Do you ever wonder as an employee how are you getting all your dues on time? Well, it directly comes from the Labor Welfare Fund, which is a key move taken by the government to raise awareness for laborers who do not get their dues on time and provides for the establishment of a fund to finance programs to promote labor welfare in the state.

In this article we shall discuss one such act under the labor Welfare Fund which is Maharashtra labor welfare fund act 1953. Following are the aspects about the act which we will be covering:

- Labor Welfare Fund

- Maharashtra Labor Welfare Fund Act,1953

- Contribution

- Payment

- Offences and Penalties under the Act

- Forms required

- Purpose of the Maharashtra labor welfare fund Act

- Key Takeaways

Labor Welfare Fund

It is a fund established for the goal of providing financial and social security to the workers in the establishment. It is solely for the benefit of laborers, such as raising their living standards to meet basic requirements, improving their working circumstances, and so on.

Different states have their own Labor Welfare Fund Act, which offers facilities, perks, and social programs for workers on their territory. For example, the "Maharashtra labor welfare fund act" and the "Karnataka labor welfare act" each have various provisions based on the socio-economic realities of the workers in their respective states.

The fund is made up of contributions from both the business and the employees. Each state contributes at a different rate. The Labor Welfare Fund was established by the state government and consists of the following components:

• Employee penalties

• Unpaid accumulations

• Penal interest

• Voluntary donations

• Employer-employee contributions

• Any interest collected on unpaid accumulations or fines realized from employees

• Loan, subsidy grant

Furthermore, the employer is expected to submit a statement detailing all aspects of the donation given.

Maharashtra Labor Welfare Fund Act,1953

The Labor Welfare Fund Act was enacted by the Maharashtra government to provide welfare benefits to workers engaged in Maharashtra businesses and factories. An act to establish a fund for the financing of actions to enhance labor welfare in the state of Maharashtra, as well as for other objectives. It covers the entire Maharashtra state.

The Maharashtra Labor Welfare Fund Rules, 1953, are read in conjunction with the Maharashtra Labor Fund Act, 1953. Contribution rates differ depending on the category of laborers and the salary they earn. Furthermore, contributions are made in June and December for states like Maharashtra, Gujarat, and Andhra Pradesh, whilst contributions are made annually for other states.

Any establishment that is covered by the Bombay Shops and Establishments Act, 1948 and employs at least 5 employees is required to make bi-annual contributions to the Maharashtra Labor Welfare Fund in the months of June and December each year on behalf of each of its employees, including contract laborers, unless they are employed in a managerial or supervisory capacity and receive a monthly salary of more than INR 3,500.

The government also contributes something to the Labor Welfare Fund, which is overseen by a Welfare Commissioner. The employer must apply to the Maharashtra Labor Welfare Board's Welfare Commissioner for a code number.

The Maharashtra Labor Welfare Fund Act was enacted by the Maharashtra State Government in 1953 to provide social security to workers employed in enterprises with a labor welfare fund. The state government understands the necessity of giving assistance to employees and their families, and has passed the Act in response.

The Act is crucial because it provides workers and their families with immediate financial assistance in the event of serious injury or death. It also contains channels for submitting complaints against employers who break the Act's restrictions.

Medical aid, education, housing, and travel reimbursements are provided to workers who are unable to get these services through their normal employment.

Objectives of the Maharashtra labor welfare fund Act

The Act also establishes the Maharashtra Labor Welfare Fund, which is controlled by the Maharashtra government and to which both employers and employees contribute. The following are the Act's objectives:

• To provide for the protection of employer and employee contributions to the Fund, as well as their payment into the Fund;

• To provide for a contributory disability pension for any worker or their dependents in the event of permanent incapacity;

• To make provisions for imposing penalties for a false statement made or information furnished by an employer or employee concerning his contribution;

• To provide welfare measures for the benefit of workers;

• To provide relief, compensation, or rehabilitation to any worker or their dependents in the event of death, injury, or permanent disability as a result of employment;

• To provide assistance and facilities to workers during periods of emergency arising from natural calamities.

