Lease accounting has moved from being a routine compliance exercise to a critical area of financial transparency and governance. As businesses increasingly rely on leased assets—from office spaces and manufacturing equipment to vehicles and IT infrastructure—the way leases are recognized and reported has a direct impact on financial statements, performance metrics, and stakeholder trust. Understanding lease accounting is no longer optional; it is essential for accurate reporting and informed decision-making.

Historically, a significant portion of lease obligations remained hidden from balance sheets, limiting the true visibility of a company’s financial position. In fact, as early as 2005, the U.S. Securities and Exchange Commission estimated that public companies in the United States alone carried nearly $1.25 trillion in operating lease commitments that were not reflected on balance sheets. This lack of transparency raised concerns among regulators and investors alike, ultimately becoming a major catalyst for reforming lease accounting standards.

The issue was not confined to a single market. On a global scale, companies reporting under IFRS and U.S. GAAP were estimated to have approximately $3.3 trillion in total lease commitments prior to the implementation of modern lease accounting standards. These figures highlighted the systemic risk of off-balance-sheet financing and underscored the need for a unified, more transparent approach to recognizing lease obligations across industries and geographies.

Today, standards such as IFRS 16, Ind AS 116, and ASC 842 have fundamentally reshaped lease accounting by bringing most leases onto the balance sheet. Managing these changes effectively, however, requires more than accounting knowledge—it demands the right technology.

Deskera ERP helps businesses streamline lease accounting by centralizing lease data, automating calculations for right-of-use assets and liabilities, and ensuring ongoing compliance with evolving standards. By integrating lease accounting into broader financial operations, Deskera enables finance teams to maintain accuracy, transparency, and audit readiness with confidence.

What Is Lease Accounting?

Lease accounting refers to the accounting treatment of lease-related assets, liabilities, revenues, and expenses for financial reporting and recordkeeping purposes. It defines how lease agreements are identified, classified, measured, and presented in a company’s financial statements. Lease accounting is governed by established accounting standards issued by global and national rule-setting bodies, including the International Accounting Standards Board (IASB) under IFRS, the Financial Accounting Standards Board (FASB) under U.S. GAAP, and the Governmental Accounting Standards Board (GASB) for public sector entities in the United States.

At its core, lease accounting aims to reflect the economic substance of a lease arrangement, rather than just its legal form. This involves properly recognizing lease-related obligations and rights over the life of the contract. For lessees, this means recording a lease liability representing future payment obligations and a corresponding right-of-use (ROU) asset that captures the economic benefit derived from using the leased asset. Both the asset and liability must be measured at inception and remeasured over time to reflect changes such as lease modifications, reassessments, or variable payments.

A critical aspect of lease accounting is the classification of leases, which determines how comprehensively a lease is reflected in the financial statements of both the lessee and the lessor. Modern lease accounting standards use five key criteria to assess whether a lease is economically similar to ownership:

- Whether ownership transfers to the lessee at the end of the lease term

- Whether there is a bargain purchase option that is reasonably certain to be exercised

- Whether the lease term covers the major part of the asset’s remaining economic life

- Whether the present value of lease payments is substantially equal to the asset’s fair value

- Whether the asset is so specialized that it has no alternative use to the lessor

Unlike earlier standards that relied on rigid numerical thresholds, current frameworks remove these “bright lines” and instead emphasize professional judgment to determine the true nature of the lease arrangement.

Lease accounting plays a vital role in improving financial transparency and comparability. By requiring companies to recognize most leases on the balance sheet, modern standards significantly reduce off-balance-sheet financing, a practice that previously allowed substantial lease obligations—especially operating leases—to remain hidden from investors and analysts. As a result, lease accounting has a direct impact on financial statements, key ratios such as leverage and return on assets, and how stakeholders evaluate a company’s overall financial health and risk profile.

Types of Leases in Accounting

Leases are classified to ensure that the economic substance of a lease arrangement is accurately reflected in financial statements. The classification determines how assets, liabilities, income, and expenses are recognized by both lessees and lessors. Modern lease accounting standards use the five classification criteria discussed earlier to assess whether a lease transfers control and ownership-like benefits to the lessee.

Based on this assessment, leases fall into the following categories.

Finance Lease

A finance lease is one in which the lessee obtains substantially all the risks and rewards associated with ownership of the underlying asset. If a lease meets any one of the five classification criteria—such as ownership transfer, bargain purchase option, or a lease term covering the major part of the asset’s economic life—it is classified as a finance lease for the lessee.

Under a finance lease, the lessee recognizes a right-of-use (ROU) asset and a corresponding lease liability on the balance sheet. The asset is depreciated over its useful life or lease term, while interest expense is recognized on the lease liability. Finance leases are commonly used for long-term, high-value assets such as buildings, heavy machinery, and vehicles.

Operating Lease

An operating lease is a lease that does not meet any of the five classification criteria and therefore does not transfer substantially all ownership-like benefits to the lessee. The lessor retains control of the asset and continues to bear most of the risks and rewards associated with ownership.

