You probably view funding your company as a big headache. And it is. After all, 82% of new companies fail because of insufficient working capital or financial planning. Having the proper capital is critical for taking your firm off the ground and flying.

Getting such cash might be a complex process—you must be familiar with a lot of jargon. Furthermore, as of March 2016, large banks only allowed 23% of loans. However, you'll have a better shot at getting that sweet cash if you polish up on what you're throwing yourself into.

One such term is APR. You've undoubtedly heard of the term "Annual Percentage Rate" if you've ever applied for a personal loan, a home loan, or a credit card.

Understanding APR can assist you in making better credit choices. It provides you with an excellent estimate of how much money you'll have to borrow. And, if you're selecting between credit cards, APR is one thing to consider when determining which card is best for you.

Having said all that, in this article, we will learn everything about APR and how it works.

Topics we will cover in this article:

- What Is the Annual Percentage Rate (APR)?

- Types of APRs

- How does the APR Work?

- How Is APR Calculated?

- What's the Difference Between APR and Interest Rate?

- Disadvantages of APR

Let's Start!

What Is the Annual Percentage Rate (APR)?

The annual percentage rate (APR) is the annual interest earned on an amount paid to debtors or payable to investors. An APR is a number that shows the real annual price of money throughout the life of a debt or the revenue received on an investment.

APR covers any charges or other expenditures linked with the operation, but excludes compounding. The APR offers customers a single data point they can use to evaluate different lenders, credit cards, and financial packages.

You should now have a basic understanding of what APR is. Next, let's look at the different types of APR.

Types of APRs

There are several APRs, but the most common are Fixed APRs and Variable APRs.

Understanding the various APR types and when rates may fluctuate will help you pick the right financial product for you. Keep in mind that the APR might vary depending on your transaction.

The APR may also vary based on the type of credit you apply for. The APR on a credit card is often greater than a vehicle loan or a home loan. And how you handle your credit card might affect your interest rate.

Here are a few different APRs to be mindful of:

Fixed APR

Throughout the term of your loan, your fixed APR does not change. However, because the rate is more predictable, this makes budgeting easier.

Variable APR

An APR that varies with an interest rate index, such as the prime rate, is called a variable APR. Your variable APR rises in tandem with the prime rate. As a result, while the loan may have a reduced APR, your rate can rise over time. Hence, it can make planning your monthly budget more challenging.

Cash Advance APR

The cash advance APR is the annual interest rate you have to pay for credit card cash advances. It's typically higher than other types of APR.

Penalty APR

If you breach the conditions of your loan agreement, such as skipping or delaying the payment, the APR on your loan can rise for a timeframe. Check your loan conditions and any notices your lender sends you about your account.

Introductory APR

The Introductory APR is a limited-time APR that credit card issuers offer whenever you get a brand-new credit card. The Introductory APR is lower than the fixed APR and only exists during the introductory phase. After this phase, normal interest rates apply. It can also apply to general purchases and specialized transactions, such as balance transfers.

These are all the types of APR you should know about. The next critical thing you should know about is how the APR works.

APR and Credit Cards

Understanding credit card APR

- Credit card APR is the interest rate charged by a credit card issuer on outstanding balances

- Credit card issuers calculate the APR based on various factors, such as your credit score, the type of credit card, and the market interest rates.

- APR on credit cards can be fixed or variable, meaning it can change over time depending on the market interest rates.

- Credit card issuers are required by law to disclose the APR, fees, and charges upfront in a standardized format.

How credit card fees and charges impact APR

- Credit card issuers may charge a variety of fees, such as annual fees, balance transfer fees, cash advance fees, and foreign transaction fees, among others.

- These fees and charges can add to the overall cost of borrowing and impact the APR you pay.

- For example, if a credit card has a 16% APR and a $100 annual fee, the effective APR would be higher at 20%.

- Balance transfers and cash advances may have higher APRs and additional fees, making them more expensive ways to borrow money.

Navigating credit card fees and charges

- To minimize the impact of fees and charges on your APR, choose a credit card with low or no annual fees, and carefully read the terms and conditions before making balance transfers or cash advances.

- Look for credit cards with a 0% introductory APR on purchases and balance transfers, which can save you money if you pay off the balance before the promotional period ends.

- If you're planning to travel abroad, look for credit cards with no foreign transaction fees to avoid additional costs.

Best practices for managing credit card APR

- Pay your balance in full every month to avoid paying interest and fees altogether.

