Did you know that offering mileage reimbursement to employees can be beneficial to both employers and employees in terms of savings?

This post will show us how.

There are times when the employees may be required to travel in order to complete tasks or business-related assignments. However, if they're on a trip associated with work, they shouldn't be responsible for all travel costs. Here is where payment for mileage kicks in.

Offering mileage is something most companies carry out. However, getting reimbursed isn't as straightforward as giving over the cash or filling out a single line on a tax form. The IRS Regulations require that the employee substantiates the amounts paid under the Internal Revenue Code's provisions.

This article dives into the following factors associated with mileage reimbursement:

- What is mileage reimbursement?

- How does a mileage reimbursement work?

- What does a mileage reimbursement cover?

- The IRS Mileage Reimbursement Rates for 2022

- Are mileage reimbursements taxable?

- How to track business mileage efficiently?

- How to calculate a fair mileage reimbursement

- Learn about FAVR allowance

- How can Deskera Help You?

- Key Takeaways

What is Mileage Reimbursement?

Mileage reimbursement is the amount a business pays an employee for using their personal vehicle for work purposes. A cents-per-mile formula commonly helps businesses with mileage reimbursement.

Reimbursement rates, covered expenses, and payment terms, on the other hand, are entirely determined by the employer and the employee's agreement. Mileage reimbursement is considered advantageous for both the employee and the business at the time of tax filing.

Employee mileage reimbursements or allowances differ greatly from firm to firm. Although there are no federal regulations requiring employers to pay employees for driving their own cars, certain states in the United States do follow some regulations.

A crucial financial approach is establishing a clear policy for handling employee mileage reimbursements. Employees should be aware of the sorts of travel for which they can claim a mileage allowance and the amount they will be reimbursed.

How does a mileage reimbursement work?

An employer pays a cents-per-mile fee to employees to cover automobile costs incurred as part of their job travel. The IRS has established the standard mileage rate for 2022 at 58.5 cents per mile.

You will be calculating the mileage reimbursement by multiplying this rate by the number of miles driven over a payment period. If 50 miles are driven by the employee, the reimbursement will be $2,925.

Companies often adopt three options for handling employee mileage reimbursement in the workplace.

Recording Expenses

Employees keep track and record their actual expenses on business trips. All the expenses made on purchasing fuel, payments for parking, and tolls are recorded in form of receipts. However, this is time-consuming and does not account for car depreciation. Therefore, a mobile application that can automate keeping the records and eliminates the manual process is recommended.

Fixed Allowance for Reimbursement

Employers pay a monthly lump payment to cover the costs of fuel, tyres, maintenance, and other expenses. However, because there is no way to gauge the vehicle's actual use for personal and business travels, this is not tax-deductible for the employee and can be inefficient.

Allowance for Mileage

For reimbursements, most organizations rely on mileage logging. Employees note the distance traveled when they utilize their personal vehicles for work. Employees must submit their travel expenses together with their timesheets.

What does a mileage reimbursement cover?

Employees will be reimbursed the amount spent on the drive for business purposes. However, any expense made towards personal work or a detour will not be reimbursed. The IRS prescribes all the necessary and important expenses covered under mileage reimbursement.

Here is a list of expenses that can be counted as valid for reimbursement:

Client Visits: When you send an employee to meet a client or make a presentation, it will be counted as a valid expense for mileage reimbursement.

Temporary jobs: This includes travel for short-term office jobs which last for less than a year.

Airports: This is usually made for an international official trip. The employee may drive to the airport to board a flight for a business meeting.

Conventions: Any travel that is meant to benefit the business is counted under this category, and should be reimbursed.

Errands: When the employee drives for fetching stationery, or any kinds of business supplies, they must be reimbursed under mileage reimbursement.

The IRS mileage reimbursement rates for 2022

The Internal Revenue Service has prescribed the optional standard mileage rates for 2022. These rates help estimate the deductible costs of driving a car for business, charitable, medical, or relocating purposes. The regular mileage rates for using an automobile have been applicable since January 1, 2022.

The details of which are as follows:

- Business miles are now worth 58.5 cents per mile, up 2.5 cents from 2021.

- 18 cents per mile traveled for qualifying active-duty members of the Armed Forces for medical or moving needs, up to 2 cents from 2021

- 14 cents per mile traveled for charitable purposes, unchanged from 2021

Alternatively, rather than using the regular mileage rates, you can always calculate the actual expenditures of using their vehicle. You can increase your mileage allowance deduction rate if your company is located in a region where petrol and tolls are expensive. However, any amount in excess of the federal threshold is taxable to the employee and must be reported on their tax return.

The Internal Revenue Service establishes a standard mileage reimbursement rate yearly based on the yearly analysis of the fixed and variable costs of operating a vehicle. The process counts in depreciation, insurance, repairs, maintenance, gas, and oil. We must note that the IRS mileage reimbursement rates are tax-exempt for employees.

Are mileage reimbursements taxable?

It is not taxable if the mileage reimbursement does not exceed the IRS mileage rate. When the mileage rate is more than the IRS prescribed rate, the difference between the mileage rate is considered taxable income.

How to track business mileage efficiently?

There are companies that demand employees to show invoices for gas and automobile maintenance for reimbursement. However, when you employ the standard deduction rate, the time-consuming process of accumulating receipts is removed. You may request your employees to download a tracking tool or keep a mileage journal.

