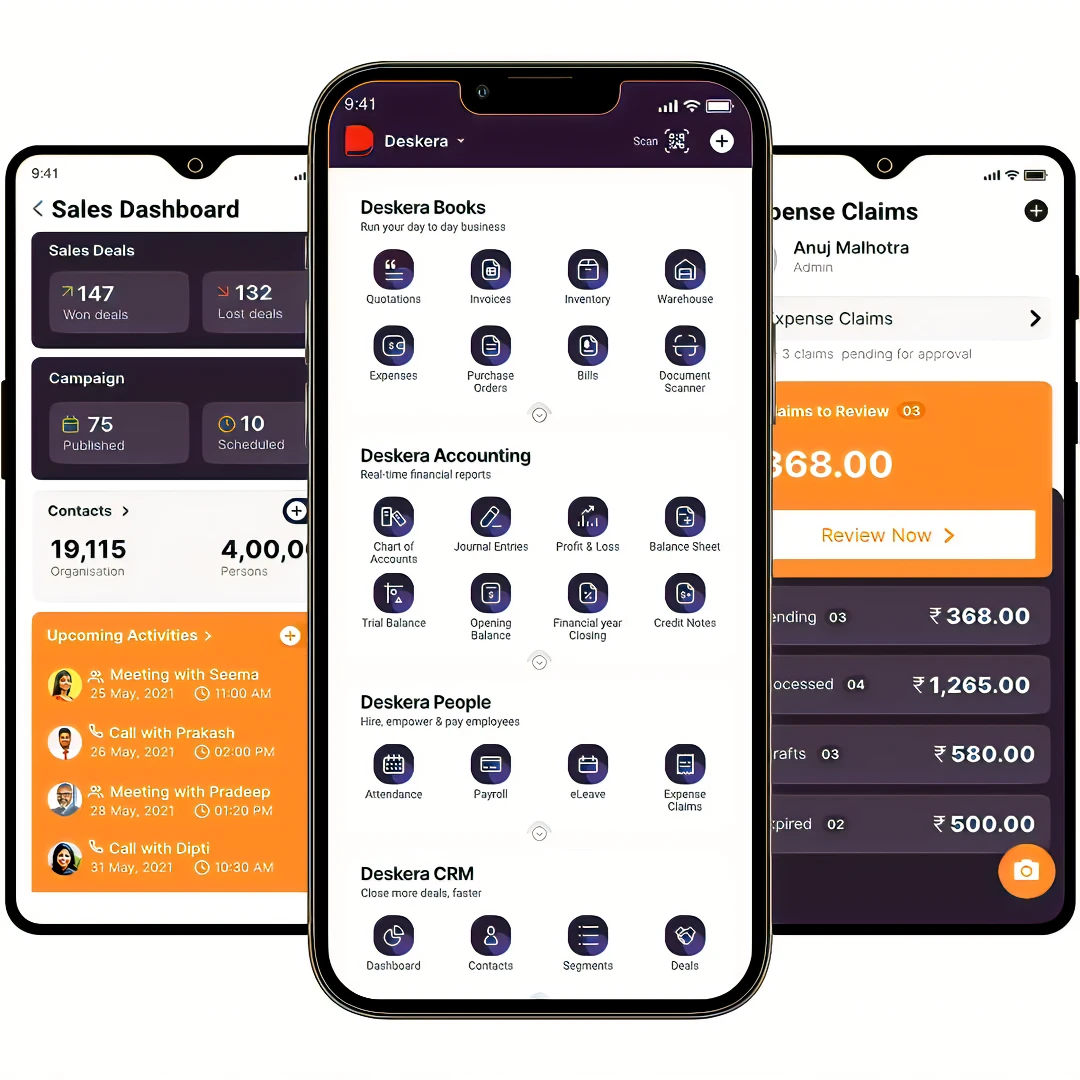

Deskera's integrated financial planning tools allow investors to better plan their investments and track their progress. It can help investors make decisions faster and more accurately.

Deskera Books enables you to manage your accounts and finances more effectively. Maintain sound accounting practices by automating accounting operations such as billing, invoicing, and payment processing.

Deskera CRM is a strong solution that manages your sales and assists you in closing agreements quickly. It not only allows you to do critical duties such as lead generation via email, but it also provides you with a comprehensive view of your sales funnel.

Deskera People is a simple tool for taking control of your human resource management functions. The technology not only speeds up payroll processing but also allows you to manage all other activities such as overtime, benefits, bonuses, training programs, and much more. This is your chance to grow your business, increase earnings, and improve the efficiency of the entire production process.

Conclusion

Mutual funds offer individual investors a convenient and accessible way to participate in the financial markets. With a wide range of options available, from stock and bond funds to specialty funds and index funds, mutual funds provide investors with exposure to a diverse range of assets and the benefits of professional management.

When considering a mutual fund investment, it's essential to thoroughly research the fund's investment strategy, fees, and performance history and to evaluate how it fits into your overall investment goals and risk tolerance.

It's also essential to clearly understand the underlying assets held in the mutual fund and to be aware of the risks associated with investing in these assets. By doing your due diligence and regularly monitoring your investments, you can ensure that your mutual fund investments are aligned with your financial goals and help you to achieve the financial future you desire.

By understanding the basics of mutual funds, you can make informed investment decisions and enjoy the benefits of professional management and the potential for long-term growth.

Key Takeaways

- Mutual funds provide individual investors with access to a diverse range of assets and the benefits of professional management.

- When investing in a mutual fund, it's essential to thoroughly research the fund's investment strategy, fees, and performance history and to determine how it aligns with your investment goals and risk tolerance.

- It's essential to understand the underlying assets held in a mutual fund and the associated risks, including market risk, credit risk, and interest rate risk.

- Mutual funds offer a convenient and low-cost way to invest, with options ranging from stock and bond funds to specialty funds and index funds.

- Diversification is a key benefit of investing in mutual funds, as it can help reduce overall portfolio risk by spreading investments across multiple assets.

- When selecting a mutual fund, consider the fund's investment strategy, fees, past performance, and management style.

- It's essential to regularly monitor your mutual fund investments to ensure they continue to align with your financial goals and to make necessary adjustments as market conditions change.

- Some mutual funds may have restrictions on buying or selling shares, known as redemption fees or deferred sales charges.

Related Articles