Have you ever wondered why financial projections that look perfect on paper often fall apart in reality? The answer lies in the complexity behind forecasting future performance. Financial projections are built on assumptions, historical data, and expectations about market behavior—factors that are rarely static. Even experienced finance teams struggle to anticipate sudden demand shifts, cost fluctuations, or economic uncertainty, making accurate projections far more challenging than they appear.

In today’s fast-changing business environment, financial projections are no longer just a planning exercise—they are a strategic necessity. Organizations rely on them to guide budgeting, investment decisions, hiring plans, and cash flow management. However, without a structured approach, projections can quickly become outdated or misleading, leading to poor decisions, missed opportunities, and financial strain.

Some of the most common financial projection challenges stem from unreliable data, overly optimistic assumptions, lack of cross-departmental inputs, and infrequent updates. As businesses grow and operations become more complex, spreadsheets and manual forecasting methods often fail to provide the agility and accuracy required. This is why companies are increasingly turning to integrated financial systems to strengthen their forecasting processes.

This is where Deskera ERP plays a vital role. Deskera ERP brings together accounting, financial reporting, and operational data into a single, centralized platform, enabling businesses to build projections based on real-time, accurate information. With automated reports, cash flow visibility, and seamless data integration across departments, Deskera ERP helps finance teams create more reliable financial projections and respond proactively to changing business conditions.

What Are Financial Projections?

Financial projections provide a forward-looking view of a company’s financial performance over a specific period. They help businesses anticipate future outcomes, prepare for uncertainty, and make informed strategic decisions. By translating assumptions and plans into financial outcomes, projections serve as a critical foundation for growth planning, risk management, and stakeholder communication.

Financial projections are estimates of a business’s future financial results based on historical data, current performance, and expected market conditions. Their primary purpose is to help organizations plan ahead—whether for budgeting, securing funding, allocating resources, or evaluating strategic initiatives. Well-prepared projections offer clarity on where the business is headed and highlight potential financial risks and opportunities before they arise.

Key Components of Financial Projections

Financial projections are typically built using several interconnected financial elements. Together, these components provide a comprehensive picture of expected financial performance and liquidity.

Revenue Forecasts

Revenue forecasts estimate future income from sales of products or services. They are usually based on historical sales trends, market demand, pricing strategies, and growth assumptions. Accurate revenue forecasting is essential, as it directly influences expense planning, cash flow management, and overall profitability expectations.

Expense Estimates

Expense estimates project the costs a business expects to incur during the forecast period, including operating expenses, payroll, production costs, and overheads. Realistic expense forecasting helps businesses control spending, maintain margins, and avoid cash shortfalls caused by underestimated costs.

Cash Flow Projections

Cash flow projections focus on the timing of cash inflows and outflows rather than just profitability. They help businesses ensure they have sufficient liquidity to meet short-term obligations, manage working capital effectively, and plan for periods of surplus or shortage.

Profit and Loss Statements

Projected profit and loss statements summarize expected revenues, expenses, and net profit over a specific period. These statements help businesses evaluate financial performance, assess sustainability, and determine whether strategic goals are financially viable.

Difference Between Financial Projections and Budgets

Although financial projections and budgets are often used together in financial planning, they serve distinct purposes and are built with different objectives in mind. Understanding the differences between the two helps businesses plan more effectively, respond to change with agility, and maintain better financial control.

Purpose and Objective

Financial projections are designed to estimate future financial outcomes based on assumptions, trends, and possible scenarios. Their primary objective is to support strategic decision-making by showing where the business could be headed. Budgets, in contrast, are created to set financial targets and limits, outlining how much a business plans to earn and spend within a specific period.

Flexibility and Time Horizon

Financial projections are flexible and regularly updated to reflect changing market conditions, business performance, or strategic shifts. They often cover multiple scenarios and longer time horizons. Budgets are typically fixed for a defined period—such as a quarter or fiscal year—and are less frequently revised, making them more rigid in nature.

Level of Detail and Structure

Budgets tend to be more detailed and granular, breaking down expected revenues and expenses by department, cost center, or project. Financial projections are usually broader and more high-level, focusing on overall financial outcomes rather than detailed spending controls.

