A study (“The Use of Grantor Retained Annuity Trusts in Estate Planning”) by the American Bar Association found that GRATs have become an increasingly popular estate planning tool, with 81% of respondents reporting that they had recommended GRATs to their clients. The same study also found that 98% of respondents believed that GRATs were an effective strategy for reducing gift and estate taxes.

This is further supported by a report by the Joint Committee on Taxation, which found that the number of new GRATs established annually has increased steadily from 3,553 in 2000 to 11,379 in 2019. The same report also found that the average value of assets transferred into a GRAT increased from $1.8 million in 2000 to $6.9 million in 2019.

A GRAT is an irrevocable trust that enables the trust's creator, also referred to as the grantor, to designate specific assets into a temporary trust and freeze their value. By doing this, additional appreciation is removed from the grantor's estate and given to heirs with little to no estate or gift tax liability.

However, GRAT is not suitable for everyone, and to be able to assess this better, it is important to have its complete understanding.

This article will help you thereby covering the following topics:

- What are Trusts?

- What are Grantor Retained Annuity Trusts?

- What is the Primary Purpose of Grantor Retained Annuity Trusts?

- How does Grantor Retained Annuity Trusts Work?

- When are Grantor Retained Annuity Trusts Popular?

- Funding a GRAT

- Additional Considerations When Using a GRAT

- What are the Benefits of Using a GRAT?

- What are the Risks Associated with Using a GRAT?

- Practical Example of GRAT

- FAQs related to GRAT

- How can Deskera Help You with GRAT?

- Key Takeaways

- Related Articles

What are Trusts?

A trust or a trust fund is a legal arrangement in which a trustee holds property or assets for the benefit of one or more beneficiaries. Trusts are often created as a way to manage and protect assets, distribute wealth, or achieve specific estate planning goals.

In a trust, the trustee is the person or entity responsible for managing the assets held in the trust and making decisions about how they should be used. The beneficiaries are the people who are entitled to receive the benefits of the trust, such as income, assets, or other forms of financial support.

Trusts can take many forms, and the terms of the trust are set out in a legal document known as the trust deed. Common types of trusts include revocable trusts, irrevocable trusts, living trusts, and testamentary trusts. Trusts can be used for a variety of purposes, including asset protection, tax planning, charitable giving, and providing for the needs of loved ones after your death.

What are Grantor Retained Annuity Trusts?

A Grantor Retained Annuity Trust (GRAT) is an estate planning tool that allows a grantor to transfer assets to a trust while still retaining an income stream from the trust for a set period of time.

The income stream is typically a fixed annuity payment that is paid to the grantor annually. At the end of the term, the remaining assets in the trust pass to the beneficiaries named in the trust agreement. GRATs are commonly used to transfer assets to the next generation while minimizing estate and gift taxes.

Here's how a GRAT works:

- The grantor creates a trust and transfers assets into it.

- The grantor retains the right to receive a fixed annuity payment from the trust for a set number of years.

- At the end of the annuity term, the remaining assets in the trust pass to the beneficiaries named in the trust agreement.

The value of the gift to the beneficiaries is determined by subtracting the present value of the retained annuity interest from the initial value of the assets transferred to the trust. This is known as the "gift tax value" of the transfer. If the grantor outlives the annuity term, the assets are included in the grantor's estate for estate tax purposes.

One of the key benefits of a GRAT is that it allows the grantor to transfer assets to the next generation with minimal gift tax consequences. The gift tax value of the transfer is reduced by the value of the retained annuity interest, which can be set at a relatively high rate to further reduce the value of the gift.

Another benefit of a GRAT is that it allows the grantor to transfer assets to the next generation while still retaining an income stream from those assets. This can be particularly useful for grantors who want to transfer assets but are concerned about losing control of those assets.

However, GRATs also comes with some risks. If the grantor dies before the end of the annuity term, the assets are included in the grantor's estate for estate tax purposes. Additionally, if the assets in the trust do not appreciate at a rate higher than the interest rate used to calculate the annuity payments, the GRAT may not provide much of a tax benefit.

In summary, a Grantor Retained Annuity Trust (GRAT) is an estate planning tool that allows a grantor to transfer assets to a trust while still retaining an income stream from the trust for a set period of time.