For lessors, operating leases result in the asset remaining on the balance sheet, with lease income recognized over the lease term. While earlier standards allowed lessees to keep operating leases off the balance sheet, current standards require most operating leases to be recognized through ROU assets and lease liabilities, improving transparency. Operating leases are typically used for short-term or high-turnover assets, such as office equipment, retail spaces, and fleet vehicles.

Sales-Type Lease

A sales-type lease applies from the lessor’s perspective when a lease meets at least one of the five classification criteria and results in a selling profit at lease commencement. Economically, the transaction is treated as a sale of the underlying asset by the lessor.

In a sales-type lease, the lessor derecognizes the asset, recognizes a net investment in the lease, and records any selling profit upfront. From the lessee’s perspective, a sales-type lease is always classified as a finance lease, requiring on-balance-sheet recognition of the leased asset and liability.

Direct Financing Lease

A direct financing lease also applies from the lessor’s perspective and represents leases that transfer risks and rewards similar to ownership but do not generate a selling profit at inception. This occurs when the present value of lease payments, including any guaranteed residual value, is less than or equal to the fair value of the underlying asset, and collectability of payments is probable.

In this case, the lessor recognizes a net investment in the lease and records interest income over the lease term rather than recognizing profit upfront. For the lessee, the lease continues to be treated as a finance lease.

Short-Term Lease

A short-term lease is a lease with a lease term of 12 months or less and no purchase option that the lessee is reasonably certain to exercise. Accounting standards provide a practical expedient allowing lessees to elect not to recognize right-of-use assets and lease liabilities for such leases.

Instead, lease payments are recognized as an expense on a straight-line basis over the lease term. Short-term leases are commonly used for temporary office spaces, short-term equipment rentals, or project-based asset needs.

Low-Value Asset Lease

A low-value asset lease applies to leases of assets that are individually of low economic value when new, such as laptops, small office furniture, or printers. Similar to short-term leases, lessees may elect a practical exemption to avoid on-balance-sheet recognition.

Lease payments for low-value assets are recognized as operating expenses, simplifying accounting without materially impacting financial transparency.

Operating Lease vs. Capital Lease (Legacy Classification)

Under older accounting standards, leases were classified as either operating leases or capital leases. This distinction is now obsolete, as capital leases have been replaced by finance leases under current standards.

The shift reflects a move away from rigid numerical thresholds toward a principles-based approach that relies on professional judgment to reflect the true economic nature of lease arrangements.

Key Lease Accounting Standards Explained

Lease accounting is governed by a set of well-defined standards designed to improve consistency, comparability, and transparency in financial reporting. The three primary standards in force today are ASC 842 and GASB 87 in the United States, and IFRS 16 for international reporting.

While these standards are largely aligned in terms of lease definitions and core terminology, they differ in accounting approaches, classification models, and presentation requirements, making it essential for organizations to understand which standard applies to them.

At a high level, ASC 842 follows a dual accounting approach, while IFRS 16 and GASB 87 adopt a single accounting model. All three standards require most leases to be recognized on the balance sheet and provide exemptions for short-term leases with a term of 12 months or less.

However, differences remain in areas such as cash flow statement presentation, lease remeasurement for material changes or impairment, and the treatment of comparative financial periods—areas where professional judgment and technical expertise are often required.

ASC 842 (U.S. GAAP – FASB)

ASC 842, issued by the Financial Accounting Standards Board (FASB), governs lease accounting under U.S. Generally Accepted Accounting Principles (GAAP). This standard introduced a more transparent framework for accounting for leases that are, in substance, asset purchases.

ASC 842 establishes:

- Three lease classifications for lessors: sales-type, direct financing, and operating leases

- Two lease classifications for lessees: finance leases and operating leases

Unlike IFRS 16, ASC 842 applies a dual accounting treatment for lessees, meaning finance and operating leases are recognized differently in the income statement, even though both appear on the balance sheet. ASC 842 became effective for public companies in 2019 and for private companies for fiscal years beginning after December 15, 2021.

The standard has since been amended to address specific scenarios. The most widely applicable update, ASU 2023-01, provides guidance on common-control leases, particularly on amortizing leasehold improvements over their useful lives when control is expected to continue and on accounting for related-party lease arrangements.

IFRS 16 (International Financial Reporting Standards – IASB)

IFRS 16, issued by the International Accounting Standards Board (IASB), introduced a single accounting model for lessees, treating nearly all leases in a manner similar to finance leases under U.S. GAAP.

Under this approach, lessees recognize a right-of-use asset and a lease liability for most lease arrangements, eliminating the operating lease distinction from the lessee’s accounting perspective.

IFRS 16 became effective on January 1, 2019, and is applied across numerous jurisdictions worldwide. It is particularly relevant for multinational organizations and U.S. companies with international subsidiaries or parent entities.