Use in Decision-Making

Financial projections are primarily used for forecasting, planning growth strategies, evaluating investments, and communicating future expectations to stakeholders. Budgets are used for operational control, performance tracking, and ensuring that spending stays within approved limits.

Approach to Assumptions

Projections rely heavily on assumptions and estimates that may change over time, such as market demand, pricing, or economic conditions. Budgets are based on approved assumptions and commitments, making them more authoritative and accountability-driven.

Adaptability to Change

When business conditions shift, financial projections can be quickly adjusted to reflect new realities. Budgets, however, often require formal revisions or approvals, which can limit responsiveness in fast-changing environments.

Top Financial Projection Challenges and How to Overcome Them

Even the most sophisticated financial models can fall short if underlying challenges are not addressed systematically. From poor data quality to human bias and outdated tools, these issues can significantly distort forecasts and weaken decision-making.

Below are the most critical financial projection challenges, each explained in context, along with practical, proven strategies to overcome them.

1. Data Quality & Consistency Issues

Inaccurate or inconsistent data is one of the most damaging challenges in financial projections. With over 60% of finance teams reporting inconsistent data sources, forecasts often suffer from compounded errors across revenue, cost, and cash flow models. Data pulled from multiple systems—such as ERP platforms, CRMs, and spreadsheets—frequently lacks standardized definitions, update cycles, and validation rules.

This fragmentation leads to forecasting variances averaging 18% and erodes stakeholder trust. When teams spend excessive time cleansing data yet still face high error rates, agility suffers and decisions are delayed. Without a single source of truth, projections become reactive rather than strategic, forcing mid-cycle revisions that weaken financial governance.

How to overcome

- Centralize data governance with standardized definitions and validation rules

- Automate data integration using ETL tools

- Conduct regular data audits to identify inconsistencies

- Assign clear ownership for data accuracy

- Train teams on data quality best practices

2. Unrealistic Assumptions

Nearly 45% of organizations cite overly optimistic assumptions as a primary cause of forecast inaccuracies. Inflated growth expectations, underestimated expenses, or aggressive market penetration targets distort projections from the outset.

These assumptions propagate through financial models, leading to cash shortfalls, missed targets, and repeated revisions—often accounting for up to 35% of forecast rework.

Cognitive biases such as optimism bias and anchoring further exacerbate the issue, reducing critical scrutiny. When assumptions are not rigorously tested against data and alternative scenarios, forecasts become aspirational rather than actionable, weakening financial discipline and long-term planning.

How to overcome

- Base assumptions on historical data and benchmarks

- Conduct cross-functional assumption review workshops

- Apply sensitivity analysis to test key drivers

- Introduce independent reviews or audits

- Document assumptions and track actual outcomes

3. Market Volatility & Economic Uncertainty

Market conditions can shift dramatically within quarters, driving over half of major forecast errors. Changes in consumer demand, interest rates, currency values, or geopolitical events can rapidly invalidate static projections.

Organizations without adaptive forecasting frameworks often struggle to distinguish short-term disruptions from structural trends, leading to overcorrections.

External shocks can reduce sales by up to 30% and significantly alter cost structures. Without scenario planning and flexible models, finance teams are left reacting instead of anticipating, undermining strategic agility and resilience.

How to overcome

- Use rolling forecasts updated with real-time data

- Develop best-, base-, and worst-case scenarios

- Track leading economic and market indicators

- Implement dynamic financial models

- Maintain contingency reserves for volatility

4. Cash Flow Predictability Challenges

Over 55% of businesses experience cash flow variances of up to 20%, largely due to unpredictable payment cycles and timing mismatches. Late receivables, accelerated payables, and unexpected capital expenditures create liquidity gaps that force emergency financing. Seasonal fluctuations and supplier terms further complicate projections.

Limited visibility into daily cash positions restricts informed decision-making, causing many organizations to rely on costly contingency credit lines. Poor cash flow predictability diverts focus from strategic growth to short-term survival.

