As an HR manager, you are responsible that everyone is paid appropriately and on schedule. Even a single blunder might jeopardize employees' confidence and the organization's reputation.

Payroll processing is thus a critical duty that you must complete correctly. Unfortunately, definitive solutions to payroll-related queries might be hard to come by.

Payroll taxes, payment dates, and employee classifications are all governed by federal and state governments. They are the ultimate experts on payroll and employment rules, yet they might be tough to locate.

We've included contact information for the payroll tax and labor agencies in each state that is most likely to be helpful. The solution to your payroll query is probably here someplace.

Let's Start!

FEDERAL RESOURCES

IRS Official Website

The IRS Employment Taxes is the IRS official website. This resource covers all the introductory information you will need. The website covers topics like:

· Fundamentals of Payroll

· How to deposit and report payroll taxes?

· Information about the due dates

· How to correct or modify payroll reports?

· Everything you need to know about filing payroll returns online.

· How can you update your business queries?

If you are self-employed, you may learn more about your tax requirements by visiting the Self-Employed section of the IRS website.

US Department of Labour Website

The USDOL is the go-to site if you have any queries regarding workers' rights, their classification, and other information that every business should know. The website covers topics like:

· Workplace Rights

· Workplace Benefits

· A section for employers

· Categorization of exempt and non-exempt workers

· Issues concerning workplace safety and health regulations

USDOL section on misclassification of workers

A crucial step for filing payroll taxes is understanding the contractor and full-time employee classification. There are different provisions for Freelance and full-time employees' payroll management. In it, you will find all the information about employee classification. The webpage covers topics like:

· Myths About Misclassification

· Misclassification Under the FLSA

· Employment Relationship Under the FLSA

· e-laws regarding independent contractors

· A video series on misclassification as an independent contractor

Now, let's look at the states, starting with Alabama.

ALABAMA

Alabama Department of Labour website

The Department of Labor provides every information you will need for the classification and registration of employees. The website covers topics like:

· Employer Registration and Account Status

· Wage and Tax Reporting

· Electronic Funds Transfer

· Tax Rate and Advanced Payment Rate

· Reimbursable Notices

· Benefit-Cost and Charge Statements

Alabama Department of Revenue website

The Department of Revenue has a Jira Service Desk-powered Help Center System. It is an excellent resource for finding information on a specific topic and reviewing Frequently Asked Questions. The website covers topics like:

· Individual Income Tax

· Business Privilege Tax

· Corporate Income Tax

· Financial Institution Excise Tax

· Withholding Tax

ARIZONA

Arizona DES Website

If you have a business in Arizona, you must be familiar with the Department of Economic Security. The "How Do I" section of the DES should solve most of your queries. The website covers topics like:

· FAQs

· Health Insurance Portability and Accountability Act

· DES Records

Arizona Department of Revenue website

Arizona Department of Revenue is like the Alabama Department of Revenue website. The website provides practical information on various topics on payroll and other types of taxes. The website covers topics like:

· TPT License

· Tax Rate Tables

· Business Audits

ARKANSAS

The Department of Workforce Services website is a brilliant resource for business owners in Arkansas. The website covers topics like:

· Unemployment insurance

· Work opportunity tax credit

· New hire registry

CALIFORNIA

There are three resources that every California business should follow:

· Department of Industrial Relations

· Employment Development Department

The websites cover topics like:

· Labor Law and Payroll Tax

· How to keep the workplace safe

· Workers' compensation requirements

· Licensing, registrations, certifications & permits

· Setting up an apprenticeship program

COLORADO

If you have any questions regarding payroll taxes and management, these are the best resources for Colorado state:

· Department of Labor and Employment

The websites cover topics like:

· Starting a Business

· Recruiting & Hiring

· Incentives & Tax Credits

· Labor Laws

· Layoffs & Separations

· Unemployment Insurance Premiums

· Workers' Compensation

CONNECTICUT

If you have any queries about payroll taxes or management in Connecticut, the following are the ideal resources:

· Department of Revenue Services

These websites cover topics like:

· Labor Laws

· Unemployment Insurance Premiums

· Workers' Compensation

· Payroll Tax

· Wage and Tax Reporting

DELAWARE

There are two resources that every Delaware business should follow:

These websites address a variety of themes, including:

· Establishing a Business

· Hiring and Recruiting

· Tax Credits and Incentives

· Labor regulations

· Layoffs and separations

· Premiums for Unemployment Insurance

· Workers' compensation insurance

DISTRICT OF COLUMBIA

If you have a business in the District of Columbia, you must be familiar with these websites:

· Department of Employment Services

These websites address a variety of themes, including:

· Payroll taxes and deductions

· Tax Credits and Incentives

· Labor regulations.