Applicability

The Maharashtra Labor Welfare Fund was established in 1953 and applies to all enterprises in the state with 5 or more employees who are classified as contract laborers under the Act. This applies to any citizen who intends to create a new shop or a commercial institution under the Maharashtra government's authority.

Except for those in managerial or supervisory positions earning more than Rs. 3,500/- per month, this category includes all employees, including those hired through contractors.

These funds are classified as fringe benefits since they are provided through a collective contribution that is supported by the employee, the employer, who contributes three times the employee's contribution, and the state government.

Benefits of Maharashtra Labor Welfare Fund Act

The Maharashtra Labor Welfare Fund Act is a law that establishes a fund for labor welfare and controls the formation of welfare boards.

The Act also establishes the conditions under which welfare boards can issue grants for the purpose of providing labor welfare facilities and other labor-related reasons. Except for Mumbai, the Act is applicable across Maharashtra.

• It raises the compensation sum in situations of death caused by injuries sustained while performing work tasks from Rs10,000 to Rs15,000.

• It increases the time a worker has to file a claim for compensation in the event of an injury or death from three to five years.

• A worker who is entitled to compensation can get it in the form of an annuity, a lump sum payment, or a combination of the two.

• A worker who is entitled to compensation can get it in the form of an annuity, a lump sum payment, or a combination of the two.

• There would be no limit on how many times a worker may seek compensation, and it would allow worthy workers to seek compensation even if they were unable to do so due to circumstances beyond their control.

Contribution

Employees who are present on the Muster rolls on the 30th June and 31st December of each year will have their contributions deducted. Employees' salaries will be withdrawn from their pay twice a year, in June and December, at the following rates:

The following are the contributions that the employer and employee must make:

|

|

Employees Contribution |

Employers Contribution |

Total |

|

Salary upto Rs.3000/- |

6 |

18 |

24 |

|

Salary from Rs.3001/- and more |

12 |

36 |

48 |

Except for managers and supervisors, an employee with a salary of up to Rs.3, 000.

Rs.18 Employer, Rs.6 per employee which means 24 rupees total contribution.

Employees earning more than Rs.3,000 per month, excluding managers and supervisors

Rs.36 Employer, 12 rupees per employee which means a Contribution total of Rs.48.

|

Labour Welfare Fund

Contribution |

|||||

|

Category |

Employee Contribution |

Employer Contribution |

Total Contribution |

Date of Deduction |

Last Date For

Submission |

|

All employees, with the exception of those in

managerial or supervisory positions who are paid up to Rs. 3,000 per month. |

6 |

18 |

24 |

30th June |

15th July |

|

Except for individuals in management or supervisory

positions who are paid up to Rs. 3,000 per month. |

6 |

18 |

24 |

31st December |

15th January |

|

All employees, with the exception of those in

managerial or supervisory positions who earn more than Rs. 3,000 per month. |

12 |

36 |

48 |

30th June |

15th July |

|

Except for individuals in managerial or supervisory

positions who earn more than Rupees 3,000 per month, all employees are

exempt. |

12 |

36 |

48 |

31st December |

15th January |

Frequency for payment of the contribution under the Act

The opposition, employees, owners, and the government all receive subsidies (MWF- Maharashtra Welfare Fund) every six months under section 6 of the Act (June and December).

The Maharshtra Labor Welfare Fund pays half-yearly (twice a year), on the 15th of July (for the 30th of June ending) and 15th of January (For 31st December ending). If paying by check, make the check payable to "Welfare Commissioner, Maharashtra Labor Welfare Board" and mail it to the following address.

These funds are classified as fringe benefits since they are provided through a collective contribution that is supported by the employee, the employer, who contributes three times the employee's contribution, and the state government.

Payment for contribution

• The contribution paid by the employer and employee goes into the labour welfare fund and is reported to the board twice a year, on the 15th of July and the 15th of December, in FORM A-1.

• On the Board's request, the state government may adjust the contribution rates every three years.