A narrow-scope amendment related to sale-and-leaseback transactions came into effect in 2024, further refining how such arrangements are measured and reported.

GASB 87 (State and Local Government Accounting – U.S.)

GASB 87 was issued by the Governmental Accounting Standards Board (GASB) and governs lease accounting for state and local government entities in the United States.

While federal government entities follow standards issued by the FASAB, GASB 87 modernized lease accounting for public sector organizations by introducing a single accounting approach similar to IFRS 16.

Under GASB 87, most leases are recognized on the balance sheet through lease assets and liabilities, improving transparency and consistency in government financial reporting. The standard became effective for reporting periods beginning after June 15, 2021, and has not undergone any substantive amendments since its implementation.

Together, ASC 842, IFRS 16, and GASB 87 represent a global shift toward greater visibility of lease obligations, reducing off-balance-sheet financing and enabling stakeholders to better assess an organization’s financial position and long-term commitments.

Benefits of the New Lease Accounting Standards

The introduction of modern lease accounting standards, including ASC 842 under U.S. GAAP and IFRS 16 under international reporting frameworks, marked a significant shift in how lease obligations are recognized and reported.

These changes were designed to address long-standing transparency gaps in financial reporting and provide stakeholders with a more complete picture of an organization’s financial commitments.

Improved Financial Transparency

One of the most important benefits of the new lease accounting standards is greater transparency. Under previous standards, many operating leases were kept off the balance sheet and disclosed only in the notes to financial statements.

This made it difficult for investors and analysts to fully understand the scale of a company’s lease obligations.

By requiring most leases to be recognized on the balance sheet, the new standards ensure that financial statements more accurately reflect a company’s true financial position.

More Accurate Representation of Liabilities and Assets

Bringing operating leases onto the balance sheet results in the recognition of both lease liabilities and right-of-use assets.

This change corrects the historical understatement of liabilities and provides clearer visibility into the assets a business relies on to generate revenue.

As a result, stakeholders gain a more realistic view of a company’s leverage, capital structure, and long-term financial commitments.

Better Quality Financial Analysis and Comparability

Under the old standards, companies with similar leasing strategies could appear financially very different depending on how much they relied on operating leases versus owned assets.

This inconsistency distorted key financial metrics, including debt ratios, return on assets, and EBITDA. The new lease accounting standards improve comparability across companies and industries, enabling more meaningful financial analysis and benchmarking.

Reduced Reliance on Footnote Disclosures

Previously, users of financial statements had to rely heavily on footnote disclosures to understand a company’s lease obligations. These disclosures were often complex and easy to overlook.

By moving lease obligations directly onto the balance sheet, the new standards reduce dependence on footnotes and make critical financial information more accessible and easier to interpret.

Stronger Governance and Decision-Making

The process of complying with the new standards required companies—particularly lessees with significant operating leases—to conduct a comprehensive inventory of their lease arrangements and apply consistent accounting judgments.

While this was a substantial administrative effort, it has led to better internal controls, improved lease data management, and more informed decision-making around leasing versus buying assets.

Greater Confidence for Investors and Stakeholders

By eliminating off-balance-sheet treatment of operating leases, the new standards enhance investor confidence in reported financial information. Stakeholders can now assess a company’s financial health, risk exposure, and capital commitments with greater accuracy, leading to more informed investment, lending, and strategic decisions.

While the transition to the new lease accounting standards required significant effort—particularly for lessees with large operating lease portfolios—the long-term benefits of transparency, comparability, and improved financial insight outweigh the initial compliance challenges.

Advantages of Leasing

Leasing is a widely used financing option because it allows businesses to access and control the assets they need without the full burden of ownership. For many organizations, leasing represents a “best of both worlds” approach—providing operational flexibility while reducing financial and operational risk.

Below are some of the key advantages that make leasing an attractive option for businesses across industries.

Higher Purchasing Power

Leases typically require significantly lower upfront investment compared to purchasing assets outright. This allows businesses to preserve capital and allocate funds to other strategic needs such as growth, staffing, or working capital.

Leasing also makes it easier to upgrade to newer or more advanced equipment, which can be costly and restrictive under outright ownership.

Improved Cash Flow Management

Leasing offers greater flexibility in payment structures, including options such as no initial down payment, stepped or deferred payments, and balloon payment arrangements.

Once lease terms are agreed upon, businesses can forecast cash outflows more accurately, leading to better cash flow planning and financial stability.

Lower Long-Term Maintenance Costs

With leased assets, lessees are generally responsible for maintenance only during the lease term. By aligning the lease duration with the useful life of the asset, businesses can avoid the higher maintenance and repair costs that often arise as assets age. In many cases, maintenance responsibilities may also remain with the lessor, further reducing operational overhead.

Simplified Asset Disposal

At the end of the lease term, lessees typically return the asset to the lessor, eliminating the need to manage resale, disposal, or write-offs. This is particularly beneficial for assets that are required only for a limited period—such as heavy equipment for a multi-year project—or for assets that become obsolete quickly, like computers and IT equipment.