· Layoffs and separations

· Premiums for Unemployment Insurance

· Workers' compensation insurance

FLORIDA

If you have any questions regarding payroll taxes and management, these are the best resources for Florida state:

· Department of Economic Opportunity

These websites cover topics like:

· Labor Laws

· Unemployment Insurance Premiums

· Workers' Compensation

· Payroll Tax

· Wage and Tax Reporting

GEORGIA

If you have any queries about payroll taxes or management in Georgia, the following are the best resources:

These websites cover a wide range of topics, including:

· Deductions and payroll taxes

· Incentives and Tax Credits

· Labor laws and regulations

· Separations and layoffs

· Unemployment insurance premiums

· Insurance for workers' compensation

HAWAII

If you run a business in Hawaii, you must be familiar with these websites:

· Department of Labor and Industrial Relations

These websites cover a wide range of topics, including:

· Deductions and payroll taxes

· Incentives and Tax Credits

· Labor laws and regulations

· Unemployment insurance premiums

· Insurance for workers' compensation

· Special considerations for business

IDAHO

If you have any queries about payroll taxes or management in Idaho, the following are the best resources:

These websites cover a wide range of topics, including:

· Starting a Business

· Tax Credits and Incentives for Hiring and Recruiting

· Labor laws and regulations

· Separations and layoffs

· Unemployment insurance premiums

· Insurance for workers' compensation

ILLINOIS

There are two resources that every Illinois business should follow:

· Department of Employment Security

The website covers topics like:

· Unemployment Insurance

· Work Opportunity Tax Credit

· New Hire Registry

IOWA

These resources cover all the introductory information you will need.

The website covers topics like:

· Labor Laws

· Unemployment Insurance Premiums

· Workers' Compensation

· Payroll Tax

· Wage and Tax Reporting

KANSAS

If you have any questions regarding payroll taxes and management, these are the best resources for Kansas state:

These websites address a wide range of subjects, including:

· How to start a business

· Labor laws and regulations concerning tax credits and incentives for hiring and recruiting

· Layoffs and separations

· Premiums for unemployment insurance

· Workers' compensation insurance

KENTUCKY

The Department of Revenue website is the go-to resource for business owners in Kentucky. The website covers topics like:

· TPT License

· Tax Rate Tables

· Business Audits

· FAQs

· Health Insurance Portability and Accountability Act

· DES Records

LOUISIANA

Owners of businesses can find important information on the Louisiana Department of Revenue website. The website includes subjects such as:

· Tables of tax rates

· Business audits

· Frequently Asked Questions

· The Health Insurance Accountability and Portability and Act of 1996

· DES Recordings

MAINE

If you have any queries about payroll taxes or management in Maine, the following are the best resources:

These websites address a wide range of subjects, including:

· Frequently Asked Questions

· Labor laws and regulations

· Premiums for unemployment insurance

· Workers' compensation insurance

MARYLAND

If you have any questions regarding payroll taxes and management, these are the best resources for Maryland state:

The website covers topics like:

· Labor Laws

· Unemployment Insurance Premiums

· FAQs

· Workers' Compensation

· Payroll Tax

· Wage and Tax Reporting

MASSACHUSETTS

For Massachusetts, follow these resources:

· Labor and Workforce Development

They contain information about:

· Corporate Income Tax

· Financial Institution Excise Tax

· Withholding Tax

· How to deposit and report payroll taxes?

· Everything you need to know about filing payroll returns online

MISSISSIPPI

There are two resources that every Mississippi business should follow:

· Department of Employment Security

These websites cover a wide range of topics, such as:

· Frequently Asked Questions

· Corporate Income Tax

· Withholding Tax

· Wage and Tax Reporting

· Labor legislation

· Unemployment insurance premiums

· Insurance for workers' compensation

NEVADA

If you have any questions regarding payroll taxes and management, these are the best resources for Nevada state:

· Department of Employment, Training, and Rehabilitation

They include information on:

· Corporate Income Tax

· Excise Tax on Financial Institutions

· Withholding Tax

· How should payroll taxes be deposited and reported?

· Everything you need to know about electronically filing payroll returns

NEW YORK

There are two resources that every New York business should follow:

· Department of Taxation and Finance

These websites address a wide range of subjects, including:

· Income Tax on Corporations

· Excise Tax on Financial Institutions

· Withholding Tax

· Where and how should payroll taxes be deposited?