• The company can deduct the contribution amount from the employees' wages, and this deduction is considered an allowed deduction.

• The amount of the contribution (both employer and employee) should be paid in cash, money order, or cheque.

• The employer provides the contribution statement in FORM A-2 to the Welfare Commissioner by July 31st and December 31st.

• The state government receives the statement that the welfare commissioner has received.

Payment

For the months of June and December, contributions must be placed with the "Welfare Fund Commissioner" in Form A-1 Cum Return of Contribution filed by the employer to the Board on or before 15th July or 15th January, respectively.

The MLWB is calculated solely through the contributions of both the company and the laborer. Employee contribution is Rs. 6.00 for employees earning less than Rs. 3000, and Rs. 12 for those earning more than Rs. 3000. Whereas the company contributes three times the amount contributed by the employee, i.e. Rs. 18 and Rs. 36 for employees earning less than Rs. 3000 and more than Rs. 3000, respectively.

Other Payments Payable to MLWF

Any outstanding dues owed to an employee for more than three years must be submitted with the Maharashtra Labor Welfare Board within the time frame set out in the Act.

"Unpaid Accumulations—All payments owing to employees but not made within three years after the date they became due, including unpaid wages, gratuities, and bonuses."

Unpaid Accumulations

Unpaid accumulations are salaries and gratuities that an employer was supposed to pay employees but did not do so within three years of the due date. Employers are responsible for transferring unpaid accumulations to the welfare board.

If an employee's wage is not paid for any reason and the amount is not claimed by the employee or any of his legal heirs (in the event of his death) within three years of the date on which it became due, the employer must deposit the unpaid accumulations with the Maharashtra Labor Welfare Board as specified in Section 2 of the Act (10)

In this regard, the liability in respect of the aforementioned accumulation shall be deposited with the Maharashtra Labor Welfare Board in the form of a cheque / demand Draft, along with a statement of unpaid accumulations in the format below (payment due to employees but not made to them within three years of the date on which they became due):

If there is no unpaid accumulation as described in Section 2(10), no such sum must be deposited, and no relevant statement of unclaimed accumulation must be filed with the Board.

The unclaimed accumulation for employees who have been unpaid for three years must be deposited with the Welfare Commissioner. Unpaid accumulations must be deposited in Form A-1, together with a list of the employees for whom the accumulations are owed.

How does the Board use and invest the money from the fund?

The funds are used for labor and their dependents' welfare, such as:

• Community works and educational reasons, such as the establishment of libraries and reading rooms

• Games and sports

• Tours, trips, vacation homes

• Entertainment and similar forms of recreation

• Home industries

• Any other corporate activities such as vocational training

• Transportation facilities

• Welfare facilities for employees' children, such as providing nutritious food, educational opportunities, and so on

Offences and Penalties under the Act

Any dues owed to the state government under this statute are recognized as land revenue. If an employer fails to pay the Board's dues, the commissioner will send a notice to pay the dues. Interest will be levied on the dues if the employer fails to pay notwithstanding notice. If the employer fails to deduct the employee's payment on time, the employer may be forced to pay it himself. The Act has no provision for incarceration.

1. Nonpayment of unpaid accumulations/fines by the employer

a. The Welfare Commissioner will issue a notice to the employer to pay the amount on time.

2. If the employer fails to pay the required amount, the employer will be subject to interest and a fine:

a. Interest at 1.5 percent of the outstanding amount for the first three months; b. Interest at 2 percent of the delinquent amount after that.

3. Failure of the employer to pay the contribution amount on time:

a. Interest at 1.5 percent of the outstanding amount for the first three months;

b. Interest at 2 percent of the delinquent amount after that.

4. Any individual who obstructs the inspector in the performance of his responsibilities or fails to deliver records or registers as required by the inspector:

a. Punished with up to 3 months in prison or a fine of up to Rs.500, or both

b. If the same offence is committed again, the punishment is either imprisonment for up to 6 months or a fine of up to Rs.1,000, or both.