GRATs are commonly used to transfer assets to the next generation while minimizing estate and gift taxes, but they also come with some risks. A financial advisor or estate planning attorney can help you determine whether a GRAT is the right estate planning tool for your specific situation.

What is the Primary Purpose of Grantor Retained Annuity Trusts?

The primary purpose of a Grantor Retained Annuity Trust (GRAT) is to transfer assets to the next generation while minimizing estate, gift, and inheritance taxes.

GRATs are a popular estate planning tool that allows a grantor to transfer assets to a trust while still retaining an income stream from the trust for a set period of time. At the end of the annuity term, the remaining assets in the trust pass to the beneficiaries named in the trust agreement.

The main benefit of a GRAT is that it allows the grantor to transfer assets to the next generation with minimal gift tax consequences. The gift tax value of the transfer is reduced by the value of the retained annuity interest, which can be set at a relatively high rate to further reduce the value of the gift.

Additionally, GRATs can be an effective way for grantors to transfer assets while still retaining an income stream from those assets. This can be particularly useful for grantors who want to transfer assets but are concerned about losing control of those assets.

Overall, the primary purpose of a GRAT is to transfer assets to the next generation while minimizing estate and gift taxes while also providing the grantor with an income stream during their lifetime.

How does Grantor Retained Annuity Trusts Work?

Grantor Retained Annuity Trusts (GRATs) work by allowing a grantor to transfer assets to a trust while retaining an income stream from the trust for a set period of time. The grantor creates the trust and transfers assets into it, then retains the right to receive a fixed annuity payment from the trust for a specific number of years.

The annuity payments made to the grantor during the term of the GRAT are typically calculated based on a specific interest rate, called the Section 7520 rate, which is published monthly by the IRS. The grantor is entitled to receive the annuity payments from the trust annually, and these payments can be made in cash or in kind.

At the end of the annuity term, the remaining assets in the trust are distributed to the beneficiaries named in the trust agreement. The beneficiaries can be the grantor's children, grandchildren, or any other individual or entity the grantor chooses.

The value of the gift to the beneficiaries is calculated by subtracting the present value of the retained annuity interest from the initial value of the assets transferred to the trust. This is known as the "gift tax value" of the transfer. If the gift tax value is less than the grantor's remaining gift tax exemption, no gift tax is due on the transfer.

In summary, a Grantor Retained Annuity Trust (GRAT) works by allowing a grantor to transfer assets to a trust while retaining an income stream from the trust for a set period of time. At the end of the annuity term, the remaining assets in the trust are distributed to the beneficiaries named in the trust agreement.

GRATs are commonly used to transfer assets to the next generation while minimizing estate and gift taxes, but they also come with some risks. It's important to work with a financial advisor or estate planning attorney to determine whether a GRAT is the right estate planning tool for your specific situation.

Thus, an overview of the GRAT strategy will be as follows:

- By transferring assets, particularly those with high projected appreciation potential, to an irrevocable trust for a predetermined amount of time, the grantor creates a GRAT.

- The GRAT's value is divided into two components: the annuity stream and residual interest, using IRS guidelines for valuing annuities, life estates, and remainders. To create a "zeroed-out" GRAT, the amount of the annuity stream is sometimes set to be equal to the value of the assets transferred into the GRAT.

- From the GRAT, the grantor receives annuity payments. The trust is anticipated to generate a minimum return equal to the interest rate specified in IRS Section 7520. If it doesn't, the GRAT fails, returning trust assets to the grantor, and the trust spends the principal to make the annuity payment.

- After the last annuity payment is made, any remaining assets and accrued asset growth are handed straight to beneficiaries gift-tax-free, presuming returns of the GRAT do exceed the Section 7520 rate within the preset time period.

When are Grantor Retained Annuity Trusts Popular?

GRATs (Grantor Retained Annuity Trusts) are particularly popular in times of low-interest rates or when the Section 7520 interest rate (which is used to calculate the value of the retained annuity interest) is low. This is because the lower the interest rate, the lower the value of the retained interest, and therefore the lower the value of the gift that is subject to the gift tax.

For example, in a low-interest rate environment, a grantor can transfer assets to a GRAT and set the annuity payments to be relatively high. This means that the gift tax value of the transfer will be relatively low, potentially allowing the grantor to transfer a significant amount of wealth to their beneficiaries without incurring significant gift taxes.

