ECR stands for Electronic Challan cum Return. This is an electronic monthly return to be uploaded by the employers through the Unified Portal. The return will have member-wise details of the wages and contributions; including basic details for the new and existing members.

The approval of uploaded ECR will result in the generation of a Challan using which the employer has to remit the dues in the designated branches of SBI. In this way, each ECR will be linked with a remitted Challan and the ECRs uploaded but not remitted will lapse after 15 days of the generation of the challan.

The monthly upload of ECR will relieve the employer from the manual filing of returns; both monthly and annually. If you upload the ECR, there is no need to file Forms 5/10/12A, 3A, and 6A. Isn’t that already a lot of information for you? But we would like to take you to the depths of ECR right in this article so that it answers all your questions.

This article covers the following:

- What does ECR mean?

- How to file ECR?

- Stepwise guide to file for an ECR

- What are the benefits of electronic challan cum return?

- What are the important developments in electronic challan cum return?

- What are the changes in the ECR?

- FAQs

- How can Deskera assist you?

What Does ECR Mean?

ECR stands for Electronic Challan cum Return. It is an electronic monthly return to be uploaded through the Employer e-Sewa portal. The return will have the memberwise details of the wages and contributions, including basic details for the new and existing members.

The uploaded ECR will result in the generation of a Challan, using which the employer has to remit the dues through an online payment. Thus, each ECR will be linked with a remitted Challan, and the ECRs uploaded but not remitted will lapse after 12 days of the generation of the Challan.

The upload of ECR each month will relieve the employers from filing any paper returns and the various monthly and annual returns.

The ministry said that the Electronic Challan-cum-Return (ECR) filing would enable the establishments to avail themselves of the relief for their eligible employees.

About any eligible establishment, the employer shall disburse wages for the month to all employees of the establishment and file an Electronic Challan cum Return (ECR) with the required certificate and declaration to avail of the benefit under the Scheme.

The challan will show the amount of employees’ and employers’ contributions due as Central Government relief regarding eligible employees and the remaining amount payable by the employer after the ECR is uploaded and validation of the eligibility of establishment and employees.

After the employer remits the payment due from him to other employees, as reflected in the challan, the EPF and EPS contributions will be credited directly in the UANs of the eligible employees of the establishment by the Central Govt.

How to File ECR?

Before we get to the stepwise guide to filing the ECR, here are a few things that you must keep in mind.

Uploading Documents

The following information will be required at the time of uploading the ECR/Arrear file:

Wage month: For selecting the wage month and year against which the file is to be uploaded. Date of disbursement: The file that has to be uploaded can be selected then.

File type: Select ECR for the Regular Monthly file and Arrear for the Arrear payments. Contribution rate: By default, it will be 12%.

If this is changed to 10%, additional information has to be selected from the following:

- Bidi Brick

- Coir Jute

- Guar Gum

- Less than 20 employees

- Sick Establishment permitted by EPFO Office

Verify ECR Statement

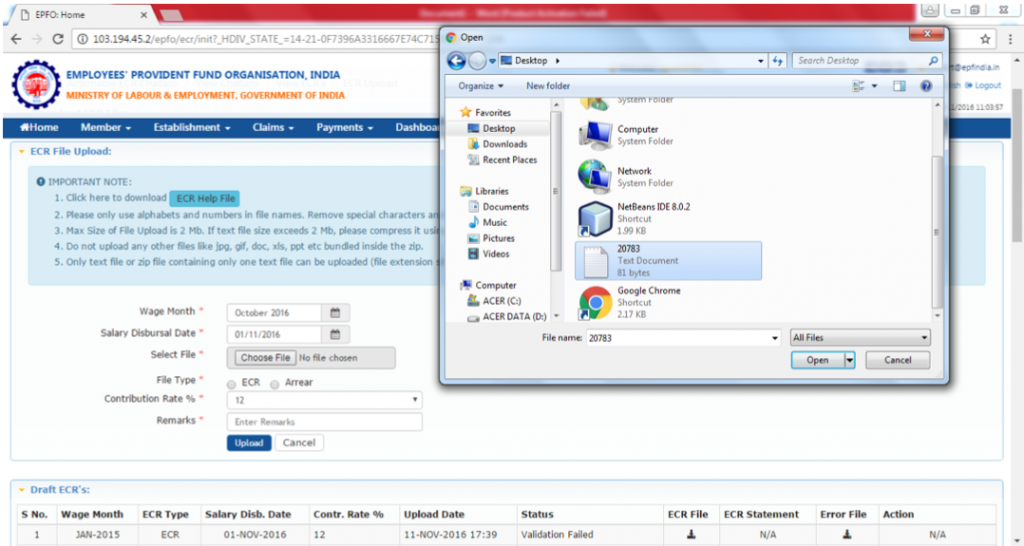

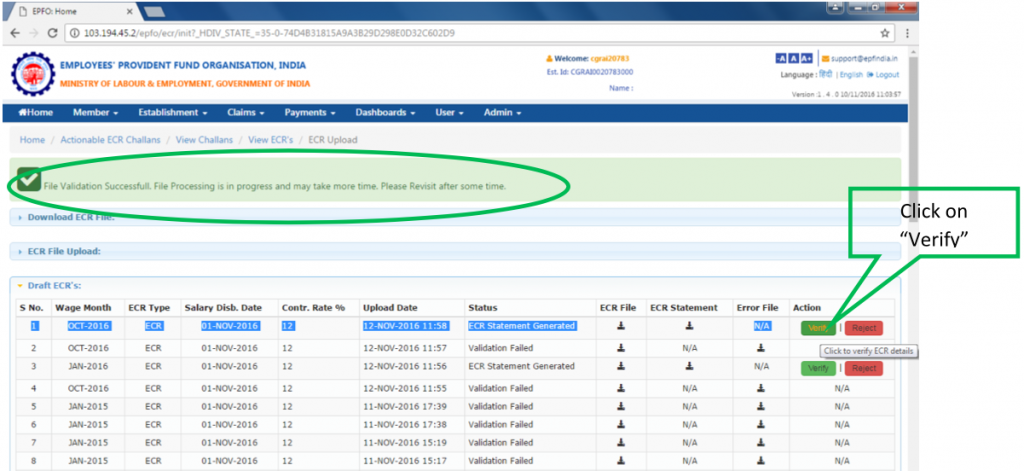

Once the data is uploaded, the software will validate the file for the format and the other validations, and if the validation fails, the error file will be created and the employer can then download the file, check the error, and rectify them and again upload the file.