Provision relating to payment of fines and of unpaid accumulations by employer

1) If, within 15 days of the act's effective date in any region, every employer in that area pays to the Welfare Commissioner by check, money order, or cash:

a) All fines collected from employees prior to the effective date and remaining un-utilized on that date, and

b) On the aforementioned date, the employer held all unpaid accumulations.

2) Along with the payment, the employer must provide a statement to the Welfare Commissioner detailing the amount paid in detail.

3) Thereafter, on or before the 15th of April, 15th of July, 15th of October, and 15th of January succeeding such quarter, all fines collected from employees and all unpaid accumulations shall be paid by the employer in the manner aforesaid to the welfare commissioner, and a statement giving particulars of the amounts so paid shall be submitted by him along with such payment to the Welfare Commissioner.

3-A) The employer must submit a statement of employer contribution and employee contribution in Form'A1' to the Welfare Commissioner on or before July 31st and January 31st, respectively, for employees whose names are in the establishment register on June 30th and December 31st.

The welfare Commissioner may serve a notice on any employer to pay any portion of fines realized from employees or unpaid held by him that the employer has not paid in accordance with rule 3 after making such inquiries as he deems necessary and after calling for a report from the inspector, if necessary. The employer must respond to the notice within 14 days of receiving it.

Any person who willfully obstructs the inspector while exercising his powers or performing his duties under the act, or who fails to produce the documents demanded by the inspector, shall be punished as follows:

a) for the first offence, imprisonment for a term up to 3 months or a fine up to Rs.500, or both;

b) for the second offence, imprisonment for a term up to 6 months or a fine up to Rs.500, or both; and

c) if the person

Forms required

• FORM A-1: Statement of contribution submitted by the employer to Welfare Commissioner

• FORM A-2: Statement of contribution given by the Welfare Commissioner to the State Government

• FORM A: Account of money

• FORM B: Register of Wages

• FORM C: Consolidated Register of Unclaimed Wages and Fines

Purpose of the Maharashtra labor welfare fund Act

The Maharashtra Labor Welfare Fund Act, 1953, was passed by the Maharashtra State Government. On December 15, 1959, the Act went into effect in order to promote industrial harmony by establishing a welfare fund for workers and giving financial aid.

The Act aims to:

–provide care and monetary relief to such workers and their families in old age or when they become incapacitated due to sickness or disablement;

– provide benefits from the welfare fund to workers employed in any industry or employment, other than works contract services;

– provide rehabilitation aid and monetary relief in case of accidents and deaths occurring during working hours or otherwise in connection with their employment;

– Providing adequate financial assistance to such workers in the event of accidents, illness, or other emergencies that render them helpless; – Providing medical aid and also medical relief in certain other cases to such workers and their families; – And generally providing for matters related to or incidental to the protection and welfare of such workers.

How Deskera Can help You?