GRATs are also popular when the grantor owns assets that are expected to appreciate significantly in value over time. By transferring these assets to a GRAT, the grantor can remove the future appreciation from their estate and transfer it to their beneficiaries without incurring gift or estate taxes.

Furthermore, the cost of producing a GRAT is frequently the only negative financial impact (legal, accounting, and, if funding it with illiquid assets, appraisal fees). The only effect, even if the GRAT assets do not increase above the established hurdle rate, is that the grantor will reclaim all of the GRAT assets (in the form of annuity payments), and no assets will have been transferred to the residual beneficiaries.

Overall, GRATs are a popular estate planning tool when interest rates are low and when the grantor owns assets that are expected to appreciate in value. However, it's important to work with a financial advisor or estate planning attorney to determine whether a GRAT is the right estate planning tool for your specific situation.

Funding a GRAT

Funding a Grantor Retained Annuity Trust (GRAT) involves transferring assets to the trust in exchange for the right to receive an annuity payment from the trust for a set period of time.

The assets that can be transferred to a GRAT can include a variety of property types, such as cash, stocks, real estate, or other assets. The grantor must transfer assets with a value that is sufficient to fund the annuity payments that will be made to the grantor during the term of the trust.

The grantor can choose the annuity payment amount and the duration of the annuity term, subject to certain limitations. The annuity payment must be a fixed amount that is payable at least annually, and the annuity term must be a fixed term of years, not exceeding the life expectancy of the grantor or the joint life expectancies of the grantor and a non-grantor beneficiary.

The value of the gift made by the grantor to the trust is calculated by subtracting the present value of the retained annuity interest from the initial value of the assets transferred to the trust. This is known as the "gift tax value" of the transfer, and it may be subject to gift tax if it exceeds the grantor's remaining gift tax exemption.

Once the assets are transferred to the trust, the trustee is responsible for managing the assets and making the annuity payments to the grantor during the term of the trust. At the end of the annuity term, the remaining assets in the trust are distributed to the beneficiaries named in the trust agreement.

What you must keep in mind here is that the ideal assets to contribute to a GRAT are those with low valuations in comparison to their intrinsic values and those whose values are anticipated to rise during the course of the GRAT.

The annuity stream will be calculated using the discounted value to the extent that an asset's value can be discounted (because of lack of marketability, lack of control, or certain constraints), making it simpler for the donated assets to surpass the applicable hurdle rate (assuming the annuity is paid with undiscounted assets).

Moreover, a GRAT can be used to benefit from low valuations if asset values have decreased or if the grantor holds an asset that they feel is undervalued.

Finally, if your GRAT is still in effect and is profitable (i.e., the assets you contributed have increased in value by more than the IRS hurdle rate), you might want to think about whether it makes sense to switch the assets in it for lower-volatility ones for the balance of the GRAT term in order to lock in the profit and benefit to your beneficiaries. This method is complex, so if you find yourself in this predicament, you should speak with your legal and tax counsel.

As is evident, it is important to work with a financial advisor or estate planning attorney to determine the appropriate assets to transfer to a GRAT and to ensure that the annuity payments and terms are structured appropriately to achieve the grantor's estate planning goals. Additionally, it's important to comply with all applicable tax laws and regulations to ensure that the transfer of assets to the trust is done correctly and efficiently.

Additional Considerations When Using a GRAT

The GRAT assets will be included in the grantor's estate for estate tax purposes if the grantor passes away within the GRAT term. It is primarily due to this reason that the Grantors generally design short-term GRATs (for example, durations of two to three years) and roll each year's annuity payment into a new GRAT (referred to as "rolling GRATs").

Tax-wise, during the GRAT term, the GRAT's income tax responsibility flows through to the grantor; however, during the remainder term, depending on how the remaining term is constructed, the tax liability will either flow through to the grantor or be paid by the trust.

This permits the GRAT's assets to increase during the GRAT's term without being subject to income taxes but also prevents the grantor from dodging taxes on any realized appreciation during that time.

What are the Benefits of Using a GRAT?