Access to Asset Financing Without Ownership Risk

Leasing enables businesses to use essential property, plant, and equipment without incurring the significant capital expenditure associated with ownership. This form of asset financing helps organizations scale operations and adopt new capabilities while limiting balance-sheet strain.

Protection Against Technological Obsolescence

For assets subject to rapid technological change, leasing provides built-in protection against obsolescence. At the end of the lease term, businesses can return outdated equipment and replace it with newer, more efficient models, ensuring continued operational efficiency and competitiveness.

Flexible Payment Terms

Compared to traditional loan agreements, lease contracts often offer more adaptable payment schedules. This flexibility allows businesses to structure payments in a way that aligns with revenue cycles, seasonal demand, or project timelines.

Potential Tax Benefits

Leasing can offer tax advantages, as depreciation and lease-related expenses may be tax-deductible, depending on the lease structure and applicable tax regulations. Both lessors and lessees may benefit from these deductions, making leasing a tax-efficient alternative to purchasing in many cases.

Overall, leasing provides businesses with financial flexibility, operational efficiency, and risk mitigation, making it a strategic choice for acquiring and managing assets in a dynamic business environment.

Disadvantages of Leasing

While leasing offers flexibility and lower upfront costs, it also comes with several financial, operational, and accounting-related drawbacks that businesses must carefully evaluate.

Understanding these disadvantages is essential for making informed decisions about whether leasing or owning an asset is more appropriate for a given situation.

Higher Long-Term Cost Due to Interest

Lease payments typically include an interest component, which represents an additional cost compared to purchasing an asset outright with cash. Over the life of a lease, these interest charges can make leasing more expensive than ownership, particularly for long-term or high-value assets.

Potential Loss of Tax Benefits

When a business purchases an asset, it can often claim depreciation deductions to reduce taxable income. Under certain lease structures, these tax benefits may be partially or entirely lost, as depreciation is generally claimed by the asset owner.

Given the complexity of tax rules and the impact of updated lease accounting standards, businesses should consult a tax professional to understand the implications specific to their jurisdiction.

No Residual or Salvage Value

One downside of leasing—especially operating leases—is that the lessee typically does not retain ownership of the asset at the end of the lease term.

As a result, any residual or salvage value reverts to the lessor, even after the lessee has made all lease payments. This can be a disadvantage when assets retain significant value beyond the lease period.

Ongoing Lease Administration and Compliance Burden

Maintaining compliance with modern lease accounting standards such as ASC 842 and IFRS 16 can be resource-intensive. Organizations must continuously track lease modifications, renewals, reassessments, and common-control arrangements while keeping right-of-use assets and lease liabilities accurately updated. This ongoing administrative effort can strain finance teams, particularly in companies with large lease portfolios.

Agency Cost and Moral Hazard Risk

Leasing introduces an agency cost problem, where ownership and control of an asset are separated. Because the lessee controls the asset but does not own it, there may be less incentive to maintain or use the asset with the same level of care as if it were owned outright.

This moral hazard can lead to higher wear and tear, disputes over asset condition, or additional costs at lease termination—an important consideration in lease accounting and contract design.

Complexity of Lease Accounting

Lease accounting is inherently more complex than accounting for owned assets. Determining lease classification, measuring right-of-use assets and lease liabilities, reassessing leases for changes, and ensuring ongoing compliance require significant technical expertise. Compared to building or purchasing assets outright, leasing introduces additional layers of accounting judgment and operational complexity.

In summary, while leasing can provide flexibility and capital efficiency, it also involves higher long-term costs, administrative complexity, and potential financial trade-offs. Businesses should carefully weigh these disadvantages against the benefits of leasing when evaluating asset acquisition strategies.

Importance of Lease Accounting

Lease accounting plays a critical role in ensuring that an organization’s financial reporting is accurate, transparent, and decision-ready. With modern standards such as ASC 842 and IFRS 16 requiring most leases to be recognized on the balance sheet, lease accounting has become central to financial governance and stakeholder trust.

Transparency and Accuracy in Financial Reporting

Proper lease accounting improves the transparency and accuracy of financial statements by recognizing lease-related assets and liabilities on the balance sheet.

This ensures a more complete representation of a company’s financial position, rather than keeping significant obligations off-balance-sheet. For investors, lenders, and regulators, this visibility is essential for understanding the true scale of a company’s commitments.

Improved Financial Statement Analysis

When lease obligations are properly recorded and disclosed, analysts can perform more reliable financial analysis. Key metrics such as liquidity ratios, leverage, return on assets, and profitability become more meaningful, enabling stakeholders to better assess the company’s financial health and operating performance.

Enhanced Comparability Across Companies

Standardized lease accounting frameworks provide a consistent approach to recognizing and reporting leases across industries. This consistency improves comparability between organizations, allowing investors and analysts to make informed comparisons without distortions caused by differing lease treatment methods.