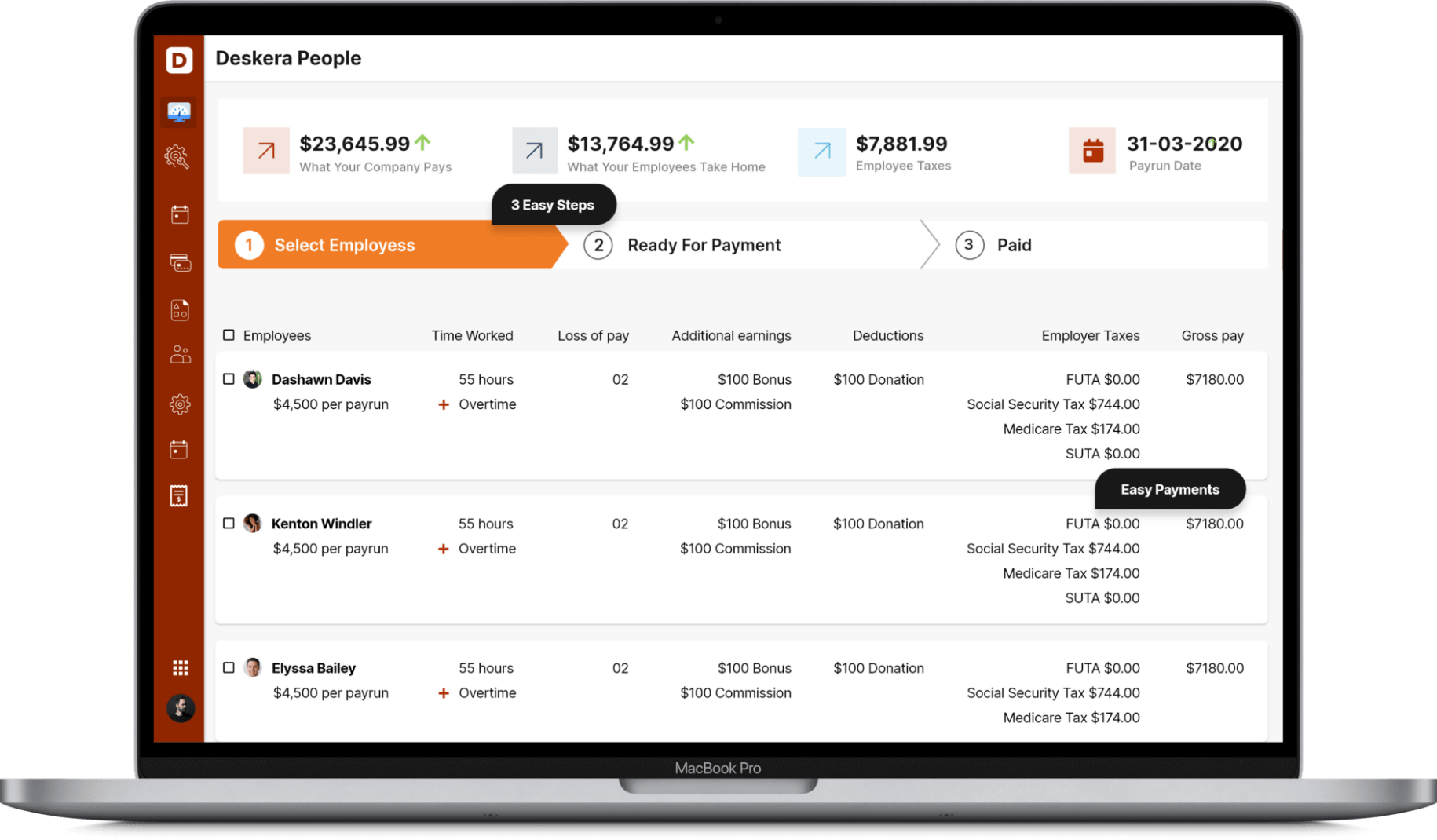

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key Takeaways

- The Maharashtra Labor Welfare Fund Act of 1953 establishes a fund for the financing of initiatives promoting labor welfare in the state of Maharashtra. For this purpose, in addition to paying its own contribution for each employee covered by the Act, the employer must take a contribution amount from the employee's wage and submit it to the labor welfare fund. Employers are given code numbers for this purpose.

- This Act demonstrates that the government cares about its residents and will take all reasonable steps to ensure their well-being. The Act will be implemented across Maharashtra, giving workers hope of receiving their wages on time and improving their living conditions.

- The goal is to promote cooperation between government agencies, employers' organizations, trade union organizations, and voluntary organizations in order to maintain worker-employer harmony; to encourage greater cultural exchange between India and other countries through international conventions convened by the International Labor Organization, and to engage in any other documentary or welfare activity incidental or conducive to achieving the above objectives.

- The MLWFA intends to achieve the goals through aiding unemployed people, workers who have been injured on the job, their dependents, and disabled workers and their dependents with medical treatment. It is also used to improve skills, training, and research in the field of labor welfare through special programs sponsored by grants from government agencies, corporate groups, or people with State Government approval.

Related articles