How to overcome

- Improve real-time visibility into cash positions

- Tighten invoicing and payment terms

- Use weekly rolling cash flow forecasts

- Build cash buffers to absorb timing gaps

- Automate alerts for overdue receivables

- Align finance, sales, and procurement teams

5. Insufficient Historical Data

Without adequate historical data, forecasts lack the foundation needed to identify trends, seasonality, and cyclicality. Over 40% of organizations report data gaps that lead to forecast variances of up to 20%. Missing or inconsistent records force reliance on assumptions or proxy metrics, increasing uncertainty.

Limited historical depth also restricts advanced forecasting techniques such as time-series analysis or predictive modeling. As a result, finance teams often default to simplistic projections that overlook recurring patterns, increasing the risk of misallocation and budget overruns.

How to overcome

- Combine internal data with external benchmarks

- Backfill missing data using documented assumptions

- Standardize data archiving and capture processes

- Enrich datasets with third-party market data

- Pilot advanced forecasting models incrementally

- Continuously refine data quality over time

6. Siloed Departmental Inputs

More than 70% of organizations report that siloed data contributes to forecast variances of up to 18%. When sales, operations, and marketing operate independently, finance lacks a unified view of performance drivers. Disparate KPIs, formats, and timelines increase reconciliation efforts and delay insights.

Leadership receives fragmented projections that fail to reflect operational realities, resulting in resource misalignment and missed opportunities. Siloed inputs also drain productivity, with teams spending excessive time aligning numbers instead of analyzing them.

How to overcome

- Establish regular cross-functional planning forums

- Use shared platforms for centralized data input

- Standardize KPIs and data definitions

- Assign departmental input owners

- Automate data flows between systems

7. Inaccurate Cost & Expense Estimates

Nearly half of organizations experience cost overruns averaging 12% due to underestimated expenses. High-level budgeting often overlooks variable, indirect, or compliance-related costs. Inflationary pressures and supplier price changes further widen gaps between projected and actual expenses.

Frequent reconciliation cycles consume finance bandwidth and weaken confidence in forecasts. Without granular cost visibility, profitability projections become unreliable and reactive adjustments dominate planning cycles.

How to overcome

- Build detailed line-item cost structures

- Analyze historical cost trends and variances

- Include contingency buffers for uncertainty

- Conduct monthly expense variance reviews

- Validate assumptions with operational stakeholders

8. Rapid Regulatory & Compliance Changes

Regulatory changes can force forecast adjustments of up to 15%, often mid-cycle. New tax rules, reporting standards, or industry mandates introduce unplanned costs and disrupt baselines.

Over half of CFOs report compliance shifts as a major trigger for forecast revisions. Without proactive monitoring, organizations risk outdated models, penalties, and reputational damage. Global operations further amplify complexity, requiring constant recalibration.

How to overcome

- Maintain a regulatory compliance calendar

- Assign a dedicated regulatory liaison

- Integrate regulatory scenarios into forecasts

- Automate alerts for regulatory updates

- Review forecasts quarterly for compliance impact

- Train teams on regulatory frameworks

9. Inadequate Scenario & Sensitivity Analysis

Only 30% of finance teams regularly perform sensitivity analysis, leaving forecasts exposed to unexpected shifts. Single base-case models fail to capture the impact of changes in pricing, volume, or costs.

Without downside scenarios, organizations are unprepared for disruptions and forced into reactive decisions. Forecast errors are significantly higher when sensitivity analysis is absent, reducing confidence in planning outputs.

How to overcome

- Develop multiple forecast scenarios

- Conduct sensitivity testing on key drivers

- Use dynamic modeling tools

- Visualize outcomes through dashboards

- Review and update scenarios regularly

10. Lack of Cross-Functional Collaboration

Poor interdepartmental alignment contributes to forecast variances averaging 17%. When finance operates in isolation, projections reflect narrow perspectives and miss operational constraints. Conflicting assumptions lead to frequent revisions and erode trust. Collaborative forecasting is essential to align strategy, resources, and execution.

How to overcome

- Schedule integrated planning workshops

- Define shared KPIs across departments

- Use collaborative planning platforms

- Appoint cross-functional liaisons

- Recognize and reward collaborative success

11. Overreliance on Static Forecasting Tools

Over 70% of finance teams still depend on spreadsheets, resulting in forecast errors around 18%. Static tools lack real-time integration, version control, and scenario flexibility. Manual updates consume time and increase error risk, while outdated data limits responsiveness. This rigidity undermines agility and strategic insight.