- If you can't pay your balance in full, pay more than the minimum payment to reduce the amount of interest you'll accrue.

- Avoid making late payments or exceeding your credit limit, which can result in additional fees and charges and negatively impact your credit score.

APR and Loans

APR (Annual Percentage Rate) is a measure of the cost of borrowing money, expressed as a percentage. It takes into account the interest rate, fees, and other charges associated with a loan. If you're considering taking out a loan, it's important to understand how APR works and how it can affect your finances.

Here are some things to keep in mind when it comes to APR and loans:

- Know the difference between APR and interest rate: APR includes all the fees and charges associated with a loan, while interest rate only reflects the cost of borrowing the principal amount. So, while a loan may have a low interest rate, it could have a high APR due to additional fees.

- Look for the lowest APR: When comparing loans, you should look for the one with the lowest APR, as this will give you the best overall picture of the cost of borrowing. It's important to compare APRs from different lenders to ensure you're getting the best deal.

- Consider the repayment term: Loans with longer repayment terms may have lower monthly payments, but they often come with higher interest rates and fees. It's important to consider the total cost of the loan over its entire repayment term, not just the monthly payment.

- Watch out for prepayment penalties: Some loans come with prepayment penalties, which can be charged if you pay off the loan early. This can add to the total cost of the loan and increase the APR.

- Check for fees: In addition to interest rates, many loans come with additional fees, such as origination fees, late payment fees, and application fees. These fees can add to the overall cost of the loan and increase the APR.

- Know your credit score: Your credit score can have a big impact on the APR you're offered for a loan. Generally, the higher your credit score, the lower your APR will be. If your credit score is low, you may need to look for loans specifically designed for people with poor credit.

- Get multiple quotes: It's always a good idea to get multiple quotes from different lenders to compare APRs and fees. This can help you find the best loan for your needs and budget.

APR and Personal Finance

Here are some key points to consider when it comes to APR and personal finance:

- Credit Cards: APR plays a crucial role in credit card payments. Credit card companies often offer a low introductory APR, which then increases after a certain period. It's essential to pay attention to the APR and the interest rates charged on credit cards to avoid high fees and charges.

- Personal Loans: APR also impacts personal loans. The higher the APR, the more interest a borrower has to pay. Before taking out a personal loan, it's essential to compare interest rates and repayment terms to ensure that you're getting the best possible deal.

- Auto Loans: APR also applies to auto loans. While the interest rates on auto loans are generally lower than those on personal loans, it's still important to pay attention to the APR and the repayment terms to ensure that you're not overpaying on interest.

- Mortgages: When it comes to mortgages, APR includes not only the interest rate but also any additional fees and charges. It's essential to compare APRs when shopping for a mortgage, as a lower APR can result in significant savings over the life of the loan.

- Savings Accounts: APR isn't only important for borrowing money; it's also important for saving money. The higher the APR on a savings account, the more interest an individual earns. While interest rates on savings accounts are typically lower than those on loans, it's still important to shop around and find the best possible rate.

How does the APR Work?

An interest rate is an annual percentage rate. It calculates what proportion of the principal you'll pay each year by considering factors such as EMIs. APR is also the yearly interest rate paid on assets that do not account for interest compounding during the year.

The Truth in Lending Act of 1968 mandated that lenders publish the interest rates they charge borrowers. As a result, credit card firms may promote monthly interest rates, but they must explicitly disclose the APR to clients whenever they sign contracts.

So, now we know how APR works, but do you know how to calculate it?

How Is APR Calculated?

Banks use APR calculation formulas to estimate how much interest you owe on your existing debt. Based on your loan, banks can calculate it on a daily or monthly basis.

It's critical to understand that certain accounts have several APRs. Financial institutes must publish how they compute APRs. Whenever you borrow money, read the disclaimers and conditions.

Remember that the charges that factor in calculating an APR might vary depending on the loan you're looking for.

An APR for a mortgage, for example, might include the lending rate, charges, initiation costs, and other expenses. With a vehicle loan, lenders calculate the APR using different criteria. These might include credit records, loan amounts, monthly payments, and vehicle conditions.

At this point, the APR sounds very similar to the interest rate. But this couldn't be further from the truth. So, let's see the difference between APR and interest rate.

What's the Difference Between APR and Interest Rate?

APR (Annual Percentage Rate) and interest rate are two important financial terms that often confuse people. While they are both used to determine the cost of borrowing money, they have different meanings and can impact your financial decisions in different ways.