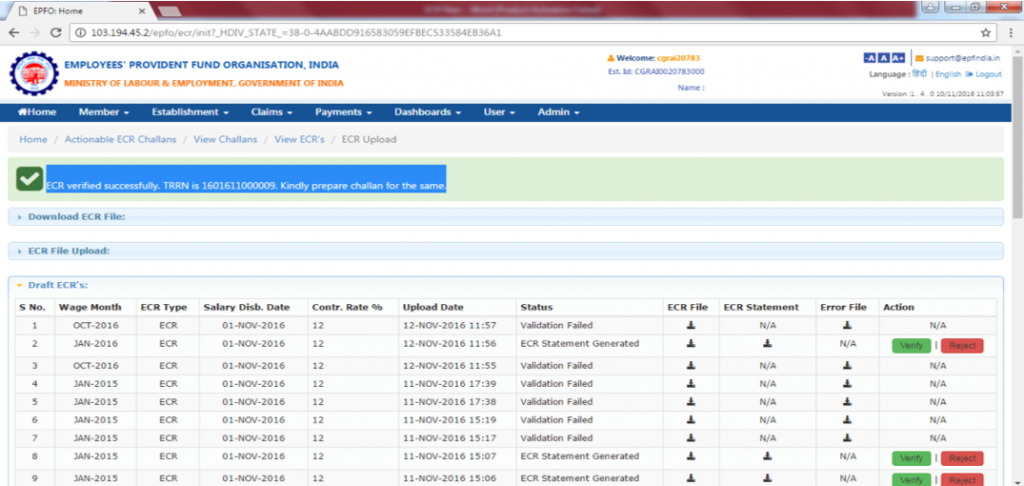

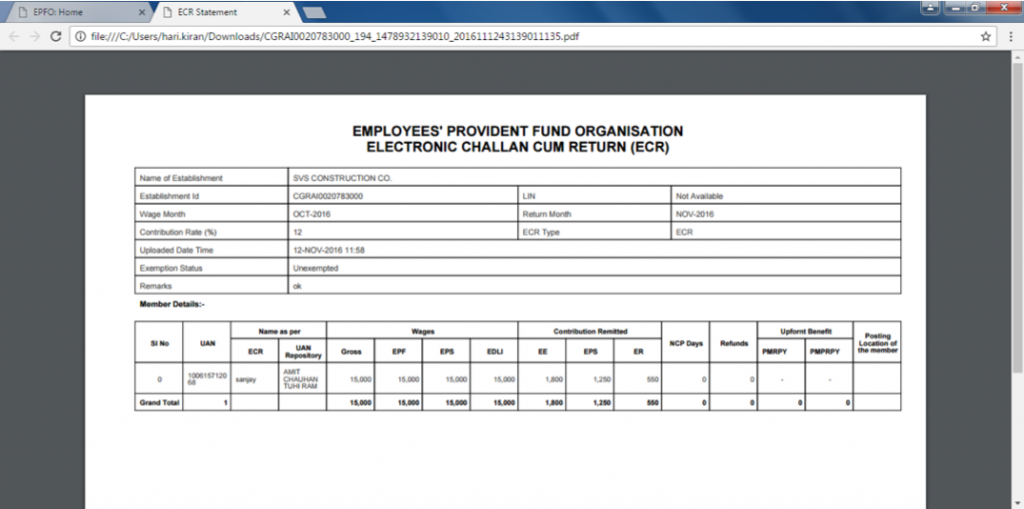

In case the validations are successful, the ECR Statement file in PDF will be generated, and the employer can download the same after verifying the data can verify the same. He can also reject the file and again upload the correct file.

The PDF will display the name as uploaded in the ECR and also the name as per the UAN Repository. In case the name is wrong, the employer should get the same changed through the process explained on the epfindia website.

The remitted amount will be credited against the UAN even if the name differs. The PDF will also display the benefit amount under the PMRPY, and PMPRPY Schemes against the eligible employees, and the benefit amount will not be added against the Challan amount to be paid.

The payment of the benefit amount in the member's account will be directly from the Government of India Fund.