How to overcome

- Adopt cloud-based FP&A platforms

- Automate data refresh and synchronization

- Enable collaborative workflows

- Use real-time dashboards

- Train teams on dynamic modeling

- Integrate predictive analytics

12. Human Biases in Projections

Cognitive biases account for up to 55% of forecast errors. Anchoring, confirmation bias, and optimism skew assumptions toward favorable outcomes, inflating revenue and underestimating risk. Herd behavior further amplifies errors when teams mirror competitors without critical analysis. Bias-driven forecasts reduce objectivity and increase variance.

How to overcome

- Train teams on cognitive biases

- Use structured assumption frameworks

- Conduct independent reviews

- Apply data-driven decision thresholds

- Build diverse, cross-functional teams

- Balance upside and downside scenarios

13. Difficulty Modeling Complex Pricing Structures

Tiered, usage-based, or subscription pricing models can drive forecast variances up to 25% if not modeled accurately. Multiple rate structures, discounts, churn, and upsell dynamics add complexity. Manual adjustments increase error risk and consume time, distorting revenue projections.

How to overcome

- Standardize pricing logic and rules

- Use configurable forecasting tools

- Model customer lifecycle behaviors

- Run price-sensitivity simulations

- Integrate CRM and billing data

- Recalibrate models regularly

14. Infrequent Review & Update Cycles

Organizations reviewing forecasts less than quarterly experience variances up to 20%. Static projections quickly become outdated, forcing emergency corrections and consuming finance capacity. Infrequent updates reduce agility and weaken confidence among stakeholders.

How to overcome

- Shift to monthly or quarterly reviews

- Automate update workflows

- Assign clear governance and ownership

- Embed performance metrics in reviews

- Conduct post-review variance analysis

15. Integration Issues with Financial Systems

Nearly half of finance teams rely on manual data transfers, causing forecast errors up to 17%. Disconnected systems create silos, delays, and inconsistencies. Manual reconciliation consumes time and undermines single-source accuracy, limiting responsiveness.

How to overcome

- Map and document system dependencies

- Use APIs or middleware for integration

- Standardize data formats and schemas

- Enable real-time or scheduled syncs

- Test integrations regularly

- Train teams on integration governance

Best Practices for Building Reliable Financial Projections

Building reliable financial projections requires more than historical data and formulas—it demands discipline, collaboration, and continuous refinement. The following best practices help organizations improve forecast accuracy, reduce variance, and support confident decision-making.

Start with Clear Objectives

Define the purpose of your financial projections upfront—whether for budgeting, fundraising, strategic planning, or cash flow management. Clear objectives determine the level of detail, time horizon, and assumptions required, ensuring projections remain relevant and focused.

Use High-Quality, Consistent Data

Accurate projections depend on clean, standardized data. Centralize financial and operational data, apply consistent definitions, and validate inputs regularly. A single source of truth minimizes errors and builds confidence in forecast outputs.

Base Assumptions on Evidence, Not Optimism

Ground assumptions in historical performance, industry benchmarks, and market trends. Challenge overly optimistic inputs and document all assumptions to enable review and refinement over time.

Incorporate Scenario and Sensitivity Analysis

Develop multiple scenarios—best case, base case, and worst case—to account for uncertainty. Sensitivity analysis helps identify key drivers and highlights which variables have the greatest impact on outcomes.

Adopt Rolling Forecasts

Replace static annual forecasts with rolling projections that update monthly or quarterly. This approach improves agility and keeps projections aligned with real-time business conditions.

Ensure Cross-Functional Collaboration

Involve sales, operations, marketing, and procurement teams in the forecasting process. Cross-functional inputs improve accuracy and ensure projections reflect operational realities.

Monitor, Review, and Refine Regularly

Compare forecasts against actual results, analyze variances, and adjust assumptions accordingly. Continuous feedback loops strengthen models and improve reliability over time.