Better Risk Assessment and Visibility

Recognizing lease liabilities allows stakeholders to evaluate a company’s risk exposure more accurately. Lease accounting highlights long-term payment obligations, potential impacts on debt covenants, and future cash flow requirements—critical inputs for credit risk assessment and financial planning.

Stronger Contract and Lease Portfolio Management

Accurate lease accounting supports effective contract management by centralizing information on lease terms, payment schedules, renewal options, and termination clauses. This enables organizations to plan ahead for renewals, renegotiate unfavorable terms, avoid missed obligations, and optimize their overall lease portfolio.

Regulatory Compliance and Governance

Compliance with lease accounting standards such as ASC 842 and IFRS 16 is essential to meeting regulatory expectations. Proper lease accounting helps organizations avoid audit issues, regulatory penalties, and reputational risks, while demonstrating strong financial governance and internal controls.

More Informed Strategic Decision-Making

Lease accounting provides reliable data for strategic decisions, such as evaluating lease-versus-buy options, assessing the financial impact of lease modifications, and understanding how leasing affects cash flow and profitability. This insight supports better capital allocation and long-term planning.

In summary, lease accounting is essential for accurate financial reporting, meaningful analysis, effective risk management, and regulatory compliance. By clearly reflecting lease-related commitments, it enhances stakeholder confidence and supports informed, data-driven decision-making across the organization.

Steps of Effective Lease Accounting

Effective lease accounting follows a structured, methodical process to ensure compliance with current standards such as ASC 842, IFRS 16, and GASB 87. For most organizations, accounting for a new lease involves six key steps, each designed to accurately capture the economic substance of the lease arrangement and reflect it correctly in the financial statements.

Step 1: Determine Whether a Lease Exists

The first step is to assess whether a contract contains a lease under the applicable accounting standards. This involves determining whether the agreement conveys the right to control the use of an identified asset for a period of time in exchange for consideration.

Each lease must be evaluated and accounted for individually. Certain arrangements are explicitly excluded from lease accounting standards, such as leases of intangible assets, inventory, assets under construction, biological assets, and specific natural resource assets, which are governed by other accounting standards.

Step 2: Separate and Remove Non-Lease Components

Many contracts include both lease and non-lease components. For example, a real estate lease may bundle office space with services such as parking, maintenance, or landlord-funded improvements.

In this step, non-lease components are separated from the lease component, and the total contract consideration is allocated accordingly. This often requires estimates or third-party valuations to determine the standalone value of non-lease elements, ensuring only lease-related payments are used for lease accounting calculations.

Step 3: Classify the Lease

Once the lease component is identified, the lease must be classified using the five classification criteria outlined in the accounting standards. These criteria assess whether the lease transfers ownership-like rights to the lessee.

Based on this evaluation, the lease is classified as either a finance lease or an operating lease for the lessee, and as a sales-type, direct financing, or operating lease for the lessor. Lease classification directly affects how expenses, income, and balance sheet items are recognized over the lease term.

Step 4: Measure the Lease’s Present Value

For leases with a term of more than 12 months, lessees are required to calculate the present value of future lease payments. This calculation reflects the time value of money and is performed using either:

- The interest rate implicit in the lease, if readily determinable, or

- The lessee’s incremental borrowing rate, which represents the rate the lessee would pay to borrow a similar amount under comparable terms

This present value measurement establishes the initial value of both the right-of-use (ROU) asset and the lease liability recognized on the balance sheet.

Step 5: Determine Amortization Method

The amortization approach depends on the lease classification.

- For operating leases, the ROU asset is typically amortized on a straight-line basis, resulting in a consistent lease expense over the lease term.

- For finance leases, amortization follows the effective interest method, which accelerates expense recognition in earlier periods through separate depreciation and interest expense components.

This step ensures that lease-related costs are systematically recognized over the life of the lease.

Step 6: Create and Maintain Journal Entries

The final step is to record the appropriate journal entries at lease commencement and throughout the lease term. Initial entries establish the ROU asset and lease liability, while recurring entries account for amortization, interest, and cash payments.

Lease accounting does not end at inception—it must be integrated into every fiscal close. Ongoing activities include tracking lease modifications, renewals, reassessments, and terminations to keep lease balances accurate and compliant.

Lease Accounting in Practice: An Illustrative Example

Operating leases for lessees were among the most significantly impacted by the updated standards. In a typical multi-year operating lease, the lessee recognizes a right-of-use asset and a corresponding lease liability based on the present value of lease payments.

Over the lease term, the ROU asset is amortized and the lease liability is reduced as payments are made, with total lease expense recognized consistently in the income statement.

By the end of the lease term, both the ROU asset and lease liability are fully amortized, reflecting the completion of the lease and return of the asset to the lessor.

Following these six steps ensures that lease accounting is accurate, consistent, and compliant, while also providing stakeholders with a transparent view of an organization’s lease obligations and asset usage.