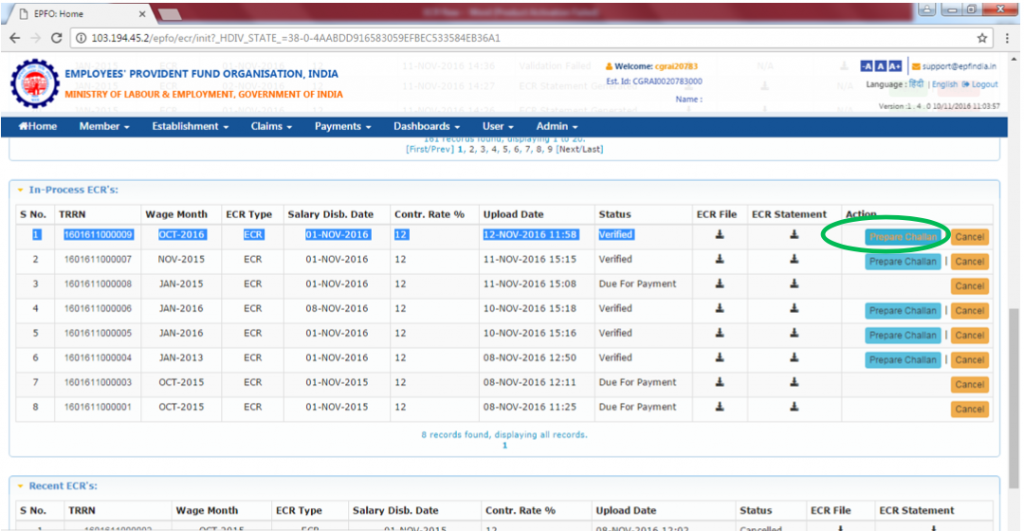

Prepare Challan

Once the ECR Statement has been verified, the said ECR will appear for preparation of the challan under the header In Process ECRs. The employer still has the option to cancel the approved ECR Statement through the Cancel Button against the In Process ECRS.

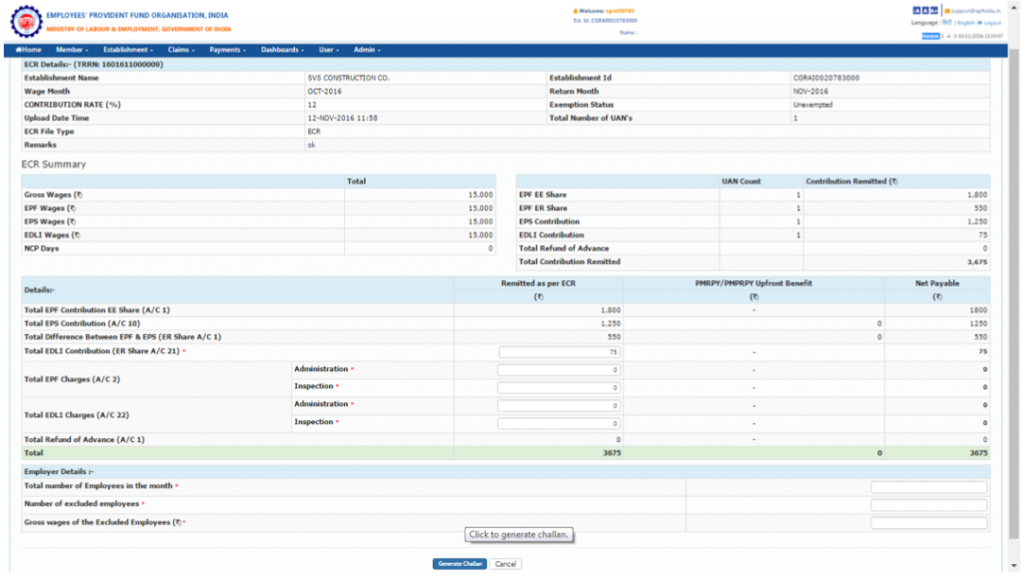

On click of the Prepare Challan, the Summary Sheet will open, and the summary data based on the uploaded ECR will be displayed.

Following additional data will have to be entered:

- Total EDLI Contribution: The calculated data will be displayed, but the employer can edit the same.

- Total EPF Charges (A/c 2): There will be data fields for Administration and Inspection. In case the establishment is exempted under the EPF Scheme employer should enter against the Inspection (for the Inspection charges) and if the establishment is not exempted, then he should enter the administrative charges against the Administration.

- Total EDLI Charges: (A/c 22): There will be data fields for Administration and Inspection. In case the establishment is exempted under the EDLI Scheme employer should enter against the Inspection (for the Inspection charges), and if the establishment is not exempted, then he should enter the administrative charges against the Administration.

- Total number of Employees during the month

- Number of Excluded Employees

- Gross wages of Excluded Employees.

After entry of the data, the employer can click the Generate Challan.