Leverage Technology and Automation

Use ERP and FP&A tools to automate data integration, reporting, and updates. Technology reduces manual effort, improves accuracy, and enables real-time visibility into financial performance.

By following these best practices, organizations can transform financial projections into dependable tools that support strategic planning, risk management, and sustainable growth.

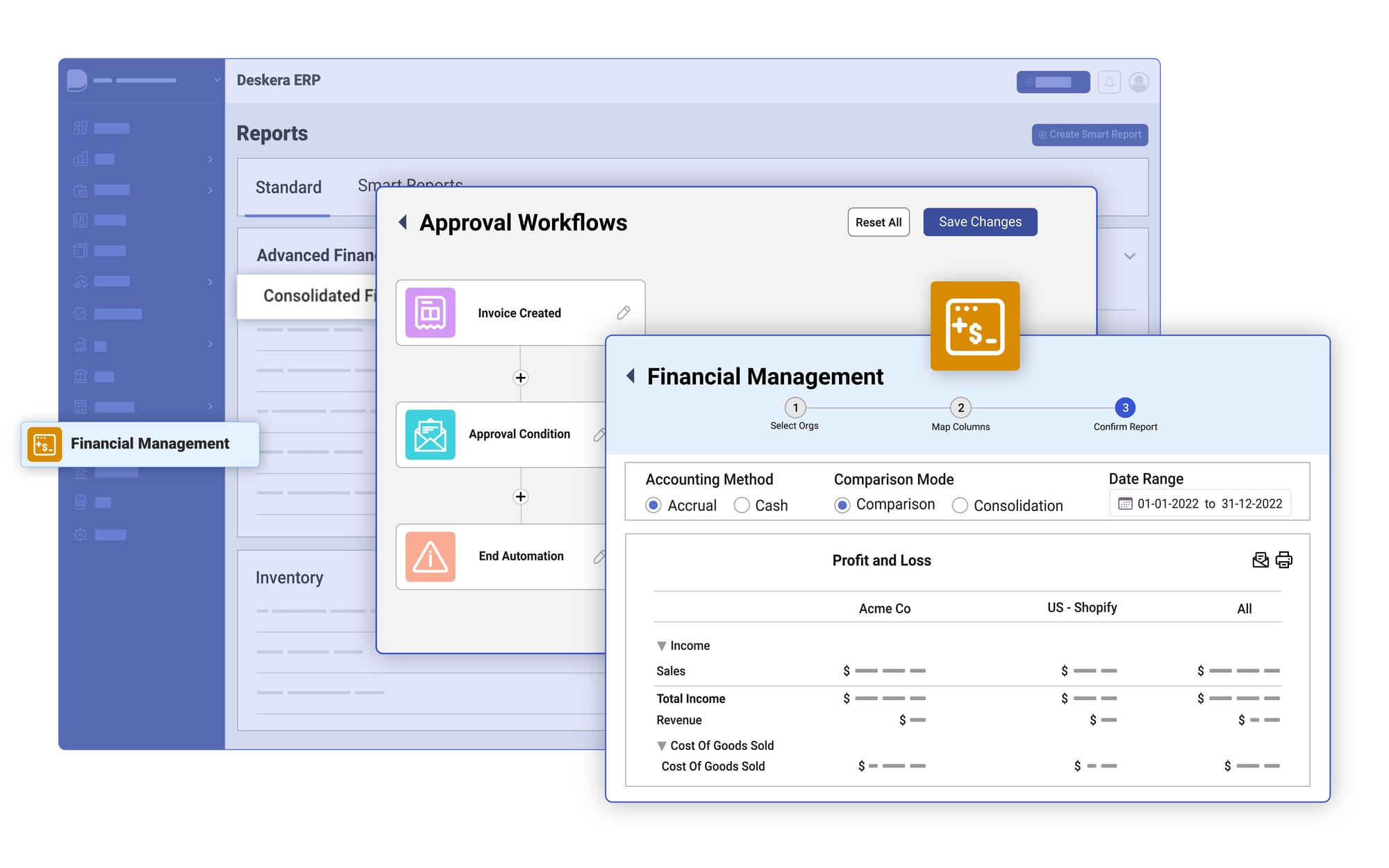

How Deskera ERP Helps Simplify Financial Projections

Creating accurate financial projections can be time-consuming and error-prone, especially when relying on multiple systems or manual processes. Deskera ERP simplifies this task by centralizing financial data, automating workflows, and providing real-time insights, allowing businesses to generate reliable forecasts quickly and confidently.