Important Lease Accounting Calculations You Need to Know

Lease accounting under modern standards involves a series of interrelated calculations that directly affect balance sheet recognition, income statement presentation, and financial disclosures. Whether you use spreadsheets or dedicated lease accounting software, understanding these calculations is essential to ensure accuracy, compliance, and audit readiness.

Present Value of Future Lease Payments

The present value (PV) of lease payments is the foundation of lease accounting. Present value represents what a future stream of lease payments is worth today, based on a specified discount rate and lease term.

Under current lease accounting standards, lessees must calculate the present value of future lease payments for both operating and finance leases. This calculation determines:

- The lease liability recorded on the balance sheet

- The initial measurement of the right-of-use (ROU) asset

The calculation uses the payment schedule defined in the lease agreement and a rate of return that is either specific to the lease or to the organization.

Lease Liability and Amortization Schedule

The lease liability represents the present value of remaining lease payments and is recognized alongside the ROU asset at lease commencement. An amortization schedule is then used to allocate each lease payment between interest expense and principal reduction over the lease term.

It is important to note that:

- Under ASC 842, lease liabilities are not classified as debt

- Under IFRS 16 and GASB 87, lease liabilities are treated as long-term debt

Accurately calculating and maintaining the lease liability amortization schedule is critical, particularly for organizations managing multiple leases or frequent lease modifications.

Right-of-Use (ROU) Asset Calculation

The right-of-use asset reflects the lessee’s right to control the use of an identified asset over the lease term. Under ASC 842, the ROU asset is calculated as:

- The initial lease liability

- Plus any lease prepayments and initial direct costs

- Less any lease incentives received

ROU assets and lease liabilities are presented separately on the balance sheet, and their values change over time as the lease is amortized and payments are made.

Straight-Line Lease Expense

For operating leases, lessees are required to recognize lease expense on a straight-line basis over the lease term. This approach ensures that total lease costs are evenly recognized, regardless of the timing of actual cash payments.

Straight-line lease expense is calculated by aggregating all fixed lease payments over the contract term and dividing the total by the number of periods in the lease. This concept is similar to straight-line depreciation and is essential for consistent income statement reporting.

Discount Rate or Interest Rate Determination

Selecting the correct discount rate is one of the most judgment-intensive aspects of lease accounting. The preferred rate is the interest rate implicit in the lease, which reflects the rate that equates the present value of lease payments and residual value to the fair value of the underlying asset.

If the implicit rate cannot be readily determined, lessees use the incremental borrowing rate, which represents the rate at which the lessee could borrow a similar amount under comparable terms. Private companies reporting under ASC 842 may also elect to use a risk-free rate when other rates are unavailable.

The chosen discount rate has a direct impact on the measurement of both the lease liability and the ROU asset.

Additional Key Lease Accounting Metrics

Beyond the core calculations, companies must also compute and monitor several supporting metrics, including:

- Reduction of lease liability over time

- Asset amortization and lease expense recognition

- Weighted average discount rates for operating and finance leases (ASC 842)

- Weighted average lease terms for operating and finance leases (ASC 842)

These calculations feed directly into financial statement disclosures and management reporting.

Disclosure-Driven Calculations

Many lease accounting calculations are also used to support mandatory disclosures, which may present the same data in different formats across the balance sheet, income statement, cash flow statement, and notes to the accounts. Ensuring consistency across these disclosures is critical for compliance and audit accuracy.

Mastering these calculations enables organizations to maintain accurate lease records, meet regulatory requirements, and provide transparent financial reporting, even as lease portfolios grow in size and complexity.

Embedded Leases in Lease Accounting

One of the most complex and often overlooked aspects of lease accounting is the identification of embedded leases. While standalone lease agreements—such as real estate or equipment leases—are usually easy to identify, embedded leases are frequently hidden within broader service, outsourcing, or maintenance contracts. Failing to identify these arrangements can result in incomplete lease portfolios and non-compliance with current lease accounting standards.

What Are Embedded Leases?

Embedded leases refer to lease components that exist within contracts that are not explicitly labeled as leases. Under modern lease accounting standards, a contract contains a lease if it conveys the right to control the use of an identified asset for a period of time in exchange for consideration—even if the contract is primarily for services.

This means that many contracts traditionally treated as service agreements may, in fact, include lease elements that must be separately identified and accounted for under lease accounting rules.

Why Embedded Leases Are Difficult to Identify

Unlike traditional leases, embedded leases are not always obvious from contract titles or procurement records. A standard real estate lease may require significant data collection, but identifying the lease itself is usually straightforward.

In contrast, embedded leases require a detailed contract review to determine whether specific assets are explicitly or implicitly identified and whether the customer controls their use.

Procurement or operations teams that negotiate these contracts may not have the accounting expertise needed to recognize embedded lease components, making cross-functional collaboration essential.