Here is what you need to know about the difference between APR and interest rate:

- Interest rate is the cost of borrowing money: Interest rate is the percentage of the amount borrowed that you will pay as interest over the life of the loan. It is typically expressed as an annual percentage.

- APR includes additional costs: APR is the cost of borrowing money including not only the interest rate but also other costs such as loan origination fees, closing costs, and other charges. APR is designed to give you a more accurate representation of the total cost of borrowing. Unlike the interest rate, the APR takes into account all fees associated with the loan.

- APR is always higher than interest rate: Because APR includes additional costs beyond the interest rate, it is always higher than the interest rate. The difference between the two rates will vary based on the type of loan and the lender.

- APR helps you compare loan offers: Because APR is a more accurate representation of the total cost of borrowing, it is an important factor to consider when comparing loan offers. When comparing loan offers from different lenders, make sure to compare the APR instead of just the interest rate. This will give you a better understanding of the true cost of each loan.

- APR may be variable or fixed: Just like interest rates, APR may be either variable or fixed. A fixed APR will remain the same over the life of the loan, while a variable APR may change over time. Variable APRs are often tied to an index, such as the prime rate, and will adjust periodically based on the index.

Disadvantages of APR

Here are some of the disadvantages of APR that you should be aware of:

- It may not reflect your actual borrowing costs: APR is calculated based on certain assumptions and standardized formulas, which may not accurately reflect the specific terms of your loan or your personal financial situation. For example, it does not take into account any fees or charges that may be added to the loan, such as application fees or late payment fees.

- It can be misleading: APR is often advertised as the single most important factor to consider when choosing a loan, but this may not always be the case. In some cases, a loan with a lower APR may actually end up costing you more in the long run if it has a longer repayment term or other less favorable terms.

- It may not account for changes in interest rates: If you have a variable-rate loan, your interest rate and APR may change over time. This means that the APR you were initially quoted may not reflect the actual interest rate you end up paying on the loan.

- It does not consider prepayment penalties: If you plan to pay off your loan early, you may be subject to prepayment penalties, which can add significantly to the overall cost of the loan. APR does not take these penalties into account when calculating the cost of borrowing.

- It may not be comparable across different loan types: APR is most useful when comparing loans with similar terms and repayment schedules, but may not be as helpful when comparing loans with different types of collateral or repayment structures.

Frequently Asked Questions

Why Is the APR Made Public?

Consumer protection regulations require companies to publish the APRs linked with their product offers to prevent corporations from deceiving customers.

Hiding the APR can cause a client to mistakenly compare a relatively cheap monthly fee with a high yearly rate. As a result, customers get an "apple to apples" comparison by forcing all providers to reveal their APRs.

What Is the Difference Between Fixed and Variable Interest Rates?

One significant distinction between fixed and variable APR is that the rate varies over time. A fixed APR does not vary during the life of your loan, but a variable APR links to an index that can alter.

Where Can You Find the APR on Your Account?

You can find the APR on your credit card in your account, opening documents, and your monthly credit card statement. In many circumstances, you can find out your current APR and whether it's based on the prime rate by reading the section on interest charge computation.

With that, we have reached the end of the article. Now, it's time to take a quick summary of everything we have covered in this article.

How Can Deskera Assist You?