A Grantor Retained Annuity Trust (GRAT) is a popular estate planning tool that can provide several benefits to grantors who want to transfer assets to the next generation while minimizing estate and gift taxes. Some of the main benefits of a GRAT include:

Gift Tax Reduction

A GRAT can be an effective way to reduce gift tax liability when transferring assets to the next generation. The gift tax value of the transfer is reduced by the value of the retained annuity interest, which can be set at a relatively high rate to further reduce the value of the gift.

For example, if a grantor transfers assets worth $1 million to a GRAT and retains an annuity interest of $800,000, the gift tax value of the transfer is only $200,000. This means that the grantor's remaining gift tax exemption can be used to shelter a larger amount of assets from gift tax.

Estate Tax Reduction

A GRAT can also be an effective way to reduce estate tax liability when transferring assets to the next generation. Any appreciation in the value of the assets transferred to the GRAT over and above the annuity payments will pass to the beneficiaries free of estate and gift taxes.

For example, if a grantor transfers assets worth $1 million to a GRAT and the assets appreciate to $2 million during the annuity term, only the initial value of $1 million is subject to estate and gift taxes. The remaining $1 million passes to the beneficiaries free of tax.

Income Stream

A GRAT can provide the grantor with an income stream during their lifetime. The annuity payments are calculated based on the value of the assets transferred to the trust, the term of the trust, and the Section 7520 interest rate.

For example, if a grantor transfers assets worth $1 million to a GRAT and sets the annuity payments at 8% per year for a term of 5 years, the grantor will receive annuity payments of $80,000 per year for five years. At the end of the term, any remaining assets in the trust pass to the beneficiaries.

Retained Control

A GRAT allows the grantor to retain control over the assets transferred to the trust during the term of the trust. The grantor can serve as the trustee of the trust, manage the assets in the trust, and make decisions about the investment strategy.

What are the Risks Associated with Using a GRAT?

While a Grantor Retained Annuity Trust (GRAT) can provide significant benefits for estate planning, it also comes with certain risks that should be considered before creating a GRAT. These should be carefully considered before creating trust.

It's important to work with a financial advisor or estate planning attorney to determine whether a GRAT is the right estate planning tool for your specific situation and to develop a plan that addresses the potential risks.

Some of the main risks associated with GRATs include:

Risk of Asset Appreciation

One of the key benefits of a GRAT is that any appreciation in the value of the assets transferred to the trust over and above the annuity payments will pass to the beneficiaries free of estate and gift taxes. However, if the assets do not appreciate as expected, the grantor may not realize the full benefit of the GRAT.

For example, if a grantor transfers assets worth $1 million to a GRAT and the assets appreciate to $1.1 million during the annuity term, only the initial value of $1 million is subject to estate and gift taxes. However, if the assets do not appreciate as expected, the grantor may end up with a larger estate tax liability than anticipated.

Risk of Early Death

If the grantor dies before the end of the annuity term, the remaining assets in the GRAT will be included in the grantor's estate and subject to estate tax. This could result in a larger estate tax liability than if the grantor had not created a GRAT.

To mitigate this risk, some grantors may choose to create multiple GRATs with shorter annuity terms, which reduces the risk of early death and provides more flexibility.

Risk of Interest Rate Changes

The annuity payments for a GRAT are based on the Section 7520 interest rate, which is set by the IRS each month. If the interest rate increases, the annuity payments will be lower, and the grantor may not receive the expected income stream.

To mitigate this risk, some grantors may choose to set the annuity payments at a higher rate to provide a greater margin of safety.

Risk of Legislative Changes

Estate and gift tax laws are subject to change, and any changes could impact the effectiveness of a GRAT. For example, if the estate and gift tax exemption is reduced, the grantor may not be able to transfer as much wealth to the next generation without incurring gift tax.

For example, there have been proposals to increase restrictions, such as requiring a 10-year minimum fixed term or eliminating the zeroed-out GRAT strategy.

To mitigate this risk, some grantors may choose to create a GRAT with a shorter term or multiple GRATs to provide more flexibility in the event of legislative changes.

Practical Example of GRAT

A straightforward example can be used to illustrate the advantage of GRATs:

Take Max, a recent retiree who is 70 years old. He is a shareholder in a high-growth tech business, and his stake is currently worth $10,000,000.

Max has chosen to use a GRAT in order to give his son Sam the shares in a tax-advantageous way. A ten-year, irrevocable trust is established with the shares. Max receives a $500,000 payment per year.