Common Contracts That May Contain Embedded Leases

Several types of service and outsourcing agreements commonly include embedded lease arrangements, including:

- Warehousing contracts: Although warehousing is often outsourced, contracts may specify the exclusive use of a particular facility or portion of a facility, which can meet the definition of a lease.

- Security contracts: These agreements may grant access to specific equipment, such as scanners, cameras, or monitoring systems, that could qualify as leased assets.

- Transportation contracts: Depending on contract terms, the use of specific vehicles or fleets may constitute a lease rather than a pure service arrangement.

- Data storage and IT contracts: Agreements for data storage or hosting services may include embedded leases related to dedicated servers or the physical space occupied by those servers.

Accounting Implications of Embedded Leases

When an embedded lease is identified, the lease component must be separated from the service component of the contract. The lease portion is then accounted for under the applicable lease accounting standard, while the service component follows other relevant accounting guidance. This separation can significantly affect balance sheet recognition, expense classification, and financial disclosures.

Best Practices for Identifying Embedded Leases

To effectively identify embedded leases, organizations should:

- Perform a comprehensive review of service and outsourcing contracts

- Involve finance, procurement, legal, and operations teams in the review process

- Establish standardized contract review checklists aligned with lease accounting criteria

- Use structured assessments or diagnostic tools to evaluate whether contracts contain lease components

Embedded leases represent a significant compliance risk if overlooked, but with proper processes and cross-functional coordination, organizations can ensure that all lease obligations—explicit or embedded—are accurately identified and reported in financial statements.