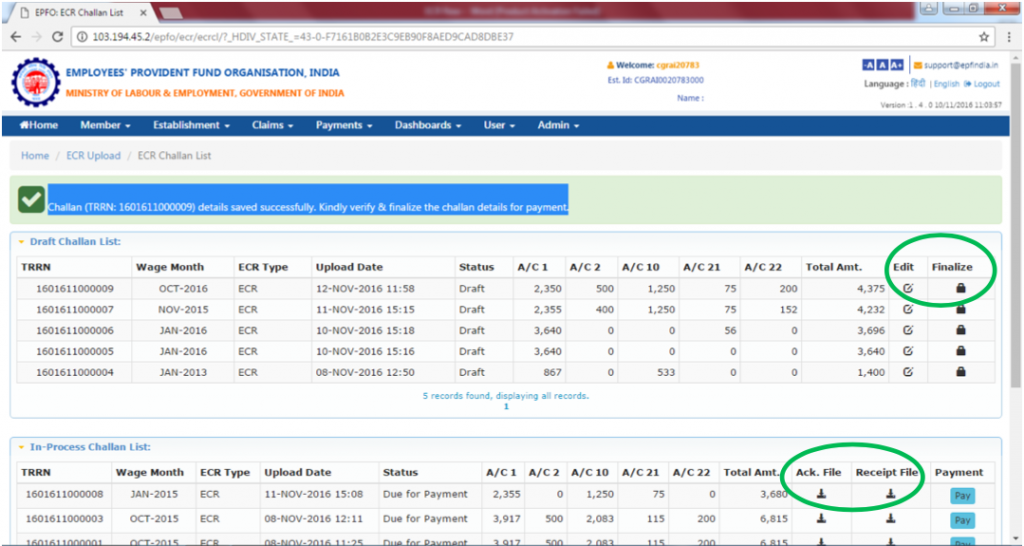

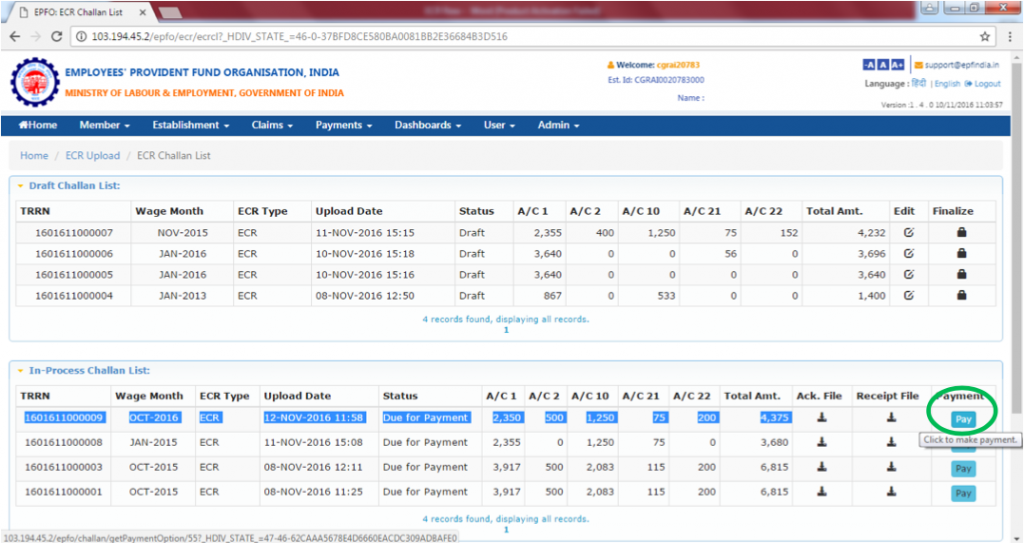

Finalize Challan

- Once the challan is generated, the same will be listed under the Draft Challan List where the employer can still edit the challan.

- Edit of the generated challan means that the employer can only edit the data in the 6 fields that were entered by him while preparing the challan.

- If the ECR data is to be changed, the employer will have to upload another ECR file with the correct data.

- If the data is correct, the employer can finalize the challan. Once finalized, the Challan will be listed for the online payment, and a link for the PAY will appear under the head In-process challan list.

- The challan can be printed for record purposes as the payment has to be made online only.

- The challan will show the amount to be paid by the employer account wisely, and the benefit amount under the PMRPY and PMPRPY Schemes will be that are not to be paid by the employer will be shown separately.

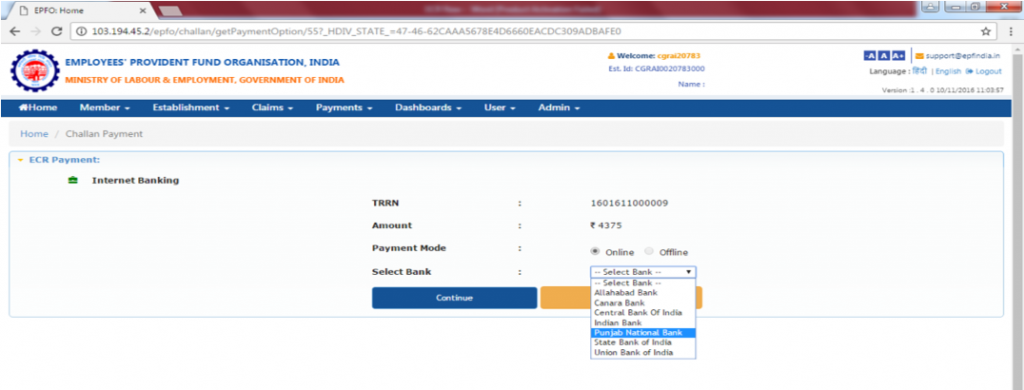

Pay Challan

The payment link will allow the employer to select the Bank through which he wants to pay. Online payment is mandatory to vide the notification dated 05.05.2015. Offline payment is possible only in case the permission has been taken from the concerned PF Office.