Here’s how Deskera ERP supports each aspect of the financial projection process.

Centralized Financial Data

Deskera ERP consolidates all financial and operational data into a single platform, eliminating discrepancies caused by fragmented sources. By providing a unified view of revenue, expenses, and cash flow, teams can generate projections based on consistent, validated information. This centralization reduces errors, saves time, and ensures all stakeholders work with the same data.

Automated Reporting and Forecasting

With Deskera ERP, finance teams can automate recurring reports, dashboards, and forecast calculations. Automated workflows remove the need for manual data entry and reconciliation, enabling teams to focus on analyzing trends and refining assumptions rather than correcting errors.

Real-Time Insights and Analytics

Deskera ERP provides dynamic dashboards and analytics tools that offer real-time visibility into key financial metrics. Users can track revenue, expenses, and cash flow trends instantly, making it easier to adjust projections in response to changing business conditions or market volatility.

Scenario Planning and What-If Analysis

Deskera ERP supports scenario-based forecasting, allowing organizations to model multiple outcomes, including best-case, base-case, and worst-case scenarios. This helps finance teams assess risks, evaluate the impact of assumptions, and prepare for uncertainties, improving the robustness of projections.

Collaboration Across Teams

The platform facilitates cross-functional collaboration by enabling finance, operations, sales, and other departments to share inputs in real time. Standardized data entry and integrated workflows ensure all teams contribute to projections accurately and consistently, reducing silos and improving decision-making.

Historical Data Tracking and Trend Analysis

Deskera ERP stores historical financial records, providing a reliable foundation for trend analysis and assumption validation. Teams can compare past performance against projections to refine models, improve accuracy, and identify areas for operational optimization.

By integrating these capabilities, Deskera ERP transforms financial projections from a manual, error-prone process into a streamlined, data-driven activity, empowering businesses to plan confidently, mitigate risks, and make informed strategic decisions.

Key Takeaways

- Reliable projections depend on accurate, standardized data; centralizing data governance and automating integration can significantly reduce errors and improve forecast trustworthiness.

- Grounding assumptions in historical data, benchmarks, and cross-functional review prevents overly optimistic forecasts and enhances the credibility of financial projections.

- Using rolling forecasts, scenario planning, and dynamic models allows organizations to remain agile and resilient against unpredictable market and economic shifts.

- Enhanced visibility, timely updates, and contingency buffers help businesses manage liquidity effectively and avoid cash shortfalls.

- Filling historical data gaps with standardized archives and external benchmarks ensures forecasts are based on meaningful trends rather than guesswork.

- Cross-functional collaboration and integrated platforms unify data inputs, reduce inconsistencies, and produce projections that reflect organizational realities.

- Detailed cost analysis, historical review, and contingency planning prevent underestimation, ensuring projections accurately reflect operational expenses.

- Proactive regulatory monitoring and scenario integration allow forecasts to adapt quickly to new mandates, avoiding disruptions and fines.

- Conducting multi-scenario and sensitivity analysis enables organizations to anticipate risks, quantify impacts, and make informed, proactive decisions.

- Regular workshops, shared KPIs, and collaborative tools ensure projections incorporate inputs from all relevant departments, improving accuracy and alignment.

- Transitioning to dynamic, cloud-based FP&A platforms reduces manual errors, supports real-time updates, and enhances the agility of projections.

- Awareness training, structured frameworks, and independent reviews mitigate cognitive biases, leading to more objective and realistic forecasts.

- Standardized pricing logic, configurable tools, and real-time data integration help accurately forecast revenue for tiered or usage-based models.

- Regularly reviewing and updating forecasts ensures projections remain current, reducing variance and supporting timely, data-driven decisions.

- Seamless integration between ERP, CRM, and reporting tools eliminates silos, minimizes errors, and enables reliable, real-time financial projections.

Related Articles