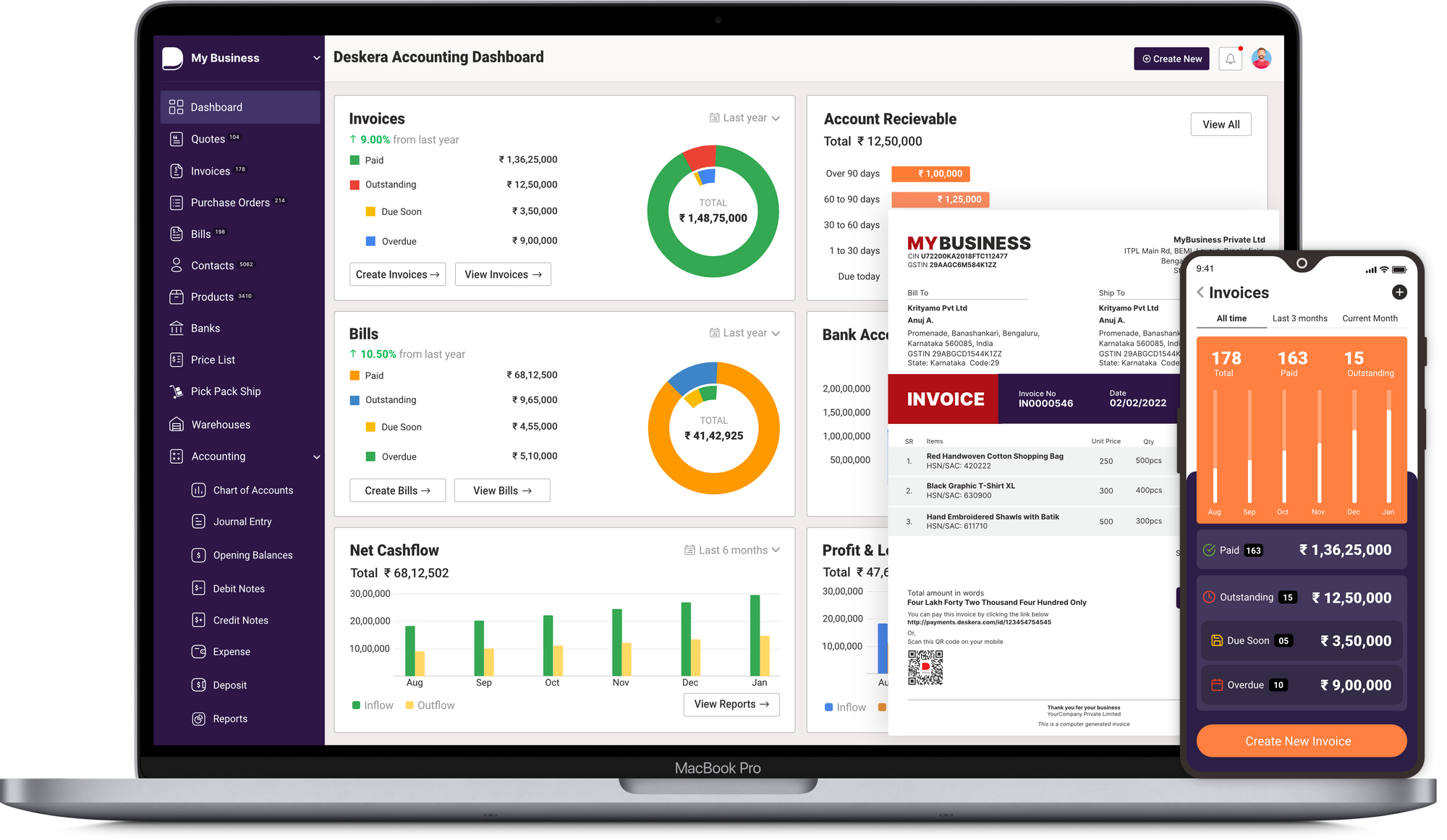

Whether you are a sales manager or running your own business, there are tons of duties and responsibilities that you have to fulfill. Using the Deskera CRM system, you can manage your contacts, leads, and sales deals.

You can use the CRM system to manage all customer data and manage your leads, sales negotiations, and deals. Doing so will help you to save the time taken in transferring customer data between the different systems. Having a good CRM system will help you manage your financial and sales reports and be prepared to kick off your meetings.

Deskera can also assist you with real-time updates about your business, like cash flow status, customer satisfaction, inventory management, sales, purchases, purchase orders, customer tickets, customer satisfaction, managing leads, revenues, profit and loss statements, and balance sheets.

Moreover, it would also help in integrating sales methodology across different platforms into one system so that you have a consolidated list for email campaigns, leads management, and sales pipeline, to mention a few.

Key Takeaways

- The annual percentage rate (APR) is the annual interest earned on an amount paid to debtors or payable to investors

- An APR is a number that shows the real annual price of money throughout the life of a debt or the revenue received on an investment

- There are several APRs, but the most common are Fixed APRs and variable APRs

- The other types of APR are Cash Advance APR, Penalty APR, and Introductory APR

- APR computes what proportion of the principal you'll pay each year by considering factors such as monthly payments

- APR is also the yearly interest rate calculated on assets that do not account for interest compounding during the year

- It's common to conflate interest rates with APRs, but they're essentially two separate rates

- Your interest rate is calculated as a percentage paid on the principal amount borrowed

- In addition to the interest rate, the APR covers other charges, such as settlement costs and general liability

- If there were no lender costs, the APR and interest rate could be the same, especially with credit cards

- The annual percentage rate (APR) is not necessarily an accurate representation of the entire cost of borrowing. In reality, it may overestimate the true value of a loan

Related Articles