· Everything you need to know about electronically filing payroll returns

OHIO

These resources cover all the necessary information you will need to manage payroll taxes:

· Department of Job and Family Services

The website covers topics like:

· Labor Laws

· Unemployment Insurance Premiums

· FAQs

· Workers' Compensation

· Payroll Tax

· Wage and Tax Reporting

TEXAS

The Workforce Commission website is the go-to resource for business owners in Texas. The website covers topics like:

· Tax Rate Tables

· Business Audits

· FAQs

· Health Insurance Portability and Accountability Act

UTAH

If you have any questions, these are the best resources for Utah state:

· Department of Workforce Services

These websites address a wide range of subjects, including:

· Income Tax

· Withholding Tax

· Where and how should you deposit payroll taxes

· E-filing payroll returns

WASHINGTON

Owners of businesses can find important information on the Washington Department of Labor and Industries website. The website includes subjects such as:

· Tax rates.

· Business audits.

· Frequently Asked Questions

· The Health Insurance Portability and Accountability

Frequently Asked Questions

What is payroll?

Payroll is the process of paying a company's employees. It entails gathering a list of employees to be paid, keeping track of the hours worked, calculating the employee's compensation, delivering the money on time, and recording the payroll expenditure.

What is an EIN?

EIN is an abbreviation for Employer Identification Number. The IRS issues you an EIN.

It helps identify your company on various tax forms. An EIN is a taxpayer identification number, like a Social Security number. When you become an employer, you must obtain an EIN. To get an EIN, fill out Form SS-4 or apply online with the IRS.

What is the most efficient way to do payroll?

You can do payroll in various ways, depending on your comfort. Payroll can be outsourced to an expert, done manually, or by using payroll software. Outsourcing payroll to a payroll accountant or PEO (professional employer organization) is often the most expensive and time-consuming way, whereas learning how to perform payroll by hand is the cheapest and most time-consuming. Payroll software might be a solid medium ground for saving time and money.

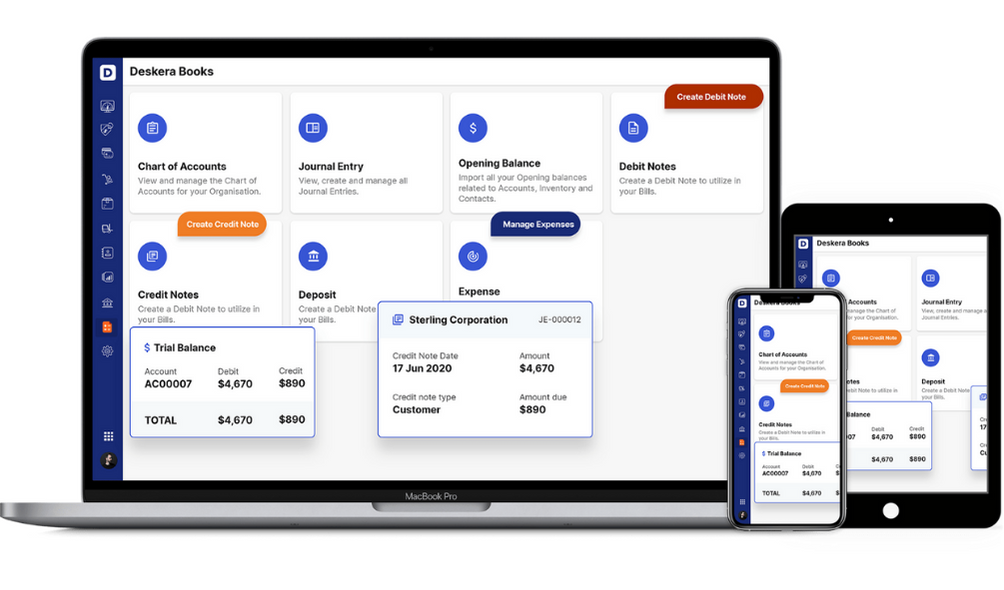

How can Deskera Help You?

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

· Payroll processing is thus a critical duty that you must complete correctly. Unfortunately, definitive solutions to payroll-related queries might be hard to come by.

· So, here is a list of contact information for the payroll tax and labor agencies in each state that can help you.

· If you have any questions regarding federal payroll taxes and labor laws the two best resources are the IRS and the USDOL websites.

· If you have any questions regarding Alabama State’s payroll taxes and labor laws the two best resources are the Department of Labor and the Department of Revenue websites.

· If you have any questions regarding labor laws and employee health insurance in Arizona, the Department of Economic Security is the best resource. Arizona Department of Revenue provides practical information on various topics on payroll and other types of taxes

· The Department of Workforce Services website is a brilliant resource for business owners in Arkansas if you want information regarding Unemployment insurance and the new hire registry.

· If you have any questions regarding California labor laws, Payroll taxes, and other requirements, the best resources are the Department of Industrial Relations, Employment Development Department, and Franchise Tax Board.

· If you have any questions regarding payroll taxes and management, these are the best resources for Colorado state: the Department of Labor and Employment and the Department of Revenue.

· If you have any queries about payroll taxes or management in Colorado, the following are the ideal resources: the Department of Labor and the Department of Revenue Services.

Related Articles