You can easily monitor your miles with an expense-tracking application. When you have fixed or determined your reimbursement rate, you may utilize the mileage logged in these apps to figure out how much you owe. You may then provide or reimburse this amount in the next salary or through any other arrangement you deem fit based on your business.

To keep track of your mileage reimbursement, follow these steps:

- Make a note of the trip's date.

- Monitor the time it took to get there.

- When you first go on the road, make a note of the odometer reading.

- Include the trip's starting point and ending point.

- Write down, in short, the outline of the trip's objective.

- Check and record the odometer reading at the end of the trip.

How to calculate a fair mileage reimbursement

Being fair while calculating mileage reimbursement is vital and you will need to be mindful of specific factors, for the same. Here they are.

- Current standard mileage rate the IRS uses. Starting in 2022, it is 58.5 cents for every mile.

- Multiply each mile with 58.5 to arrive at the correct digits

- Make a note of any extra expense that the employee may have incurred

- Reimburse the amount with the next paycheck

Let’s consider a quick example.

Your employee needs to travel to the client’s place 50 miles away for a product demonstration and maintenance in the year 2022. You have the current mileage rate of 58.5 per mile. How much amount will you reimburse?

Reimbursement rate for 2022 = 58.5 per mile

Miles traveled in the year 2022 = 50

Reimbursement amount

= Reimbursement Rate x Miles traveled

= 58.5 x 50

= $2,925

The final amount you reimburse is $2,925.

Learn about FAVR allowance

Your employees may use their own or leased automobiles for business purposes; they are later reimbursed using the fixed and variable rate allowance, also known as fixed and variable rate reimbursement or the FAVR.

In terms of taxation, FAVR payments must be made at least quarterly. It is essential to learn about specific restrictions on how much an employee's car can be used to qualify for the FAVR allowance.

A FAVR has the advantage of being adjusted based on each employee's location-specific costs and exact monthly miles. If you are able to implement this kind of arrangement correctly, it can prevent employees from being overpaid or underpaid.

How can Deskera Help You?

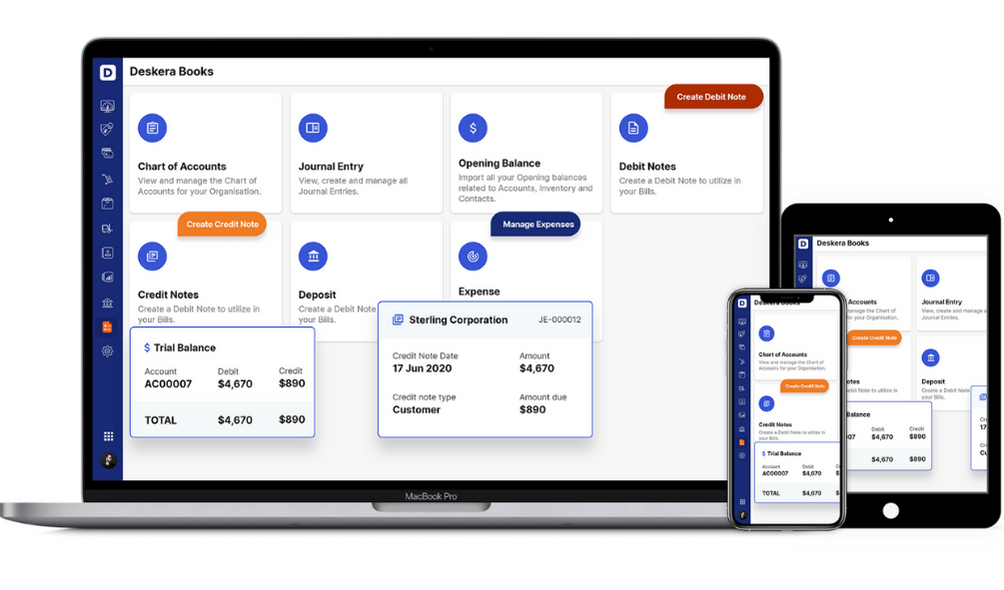

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs from creating invoices, tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

Key points from the articles:

- Mileage reimbursement is the amount a business pays an employee for using their personal vehicle for work purposes

- A cents-per-mile formula is commonly used by businesses for mileage reimbursement

- Reimbursement rates, covered expenses, and payment terms, on the other hand, are entirely determined by the employer and the employee's agreement

- Employee mileage reimbursements or allowances differ greatly from firm to company

- The IRS has established the standard mileage rate for 2022 at 58.5 cents per mile

- You will be calculating the mileage reimbursement by multiplying this rate by the number of miles driven over a payment period. If 50 miles are driven in a month, the amount for reimbursement will be $2,925

- Client visits, temporary jobs, airports, conventions, errands, are some of the instances for which reimbursement can be claimed

- Business miles are now worth 58.5 cents per mile, up 2.5 cents since 2021

- 18 cents per mile traveled for qualifying active-duty members of the Armed Forces for medical or moving needs, rising 2 cents from 2021

- 14 cents per mile traveled for charitable purposes, unchanged from 2021

- Year after year, the Internal Revenue Service establishes a standard mileage reimbursement rate based on the yearly analysis of the fixed and variable costs of operating a vehicle. This includes depreciation, insurance, repairs, maintenance, gas, and oil

- If the mileage reimbursement does not exceed the IRS mileage rate, it is not taxable

- Your employees may use their own or leased automobiles for business purposes; they are later reimbursed using the fixed and variable rate allowance (FAVR), also known as fixed and variable rate reimbursement

Related Articles