Stepwise Guide to File For an ECR

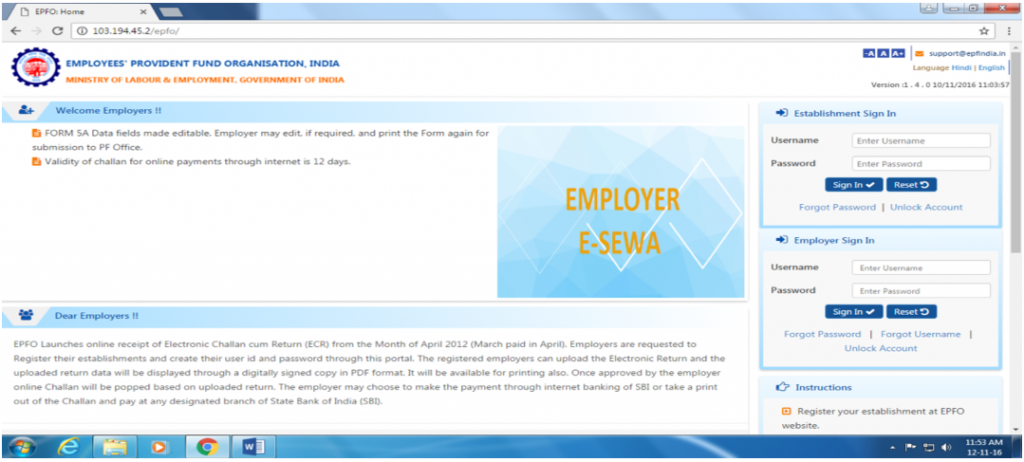

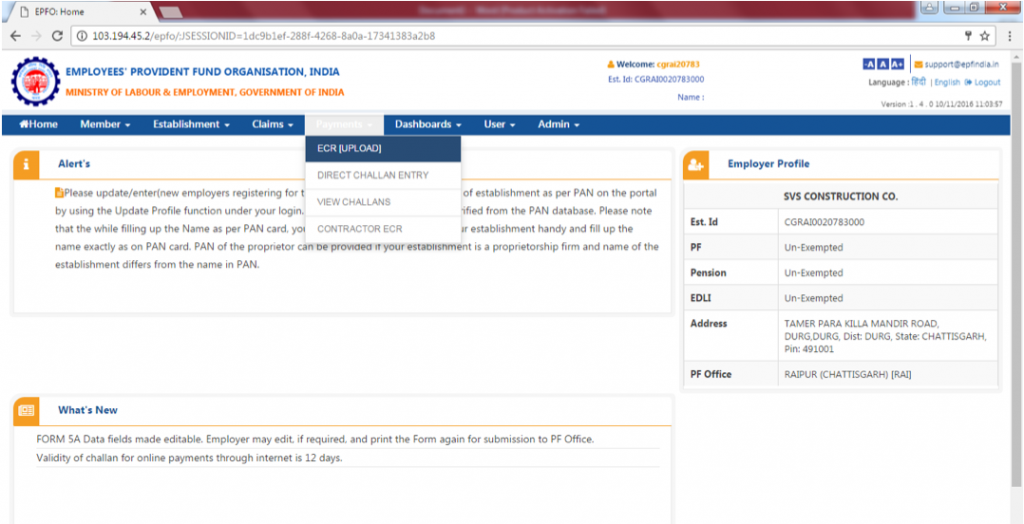

Step 1: Log in to the EPFO portal using your ECR portal credentials

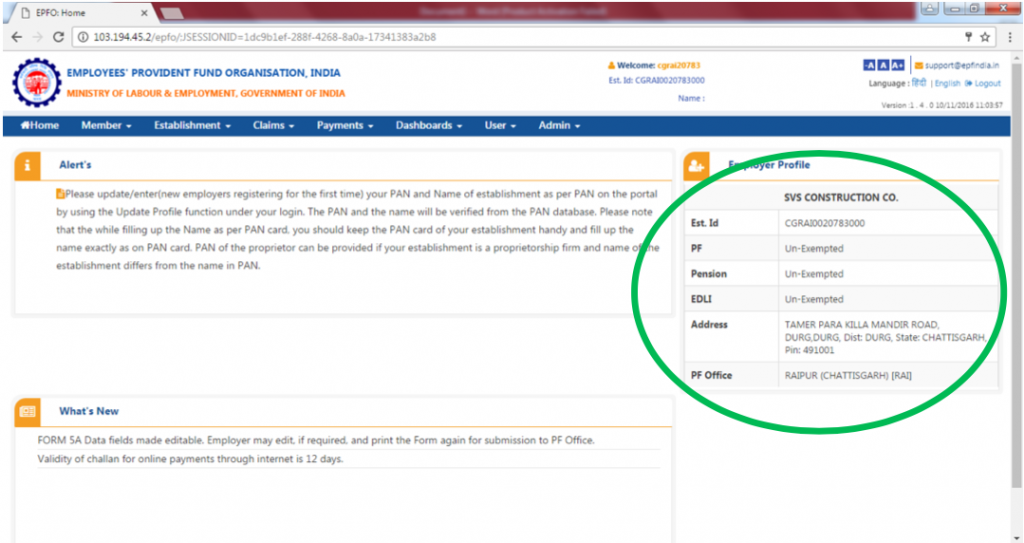

Once logged in, you can check the details of Establishment Name, Establishment ID, Exemption Status (PF, Pension, EDLI), Establishment Address, and PF office.

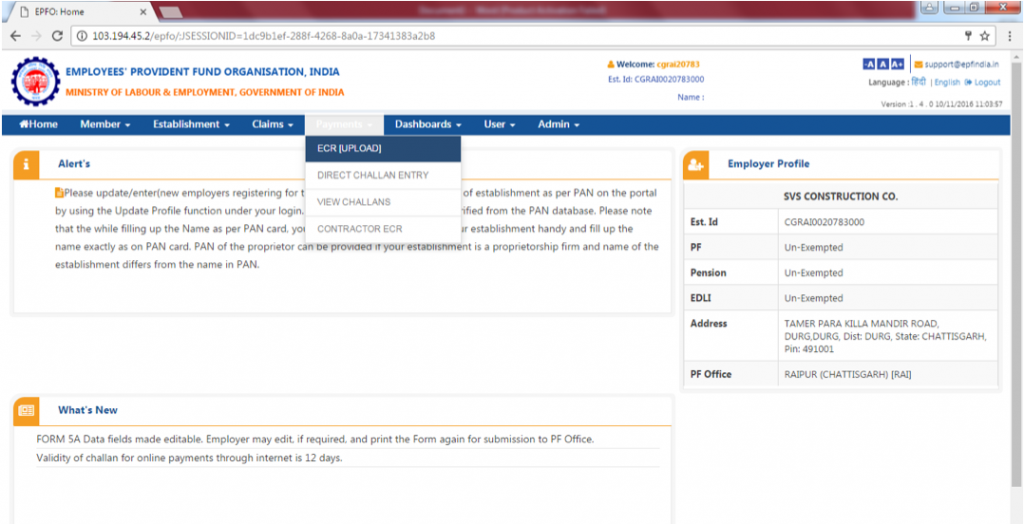

Step 2: To upload ECR, go to the Payments tab, then ECR and upload.