The shares' value has climbed to $20,000,000 after ten years. Max has received a total payout of $5,000,000, leaving the trust's remaining worth at $15,000,000.

As we can see, the trust's value has risen from $10,000,000 to $15,000,000, a gain of $5,000,000. Sam has access to the $5,000,000 gain tax-free.

Figures that are extremely simplified are utilized in the example above. It should be noted, nevertheless, that the actual trust's structure and payout amount are far more intricate.

Normally, the Internal Revenue Service's (IRS) expected return rate, which is derived from market interest rates, would be used to calculate the $500,000 payment. As a result, when using GRATs, the interest rate environment must also be taken into account.

FAQs related to GRAT

- What does GRAT stand for?

GRAT stands for Grantor Retained Annuity Trust.

- What is a GRAT?

A GRAT is a type of irrevocable trust used for estate planning purposes that allows the grantor to transfer assets to beneficiaries with minimal or no gift tax consequences.

- How does a GRAT work?

With a GRAT, the grantor transfers assets into the trust and receives an annuity payment for a specified number of years. At the end of the trust term, any remaining assets are transferred to the beneficiaries without additional gift tax.

- Who is the grantor in a GRAT?

The grantor in a GRAT is the person who establishes the trust and transfers assets into it.

- Who are the beneficiaries in a GRAT?

The beneficiaries in a GRAT are the individuals or entities who will receive the remaining assets in the trust after the annuity payments have been made to the grantor.

- What types of assets can be transferred into a GRAT?

Almost any asset can be transferred into a GRAT, including stocks, real estate, and businesses.

- How long can a GRAT last?

The term of a GRAT can be any length of time, but it is typically between two and ten years.

- What is the minimum annuity payment in a GRAT?

The minimum annuity payment in a GRAT is 5% of the initial fair market value of the assets transferred into the trust.

- Can the annuity payments in a GRAT be made in a lump sum?

No, the annuity payments in a GRAT must be made annually.

- Can a GRAT be revoked?

No, a GRAT is an irrevocable trust, meaning that once it is established, it cannot be revoked or amended.

- What happens if the grantor dies during the term of the GRAT?

If the grantor dies during the term of the GRAT, the remaining assets in the trust are included in the grantor's estate for estate tax purposes.

- What happens if the assets in a GRAT do not appreciate during the trust term?

If the assets in a GRAT do not appreciate during the trust term, the beneficiaries will receive only the value of the annuity payments made to the grantor and no additional assets.

- Can a GRAT be used to transfer assets to charity?

Yes, a GRAT can be used to transfer assets to charity by naming a charitable organization as the beneficiary of the trust.

- What are the tax implications of a GRAT?

The tax implications of a GRAT depend on various factors, such as the length of the trust term and the rate of appreciation of the assets in the trust. Consult with a tax professional for more information.

- Is a GRAT right for everyone?

No, a GRAT may not be the best estate planning tool for everyone, as it requires careful consideration of various factors, such as the grantor's financial goals and the current economic climate. It is important to consult with an estate planning professional to determine whether a GRAT is appropriate for your situation.

How can Deskera Help You with GRAT?