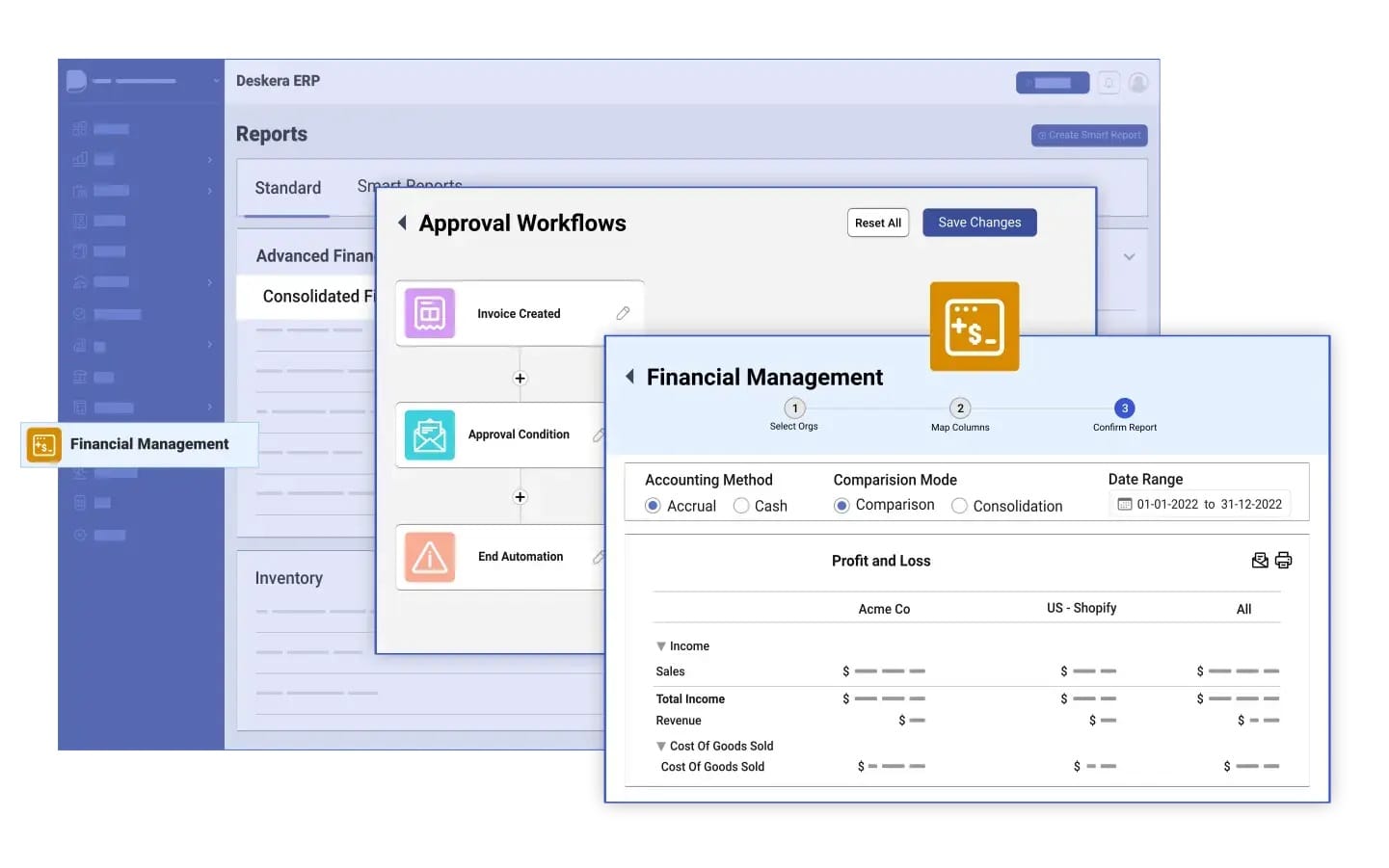

How Deskera ERP Can Help You With Lease Accounting

While Deskera ERP doesn’t have a dedicated lease accounting module like specialized lease accounting systems, it provides core financial and accounting capabilities that make the process of managing and reporting lease-related transactions much easier, accurate, and compliant. By leveraging Deskera’s accounting and financial tools, you can integrate lease accounting into your broader financial operations with confidence.

Centralized Financial Data Through the General Ledger

At the heart of lease accounting is accurate recognition of assets, liabilities, expenses, and lease-related journal entries. Deskera’s General Ledger serves as a centralized repository for all financial entries, enabling you to enter and track lease liabilities, right-of-use assets, amortization, interest expense, and cash payments in one place. Automated journal entries help ensure accuracy and reduce manual errors at month-end and year-end closing cycles.

Flexible Journal Entry Management

Deskera allows you to create and manage journal entries for lease accounting transactions, such as initial recognition of lease liabilities and ROU assets, interest and amortization expenses, and periodic lease payments. Automation of recurring entries helps streamline lease accounting compliance as leases progress through their terms.

Accurate Financial Reporting and Compliance

With Deskera ERP, you can generate comprehensive financial statements, including balance sheets and income statements that reflect your lease-related entries. These reports support transparency and compliance with lease accounting standards by presenting lease liabilities and assets alongside other financial data. Deskera’s reporting tools also help with audit readiness and financial disclosures.

Multi-Currency and Multi-Entity Support

If your business operates in multiple countries or consolidates reporting across entities, Deskera ERP supports multi-currency accounting, allowing lease transactions in different currencies to be accurately converted and consolidated. This helps maintain consistent global financial reporting.

Integration With Fixed Asset Accounting

While Deskera’s Fixed Asset Accounting module primarily manages owned assets (such as depreciation and disposals), it can be used in conjunction with lease accounting entries to track and report on ROU assets alongside physical assets. This provides a unified view of all assets in your organization and enhances fixed asset reporting.

Real-Time Financial Visibility and Audit Trails

Deskera’s real-time dashboards and customizable financial reports provide visibility into the financial impact of leases as lease-related entries flow through the system. Its built-in audit trail capabilities ensure that all journal entries and adjustments are recorded with traceability, supporting internal controls and audit requirements.

Scalable and Integrated Financial Platform

Since Deskera ERP is a fully integrated accounting and financial platform, lease accounting entries automatically flow through to related modules such as accounts payable, budgeting, forecasting, and cash flow management. This integration reduces siloed data and enables more holistic financial planning and analysis.

In summary, while Deskera ERP may not have a specialized lease accounting engine, its robust general ledger, journal entry automation, financial reporting, multi‑currency capabilities, asset tracking, and audit trails collectively help organizations manage lease accounting tasks accurately and efficiently within an integrated financial system.

Key Takeaways

- Lease accounting ensures that all lease-related obligations, assets, and expenses are accurately recorded, improving transparency and reflecting the true financial position of a company.

- Understanding lease classifications—finance, operating, sales-type, and direct financing leases—is critical because each type requires distinct accounting treatment and affects financial statements differently.

- ASC 842, IFRS 16, and GASB 87 provide standardized frameworks for lease accounting, ensuring consistent treatment of leases, enhancing transparency, and aligning reporting with regulatory requirements.

- Modern lease standards bring operating leases onto the balance sheet, increasing financial transparency, improving stakeholder trust, and enabling more accurate analysis of liabilities and obligations.

- Leasing provides businesses with flexibility, lower upfront costs, better cash flow management, protection against obsolescence, and access to assets without full ownership risk.

- Leasing can lead to higher overall costs due to interest, loss of residual value, administrative burden, and complexity in accounting and compliance.

- Effective lease accounting requires a structured approach, including identifying leases, separating non-lease components, classifying leases, calculating present value, amortizing assets, and recording journal entries.

- Accurate lease accounting depends on key calculations, including present value of payments, ROU asset valuation, amortization schedules, straight-line lease expense, and selecting the appropriate discount rate.

- Identifying embedded leases in service, outsourcing, and maintenance contracts is essential, as these hidden leases must be separated and accounted for to comply with lease accounting standards.

- Lease accounting enhances transparency, supports informed financial analysis, facilitates risk assessment, ensures regulatory compliance, and improves contract and portfolio management.

- Deskera ERP supports lease accounting by providing a centralized general ledger, automated journal entries, integrated financial reporting, audit trails, and fixed asset tracking, making lease management accurate, efficient, and compliant.

Related Articles