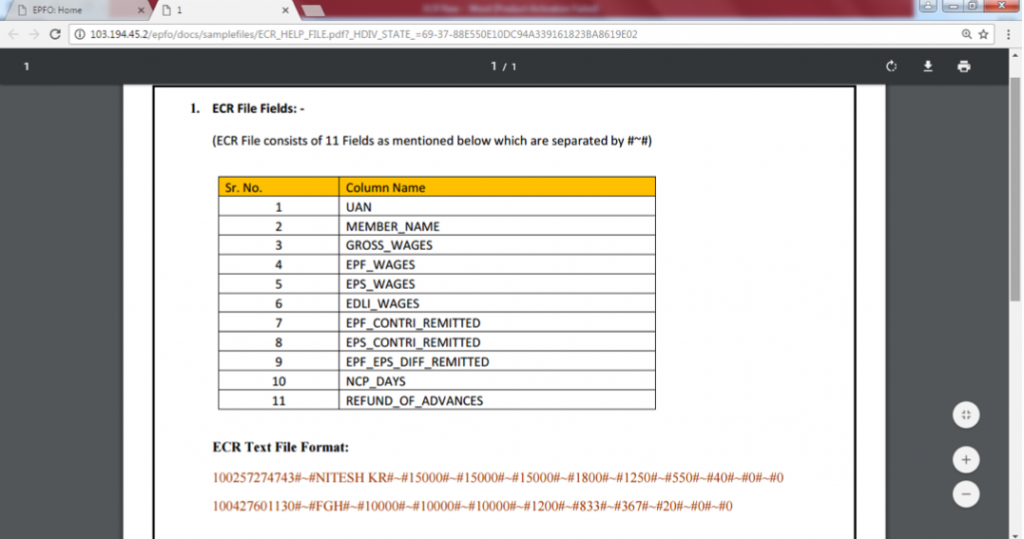

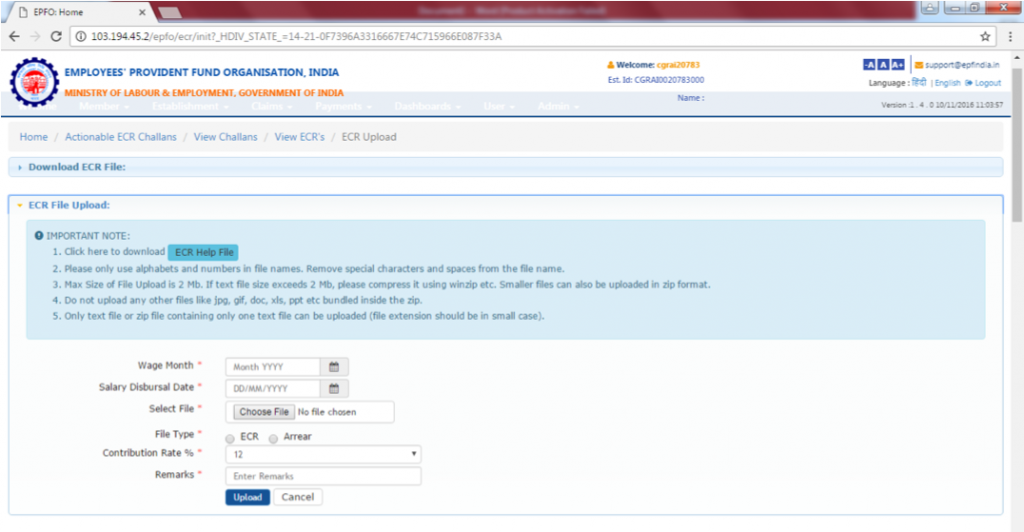

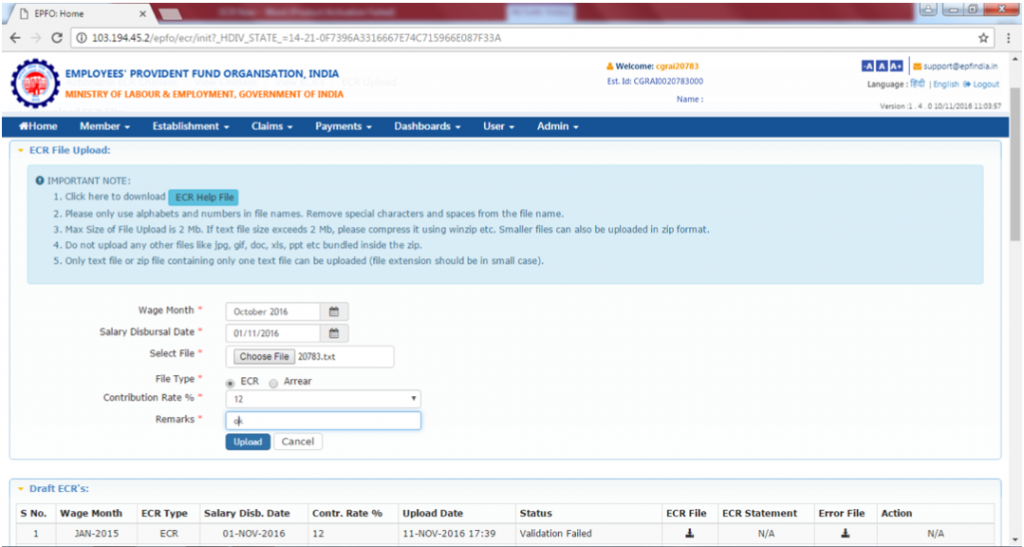

Step 3: On the next screen, i.e., ECR File Upload, click on ‘ECR Help File’ to view the ECR file format.