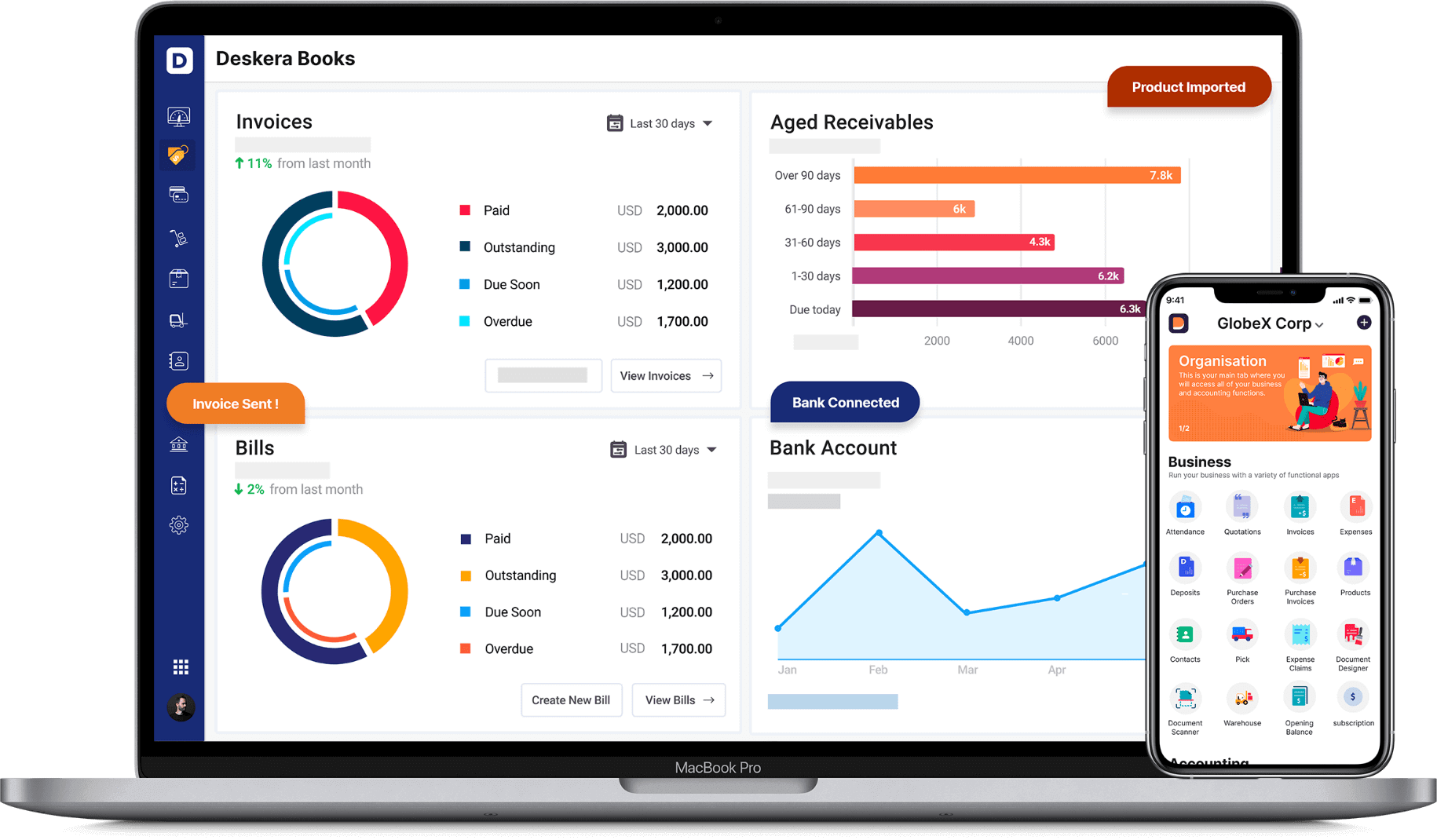

Deskera is a software platform that provides a variety of business management tools, including accounting, inventory management, and customer relationship management (CRM) software. While Deskera does not provide legal or financial advice, it can be a valuable tool for managing the financial aspects of your GRAT.

Specifically, Deskera Books can help you keep track of the annuity payments and other financial transactions associated with your GRAT, which can be helpful for tax reporting purposes. The inventory management tools can also be useful if you have transferred assets such as stock or other investment assets into the GRAT.

Additionally, if you are using a GRAT as part of your estate planning strategy for a family business, Deskera's business management tools can help you streamline operations and stay organized, which can be especially important when dealing with complex financial structures like a GRAT.

Key Takeaways

A Grantor Retained Annuity Trust (GRAT) is an estate planning tool that allows a grantor to transfer assets to a trust while still retaining an income stream from the trust for a set period of time.

The primary purpose of a GRAT is to facilitate the transfer of assets to the next generation while minimizing estate and gift tax, as well as having a steady source of income from those assets for the grantors.

GRATs are especially popular when the Section 7520 interest rates are low, and the assets have the potential for significant appreciation over time.

The benefits of using a GRAT are as follows:

- Gift tax reduction

- Estate tax reduction

- Income stream

- Retained control

The risks associated with using a GRAT are as follows:

- Risk of asset appreciation

- Risk of early death

- Risk of interest rate changes

- Risk of legislative changes

To conclude, while Deskera Books cannot provide legal or financial advice, it can be a useful tool for managing the financial aspects of your GRAT and other estate planning strategies.

Related Articles