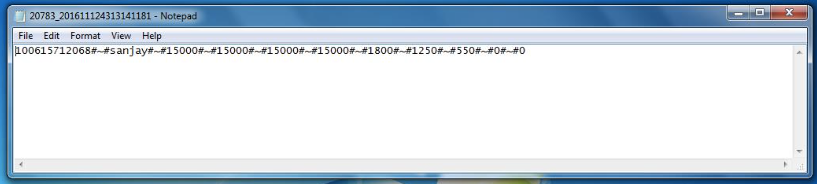

Step 4: Select your ECR text file to be uploaded.

Step 5: Select the remaining fields like File Type (Select ECR), Contribution Rate % (Default value is 12%), add a comment, and click on Upload Button.

Step 6: Once uploaded, the file will be validated by the portal against the pre-defined conditions. Once validation is successful, you can see the following screen with the ‘Validation Successful’ message:

Step 7: Generate the ECR summary sheet by clicking on the ‘Prepare Challan’ button

Step 8: On the next screen, you can adjust “Total EDLI Contributions (ER Share A/C 21)” (if required), enter Administration & Inspection Charges for “Total EPF Charges (A/C 2)” & “Total EDLI Charges (A/C 22).” Once done, click on the ‘Generate Challan’ Button.

Step 9: From the challan list page that follows, click on the “Finalize” icon after reviewing the Total Amount under Draft Challan List. You can also download Acknowledgment File and Receipt File under “In-Process Challan List”.

Step 10: The finalized ECR (Electronic Challan-cum-Receipt) will look similar to this:

Step 11: Once finalized, you can go ahead and make the payment. Click on the “Pay” button to make the payment:

Step 12: Please select Payment Mode as “Online” and select the bank from the list from which you wish to make the payment. Once selected, click on “Continue,” and this will navigate you to the payment gateway for completing the payment.

Benefits of Electronic Challan Cum Return

- No paper return is to be prepared and submitted to EPFO.

- No need to submit other returns viz Form 5/10/12A,3A, and 6A.

- Employers will get the confirmation of payment through SMS instantly.

- The members’ accounts will be credited with the contribution on a monthly basis.

- Employers can view the annual accounts slip.

- For earlier years, employers can request the annual slips through this portal.

Important Developments in Electronic Challan Cum Return

A big development has taken place with respect to the Date of Filing Electronic Challan Cum Return (ECR) for the Wage Month of March 2020. The date has been extended to 15th May from 15th April.

According to a government notification, considering the unprecedented situation created by COVID-19 and the lockdown announced by the Central Government from 24.03.2020 midnight onwards to prevent the spread of Covid-19, the due date for filing of Electronic Challan Cum Return (ECR) for wage month March 2020 is extended up to 15.05.2020 for employers who have paid wages to their employees for March 2020.

The due date for March 2020 is ordinarily 15.04.2020, so a grace period of thirty days has been allowed to the establishments covered under EPF & MP Act, 1952 to remit the contributions and administrative charges due for March 2020.

This relief will benefit about 6 lakh establishments to file ECRs without default by paying salaries to about five crore employees. The employers disbursing the wages for March 2020 not only get relief of extension of due date for payment of EPF dues for March 2020 but also avoid liability of interest and penalty if they remit on or before 15.05.2020.

The above decision of Ministry of Labour and Employment is to support and provide relief to Employers of establishments which have disbursed wages for March 2020 to its employees and an incentive to employers for the wage paid to employees during COVID-19 pandemic.

The move is in keeping with the objective of the Pradhan Mantri Garib Kalyan Yojana to prevent disruption in employment and ensure earning to employees to help them fight the pandemic," the statement by the government said.

To insulate business establishments amid the scare of the COVID-19 pandemic, the Employees Provident Fund Organization has given relief to employers. Now they can file the Electronic-Challan cum Return (ECR) without depositing their contribution to the Organization.

In the current scenario of a government-declared lockdown, businesses and enterprises are not able to function normally and hence lack money/funds to pay their statutory dues.

The employers have to declare the date of disbursement of wages for March 2020 in the ECR for March 2020. The ECR, with the said declaration, and contributions and administrative charges for March 2020 are now due on or before 15.05.2020.

To simplify the compliance process under the Employees Provident Fund and Miscellaneous Provisions Act, 1952, the reporting of the contribution made by the employer in the filing of electronic-challan-cum-return (ECR) has been excluded.

Changes to the ECR

The format for the ECR has undergone significant changes.

1. Reduction in the number of fields

The earlier ECR format had 25 fields, while the new format had only 11 fields. The membership ID field has been discarded since the UAN was introduced. Employee attributes such as date of birth, gender, father’s name, date of joining, and exiting PF have been discarded from the ECR since such attributes are to be updated on the PF portal separately.

2. Separate ECR for arrear PF

The PF department has introduced a separate ECR format for remittance of arrear PF. The arrear ECR contains 8 fields such as arrear wages, employee share, and employer share.

3. Gross Wages

The PF department has introduced a new field called “Gross Wages” in the ECR. The term Gross Wages, as per the documentation released by the PF department, refers to “total emoluments payable to the employee in the wage month for which the ECR is being filed.”

We presume this is nothing but the gross pay of an employee including salary heads such as HRA, which are left out for PF calculation. In case you include non-salary reimbursements as part of payroll, please deduct such amounts from the gross pay in order to arrive at the Gross Wage for the purpose of PF ECR.

In case there is a significant difference between EPF wage and the Gross Wage for employees whose salary is below Rs 15,000, the PF department could seek an explanation for the same.

Please note that the Gross Wages amount cannot be less than the EPF wages amount.

4. EPF Wages

According to the documentation released by the PF department, EPF wages refer to the “wages on which the employer is supposed to remit the dues. (If the employer is restricting the dues on wage ceiling of 15000 and the employee is contributing on his full wages above 15000/- then 15000 should be shown as EPF wages. In case the employer is paying his dues on above wage ceiling, that wage should be entered.”

The definition of EPF Wage for the new ECR format is somewhat puzzling. Currently, we compare the two wages on which we calculate the employee and employer PF contribution and take the higher wage as the EPF wage for the purpose of ECR.

For example, suppose the employee’s contribution is calculated as 12% of 20,000 (say, the employee’s basic wage), and the employer's contribution is calculated at Rs 15,000 (restricted wage. In that case, we calculate the administration charges on Rs 20,000 and show Rs 20,000 as the EPF Wage in the ECR.

As per the new ECR guidelines, the wage on which the employer contribution is calculated will have to be shown as EPF Wages (Rs 15,000 in the example). This is odd since if we show the employer PF wage as the EPF Wages, there will be no apparent relationship between the EPF Wages and the administration charges (at least in the example stated above).

5. NCP Days

According to the documentation, the NCP days figure has to be in a number of full days, and half-day NCP is not permitted. This, too, is puzzling since organizations widely apply half-day loss of pay on PF calculation.

If we have to round off NCP days for the purpose of ECR upload, there would be no connection between the PF amounts and the NCP days in case of half-day loss of pay. We wonder why the department decided not to allow 0.5 days (or multiples of it) for NCP days.

6. ECR shall not expire

Earlier, ECR files had validity for a certain number of days after which they expired. In the new portal, ECR files do not expire. Here is an excerpt from the PF document.

FAQs

What is the relief announced by the EPFO on the 30th of April, 2020, in regards to the ECR process?

ECR can now onwards be created by any employer without the need for simultaneous payment of contributions which may be paid later by the employer after creating the ECR.

How the payment can be paid later on after filing ECR?

The ECR created by the employer furnishing the statutory information will not lapse and shall always be available at future dates for reference to complete the payment.

My establishment qualifies for PMGKY benefits, but the date for filing ECR for March 2020 is extended till 15.05.2020. If I file ECR now for March 2020, when will I get time up to 15.05.2020 for payment?

Yes, after creating ECR for March 2020, you may make payment on or before 15.05.2020. If you file ECR now, you can fill up the declaration for PMGKY properly, edit any errors, if any, in the declaration and you will avoid the last-minute rush.

If the ECR for March 2020 is filed now, would PMGKY benefits remain available to eligible establishments when payment is made later on?

Yes, filing of ECR now and paying later will help in securing the relief of payment employer’s and employee’s share of contributions, totaling 24% of wages, by Central Govt in r/o of employees of your establishment earning monthly less than Rs.15000/- under PMGKY package Scheme.

What is the last date for filing ECR and making payment for wage month of April 2020 to avail of benefits under PMGKY? Will there be any extension of the date since the lockdown is extended up to 17.05.2020?

Since the filing of ECR is now separated from the payment process, the time for filing ECR for April 2020 is on or before 15.05.2020, and dues may be remitted within the due date or within an extended time if any, as announced by the Central Govt. For establishments eligible for PMGKY benefits, the ECR for April 2020 must be filed as soon as possible.

Whether damages will be leviable for delayed deposits?

No damages will be leviable if deposits are made within the extended time declared by the Central Government.

If the employer wants to pay the monthly ECR and arrears also, can he do so?

He can pay for both but through separate files, and the file formats for both are different. The ECR monthly file format has 11 fields, while the arrear file has 8 data fields. The filed details are explained in the Information sheet for both the files.

Whether the Gross wages to be restricted on Pay and DA?

No, the Gross wages should have total emoluments payable to the employee in the wage month for which the ECR is being filed. In the arrear ECR file, this field is not there.

Are the establishments that are exempted under the EPF Scheme 1952 required to declare the EPF Wages?

Yes, the EPF wages have to be declared as that wages will be taken into account for the Inspection charges. Also, if the wages are shown as 0, then the EPS wages cannot be entered as the validation has been put that the EPS wages cannot be more than EPF Wages.

How much time will the uploaded ECR lapse if payment is not made?

The ECR will not lapse now. You can make the payment after uploading the same through the online payment link. However, the applicable rules on Damages and Interest will apply for the delay beyond the due date.

Does every business have to file this return?

All the Establishments registered under EPFO must file monthly Electronic Challan cum Return (ECR) irrespective of the type of business or employment strength.

What is the last date for filing ECR and making payment?

The time for filing ECR and making the payment is on or before 15.05.2020. But the filing of ECR and payment of dues are separate processes and can be done separately.

Can I pay both regular salary and arrears to employees and file a single return?

Return can be filed for both but through separate files, and the file formats for both are different. But don’t worry, SuperCA will help you file ECR for regular salary and arrears both with no inconvenience.

How Can Deskera Assist You?

Want to manage your finances and budgets? Look no further than Deskera. Whether it is invoicing, inventory, CRM, accounting, or HR & payroll, as a business owner, you need to manage thousands of things. This is where Deskera Books can help you.

Key Takeaways

- A challan is an official paper that is issued to the motor vehicle driver who violates the traffic rules and regulations in India.

- A vehicle e challan is a computer-generated challan used by the Traffic Police and is being issued to all the traffic defaulters in India.

- An SMS will be sent to you notifying you about the fault committed and the amount of fee which needs to be paid. Traffic police are given the swiping machines for them to generate and print the vehicle e challan instantly to the traffic violators. This is how e-challans work.

- ECR stands for Electronic Challan cum Return. It is an electronic monthly return to be uploaded by employers through the Employer e-Sewa portal.

- The return will have the memberwise details of the wages and contributions, including basic details for the new and existing members.

Related Articles: